This tiny biotech just bought a brand name non-opioid cancer pain drug approved for sale in 22 countries.

We hope the importance of this report does not go unnoticed.

Doctors all over the world are being forced to rethink how the prescribe harmful opioid drugs. This crisis is causing massive waves in the pain management community and huge opportunity for those savvy enough to recognize it.

Before we introduce the company, please consider the magnitude (and market size) of this new drug and how urgently it is needed in current medicine.

Public Broadcasting Service (PBS) reports that pain intervention therapies in use today have triggered the deadliest drug epidemic in American history.2

America’s National Institute on Drug Abuse (NIDA) reports that widespread use of prescription opioids has triggered a staggering spike in deaths due to drug overdoses. As of 2017, the NIDA projects that over 49,000 Americans will die as a result. More than half those deaths trace back to prescription drugs. Worldwide, the death toll is nearly incalculable. Radical changes in prescribed pain management are long overdue and this report may reveal the answer.

Established protocols for intense pain management using opioids; oxycodone, fentanyl and hydrocodone have lead to 27,000 deaths annually from addictive drug overdose.

Over 2 million people are currently suffering from debilitating bone pain caused by cancer that has spread to their bones. A non-addictive alternative that works in 80% of the patients treated and lasts as long as six months with a SINGLE dose could have a major impact and improve lives! Clearly, the market potential for such a drug is simply enormous.

To put a price tag on it, Science Daily reported in 2012 that chronic pain costs the U.S. up to $635 billion annually. By now, we project that figure could be well over a quarter-trillion dollars.3

The impact to a publicly traded company having a major impact on a quarter-trillion-dollar market is staggering to consider.

Even smaller pharmaceutical breakthroughs have made fortunes for investors. Here are just three examples of lesser medical innovations that went on to return triple-digit gains for early shareholders.

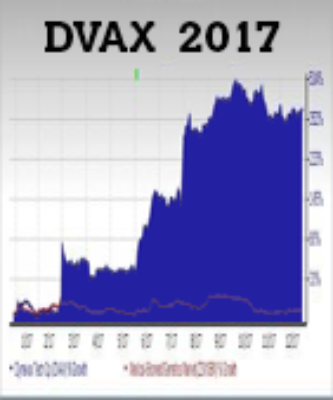

Dynavax Technologies Corporation (DVAX) nearly doubled in the first two months of the year tempting many to pocket gains. But patient investors were in for even greater gains. At the end of Q2 2017, DVAX shares took off hitting over five-fold gains over the following four-months. The driver for these gains was the first-ever FDA approval of a hepatitis-B vaccine for adults.

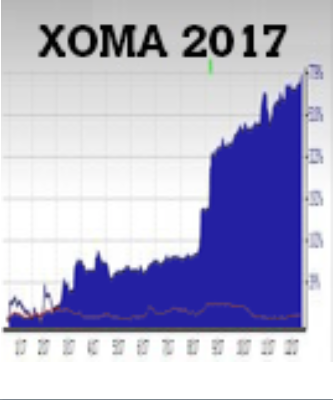

XOMA Corporation (XOMA) posted a stunning 779% gain in 2017, propelling a $10,000 investment to nearly $78,000 in market value! The company secured several licensing agreements for its unique therapeutic antibodies that sent its shares soaring in the latter part of the year. Shareholders on board in January saw their shares double in eight months then explode to nearly eight-fold gains on announcements made in August.

Sangamo Therapuetics, Inc. (SGMO) finished 2017 with 473.5% gains, which sent an initial $10,000 position to a $47,350 market value. Fuel for these gains fired when Sangamo secured a $70 million upfront payment from Pfizer, which included agreement for double-digit royalties from the company’s gene therapy tech.

We can only guess how big an impact a non-addictive “pain killer” could have on the bone cancer market. But it’s not hard to imagine!

That’s why we were thrilled to discover Q BioMed, Inc. (OTCBB: QBIO).

Q BioMed has effectively locked up a huge segment of this market by buying a leading brand name drug as well as licensing the only generic version of the drug in this palliation space. This drug has helped THOUSANDS of patients live more comfortable lives and in the current opioid crisis climate we see a huge growth opportunity for this very effective medication.

Introducing a novel approach to investing in pharmaceutical innovations.

Q BioMed (QBIO): An “insider” approach to profiting from pharmaceuticals.

Unlike most pharmaceutical pioneers, QBIO is not a single entity chasing down one big idea. They diversify risk by owning near term profitable assets as well as developing new ideas that can generate huge returns down the road. With this company there will always be something BcogIG on the horizon!

