NG Energy International (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) Could Be One of the Saviours of Colombia’s Natural Gas Deficit. Production Expected To Start By The End Of The Year

2021 has been a big year for energy markets; just take a look at natural gas prices.

Natural gas has more than doubled this year in many parts of the world. The ripple effects are starting to be felt, but how wide they will spread may not be known until winter comes.

US natural gas prices are up 180% over the past 12 months.

In September, futures hit their highest settlement price since February 2014, after a long climb over the last 7 years.

In Europe and Asia gas prices have climbed even higher. As Bloomberg reported, “the deepening global energy crunch has pushed natural gas in Europe and Asia to the equivalent of about $190 a barrel, something the oil market has never seen.”

It’s no surprise that legendary billionaire investor Warren Buffett is pumping billions into the sector.

Last year, Warren Buffett paid almost $10 billion dollars to buy Dominion Energy Inc.’s natural gas assets!1

Source: Image of Dominion logo by Casimiro PT / Shutterstock.com; Image of Warren Buffet by Kent Sievers / Shutterstock.com: https://www.hartenergy.com/exclusives/warren-buffetts-berkshire-hathaway-buys-dominion-gas-business-worth-nearly-10-billion

While everyone else is looking at solar panels and wind turbines, the Oracle of Omaha is buying up natural gas assets.

Does he know something everyone else doesn’t?

Its abundance, versatility, and tag for being the cleanest-burning hydrocarbon make it the ideal fuel to help meet growing demand for energy globally.

As CV-19 restrictions loosen up and economic activity around the world accelerates, global energy demand has increased quickly. At the same time, though, the uncertainties of the pandemic have made producers reluctant to make significant capital investments, contributing to supply shortages.

To make matters worse, another major driver of this shocking price growth is the meteorological outlook for winter 2021. Harsh winters require more heating, and more natural gas to get the job done. Demand is already running faster than supply, and if winter accelerates that trend, it could squeeze prices higher very quickly.

For now, it looks like the only direction is up.

An Industry and a Country in Crisis, NG Energy Strives to be a Big Part of the Solution

One country where this energy deficit is particularly problematic is Colombia, where declining production has been a concern for many years leading up to the current global crisis. With Colombian natural gas reserves projected to be cut in half this decade, Colombia will need 1 billion cubic feet (BCF) per day of additional production for use in electricity generation, providing heat for essential industrial processes, heating homes and fueling the transport of people and goods.

Colombia as a whole depends on hydropower for 65% of its electricity generation. However, droughts have caused reservoir levels to fall to an average 32% of capacity, forcing the power utilities to import more and more expensive LNG. As a result, Colombia will be forced to compete for LNG just as more of the world is doing the same, with Europe and China facing enormous energy squeezes as well.

One near-term producer on a mission to help boost Colombia’s domestic production is NG Energy International (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF). It is set to develop its natural gas projects at just the right moment with production expected to begin before the end of 2021.

With three large and highly prospective blocks, along with a team of proven company builders, NG Energy aims to play a crucial role in providing energy to a market that desperately needs it.

Maria Conchita is the most advanced block NG Energy is developing and provides a solid valuation base with 2P reserves and near-term production to provide cash flow as the company derisks its larger assets.

NG Energy’s flagship SINU-9 is licensed for the development of up to 22 conventional onshore wells with 1.5 trillion cubic feet (TCF) of prospective resources providing significant exploration upside.

