ADVERTISEMENT

Early stage technology company releases groundbreaking platform to revolutionize the global, multi-trillion-dollar payments industry. This first-of-its-kind tech completes the last remaining step in a transaction pipeline that has been clogged for years.

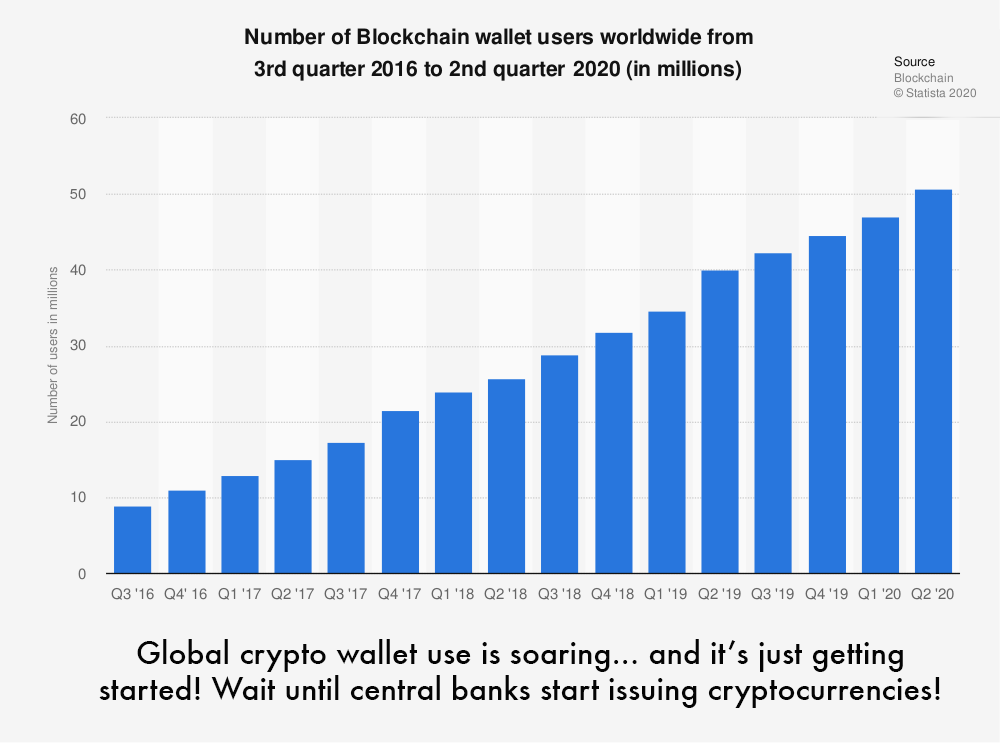

- The platform opens everyday commerce to transparent interaction with over 50 million crypto wallets worldwide holding $384 billion in cash! By 2025, that figure is projected to leap past $1.1 trillion!

- The doors have been thrown wide open. Global use is virtually assured as VISA signed on, allowing for instant penetration to over 44.4 million vendor accounts worldwide.

- This is a full throttle move that could rapidly accelerate this little known company to world prominence.

- For aggressive, growth-focused investing, this is about as good as it gets. This essential technology breakthrough opens the entire landscape of cryptocurrencies to everyday commerce.

And as you will learn in this report, that’s a current $384 billion set to pour into consumer markets.

That’s not all. In the coming years you can expect the cryptocurrency economy to grow exponentially. By 2025, total deposits held in crypto accounts are projected to $1.1 trillion!

And here’s why there’s a 9,000% upside to that $1.1 trillion dollar figure!

Central banks worldwide (including the Fed) are moving aggressively into issuing their own digital currencies. This transition to digital will be the foundation of a cashless economy.

As this trend accelerates, digital reserve currencies will push $90.4 TRILLION in current global, broad money supply toward billions of new crypto wallet accounts.

At current monetary growth rates, that $90.4 trillion figures is likely to rocket into the mid-one-hundred-trillion-dollar range!

Central banks shifting to digital reserve currencies will be totally transformative to world economies. It builds a massive ocean of money that can only be accessed through crypto wallet accounts. The impact of those trillions of dollars is not hard to predict.

Crypto wallet use should absolutely skyrocket.

The global count of crypto wallets has already been growing at a brisk rate of about 10 million wallets annually. But that’s a fraction of the wallet count that should follow the growth of digital reserve currencies.

Under current conditions alone, economists anticipate a short-term 500% leap in crypto wallet growth rates as digital currencies spread worldwide. That growth rate could be much higher if central banks move more quickly than currently anticipated.

This trend is underway right now…and it’s all being made possible by the rapid growth of blockchain ledger technology.

All of cryptocurrency is grounded in blockchain ledger technology and virtually ALL financial technology firms around the world are transitioning into it.

Blockchain cuts costs, reduces losses and has the potential to prevent up to 35% of all future financial fraud.