Staffed with business and pharmaceutical specialists, QBIO winnows through mountains of pharmaceutical research projects to isolate those few with exceptional promise.

Once identified, QBIO pulls each into their intellectual property portfolio, then proactively accelerates the product development trajectory toward commercialization and profits.

That’s what lead to Q BioMed’s “discovery” of this powerful new non-addictive pain killer introduced at the top of this report.

Q BioMed now owns a non-addictive pain-killer that is approved for use in 22 countries!

On November 28, 2018, Q BioMed announced it had acquired the “metastatic skeletal cancer palliation drug, Metastron™, from GE Healthcare.”

The full impact of this announcement has yet to be realized, and we’re not just referring to QBIO share prices. Metastron has already been approved by the FDA, as well as 22 countries worldwide, for metastatic bone cancer patients. That in itself can be significant, but the long-term implications for Metastron could improve dramatically as Q BioMed looks to expand its use into much larger treatment markets.

It could also trigger skyrocketing QBIO share prices! In its November announcement, Q BioMed made the market potential for Metastron abundantly clear.

Q BioMed CEO Denis Corin said, “[Metastron] gives us a tremendous springboard to accelerate our revenue potential and…it is important to note that our focus is not on the short-term horizon, but rather on the long-term strategic initiative as we look 2 and 5 years down the road at expanding the therapeutic scope for the drug.”

At present, Metastron is approved only for “skeletal cancer palliation”. But that may just be the start of the story in this drug.

With the pain management market topping a quarter-trillion dollars, Metastron’s use in the therapeutic treatment of cancer as a standalone drug or in combination with other oncology treatments could totally disrupt this marketplace.

Metastron could quite literally be worth hundreds of millions of dollar a year almost overnight, if it is proven to improve survival…. And there is plenty of clinical evidence to support this endeavor. It’s not too difficult to imagine what that could do to QBIO share prices!

We can only speculate as to why Q BioMed’s announcement of this acquisition escaped investor attention. Perhaps it’s because it took place between Q BioMed and GE Healthcare, the latter being focused principally on medical diagnostic technology and equipment, not pharmaceuticals. Seasoned medical investors simply weren’t looking there!

Whatever the reason, QBIO shares are holding steady at under $2.00. Now may be an ideal time to make a buy.

First, of course, we encourage you to do your own due diligence. QBIO must be described by us as a high-risk stock, one that could lead to substantial loss of your investment. But, that risk is what makes it potentially so highly rewarding!

To get started, we strongly recommend that you do two things right away.

- Go to the Q BioMed website to learn more about this company’s unique and potentially lucrative business model. As they say on their opening page: “We acquire, develop and finance undervalued medical assets.” Go to: qbiomed.com

- Get yourself onto the company email list! Whether or not you soon pull the trigger on QBIO stock, stay informed with their news as it breaks. Their mailing list means you could be among the first to know any breaking news that could trigger a run on QBIO shares.To be placed on Q BioMed’s email list, go to: https://qbiomed.com/index.php/contact

Now is the time to seriously consider securing a QBIO position on the Metastron drug alone. We urge anyone considering a QBIO buy to act without delay.

We also believe that QBIO shareholders today position themselves for substantial additional upside, particularly over the long haul.

As such, we see QBIO a strong consideration for a buy-and-hold strategy because there’s a lot more that could be coming from Q BioMed!

