The whole world is turning to electric vehicles.

As a result, investors are piling back into lithium stocks like Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION), hoping for a repeat of the triple-digit gains of 2016-2017.

If there is one thing investors love as much as cannabis stocks, it’s lithium stocks — such as Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION), a new exploration company seeking to capitalize on China’s limitless demand for lithium carbonate.

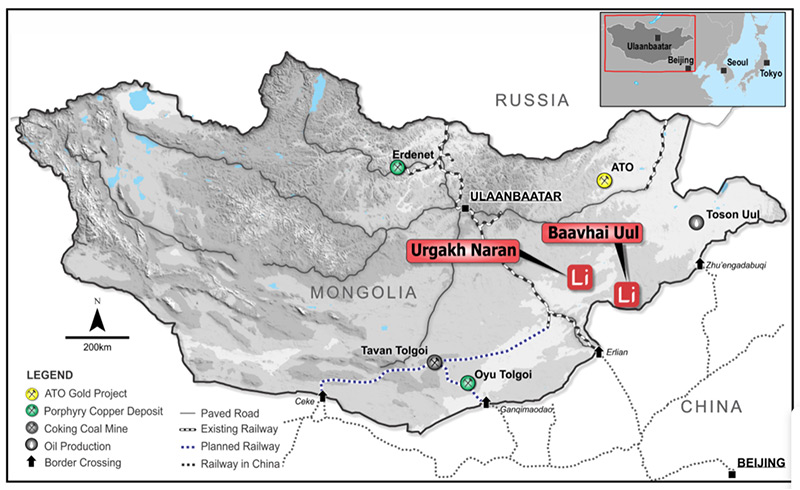

Ion Energy’s appeal is obvious: Led by a team of mining industry experts, the Canadian company holds a 100% interest in two enormous lithium brine projects in Mongolia totaling 247,000 acres and located just 15 miles from China’s northern border.

The location is crucial. China now manufactures a whopping 70%3 of the lithium batteries needed to power electric vehicles, and its rapidly developing EV market is already three times the size of that of Europe or the United States.

And although China is the world’s second largest4 producer of raw lithium, the impurity levels found in many of China’s lithium sources are too high for them to be used in long-life batteries, such as those used in EVs.

As a result, in 2021 the price for lithium has skyrocketed 68% to $11,250 a metric ton, according to Benchmark Mineral Intelligence.5

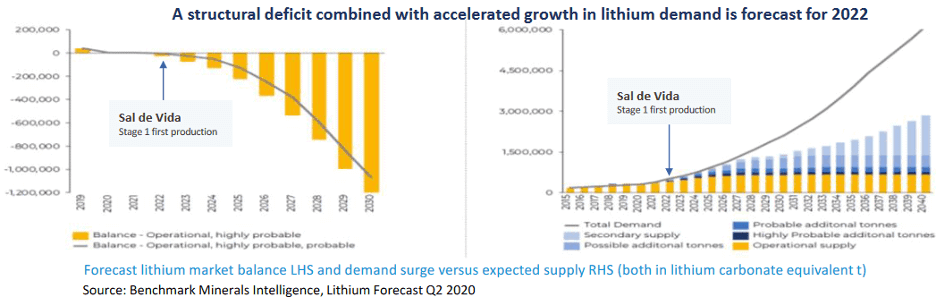

Industry analysts predict demand for lithium will explode over the coming years, increasing 650% by 2027.6

Positioned to Supply the World’s #1 Producer of Lithium-Ion Batteries

This means Ion Energy’s properties in Mongolia are uniquely positioned to supply China’s exploding EV and battery markets – as well as the large tech industries of Korea, Taiwan, and Japan.

For their part, investors are hoping it’s déjà vu all over again.

During the first electric vehicle boom in lithium, from 2016 to 2018, many lithium stocks saw eye-popping gains.

Lithium Americas Corp (LAC) jumped from $1.17 a share in January 2016 to $10.22 two years later, a nearly 8-fold7 return (795%) in just 24 months.

Millennial Lithium Corp (MLNLF) soared 554%8 from June 2016 to November 2017. Wealth Minerals Ltd (WMLLF) climbed 845%9 in the first ten months of 2016, while Mgx Minerals (MGXMF) rose 1,399%10 in 60 days in late 2016.

Now, thanks to the Biden Administration’s $2.3 trillion11 infrastructure plan and a new push for renewable energy worldwide, the electric vehicle market is red hot right now.

Volkswagen sold more electric cars worldwide at the end of last year than Tesla.12 Mercedes just released its first first-class, all-electric sedan.13

GM will spend $27 billion on all-electric and autonomous vehicles through 2025 – and many manufacturers, such as Volvo, are now predicting that they will be fully electric by 2030.14

As a result, lithium exploration companies such as Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION) are rushing to capitalize on a growing shortfall in supplies of high-quality lithium – and the skyrocketing boom in electric vehicles.

China’s Red Hot Battery Market Desperate for High-Quality Lithium

Lithium is actually one of the most common elements on earth. A highly reactive alkali metal, it’s an essential component for the batteries used in electric vehicles, both the NMC (nickel manganese cobalt) batteries used in North America and in Europe and the LFP (lithium phosphate) batteries favored in Asia.

With its two enormous lithium brine projects in Mongolia totaling over 247,000 acres, Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION) could be uniquely positioned to supply the largest EV battery markets in the world: China, Korea, Taiwan, and Japan.

Initial tests indicate the largest of the two properties, dubbed Baavhai Uul, contains significant levels of lithium, with an average grade of 426 ppm and a maximum grade of 811 ppm.

