ADVERTISEMENT

3 Stocks Set to Lead the Cloud Revolution

From remote threat detection…to hybrid data security…and a fast-growing cloud-based video software platform these microcaps are poised to prosper in the cloud economy.

Cloud stocks are “one of the only durable growth markets out there right now.” – RBC Capital Markets

What it means for investors

“Cloud computing is one of the most disruptive technological forces since the early days of the digital age”

It is so vital to the global economy, in fact, that in their 2020 State of the Cloud report, multi-billion dollar venture capital firm Bessemer Venture Partners proclaims that:

“The cloud is becoming as fundamental to how the world runs as the electric grid, telecom network, or the railroad.”

Today, around 60% of workloads are cloud-based, which reflects how incredibly fast cloud adaptation is happening.

And that means there is tremendous opportunity for investors who find the right stocks.

Tech investing advisory Lombardi Financial advises investors to get in now, saying:

“The cloud is having a massive impact on virtually every sector and industry on the planet. And it’s just getting started.”

“The cloud” refers to servers that are accessed over the internet, and the software and databases that the servers run.

Cloud computing allows businesses to operate more efficiently, including eliminating the need for expensive hardware and software, and enabling employees to work from anywhere.

Twenty years ago even tech leaders were skeptical of “the cloud.”

Many investors thought it was a fad that would soon pass. They were very, very wrong!

Cloud stocks are up more than 800%

Just 10 years ago, the entire market capitalization of the cloud industry was under $40 billion.

By February 2020, the cloud’s market cap had reached and then soared above a massive $1 trillion.

And it’s still growing at a whopping 35% CAGR!

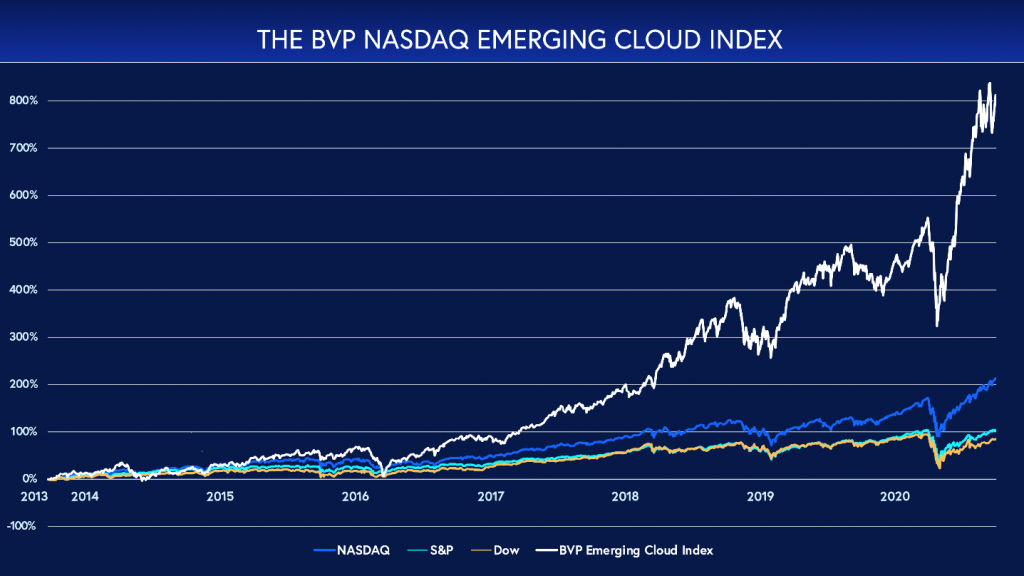

You can see the phenomenal growth of the cloud industry in the chart below.

The BVP Nasdaq Emerging Cloud Index has soared more than 800% since its inception back in 2013. That’s more than four times better than the Nasdaq, and eight times better than either the S&P 500 or the Dow.

What’s more, the cloud’s outperformance became even more pronounced in mid-March.