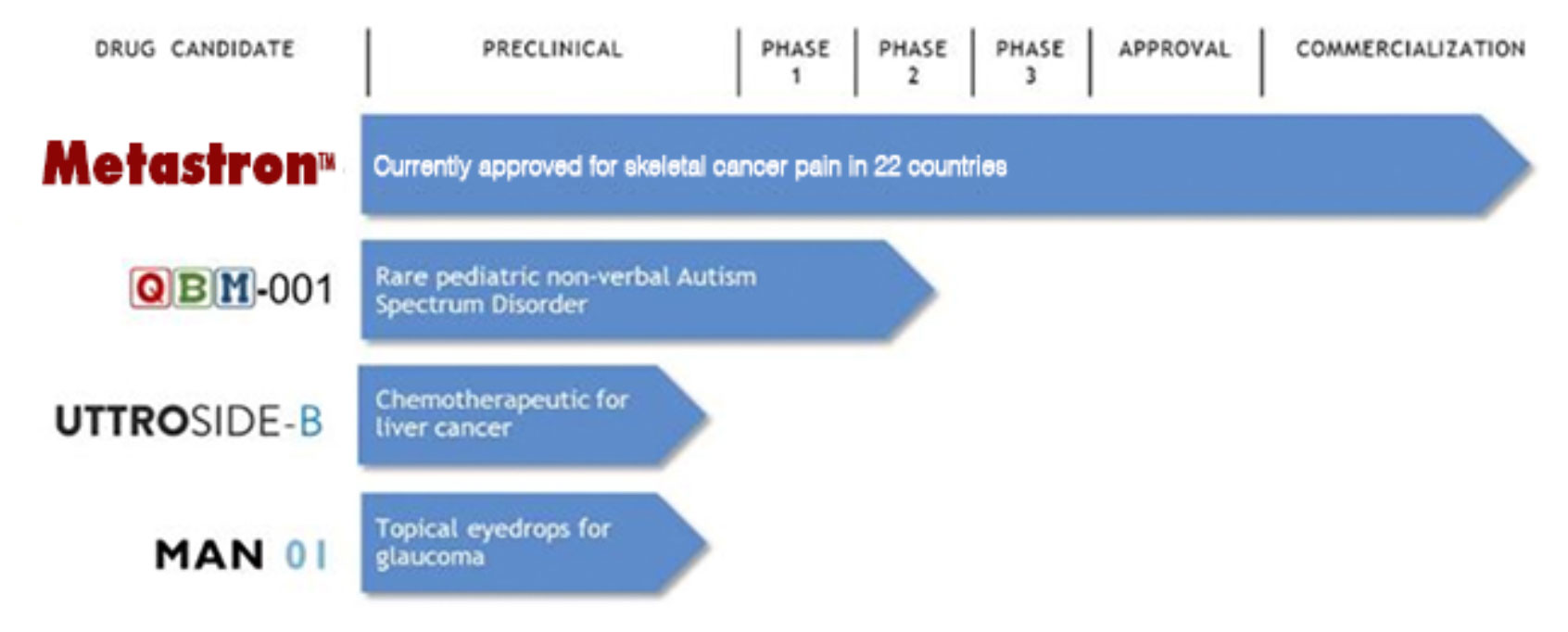

Along with Metastron, Q BioMed is now actively advancing the development of three more pharmaceutical innovations. Each promises breakthroughs in much needed therapies for:

- Amelioration of Pediatric Autism (Non-Verbal) Spectrum Disorder

- Chemotherapeutic Interventions for Liver Cancer

- Topical Eyedrop Treatment for Glaucoma and Intraocular Eye Pressure

Any one of these assets under Q BioMed’s umbrella could trigger a multi-billion-dollar breakout! Here’s our reasoning on why you should be looking into a position in QBIO with utmost urgency.

As you proceed with your due diligence you undoubtedly will note that QBIO currently trades at or below $2.00 a share. In this range we believe QBIO remains severely undervalued. With the Metastron pain medication already past approval and headed to market, plus three more drugs in the pipeline this could be an ideal time to buy!

Of course, that’s our opinion…we strongly encourage you to do your own research to confirm our assessment.

You can learn a lot right now by watching this short video interview with Q BioMed’s Chairman and CEO, Denis Corin. Mr. Corin speaks about Q BioMed’s unique accelerated R&D business model and the company’s prospects for growing shareholder value through 2018 and 2019.

We also recommend that you carefully consider the buy-and-hold strategy.

Q BioMed’s other assets hold additional growth potential that could quickly trigger multiple rounds of double-digit growth in QBIO share prices.

Let’s consider the potential in Q BioMed’s QBM-001 treatment for a rare, devastating pediatric disorder, which has no existing treatment therapy.

This is where the FDA’s “fast track” and “Orphan Drug” approval process comes into play.

The disease is Pediatric Non-Verbal Autism Spectrum Disorder. It is beyond the scope and purpose of this report to get into the medical details, suffice it to say that this is a devastating condition that cripples 20,000 American children annually, with staggering lifetime cost in the millions of dollars.

In this video, Mr. Corin explains how Q BioMed stands on the brink of a revolutionary breakthrough for treating this devastating childhood disease.

If approved by the FDA, Q BioMed’s QBM-001 will be the first ever pharmaceutical intervention for this disease, Pediatric Non-Verbal Autism Spectrum Disorder. The drug is currently being formulated and manufactured for a fairly short single Pivotal clinical trial (505(b)2 and because it is targeting a rare disease with no known Rx therapies, we also believe that QBM-001 is a prime candidate for FDA fast track and Orphan approval.

