A Bonanza Gold And Silver Opportunity Arises In The World-Famous Sierra Madre

Editorial Feature | March 28, 2022

- MARKET POWER – Driven by rocketing inflation, long stagnant gold prices are showing signs of a resurgence, leading experts like David Garofalo to predict gold could hit $3,000 in the near-term. And silver looks to be heading upward in the near term, with expectations to pass $30 by 2025.1

- PEAK DEMAND – As a critical element in the development of electronics and EVs, silver demand is expected to quickly eclipse supply. And with billions now pouring into clean energy infrastructure, new North American sources are in critical need.

- FOLLOW THE NEWS – Exploring in Mexico’s prolific gold belt, initial samples taken by Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) come in at nearly triple the project’s historical findings.

- TIME TO JUMP ON BOARD – Shares appear undervalued relative to the resource potential in this historically rich region.

It was only last year when a group of senior mining executives landed the deal they’d long been chasing.

Their acquisition target was two under-developed Mexican silver prospects with enormous potential that had languished for years. They knew the projects and moved aggressively to reel them in.

With millions of dollars in the bank and a seasoned team of exploration and mining experts, they launched project development plans that produced almost immediate, exciting results.

Work is ongoing and the potential for dramatic growth in shareholder value looms large. But the best part is they only recently began publicly trading and remain totally off-radar.

Sierra Madre Gold & Silver launches aggressive exploration programs on two of Mexico’s most prolific gold and silver mining regions.

The first of two is Sierra Madre’s flagship Tepic Project, over 6,500 acres of known gold and silver resources lying in the Sierra Madre gold and silver belt. This is an enormous resource area, with upwards to 1.5 billion ounces of silver equivalent reserves already discovered… and that number is still growing.1

Newly discovered veins, like those being explored right now by Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF), hold promise to add millions more to the region’s resources and ultimate reserve data.

Sierra Madre acquired the Tepic Project last year. Approximately 3.5 kilometers of previously identified strike length came with the acquisition.

Within a few short months, Sierra Madre geologists nearly tripled the strike length to ten kilometers. Work continues and this number could grow sharply over the coming months.

The discovery and resource potential at Tepic could be off the charts. Resource calculations at the time of acquisition remain “unofficial”, but the data was compelling to Sierra Madre management following their pre-acquisition due diligence.

An historical estimate of economical in-ground mineral assets in 2013 totaled 10.3 million ounces of silver equivalent resources with an economical cut-off of 75 grams/ton.

A decade later, those numbers may improve sharply as lower production costs and improved technology make recovery of ore more economical, particularly on rising silver prices and soaring global demand projections for the near future.

However, management cautions in its current Investor presentation (emphasis added) “that an independent Qualified Person (“QP”), as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Sierra Madre to classify the historic estimate as a current Measured, Indicated or Inferred Mineral Resource, and Sierra Madre is not treating the historical estimate as a current Mineral Resource. Sierra Madre will need to validate previous work to produce a mineral resource that is current for CIM purposes.”

That last point is key.

Sierra Madre management is strongly convinced of the accuracy of the 2013 resource estimate, so much so that they made it the basis for their acquisition offer. However, this 2013 data, despite its presumed accuracy, cannot be used to calculate fair market value.

That’s to your advantage right now because for technical reasons, Sierra Madre cannot report a mineral resource on its balance sheet.

This may be a significant reason why Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) trades where it does today, as a junior penny stock, not as a more advanced company with proved resources in the ground.

Without an updated, official NI 43-101 compliant resource report, Wall Street investors have been slow to pull the trigger.

There’s a lot of wait-and-see in that crowd. But that hasn’t slowed experienced private money and institutional investors. When word got out about Sierra Madre’s acquisition intent, money came pouring in.

The company now reports over $10.5 million in the bank, post-acquisition.

To help get their stock launched, management’s immediate priority is to update resource data and publish an NI 43-101 compliant resource calculation, hopefully later this year.

With that, ALL resources can be accrued to shareholder value.

Virtually overnight, the value in Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) shares could be triggered by millions of ounces of newly published silver equivalent resources.

With silver trading over $22/ounce…and projected by many analysts to rise sharply…Sierra Madre shares are poised for explosive, near-horizon gains.

Consider the three main drivers of that potential:

- Silver is hot. Prices are rising and demand is projected to soar as green energy, electronics and electric vehicle push demand for more silver than ever. What’s more, early-stage juniors like Sierra Madre have been known to pay triple-digit, even quadruple-digit gains for ground floor investors. Below you’ll find a few examples of how substantial those gains can be.

- Though it landed on a well-documented silver/gold project, Sierra Madre only recently began public trading. The company has yet to gain traction in the market, but with the resources that may be in play, that can change fast. Today’s share prices may never be this low again so now is the ideal time to launch your due diligence.

- Compelling data points to a massive, 10.3 million ounce silver equivalent resource based on the 3.5 kilometer strike length originally identified in 2013. Over the last few months, Sierra Madre geologists have extended that strike length to almost 10 kilometers and they’ve still not yet hit bottom. There could be millions more ounces of silver and gold in the ground remaining to be discovered.

This is a huge opportunity that should be acted on without delay. Everything here appears in line for a stunning breakout as Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) moves aggressively to build awareness of its resource potential and accelerate shareholder value.

Sierra Madre’s second project to the north, La Tigra, lies in historical silver and gold production regions that date back to the turn of the last century. Production wound down three decades ago when both metals sold at a fraction of today’s prices.

In 1990, silver prices plunged to around $3.50 an ounce and for the next 14 years, silver barely cracked the $5/ounce range.2

The same held true for gold, which fell under $400 an ounce at that time and never decisively broke through that price ceiling for 15 years.3

Outdated, inefficient mining techniques simply made historic mines uneconomical. Failures and shutdowns became an epidemic throughout the Sierra Madre belt.

For about one-hundred years, miners simply picked the easy stuff. Millions of ounces in silver and gold appear to have been left untouched. With modern mining technology, coupled with gold and silver prices many-times higher than in the past, enormous resources over and above historical data could be calculated at both Tepic and La Tigra.

Metal prices and reserves are interlinked. As prices rise, resource figures can be raised with lower grade or deeper buried mineralization, which can be added to net asset value (NAV) and further propel stock valuations.

There's an old saying in the mining business, "The best place to mine is where they mined before.”

Past producing mines, particularly in Mexico, are proving to be fantastic opportunities when modern technologies are brought into play.

Past producing mines, particularly in Mexico, are proving to be fantastic opportunities when modern technologies are brought into play.

The unique Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) geology hosts a multitude of silver- and gold-bearing structures that have been known since the native populations and later the Spaniards first began picking the surface centuries ago.

Many past producing surface deposits, like Tepic and La Tigra, have been superficially explored and deeper below-surface exploration remains virtually non-existent.

A hundred years ago high-grade surface veins were hand mined. Fast forward to today; contemporary exploration technology can expose great opportunity in these veins.

Both the La Tigra and Tepic Projects fit precisely to that adage and they each became a focus for Gregory Liller, Executive Chairman and COO at Sierra Madre.

Over the last four three decades, Liller has been deeply involved in exploration and mine development targeting past-producing Mexican resources in the Sierra Madre belt.

Liller knew that the Sierra Madre belt sits is rich with undeveloped resources and untapped potential. He launched a campaign to recruit the best and the brightest in the industry knowing that the potential of both projects would attract the right talent.

Leading a string of great hires is Alex Langer, company President and CEO.

Mr. Langer brought in a wealth of experience in mining and finance with a strong background in Mexican assets. His prior successes in private equity funding and IPOs for over 100 private and publicly listed companies helped attract the talent and the financial resources to land the acquisition and get boots and equipment on the ground.

Documenting The Potential Of These Overlooked Resources

Previous operators at these projects simply didn’t have the cash nor experience to bring these prospects to full potential. The management team at Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) have both…millions of dollars and years of exploration/mining experience.

Last year they made the moves that closed the deals.

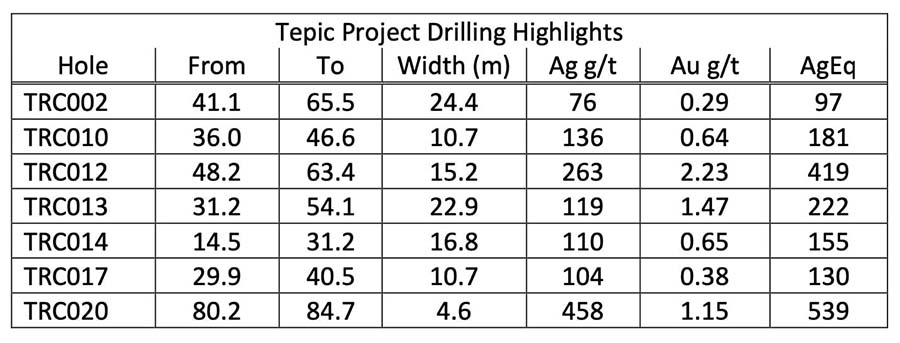

On July 20, 2020, it was made official. Sierra Madre acquired controlling interest over both prospects and they wasted no time getting started with exploration development. In less than two months they made their first big announcement at Tepic. 21 newly drilled reverse circulation holes, seven returning exceptional new discoveries in silver, with significant gold showings as well.

