This Old School Nevada mining project is launching 2021 exploration that could uncover millions in long-ignored gold and copper resources.

This massive undeveloped project has sat untouched for decades even though…

- Visible placer gold was already confirmed.

- Massive lode deposits also have been identified and confirmed.

- The site now shows promising undiscovered assays in copper.

- Lode discoveries are being measured in ounces per ton, not grams.

- The resource value at this site could be hundreds of millions no matter where the price of gold moves over the coming months.

If you are a resource investor seeking grand slam growth potential in an off-radar junior, this discovery should get your attention fast. More important, it should get you started on your due diligence without delay.

As you may know, early positions in a resource junior can lead to stunning gains. Ten- to twenty-fold gains are not uncommon when an undiscovered resource junior makes a major discovery announcement.

As you read this report, you will learn the very unique history of this “Old School” Nevada gold prospect and why Walker River Resources (TSX.V: WRRTSX.V: WRR) may be close to a major breakout for its shareholders.

Hollywood couldn’t write this script…it opened early in the last century when miners were hauling out millions in gold and silver from newly discovered prospects in Nevada’s Walker Lane Trend.

Hundreds of small mining operations quickly discovered the abundant resources that laid at or near surface.

Placer gold was being plucked from the ground and panned from rivers. Hard rock miners broke into lode gold formations and made fortunes. These scenes played out early last century and one of the most productive regions was Mineral County, Nevada.

By today’s accounting, close to a half-billion dollars in gold was plucked from every mine site in the county…that is, every mine site except for one.

Focus on that: every mine site except for one!

That site is the Lapon Gold Project, now owned today by Walker River Resources (TSX.V: WRRTSX.V: WRR)

Walker River Resources (TSX.V: WRR) holds 100% ownership across 2,940 acres of what is known to be among Nevada’s most historically productive gold, silver and copper districts, the Walker Lane Trend. The company has targeted for immediate exploration the Lapon Canyon project, which has been virtually untouched for decades, yet could yield one of the biggest, most profitable resource investment opportunities in the market today.

Massive resource potential was discovered on this site as part of the abundantly rich Walker Lane Trend. But despite the overwhelming evidence of gold, silver and copper resources, which includes historical and modern exploration, the Lapon Gold Project has laid largely untouched, never fully mined despite its enormous resource potential.

Today, resources at the Lapon Gold Project remain in the ground much like miners might have found when first walking onto the site over 100 years ago.

This site has been known to host gold since the earliest of Nevada’s gold rush days. Mining should have gotten started decades ago. But hotly challenged ownership claims went unresolved and serious mining never got started. Family disputes raged to near legendary scale until very recently when cooler headed grandchildren decided they’d fought over this long enough, it’s time to make some money.

And based on what their grandparents uncovered, there’s an enormous amount of money to be made.

Millions of dollars in unharvested gold, silver, copper and other metals are thought to be sitting idle waiting to be fully explored and recovered. Finally the work is getting started.

Historical and current exploration suggest that the Lapon Gold Project could be one of the last remaining “old school” gold strikes in Nevada, if not the entire United States.

Old school because back in the day, Nevada gold discoveries like this were massively prolific.

This is not like a modern-day Carlin deposit where gold is extracted from ore assaying just one or two grams per ton of rock.

This is gold ore that is assaying in the hundreds of grams per ton.

You just don’t find sites like this any longer.

The Lapon Project may be one of the last remaining carryovers from the days when miners with picks and shovels swarmed the region for the placer gold and lode gold that first made Nevada and Mineral County famous.

Placer gold is gold that has been eroded from rich lode deposits, plucked or panned from waterways downstream from the geological source, i.e. the lode rock.

Lode deposits are typically rich, heavily assayed veins of gold (or other minerals) that when exposed through outcrops to erosion processes, feed the gold to the placer deposits. The total mineralization however can extend along shallow or deep veins running great distances near or below surface.

Excepting perhaps the modern Carlin Trend gold discovery, every major gold rush in North American history has been launched through the discovery of abundant placer and lode deposits.

Nevada’s Walker Lane Trend, on which Walker River Resources (TSX.V: WRRTSX.V: WRR) is located, gold and silver were first discovered and opened to mining in the late 1800s. In Mineral County alone, over 900 mining operations were launched ranging from small to large operations taking off the placer metals and chipping away or tunneling for the lode formations.

How about the price of gold…how does that factor in?

If you’ve been following the price of gold then you are already aware that for the last few months gold has channeled in the $1,750/oz range. What’s important to note is that the profit potential for early investors in Walker River Resources is not driven by the price movement in gold. Rather, the potential lies in the unreported gold assays and subsequent resources that Walker River could be reporting as a result of its 2021 drilling program. Many believe that gold could soon begin climbing again in response to inflationary pressures of U.S. deficit spending. It’s just one more reason to anticipate a favorable upside to Walker River shareholder value.

And the veins making up those lode formations were stunning. Westernmininghistory.com reports that, “Most of the veins are 2 to 4 feet thick, but some are as much as 80 feet thick.”1

To exploit those deposits, underground mining sought out the lines of those veins. At the Lapon Gold Project, tunneling had already been launched years past to target the most abundant mineralization zones. The discoveries were stunning. But the results remained unexploited over ownership disputes. So, the gold still sits, some in plain view, just waiting to be recovered.

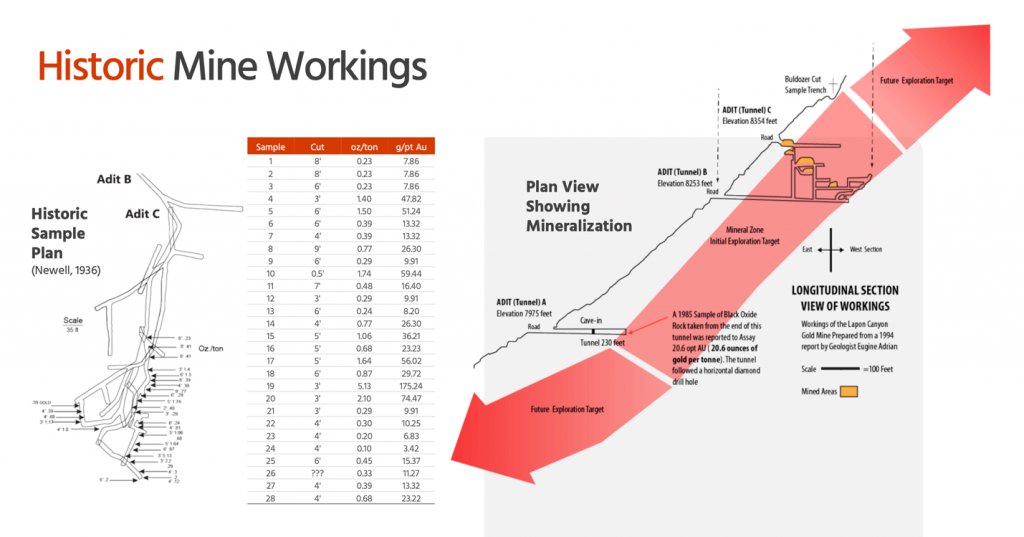

In publishing the historical records that documented these discoveries, Walker River Resources revealed assay numbers rarely seen in gold mining today. One vein reached at the end of an unfinished adit assayed at an astonishing 20.6 ounces per ton in gold!

To put that in perspective, economical cut-off grades for modern gold mining can range in the one-gram-per-ton range. Translated to grams-per-ton, this aforementioned assay equates to an astonishing 584 grams per ton in gold (Au)! 2

The potential here is not just speculative. Some historical, small scale high grade underground work began at Lapon Gold Project in 1914.

Walker River reports that, “Approximately 600 meters of drifts and raises were developed from two adits and a two-stamp mill was built. Further underground work was carried out, returning numerous assay values in the range of one ounce per ton, with a sample at the end of an adit returning 20.6 ounces per ton. (National Instrument 43-101, Montgomery and Barr, 2004).”

