Early investors are just getting started. Here is one off-radar company that is poised for soaring gains this year.

Now is the time to get in front of this!

An Urgent Report to Growth Focused Investors:

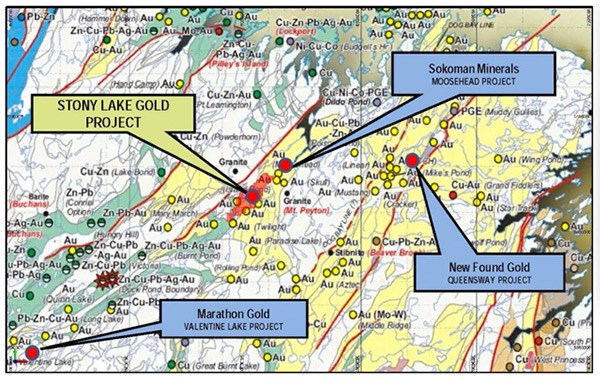

Take a look at this provincial map of Newfoundland on the Canadian Atlantic coast. Gold exploration activity has been skyrocketing throughout the province.

Millions of ounces in the yellow metal are being discovered, which has triggered an explosion in investing activity and soaring share prices from junior companies uncovering the richest resources.

For investors seeking an early entry into a well-positioned junior, K9 Gold Corp’s Stony Lake Gold Project sits as a standout opportunity in one of the best gold-bearing regions in the province. Over many millennia, Newfoundland’s unique geology evolved out of opposing continental tectonics that pressed millions of tons of gold-bearing ore to the surface. It created distinctively evident structural trends where gold can be concentrated in high-grade ore bodies.

K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) holds 13,025 hectares along 27 kilometers of the Cape Ray/Valentine Lake structural trend in central Newfoundland.

The Cape Ray trend has already proven itself as a prolific carrier of gold ore. To the southwest, Marathon Gold is aggressively drilling on trend announcing exceptional results well above economical cut off grades.

Proven reserves have already passed 1.3 million ounces Au along with additional data that puts combined reserves and resources above the 4.6 million ounce mark.1

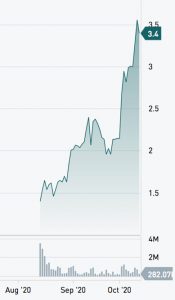

Charts like this are now screaming out of eastern Canadian gold country…

The impact of these resources has sent Marathon share soaring. Just four years ago, you could have locked in share at around 15¢ per! In mid-August it hit $2.60/share! That’s over 17-fold in share price gains!

Could you expect similar gains from an early start in K9 Gold Corp? Now is the time to look into it.

K9 not only lies on the same trend as Marathon, historical exploration on the site strongly suggests significant undiscovered gold potential. And as you will see in a moment, its stock lies in ground floor territory that could soon fly in value.

K9 not only lies on the same trend as Marathon, historical exploration on the site strongly suggests significant undiscovered gold potential. And as you will see in a moment, its stock lies in ground floor territory that could soon fly in value.

Here’s why K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) holds such strong growth potential.

As far back as 1989, Canada’s largest diversified resource mining company, Teck Resources (NYSE: TECK) moved exploration geologists onto the property to seek, find and report on the gold prospects. At the time, gold prices were crashing on a path to under $400. Though the Picket geology report came in favorably for its gold findings, Teck officials tabled the project and ultimately sold the claims.

In 2018 a detailed compilation of all historical exploration from the Picket report, along with substantial exploration data accumulated over subsequent years, was published for the Stony Lake property and properties bounded to the northeast on trend.

The report concludes: “There have been significant gold discovery results from past intermittent exploration work on the current Stony Lake East Project area…hosting very anomalous to high-grade gold values in tills, soils and rocks occur on District Copper’s Project.”

The same report identifies Sokoman’s Moosehead discovery to the northeast as being exceptionally rich. From that same report:

“The Moosehead property has seen more than 25 years of sporadic exploration, with discoveries of angular, epithermal-style auriferous quartz vein boulders assaying up to 442 g Au/t (13 oz Au/t) and drill intersections of up to 171 g Au/t (5 oz Au/t) over 1.5 m, 14.1 g Au/t over 16.8 m and 112.0g Au/t over 2.0 m.” (Emphasis from the original document!)

