When Bankers Start Using Terms Like “Megatrend” It’s Time For Investors To Pay Close Attention

- When it comes to electric vehicles, it’s no longer huge news that they are driving an unrelenting demand for lithium and copper.

- But it‘s not just EVs, with a global paradigm shift to developing renewable energy platforms and infrastructure, millions of tons of these critical metals will need to be mined for many decades to come.

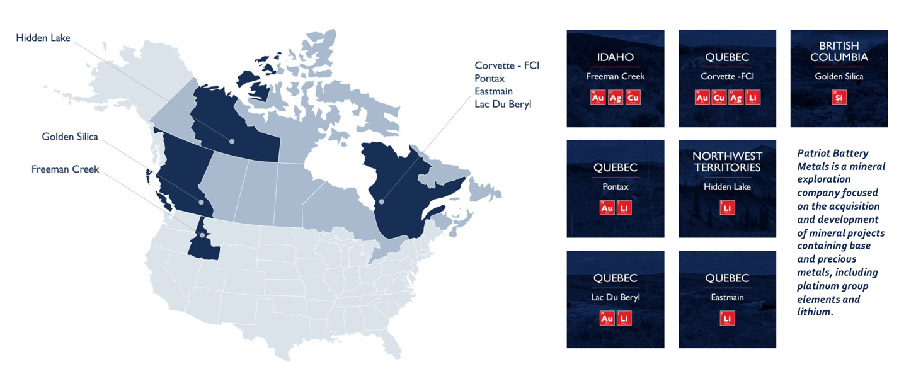

- With supply shortages forecasted on both fronts, junior explorer Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF) could be set to claim center stage.

- Especially now that its all-star mining team looks ready to deliver in a big way on projects that boast high grades of copper, lithium, silver, and gold.

What It Means For Investors

Readers have no doubt been enjoying the spectacular gains in the stock market since the COVID-19 induced market bottom last year.

Especially when it comes to the mining sector. Overall, copper, lithium, and uranium sectors have seen unprecedented jumps in demand and in price.

Lithium and copper prices have tripled and doubled, respectively, from COVID-19 lows; many analysts believe both could double again.

Even at current levels, junior mining companies that make new discoveries and advance projects towards commercial production could see huge gains.

And as a result, smart money investors are turning to natural resource stocks, especially battery metal companies producing the resources necessary to move the globe into a greener future; hard asset companies that also offer a hedge on inflation.

There have already been some outstanding wins in this space…

Quantum Battery Metals shot up 2,500% from its 52-week low

Vulcan Energy Resources soared 1,800% in the same time frame

American Battery Metals skyrocketed 1,400% before settling back down to average around $1.50.

That’s why there’s a copper, gold, silver, and lithium mining company that natural resource investors need to immediately move onto their radars: Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF).

In a highly unusual turn of fate, Patriot Battery Metals is exploring for BOTH copper and lithium on the same property. Investors get two bites of the exploration apple — more bang for the buck. And that’s not even mentioning what could be bonanza grade gold and silver assets.

If Patriot finds what it’s looking for on either of its copper or lithium trends, its C$16M market cap could become a distant memory. To be clear, this is an early-stage project, but management knows from surface samples that there’s high-grade copper and lithium mineralization.

The question now is how much.

Make no mistake, there’s a chance the grades won’t impress or the size of deposits will disappoint. This is exploration, those are the risks. However, there’s reason to believe drill results will be promising and provide critical information to prudently target the next set of drill holes.

There’s also the possibility of hitting blockbuster grades or wide intervals of mineralization. That’s what makes exploration drill plays so exciting and potentially rewarding.

The crazy thing is this: the fact that the company could be sitting on a resource… or that it’s run by men who’ve done at significant mining deals… well, those aren’t the biggest factors for investing in it.

Call it the Friedland factor – because the number one reason for making a move into Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF) is timing.

For while it’s generally true that you can’t time the markets… you can time a sector.

And since early January, world-class investing analysts and expert mining executives have been bellowing that global mega trends have combined to create a huge – “new bull market” for these two vital metals.

In a recent Wall Street Journal article, CEO Davis Archer of Savanah Resources said,

“You will find there is a ‘sold out’ sign on every operating mine at the moment. There will be some bad moments in the coming years where there will be a shortage of lithium production.”

USA Today claimed, “We’ve gone electric, and there’s no going back at this point. Lithium is our new fuel, but like fossil fuels, the reserves we’re currently tapping into tapping into are finite — and that’s what investors can take to the bank”1

And legendary mining financier Robert Friedland claimed the price of copper will soar so high that “you’ll need a telescope to see it.”2

The Entire World is Going Electric, Driving Lithium and Copper Prices Sky-High

There is little doubt that much of the world is turning away from fossil fuels to electric power.

Ten year demand forecasts for lithium range from 15% to 25%/yr., 5x the potential growth rate of copper. And that’s on the conservative side.

According to a new report by Fitch Solutions, the global electric vehicle fleet will grow an average of 23.6% a year between 2021 and 2030, reaching 83.6 million vehicles on the road worldwide by 2030 compared to only 300,000 in 2020.1

Although lithium prices pulled back three years ago when production outpaced demand, many analysts believe the overall trend remains very bullish.

The International Energy Agency (IEA) estimates the need for lithium will increase by up to 70 times2 over the next 20 years.

For its part, Fitch Solutions projects that for every 1 million electric vehicles on the road, the electric vehicle market will need 60,000 tons3 of lithium. At that rate, the world will need between 2 and 5 million tons of high-grade lithium over the next five to ten years.

Current production is estimated to be only around 82,000 tons4 annually worldwide – a small fraction of what will be needed.

You don’t have to be a Wall Street trader to connect the dots here.

Millions of battery-powered cars will hit the road in the 2020s. And each year they’ll need more and more lithium.

Lithium demand will continue to go up. One bullish point to lithium producers.

Then as lithium demand soars, so will lithium prices to spur the build-out of new mines and meet the growing demand from EVs. Another bullish point to lithium producers.

All this hints that lithium producers might be in for a hell of a decade.

And Low-priced, undiscovered lithium exploration stocks like Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF) are best positioned to leverage the sharp upturn in prices.

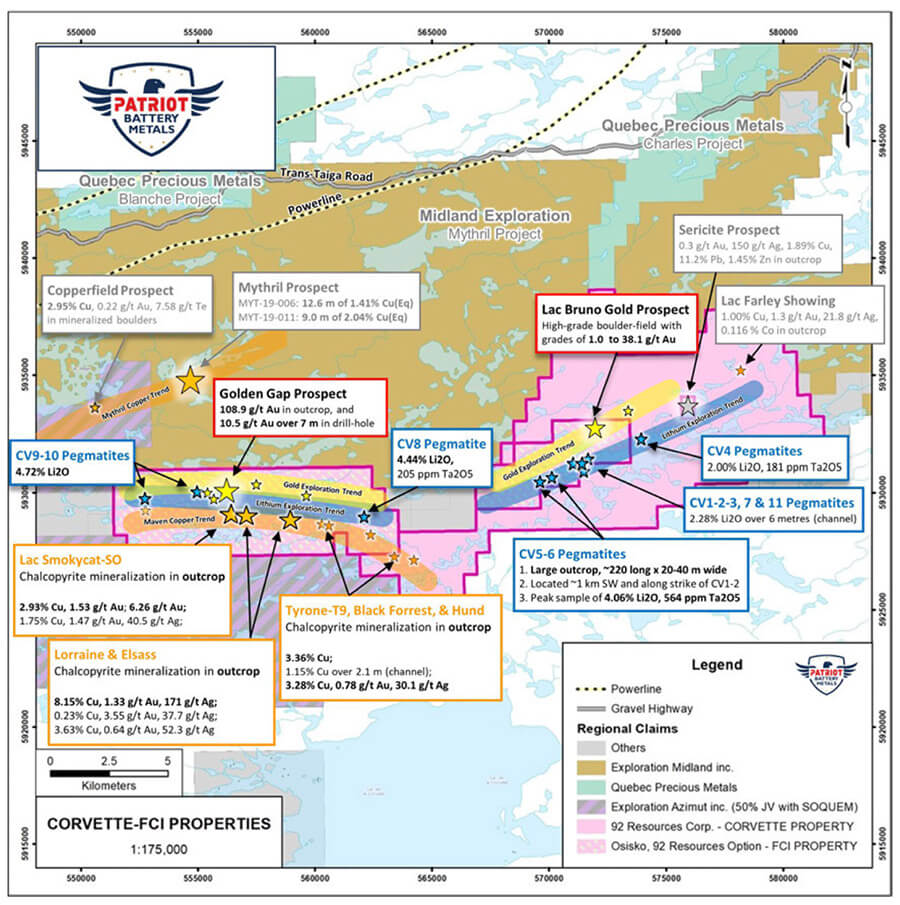

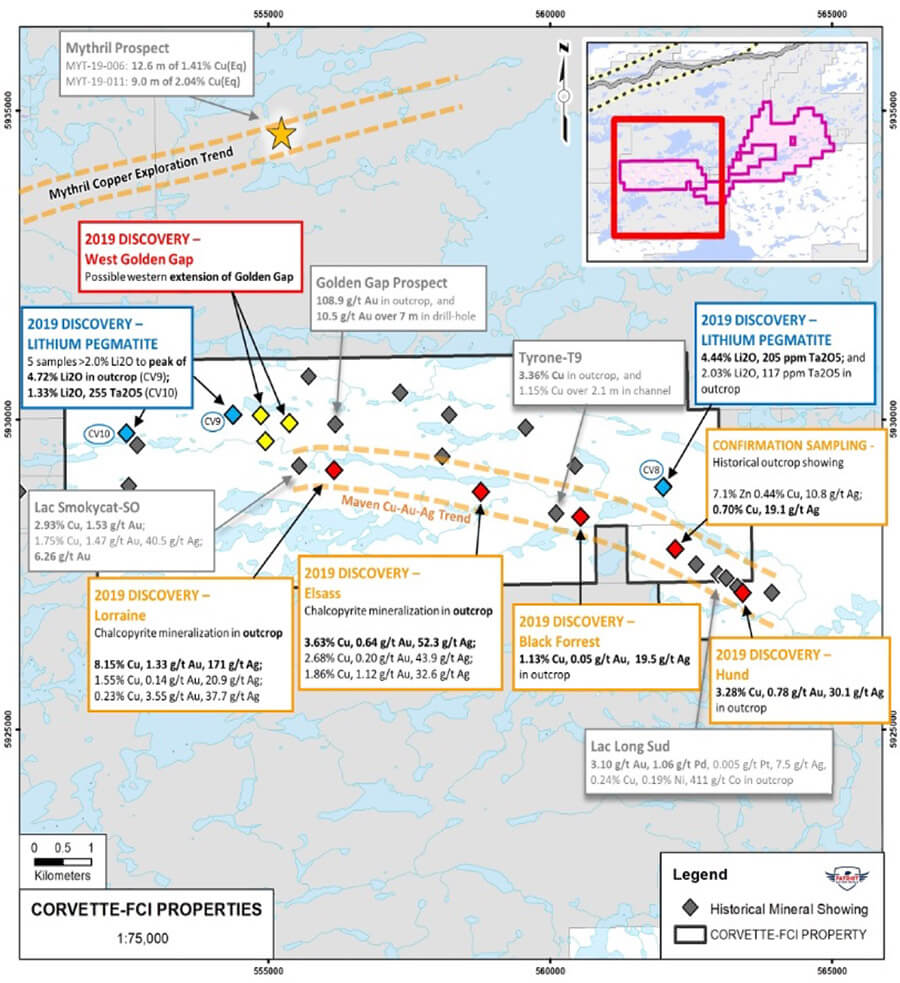

Historical exploration on Patriot Battery Metals’ flagship Corvette-FCI project

Patriot Battery Metals already has highly prospective properties, with known lithium mineralization, in great jurisdictions.

And they’re currently drilling for lithium and copper in Quebec, Canada, as well as holding several other promising properties, including gold & silver prospects.

Patriot is sitting on over 2 km, prospective lithium strike length, where 11 spodumene pegmatites have been discovered to date. In 2019, eight surface samples were taken with an average grade of 3.00% Lithium Oxide (“Li2O”), the highest grade was a grab sample of 4.06%.

By any measure, those are high-grades. If management can follow up with multimeter drill intercepts of 1.00%+ Li2O, then the world will know Patriot’s onto something.

Because of their ample assets, downside might be somewhat limited. And that’s not just because the property boasts high-grade showings, but due to the potential for what could be extraordinary upside upon the release of drill results in October or November.

Management commented in their corporate presentation, “A high number of well-mineralized pegmatites indicate a strong potential that a series of relatively closely-spaced / stacked, sub-parallel & sizable spodumene pegmatites, with significant lateral & depth extent, may be present.”

If drill results this Fall show a few 5+ meter intercepts of > 1.50% Li2O, then it’s game on.

Lithium peers with maiden mineral resource estimates have Li2O grades ranging from 0.80% to 1.99%, [average of 1.28%].

Notice the total resource sizes, ranging from < 5 to 309M metric tonnes. Patriot controls 25 km of prospective lithium strike, so there’s plenty of room to possibly find millions of tonnes of Li mineralization.

3M tonnes with an average grade of 1.10% Li2O would contain 15,312 tonnes of Li, enough to produce 81,506 tonnes of Lithium Carbonate, OR 92,620 tonnes of Lithium Hydroxide, both of which sell for upwards of US$18,000/tonne.

How much might Patriot’s unprocessed ore be worth to the owner of a mill?

If the logistics of shipping made sense, Patriot’s ore would likely be worth hundreds of dollars per tonne of Li2O.

With lithium prices near US$20k/tonne, and expected to remain elevated for years to come, it’s no wonder lithium players around the world are extremely interested in Canadian hard rock properties.

Earlier this year, Australian-listed Sayona Mining strongly advanced its Canadian project by selling part of it to the larger Piedmont Lithium. It is not a stretch that both of those companies are knocking on doors of companies like Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF) to track their progress and potentially strike deals.

Therefore, depending on drill results, investors could be looking at a lithium deposit worth tens of millions.

It’s Time To Focus On Copper

The experts’ voices have been drowned out by other big trends such as bitcoin, pandemic fears, vaccine pleas, and political skullduggery in the U.S, ignoring the huge promise right in front of them with copper.

Now it’s time to pay attention… particularly to Patriot Battery Metals’ properties in the renowned mining territory of Quebec.

Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF) could be set to go on a multi-decade run because Goldman Sachs’ world-famous copper analytics team is forecasting that sky-high enthusiasm for copper will form a decades-long copper bull.

Nicholas Snowden, Jeffrey Currie, Daniel Sharp and Mikhail Sprogis, wrote in a December note headlined “Copper Charting A Course To $10,000/ton,” that the current price strength of copper was not an irrational aberration. “Rather,” they wrote, “we view it as the first leg of a structural bull market in copper.”

The Increased Demand Will Be “Mind Boggling”

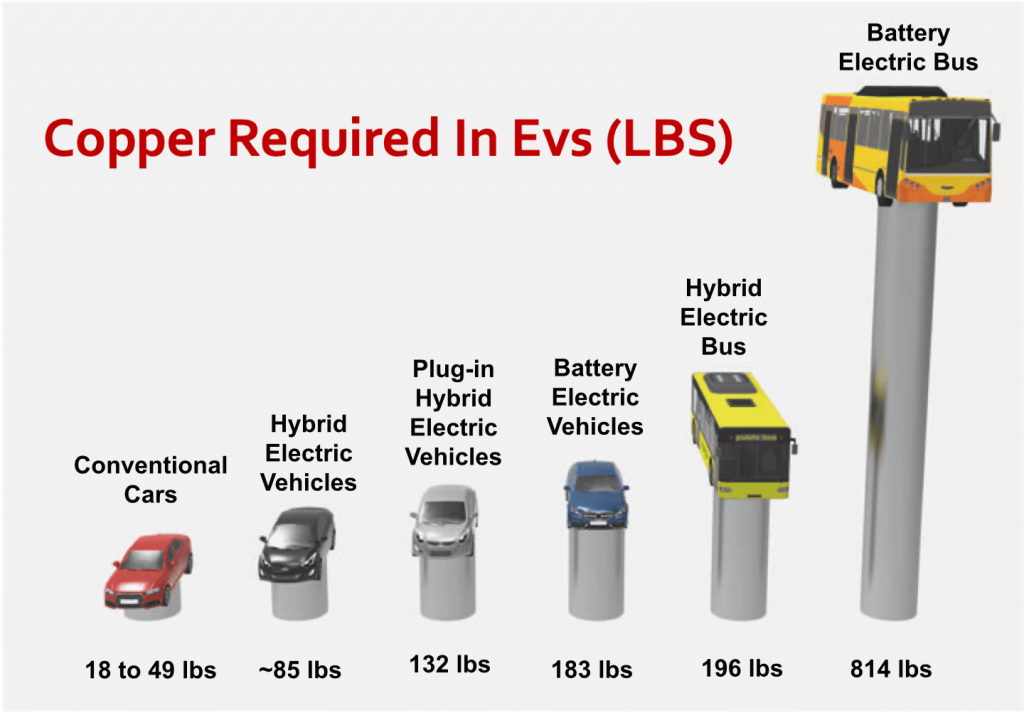

Astute investors might be wondering why copper is considered a battery metal — it’s not inside batteries like lithium is.

Yet copper is the single most important link to the next 100 years of technological advancement. Each EV uses 4x more copper than conventional gas-powered cars and that’s not including the copper needed in charging stations.

This century, Copper demand has grown 1.5%-2.0%/yr. Analysts believe the next 20-30 will see annual growth of 3%-5%.

Why such a leap?

In addition to renewable energy (global decarbonization) & EVs, COVID-19 is unleashing massive debt-fueled spending in the form of global stimulus packages totaling tens of trillions of dollars.

The transition to EVs is a driver of copper demand for now, but the world’s also undergoing a paradigm shift to renewable energy platforms, which are highly copper intensive to build and connect to the grid.

Wind and solar farms require a staggering amount of copper, in wires, cables, motors and transformers. Soon, most new wind / solar farms will be equipped with battery-powered energy storage systems.

Copper is essential and nearly impossible to substitute for in every telecom / communications system on the planet, and for building new, (and rebuilding aged or damaged) infrastructure, including building / rebuilding electrical grids.

It’s critical in a wide range of high-tech & military applications and supports the Internet of Things.

Every new device connected to the Internet; drones, mining cryptocurrencies ,appliances, health diagnostic tools, you name it — requires copper to add new power generating capacity.

And then you have the Biden Administration, which recently announced that solar and wind power alone could amount to 76% of U.S. electricity generation by 2035. Even if the U.S. reaches 60% by 2040, that would require far more copper than any analyst is forecasting.

And the sensational trend favors Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF).

That’s because Patriot’s new copper property has off-the-charts upside thanks to a number of factors…

High Grade Copper Should Excite Interest In Patriot Battery Metals

Part of Patriot’s imminent drill program is on the Maven Trend where surface sampling returned 3.63% Cu, 0.64 g/t gold & 52 g/t silver (at Elsass) and 8.15% Cu, 1.33 g/t gold & 171 g/t silver (at Lorraine).

The copper equivalent (“Cu Eq.”) grades of those samples (at today’s prices) are ~4.4% & 10.3%, respectively. Cu Eq. grades above 0.50% are considered very good if found near- surface, and across wide intercepts (tens of meters).

And, 0.50%+ plays very well in top jurisdictions like Canada.

Early-stage copper stories typically trade around C$0.01-$0.05/lb. in the ground.

That’s a wide range because a deposit’s grade, depth, jurisdiction and the strength of neighboring companies come into play. At the top of bull markets, copper M&A sometimes gets done at > C$0.05/lb.

Given the high-grade samples and the significant size of the property, management is optimistic about the possibility of hitting both good grade and decent widths (hopefully together in the same intercepts!).