These adits remain accessible today and that 20.6 ounce discovery may well expose the face of a richly mineralized vein, the potential extent of which could be announced as the company proceeds with further underground work.

And it’s not just the underground work that is holding such enormous promise.

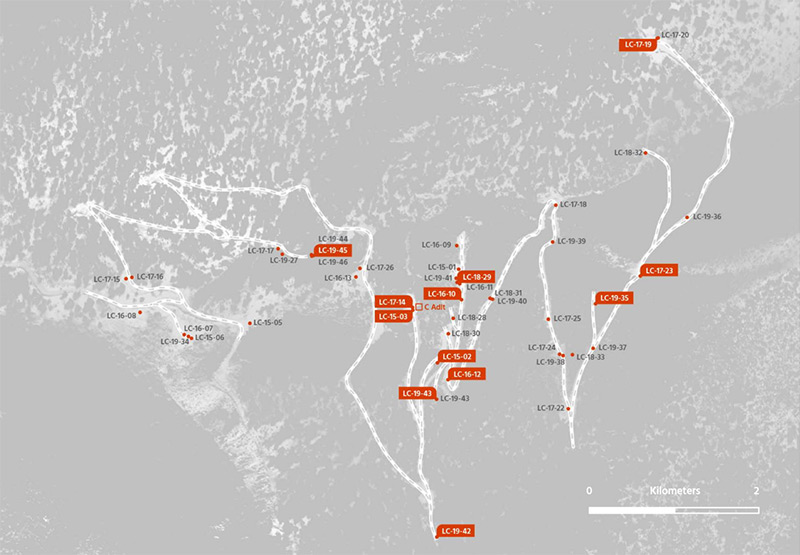

As family disputes were being resolved, some modern-day exploration work was commenced, which produced results from a number of drilling locations.

41 drillholes completed since first launched in 2004 returned assays simply unheard of today. Six of those drill sites returned assays ranging from 12.85 to 96.03 grams per ton in gold. And those assays measured from nine to thirteen meters in thickness!

Numbers like these are extremely rare in contemporary exploration work. Companies intercepting one to two gram per ton mineralization over a few meters often trigger significant investor interest. It’s hard to imagine what Walker River’s numbers could trigger.

As you launch your due diligence, take a look at recent results from other junior resource companies that have exploded in value on such assay announcements. Make the comparisons with Walker River’s historical data, you’ll likely be amazed.

There’s more to come. Additional exploration work has been launched for 2021 that can allow resource calculations that adhere to contemporary NI43-101 reporting standards.

Walker River (TSX.V: WRRTSX.V: WRR) has already announced and launched this expanded drilling program. From the company website (with added emphasis on a key point).

“The Lapon Canyon drill program will consist of systematic drilling on section for geological modelling purposes, exploration drilling to discover new gold mineralization and extend known gold mineralization.”

Here’s the key point: “known gold mineralization.”

There appears to be no doubt that the Lapon Project has gold in the ground…the question remains, how much?

Thinking back on the known history of the entire Mineral County region and the Walker Lane Trend, the extent of the unrecovered gold mineralization at the Lapon Gold Project could be substantial.

That thought is not only consistent with what is already known of the Lapon location, it’s consistent with the production records of nearby mines. For example, the Borealis Mine immediately to the south and on trend had been in production for 60 years until work got bolloxed up in legal disputes. As of 2011, and despite six decades of operations, mining-technology.com reports that the Borealis Mine is at present estimated, “…to contain proven and probable oxide and mixed oxide reserves of 17.2Mt of ore grading 0.021 ounces per short ton (oz/t) of gold and 0.13oz/t of silver. The contained volumes were estimated to be 368,800oz of gold and 2.2Moz of silver.” 3

Also reported through the company website is this information about the trend.

“The Lapon Gold Project is located within the Walker Lane shear zone, a 100-kilometre-wide structural corridor extending in a southeast direction from Reno, Nevada. Situated within this trend are numerous gold, silver, and copper mines, notably the historic Comstock Lode mines in Virginia City, the past-producing Esmeralda/Aurora gold mine, with reported production of some one million ounces [Au] and the Anaconda open-pit copper mine in Yerington, Nevada.”

