Are These The Early Days Of A 30-Year Copper Supercycle?

When Bankers Use Terms Like "Megatrend", Investors Need To Pay Close Attention

Featured Editorial | Feb 10, 2021

One of the largest projects in human history is underway... the transition to carbon-free energy.

- It’s electrified savvy copper miners, the ones sitting on blockbuster properties, that have been waiting for unprecedented demand to drive prices higher.

- With supply shortages forecast, and new mines hard to come by, one copper developer could be set to claim center stage.

- That’s because a small company owns 100% of what could be one of the world’s last great copper properties in a historic producing belt not yet controlled by the majors

Copper’s big moment has arrived.

A revolution that’s abandoning fossil fuels for batteries, solar, and wind power means the shiny metal has decades of growth ahead of it.

The trend has copper now selling at nearly $10,000 a metric ton with no significant retreat in recent times. That’s why miners with near shovel-ready projects are today’s biggest winners.

Investors are starting to look at commodities and inflation on the horizon. Technology needs metal. And why there’s a copper mining company that natural resource investors need to move onto their radars immediately.

Surprisingly, the fact that they are advancing a project with what is anticipated to be significant resources… or that it is run by a team with extensive mining experience… well, those aren’t the biggest draw.

The number one reason to take a look at Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) is timing and the commodity it owns.

For while it’s generally true that you can’t time the markets… you can time a sector.

And, since the beginning of the year, investment analysts and mining executives have been bellowing that global trends have combined to create an accelerated interest in copper.

It’s Time To Focus On Copper

The experts’ voices, however, have been drowned out by other big trends such as cryptocurrencies and political antics in the U.S.

Now it’s time to pay attention… particularly to Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) and its Vizcachitas property in Chile’s world-famous copper belt.

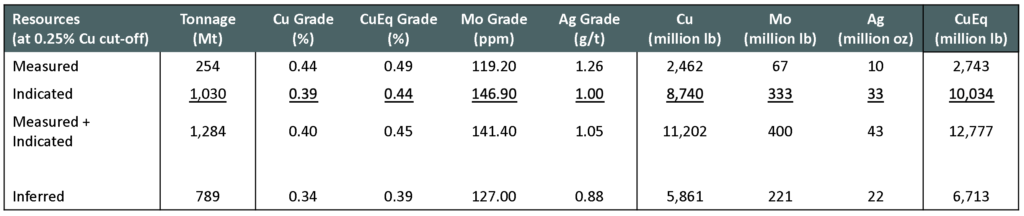

You see, Los Andes has been sitting on an estimated 13-billion pounds of copper here for the past seven years.1

In other words, Los Andes Copper has a property with a potential 40-year-mine life.

Los Andes Copper has completed a Preliminary Economic Assessment with a $3.50 copper price, and independent engineers have estimated it to be worth as much as $2.7 Billion (NPV @ 8%, post tax).

That report is assuming copper at $3.50 a pound. It’s important to note that copper is currently trading at over $ 4.00 per pound.

The company is trading at a market cap of just under $250 Million. There are many risks and a significant capital cost to bring this value to fruition; however, Los Andes Copper is running under the radar compared to its peers.

This is also why Los Andes boldly posts that its Vizcachitas Project is – “Chile’s Next Major Copper Mine.”2

That’s saying a lot when you consider the fact that seven of the world’s top 10 copper mines are located in Chile.3 And that Chile mines nearly 30% of the world’s copper.4

Mining Analyst Suggests There Could Be Big Numbers On The Table

Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) is in position to establish a mine that could someday be in the ranks of other Chilean mines run by majors like Glencore, COLDELCO, Anglo American, Teck, and Antofagasta.

And investors are already taking notice.

From September to the beginning of December 2021, Los Andes Copper’s share price has pushed past $8 in the U.S. and over $11 in Canada.

But there could be way more to come… a lot more… because on December 1, 2021, a Cantor Fitzgerald mining analyst, Mike Kozak, mapped out the future for the Vizcachitas project.