For those unfamiliar, FDA fast track and Orphan designation is an approval process that the FDA reserves exclusively for treatment of rare or currently untreatable diseases. Approval could therefore come quickly and should that happen as we believe it might, QBIO shareholders stand to see a significant uptick in share prices sooner than normal processes might suggest.

What makes Q BioMed (QBIO) unique in the biotech sector

In a nutshell, Q BioMed is diversified; its shareholder value is not tied to just one R&D process and product. We believe this substantially increases the potential for gains while suppressing the risks of loss.

The company describes itself as a biotechnology development company that nurtures highly promising technologies and accelerates the R&D process through to commercialization or a major value inflection. The objective is simple. Rapidly grow shareholder value by managing multiple assets with the focus always on Return on Investment.

At present the company directs development of four core products in its pharmaceutical portfolio.

Metastron is already entering commercialization and revenue flow should soon follow. The window for securing a ground floor position in QBIO shares may be closing fast. Couple that with the potential for FDA fast-track approval of QBM-001 and we feel that the time to act on this is now.

Still early in development are Q BioMed’s UTTROSIDE-B and MAN 01 products. Each is entering Phase 1 clinical trials in the next 12 to 18 months, which is a significant validation of preliminary R&D. What attracts us more to the potential of these two assets is the commercialization potential.

UTTROSIDE-B is a promising new chemotherapeutic treatment for liver cancer. Sadly, the market potential for this drug is soaring. According to a recent report from the Center for Disease Control (CDC) the incidence of liver cancer is growing rapidly and “the rate of deaths due to liver cancer is increasing faster than for any other type of cancer.”

The cause for this is due in large part to the near-epidemic level of hepatitis C infections in the aging adult population. The CDC reports that, “approximately 3.5 million Americans are living with chronic hepatitis C infections”. All of these patients live with extremely high risk of developing liver cancer, which UTTROSIDE-B seeks to treat.

Unfortunately, liver cancer is very difficult to cure. As a result, mortality rates are quite high. In 2018, estimates are that nearly 30,200 Americans will succumb to the disease making it the fifth leading cause of cancer death in America. We believe that the high incidence rate coupled with a paucity of effective treatments can make UTTROSIDE-B a highly promising asset when commercialized. Again this is an Orphan drug because of the small patient population (less then 200,000). Orphan status comes with many benefits and significant value!

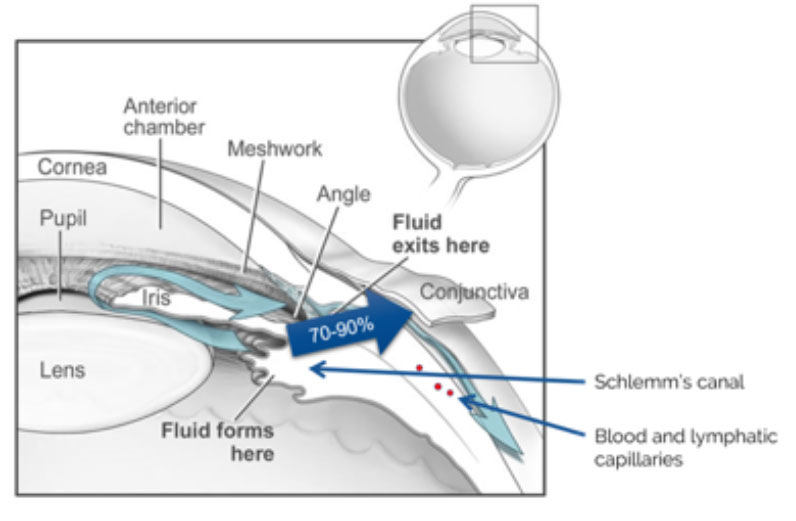

Also in Q BioMed’s portfolio is MAN 01, a product in development to treat glaucoma using a topically applied medication. The implications of this product’s commercialization are staggering.

Q BioMed reports that 60 million people worldwide are afflicted with glaucoma today. Without proper treatment, glaucoma can lead to irrecoverable blindness. It is not a disease to be ignored and though 2.2 million Americans are among those with the disease, 50% don’t know that they have it!

The incidence of glaucoma is further exacerbated by America’s growing incidence of type 2 diabetes.