These are stunning assays well above typical economic cut-off grades at today’s gold price and point clearly to the enormous gold mineralization potential that exists in these Newfoundland trends.

The discoveries continue to build.

In late October the company announced results from its initial step-out drilling, which continues to intercept significant gold mineralization on trend; 22.3 g/t over 41.35 meters and 31.2 g/t over 18.85 meters! Again, these are exceptional results that appear to be the start of more to come.

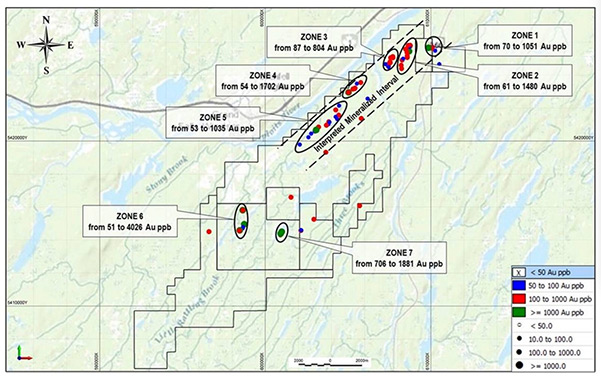

Recent exploration work bears out K9’s potential on the Cape Ray/Valentine Lake trend.

In 2019, an extensive field program was launched on the K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) prospect to map and further sample gold mineralization near surface. In addition, a property-wide magnetometer and radiometric survey was commissioned to map structural features and identify target areas for advanced on-the-ground exploration.

Eight areas of highly anomalous to high grade gold (15.05 g/t) mineralization were delineated and are now targeted for further exploration that can yield 43-101 compliant resource calculations.

Newly identified mineralization zones.

At current gold prices and with the relatively low cost of mining these near surface resources, economical cut-off grades can begin at 0.5 grams/per ton gold (Au). Updated exploration results identified seven high-quality prospects at Stony Lake for advanced exploration with multiple assays ranging from cut-off grade to four grams per ton Au.

Referring back to the regional map at the top of this report, data released by K9 Gold Corp management describe Stony Lake as being geologically analogous to the New Found Gold Queensway project which lies to east on a parallel gold trend. New Found Gold got an earlier start in the region, launching its sampling program in 2016.

Since that time, the company has released numerous gold findings that gave them a jump start on share price growth. On October 2, 2020, Mining Journal reported that:

“Shares in newly-listed explorer New Found Gold shot up to a fresh peak on Friday as the company reported high-grade results from its first drill hole at the Lotto zone, at its Queensway project in Canada’s Newfoundland.”

“Hole NFGC-20-17 returned 4.75m at 41.2g/t gold from 35m and 5.15m at 25.4g/t from 57m.”

“New Found Gold has said there was “strong evidence to suggest” the Central Newfoundland gold belt held many similarities to the Bendigo goldfields in Victoria, Australia, which hosts Kirkland Lake Gold’s high-grade Fosterville mine.”

Why is this important? Please note that Mining Journal described New Found Gold as “newly listed” in the U.S., but it came to America too late for the big gains. The stock price had already been run up on Canada’s Toronto Exchange where the shares rocketed on news of its Queensway exploration progress. From its March low of 69¢, shares soared to a recent high near $4.00 CAD per share.

The door to this entry-level buy on New Found Gold was closed even before it got started!

However, K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) stands wide open!

As of today’s report, K9 trades under 30¢/share in the US and it’s just getting started. Advanced work on trend with Sokomon bordering on the north and Marathon to the south, along with significant historical exploration on site suggest that K9 Gold Corp stands out as an entry-level opportunity capable of explosive gains for those who lock in an early shareholder position.

As of today’s report, K9 trades under 30¢/share in the US and it’s just getting started. Advanced work on trend with Sokomon bordering on the north and Marathon to the south, along with significant historical exploration on site suggest that K9 Gold Corp stands out as an entry-level opportunity capable of explosive gains for those who lock in an early shareholder position.

