The Key to Unlocking Carbon-Free Power

lies beneath the Nevada Desert

Can Nevada Solve the Global Lithium Demand Shortage?

Editorial Feature | Feb 23, 2023 | Industry

- There’s a trillion-ton elephant in the room. Carbon-free power cannot become a reality without the discovery of new and profound lithium sources.1

- EVs alone will need at least 20.8 billion pounds of lithium, requiring a 20X jump in output. Right now, production isn’t even close to keeping up.

- By 2030, 2,700 GWh worth of batteries will be necessary for EVs each year, equivalent to225 billion iPhone 11 batteries. That’s 13X more battery power than we use today.2

“You will find there is a ‘sold out’ sign on every operating mine at the moment. There will be some bad moments in the coming years where there will be a shortage of lithium production.”

~ Davis Archer, CEO Savanah Resources, March 10, 2021 Wall Street Journal

This is a junior lithium explorer worth looking at, and you don’t need to be a Wall Street trader to see why.

Let’s face it, America’s hopes and dreams for a carbon-free future are in big trouble, due to this SHOCKING fact:

America has been searching for the answers to clean-energy future for years, and all of the exciting talk about solar and wind power… for all those forecasts for tens of thousands of electric vehicles… the truth is that there is not nearly enough lithium being mined in the world to make those clean-energy dreams come true.

To make things worse, between 2018 and 2020, low prices for raw lithium led major miners to cut back or scuttle plans for new projects.3

As lithium prices soar beyond $76,000 a metric ton, they’re now scrambling to meet demand. But it’ll take years to catch up.

And that’s why every natural resource investor needs to review and consider adding Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) to their portfolio.

Ameriwest Lithium has five exciting lithium exploration projects, each with the potential to generate lithium resources, subject to exploration success.

Don’t Wait For The News

Best of all, early investors can position themselves to ride any potential upside in Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) for years to come, should they be successful in their exploration activities.

Ameriwest Lithium is positioned for a busy 2023 with exploration plans in full force. We could see steady bursts of exploration results as Ameriwest Lithium geologists finally crack open its Railroad Valley, Edwards Creek Valley, and Thompson Valley projects.

There’s never been a better time for Ameriwest Lithium to explore its high-potential lithium properties because this market will only get hungrier for new lithium supplies as shortage questions loom.

Go Long On Supply

These are anxious times for companies on the demand side, which rely on hundreds of thousands of additional tons of lithium to stay afloat.

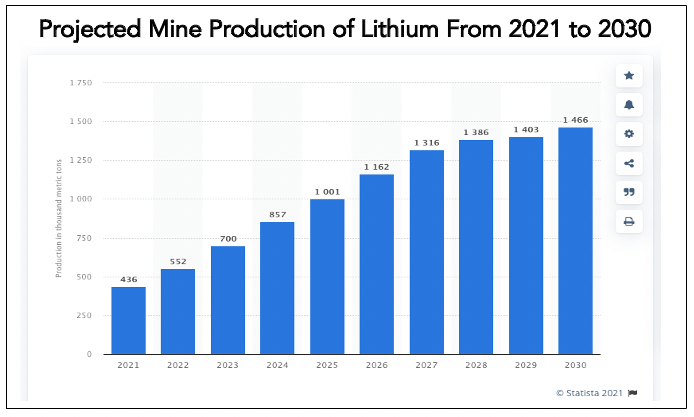

These demands have led some analysts to now estimate that the lithium market will grow nearly 4X over the next eight years, from the 320,000 metric tons mined last year, to 1.4 million metric tons by 2030.4

That pace may seem historic, but even quadrupling the of supply means meeting the lithium demand will come up about 1.6 million metric tons short.

Other analysts now forecast that demand is expected to hit 1.1 million metric tons by 2025 and 3 million tons by 2030, according to Reuters.5

That begs the multi-billion dollar question… where the heck is all that extra lithium going to come from?

In late 2020, Glyn Lawcock, UBS’s formerly renowned Global Head of Mining Research, issued a dire warning.

Lawcock wrote,

“There is not sufficient supply to meet this demand projection based on our knowledge of known projects today. That includes all projects whether they are under construction, in feasibility or still in exploration.”6

His warning is now entrenched in the lithium culture where Global X ETF analysts report that lithium miners need to plan for scenarios where annual demand exceeds 1.1 million metric tons of lithium by 2025.7

And, as you’ve already seen, any inability to expand that number could leave the world 2 million metric tons short by 2030.

This massive demand is why some big EV makers such as Tesla, will likely be forced to secure long-term supply contracts with individual mining companies.

That’s a formula that could put companies, such as Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) in the driver’s seat when it comes to developing new U.S. lithium resources to meet future national and global demands.

EVs reaching price parity with internal combustion engine cars is a mind-bending thought. Yet Volkswagen expects to reach price parity by 2025.

At that point, going green is merely a decision and not a financial burden.

That’s why investors need to keep an eye on Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI), and its Edwards Creek Valley property in particular.

At the moment, there is just one small working lithium mine in the U.S.

Moreover, plans for a much-anticipated huge mine at Thacker Pass, NV, near the Oregon border are under siege as we speak.

And, even if it manages to win approval, the Chinese are the majority shareholder in the “North American” company that’s trying to develop Thacker Pass.

Europe is in the same position, where plans for its first huge mine, in Portugal, have come undone.

That means all the lithium being mined in Chile, Argentina and Australia will barely be enough to keep up with today’s demand.

The China Syndrome

America’s minerals crisis cannot be understated or ignored.

The U.S. Geological Survey tracks supply of 90 critical minerals. Of those, 20 minerals are 100-percent imported, and 51 are at least 50 percent import reliant.8

With only one domestic working lithium mine, America’s energy security is fully dependent on foreign lithium sources.

The bulk of the imported lithium comes from South America and China. And China has been on a multi-year campaign to control virtually all mineable lithium on the planet. They’re bidding enormous sums to secure global resources, specifically in South America.

Silicon Valley publisher, VOA news, reported that the U.S. Geological Survey (USGS) acknowledged China “has been buying stakes in mining operations in Australia and South America where most of the world’s lithium reserves are found.9“

The devastating fact is that China now processes 60% of all the world’s lithium. And as Abigail Wulf put it, China’s questionable intentions could hamstring the American EV industry.

“If China wanted to cut off supplies of processed materials for li-ion batteries, as it did with rare-earth materials to Japan in 2010, it would create a dire situation,” said Wulf, who is the director of the Center for Critical Minerals Strategy at Securing America’s Future Energy10

The New Global Hotspot for High Grade Lithium

Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) could be located in what could become one of the world’s next great lithium belts.

They’ve been extracting and processing lithium here since the sixties, but the recent drive towards clean energy has brought this region back into focus for technology industry leaders and investors alike.

In fact, Nevada looks as if it could hold similar resource potential to Argentina’s Lithium Triangle. And similarly this region could soon become a coveted hotspot flooded with major lithium miners.

Right now, there’s just one working mine in the vicinity – Albemarle’s Silver Peak, operating in the prolific Clayton Valley.

Currently, the Silver Peak mine produces 5,000 metric tons of lithium carbonate each year.11

And since lithium carbonate prices have jumped more than 469% these last few years, to $74,000 a metric ton, Albemarle’s small mine is now worth a fortune.12

In fact, that relatively small output helped drive Albemarle’s share price up more than 229% between January 2020 and May 2022.13

Albemarle just committed $30 million to expand its mine to 10,000 metric tons a year. At today’s price, that would be valued at about $740 million a year.

No Wonder Tesla Built Its Gigafactory Here

Albemarle’s Silver Peak mine sits atop Clayton Valley’s world-class brine deposit estimated to hold 300,000+ tons of lithium.14

A deposit so rich that the U.S. Geological Survey calls it “the best-known [brine] deposit in the world.”15

So, it’s no wonder that Elon Musk decided to build his first Tesla battery plant just 200 miles to the north of Silver Peak.