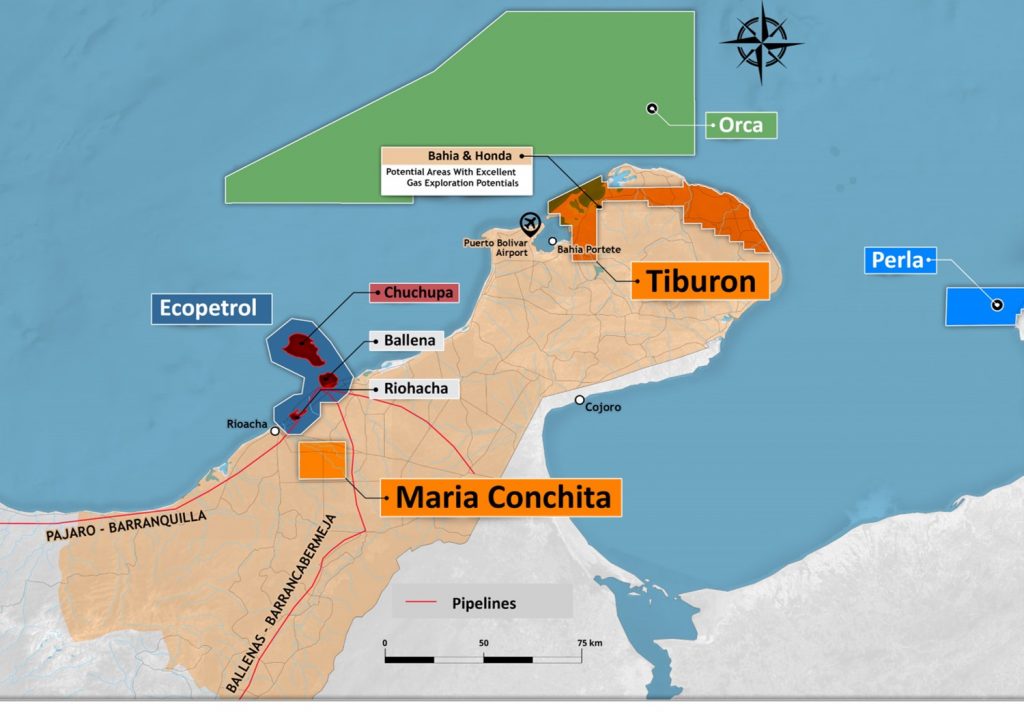

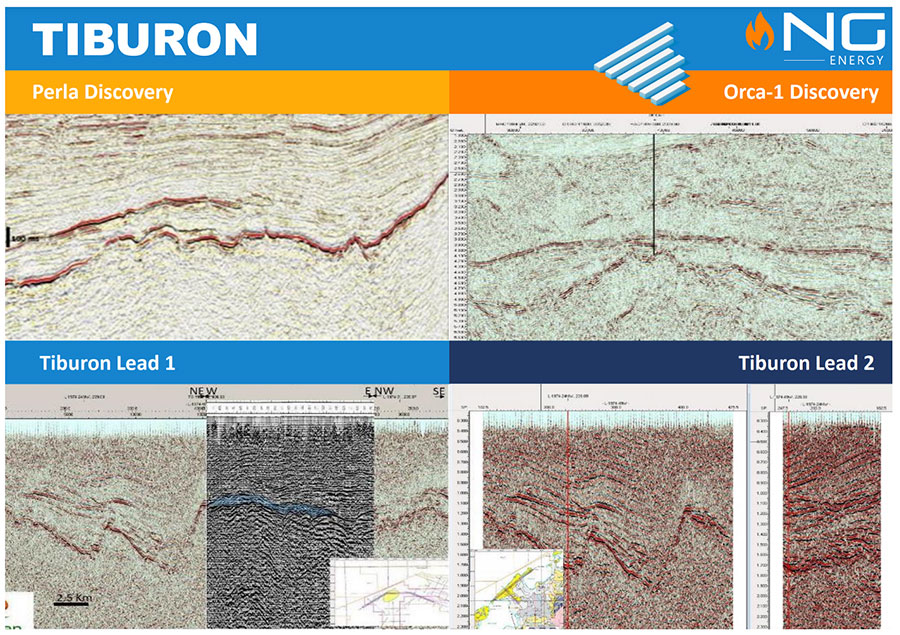

Finally, Tiburon provides blue-sky upside, located in the same basin as the largest producing gas field in Colombia and surrounded by two of the largest offshore gas discoveries on the Caribbean coast in recent history.

Projects like these are complex undertakings, but NG Energy’s (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) CEO is one of the ultimate veterans in the Latin American energy and resource sector. Serafino Iacono has over 30 years of experience in resource capital markets having raised more than $4 billion dollars for projects in his career.