But there could be way more to come… a lot more… because on December 1, 2021, a Cantor Fitzgerald mining analyst, Mike Kozak, mapped out the future for the Vizcachitas project.

His reasoning is based on recent mergers and acquisitions action in Chile… and that Los Andes Copper’s Vizcachitas project is the largest copper project in South America that has yet to announce either a joint-venture partnership or strategic investment from a large-tier mining company.

Kozak believes that could soon change because M&A activity in the region is heating up.

During the late fall, Australia-based South32 acquired 45% of the Sierra Gorda mine for $2.05 billion in cash, while Capstone Mining acquired 70% of the Mantoverde mine for $1.29 billion in shares.

Then in a December 2021 Copper M&A Update Report, the analysts at RFC Ambrian named the Vizcachitas project as having been in the top ranked candidates for M+A in copper.

That bodes well for Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF).

The Green Energy Revolution’s Unexpected Supply Crisis

The M&A, or joint-venture speculation, is driven by the sudden reality that the world will soon need a massive new supply of copper.

In fact, a who’s who of analysts agree that a far-reaching, global shift towards clean energy will soon be met by historic copper shortages.

Moreover, the analysts, Nicholas Snowden, Jeffrey Currie, Daniel Sharp, and Mikhail Sprogis, doubled down on their forecast.

They wrote that copper’s price strength is not an irrational aberration,

“Rather, we view it as the first leg of a structural bull market in copper.”5

Mark Lewis, the chief sustainability strategist at BNP Paribas Asset Management, was just as bullish.

He told The Guardian that the next 30 years should be copper’s “supercycle” thanks to a worldwide acceptance of green energy.6

It’s a supercycle Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) is poised to take part in.

The EV Market Alone Needs 25 Billion Pounds Of Copper

The M&A, or joint-venture speculation, is driven by the sudden reality that the world will soon need a massive new supply of copper.

Today, the average EV holds about 200 pounds of copper. That’s 60% more than the content in an average internal combustion powered vehicle.7

And there could be between 125 and 220 million EVs on the road across the globe by 2030, according to a report released by the International Energy Agency.8

The math is simple, 125 million EV’s will require about 25 billion pounds of copper.

Remember, that’s on top of current demand, and we’re not yet factoring in wind and solar energy.

Or that copper is a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves massive amounts of fiber and copper cable to connect equipment.

As a rule of thumb, wind energy requires on average 2,000 tons of copper per gigawatt of capacity, while solar needs about 5,000 tons per gigawatt — several times higher than fossil fuels and nuclear energy.

This puts Los Andes Copper in a sweet spot because U.S. solar and wind deployments are on track to hit new records in 2022.

Green Infrastructure Goals Multiply Copper’s Potential

The increased momentum is laid out in a new report from S&P Global Market Intelligence.

Across the globe, S&P Global expects as much as 44 gigawatts of utility-scale solar and 27 gigawatts of wind to come online next year.9

Between EV’s need for 1.84 million metric tons of new copper supply, plus wind/solar due to add 929,000 metric ton supply demand, the world will soon need nearly 3 million metric tons of new copper supply.

That’s a 15% jump in demand from today’s 20 million metric tons of copper mined worldwide.

Where All That New Copper Comes From Is Still A Mystery

BloombergNEF made a mid-term forecast that’s just as dire.

Bloomberg reports that copper miners need to double global copper production just to meet the demand for a 30% worldwide penetration rate of electric vehicles.10

Bloomberg reports that copper miners need to double global copper production just to meet the demand for a 30% worldwide penetration rate of electric vehicles.10

It says the jump must be from the current 20 metric tons a year to 40Mt.11

That’s too conservative a forecast, according to the consultancy CRU Group. It says copper consumption by green energy sectors globally is expected to jump fivefold in the next 8 years.

Fivefold means 100 metric tons… and the world has no idea where that will come from.