Consider moving quickly. Newfoundland is in the midst of a modern day gold rush that has investors pouring into the province and growing wealth right now. You do not want to miss this.

Not only is the Newfoundland gold rush fueling new investor excitement, the underlying asset itself has been soaring…with no end in sight.

Bank of America famously projected the world will hit $3,000 gold by the end of 2021. That’s over 50% higher than gold priced today. Soaring gold prices like this could double or triple the growth curve K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) posts on its resource valuations alone. Bloomberg reports:

“Bank of America Corp. raised its 18-month gold-price target to $3,000 an ounce — more than 50% above the existing price record — in a report titled “The Fed can’t print gold.”

“The bank increased its target from $2,000 previously, as policy makers across the globe unleash vast amounts of fiscal and monetary stimulus to help shore up economies hurt by the coronavirus.”

That’s another reason to move on K9 without delay. If gold were priced at $3,000 right now, K9 shares might be two- to three-times higher!

Of course, there is substantial risk that has to be considered as well. Gold prices could reverse. K9 Gold Corp could fall short of expectations. Any investment into a junior resource company should be considered as a high risk for substantial if not complete loss of your investment. Limit your investment decision only to that amount you feel comfortable with putting into a high-risk investment.

But keep in mind, for building wealth, few opportunities can match what can be earned from a well-placed position in a successful junior company holding the potential of K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF). Look at the results that neighboring projects gained from their earlier start. Share prices soared by triple digits in a matter of just months. The key is that those gains were earned by investors who secured those early positions…exactly where K9 appears today.

What to do now…

Get started on your due diligence. Go to the company website and sign up for email news releases. Contact your broker and put K9 on your stock watch list.

Better still, consider getting some skin in the game while K9 shares are priced so low. Now is the ideal time to act aggressively and both maximize your profit potential and limit your risk exposure!

Recapping…

- A modern day gold rush is underway right now in the Canadian province of Newfoundland. Millions of ounces are being discovered, which has triggered a global rush of investing interest into the region.

- K9 Gold Corp launched an exploration program on what’s known to be one of the most prolific gold trends in Newfoundland, the Cape Ray/Valentine Lake structural trend. Bounded on the north by Sokoman Minerals and further to the south with Marathon Gold, recent and historic exploration has documented millions of ounces of gold resources all along this trend shared by K9 Gold Corp (TSXV: KNCTSXV: KNC).

- The underlying asset, gold, appears on track for a major bull run through 2021 and beyond. Central banks are debasing currencies at an alarming rate, putting significant upside pressure on gold. BofA calls for $3,000 gold by the end of 2021, over 50% higher than today.

The conclusion is simple. Now is an ideal time to be making a move on gold. Everything is aligned for growth and few investments in the market today offer the rapid growth potential of a gold exploration company. To get started, visit the K9 Gold Corp website through this link and make sure you enter your email address for future information and breaking news. Stay ahead of the market to make the most of your investment decision.

1https://marathon-gold.com/site/uploads/2020/10/21-10-2020-Marathon-Announces-Latest-Berry-Drill-Results-vFinal.pdf

2https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

3Source: First Year Assessment Report on the Geology and Geochemistry of the Bishop’s Falls Property, 1990, J. Wayne Pickett

4National Instrument 43-101Technical Report: Compilation of Historical Geological, Geochemical and Geophysical Exploration Work Carried Out Over the Stony Lake East Epithermal Gold Project, 2018, Larry Pilgrim , P. Geo, page 26

5Ibid. page 27

6#

7 https://www.mining-journal.com/discovery/news/1396436/lotto-find-lifts-new-found-gold

8 https://www.theglobeandmail.com/investing/markets/stocks/NGD-T/

9 https://www.bloomberg.com/news/articles/2020-04-21/bofa-raises-gold-target-to-3-000-as-fed-can-t-print-gold

10https://www.bloomberg.com/news/articles/2020-04-21/bofa-raises-gold-target-to-3-000-as-fed-can-t-print-gold

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling K9 Gold Corp..

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.