Projects like these are complex undertakings, but NG Energy’s (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) CEO is one of the ultimate veterans in the Latin American energy and resource sector. Serafino Iacono has over 30 years of experience in resource capital markets having raised more than $4 billion dollars for projects in his career.

He currently serves as the executive chairman of Gran Colombia Gold, Colombia’s largest gold producer, giving him great insights into the business environment and climate in the region.

For an understanding of Serafino’s confidence in his team and assets, look no further than his insider filings where he continues to purchase stock in the open market. Serafino recently picked up 35,000 shares at $1.35 adding to his insider ownership of roughly 10%. Another notable insider is famed resource financier Frank Giustra, who owns roughly 20% of the Company.

Heading up NG Energy’s operational expertise is Executive Chairman Ronald Pantin, another veteran of the Latin American oil & gas industry. Pantin was previously CEO of Pacific Rubiales which, along with Serafino Iacono and Frank Giustra, he built from nothing to a 330,000 barrel of oil equivalent per day (boepd) producer hitting a peak enterprise value of US$12 Billion. Prior to Pacific, Pantin spent 23 years in the Venezuela oil & gas industry holding several senior executive positions at Petroleos de Venezuela (PDVSA) at a time when it was the second largest oil producer in the world after Saudi Aramco.

Heading up NG Energy’s operational expertise is Executive Chairman Ronald Pantin, another veteran of the Latin American oil & gas industry. Pantin was previously CEO of Pacific Rubiales which, along with Serafino Iacono and Frank Giustra, he built from nothing to a 330,000 barrel of oil equivalent per day (boepd) producer hitting a peak enterprise value of US$12 Billion. Prior to Pacific, Pantin spent 23 years in the Venezuela oil & gas industry holding several senior executive positions at Petroleos de Venezuela (PDVSA) at a time when it was the second largest oil producer in the world after Saudi Aramco.

Having investors and company builders like Iacono, Giustra and Pantin on your team not only means that you are able to raise the capital needed to expedite projects towards production; it also means you have the expertise, business insight and vision to build companies that return significant shareholder value.

5 Compelling Investment Reasons to Start Your Research on GASX Right Now

NG Energy (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) intends to help fuel Colombia’s clean energy transition by developing and bringing gas to the Colombian market from its three concessions and capitalize on a golden opportunity in a fantastic macro price environment – here’s how.

Reason #1 - The Dream Team Back Together Again

The last time this team came together they built Pacific Rubiales—a Colombian oil and gas play—that grew from 14,000 boepd to 330,000 boepd in just four years, hitting a peak enterprise value of $12Bn.

A truly remarkable growth story led by Pantin as CEO and Iacono as Executive Chairman.

The stock ran from pennies to $34 in a little more than 2 years.

Rubiales started in much the same way as NGE. They acquired a large land package and made a discovery—in that case a gas area in northern Colombia called La Creciente.

La Creciente turned out to be the second largest field in Colombia today.

The difference between then and now? Location, location, location.

La Creciente was remote. Infrastructure was sparse – there was nothing there and the CAPEX spend was enormous.

In contrast, NG Energy’s flagship SINU-9 and Maria Conchita fields are located in regions extremely well known for gas-production potential and very close to existing infrastructure.

Maria Conchita is 14 kilometers from the existing national pipeline system with the Company’s pipeline expected to be complete and tied in by the end of the year. SINU-9 is 25 kilometers from existing infrastructure. Tiburon is remote but perhaps the next La Creciente.

Reason #2 - Near-Term Production at Maria Conchita with Infrastructure Almost Complete

NG Energy’s most advanced block is Maria Conchita, set to begin production by the end of the year. Located in the Guajira Basin on Colombia’s Caribbean coast, the property borders one of the largest natural gas deposits in Colombia, the Chuchupa Ballena field.

Chuchupa boasts more than 900 millions of barrels of oil equivalent (MMboe) in reserves and accounts for approximately 40% of Colombia’s daily natural gas output.

NG Energy’s neighbouring property Maria Conchita currently has 2P reserves of 27.7 billion cubic feet (BCF) and best estimated prospective resources of 155.9 BCF.

