The longest economic expansion in history is officially over. Now the cycle turns to gold. Smart investors will too…

3 BEST GOLD STOCKS

That are Dirt Cheap Right Now

-- But Not for Long!

One company offers the best leverage to the rising price of gold. The second is poised to duplicate the success of the 70-bagger it’s adjacent to. The third, GoldHaven Resources (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) could be the best wealth-building opportunity in today’s market.

It’s official.

The U.S. National Bureau of Economic Research (NBER) has ruled:

The longest economic expansion in history is officially over.

On June 8, NBER announced that economic expansion peaked in February 2020, and began its decline into recession.1

Now it’s gold’s turn to fuel investors’ returns.

Because as sure as day follows night, when the economy contracts, the price of gold soars as investors flee to safe havens.

And what is safer than gold?

Nothing, according to the amount being hoarded by central banks. Gold purchases by the world’s central banks is at a 50-year high.2

Even Warren Buffett, a well-known gold naysayer, changed his tune and became a gold yay-sayer this past August, saying he’s worried the economy is topped out.

Gold is the proverbial Play of the Day.

Which is why you’re about to discover the three best ways to ride your way to riches right now, at the dawn of the gold decade.

Because you definitely don’t want to miss out on what could be the top performing asset of at least the next few years.

And you most definitely won’t want to miss out on the top three ways to multiply your returns to potentially many times gold’s. Especially:

-

➢ The #1 wealth-building opportunity in today’s market.

It’s an asset that’s being propelled by a “perfect storm” of powerful forces, including:

- Soaring gold demand by central banks

- Fast-shrinking reserves of untapped gold deposits

- Desperate search for gold by major producers

And especially:

- The unexpected grant of seven potentially multi-million ounce gold mining concessions to a little-known junior gold developer instead of the mega-producers who want them.

You’ll discover all three of these great profit opportunities in a moment. But first, here’s why those who think gold’s recent pullback is signaling the end are wrong.

Instead, this is just the beginning.

“Massive 2020s gold and gold stock bull market is just beginning.”

In February, just as the economic expansion was coming to an end, analysts started sounding their alert.

On Feb. 16, resources analyst Kirk Spano of Fundamental Trends declared that a “massive 2020s gold and gold stock bull market is just beginning.” 3

Three months later, in May, Liechtenstein-based asset management company Incrementum AG made the long-term case for gold in a massive 420-page report titled “The Dawning of a Golden Decade.”

“The question is not whether the gold price will reach new all-time highs,” the report says, “but how high these will be.” 4

If you’re not a dedicated precious metals investor, it might surprise you to know just how long these bulls can last, and how high profits can go.

Research by gold analyst Eric Muschinski, CEO of Phenom Capital Markets shows that:

-

➢ Gold bull markets return an average of about 440% and last about seven years. 5

That holds true for every gold bull market of the last 80 years.

Muschinski’s research also shows that 80% of the gains will occur in the last 20% of a gold bull market’s duration.

That gives you plenty of time to choose your best position for profiting.

From the time the cycle changed in February until gold hit its high six months later in August, gold soared 33%.

Since then gold has taken a breather, and some investors are wondering if they missed the boat.

My answer to you is: “No.” 6

Instead, the pullback gives you the perfect opportunity before gold shoots higher once more in the next leg up.

Especially your opportunity in gold stocks, which benefit from the law of leverage.

What Badiali and other skilled resource investors know is that the law of leverage” is a powerful profit maximizer in the world of resource investing.

True to his reputation as a world-class investor, Warren Buffett wisely used the law of leverage with his recent launch into gold investing.

Savvy investors like Buffett know that “gold” is not the main story, and if you opt for gold bullion or gold ETFs, you’re probably leaving a lot of money on the table. Because:

When gold prices soar, gold mining stocks soar higher

That principle has held true in every gold boom dating back to at least the 1970s.

In fact, a rule of thumb used by gold industry insiders is that a 1% increase in the price of gold leads to a 3% to 10% increase in gold stock returns, according to study from the Centre for Asset Management Research at City University London. 7

In fact, a rule of thumb used by gold industry insiders is that a 1% increase in the price of gold leads to a 3% to 10% increase in gold stock returns, according to study from the Centre for Asset Management Research at City University London. 7

Which is one of the reasons why Warren Buffett invested more than half a billion dollars in top producer Barrick Gold.