Because that precise spot, in a desolate corner of Nevada is:

One of only three places in the world that produce the lithium chloride needed to make li-ion batteries.16

At full capacity, the Gigafactory will consume 35,000 tons of lithium carbonate per year to manufacture its batteries.17

That is equal to around 14% of the current global output, and immensely more than the Silver Peak mine alsone can produce.18

In 2021, Tesla delivered 936,000 EV’s. If they continue that pace, it will require today’s entire global supply of lithium.

Already, the Gigafactory makes more li-ion batteries than all other carmakers in the world combined.19

To reach an output of almost a million EVs per year, Tesla’s going to need to secure a whole lot more lithium carbonate.

The prospect is what led Elon Musk to make a startling declaration, revealing what could lead to a monumental industry shakeup.

In response to data that showed there had been a 1,654% rise in the lithium price in the last ten years, Musk stated, the “Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.”

Soon after, on an April earnings call, Musk claimed, “We think we’re going to need to help the industry on this front. I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business.”

If Musk indeed plans to get into the mining business, either directly through project acquisition, or indirectly through funding, it puts all eyes on explorers and potential producers like Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) and its highly strategic location just 240 miles from the Tesla’s massive refining operation.

Ameriwest’s Railroad Valley: Could it Shift Geopolitics?

Now here’s a matter of critical importance. Albemarle is in Clayton Valley, in tight quarters with eight other lithium-focused companies. And Albemarle is challenging their water rights.

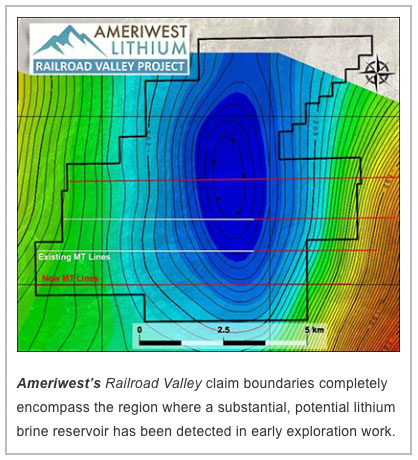

Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) is one of the first companies into Railroad Valley… which even the USGS says is geologically similar to Clayton Valley. 20

The US Geological Survey says it has real potential to host lithium bearing brines in its subterranean aquifers beneath the valley floor.21 Railroad Valley fits the current geological model and understanding of lithium brine deposit as defined by USGS Open File 2013-1006.22

The main difference is that Railroad Valley represents a new and virtually unexplored target, with no current competition for water rights. But the real excitement is due to seismic surveys… Railroad Valley is about three times the size of Clayton Valley, and comparable in size to the Salinas Grandes salt flat in Argentina.

The main difference is that Railroad Valley represents a new and virtually unexplored target, with no current competition for water rights. But the real excitement is due to seismic surveys… Railroad Valley is about three times the size of Clayton Valley, and comparable in size to the Salinas Grandes salt flat in Argentina.

News over the last few months points to the aggressive action the company is taking here. In August last year, Ameriwest announced they were initiating a deep target geophysical study on the Railroad Valley prospect.

Subsequent announcements suggest evidence of a large brine deposit. So large, in fact, that the company quickly moved to substantially increase its footprint at Railroad Valley.

Two months later, Ameriwest announced, “…based on positive preliminary results from a recent geophysical survey, the Company has elected to stake 150 additional placer claims on its Railroad Valley property in Nye County, Nevada.”

The Company then acquired an additional 224 placer claims from American Battery Technology Company (NYSE: ABTC) making the total size of the property to 780 placer claims totaling 15,300 acres.

What wasn’t made part of that announcement was the fact that in the same time frame, Ameriwest spun off all its gold prospects in what appears to be a total commitment to the prospects of their U.S. lithium projects.