Diabetics are at much higher risk of developing glaucoma symptoms, which suggests an urgent need for an effective, patient-administered treatment. MAN 01 may be the right product at the right time. It is being developed as a patient-administered daily eyedrop that relieves the symptoms of glaucoma and preserves patient eyesight. MAN 01 holds promise to become a multi-billion-dollar asset in the Q BioMed portfolio.

What to do now…

Q BioMed (QBIO) deserves immediate and serious consideration as an entry to the highly lucrative profit opportunities prevalent in an fast moving pharmaceutical.

Referring back to the four key points presented at the top of this article, we feel that:

- QBIO minimizes risk in ground-floor biotech investing through a diversified portfolio of assets in development.

- QBIO maximizes the potential for outsized shareholder profits by only selecting assets that hold exceptional market value when commercialized.

- QBIO expertly mines the early-stage biotech sector to extract only the very best, most promising emerging technologies.

- QBIO offers its shareholders an entry to professionally managed early-stage biotech investing with a single shareholder position.

Keep this in mind as you consider adding QBIO to your growth portfolio. Share prices in biotech can move rapidly on release of a single piece of news. Shares you buy today up to $2.00 could double in a matter of just days, perhaps even hours. QBIO deserves your immediate attention.

And, as you ponder the profit potential in QBIO, keep in mind that unlike conservative “steady growth” stocks that can take years to deliver big results, QBIO holds potential to deliver massive gains virtually overnight! An exaggeration perhaps, but we need to emphasize this point.

We urge you to take immediate steps to determine if QBIO is a right addition to your growth portfolio. Even a few days’ delay could leave huge profits behind you.

Once again, we strongly urge that you:

- Begin due diligence immediately.

- Sign up for Q BioMed’s email list for future news and reports.

Staying informed keeps you ahead of the crowds…and sets the stage for any profits to come!

markettactic.com has received permission to send its readers a special investor kit prepared by the company. To register to receive this kit and future updates on Q Biomed, Inc. (QBIO), enter your email address in the box below.

2 https://www.pbs.org/wgbh/frontline/article/how-bad-is-the-opioid-epidemic/

3 https://www.sciencedaily.com/releases/2012/09/120911091100.htm

4 https://qbiomed.com/index.php/news-and-media/news-2018/133-q-biomed-inc-announces-acquisition-of-cancer-pain-drug-metastron-from-ge-healthcare

5 https://www.cdc.gov/nchhstp/newsroom/docs/factsheets/viral-hep-liver-cancer.pdf

6 ibid.

7 https://www.medicinenet.com/liver_cancer_hepatocellular_carcinoma/article.htm#what_is_the_medical_treatment_for_liver_cancer

8 https://cancerstatisticscenter.cancer.org/#!/

IMPORTANT NOTICE AND DISCLAIMER: This stock profile should be viewed as a paid advertisement. The publisher, Market Tactic, understands that in an effort to enhance public awareness of Q BioMed Inc. and its securities through the distribution of this advertisement, Cayvan Consulting Ltd. paid all of the costs associated with creating and distribution of this advertisement. The publisher was paid the sum of $500 or more for his contributions. This report is for information purposes only and is neither a solicitation or recommendation to buy nor an offer to sell securities. Market Tactic is not-a-registered-investment-advisor. Market Tactic is not a broker-dealer. Information, opinions and analysis contained herein are based on sources believed to be reliable, but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. The opinions contained herein reflect our current judgment and are subject to change without notice. Market Tactic accepts no liability for any losses arising from an investor’s reliance on the use of this material. Market Tactic and its affiliates or officers currently hold no shares of these stocks. Market Tactic and its affiliates or officers will not purchase or sell shares of common stock of these stocks, in the open market at any time without notice. Certain information included herein is forward-looking within the context of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements concerning manufacturing, marketing, growth, and expansion. The words “may”, “would,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend,” ” project,” and similar expressions and variations thereof are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could affect actual results and cause them to differ materially from expectations expressed herein. * Market Tactic does not set price targets on securities. Never invest into a stock discussed on this website or in this email alert unless you can afford to lose your entire investment. This publication, its publisher, and its editor do not purport to provide a complete analysis of any company’s financial position. The publisher and editor are not, and do not purport to be, broker-dealers or registered investment advisors. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC filings. Investing in securities is speculative and carries a high degree of risk. Past performance does not guarantee future results. This publication is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains “forward-looking” statements, including statements regarding expected continual growth of the featured company and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the company’s actual results of operations. Factors that could cause actual results to differ include the size and growth of the market for the company’s products and services, the company’s ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.