Looking at the forecast for demand, that would mean between an 18 metric ton shortfall to an 85 metric ton shortfall.

The Century’s Last Great Copper Discovery

Here’s something important to ponder. Expectations are that more than 200 copper mines will run out of ore before 2035, with few new mines in the pipeline to take their place.12

One of the sector’s few bright spots is likely Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF), with its potential for reserves that exceed 13 billion pounds of copper – every ton located smack in the heart of a world-famous copper basin.19

While Los Andes Copper is in its beginning stages, many of the largest copper mines are in their twilight years as reserves continue to dwindle.

Moreover, according to MINING, they must dramatically slow production due to major capital-intensive projects to move operations from open pit to underground.12

Examples include the world’s two largest copper mines, Escondida in Chile, Grasberg in Indonesia, and Chuquicamata, the biggest open pit mine on Earth.

Adding insult to injury, in Chile, copper grades have declined by about 25% at established mines over the past decade.14

That means bringing less ore to market.

Los Andes Copper Won’t Have To Put A Shovel In The Ground To Gain Recognition

So here is copper’s ultimate reality… and likely the true reason Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) has a third-of-a-billion-dollar market cap… and growing.

It’s a truth that until very recently has only been whispered.

Then, on November 4, 2021, MINING yelled it out to the world.

And, that truth is this: giant mining companies with crappy or dwindling copper reserves are likely to have strong interest in smaller companies with huge new reserves.

There’s a reason why, but first, here’s what MINING wrote:

It said that expanding the copper supply was not an insurmountable goal, but it would take major investments in copper exploration at a scale that has never been attempted.

Then it wrote this…

“Any copper junior with a deposit of significant size and grades, will have no problem attracting a major or mid-tier acquirer, that can help finance a future copper mine and bring it to commercial production.”

Los Andes Copper’s neighbors in Chile are some of the world’s biggest and most influential mining companies. They include, BHP Billiton, Glencore, COLDELCO, Anglo American, Freeport-McMoRan, Teck, and Antofagasta.

And, as you’re going to see now…

Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) is led by a management team with deep relationships across Chile’s mining sector and the globe.

An All-Star Team That’s Dedicated To Its Shareholders, The Environment, And Its Citizen Neighbors, Too

From The Ivy League To World Renowned Miner

FERNANDO PORCILE, Executive Chairman – A mining engineer, schooled at the University of Chile. Who earned a Master’s in Mineral Engineering from Columbia University in New York, Mr. Porcile brings more than 50 years of mining experience to Los Andes Copper.

He’s been responsible for the development, implementation, commissioning, and operation of new mining projects, as well as the management of various world-class operations.

Mr. Porcile has served as a Director of the Codelco, Chile’s state-owned copper mining company, President of Collahuasi, a high-attitude copper miner with nearly 4 billion metric tons of reserves. He was also President of Falconbridge’s Copper Business Unit and Vice President Project Development for BHP Billiton’s Base Metals.

The Advisor To Giants

WARREN GILMAN, Director – A mining engineer with more than 30-years of experience, Mr. Gilman was Chairman and CEO of Queens Road Capital, founder of the CIBC Global Mining team in Toronto. Before that, he served as an advisor to the largest mining companies globally, including BHP, Billiton, Rio Tinto, and many others. Mr. Gilman also led CEF Holdings Ltd., a global mining investment company, equally owned by CIBC and CK Hutchison Holdings Ltd.

From MIT To Wall Street

EDUARDO COVARRUBIAS, Vice Chairman – With a degree in Industrial and Chemical Engineering from the Catholic University of Chile and a Masters in Management from the Massachusetts Institute of Technology, Mr. Covarrubias oversees Los Andes Copper’s mining interests at the Vizcachitas project. Putting both his degrees to work, he was a banker with the Chase Manhattan Bank for almost a decade, covering the mining sector in Chile. His responsibilities included project financing, structured finance, and mergers and acquisitions transactions.