In July 2020, NG Energy re-entered the Aruchara-1 well and tested 30 million standard cubic feet per day (MMSCFD) across three zones. The well has been completed and stands ready to be put into production. Earlier this year, NG Energy also re-entered the Istanbul-1 well, where a dewatering system is currently being installed which will allow the well to be completed and put into production at a rate management estimates to be between 3 to 5 MMSCFD.

NG Energy (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) has LOI’s in place with two very credible counterparties to sell the natural gas produced from Maria Conchita at >US$5 / million British thermal units (MMbtu).

With production facilities and the 14 kilometer pipeline connecting Maria Conchita to the national pipeline system expected to be complete by the end of the year, this is a very exciting time for NG Energy and investors.

Reason #3 - Crisis Looms Large for Colombia, and Needs a Solution Now

Colombia is in need of clean, reliable power to stimulate economic growth and meet its Paris Agreement CO2 emissions target of decreasing emissions by 51% by 2030.

Colombia is heavily reliant on hydropower, but climate change is shifting the dynamics as long-lasting and worsening droughts overtake the region, hydropower is increasingly less dependable. Natural gas is a perfect partner for hydropower, providing a secure electricity supply when there is insufficient rainfall.

Natural gas produces 50% less emission than coal and 30% less than oil. By replacing coal and oil, and supporting hydropower and renewables, natural gas can positively affect the energy transition by providing uninterrupted energy and reducing annual emissions.

Unfortunately, despite double-digit growth in domestic consumption, the country’s 14 primary gas-producing fields have seen shrinking production over the past several years with reserves projected to be cut in half this decade.

Given the shortfall in Colombian domestic production, utilities are forced to import expensive liquified natural gas (LNG) just as more of the world is doing the same, competing with continents and countries like Europe and China.

NG Energy’s mission is to boost domestic Colombian gas production, reducing the country’s reliance on LNG imports and helping fuel its clean energy transition.

Reason #4 - Huge Exploration Potential at Flagship SINU-9 (next door to Canacol’s producing project

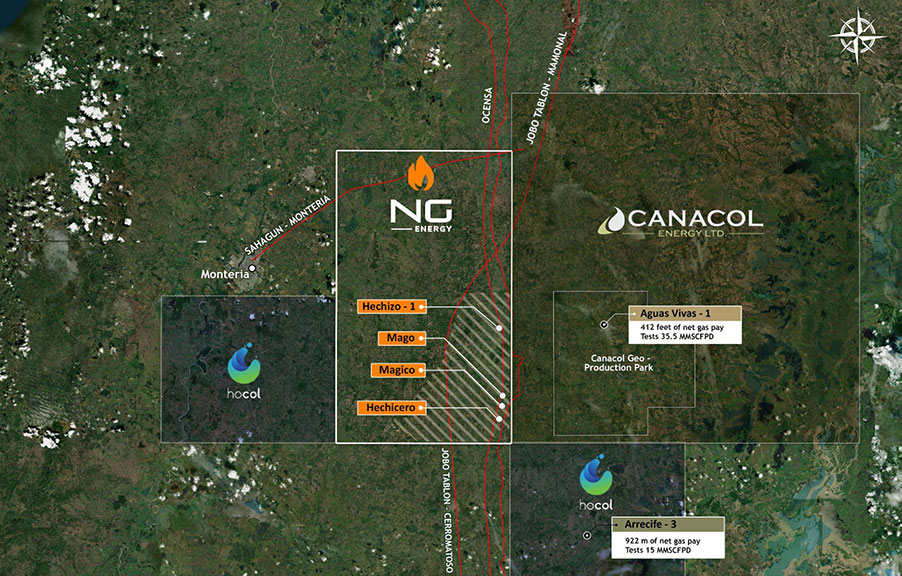

NG Energy’s (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) management refers to SINU-9 as the “jewel of the crown”, a large land package located in the heart of elephant country. SINU-9 is in a region extremely well known for its gas-producing potential and blocks are normally only reserved for major producers to bid on. Canacol Energy’s flagship project, which produces 200 MMSCFPD and makes it the largest independent gas producer in Colombia, is located directly east of NG Energy. The blocks to the west and south are owned by Hocol, a division of Colombian state-owned Ecopetrol.