That’s a telling move, a compelling clue to what company insiders are viewing as a lithium future for Ameriwest.

Ultimately, Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) checks all the boxes for investors looking to make a move into a junior lithium explorer. It’s 21-square mile (15,300 acres) swath of Railroad Valley has these stellar attributes:

- Only 95 miles to the West of the Tesla Gigafactory (as the crow flies)

- Enclosed, fault-bounded basin valley surrounded by volcanic rocks (a potential source for lithium)

- Hot springs in the basin area (a potential source for lithium)

- Large gravity lows

- A deep basin containing a thick sequence of saturated sediments

- Dry lakebed (playa) that is exposed to evapotranspiration

- Historic oil drilling activities and seismic surveys have amassed invaluable data for targeting potential brine aquifers

And Ameriwest Lithium’s earliest exploration results are just coming out.

Those include magnetotelluric data that show a potential for a sizeable discovery. The data indicates the potential for a large brine reservoir at a depth of approximately 2,000 ft to 4,000 ft below Railroad Valley’s surface.23 Exploration to date has included combined geophysical studies (gravity, MT, and seismic). Next, subject to the permitting process, a drilling program in 2023.

If a lithium brine resource is ultimately generated at Railroad Valley, it will be one of the few lithium brine resources identified to date in North America. Ameriwest will have several paths to choose – either to generate resources and, if successful, mineral reserves. If the project is determined to be an economically feasible deposit, the company may elect to ultimately develop a mining operation and become a producer. Alternatively, the company could sell the project or partner with an operating mining company to advance the property. The company’s management is highly skilled and experienced and will create multiple opportunities for growth. Note that no mineral resources or reserves have yet been delineated on the property.

Keep in mind, that’s just one of the five projects that Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) has in play.

The Sleeping Giant At Edwards Creek Valley

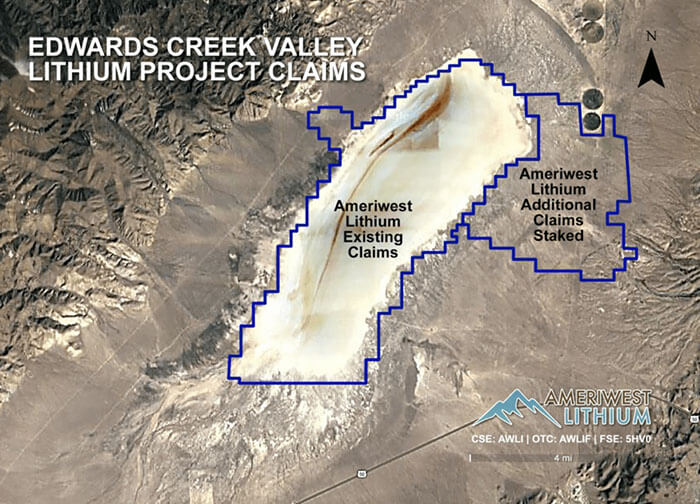

Ameriwest Lithium holds the rights to explore another Nevada project, just 215 miles northwest of the Tesla Gigafactory (as the crow flies). This one in the Edwards Creek Valley in a hydrologically closed basin with a playa, which is a flat desert basin where water evaporates quickly.

Without getting too technical, a ground geophysical survey produced a “gravity map” that revealed evidence that the property contained a large basin that could be a host for lithium brines.

Ameriwest saw how that basin spread to the east, and subsequently jumped on the “additional claims” shown on the map. These new claims bump the company’s Edwards Creek Valley holdings to 1,243 contiguous claims, totaling a whopping 22,200 acres.

That gives Ameriwest Lithium’s Edwards Creek Valley project one of the largest lithium footprints in North America.

Combined, the Edwards Creek Valley claims could yield a substantial lithium resource, subject to exploration success. The entire area is identified as a “hydrologically closed basin”, which means that virtually any resource generated in the valley through exploration will accrue to Ameriwest’s lithium resource valuation.