As you can see in the chart below, the best performing broad index, Nasdaq, has gained 54.10% since March (as of this writing).

EMDEX, though, has soared 72.91% in the same period, a whole 35% greater returns than Nasdaq.

Scores of emerging cloud stocks that investors have not discovered yet

The evolving cloud economy is beginning to turn from one-size-fits all platforms to niche platforms built to serve specific needs or even specific market segments.

Right now, more than 140 cloud companies have market caps of over $1 billion.

And there are are also more than 57,000 medium, small and microcap software companies nipping at their heels.

The vast majority of the heel-nippers are likely already offering cloud-based products, or soon will be. And nearly all of them are still relatively unknown to investors.

So which of the undiscovered could follow this type of pattern?

The answer is clear once you see where the cloud revolution is headed. The days of text and static images are going the way of analog television.

The digital video market is growing so fast that by 2022, just a little more than a year from now, 82% of all internet traffic will be video, according to forecasts from Cisco.

Even the venerable 86-year old marketing institution Randall & Reilly gushes that “video is taking over the world.”

Which is exactly what the founder of one little-known company became well aware of back in 2010. The future, he saw, was digital. And the future of digital was video.

But it was one key fact that really caught his attention – he had learned just how expensive it was for companies to hire video production firms for content development.

Too expensive, in fact, to serve the needs of the vast majority of the companies that could benefit from video in countless ways.

There was a gap in the market.

A gap he was determined to fill.

Professional multimedia software… But for the masses

Instead of catering to design professionals, this company is bringing the tools of video pros to the masses.

As video increasingly controls media and communications, there is increasing need for the video production market to break free from the expensive gatekeepers who have controlled it.

In the old economy, companies relied on video production studios to create slick videos for TV commercials, sales promotions, training materials, and corporate communications.

The cost of professionally produced videos still runs from as little as a few thousand dollars to well over a million. (The most expensive commercial ever made cost a jaw-dropping $33 million to produce for client Chanel No. 5.)

But even a few thousand dollars is a lot to pay for many of the 30.7 million small business owners that make up 99.9% of all businesses in the US.

And even multi-billion dollar corporations have plenty of video needs that don’t require slick (aka expensive) production values.

This company has ingenuously developed an easy, intuitive, “drag-and-drop” video-editing platform that puts professional-quality video creation in the hands of any non-pro.

So that anyone, anywhere, of any skill level, who wants to put together any kind of video, for any purpose they can dream up, can do exactly that.

And already this company serves more than three million users, including from more than 300 of the Fortune 500 companies as well as many government agencies.

The value of this company’s unique platform is reflected in the impressive list of the company’s billion-dollar clients.

This is just the beginning for the rapidly growing company that still trades at a price well below its peers. As more news is generated and word gets out, expect investors to discover this up-and-comer. Sign up to receive more information about this innovative young company, as well as two others that are poised to take the lead.

1 https://www.bvp.com/atlas/state-of-the-cloud-2020/

2 https://451research.com/blog/764-enterprise-it-executives-expect-60-of-workloads-will-run-in-the-cloud-by-2018

3 https://www.bvp.com/cloud100/the-cloud-industry-update-for-2020#:~:text=But%20you%20know%20that%20the,all%20of%20technology%20right%20now

4 https://www.bvp.com/bvp-nasdaq-emerging-cloud-index

5 https://www.marketwatch.com/story/moats-will-make-all-the-difference-for-cloud-companies-as-tech-costs-come-under-pressure-2020-07-08

6 https://www.randallreilly.com/statistical-proof-that-video-is-taking-over-the-world/

7 https://www.oberlo.com/blog/small-business-statistics

Legal Notice: This work is based on what we’ve learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Don’t trade in these markets with money you can’t afford to lose. Investing in stock markets involves the risk of loss. Before investing you should consider carefully the risks involved, if you have any doubt as to the suitability or the taxation implications, seek independent financial advice. Invictus News expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Invictus News, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast.