$11 Billion Changed Hands To Buy This Earthy Product Last Year...

Orders Backlogged, Prices Soared 600%1

And The New York Times, Wall Street Journal, Forbes, Fortune and Barron’s Never Noticed! 2

Editorial Feature | Mar 28, 2022 | Industry

That’s why the new dirt doctor4, Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF), could be the smartest investment you’ll see this decade.

- Industry leaders find the big winners before Wall Street does … Now Big Ag is focusing on the small company that may be the only one that can fix its dirt problem.

- When it comes to solving big problems, it doesn’t get any bigger than this… Half our farm soils are already dead, the rest are dying.4

- Biological amendments are the only real way to restore depleted soil life without waiting 500 years for Mother Nature to create new topsoil. US growers spent $11 billion last year on old-school biological treatments like mulch and manure, but they wanted more.

- There’s only one company whole-heartedly stepping into this space. With a new technology for biologically active soils that heal the land… Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF)

- Fertilizer prices are skyrocketing as Russian and Ukrainian fertilizer trade stops cold… The ARGO alternative gets better and better.

The club of “dirt poor farmers” is bigger than ever. All farmers are dirt poor now. Literally—their soil is bankrupt.

As much as 60% of the land being worked in America’s Grain Belt is badly depleted. At least a third of these Midwestern farmlands have lost ALL their topsoil.5 Huge swaths of Southern farmland are long gone from healthy production. The bad acreage grows every year.

Every season, farmers spend an average $171 an acre to spread tons of fertilizers on these soils so they can eke out another crop6. For corn farmers that tab will reach $250 to $300 an acre this year.

In total, it’s a $42 billion Hail Mary pass farmers throw at the problem every year. And it doesn’t restore a single ounce of soil.

Adding fertilizer is like feeding vitamins to a cadaver hoping for a miracle.

Dead dirt needs a blood transfusion.

The Problem Wall Street Hasn’t Seen Yet Could Be Your Sweet Spot

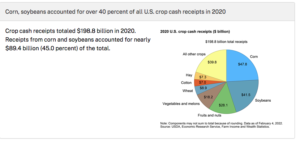

That’s what makes Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) the most important emerging company in the $198 billion7 American farm industry. This is the one company you should be watching if you like to be early on growth mega-trends.

Argo’s unique products can actually put the life back into our dying soil. And best of all for investors who are alert to this opportunity… ARGO has literally no competition.

The giants in the fertilizer business like Nutrien (NYSE:NTR–$25 billion in annual sales) and Mosaic (NYSE:MOS–$10 billion in annual sales) are too happy mining for phosphate and bagging up minerals to sell to farmers. They are not in the biology/life sciences business.

So the giants have literally left the door wide open for ARGO.

And the farmers are paying attention. They know what their problems are and they know they need ARGO’s help.

Russia’s War on Ukraine Just Amplified An Already

Critical Fertilizer Shortage

Hands down, nitrogen is the most important fertilizer mineral in the world. And Russia is the world’s largest supplier.

College Educated Agriculture Is Ready For ARGO

Wall Streeters may not realize how ready farmers are to adopt something like ARGO’s new, better technology because farming has long been considered a blue-collar occupation…

But the truth is that farmers are very well educated. Especially about their business. Nationally, 38% of farmers have a bachelor’s degree, and another 32% have an associate’s degree or certificate.8 They’re constantly getting bulletins and information from the USDA and farm organizations and reading periodicals.

They understand what’s happening to their land. This means that when ARGO takes its Living Soil production to national scale, every farmer in America will know its value.

They all know that the traditional fertilizers they’re buying are just a stopgap. You can’t throw potash, nitrogen, and phosphorus on dead ground and expect much to happen. It takes a rich population of microbes, bacteria, worms, and live content to break down these minerals so plants can use them.

Farmers know that the only way to revive worn out soil is to restore the life force within it… not just top up the minerals.

They’re ready for answers. In fact, today’s big problem is on the path to desperation…

More than half the farming soils in America’s Grain Belt are severely eroded—so badly they have little or no topsoil layer. 9

Within 30 years, 90% of the worldwide acreage in production now will be tragically depleted. Much of it won’t support crops anymore.10

This Is A National Emergency

This situation gets so little attention in city papers and Internet blogs that few of us suburbanites and city dwellers realize what’s going on.