But there’s something else you should know about stocks in general and gold stocks in particular.

-

➢ If Warren Buffett had the freedom to choose the gold stocks he really wanted, he would not have bought a major producer.

Buffett famously once said he could earn returns of 50% a year if he could buy small cap companies.

But with his company, Berkshire Hathaway, sporting a market cap of $509 billion, small stocks just wouldn’t move the needle.

And so Buffett can’t take advantage of the second part of the law of gold price leverage, which is that:

-

➢ Gold stocks outperform gold, but junior stocks outperform the gold mining sector

Major mining companies can only grow incrementally, and rising resource prices don’t do much to sway their valuations or stocks.

In fact, during the last precious metals bull market it wasn’t the majors that built the biggest investor fortunes.

It was the juniors.

-

➢ Even small exploration stage miners can see gains of well over 1,000%.8

In that bull market:

Junior miner Ventana Gold soared from $0.12 to $12.00 per share.

Aurelian burst from $0.15 to pre-split highs of $40.00, a gain of 26,566%!

Of course, it doesn’t happen for every junior miner, which is why its crucial to do a real evaluation to show exactly how to identify a first-rate junior gold stock.

And what better stock to evaluate than:

The little-known, up-and-coming junior that beat out industry giants for one of the

“world’s last great gold properties”

If you’re interested in building long-term wealth, real wealth, look no further than the gold junior that is already standing among the giants of the industry:

-

➢ GoldHaven Resources (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH)

From its stellar management team to its shocking selection as the grantee of seven potentially world-class gold projects, GoldHaven is aligned for success.

By relying on the stellar reputation and industry alliances of its management team, the company has been granted control of one of the most highly-sought mining concessions in the world.

Which sets them on a course to potentially become one of the brightest stars in the gold mining universe in a very short time.

It’s the kind of dream setup that can mean real wealth for investors who recognize the potential.

It’s not impossible that a junior mineral resource company could score some of the world’s last remaining underdeveloped gold properties.

But it’s rare, and even more so when those properties sit squarely between and shoulder-to-shoulder with high-value operations owned by two of the world’s biggest gold producers, Gold Fields and Kinross.

And especially since the four projects it nabbed were just about the last high-potential properties left in the region.

-

➢ Yet that is exactly what junior explorer GoldHaven Resources (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH)

has done.

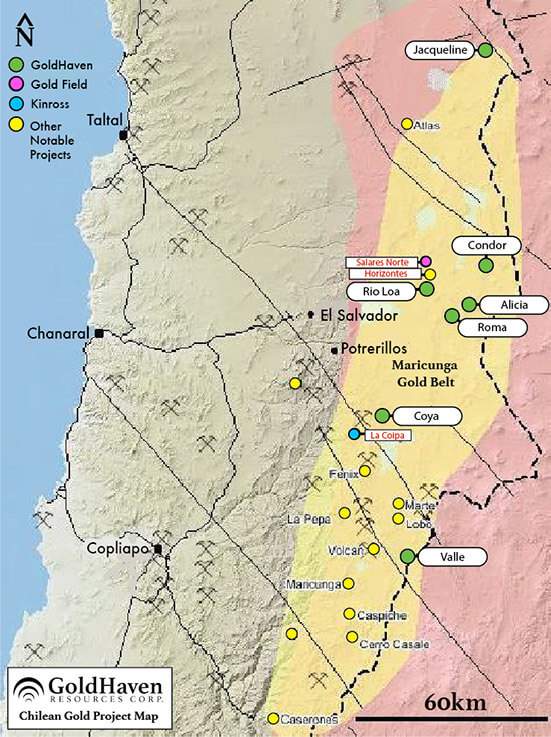

The Canadian company set its sites on the Maricunga Gold Belt of northern Chile, an area that is becoming one of the hottest targets for major producers looking to replenish their rapidly-declining reserves.

Harvard-trained mining geologist and gold industry analyst Byron King calls the Maricunga: 9

-

➢ “One of the world’s largest undeveloped gold districts.”

International Mining calls the Maricunga:10

-

➢ “A veritable monster.”

The resource-rich region has only been the focus of modern mining efforts since about 2017.

In May of that year, gold analyst King announced that “big news just broke in the gold sector.”

A “new gold-bearing mineral district called Maricunga” was starting to see activity, he wrote, “and it’s a game-changer.”

Goldcorp, Kinross, and Barrick all swooped in for a land grab, putting “a world-class level of new gold-silver-copper resource onto the global development table – tens of millions of ounces of gold-silver, and billions of pounds of copper.”

And so within a few short years, nearly every inch of that vast gold-rich land was brought into the reserves of the mega-producers.

All, that is, except what the Chilean government held back for their own.

There were still unexplored deposits left that undoubtedly held vast mineral riches, and Chile’s Economic Development Agency (CORFO) wasn’t going to let them go until they knew what they were worth.

After spending a couple of years mapping and analyzing all of the country’s mineral regions, CORFO identified the areas of utmost potential.

Five stood out as superior to all others.

That GoldHaven Resources (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) was awarded all five is attributable to one overriding quality:

-

➢ Trust.

How it all unfolded is a textbook lesson in the value of reputation and expertise.

Mining authorities know they have an asset worth its weight in gold

CORFO launched its initiative to map the country’s most valuable mineral properties with one ultimate goal in mind:

To boost the already large contribution that mining adds to the country’s GDP.

An army of geologists deployed around the country, including one division that headed north to the rich region of the Maricunga Gold Belt.

An army of geologists deployed around the country, including one division that headed north to the rich region of the Maricunga Gold Belt.

That group identified a whopping 403 potential prospects, and then began the ranking process to determine which ones had the potential to become world-class producing mines.

Their first cut narrowed the field to 57…

…and then to 19…

…and finally, after performing in-depth analysis including geological mapping, rock and soil sampling, and detailed TerraSpec (PIMA) analyses on geochemical grids for alteration mapping…

…their exacting standards resulted in five properties they rated as having world class potential.

-

➢ Properties with the potential to equal the expected production of the enormous operations being developed by Gold Fields, Kinross, Barrick, and other industry giants.

And they weren’t going to hand such valuable assets out to just anyone.

It had to be a company they could trust to see a project through to the end.

A company that had the team that could make it happen and do it within a reasonable timeframe, without endless delays to drum up funding or chase down permits and approvals.

Major mining companies lobbied, of course.

Several of them already owned valuable operations in the Maricunga, and they desperately wanted expansion areas.

These five properties would be ideal.

All five are within spitting distance of major projects owned by Gold Fields, Kinross, Rio2, and Kingsgate, and within the same geologic formation as Barrick.

All five are within spitting distance of major projects owned by Gold Fields, Kinross, Rio2, and Kingsgate, and within the same geologic formation as Barrick.

Enter GoldHaven Resources.

Or, more specifically, GoldHaven Director and VP of Exploration, Patrick Burns.

Intrepid GoldHaven (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) explorer goes way back with Chilean mining authorities

Chile’s Atacama Desert is the driest place on Earth. It also holds the record for longest dry streak, once going 14 and a half years without a drop of rain.

That didn’t stop geologist Patrick Burns from venturing into the vast and empty Atacama in 1979, searching for the mineral wealth that had been cut off from foreign investors since the Allende years.

After two years of grueling work, Burns, along with geologists J.D. Lowell, Francisco Ortiz, and Nivaldo Rojas, made one of history’s greatest mineral discoveries.

The Escondida, 140 kilometers into the Atacama desert and at the heart of the Maricunga Gold Belt, was the largest copper orebody ever discovered.

After their discovery, the geologist Francisco Ortiz later become the Sub-Director of Chile’s Institute of Geological Research, and Nivaldo Rojas to be one of Latin America’s most distinguished mining authorities.

Burns went on to be instrumental in many more discoveries, including the million-ounce San Cristobal gold and silver mine, and the 150 million-pound Sustut copper mine.

So after joining with a few of his fellow gold industry insiders to form GoldHaven Resources, Burns turned his sights back to the Maricunga and his friends within Chile’s mining establishment.

Although it wasn’t a slam dunk for GoldHaven, the company ultimately was given ownership of all five projects.

There was one overriding reason. The organization that held rights to all five properties knew that GoldHaven (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) has all the right stuff:

- ➢ Skills

- ➢ Experience

- ➢ Track record

- ➢ Leadership team

- ➢ Financial resources, and

- ➢ Intimate knowledge of the local legal and permitting processes

In other words, all the qualities necessary to help ensure the successful development of these five valuable mining concessions.

When the acquisition was finalized in April 2020, Patrick Burns and his fellow GoldHaven directors knew they had a winner.

In fact, even after his discovery of the highest-producing copper mine on Earth, the million-ounce San Cristobal mine, and all the other projects he has discovered and developed throughout the Maricunga region, Burns still claims that:

“GoldHaven is the best opportunity that’s come my way in 40 years”

What could cause the discoverer of the world’s largest copper-producing mine say such an astonishing thing?

It’s because he knows a thing or two about gold and where it’s found.

So does GoldHaven director Scott Dunbar, the head of the Institute of Mining Engineering at the University of British Columbia.

Under Dunbar’s leadership, the Institute has achieved the rank of ninth best in the world for mining engineering.11

GoldHaven’s leadership team also includes geophysical engineer and gold mining industry veteran Gordon Ellis, who has a long track record of junior mining company development.

The strength of the team is the accomplishment of GoldHaven President and Director, David Smith, who himself has founded several companies that achieved listing on the TSX before being sold at significant profit to shareholders.

Which is exactly what he keeps the GoldHaven team focused on: building a company that a major gold producer will see as their solution to declining gold reserves.

Declining gold reserves is a key concept in the business decisions of every gold mining company in the world today.

For GoldHaven, it means that major producers will no doubt keep a close eye on how well the company manages development of its seven valuable projects.

Takeovers are one of the fastest ways for both junior miners and their shareholders to strike it rich, and the returns can be staggering.

Major producers are feeling the pain of shrinking reserves, and now with the high price of gold providing them with plenty of cash, they’re on a buying spree.

Peter Grosskoph, CEO of precious metals asset firm Sprott, estimates that shareholders in juniors are now getting an average premium of 30% to 40% from mergers and buyouts.12

It matters a great deal that all seven of GoldHaven’s Maricunga projects are just a stone’s throw from other massive deposits and discoveries.

GoldHaven (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) properties are geologically identical to nearby multi-million ounce deposits

The projects awarded to GoldHaven include the Rio Loa, the Coya, the Alicia, the Roma, the Jacqueline, the Valle, and the Condor.

All are situated squarely at the heart of the Maricunga Gold Belt, and all are within geological formations identical to those of nearby million-ounce deposits.

- The Coya project is located 16 km northeast of the 6.2 million ounce gold La Coipa, owned by Kinross.

- The Rio Loa project is 25 km south of Gold Field’s five million ounce gold Salares Norte discovery.

- The Alicia project is 30 km southeast from Gold Field’s Salares Norte.

- The Roma project is 33 km southeast of Salares Norte.

- The Jacqueline, Condor, and Valle projects are also close to producing mines.

You can see the GoldHaven projects’ proximity to other major operations on the map above. Goldhaven’s properties are named within the white oblong-shaped callouts.

Drill-ready and ready to go

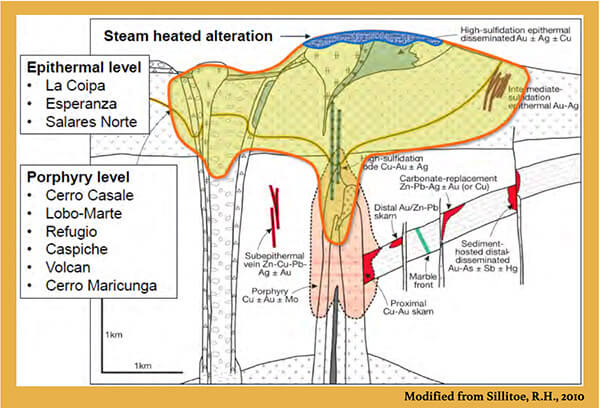

Initial rock geochemical studies on GoldHaven’s Rio Loa project have discovered highly anomalous arsenic and lead values, a key characteristic of potential gold mineralization.

Results of geophysical surveys at Rio Loa are comparable to those seen at neighboring mines such as the Gold Fields Salares Norte deposit, which has reported more than five million ounces in estimated gold reserves with AISC (all-in sustainable costs) estimated at $552 per ounce.

Location is also a key component for GoldHaven’s Coya project, which is situated within close proximity to one of the richest and largest epithermal gold and silver districts in Chile.

The La Coipa property, an active mining site owned and operated by Kinross, is in close proximity, and its production of more than 6.2 million ounces of gold to date bodes well for Coya.

Geochemical rock sampling at Coya revealed favorable gold and silver values, in some cases ranking as high as 764 grams/tonne of gold and 719 grams/tonne of silver.

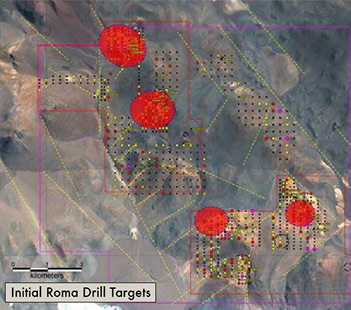

Both the Alicia and Roma projects are also near drill ready.

Both properties are located in an area just southeast of the Gold Fields Salares Norte deposit, and both projects have undergone preliminary geological mapping and geochemical sampling with more than a thousand soil and rock samples collected and analyzed with promising results.

Both properties are located in an area just southeast of the Gold Fields Salares Norte deposit, and both projects have undergone preliminary geological mapping and geochemical sampling with more than a thousand soil and rock samples collected and analyzed with promising results.

Encouraged by the due diligence exploration results received to date on the Maricunga projects, GoldHaven is working to identify specific drill targets on these properties within the next few months

While no drilling has been carried out on any of the Maricunga projects, the company plans to begin drilling as early as next year.

Playing a key role in GoldHaven’s ability to acquire these projects and begin operations so quickly is the company’s solid management team, which has decades of experience in the mining industry and has developed invaluable relationships and contacts within Chile, including both government and the private sector.

GoldHaven (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) management team is focused squarely on rapid project development

GoldHaven president and director David Smith has co-founded two successful environment-related companies that traded on the TSX; both companies were sold, providing a significant profit to shareholders.

Smith has been immersed in the mining industry for the last eight years, working in corporate development and finance.

Patrick Burns, VP of exploration and a director, is an exploration geologist. Burns was educated at the University of British Columbia and has spent over 40 years in Chile and Argentina. He speaks fluent Spanish and is essentially a fixture in the mining industry in Chile.

He was directly involved in the discovery of the Escondida porphyry copper deposit in Chile, currently the world’s largest copper mine, and the San Cristobal gold mine, also located in Chile. Burns has been involved in publicly traded mining companies in Chile for 35 years.

GoldHaven director Gordon Ellis has more than 50 years of expertise in the mining industry as a professional engineer.

Ellis holds an MBA in international finance and numerous senior positions in the mining industry; he is presently a director of a multibillion-dollar ETF.

Scott Dunbar, also a GoldHaven director, is a professor and the department head of Mining at the University of British Columbia.

Dunbar has been involved in mining exploration, geotechnical engineering and mine design projects around the world.

The unique combination of government support and seasoned management experience is a distinctive advantage in setting GoldHaven apart from others maneuvering for position in the gold mining space.

GoldHaven Resources (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH) could be a great way for investors to build wealth as the company moves through its development stages.

Since ATUMF started trading on the OTC on June 9, 2020, the stock shot up 157% to $0.39 by early August, and now trades in the range of $0.30 to $0.35.

Alert readers will recall that there are two other gold stocks worthy of your consideration.

If you want to invest like Warren Buffett, take a look at one of the gold mining industry’s top producers.

It’s not Barrick, though. Most of the large producers are still expensive, even after the recent gold price correction.

But there’s one major that is dirt-cheap today despite leading the industry in earnings growth.

Yamana Gold (AUY) is on fire

There aren’t many companies that treat their shareholders better than Yamana. They like to spread the love, and they’re doing it in spades right now.

The company’s dividend was already among the highest in the industry, but with earnings growth on fire at a massive expected 2020 EPS growth rate of 123%, Yamana has bumped its dividend four times in the past year.

Yamana is a sterling testament to the power of leadership, a quality you’ll see surface again in the third and most interesting stock in this report.

Yamana knocked around the mining space for 10 years or so until Peter Marrone knocked on the door in 2003.

Marrone was a Toronto investment banker, and he decided there was opportunity in the mining sector, so he bought Yamana for $18 million.

Today Yamana is the 14th largest mining company in the world, with a $3.3 billion market cap.

Between Marrone’s 2003 purchase of the company and today, Yamana has made more than six profitable junior miner acquisitions, including the enormous El Penon, one of the largest gold mines in the world, located in the mineral-rich Maricunga Gold Belt of Chile.

Today Yamana has five producing assets and a production platform of one million gold equivalent ounces.

The company recently reported yet another quarter of free cash flow generation, making it now five quarters in a row.

Which means there’s probably not a better mining company out there that is better position to take advantage of soaring gold prices now and in the future.

If you’re more comfortable with the kind of solid but conservative companies that Warren Buffett invests in, Yamana is a great buy right now, trading at a comparatively cheap 13.1 times earnings.

Which brings us to the third dirt cheap gold stock you’ll want to take a look at.

Starr Peak Exploration (STRPF) is at the gate and ready to run

If you haven’t heard of Amex Explorations (AMXEF), you’re probably not in the tiny group of investors that scored a 70-bagger in the last two years.

On a good day, AMXEF trades 100,000 shares.

Even after the stock started to rise consistently throughout 2019, daily trading volume seldom peaked over 30,000 shares.

Then the economy stopped expanding, gold took its turn, investors starting scanning the gold stocks, and a lucky few landed on Amex Explorations.

But Amex isn’t the star of this story. Starr Peak Exploration (OTC: STRPF) is.

Starr Peak has staked its claim of a property that is just a hairsbreadth away, literally only one kilometer from the land where Amex made a world-class gold discovery.

Now the company is lining up to duplicate the major success Amex has enjoyed.

Starr Peak is getting ready to drill. Even the founders of Amex believe Starr Peak is going to hit very rich pay dirt, and so they jumped in right away as shareholders.

Starr Peak is one of those rare juniors that’s fully funded for an ambitious drill campaign.

That means no endless waiting while management runs around drumming up cash to start the engines.

All this is happening in Quebec, one of the richest mining venues in one of the most mining-friendly jurisdictions on the planet.

After the stunning stock gains achieved by Amex, Starr Peak could likely see significant stock gains just from riding Amex’s coattails.

But Starr Peak is more than that. The company has solid potential for a major discovery within a short timeframe.

All of which makes STRPF a good stock to consider for rapid and significant gains.

Don’t let the gold bull market pass you by

Remember:

- ➢ The average gold bull market returns 440% and lasts seven years.

- ➢ Gold mining stocks historically show higher returns than gold.

- ➢ Junior mining stocks historically outperform the larger gold mining sector.

- ➢ For investors who prefer to “buy like Buffett,” take a look at Yamana Gold (AUY)

- ➢ For investors willing to take on high risk for the potential of high reward, consider Starr Peak Exploration (STRPF).

- ➢ For building real wealth, there might not be a better potential for investors today than GoldHaven Resources (OTC: ATUMF, CSE: GOHOTC: ATUMF, CSE: GOH)

And of course, always remember to do your own due diligence before investing in any stock.

1https://www.nber.org/cycles/june2020.html

2https://www.kitco.com/commentaries/2019-12-09/Swot-analysis-50-year-high-in-central-bank-gold-purchases.html

3https://seekingalpha.com/article/4324632-massive-2020s-gold-and-gold-stock-bull-market-is-just-beginning

4https://ingoldwetrust.report/wp-content/uploads/2020/05/In-Gold-We-Trust-report-2020-Extended-Version-english.pdf

5hhttps://www.pinnacledigest.com/featured-post/gold-mining-bull-market-half-over/

6https://stocknews.com/news/gld-gold-nem-golds-bull-market-still-has-a-long-run-ahead-of/

7https://www.cass.city.ac.uk/__data/assets/pdf_file/0005/69935/Gold-Stocks,-the-Gold-Price-and-Market-Timing.pdf

8https://cabotwealth.com/daily/growth-stocks/best-performing-silver-stocks-buy-now/

9https://www.bullionvault.com/gold-news/gold-mining-050220173

10https://im-mining.com/2010/05/28/gold-in-latin-america-six-juniors-amass-100-moz-plus-resources/

11https://www.topuniversities.com/university-rankings/university-subject-rankings/2020/engineering-mineral-mining

12https://sprott.com/insights/video-sprott-ceo-says-junior-gold-miners-are-set-for-major-acquisitions-next-year/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling GoldHaven Resources Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.