Renowned Mining Team Just Delivered In A Big Way

Editorial Feature | Oct 11, 2023 | Industry

This esteemed executive’s latest exploration results could amount to one of the best discoveries in the recent history of the Sierra Madre.

- Investors who follow the name Bruce Bragagnolo know what to expect when it comes to his track record with mining ventures, but what he just found could be bigger than his last 100,000-ounce-a-year gold mine.

- According to Regency Corp.’s (TSXV:RSMX) (OTCQB:RSMXF)(TSXV:RSMX) (OTCQB:RSMXF)

recent assay results, they could be seeing 10X to 15X more gold per ton than the company’s closest competitors… as much as 71% more than other world-class discoveries. That’s on top of sizable grades of copper and silver, making it one of the richest discoveries in recent Mexican history.

Drill results near a past-producing silver mine in Mexico has a group of seasoned mining executives turning cartwheels. One of which is legendary gold and silver explorer, Bruce Bragagnolo.

Drill results near a past-producing silver mine in Mexico has a group of seasoned mining executives turning cartwheels. One of which is legendary gold and silver explorer, Bruce Bragagnolo.

He’s familiar with success, such as when he founded Timmins Gold, then oversaw its rise to becoming a 100,000+ ounce-of-gold-a-year producer.1

So, you can imagine there’s something substantial in motion when these normally reticent men get excited.

It began in August of 2022 when they located what appeared to be a large-mineralized zone just 1,600 feet from the historic Dios Padre silver mine. Operations at this mine go back to the 1600’s, but none of the project’s prior prospectors had detected this large anomaly.

What had been recovered near surface at Dios Padre suggested that this could be a zone hosting a large new discovery of gold, copper, and silver.

Experience told Mr. Bragagnolo that despite a production history of high grade silver and obvious development potential, exploration drilling at the existing silver mine site was off target.

Previous mine site operators drilled thousands of feet, trying to locate the mother lode at the source of the silver-rich surface. Everyone knew that it had to be there, they just never found it.

Their failures are what caught his attention.

They’d been drilling below the historic mine where they had been producing silver near surface.

