One microcap that’s still dirt cheap — but not for long…

Don't let this one get by you. Now is the ideal time to investigate a soaring opportunity from an essential, yet unexpected industry: Organic living soils and soil amendments.

- This niche sector grew over 20% in 2020 and is on its way to pass a $100 billion mid-decade projection…double today’s market size.

- And that rapid growth is accelerating the potential for one company, Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF). It’s off-radar for now, but its unique footprint could quickly prove essential to the long-term growth of this multi-billion-dollar marketplace.

- The microcap just started trading in America, so now is the time to act. Its share price may never be this low again.

It should come as no surprise that millions of people, largely the younger generations, are driving enormous changes in the American marketplace. One of the more significant of those changes is in diet. Americans are turning to organic foods at a pace few saw coming.

Supermarket News reported that:

“U.S. organic product sales climbed 12.4% in 2020, breaking the $60 billion mark for the first time and more than doubling the previous year’s growth, according to the Organic Trade Association (OTA).”1

And according to a survey produced for OTA by Nutrition Business Journal, they then went on to reveal:

“Last year in the United States, nearly 6% of all food sold was certified organic, OTA noted. Fresh produce led the way, with organic fruit and vegetable sales up 11% to $18.2 million in 2020.”

But here’s the clincher, and it could be the key to one of the biggest investing trends of the decade…

Angela Jagiello, director of education and insights at Organic Trade Association pointed to a little-known fact when she stated,

“The only thing that constrained growth in the organic food sector was supply.”

Now just to clarify, when you think of “supply” one would assume that referred to the actual food products, that there’s not enough “organic food” to meet demand.

Now just to clarify, when you think of “supply” one would assume that referred to the actual food products, that there’s not enough “organic food” to meet demand.

Wrong. What’s constraining growth is how organic produce is grown…more importantly, what kind of growing media can be used to qualify as “organic”.

In a moment, this article will get into the details of what is needed to qualify a product as organically grown. And it’s not as simple as you may think.

In fact, it can take three years for commercial agricultural land to be brought into organic specification…if ever.

But first, let’s take a look at how investors have been profiting from soaring demand for organic foods and why Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF) could become a major new player in the sector.

Since 2019, companies in this space have been rocketing.2,3

Off-radar Sunopta Inc., for example, traded under $1.40 mid-October, 2019. Over the next 22 months the stock soared to past $16 a share. Aggressive profit-taking pulled it back, but it still trades today at nearly five-times that low.

Better known as an organic foods company, Hain Celestial Group soared from trading at $16 in 2019 to a high of $48+ this past November.

Lifeway Foods launched 2019 at around $2.10. Two years later it traded at $7.40, up over 300%.

United Natural Foods dipped to $5.72 at the start of 2020 and has since soared to pass $37.90 as of September this year. More than a 660% leap in value!

These and other winning companies in the sector appear on a rapid growth curve driven by soaring demand for organic product.

Yet despite that soaring demand, U.S agriculture remains behind the curve.

That could change rapidly as Argo Living Soils positions itself to become a key supplier of organic growing media to producers. Argo could be an essential supply resource for growers seeking to scale their production to meet growing market demands.

And there’s plenty of demand yet to be met.

“With demand outpacing domestic supply, the [United States] imported more than $2 billion in organic food last year, and likely significantly more…” 4

Translation: The U.S. isn’t nearly as productive in organics as it could be.

Argo Living Soils seeks to create the growing conditions that feed the marketplace with domestically grown organic agricultural commodities.

In the coming years, explosive demand for organic products will drive more and more agricultural producers to the high value crops that can carry the official “organic” label.

That means they must abandon long-standing chemical fertilization and soil enhancement, switching to the “living soils” and soil supplements that ensure productive harvest of organic agricultural commodities.

That means they must abandon long-standing chemical fertilization and soil enhancement, switching to the “living soils” and soil supplements that ensure productive harvest of organic agricultural commodities.

The key to increasing production of organic agricultural commodities in North America will significantly depend on the availability of organic growing media.

Here’s where the investment potential in Argo Living Soils can be found. Providing scalable, on-demand availability of organic soils and soil supplements will be the driving force behind growth in Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF).

In The World Of Organics, Soil Is Everything

In the United States, over 900 million acres of land is dedicated to farm production.5 Of that acreage, less than 1% is certified organic. The vast majority of that land is dedicated to field crops, corn, wheat and soybeans.

As National Geographic describes in its article, Why Don’t We Have Enough Organic Farms:

“Farmers must learn to manage soil nutrients without fertilizer and tackle weeds and insects without herbicides and insecticides. It’s a steep learning curve.” 6

Steep indeed!

For organic farming operations to be successful, regardless of size or crop, soil conditions are paramount.

Otherwise organic farming of field crops can actually be counter-productive in many ways. Yields can plummet and costs can soar. Large acreage production of certified, organically grown corn, wheat and soybeans simply does not fit well to prevailing agricultural practices and business models. It could take decades to move these and similar field crops to organic practices.

It’s fair to say that even if they wanted to go organic, the vast majority of agricultural producers are too deeply embedded in current practices…the risks, time and expertise to go organic could literally put them out of business.

Where organic farming practices hold most potential is for what is called “high-value” crops…mostly crops destined for kitchen tables, like leaf vegetables, fruits, tomatoes, etc.

Typically, crops like these are grown through smaller acreage operations, greenhouses or even food plots where production risks and growing conditions, like the soil, can be carefully controlled.

Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF) entered the market to specifically provide a rapidly growing population of organic food producers with the soil amendments…and the expertise to manage them…that are necessary to maintain optimum, certifiable growing conditions.

In addition, as the market for organics continues to grow, Argo Living Soils reports that it geared its own operations to scale quickly and efficiently in response to rising market demands.

And that demand appears to be moving quickly, which is why today presents an ideal entry point for investors.

The rapid growth in consumer demand for organically grown products appears to be outpacing American producers’ ability to scale up their organic operations. (It’s why $2B in organics had to be imported!)

But here’s the key…

Scaling up production begins with the soil and not just any soil. It must be certifiable. Strict, federally mandated growing conditions must be documented in order to label any product as being “organic”. Any U.S. organic farming operation, regardless of current size, can only expand operations on organically certifiable soil.

So to double production the grower would need to double square footage being cultivated. All that’s needed is twice as much qualifying organic soil.

That’s where Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF) steps in. Their investor deck clearly states the company’s business objectives:

Argo Living Soils is a company dedicated to agribusiness, specializing in producing and developing soil amendments, living soils, natural pesticides and fungicides, vermicompost, and compost tea kits formulated specifically for high value crops to be grown exclusively under certifiable organic growing conditions.

Argo’s core objective is to focus on scalable production of the organic soil amendments required by all producers. And their revenue potential could be significant.

For those not familiar, soil amendments can be the most expensive input cost to a farming operation. It can also be the most consequential. Without them, yield suffers and soil condition deteriorates. Weakened crops and poor soil leads to accelerating declines in productivity, as well as heightened risk for disease or infestation.

But fertilization alone does not ensure optimal outcomes, particularly in organic farming operations. A multitude of variables, largely tied to soil condition and importantly, the living conditions for beneficial micro-organisms, can have significant impact on productivity and end-product quality.

While it is beyond the scope and purpose of this article to dive into those details, you’ll find much on this topic published on the Argo Living Soils website.

What’s important to note is that Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF) intends to be a one-source supplier of all things organic and do so at a scale that can allow any grower to not only maintain its ongoing operations, but to quickly expand production in response to soaring market demand for organic products.

Argo Living Soils may be the only company in North America in position to not only supply all foreseeable resources to organic farm operations; it can do so with a long list of proprietary products and depth of experience that ensures farming success.

That objective is summed up in the company’s mission statement:

“Our core business lies in creating organic, nutrient-dense growing mediums capable of producing high-value crops, while eliminating, or substantially reducing the need for costly pest control measures.”

The company reports that it is currently enjoying a surge of interest “in the absence of competitors capable of providing a comparable level of quality assurance and control at every step in the [organic] production process.”

Note those three words: “Absence of competitors.”

Herein lies the enormity of the potential in Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF).

With a market for organic products growing at a stunning double-digit annual growth rate, Argo Living Soils presents an outstanding investment opportunity for anyone seeking a ground floor entry to this growing agricultural sector.

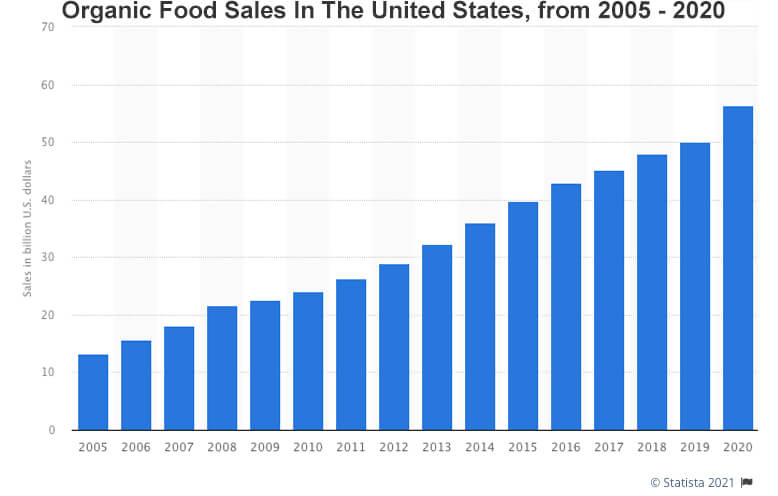

It is reported that in 2019, U.S. organic food sales hit a record-setting $50 billion.

