A Bonanza Gold Opportunity Arises In Canada's Abitibi Belt

Editorial Feature | Nov 30, 2021 | Industry

This famous greenstone mineral belt boasts off-the-charts gold deposits that rival some of the world’s most prolific mines.

Historical assays include a breathtaking 167.0 g/t gold intercept that suggests massive, undeveloped gold-bearing potential throughout the Clarity Gold Destiny Project.

This one intercept alone is forty to fifty-times the cut off grades prevailing on this trend. No question that there is gold in the ground!

Though the resource potential is not yet fully calculated, results from historic and ongoing exploration could be breathtaking. The good news for investors: Clarity Gold Corp (CSE: CLAR | OTC: CLGCF | FRA: 27GCSE: CLAR | OTC: CLGCF | FRA: 27G) shares remain channeled at entry level prices. Should this play out like it has for others in the region, investors who act now stand to reap fortunes.

That’s how it played out for early investors in Amex Exploration, which got started a few years ahead of Clarity Gold on trend to the west. Despite not yet producing an ounce of gold nor reported resources, Amex leaped to stunning gains on news of its exploration work.

In November of 2018, Amex was trading under 5¢ a share. By December of 2020, it had leaped past $3.00 a share, a breathtaking 60-fold gain for those who got in early! A $1,000 position at the start would have hit a $60,000 valuation in only 24 months! Aggressive profit taking drained some of those meteoric gains, but buy-and-hold investors have nothing to complain about. Their shares now trade at over 41-times that early valuation!

Could Clarity Gold Corp reach or exceed such gains? It’s certainly possible being situated not just on trend…but with gold resources already accounted for.

This information may well remain off-radar! An historic estimate containing 10,800,00t @ 1.05 g/t Au containing 360,000 ounces indicated resource and 8,300,000t @ 0.92g/t Au containing 247,000 ounces inferred resource has already been reported at Clarity Gold’s Destiny Project.

The historical estimate for DAC can be found in the Technical Report “NI 43-101 Technical Report and Resource Estimate of the DAC Deposit, Destiny Property, Quebec” effective March 1, 2011, completed by Todd McCracken, P. Geo., of Wardrop Engineering Inc. for Alto Ventures Ltd (now Big Ridge Gold Corp) and filed on SEDAR.

- Values were rounded to reflect summary nature of the estimate.

- The 2011 Report was compiled in accordance with Canadian Institute of Mining (2005) standards and best practices for Mineral Resources, adhering to NI 43-101. Alto Ventures established a QAQC program that was reviewed by the independent QP who accepted the data as suitable for mineral resource estimation at that time.

- Capped gold grade was interpolated using IDW method into a block model constrained by mineralized domains. Parameters used include a cut-off grade of 0.5 g/t Au, Au price of US$973/Oz, US$ to CAD$ conversion of 1.02, Au recovery 94%, 4:1 Strip ratio, Operating cost of $14.30/t at 10,000 tpd, density of 2.76

- In accordance with NI 43-101 as defined in 2011, the DAC historical estimate used the terms inferred and indicated mineral resource having the same meanings ascribed to those terms by the CIM Definition Standards on Mineral Resources and Mineral Reserves.

- There are no more recent estimates available to the issuer. There are only 17 drill holes totaling approximately 4,485 m completed that are not included in the 2011 historical estimate, with only one hole being within the historical estimate area.

- An independent Qualified Person has not done sufficient work to review the historical data and historical estimates to determine what further work would be required to write an updated current Technical Report in accordance with NI 43-101. It is envisaged that this will involve an update/refinement to the geologic model and grade interpolation methods. The company is treating this estimate as historic.

Massive discoveries have become common across the entire Abitibi Greenstone Belt and Clarity Gold is already exposing real value for the company’s shareholders.

