ADVERTORIAL

$2 Trillion Injection Could Electrify Eco-Friendly Stocks

The whole world is turning to electric vehicles. As a result, investors are piling back into lithium stocks like this eco-friendly company, hoping for a repeat of the triple-digit gains of 2016-2017.

If there is one thing investors love as much as cannabis stocks, it’s lithium stocks, we are discussing a new exploration company seeking to capitalize on China’s limitless demand for lithium carbonate.

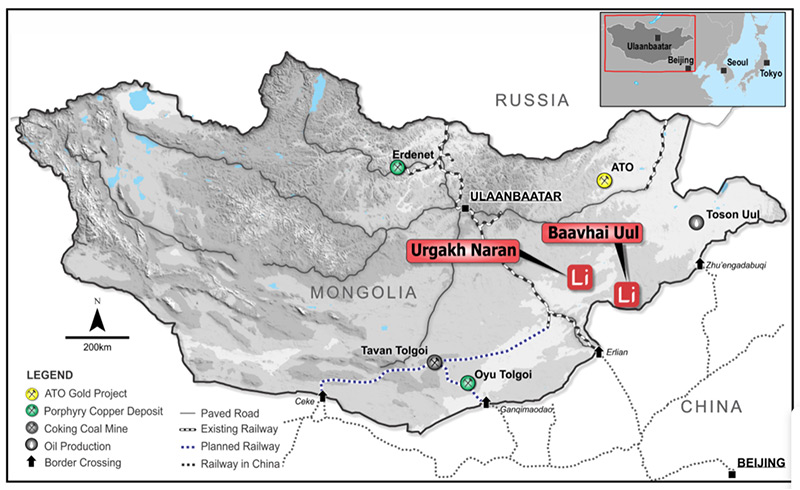

This Eco-friendly energy company’s appeal is obvious: Led by a team of mining industry experts, this company holds a 100% interest in two enormous lithium brine projects in Mongolia totaling 247,000 acres and located just 15 miles from China’s northern border.

The location is crucial. China now manufactures a whopping 70%1 of the lithium batteries needed to power electric vehicles, and its rapidly developing EV market is already three times the size of that of Europe or the United States.

And although China is the world’s second largest2 producer of raw lithium, the impurity levels found in many of China’s lithium sources are too high for them to be used in long-life batteries, such as those used in EVs.

Positioned to Supply the World’s #1 Producer of Lithium-Ion Batteries

This This Eco-friendly companies’ properties in Mongolia are uniquely positioned to supply China’s exploding EV and battery markets – as well as the large tech industries of Korea, Taiwan and Japan.

China’s Red Hot Battery Market Desperate for High-Quality Lithium

Lithium is actually one of the most common elements on earth. A highly reactive alkali metal, it’s an essential component for the batteries used in electric vehicles, both the NMC (nickel manganese cobalt) batteries used in North America and in Europe and the LFP (lithium phosphate) batteries favored in Asia.

With its two enormous lithium brine projects in Mongolia totaling over 247,000 acres, this company could be uniquely positioned to supply the largest EV battery markets in the world: China, Korea, Taiwan and Japan.

Initial tests indicate the largest of the two properties, dubbed Baavhai Uul, contains significant levels of lithium, with an average grade of 426 ppm and a maximum grade of 811 ppm.

What’s more, both properties are made up of lithium-rich brine aquifers (underground rivers) just 20 meters below the surface, a significant advantage in terms of production costs.

Untapped and Unlimited Potential for Mongolian Lithium

Little-known but mineral-rich Mongolia represents a ground-floor opportunity for lithium investors.

Roughly the size of Alaska3, the country is located between China and Russia on China’s northern border.

Mongolia’s position allows it to supply two of the world’s largest countries directly, China and Russia, with its mining industry contributing 20% of the nation’s entire domestic output and up to 90% of its exports.4

The country also has a year-round operating environment with a highly skilled in-country labor force.

And with China now controlling 101 of the world’s 1365 lithium battery manufacturing plants, the Mongolian properties could give this company an unparalleled strategic advantage over lithium exploration companies in Latin America, Australia or the U.S.

Experience Turning Mongolia Mining Startups into HUGE Winners

This Eco-friendly companies’ management team seems uniquely qualified to capitalize on this opportunity.

Their Chief Executive both have more than a dozen years’ experience as mining industry executives with proven track records in the mining development space.

One director serves as an advisor to a large mining company and the other has worked for 30 years for various multinational mining companies and is credited with having discovered several prospective gold, molybdenum and copper deposits in Mongolia.

Hands-On, Insider Knowledge of the Mongolia Mining Sector

The company’s management team knows the Mongolian mining industry from the inside out — with a former Mongolian government official serving as a director — and has a proven track record of taking companies from tiny start-ups to hugely profitable takeover targets.

Do your due diligence. But then consider adding this innovation eco-friendly company to your speculative portfolio.

With China now producing 70% of all the lithium-ion batteries in the world and electric vehicles now being virtually mandated in many countries, China’s need for lithium carbonate can only go up.

And a company such as this energy company, exploring lithium-rich properties just 15 miles from China’s northern border, could end up writing its own ticket.

This is a rapidly developing story that deserves your immediate attention. I urge you to sign up for our newsletter and learn the name of this little-known explorer, before more news comes out, and as lithium prices are finally taking off again.

1https://asia.nikkei.com/Spotlight/The-Big-Story/Battery-wars-Japan-and-South-Korea-battle-China-for-future-of-EVs

2https://www.metalary.com/lithium-price/

3605,000 square miles versus Alaska’s 650,000 square miles. https://en.wikipedia.org/wiki/Mongolia

4Ion Energy Presentation, p. 14, https://www.ionenergy.ca/wp-content/uploads/2021/03/ION_PRESENTATION-March-2021-Final.pdf

5https://www.instituteforenergyresearch.org/renewable/china-dominates-the-global-lithium-battery-market/

Legal Notice: This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any company or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.