A Powerful Advocate

CORINNE BOONE, Director – An environmental economist with more than 25 years of experience focused on sustainable business, climate risk, carbon markets, and executive leadership, Ms. Boone Chairs Los Andes Copper’s Environmental, Social, and Governance Committee. She is also the Board Chair of the Canadian Energy Research Institute. Ms. Boone also sits on the energy consultancy Efficiency One board, and she is CEO of the boutique consultancy Climate and Sustainable Innovation. The former Managing Director of Hatch’s Environmental Services Group, and Managing Director of CantorCO2e, a Cantor Fitzgerald subsidiary, she holds a Master of Environmental Studies from York University and a BA from St. Thomas University.

An Experienced Hand At The Wheel

R. Michael Jones, CEO and President – Mr. Jones has a Bachelor’s Degree in Applied Science, Geological Engineering from the University of Toronto. He is a licensed Professional Engineer with a solid track record as a CEO and Director at mining companies.

His notable accomplishments include being CEO and Director of Platinum Group Metals Ltd, where he created several JVs with major mining houses, raised over $750 million institutionally, and discovered and advanced a new mine with 19 million ounces of Palladium reserves. In addition, he co-founded the Toronto and Vancouver listed, West Timmins Mining, and the Toronto and New York listed, MAG Silver, where he was Director.

The Man Who Builds Big Things

MANUEL MATTA, Director of the Vizcachitas Project – This University of Chile Mining Engineer grad has 30 years of experience in operations, planning, and projects. Mr. Matta has a well-proven talent for asset optimization and the development of copper concentrate treatment technology. He worked for Barrick Gold as Vice President of Project Construction, responsible for the construction of large capital projects worldwide. Mr. Matta also worked for Falconbridge and Xstrata as Vice President of Projects and Development, where he led the expansion of the Collahuasi copper project. And, as General Manager of the Altonorte Smelter in Antofagasta, Chile, Mr. Matta led the operation upgrade for the custom copper smelter, which is one of the world’s largest.

A Multi-Talented Man Of The People

IGNACIO MELERO, Director of Corporate Affairs and Sustainability – The truth is, natural resource companies can be lousy neighbors. Mr. Melero, a lawyer with a JD from Pontificia Universidad Católica de Chile, makes sure that’s not the case with Los Andes Copper. He has vast experience in corporate and community affairs, including one of the toughest jobs in the world — community affairs for CMPC. There, he managed community and stakeholder affairs for the forestry divisions of CMPC, which Forbes says is the world’s largest pulp and paper company. Mr. Melero also has friends in high places, having worked for the Government of Chile in the Ministry General Secretariat of the Presidency. He was responsible for the inter-ministerial coordination of the ChileAtiende project, a multi-service network linking communities, regional governments, and public services to bring the state closer to its citizens.

10 Reasons To Make Your Move On Los Andes Copper Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) Without Delay

- Los Andes Vizcachitas Project, in the heart of Chile’s world-famous copper basin, could hold as many as 13-billion pounds of copper that a major mining company does not control.16

- To be blunt, there’s the long-term future, and there’s today’s reality. Here’s how MINING explains it … “Any copper junior with a deposit of significant size and grades, will have no problem attracting a major or mid-tier acquirer, that can help finance a future copper mine and bring it to commercial production.”17

- Copper is just entering what could be as long as a 30-year supercycle, with $10,000 per metric ton being copper’s new normal.

- The supercycle is driven by a fundamental change… the carbon-based climate crisis.

- Electric vehicles use at least 200 pounds more copper than the internal combustion engines that power traditional vehicles.

- Wind energy requires on average 2,000 tons of copper per gigawatt, while solar needs about 5,000 tons per gigawatt — between 2021 and 2022, the U.S. Energy Administration forecasts that 23 GW of wind and 34 GW of solar power will come.