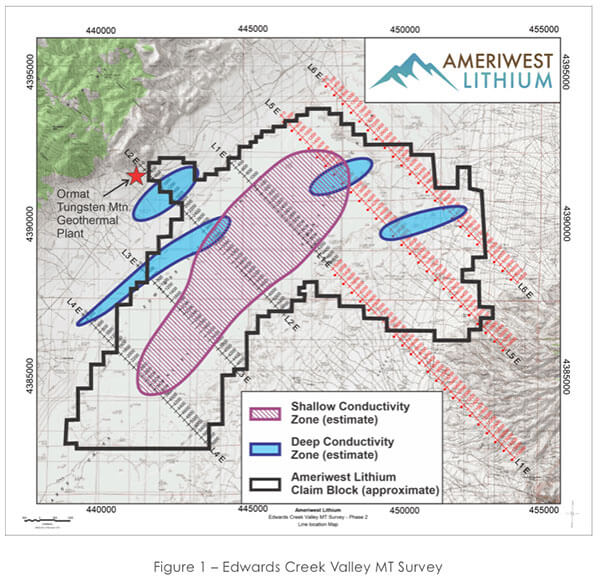

Just this past August, the company conducted an extensive magnetotelluric geophysical survey at Edwards Creek, which indicated the property could potentially host a large shallow brine target and several deeper targets.

David Watkinson, President, and CEO of Ameriwest stated,

“We are extremely excited by the results of the MT Survey, especially the delineation of a large near surface brine target that appears to be almost 20 square kilometers in size. The Company plans to move forward with permitting to test this shallow target with drilling and will ultimately follow up with testing of the deeper targets in the future.”

As you can see from the map below, the shallow conductivity zone occurs at surface, and is estimated to have an area approximately 8 square miles and 300 to 600 feet thick.

Future exploration drilling will reveal the full extent of the exploration potential, so this is one to watch closely.

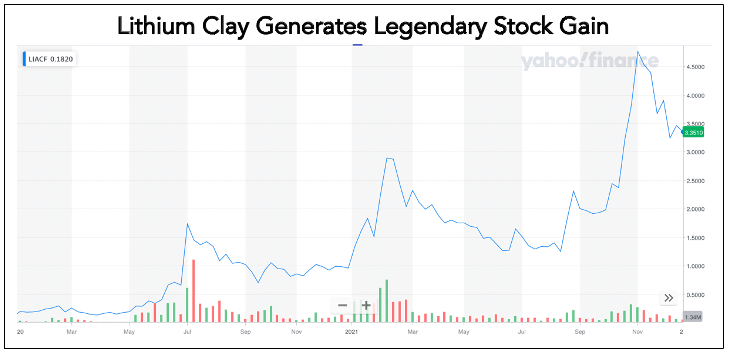

How New Technologies For Extracting Lithium From Clay Generated A 3,300% Gain

In Thompson Valley, Arizona, Ameriwest Lithium has another enviable project that could be rich in lithium clays, similar to the grades found in the Clayton Valley region.

Earlier this year, the company began Phase 1 exploration on this 2,859 acre property. Geologic and structural mapping was conducted to dial in the potential targets, followed by an initial surface soil sampling program.

What they discovered was highly promising.

Assay results from 44 surface grab samples show lithium contents ranging from 15 to a whopping 1,670 ppm Li.

From the 44 samples submitted for assaying, 27% had lithium contents greater than 500 ppm, and 9% were greater than 1,000 ppm.

Details about these exploration results, including QA/QC procedures, can be found in an August 10, 2022, press release on the company’s website or filed on www.sedar.com.

David Watkinson, President and CEO of Ameriwest stated,

“We are very excited to make this first significant discovery of lithium for the Company on our five properties located in Nevada and Arizona. This sedimentary clay deposit has surface or near-surface exposures of lithium-bearing materials that were deposited in a lacustrine environment and have potential to host a significant lithium deposit, subject to exploration success. Continued exploration is warranted and will include additional surface sampling to define drill targets. Once the drill targets are defined and permitting is complete, Ameriwest’s technical team looks forward to drilling the Property with the ultimate goal of delineating lithium resources.”