What’s more, both properties are made up of lithium-rich brine aquifers (underground rivers) just 20 meters below the surface, a significant advantage in terms of production costs.

Untapped and Unlimited Potential for Mongolian Lithium

Little-known but mineral-rich Mongolia represents a ground-floor opportunity for lithium investors.

Roughly the size of Alaska15, the country is located between China and Russia on China’s northern border.

Mongolia’s position allows it to supply two of the world’s largest countries directly, China and Russia, with its mining industry contributing 20% of the nation’s entire domestic output and up to 90% of its exports.16

The country also has a year-round operating environment with a highly skilled in-country labor force.

And with China now controlling 101 of the world’s 136 lithium battery manufacturing plants17, Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION) Mongolian properties could give it an unparalleled strategic advantage over lithium exploration companies in Latin America, Australia or the U.S.

Lithium Market Poised to Explode with Renewable Energy Push

Light electric vehicle sales were growing at an annual rate of 28% in the European Union, 46% in the United States and an eye-popping 69% in China, before a temporary slow-down due to the coronavirus.18

And with the election of Joe Biden as president in the U.S. and his push to transition the U.S. economy “away from the oil industry”19 and toward an all-electric future, experts believe the EV market will grow at an even faster rate going forward.20

In March, a number of U.S. senators called for a ban on new sales of gasoline-powered cars anywhere in the United States by 203521 – and industry analysts predict that sales of electric vehicles in the U.S. could grow from 3% of all vehicles today to 50% by 2035.22

As a result, the lithium-ion battery market is expected to grow at a compound annual growth rate of 16.5%,23 reaching $92 billion by 2024.

Experience Turning Mongolia Mining Startups into HUGE Winners

Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION) management team seems uniquely qualified to capitalize on this opportunity.

Chief Executive Officer Ali Haji and Chairman Matthew Wood both have more than a dozen years’ experience as mining industry executives with proven track records in the mining development space.

Wood’s first foray into Mongolia was in a coal exploration project, Hunnu Coal, in which he raised $15.224 million in start-up capital and then sold the company for $500 million. Haji, a director of Antler Hill Mining Ltd, then joined Wood in launching Steppe Gold in 2016, a precious metals explorer, and now producer, focused on Mongolia. Steppe Gold has seen its share price soar 254%25 in the past three years.

Wood and Haji are joined by two Mongolian citizens, Bataa Tumur-Ochir and Enkhtuvshin Khishigsuren, both with decades’ experience in the Mongolian mining industry, as company directors.

Tumur-Ochir serves as an advisor to the Mongolia Ministry of Mining and Heavy Industry, and Khishigsuren has worked for 30 years for various multinational mining companies and is credited with having discovered several prospective gold, molybdenum and copper deposits in Mongolia, including the Olon-Ovoot multi-million ounce gold deposit.

Rounding out the team is John McVicar as chief financial officer, and another mining industry veteran, Aneel Waraich, as director. Waraich also serves as an executive vice president and director of Steppe Gold.26

Betting on the Future of Electric Vehicles

It goes without saying that many investors look at lithium exploration stocks as highly speculative.

Yet at the same time, the allure of lithium stocks such as Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION) is undeniable.

Currently selling for less than $1.00 per share, it has the distinction of having the first lithium brine license ever granted in Mongolia, with 100% interest in two enormous properties of more than 247,000 acres.

Plus, the company is fully funded for the next two years. Enough capital to complete its exploration program to prove the quality of the lithium already identified on the properties and acquire additional lithium bearing licenses in country.

Hands-On, Insider Knowledge of the Mongolia Mining Sector

The company’s management team knows the Mongolian mining industry from the inside out — with a former Mongolian government official serving as a director — and has a proven track record of taking companies from tiny start-ups to hugely profitable takeover targets.

Do your due diligence. But then consider adding Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION) to your speculative portfolio. If geophysical and drilling tests confirm the lithium quality previously discovered, this is a stock that could see substantial price appreciation very quickly.

With China now producing 70% of all the lithium-ion batteries in the world and electric vehicles now being virtually mandated in many countries, China’s need for lithium carbonate can only go up.

And a company such as Ion Energy, exploring lithium-rich properties just 15 miles from China’s northern border, could end up writing its own ticket.

For more information about Ion Energy (OTC:IONGF | TSX.V:IONOTC:IONGF | TSX.V:ION), visit the company’s website at: https://www.ionenergy.ca/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Ion Energy Ltd.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Ion Energy Ltd. and has no information concerning share ownership by others of any profiled Ion Energy Ltd. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Ion Energy Ltd. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Ion Energy Ltd. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Ion Energy Ltd.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Ion Energy Ltd. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Ion Energy Ltd. industry; (b) market opportunity; (c) Ion Energy Ltd. business plans and strategies; (d) services that Ion Energy Ltd. intends to offer; (e) Ion Energy Ltd. milestone projections and targets; (f) Ion Energy Ltd. expectations regarding receipt of approval for regulatory applications; (g) Ion Energy Ltd. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Ion Energy Ltd. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Ion Energy Ltd. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Ion Energy Ltd. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Ion Energy Ltd. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Ion Energy Ltd. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Ion Energy Ltd. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Ion Energy Ltd. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Ion Energy Ltd. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Ion Energy Ltd. business operations (e) Ion Energy Ltd. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Ion Energy Ltd. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Ion Energy Ltd. or such entities and are not necessarily indicative of future performance of Ion Energy Ltd. or such entities.