If management can demonstrate strong continuity of copper mineralization — it wouldn’t require a large footprint to host 100M+ pounds Cu.

History Making Founders

In the end, none of this matters without an excellent management team and board. A natural resources company this size typically has 1 or 2 presentable senior execs (with direct metals / mining experience). Patriot has five!

Patriot is led by CEO + Director Adrian Lamoureux, a gentleman with critical corporate development experience, especially in the metals & mining space. He has had great success in raising capital for small-cap companies like Patriot Battery Metals.

CEO Lamoureux is surrounded by a team of experts including President & Director Blair Way, B.Sc., MBA. Blair has 30 years’ international experience, across many commodities including gold, copper, lithium, nickel & cobalt. He’s held senior positions in a number of public junior mining companies, including the CEO role. Mr. Way also has significant big company experience including BHP.

Darren L. Smith is Patriot’s VP of Exploration. He has vast experience across multiple disciplines, commodities & jurisdictions. He’s invaluable when it comes to technical work for a PEA/PFS/BFS reports and even metallurgical studies. In 2009, Darren and his team discovered one of the world’s largest REE deposits.

Director Paul Chung has extensive deal-making experience. Paul is a geologist with direct and long-standing expertise in Lithium exploration / discovery in both Argentina & Canada. His business contacts will continue to open doors for Patriot.

CFO + Director Dusan Berka, P Eng. has 50 years experience in international business. Perhaps more important, he’s a long-standing, graduate-level geo-scientist & engineer. Mr. Burka is highly skilled in corporate communications & contract negotiations.

What To Do Now…

Patriot Battery Metals (CSE: PMET | OTCQB: RGDCFCSE: PMET | OTCQB: RGDCF) currently has a tiny market cap of C$16M. It’s up 150% from its 52-week low, but that’s nothing compared to many other metals & mining juniors. The company is focused on the right metals, at the right time, in the right jurisdictions!

Near-term, ongoing news flow, and high-impact drill results this Fall should keep shareholders engaged.

With the need for new sources of copper and lithium quickly becoming a worldwide crisis, you could expect Patriot Battery Metals to stay in the news for years to come. That’s why now could be the very best time to latch onto its affordably priced shares.

It’s time to take a closer look at Patriot Battery Metals (CSE: PMET, OTCQB: RGDCF). You can visit their website and see more details on their projects here.

Or ask your broker about Patriot.

And remember to always do your own due diligence on any stock before you buy.

1https://www.miningweekly.com/article/lithium-prices-to-normalise-as-demand-increases-fitch-solutions-2021-05-07

2https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

3https://www.miningweekly.com/article/lithium-prices-to-normalise-as-demand-increases-fitch-solutions-2021-05-07

4https://www.statista.com/statistics/606684/world-production-of-lithium/

ihttps://www.usatoday.com/story/money/markets/2016/08/26/could-lithium-shortage-derail-electric-car-boom/87684224/

iihttps://katusaresearch.com/dr-copper-signals-bull-market-is-on/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Patriot Battery Metals.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Patriot Battery Metals and has no information concerning share ownership by others of any profiled Patriot Battery Metals. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Patriot Battery Metals or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Patriot Battery Metals. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Patriot Battery Metals’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Patriot Battery Metals future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Patriot Battery Metals industry; (b) market opportunity; (c) Patriot Battery Metals business plans and strategies; (d) services that Patriot Battery Metals intends to offer; (e) Patriot Battery Metals milestone projections and targets; (f) Patriot Battery Metals expectations regarding receipt of approval for regulatory applications; (g) Patriot Battery Metals intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Patriot Battery Metals expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Patriot Battery Metals business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Patriot Battery Metals ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Patriot Battery Metals ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Patriot Battery Metals ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Patriot Battery Metals to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Patriot Battery Metals operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Patriot Battery Metals business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Patriot Battery Metals business operations (e) Patriot Battery Metals may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Patriot Battery Metals or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Patriot Battery Metals or such entities and are not necessarily indicative of future performance of Patriot Battery Metals or such entities.