Only weeks after this announcement, the company doubled down on Thompson Valley, announcing the renewal of its original seven permits, as well as the addition of six new mineral exploration permits by the Arizona State Land Department.

These additional permits encompass an acreage of about 3,410 acres. That means, together with the recently acquired Federal mining claims, total mineral rights have been nearly doubled to just over 6,890 acres.

Moving forward, the Arizona State Land Department has approved an expanded surface sampling program, which allows up to an additional 300 samples.

That means updated assay results could be just a matter of months away.

Now here’s where it gets even more exciting. Until recently there was no viable way to economically mine these type of near-to-the-surface clays, which can be made up of as much as 90% lithium.

But new technologies not only make mining lithium clays possible, but perhaps the most profit-laden method of lithium mining and investors are paying close attention.

The one company we’re aware of, American Lithium (OTC:LIACF), developing a lithium clay project, rocked from 14 cents in March of 2020 to $4.76 in late 2021… that’s a 3,300% gain.24 There can be no guarantee Ameriwest Lithium will see similar share appreciation, but it is certainly a company to watch.

7 Reasons Ameriwest Lithium (OTC:AWLIF, CSE:AWLIOTC:AWLIF, CSE:AWLI) Should Be In Your Investment Portfolio Now

- Quadrupling of Supply Just to Stay Even – Analysts believe quadrupling the world’s annual lithium output to 1.1 million metric tons a year by 2025 will be paltry compared to looming future demand. That’s because the world will likely need 3 million metric tons rapidly in order to meet demand.

- Success Breeds Success – Ameriwest Lithium controls more than 160-square miles in Nevada playa basins, where its nearby neighbors include multi-billion-dollar major Albemarle, along with Tesla’s Gigafactory. Ameriwest’s five exploration properties in Nevada and Arizona, including three brine and two clay projects, have a combined size of 58,339 acres.

- Huge Home Run Potential, Subject to Exploration Success – Ameriwest Lithium is completing ongoing exploration in Thompson Valley, an under-explored lithium-rich slice of Arizona. It’s a lithium clay project. That’s a relatively new form of lithium mining, but one that’s growing quickly in popularity. Early junior Nevada clay lithium explorer American Lithium (OTC:LIACF) saw its shares rocket 3,300% in the past year.

- Homeland Security – It doesn’t get talked about much. But the modern military runs on lithium batteries. Yet, National Defense Magazine reports that, the U.S. military’s lithium battery supply chain, especially rechargeable lithium batteries, “is virtually entirely from offshore suppliers.”25

- The U.S. Finally Gets It – Lithium mined in America could soon be mighty valuable. In June 2021, the U.S. rolled out a National Blueprint for Lithium Batteries. Developed by the Federal Consortium for Advanced Batteries it will guide investments to develop a domestic lithium-battery mining and manufacturing value chain.26

- 125 million EVs in the Next Decade – Volkswagen will lead this winning drive with the goal of building 15 million EVs in the next five years. GM wants to build 1 million EVs a year.

- Demand Will Likely Outstrip Supply – If the average EV battery size holds, the world is going to need at least 20.8 billion pounds, or 10.4 million tons, of lithium over the next decade.

The media loves a crisis, and sooner than later, it will move on from the pandemic and politics to the next big threat… foreign lithium.

With the hunt for new locally sourced lithium, a major part of the worldwide energy and climate change crisis, Ameriwest Lithium, if they are successful, may be in the news for years to come.

It’s time to call your broker or advisor and show them this report. Then discuss this new lithium opportunity that Ameriwest presents to solve America’s clean-energy crisis. Do your research and compare the company to other up and coming junior lithium explorers.