This situation gets so little attention in city papers and Internet blogs that few of us suburbanites and city dwellers realize what’s going on.

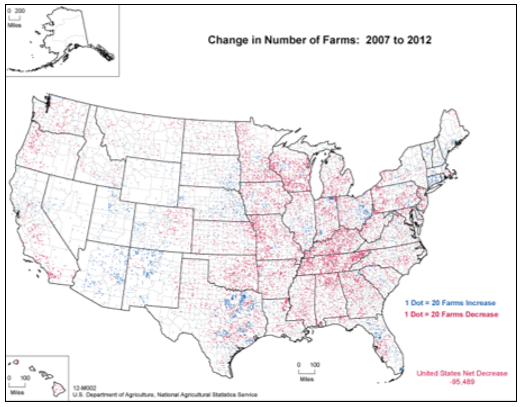

This USDA map gives red states-blue states a whole different meaning.

Each red dot shows where 20 farms were lost between 2007 and 2012.

Each blue dot shows a 20-farm gain.

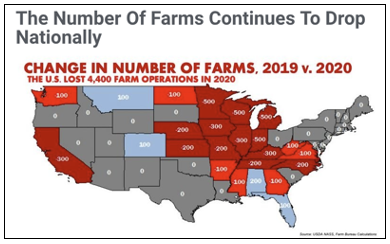

And this 2020 map from the American Farm Bureau shows the trend has not slowed down.

And this 2020 map from the American Farm Bureau shows the trend has not slowed down.

America easily feeds itself today. But not for long at this rate.

When you are looking for a big opportunity and you find that only one company has the only viable solution—it’s pay dirt time.

Literally, time to look at Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF)

Large Scale Is Finally on the Horizon

If the average home gardener has a clue about the value of compost, you can bet America’s farmers understand the power of microbes that are in ARGO’s living soils.

They know that healthy soil should be teeming with organic matter, worms, microbes, bacteria and other microscopic organisms… the same things that show up in home gardens that use compost, but on a much larger scale.

But living soils have not been practical at a commercial farm scale, until now.

Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) is bringing true, soil-reviving products to farmers who work on the large scale. It specializes in

- Biofertilizers from organic waste

- Living soils

- Natural pesticides

- Fungicides

- Vermicompost (worm-rich medium)

- Compost Tea Kits

All of Argo’s live soil products are aimed at high-value crops.

Best of all, they can be applied at large scale… just like fertilizers are, spread with the same equipment. But with very different results.

ARGO products improve the soil’s ability to retain water. They improve its ability to hold nutrients and reduce the amount of fertilizer needed. They have a long-term, life-enhancing benefit instead of a one-season boost.

Never Underestimate the Brilliance of Simplicity

A company devoted to better dirt is a lot bigger idea than it seems.

- ARGO’s living soil products could save organic operations as demand rises and the need for organic-friendly mediums and amendments increases

- Their products could make vertical farming work on a large scale.

- It could solve supply chain issues.

- It could restore nutritional levels in fruits and vegetables that have become less healthy due to poor soils. Live soils allow crops to use nutrients better and yield healthier grains, vegetables, and fruits.

- It could support cleaner plant-based cosmetics and drugs—a pressing supply chain concern as certified organic growers struggle to meet demand.

- It could provide more security and predictability to farm enterprises because better soils help plants thrive better under all types of weather.

ARGO’s concentration on live soil means this company has a clear purpose to guide it… and that’s a mark of brilliance, because companies that start out to do one simple, surprising thing exceedingly well typically turn into great investments.

It’s a Proven Technology—Now It’s Scaling UP

Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) was born to solve a problem.

On Galliano Island, just off the coast from Vancouver, BC, Chad Diakow had hit a stone wall. He was trying to source organic ingredients so he could make high-quality soil amendments.

Materials were in short supply, so he set to work creating his own solution. He figured out a way to use fungal-heavy worm castings so he could stack several nutrients in each batch of living soil… and his technology with a high cation exchange capacity (CEC) means the nutrients will stay where they should—to feed plants, not wash into nearby streams and rivers.

Now that has become a whole product line for responsible organic and high-end growers. ARGO supplies the means to boost soil productivity, by actually restoring life. And that means less chemical fertilizers, pesticides and other inputs.

It worked on the island, and now to meet waiting demand, ARGO is ready to grow.

Investors now can be in that special place where a proven, but little-known, winner meets its destiny. The demand is strong and the outlook for Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) is bright.

Organic Farmland Can’t Keep Up With New Demand

Every year, more people insist on organic produce and meats.

This demand is a force that favors Argo Living Soils, because consumers often bend producers to their will.

- Even though genetically modified (GMO) plants are easier to grow, need less fertilizer and pesticides, and yield more, the public wasn’t having it. GMO products are so widely shunned that food companies slap “No GMO’s” on their labels.

- It was consumers who drove the regulators, lawmakers, and entire poultry industry to stop giving chickens antibiotics.

- And now, organic is at the tipping point. The Hartman Group and Food Marketing Institute have found that two-thirds of shoppers buy organic at least sometimes.11

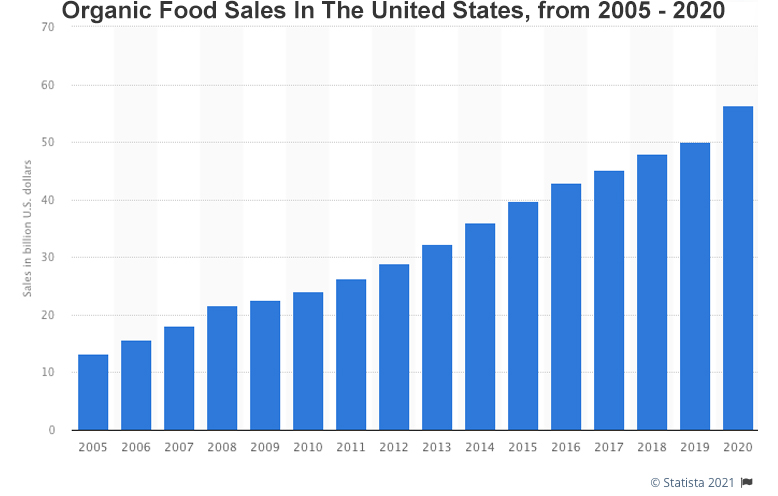

“U.S. organic product sales climbed to 12.4% in 2020, breaking the $60 billion mark for the first time and more than doubling the previous year’s growth, according to the Organic Trade Association (OTA).”

The pace is picking up…

From 2010 to 2016, organic sales rose less than 10% a year. Last year, that growth rate jumped to 14% overall. Some foods, like spices and potatoes, saw greater than 20% increases in organic sales.

But more organic demand is creating a massive supply chain problem.

You see, it’s not a matter of throwing out the inorganic fertilizers and ditching the pesticides when a grower goes organic.

That term is legally protected. To gain the right to use it, a grower must keep records verifying that it hasn’t used inorganic products in at least three years.

Demand is growing faster than growers can convert.

And it’s creating a land supply problem that only Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) is positioned to address in quick manner.

Supply Chain Woes Hit Fertilizer—ARGO Can Help

There’s also a global shortage of organic fertilizers.

Prices for manure have hit new highs in Iowa—the “pig poop” that farmers bought at $10 a ton in 2020 soared to prices running from $40 to $70 in 2021. Supply chain woes.

Biosolids from waste treatment sludges are seeing demand rise to seven times the rate of last year.12 More supply chain woes.

Phosphorus, too, is getting harder to find. Most of it comes from mines in the US, China, and Morocco, but geologists say that those supplies could be completely gone within 50-100 years.

Meanwhile, each year phosphorus miners have to tap into more and more difficult and inaccessible sources.

Clearly the demand for organic-friendly supplements is strong, and ARGO brings a whole new solution to the problem.

Clean Inputs, Unique System

ARGO’s founder used a reverse engineering process to create a growing medium that matches natures most lively and productive soils.

ARGO’s founder used a reverse engineering process to create a growing medium that matches natures most lively and productive soils.

It starts with clean, organic dairy manure, spent grains from brewing operations, and tree byproducts. These materials naturally discourage the growth of bacteria. And it’s a perfect feed for ARGO’s Vermicast reactor…. Where worms break down ingredients.

The system also discourages fungus in a way that helps inoculate plants grown in it. Plants grown in ARGO’s living soil thrive.

They grow faster with less need for fertilizer. Plus, all Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) soil is tested for nutrient contents, lime matter and cation exchange capacity (CEC).

The result… a product perfect for natural, healthy farming that is unlike any other.

Better Soils Create Better Food

Farmers aren’t the only ones suffering from the poverty of our growing soils. It’s a problem hidden in plain sight, right on your dinner table.13

- Since the 1940s, vegetables and fruits have lost 76% of their copper and 59% of their zinc on average.

- A famous study from University of Texas found that 43 different fruits and vegetables had significant declines in protein, calcium, phosphorus, iron, vitamin B2 and vitamin C between 1950 and 1999.

- Kushi Institute found that calcium levels in fresh vegetables dropped 27%, iron fell 37%, vitamin A dropped 21%, and vitamin C was down 30% over the past decades.

And all that time, farmers were dumping fertilizers with these minerals on the ground hoping it would help. It’s a losing battle, because dying soil can’t use the extra minerals efficiently.

ARGO on the Up and Up

In the US and Canada, cannabis farming is most often done indoors and sometimes vertically.

But in other countries, vertical farming is a godsend for the food supply. Sweden, for instance, imports 80% of its food. Most of its arable land is already in use and there’s no more to find. Cities in Sweden are actively encouraging vertical farm operations in their areas.

Until recently vertical farms were hydroponic. But new technologies are exploring soil-based vertical farming.

Soil-based vertical farming is clean, environmentally sound, it eliminates pesticides, and it reduces water. Soil based crops may also have better textures and taste than water-grown ones.

Call it another market made for Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF).

Plant-Based Drugs Need Strong, Clean Soils

The makeup counter at Macy’s might seem a long way from wheat fields and soybean farms, but farming supports the biggest new trend there too.

Botanical ingredients in makeup is in high demand. On top of that, hundreds of botanical-based supplements and raw materials for new medicines depend on clean, organic crops.

Certain ingredients like hydrolyzed soy or wheat proteins are widely used in makeup and skincare because they have excellent anti-aging actions. More and more, consumers are asking companies to be sure these ingredients are from clean, organic sources.

It’s yet another outlet for Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) to show its worth.

Taken All Together, This Is The Right Company at the Right Time

Consider everything you’ve learned about the desperate situation on American farms today.

Take a look at Argo’s website: ArgoLivingsoils.com and see why it’s so proud of the contribution it can make to modern farming.

ARGO’s founder, Chad Diakow, has put 8 years of research and innovation into creating Argo Living soils, perfecting his production system and put his young company in a position to go large.

6 Major Reasons to Invest in Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF) Now

- All Alone in a Big Field. Home gardeners can buy bags of Black Kow or make their own compost, but nobody’s making biologically rich soil amendments at big-farm commercial scale. ARGO is the only company we know of that has developed a biologically active soil-redeeming product aimed and the Big Ag industry.

- The Money’s There. U.S. farmers already spend $11 billion on biological enrichments (like manure) and $42 billion on fertilizers each year. They would be glad to divert some of the constant spending into ARGO products that can actually improve soil and reduce future fertilizer, pesticide, and water costs.

- Organic Demands. The growing organic demand in the US is causing farmers to convert more and more land to organic production. Every time they do, the demand for inorganic fertilizers, soil amendments and pesticides drops… and the demand for viable organic soil amendments goes up.

- ARGO Is A Game Changer. After years of throwing fertilizers on degrading soils, ARGO finally gives large-scale farm operations a way to save the land. Living soils can prevent weak soils from getting worse and even help completely degraded soils regain viability. Fertilizers can’t match that.

- Supply Chain Woes Hits Ag Inputs. For years, pig farming had a problem getting rid of its waste. Now manure is in high demand. So are waste treatment sludges. Even regular fertilizer ingredients like potash are running scarce. Argo Living Soil amendments can add new material to ease supply chain woes, but even better they can reduce future demand.

- This Is the Takeoff Point. Inventor Chad Diakow has proved his products work on real farm operations. Now he’s taken Argo Living Soils public with listings on the Canadian Stock Exchange and OTC exchange in the US. This is where the expansion and ramp-up to full production begins. You can’t get in any earlier… and that’s an especially prized opportunity since the product is already fully developed and known to excel.

Visit the company’s website. Call your broker and get his feedback, too. We think he’ll see the potential in Argo Living Soils (CSE: ARGO | OTCQB: ARLSFCSE: ARGO | OTCQB: ARLSF).

1In Iowa, manure is selling for between $40 to $70 per short ton, up about $10 from a year ago and the highest levels since 2012, according to Daniel Anderson, assistant professor at Iowa State University and a specialist on manure. https://www.bloomberg.com/news/articles/2021-12-09/global-shortage-of-fertilizers-sends-demand-for-dung-soaring

2By calculation: USDA Global Agriculture Biologicals Market Report released Dec. 2021. Market growth 12.82% CAGR to $27.38 billion by 2028 (7 years), back calculates to $11.77 bn in 2021. Or, $10.43 billion in 2020 (aslo from report) + 12.84% = 11.75 in 2021. https://www.globenewswire.com/news-release/2021/12/07/2347163/0/en/Outlook-on-The-Agricultural-Biologicals-Market-to-Reach-USD-27-38-Billion-by-2028-Agricultural-Biologicals-Industry-Share-Demand-Outlook-Business-Opportunities-Revenue-Analysis-Rep.html

3Checked to be sure this was not trademarked for soil treatments. OK. Other live trademarks are for a carwash, heavy equipment, and a NJ landscaping company that supplies mulch, sand, stone, and tile for landscaping.

4https://www.pnas.org/content/118/8/e1922375118

5he extent of soil loss across the US Corn Belt – Evan A. Thaler, Isaac J. Larsen, Qian Yu – Proceedings of the National Academy of Sciences Feb 2021, 118 (8) e1922375118; DOI:

6https://www.bloomberg.com/news/articles/2021-12-09/global-shortage-of-fertilizers-sends-demand-for-dung-soaring data as of Jan 7, 2021

7https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/farming-and-farm-income/

8https://www.careerexplorer.com/careers/farmer/education/

8https://www.careerexplorer.com/careers/farmer/education/

9https://www.pnas.org/content/118/8/e192237511

10https://www.weforum.org/agenda/2020/12/a-tangible-plan-to-restore-soil-health-in-the-next-ten-years/0

11https://www.ers.usda.gov/topics/natural-resources-environment/organic-agriculture/organic-market-summary-and-trends/

12https://www.bloomberg.com/news/articles/2021-12-09/global-shortage-of-fertilizers-sends-demand-for-dung-soaring

13https://www.scientificamerican.com/article/soil-depletion-and-nutrition-loss/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Argo Living Soils Corp. (“ARGO”) and its securities, ARGO has provided the Publisher with a budget of approximately $40,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by ARGO) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company ARGO and has no information concerning share ownership by others of in the profiled company ARGO. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ARGO industry; (b) market opportunity; (c) ARGO business plans and strategies; (d) services that ARGO intends to offer; (e) ARGO milestone projections and targets; (f) ARGO expectations regarding receipt of approval for regulatory applications; (g) ARGO intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ARGO expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ARGO business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ARGO ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ARGO ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ARGO ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ARGO to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ARGO operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ARGO business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ARGO business operations (e) ARGO may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Argo Living Soils Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Argo Living Soils Corp. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Argo Living Soils Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Argo Living Soils Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Argo Living Soils Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Argo Living Soils Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Argo Living Soils Corp. industry; (b) market opportunity; (c) Argo Living Soils Corp. business plans and strategies; (d) services that Argo Living Soils Corp. intends to offer; (e) Argo Living Soils Corp. milestone projections and targets; (f) Argo Living Soils Corp. expectations regarding receipt of approval for regulatory applications; (g) Argo Living Soils Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Argo Living Soils Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Argo Living Soils Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Argo Living Soils Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Argo Living Soils Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Argo Living Soils Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Argo Living Soils Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Argo Living Soils Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Argo Living Soils Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Argo Living Soils Corp. business operations (e) Argo Living Soils Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Argo Living Soils Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Argo Living Soils Corp. or such entities and are not necessarily indicative of future performance of Argo Living Soils Corp. or such entities.