Then came COVID-19, which triggered a massive shift in consumer focus on healthy diets. Early in the pandemic, U.S. organic produce sales leaped by 20% by spring of 2020. Such spectacular growth rates project enormous Y-O-Y sector growth. Straight projections off the 2020 record would eclipse $100 billion by 2025. Will that number be reached? This is not a firm projection. The point to be made is that this sector appears to be rocketing into a very big future.

A ground floor position in such an environment can yield stunning gains. The question is, where best to invest?

Many have already moved into the sector. Share positions in food companies like those listed above that have returned triple-digit gains in this time frame. But these companies have already seen initial growth spurts…they also present investment risk in being only category players in the entire organic sector.

Argo Living Soils presents an entry point that is not only ground floor, it is broad reaching, serving the entire organic sector with essential products and expertise that all growers require to scale quickly to rapidly growing consumer demands.

Now is the time to act on this information. Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF) has only recently begun public trading in the United States. For the moment it lies off radar. But as this sector continues what appears to be a very rapid growth rate, Argo’s participation in facilitating that growth could quickly drive broad investor interest and an accelerating share price.

What to do now…

This is a fast-moving situation that is gaining more and more investor attention. To ensure an early entry with the greatest profit potential, get started with your due diligence now. An ideal starting point is the company website where you’ll find more information about Argo’s business objectives, details into the complexities of organic agriculture, and importantly, how Argo intends to make it easier for organic farmers to not only sustain their operations, but respond rapidly to growing market conditions.

While on site, be sure to download the company’s current 2021 Investor Deck. And to stay ahead of news and important announcements, register your email address for future company mailings.

As you advance in your research, consider the immediate potential of becoming an Argo Living Soils shareholder. As a recent addition to U.S. markets, Argo appears to be starting as an off-radar value to its longer-term potential. If you see strong growth in the U.S. organic products marketplace, Argo could be an ideal entry point to profit from the gains you see coming.

Five Key Points to Keep in Mind about Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF)

- The organic foods sector has been soaring, hitting $50 billion in 2019 followed by 20% continued growth through mid-2020. Argo Living Soils intends to become a major player throughout the entire sector.

- Organic growers must adhere to stringent, federally mandated cultivation and handling guidelines to qualify for “Organic” product labeling. Argo Living Soils plans to serve all the critical supply needs that growers require to secure their organic labeling standards.

- Argo Living Soils states that it fits uniquely in a market where there exists an “absence of competitors capable of providing a comparable level of quality assurance and control at every step in the [organic] production process.”

- Argo Living Soils has only recently begun trading in the United States. But it’s not starting out as a potentially overpriced IPO. The company has been trading on the Canadian exchange, thus its current low-price is market based, not speculated. Now may be the ideal time to consider this entry point for maximum growth potential.

- ..and not discussed above…Argo Living Soils Corp (CSE: ARGO | OTC: ARLSFCSE: ARGO | OTC: ARLSF) qualifies as a socially responsible investment that you can be proud to own and support. In the years to come, Argo may prove to become one of the most influential new companies that pioneers a future of more sustainable agriculture and healthier living.

1https://www.supermarketnews.com/produce-floral/organic-food-sales-jump-nearly-13-record-high-2020

2 https://investorplace.com/2020/10/7-organic-food-stocks-for-healthy-living/

3 https://www.yahoo.com/now/12-healthy-sustainable-food-stocks-205115933.html

4 https://www.supermarketnews.com/produce-floral/organic-food-sales-jump-nearly-13-record-high-2020

5 https://www.nass.usda.gov/Publications/Highlights/2014/Highlights_Farms_and_Farmland.pdf

6 https://www.nationalgeographic.com/environment/article/organic-farming-crops-consumers

PAID ADVERTISEMENT.

This communication is a paid advertisement and is not a recommendation to buy or sell securities. Think Ink Marketing has been paid by Argo Living Soils thirty thousand US dollars for a 6 month marketing campaign contract.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Argo Living Soils Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Argo Living Soils Corp and has no information concerning share ownership by others of any profiled Argo Living Soils Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Argo Living Soils Corp or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Argo Living Soils Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Argo Living Soils Corp’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Argo Living Soils Corp future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Argo Living Soils Corp industry; (b) market opportunity; (c) Argo Living Soils Corp business plans and strategies; (d) services that Argo Living Soils Corp intends to offer; (e) Argo Living Soils Corp milestone projections and targets; (f) Argo Living Soils Corp expectations regarding receipt of approval for regulatory applications; (g) Argo Living Soils Corp intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Argo Living Soils Corp expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Argo Living Soils Corp business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Argo Living Soils Corp ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Argo Living Soils Corp ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Argo Living Soils Corp ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Argo Living Soils Corp to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Argo Living Soils Corp operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Argo Living Soils Corp business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Argo Living Soils Corp business operations (e) Argo Living Soils Corp may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Argo Living Soils Corp or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Argo Living Soils Corp or such entities and are not necessarily indicative of future performance of Argo Living Soils Corp or such entities.