1https://www.forbes.com/sites/neilwinton/2021/11/14/lithium-shortage-may-stall-electric-car-revolution-and-embed-chinas-lead-report/?sh=6e2f605646ef

2https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=615454371a44

4https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=615454371a44

5https://www.statista.com/statistics/1225076/global-lithium-mine-production-projection/

6https://www.forbes.com/sites/neilwinton/2021/11/14/lithium-shortage-may-stall-electric-car-revolution-and-embed-chinas-lead-report/?sh=6e2f605646ef

7https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=615454371a44

8https://www.usgs.gov/news/risk-and-reliance-us-economy-and-mineral-resources

9https://www.voanews.com/silicon-valley-technology/how-china-dominates-global-battery-supply-chain

10https://www.wardsauto.com/industry-news/expert-warns-china-calling-shots-ev-battery-materials

11https://www.mining.com/mountain-pass-sells-20-5-million/

12https://www.miningmagazine.com/supply-chain-management/news/1402188/ablemarle-to-double-silver-peak-lithium-production

13https://tradingeconomics.com/commodity/lithium

14https://finance.yahoo.com/quote/ALB?p=ALB&.tsrc=fin-srch

15https://pubs.usgs.gov/pp/1802/k/pp1802k.pdf pK10

16https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf

17http://www.meridian-int-res.com/Projects/Lithium_Problem_2.pdf

18https://pubs.acs.org/doi/10.1021/cen-09431 notw8#:~:text=%E2%80%9CTesla%20is%20starting%20to%20lock,measured%20in%20lithium%20carbonate%20equivalents

19https://www.tesla.com/gigafactory

20https://financialpost.com/globe-newswire/ameriwest-lithium-railroad-valley-geophysics-results-in-staking-of-additional-claims

21https://financialpost.com/globe-newswire/ameriwest-lithium-railroad-valley-geophysics-results-in-staking-of-additional-claims

22https://financialpost.com/globe-newswire/ameriwest-lithium-railroad-valley-geophysics-results-in-staking-of-additional-claims

23https://ameriwestlithium.com/ameriwest-lithium-nevada-exploration-update/

24https://finance.yahoo.com/quote/LIACF?p=LIACF&.tsrc=fin-srch

25https://www.nationaldefensemagazine.org/articles/2018/11/8/offshore-battery-production-poses-problems-for-military

26https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Ameriwest Lithium (“AWLI”) and its securities, AWLI has provided the Publisher with a budget of approximately $100,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by AWLI) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company AWLI and has no information concerning share ownership by others of in the profiled company AWLI. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to AWLI industry; (b) market opportunity; (c) AWLI business plans and strategies; (d) services that AWLI intends to offer; (e) AWLI milestone projections and targets; (f) AWLI expectations regarding receipt of approval for regulatory applications; (g) AWLI intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) AWLI expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute AWLI business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) AWLI ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) AWLI ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) AWLI ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of AWLI to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) AWLI operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact AWLI business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing AWLI business operations (e) AWLI may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Ameriwest Lithium

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Ameriwest Lithium and has no information concerning share ownership by others of any profiled Ameriwest Lithium The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Ameriwest Lithium or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Ameriwest Lithium Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Ameriwest Lithium ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Ameriwest Lithium future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Ameriwest Lithium industry; (b) market opportunity; (c) Ameriwest Lithium business plans and strategies; (d) services that Ameriwest Lithium intends to offer; (e) Ameriwest Lithium milestone projections and targets; (f) Ameriwest Lithium expectations regarding receipt of approval for regulatory applications; (g) Ameriwest Lithium intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Ameriwest Lithium expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Ameriwest Lithium business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Ameriwest Lithium ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Ameriwest Lithium ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Ameriwest Lithium ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Ameriwest Lithium to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Ameriwest Lithium operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Ameriwest Lithium business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Ameriwest Lithium business operations (e) Ameriwest Lithium may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Ameriwest Lithium or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Ameriwest Lithium or such entities and are not necessarily indicative of future performance of Ameriwest Lithium or such entities.