Walker River’s 2021 drill program intends to more fully delineate the resource potential of Lapon Gold Project as well as the adjoining potential of the company’s Rattlesnake and Pikes Peak claims…all of which lie on the Walker Lane Trend. (See company website for maps and further details.)

A fully funded exploration program underway.

As of the September last year, Walker River (TSX.V: WRRTSX.V: WRR) reported “total gross proceeds [of] $3,500,000.00 in [a] non-brokered private placement” targeted for launch and completion of this year’s drilling program.

A total of 70 drill sites are planned (10 already completed with results pending announcement), which will increase the drilling data set to 111 locations and move the company closer to its first NI43-101 compliant resource calculations.

For investors, this can be a significant landmark. Exploration results when announced can fuel rapid share price movement. To invest for maximum growth potential, it’s best to stake a position in advance of those announcements. Even more important is to stake a position prior to the resulting resource calculations.

Resource calculations accrue directly to shareholder value and the trading range. Since Walker River’s resource calculations are assumed to be pending, the company’s share price could be significantly lower than the per/share value of the resource. Resource calculations become the launch pad from which companies take off. Getting in ahead of those reports sets the investor up for the greatest potential gains.

Of course, it’s possible that results from the 2021 drilling program will disappoint. Any investment in Walker River shares should be limited to that amount you feel comfortable putting at high risk for significant if not complete loss. Walker River must be evaluated in your due diligence as a highly speculative investment. However, high risk also sets the stage for high reward. In its current trading range around 11¢/share (typical for a junior resource company), Walker River (TSX.V: WRRTSX.V: WRR) holds tremendous triple-digit growth potential on its very promising historical records alone.

Now, with the company’s 2021 drill program already underway, the Lapon Gold Project could prove itself enormously valuable. That’s not all.

The Pikes Peak claims holds additional promise because historical findings on these claims confirm potential for significant new gold resource discoveries. Drilling planned for Pikes Peak could substantially bolster Walker River resource calculations.

Pike Peak also shows potential for copper recovery as well. From the company website, emphasis added

“The Pikes Peak drill program, will focus on the results of the 2020 reconnaissance mapping and sampling program that returned values of 9 g/t Au and 2.22% Cu from outcrops. Drilling will also focus on the extension of the significant historical mine workings.”

In summary, Walker River appears to be an exceptionally rare opportunity to secure a ground floor position in a company that holds enormous upside potential for early investors.

The company’s mining claims on an historically prolific trend are significant and well documented, though not documented to contemporary reporting requirements. Until those requirements are met through additional exploration and assay work, Walker River (TSX.V: WRRTSX.V: WRR) shares may be highly undervalued relative to the resource potential it holds. Now is an ideal time to launch your due diligence and get Walker River on your watch list radar screen.

What to do now…

If you’re looking for an entry point into what holds promise to be a highly rewarding investment, Walker River Resources (TSX.V: WRRTSX.V: WRR) deserves your immediate attention.

Also, if you prefer investing in an American exchange, be sure to get Walker River Resources (TSX.V: WRRTSX.V: WRR) on an investor watch list that covers the Canadian TSX.Venture exchange. Should Walker River begin trading on an American exchange (most likely OTC), news of that listing puts you well ahead of those to follow.

The company’s website should be your first stopping point. On this site you will find in-depth information about all three Walker River projects as well as the historical data that underpins the significant resource potential of the Lapon Gold Project location. Keep in mind that the numbers being reported at this site are unprecedented from contemporary North American gold exploration projects. These data points simply haven’t been routinely seen for decades, which is why the Walker River (TSX.V: WRRTSX.V: WRR) Lapon Gold Project can be readily labeled as “Old School”.

They just don’t come along like this any longer.

1https://westernmininghistory.com/articles/128/page1/

2https://wrrgold.com/the-lapon-gold-project/

3https://www.mining-technology.com/projects/borealis-gold-project-nevada/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Walker River Resources.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.