- Despite the COVID-19 disruption, there are now a total of 5.6 million EVs on the road worldwide. Now, based on a compound annual growth rate of 29%, Deloitte’s research estimates annual sales could top 11.2 million in 2025 and 31.1 million by 2030. At this milestone, fully electric vehicles will account for 81% of all new EVs sold, according to the research, outperforming their plug-in hybrid peers. At 200 pounds of copper per car, where are the extra 62 billion pounds of copper coming from?18

- Junior miners with less spectacular potential copper reserves have seen their shares prices soar to mid to high-triple-digit gains in the past year.

- Los Andes is located in a mining friendly jurisdiction, one with available large-scale resources to match the company’s large-scale intentions. That includes easy access to water, rail, roads, and power. And its lower elevation compared to some Chile operations offers reduced costs and heightened efficiency.

- Engineering factors also play to Los Andes strengths. For example, since the deposit is in a river valley, a river diversion tunnel will be required. That means that environmental controls will be tight, which should appeal to investors seeking company’s that maintain sustainable practices.

The Power To Transform Los Andes To An Established Mining Company

While Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF) is well known in the hallways of the large copper producers, it is not yet well known in the investment market.

But this is quickly changing.

Demand for copper is only increasing, and mines with the ability to scale are harder and harder to come by.

And these factors have aligned at a time when Los Andes is preparing to advance a world class, easy to access 13 billion pound copper resource. Needless to say, deposits like this are not only difficult to locate, but they take years to explore and develop. Los Andes Copper stands out when compared to other copper projects in terms of its value and lack of market recognition. Resource Analysts are just starting to take note.

We highlight for balanced disclosure, and there are risks in any new mining project. We refer investors to the independent Technical Report, https://www.losandescopper.com/projects/technical-reports/ Preliminary Economic Assessment, June 2019, for technical and other project risks and opportunities.

There’s little doubt that this project is both attractive and competitive. Of course, there are inevitable risks when it comes to any new project, which is why you’re encouraged to talk to your investment advisor about the opportunity in Los Andes Copper (TSXV:LA, OTC:LSANFTSXV:LA, OTC:LSANF).

1https://www.losandescopper.com/site/assets/files/3561/los-andes-corporate-presentation-november-3-2021.pdf

2https://www.losandescopper.com/

3https://mining.com/wp-content/uploads/2015/11/Top-ten-copper-mine-table-full-size.jpg

4https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-copper.pdf

5https://www.miningweekly.com/article/copper-bull-market-now-fully-under-way-goldman-sachs-2020-12-02/rep_id:3650

6https://www.theguardian.com/business/2021/feb/17/mining-boom-commodity-supercycle-copper-nickel-price-investments-clean-energy

7https://www.reuters.com/article/sponsored/copper-electric-vehicle

8https://www.reutersevents.com/downstream/supply-chain-logistics/125-million-electric-cars-be-road-next-decade-chemical-industry-must-prepare

9https://www.spglobal.com/marketintelligence/en/news-insights/research/green-energy-revolution-boost-for-industrial-metals-demand

10https://www.mining.com/web/copper-discovery-cupboard-bare/

11https://www.mining.com/web/copper-discovery-cupboard-bare/

12https://www.mining.com/web/copper-discovery-cupboard-bare/

13https://www.mining.com/web/copper-discovery-cupboard-bare/

14https://www.mining.com/web/copper-discovery-cupboard-bare/

15https://www.mining.com/web/copper-discovery-cupboard-bare/

16https://finance.yahoo.com/news/los-andes-copper-starts-additional-070000854.html

17https://www.mining.com/web/copper-discovery-cupboard-bare/

18https://www.automotiveworld.com/news-releases/deloitte-worldwide-roads-on-course-for-31-1-million-electric-vehicle-milestone-by-2030/

19

** IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY! **

This article is a paid advertisement. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Los Andes Copper (“LA”) and its securities, LA has provided the Publisher with a budget of approximately $197,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by LA) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled LA and has no information concerning share ownership by others of any profiled LA. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