There’s another big benefit. Blockchain ledger technology can increase the transaction speeds within financial networks, which is why transitions to blockchain are well underway at major corporations like IBM, McKinsey, and JPMorgan. These and many more large consulting, banking, or software companies are investing heavily in the move. It is the largest technology revolution since the launch of the internet.

The above projections anticipate that new crypto wallet accounts will skyrocket to 50 million (or more) new accounts annually! This stunning growth rate could ultimately propel hundreds of billions, if not trillions of dollars through transaction pipelines.

This is not something that might happen in the distant future. It’s underway right now!

An investment here could be life-changing.

As with most new technologies, this cryptocurrency transaction platform comes out of the shadows…a tiny company set to change the world forever.

The nearest comparable might be Microsoft. Their PC technology bridged the gap between arcane computer mainframes and the home user…and it changed the world.

Apple, Google, Amazon, Netflix, and so many more made fortunes for their early shareholders by releasing essential soft technology that bridged a gap in product/service delivery to consumers.

50 million crypto wallets are already in market holding an aggregate cash value of over $384 billion.

But it’s a splash in the pan compared to what comes next.

Later in this article you will learn how central banks worldwide are working feverishly to transition out of paper money into cryptocurrencies. It’s an inevitable transition to cashless economies where the monetary “printing press” becomes a relic of the past.

Where is this headed? The end game is almost beyond comprehension!

All of this progress can be made possible by this first-of-its-kind technology. And this is not an over-the-horizon pipe dream. This tech has now been adopted by VISA, the largest credit card network on the planet with 44.4 million vendor locations and over 1.1 billion VISA credit cards in circulation worldwide.

To see where this is all going, you need to project yourself into the near future.

Though the exact dates are hard to predict, in due course the entire world is on track for a transition to crypto reserve currencies. In other words, central banks will stop printing and distributing cash as we know it today and instead, issue currency in crypto form.

It appears inevitable. The cash balance in what was once your checking account will become a crypto wallet from which you withdraw funds for day-to-day needs.

If you think this is crazy talk, consider this.

The change is already underway for the dollar…and currencies worldwide. Most Americans appear unaware that it is happening, but it is and it is moving fast.

This excerpt from an August, 2020 report sums it up (emphasis added):

In a letter sent to Federal Reserve Chairman Jerome Powell, Rep. French Hill (R-Ark.) and Rep. Bill Foster (D-Ill.) outline concerns they have about risks to the U.S. dollar if another country or private company creates a widely used cryptocurrency, and ask whether the central bank is looking into creating its own version.

“The Federal Reserve, as the central bank of the United States, has the ability and the natural role to develop a national digital currency,” the Congressmen wrote, adding:

“We are concerned that the primacy of the U.S. Dollar could be in long-term jeopardy from wide adoption of digital fiat currencies. Internationally, the Bank for International Settlements conducted a study that found that over 40 countries around the world have currently developed or are looking into developing a digital currency.”

Since their inception, cryptocurrencies have never really achieved Main Street acceptance. But that’s about to change in a very big way. Don’t be caught on the sidelines during an opportunity this transformative.

This promises to be the biggest change in global commerce in our lifetimes.

You can prepare now for the opportunities that creates by signing up to receive our exclusive report, which details the one company we think is positioned to dominate this fast-growing market.

1https://www.statista.com/statistics/647374/worldwide-blockchain-wallet-users/

2https://www.coinmarketcap.com/currencies

3https://www.globenewswire.com/news-release/2020/06/19/2050572/0/en/The-global-crypto-asset-management-market-size-is-projected-to-grow-from-USD-0-4-billion-in-2020-to-USD-1-1-billion-by-2025-at-a-Compound-Annual-Growth-Rate-CAGR-of-23-8.html#:~:text=Filings%20Media%20Partners-,The%20global%20crypto%20asset%20management%20market%20size%20is%20projected%20to,Rate%20(CAGR)%20of%2023.8%25

4ttps://www.comparecards.com/blog/credit-cards-most-accepted-worldwide/

5https://www.marketwatch.com/story/this-is-how-much-money-exists-in-the-entire-world-in-one-chart-2015-12-18

6https://www.globenewswire.com/news-release/2018/12/05/1662517/0/en/Global-Blockchain-Market-in-Banking-Industry-Forecast-up-to-2024-Opportunities-in-Increasing-Demand-for-Blockchain-as-a-Service-Growing-Usability-of-Blockchain-in-IoT.html

7https://www.statista.com/statistics/618115/number-of-visa-credit-cards-worldwide-by-region/

8https://www.creditcards.com/credit-card-news/market-share-statistics/

9https://www.coindesk.com/us-congressmen-ask-fed-to-consider-developing-national-digital-currency

Legal Notice: This work is based on what we’ve learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Don’t trade in these markets with money you can’t afford to lose. Investing in stock markets involves the risk of loss. Before investing you should consider carefully the risks involved, if you have any doubt as to the suitability or the taxation implications, seek independent financial advice. Invictus News expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Invictus News, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast.