3 Stocks Set to Lead the

New “Cloud Economy”

Stocks like Zoom, Slack, and TelaDoc led the lockdown. Now a whole new group is fueling the recovery.

From remote threat detection…to hybrid data security…and a fast-growing cloud-based video software platform that could give Adobe a run for the money…these microcaps are poised to prosper in the new cloud economy.

Cloud stocks are “one of the only durable growth markets out there right now.”

– RBC Capital Markets

What it means for investors

If the old world seems long ago, in a different life, that’s because it was.

Since March, we’ve seen a massive, society-wide migration to remote everything.

From work and school to shopping and socializing, “remote” is the new normal.

Futurists have been predicting these changes for years. But the coronavirus compressed a decade’s worth of change into these few months.

Or, as tech productivity expert Erik Brynjolfsson, director of Stanford University’s Digital Economy Lab, put it:

“We’re compressing 10 years of structural change into 10 weeks.” 1

And there’s no going back. Our economy and society have been permanently reshaped.

One of the most remarkable changes is being played out in the stock market.

Because if business is forever changed, those changes are magnified in stock performance.

Finding the new Zoom, Teladoc, or DocuSign

Forward-thinking investors are already pivoting. They’re reconfiguring their portfolios for the new normal.

Quick-thinking investors have already made a lot of money from pandemic-related stocks.

Especially in the stocks companies in the one sector that, more than any other, has driven the change to a remote economy.

Year-to-date, investors in this sector have reaped stock gains like these:

- 766% in teleconferencing leader Zoom Video (ZM)

- 555% in cloud-based infrastructure as a service platform Fastly (FGSLY)

- 253% in cloud-based software as a service documentation platform DocuSign (DOCU)

- 220% in digital payment solutions provider Square (SQ)

- 209% in virtual healthcare provider Teladoc Health (TDOC)

These are all solid companies, and they will continue to grow in the new economy.

But with investors piling in and driving up valuations, none are a bargain now.

Instead, investors are now on the hunt for the companies that will lead us out of the pandemic and into the future.

More than any other, these are the companies that develop cloud-based technologies.

It’s hard to overstate the impact of cloud computing.

Global business research firm Gartner issued its analysis showing that: 2

“Cloud computing is one of the most disruptive technological forces since the early days of the digital age”

“Cloud computing,” says Gartner, “is firmly established as the new normal.” 3

It is so vital to the global economy, in fact, that in their 2020 State of the Cloud report, multi-billion dollar venture capital firm Bessemer Venture Partners proclaims that:

“The cloud is becoming as fundamental to how the world runs as the electric grid, telecom network, or the railroad.” 4

The transformation is happening so fast that $175 billion IT leader Cisco predicts:

Within the next year, 94% of all internet-enabled work will take place in the cloud. 5

Today, around 60% of workloads are cloud-based, which reflects how incredibly fast cloud adaptation is happening. 6

And that means there is tremendous opportunity for investors who find the right stocks.

Tech investing advisory Lombardi Financial advises investors to get in now, saying:

“The cloud is having a massive impact on virtually every sector and industry on the planet. And it’s just getting started.”

“The cloud” refers to servers that are accessed over the internet, and the software and databases that the servers run.

Cloud computing allows businesses to operate more efficiently, including eliminating the need for expensive hardware and software, and enabling employees to work from anywhere.

Twenty years ago even tech leaders like Oracle founder Larry Ellison and Microsoft exec Steve Ballmer were skeptical of “the cloud.”

Many investors thought it was a fad that would soon pass. They were very, very wrong!

Cloud stocks are up more than 800%

Just 10 years ago, the entire market capitalization of the cloud industry was under $40 billion.

By February 2020, the cloud’s market cap had reached and then soared above a massive $1 trillion.7

And it’s still growing at a whopping 35% CAGR!

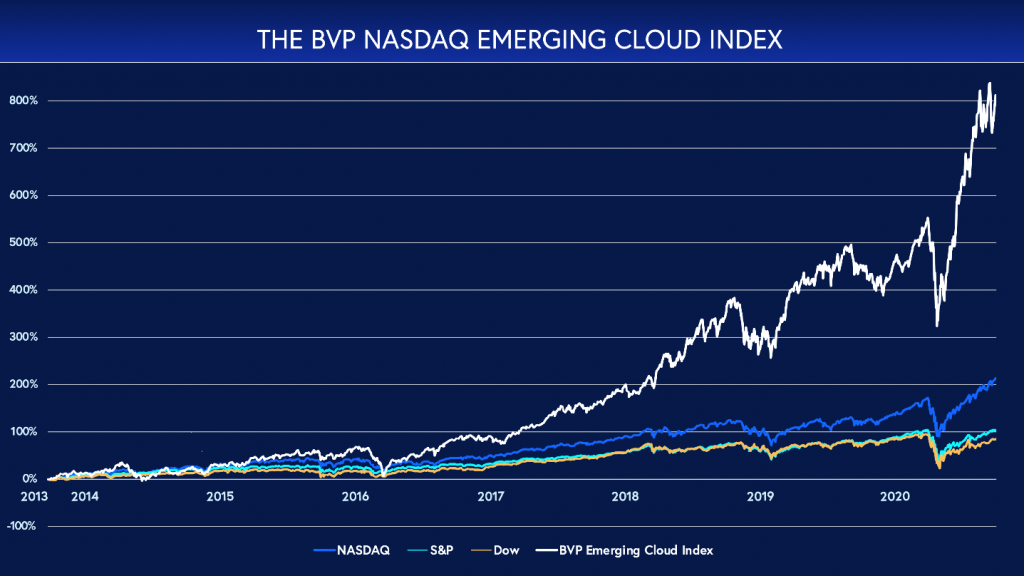

You can see the phenomenal growth of the cloud industry in the chart below.

The BVP Nasdaq Emerging Cloud Index has soared more than 800% since its inception back in 2013.8

That’s more than four times better than the Nasdaq, and eight times better than either the S&P 500 or the Dow.

What’s more, the cloud’s outperformance became even more pronounced once the pandemic was declared in mid-March.

As you can see in the chart below, the best performing broad index, Nasdaq, has gained 54.10% since the March crash (as of this writing).

EMDEX, though, has soared 72.91% in the same period, a whole 35% greater returns than Nasdaq.

Cloud computing is what enabled the colossal growth of Amazon, Netflix, Adobe, Apple, Alphabet (Google), and Microsoft.

Now, with the pandemic, stocks like Zoom, Fastly, DocuSign, Square, Teladoc, and other niche cloud platform companies have given investors eye-popping gains.

But they are just the beginning.

Scores of emerging cloud stocks that investors have not discovered yet

And they’re going to give investors some of the best stock returns in a generation.

Right now, more than 140 cloud companies have market caps of over $1 billion.

And there are are also more than 57,000 medium, small and microcap software companies nipping at their heels.9

The vast majority of the heel-nippers are likely already offering cloud-based products, or soon will be. And nearly all of them are still relatively unknown to investors.

So which of the undiscovered could give investors Zoom or Fastly style returns?

The answer is clear once you see where the cloud revolution is headed.

The evolving cloud economy is beginning to turn from one-size-fits all platforms to niche platforms built to serve specific needs or even specific market segments.

Companies like NIC Inc that allows governments to provide a higher level of service in, for example, renewing vehicle registrations or purchasing national park tickets.

Or DigitalOcean, which gives small-scale web developers the programming interface tools they need to configure and deploy their products.

Or Adobe, a tech giant that is a textbook cloud success story.

Finding the next Adobe (189% CAGR stock gains since 2013)

Adobe made its name in creative software development and licensing.

Designers, ad agencies, and graphic artists could buy Adobe software either online or in a retail store. As new versions of the programs were released, Adobe would provide free updates.

From 2000 through early 2013, investors pocketed returns averaging of about 30% per year on ADBE.

Then, in 2013 Adobe made a momentous decision.

The company transitioned to a completely cloud-based, software-as-a-service (SaaS) business model.

That decision paid off in a big way. From 2006 until 2013 Adobe stock traded at around the $40.00 range.

When Adobe launched its cloud-based subscription model, the company and the stock took off and never looked back.

From the $40.00 range in 2013, ADBE soared to over $500. That’s an average of 164% per year for seven straight years!

Now another company is following the Adobe blueprint.It’s one of the three up-and-coming niche cloud platform developers that you will discover in this report.

Now another company is following the Adobe blueprint.It’s one of the three up-and-coming niche cloud platform developers that you will discover in this report.

And it’s a company that is operating at the convergence of two of the biggest tech growth stories of this era.

Moovly Media (OTC: MVVYF, TSXV: MVY) soars atop the cloud computing and digital video revolutions

The days of text and static images are going the way of analog television.

The digital video market is growing so fast that by 2022, just a little more than a year from now, 82% of all internet traffic will be video, according to forecasts from Cisco.

It might surprise you to know that the all-video platform YouTube is now the second largest search engine in the world, which is a powerful reminder of video’s market dominance.10

The supersonic growth of online video has not escaped the notice of marketers looking for the most effective way to reach their audience.

Even the venerable 86-year old marketing institution Randall & Reilly gushes that “video is taking over the world.”11

Which is exactly what Moovly founder, Harvard alumni, and former Antarctica research scientist Brendon Grunewald saw would happen way back in 2010.

Grunewald has a long history in tech venture capital funding and startup management, having served as head of E6Ventures and managing director of VC fund Praefidi.

As co-founder and CEO of Belgium-based Sinfilo, Grunewald built that company into the largest wireless LAN operator in Europe before selling to Telenet, part of the $15.77 billion Liberty SiriumXM Group.

In 2010, Grunewald was executive director of digital content firm Instruxion. That position gave him a birds-eye view of just how fast video was taking over the internet.

The future, he saw, was digital. And the future of digital was video.

From his time with Instruxion, Grunewald had learned just how expensive it was for companies to hire video production firms for content development.

Too expensive, in fact, to serve the needs of the vast majority of the companies that could benefit from video in countless ways.

There was a gap in the market.

A gap he was determined to fill.

Like $224 billion multimedia software giant Adobe…but for the masses

Moovly Media (OTC: MVVYF, TSXV: MVY) is democratizing video content development.

The company is applying the Adobe business model to the rapidly expanding video communications market.

But instead of catering to design professionals, as Adobe does, Moovly is bringing the tools of video pros to the masses.

Adobe is the undisputed leader in creative software. Worldwide, it is the number one choice of design pros.

But its programs are notoriously hard to master, which is why it isn’t used much outside of professional designers.

That’s good for keeping design pros in business, but bad for everyone else.

Grunewald and his Moovly team ingenuously developed an easy, intuitive, “drag-and-drop” video-editing platform that puts professional-quality video creation in the hands of any non-pro.

So that anyone, anywhere, of any skill level, who wants to put together any kind of video, for any purpose they can dream up, can do exactly that.

As video increasingly controls media and communications, there is increasing need for the video production market to break free from the expensive gatekeepers who have controlled it.

In the old economy, companies relied on video production studios to create slick videos for TV commercials, sales promotions, training materials, and corporate communications.

The cost of professionally produced videos still runs from as little as a few thousand dollars to well over a million. (The most expensive commercial ever made cost a jaw-dropping $33 million to produce for client Chanel No. 5.)

But even a few thousand dollars is a lot to pay for many of the 30.7 million small business owners that make up 99.9% of all businesses in the US.12

And even multi-billion dollar corporations have plenty of video needs that don’t require slick (aka expensive) production values.

Not to mention to countless young adults who are driving the success of short-form video and social media platforms like Vimeo, Facebook, Tik-Tok, Instagram, Twitter, Snapchat, and more and more seemingly every day.

All of them are finding countless new opportunities to reach their audiences through digital video.

And those opportunities are being poorly served.

There are few choices between the lavish expense of professionally produced commercials and the poor choice of shooting a video with your smartphone and slapping it online.

Moovly Media (OTC: MVVYF, TSXV: MVY): Filling a critical gap in the soaring digital video market

Now there’s a solution to fill that gap for all of them: small businesses, corporate giants, and just plain people.

Moovly is the Adobe of “drag and drop” video production.

From corporate in-house marketing departments and small business owners to educators, students, and social media influencers, more than three million users rely on Moovly software, and more are joining every day.

Moovly Media is putting control of video communications back into the hands of companies and people.

Moovly Media is putting control of video communications back into the hands of companies and people.

Moovly’s simple and intuitive cloud-based digital video editing platform allows anyone to produce professional-looking video in minutes.

Promotional videos, product videos, how-to videos, breaking news videos, educational videos, training videos, exercise videos, and every other kind of video you can think up.

If there’s a message that needs to be communicated, today’s audiences prefer to discover it through video.

And in nearly any case, that message can be brought to life on Moovly Media’s cloud-based video maker platform.

Disney, Procter & Gamble, IBM all use Moovly

Moovly serves more than three million users, including from more than 300 of the Fortune 500 companies as well as many government agencies.

Google, Bloomberg, IBM, KPMG, Procter & Gamble, Disney, and Oracle are just a few of the companies that have found that creating video communications is faster, easier, and cheaper than any other way.

Moovly sees its primary market as large corporations that need more effective ways to connect with customers or within the company itself.

Since the pandemic, Moovly has also seen tremendous growth from schools, students, and companies that are now forced to reach out to potential customers remotely.

While there are other programs that claim to do the same, Moovly is the first that delivers.

Moovly (OTC: MVVYF, TSXV: MVY) is rated #1

A hodgepodge of video makers has popped up lately. So many, in fact, that it has become a maze of confusion for anyone looking to choose which service to use.

But fortunately, tech experts have come to the rescue with detailed reviews to help consumers choose.

Which means the internet contains numerous professional reviews of the Moovly platform.

The common thread in nearly every one is that Moovly is one of the best and easiest video production platforms on the market.

- Leading tech portal TechGenyz, with a reach of over one million readers, names Moovly as “one of the best online video making solutions available.”

- Cristian Stanciu, CEO of Veedyou Media, says “there is no friendlier tool than Moovly,” and concludes his in-depth review saying “Moovly’s online video editor is the perfect and convenient tool you should consider using in your video projects today.”

- Tech trends website TechStorify rates Moovly first out of 12 video production services they reviewed.

- Tech tool analyst CrozDesk gave Moovly 4.5 out of 5 stars, among the highest of 74 reviewed.

Moovly’s big advantage, though, the one that keeps them head and shoulders ahead of the competition, is the platform’s ability to give users more options to create something totally unique to them.

Customization and personalization are what set Moovly (OTC: MVVYF, TSXV: MVY) apart

There is no question that personalization and the creation of focused, targeted content is the future of video.

That means a video targeted to a mass audience is going to have less and less value.

Customers want videos that are created and delivered to meet the needs of a very specific audience, wherever and whenever they are.

The Moovly platform helps users create professional looking video in minutes, using a simple and very versatile tool with an intuitive and straightforward user interface.

Users can either use a template or start from scratch, with the option to add any of the millions of royalty-free images or video clips available.

CEO Brendon Grunewald says it best, though:

“If you are someone who just wants to make a quick social media video, you can do that within seconds using our templates.

“If you are an experienced videographer then you can use some of our advanced features like green screening, screen recordings, and automated subtitling.

“Then there’s our automator. Many companies want to make vast volume of content using programs or spreadsheets where they import data to mass personalize and customize videos.

“And of course, we have an exceptionally good price offering which makes us very competitive in the market in terms of value for money.”

For all those reasons, Gruneweld can confidently claim:

“We have successfully integrated advanced features that anyone can use, from large corporations, to educators, to social media influencers, to every day users looking to produce a customized video quickly and easily for whatever their needs are.

For the corporations who want to set themselves apart we are becoming the product of choice. In every head to head competition we win because the core essence of what we have is flexibility. That’s what companies want.”

But Moovly Media also has another compelling benefit.

They are the only pure play video production platform stock

The only other public company that operates at the junction of the massive cloud computing and digital video revolutions is Adobe.

And Adobe is not a pure play. In fact, video editing and production is a small (though growing) segment of their suite of design products.

Moovly (OTC: MVVYF, TSXV: MVY) is the only stock that will get you the joint power of niche cloud platform technology and digital video content creation.

Consider whether Moovly is the right investment for you, as it has been for a growing number of investors who have recognized the company’s potential.

MVVYF is up 79% since the March crash. But the stock has enormous growth potential.

Converge Technology Solutions (CTSDF): Best hybrid cloud play today

Converge Technology Solutions isn’t on many investors’ radar.

But that didn’t stop tech giant Dell from awarding Converge its highest partnership tier in October, following similar partnerships with Microsoft, Amazon, IBM, and VMware.

Converge Technologies is a developer of hybrid IT solutions that enable companies to operate both cloud and enterprise technologies.

The company has made 12 acquisitions since late 2017 to the end of building a national platform of regionally focused hybrid IT solution providers (ITSP).

Converge has risen to become IBM’s second largest reseller partner in North America, and ranks in the top 3% of Cisco partners.

Recently, the print and online issues of MicroCap Review magazine wrote that “we believe the best microcap way to play the Hybrid Cloud trade in the small-to-medium enterprise (SME) market is through Converge Technology Solutions.” 17

CTSDF is currently up 288% since the March crash. But the stock is worth keeping an eye on, with consideration to buy on any significant dip.

The third cloud economy stock is one of the global leaders in lone-worker safety monitoring and communication.

Blackline Safety (BLKLF): Digitally transforming how companies keep their employees safe

Blackline Safety develops connected safety technology and award-winning wearable safety devices.

Twelve years ago, Blackline created the industry’s first industrial-focused safety wearable for lone worker monitoring.

In 2017, the company transformed the gas detection industry with their introduction of the first comprehensive safety wearable.

Called the G7, that device made worker safety monitoring more affordable more automated than previous technologies.

Blackline operates its platforms through Amazon Web Services cloud hosting, providing uninterrupted connectivity to the company’s customers.

Canaccord Genuity analyst Doug Taylor wrote recently that Blackline is expected to “deliver outsized revenue growth in the near and medium term, with a growing base of recurring services revenue.”

Taylor put a price target of $7.50 on BLKLF, about 50% higher than where it trades today.

Today’s best opportunity for big profits in the new cloud economy

The stock market recovered its losses thanks to quick action by the Federal Reserve.

But a second wave this winter could send markets spiraling down again.

Advisors are generally agreed that investors should not panic, but stay the course.

And to give a bump to your returns, consider investing in a handful of stocks that could do well in the remote work cloud economy, including Moovly Media (OTC: MVVYF, TSXV: MVY), Converge Technology Solutions (CTSDF), and Blackline Safety (BLKLF).

And always remember to do your own due diligence before buying any stock.

1 https://mitsloan.mit.edu/ideas-made-to-matter/what-happens-to-industry-and-employment-after-covid-19

2 https://www.gartner.com/smarterwithgartner/cloud-shift-impacts-all-it-markets/

3 https://www.gartner.com/smarterwithgartner/4-trends-impacting-cloud-adoption-in-2020/

4 https://www.bvp.com/atlas/state-of-the-cloud-2020/

5 https://www.networkworld.com/article/3253113/cisco-says-almost-all-workloads-will-be-cloud-based-within-3-years.html

6 https://451research.com/blog/764-enterprise-it-executives-expect-60-of-workloads-will-run-in-the-cloud-by-2018

7 https://www.bvp.com/cloud100/the-cloud-industry-update-for-2020#:~:text=But%20you%20know%20that%20the,all%20of%20technology%20right%20now

8 https://www.bvp.com/bvp-nasdaq-emerging-cloud-index

9 https://www.marketwatch.com/story/moats-will-make-all-the-difference-for-cloud-companies-as-tech-costs-come-under-pressure-2020-07-08

10 https://wpforms.com/the-ultimate-list-of-online-business-statistics/

11 https://www.randallreilly.com/statistical-proof-that-video-is-taking-over-the-world/

12 https://www.oberlo.com/blog/small-business-statistics

13 https://www.techgenyz.com/2020/06/13/moovly-review-2020-easy-to-use-video-editor-for-business/

14 https://www.veedyou.com/

15 https://techstorify.com/online-video-maker/

16 https://crozdesk.com/design-multimedia/video-editing-3d-software

17 https://stocknewsnow.com/microcapreview-issue.php?id=471953490

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Moovly Media Inc.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.