Unfortunately for the 2011 owners, financial challenges and the untimely death of the company’s CEO put a halt to their exploration work. The property languished until recently when Clarity Gold Corp (CSE: CLAR | OTC: CLGCF, FRA: 27GCSE: CLAR | OTC: CLGCF, FRA: 27G), funded with $8 million in private placement capital, secured a 100% purchase option on the property. Clarity management immediately launched the advanced exploration on the same drill site that yielded the stunning intercepts you will now find reported on the company website:

- Gold mineralization occurs in high-grade quartz veins within shear zones starting at 15m below surface

- Drilling results include:

- 167 g/t Au over 1 m (from 221.7 m)

- 15 g/t Au over 23.6 m (from 117.2 m)

- 49 g/t Au over 2.7m (from 166.0 m)

Earlier this year, guided in part by the historic records, Clarity Gold Corp (CSE: CLAR | OTC: CLGCF | FRA: 27GCSE: CLAR | OTC: CLGCF | FRA: 27G) targeted its new drill program to more fully map and quantify the mineralization zones.

Early results were exceptional. On June 16, 2021, the company announced assays from four of the initial drill holes that returned significant gold intercepts ranging from 6.97g/t to 32.67g/t au.1

From this data, Clarity management felt they were on target to better identify a major find that could greatly add to the existing historic estimate.

Through the course of the summer, management advanced exploration by investing roughly four million dollars in additional drilling intending to expand both the depth and width of the gold resource intercepts. Roughly 10,000 meters of new drilling has thus been completed this year.

Final figures from this year’s drilling have yet to be announced, but given already known data, the expectations are high that significant new intercepts could be soon reported. That makes this the ideal time to consider an entry point for early investing.

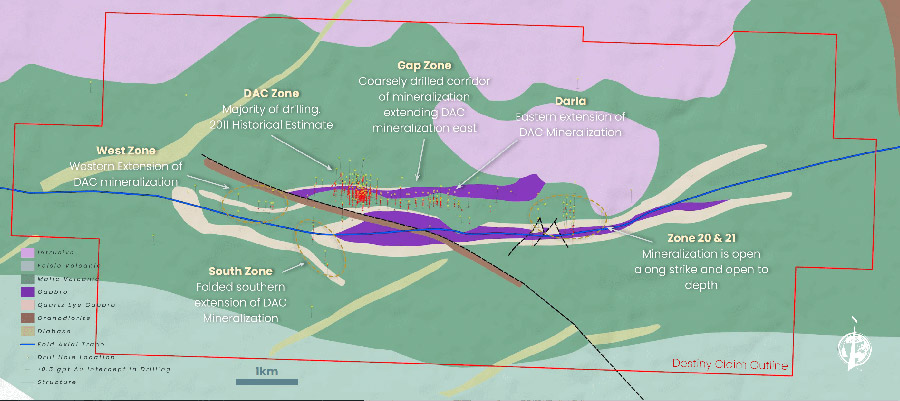

Bear in mind that the current exploration program, which intends to expand on the existing historic estimate, targets a very small area on 5,000+ acre project site. As can be seen from the map of the entire project, only a fraction of the project has been probed. Management believes (and some historical drilling supports that belief) that exploration potential remains high on the. Future exploration programs intend to target and identify new potential gold discoveries.

As new results are made public, you can expect these data to have a powerful impact on Clarity Gold share prices.

Geological mapping has identified large areas of potential gold mineralization on Clarity Gold’s (CSE: CLAR | OTC: CLGCF | FRA: 27GCSE: CLAR | OTC: CLGCF | FRA: 27G)Destiny Project. Historical and current exploration has been confined to a small portion of the property, producing exceptional gold intercepts beginning at depths as shallow as 15 meters. Company management has identified six additional targets for future exploration.

Could this be yet another million-plus-ounce Abitibi Greenstone Belt discovery?

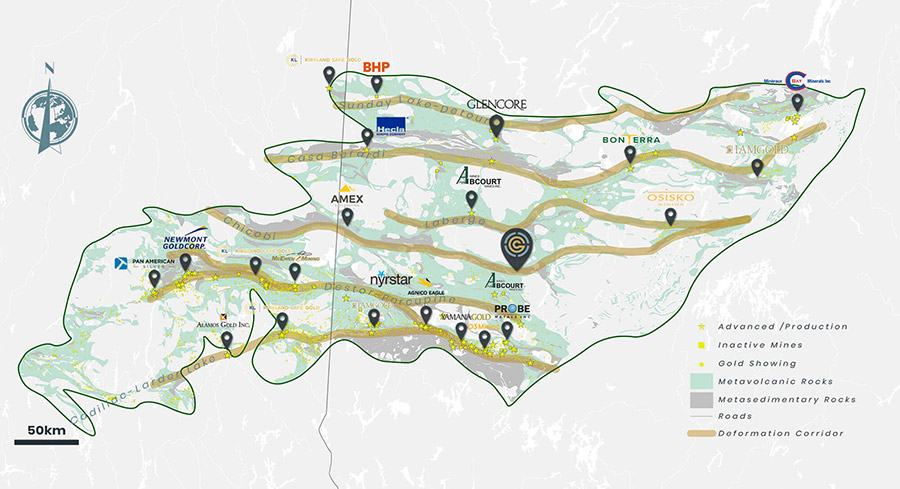

The Abitibi Greenstone Belt is already known to host multiple million-ounce-plus gold deposits. Two hundred million ounces have already been recovered from the Abitibi and it appears that this figure is just the start.

some of the biggest mining operations have been exploring and producing in the region since the end of the 1800’s, as seen in the map below. More important, and not seen in this image is the direction of development.

Based on what is known now, the Destiny Project could in the Abitibi Greenstone Belt. Of course, such discoveries are speculative at present, but with an historic estimate showing the potential on the property now, plus new numbers pending from just completed exploration, today’s investor appears well grounded. Add in future numbers and Clarity Gold shares could move quickly. Now is the time to consider your entry.

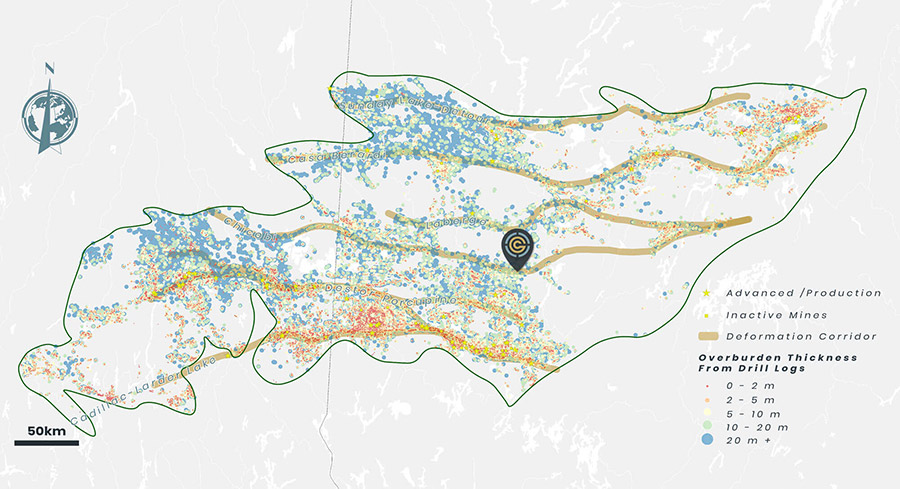

Early exploration and development of the Abitibi Greenstone Belt began in the southern and northern regions. Mining and exploration companies moved in quickly from both directions when it was discovered that the gold resources in these regions lay very close to the surface. It made for easy pickings, but now, development has moved to the heart of the Abitibi where gold resources are more deeply found, as seen in this next overburden map.

Historic drill logs from the southern boundary and the northeastern boundary exploration record gold findings at surface or within a few meters of the surface. These conditions were ideal for low-cost open pit mining, which triggered a run of mining operations. As you move into the east central region of the Abitibi, the surface geology changes. A layer of ground (overburden) separates the surface from the gold mineralization zones. Advanced development of the Abitibi region is now exploiting these zones. Gold is already in heavy production along the southern trend lines as well as the north eastern lines. Clarity Gold’s Destiny Project appears ideally located at the heart of this entire gold-bearing region.

Assuming that the greater concentrations of gold lie at the center rather than on the edges of the Abitibi region, current exploration has now moved to the underexplored Chicobi Deformation Corridor (the trend) indicated by the tan line running east west. Clarity Gold Corp (CSE: CLAR | OTC: CLGCF | FRA: 27GCSE: CLAR | OTC: CLGCF | FRA: 27G) laid claim to what is already known to hold an historic estimate, with as little as 15 meters of overburden.

The Abitibi Greenstone Belt is widely considered one of the most productive gold-bearing regions of North America.

You can be certain that the majors are already looking.

Gold was first discovered on the Destiny Project in 1988 as exploration advanced from the highly productive southern boundary of the Abitibi (and some in the northeast) to the heart of the formation.

It’s rare to catch an entry-level position in a known producing area like this. Your due diligence should bear this out. Share prices for Clarity Gold now trade at around 25¢, creating enormous upside potential as this off-radar junior gains attention among investors.

Attention could be forthcoming...this is the time to get involved!

Clarity’s 2021 exploration is already completed. You can expect results from the 2021 program to be fully announced at any time, if not already. Management also reports that the 2022 program will follow and is well funded with roughly $4 million cash on hand.

For entry-level investing, the timing could not be better.

What to do now...

Everything starts with the launch of your due diligence. The company website is an ideal starting point. From this site you will access more detailed information about the Destiny Project and the company’s plans to develop the full potential of the site. If you like what you see, you might consider establishing an early position while the stock trades at such low prices. A modest investment today could ultimately return substantial gains in the not-too-distant future.

There's real potential here that should not be ignored.

Clarity Gold (CSE: CLAR | OTC: CLGCF | FRA: 27GCSE: CLAR | OTC: CLGCF | FRA: 27G) initially launched its business in June of last year coincidental with the acquisition of the Destiny Project and one other highly promising project in western Canada that is also detailed on the company website. This is still very early in the game (Clarity only began public trading in October) and as of this report still resides off-radar trading in the 25¢/share range.

Clarity share prices seem undervalued relative to its potential. This is a stock that could gain speed as new data comes in, particularly when a new resource estimate is published.

Based on this existing data, Clarity Gold is well poised to potentially be one of the biggest gold junior bargains in the market today. The company holds a strong financial position after closing two non-brokered private placements totaling $8.3 million. ($4.5 million in January and $3.8 million in March.)

Despite all this, don’t leap into this blindly. Bear in mind that all early-stage investments like Clarity should be approached with caution and following extensive due diligence. It is only prudent to consider Clarity to be a high-risk investment that could lead to significant if not complete loss of your investment. Proceed wisely, but keep in mind that with high risk comes high reward. Just look at how it played out for Amex Exploration to the west…60-fold gains in about 24 months.

One thing seems clear, with $4 million in the bank, shareholders can expect Clarity to be well financed for their 2022 exploration projects…and the discoveries that these might reveal could greatly expand and grow Clarity shareholder value.

Make your first move now by visiting the company website. You can dig into the details, download the current company-published investor deck and register your email address for ongoing news and updates.

A closing thought...

For months now gold has been channeling in the $1,800/ounce range. With inflation rearing its ugly head and even worse, China moving aggressively to dethrone the dollar as the world’s reserve currency, the dollar value in an ounce of gold is subject to sudden and meteoric upside growth. In such an environment, one of the most lucrative positions you can hold could be a junior gold exploration company like Clarity Gold.

The profit potential is enormous as Clarity (CSE: CLAR | OTC: CLGCF | FRA: 27GCSE: CLAR | OTC: CLGCF | FRA: 27G) appears well positioned in a world-class gold-producing region. All this simply adds to the urgency of launching your due diligence in advance of what many believe will be a major upturn in the fortunes for gold investing.

1 Details can be found on the company website.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Clarity Gold Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Clarity Gold Corp. and has no information concerning share ownership by others of any profiled Clarity Gold Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Clarity Gold Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Clarity Gold Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Clarity Gold Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Clarity Gold Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Clarity Gold Corp. industry; (b) market opportunity; (c) Clarity Gold Corp. business plans and strategies; (d) services that Clarity Gold Corp. intends to offer; (e) Clarity Gold Corp. milestone projections and targets; (f) Clarity Gold Corp. expectations regarding receipt of approval for regulatory applications; (g) Clarity Gold Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Clarity Gold Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Clarity Gold Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Clarity Gold Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Clarity Gold Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Clarity Gold Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Clarity Gold Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Clarity Gold Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Clarity Gold Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Clarity Gold Corp. business operations (e) Clarity Gold Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Clarity Gold Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Clarity Gold Corp. or such entities and are not necessarily indicative of future performance of Clarity Gold Corp. or such entities.