The block currently has prospective resources of 1.5 TCF which the company is looking to prove up and develop. That is an ENORMOUS amount of gas.

NG Energy just received its environmental license, allowing for the development of up to 22 onshore conventional wells. It has begun construction of the road and the pad for its first well, Magico-1X, with drilling expected to commence in early November. Magico-1X is the first well in a fully funded four well drill program to be followed by Mago, Hechicero and Hechizo at the beginning of 2022.

Executive Chairman Ronald Patin enthusiastically commented in a recent news release that “we will start our exploration program focusing on the Magico/Mago/Hechicero area, which shows strong evidence of gas-bearing formations due to the presence of class 6 AVO interpretations with several flat and bright spots.”

The opportunity to develop SINU-9’s 1.5 TCF of prospective resources is HUGE.

Reason #5 - Blue Sky at Tiburon

NG Energy’s (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) third block, Tiburón, is icing on the cake, with blue sky multi-TCF exploration potential. Located in the Upper Guajira on Colombia’s Caribbean coast it belongs to the same basin as the Chuchupa block, the most prolific gas block in Colombia. Furthermore Tiburón is surrounded by Orca and Perla, two of the largest offshore natural gas discoveries on the Caribbean coast in recent history and shares many seismic similarities.

NG Energy intends to conduct a seismic survey and then evaluate next steps. Due to the large-scale nature of the territory, management will likely consider a partner to help develop the block.

6 More Great Reasons to Invest in NG Energy International (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF)

- Fully funded: With a long runway of cash on the balance sheet, NG Energy has raised necessary funds to expedite key milestones in one of the hottest commodity markets on the planet today.

- High Quality Asset Base: NG Energy has three substantially sized land packages offering both near-term production and blue sky exploration potential.

- Company Making Wells at SINU-9: construction of the roads and pads for the first four fully funded wells underway with Magico-1X set to be drilled in November 2021.

- Production Imminent at Maria Conchita: Maria Conchita is so close to being hooked up to the main TGI pipeline that the company is preparing its other projects simultaneously. Maria Conchita will be complete by the end of the year, and the project and stock are set to heat up quickly before the end of 2021.

- Essential to Renewable Transition: Its abundance, versatility, and tag for being the cleanest-burning hydrocarbon make it the ideal fuel to help meet growing demand for energy globally.

- Buffett boost: Never underestimate the Oracle. Warren Buffett makes calls that no one understands because they don’t see the multi-billion dollar macro picture. Want to make money like Warren Buffett? Invest like Warren Buffett!

Natural Gas Has a Chance to Go Parabolic

The energy sector is currently picking up steam and investors have already missed out on a lot of the big gains. NG Energy (TSXV:GASX | OTCQX:GASXFTSXV:GASX | OTCQX:GASXF) is under the radar for now, but when this becomes a crowded trade and stocks in the sector heat up quickly, the ones that will start to make moves and break out are the producers, not the explorers.

1https://www.worldoil.com/news/2020/7/16/warren-buffett-bets-97-billion-on-a-long-future-for-natural-gas

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling NG Energy International.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled NG Energy International and has no information concerning share ownership by others of any profiled NG Energy International. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any NG Energy International or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the NG Energy International. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled NG Energy International’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding NG Energy International future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to NG Energy International industry; (b) market opportunity; (c) NG Energy International business plans and strategies; (d) services that NG Energy International intends to offer; (e) NG Energy International milestone projections and targets; (f) NG Energy International expectations regarding receipt of approval for regulatory applications; (g) NG Energy International intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) NG Energy International expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute NG Energy International business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) NG Energy International ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) NG Energy International ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) NG Energy International ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of NG Energy International to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) NG Energy International operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact NG Energy International business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing NG Energy International business operations (e) NG Energy International may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of NG Energy International or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of NG Energy International or such entities and are not necessarily indicative of future performance of NG Energy International or such entities.