Bitcoin has received several criticisms on its role in negating sustainability with its assumed energy usage.

Since the number one cryptocurrency employs mining which requires continuous electrical usage, analysts believed that it consumes as much energy as the US Federal government or the country of Greece.

However, according to the New York-based crypto firm Galaxy Digital report, Bitcoin uses less than half the energy that the banking and gold sectors consume.

A timely response for criticism on Bitcoin’s electrical usage

The authors of the said report, namely Rachel Rybarczyk, Drew Armstrong, and Amanda Fabiano, emphasized how Bitcoin became an easy target for this type of criticism.

Bitcoin’s mining computers present specific electrical capacity requirements; hence, calculating its net usage has become relatively easy. As a result, traditional industries draw criticism against Bitcoin’s impact on environmental sustainability.

Galaxy Digital’s report utilized the Cambridge Bitcoin Electricity Consumption Index as a resource for its analysis. The graph presented in the report shows that Bitcoin’s energy usage began to rise in late 2020 when bitcoin’s price was increasing fast.

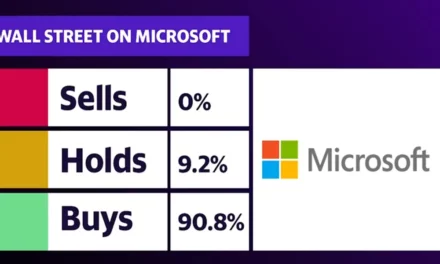

On a global scale, the calculation of Bitcoin’s total electricity consumption runs at 13.89 terawatt-hours (TWh).

On the other hand, the banking sector worldwide 238.92 TWh per year. This figure accounts for the banking system’s four key areas of electricity consumption, namely bank branches, data centers, ATM, and card network data centers.

In the Gold industry, the World Gold Council reported the annual energy usage for the sector falls at 240.61 TWh per year. Galaxy Digital used this data as a reference for comparison.

However, the authors admitted that the said figure might have filtered other critical sources of energy use, such as the “energy and carbon intensity of the tires used in gold mines.”

According to the repost of silver and gold dealer Money Metals, there are hidden sources of energy use in the Gold industry.

One example is the consumption of about 25,000 tons of rubber tires by Barrick Gold in 2013, which utilized oil during the production process.

On the subject of emissions footprint

Despite the reports negating Bitcoin’s energy consumption speculations, critics are still pushing Bitcoin’s alleged unjustifiable environmental cost.

Among industry giants, the actual value of bitcoin and cryptocurrency, in general, is still subjected to debate.

Bill Gates and Warren Buffett have pessimistic views about bitcoins, while Elon Musk, Tesla’s CEO, and Twitter CEO Jack Dorsey are optimistic about the future of cryptocurrency.

However, as long as the criticisms against Bitcoin’s electrical use exist along with other determining factors, the price of Bitcoin will continue to sway.

As evidence, Musk acknowledged the large emissions footprint Bitcoin produced, forcing him to forbid the use of bitcoin as payment for Tesla cars.

His tweet about the use of coal and fossil fuel by some cryptocurrency companies is said to have spiraled the value of the digital coins.

Speculations that Musk will be selling his holdings have sent waves of doubts among investors resulting in cryptocurrency’s lowest price since the end of February.