- Hole TRC012 returned 15.2m @ 2.23 g/t Au, 263 g/t Ag (419 g/t AgEq)

- Hole TRC013 returned 22.9m @1.47 g/t Au, 119 g/t Ag (222 g/t AgEq)

As important, all these discoveries were made at an average depth of around 100 meters. At that depth, results are already well over economical grades, which are the starting point for documenting NI 43-101 compliant resource and reserve calculations.

Then 45 days later, Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) announced even more great news from the first phase of a five kilometer trenching program intending to extend the length and breadth of already known formations.

This key quote from that second new release hints strongly at the potential uncovered on new ground (emphasis added): “The fact that the trenches are returning silver and gold values outside of the previously mapped vein and breccia structures and revealing the presence of multiple secondary mineralized structures, gives us new targets and increases the potential of the Tepic project.”

As mentioned above, the Tepic project is one of two in this area. Sierra Madre also acquired the nearby La Tigra project and launched immediate exploration to identify the resource potential there as well.

As mentioned above, the Tepic project is one of two in this area. Sierra Madre also acquired the nearby La Tigra project and launched immediate exploration to identify the resource potential there as well.

In November, management released surprising discoveries in gold as well as silver.

Mr. Liller reports that, “These first four trenches [at La Tigra], together with the previously released reconnaissance sampling, confirm our view that the Districo del Tigre has significant gold and silver potential. No methodical modern exploration program has ever been conducted in the district and the entire team is excited by the initial results.”

What to do now…

Millions of ounces in gold and silver may be in play with Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF)… little of which is reflected in today’s share price for lack of a contemporary NI 43-101 resource report.

That could change quickly as the company moves aggressively to correct that situation…starting with the 10.3 million ounces silver equivalent reported in 2013 at La Tigra.

Should those millions be made “official” soon, it could be the fuel that sends Sierra Madre rocketing. And with the price of both gold and silver set to explode, this could be one of the biggest wealth builders you’ll find on the market today!

Now is the time to get started with your due diligence. Sierra Madre Gold & Silver (TSXV:SM, OTCQB:SMDRFTSXV:SM, OTCQB:SMDRF) shares have already captured the attention of institutional investors (a rarity for a junior) as well as seasoned resource investors who recognize opportunity when they see it.

1https://investingnews.com/daily/resource-investing/precious-metals-investing/silver-investing/mexicos-silver-belt/

2https://silverprice.org/silver-price-history.html

3https://goldprice.org/gold-price-history.html

1https://coinpriceforecast.com/silver

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Sierra Madre (“SMDRF”) and its securities, SMDRF has provided the Publisher with a budget of approximately $225,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by SMDRF) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company SMDRF and has no information concerning share ownership by others of in the profiled company SMDRF. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to SMDRF industry; (b) market opportunity; (c) SMDRF business plans and strategies; (d) services that SMDRF intends to offer; (e) SMDRF milestone projections and targets; (f) SMDRF expectations regarding receipt of approval for regulatory applications; (g) SMDRF intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) SMDRF expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute SMDRF business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) SMDRF ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) SMDRF ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) SMDRF ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of SMDRF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) SMDRF operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact SMDRF business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing SMDRF business operations (e) SMDRF may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Sierra Madre Gold & Silver

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Sierra Madre Gold & Silver and has no information concerning share ownership by others of any profiled Sierra Madre Gold & Silver The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Sierra Madre Gold & Silver or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Sierra Madre Gold & Silver Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Sierra Madre Gold & Silver’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Sierra Madre Gold & Silver future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Sierra Madre Gold & Silver industry; (b) market opportunity; (c) Sierra Madre Gold & Silver business plans and strategies; (d) services that Sierra Madre Gold & Silver intends to offer; (e) Sierra Madre Gold & Silver milestone projections and targets; (f) Sierra Madre Gold & Silver expectations regarding receipt of approval for regulatory applications; (g) Sierra Madre Gold & Silver intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Sierra Madre Gold & Silver expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Sierra Madre Gold & Silver business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Sierra Madre Gold & Silver ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Sierra Madre Gold & Silver ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Sierra Madre Gold & Silver ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Sierra Madre Gold & Silver to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Sierra Madre Gold & Silver operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Sierra Madre Gold & Silver business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Sierra Madre Gold & Silver business operations (e) Sierra Madre Gold & Silver may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Sierra Madre Gold & Silver or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Sierra Madre Gold & Silver or such entities and are not necessarily indicative of future performance of Sierra Madre Gold & Silver or such entities.