Certain of the information and statements contained in this presentation constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is often, but not always, identified by the use of words such as: “believe”, “expect”, “anticipate”, “intend”, “estimate”, “postulate” and similar expressions, or are those, which, by their nature, refer to future events. Forward-looking information in this presentation includes, without limitation, statements regarding the Vizcachitas project becoming Chile’s next major copper mine; the anticipated timing for completion of future milestones, such as the completion and filing of the Environmental Approval Package, the completion of a preliminary feasibility study and feasibility study, the initiation of project construction and the initiation of commercial production; the ability to achieve the recoveries and the processing capacity of the mines; regulatory processes and permitting; estimates of copper or other minerals grades; anticipated costs, anticipated sales, project economics, the realization of expansion and construction activities and the timing thereof; the demand for and supply of copper; production estimates and other statements that are not historical facts. Information concerning mineral resource estimates and the preliminary economic analysis are also forward-looking information in that they reflect a prediction of the mineralization that would be encountered, and the results of mining it, if a mineral deposit were developed and mined. Although the LA believes that such forward-looking information as set out in this presentation are reasonable, it can give no assurance that any expectations and estimates contained in the forward-looking information will prove to be correct. The LA cautions investors that any forward-looking information provided by the LA is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors, including, but not limited to, the state of the financial markets for the LA’s equity securities; the state of the market for copper or other minerals that may be produced generally; significant increases in cost of any of the machinery, equipment or supplies required to develop and operate a mine; a significant change in the availability or cost of the labour force required to operate a mine; a significant increase in the cost of transportation for the LA’s products; variations in the nature, quality and quantity of any mineral deposits that may be located; the LA’s ability to obtain any necessary permits, consents or authorizations required for its activities; the LA’s ability to raise the necessary capital or to be fully able to implement its business strategies; the evolving legal and political policies of Chile; the volatility in the Chilean economy, military unrest or terrorist actions; industrial or environmental accidents; availability and cost of insurance; currency fluctuations; and other risks and uncertainties associated with the exploration and development of mineral properties. The reader is referred to the LA’s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the LA’s profile on SEDAR at www.sedar.com. Except as required under applicable securities legislation, the LA undertakes no obligation to publicly update or revise forward-looking information. The scientific and technical content of this presentation was reviewed, verified and approved by R. Michael Jones P.Eng (CEO), a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects”. Information Containing Estimates of Mineral Reserves and Resources The mineral reserve and resource estimates reported in this presentation were prepared in accordance with Canadian National Instrument 43-101Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. For United States reporting purposes, the United States Securities and Exchange Commission (“SEC”) applies different standards in order to classify mineralization as a reserve. In particular, while the terms “measured,” “indicated” and “inferred” mineral resources are required pursuant to NI 43-101, the SEC does not recognize such terms. Canadian standards differ significantly from the requirements of the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories constitute or will ever be converted into reserves. In addition, “inferred” mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, issuers must not make any disclosure of results of an economic analysis that includes inferred mineral resources, except in rare cases..

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Tycona Media Ltd. is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Los Andes Copper.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Los Andes Copper and has no information concerning share ownership by others of any profiled Los Andes Copper. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Los Andes Copper or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Los Andes Copper. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Los Andes Copper’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Los Andes Copper future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Los Andes Copper industry; (b) market opportunity; (c) Los Andes Copper business plans and strategies; (d) services that Los Andes Copper intends to offer; (e) Los Andes Copper milestone projections and targets; (f) Los Andes Copper expectations regarding receipt of approval for regulatory applications; (g) Los Andes Copper intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Los Andes Copper expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Los Andes Copper business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Los Andes Copper ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Los Andes Copper ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Los Andes Copper ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Los Andes Copper to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Los Andes Copper operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Los Andes Copper business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Los Andes Copper business operations (e) Los Andes Copper may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Los Andes Copper or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Los Andes Copper or such entities and are not necessarily indicative of future performance of Los Andes Copper or such entities.