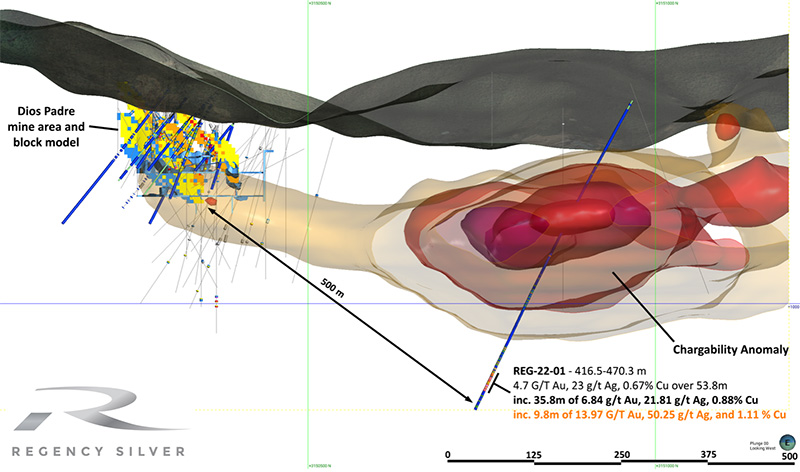

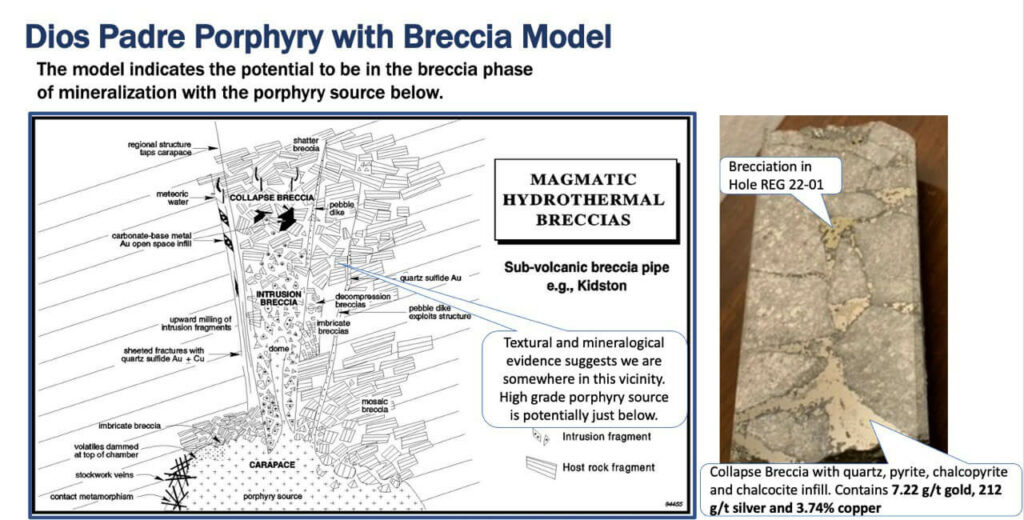

Knowing the geology of the Sierra Madre Occidental as he did, and using the latest exploration software, Mr. Bragagnolo suspected that the volcanic source that fed precious metals to the surface at Dios Padre was beneath the anomaly and flowing laterally, not vertically as the others had presumed.

While this flew in the face of conventional wisdom, the following illustration explains his well-founded hypothesis.

A 250-meter-deep ground-penetrating Induced Polarization (IP) survey confirmed its existence, leading to a drill program the company started in the summer of 2022.

More Than Just Silver At Dios Padre

When Regency’s drills punched through a fault underneath the anomaly, they entered a zone of high sulfidation which contained rich concentrations of gold and copper. The drilling revealed what could shape up to be one of the largest new gold and copper discoveries in Mexico in years.

When Regency’s drills punched through a fault underneath the anomaly, they entered a zone of high sulfidation which contained rich concentrations of gold and copper. The drilling revealed what could shape up to be one of the largest new gold and copper discoveries in Mexico in years.

The initial grades of gold and copper are sizable.

The drill samples at Dios Padre suggest a vast swath of underground gold with copper in very high concentrations.

Regency found a massive 36-meter-wide zone of 6.84 g/t gold, 0.88% copper, and 21.8 g/t silver, along with 13.97 g/t gold, 50.25 g/t silver and 1.11 % copper over 9.8 meters, starting at 460.5 meters down. At 460 meters they even found 53.5 g/t of gold, 1.2% copper and 53.5 g/t of silver over 1 meter. Just to offer some perspective on the scale of this discovery, 36 meters is the size of a ten story building.

That well exceeds, by as much as 71%, the upper limit the World Gold Council sets to define an open pit mine as World Class.

This will not be an open pit but it shows how rich the mineralization is.

Additional extension drilling to the east of the existing mine garnered very high grades of silver and gold:

- 582.47 g/t silver over 3.9 meters

- 558.30 g/t silver over 5.85 meters

- 420.23 g/t silver over 3.10 meters

- 1.34 g/t gold over 17.9 meters

Regency followed up with more drilling in 2023 and in April announced 2 follow up holes down-dip from hole REG-22-01 intersect wide zones of gold and copper mineralization. REG-23-14 intersects 35.9m of 5.51 g/t Au including 29.4m of 6.32 g/t Au ~25m down-dip from REG-22-01. REG-23-15, which is ~ 65m down-dip from REG-23-14 and ~90m down-dip from REG-22-01 intersects 128.35m of 0.84 g/t Au including 57.95m of 1.49 g/t Au and 32.5m of 2.23 g/t Au.

What makes this so unique is the high gold content along with copper and silver. Time and more exploration will reveal the size of this deposit, but there’s a sense among experts in the mining community that the Dios Padre project could be a large find.

That’s what Regency Corp. (TSXV:RSMX) (OTCQB:RSMXF) has set out to discover with a follow up exploration program that started in early January of 2023. Assay results from 7 more holes are expected soon.

Nearby mining operations producing within the same Sierra Madre gold/silver trend confirm the existence of large deposits.

Pan American Silver (NASDAQ $6.075B) reports that its Dolores open-pit mine produced 2.24 million ounces of silver and 136,000 ounces of gold in 2022. The company also reports that Dolores contains 11 million ounces of silver and 313,000 ounces of gold in unmined, proven and probable reserves.1

Alamos Gold’s (NYSE $5.13B) Mulatos gold mining operation produced more than 2.3 million ounces of gold to date with 135,000 ounces reported in 2022.2

Agnico Eagle’s (NYSE $26B) La India mine produced 74,000 oz of gold and 429,000 oz of silver in 2022. That same year its Pinos Altos mine produced 99,552 oz gold and 1 million oz silver.3

From Startup To Hundred-Million-Dollar Market Caps

Regency was founded by CEO Bruce Bragagnolo who’s already famous for three legendary Mexican mines he grew from startups. It’s not hyperbole to say that his first three projects knocked it out of the park.

The first was Silvermex Resources. Mr. Bragagnolo launched it with an initial $7 million market cap and guided the company to a peak market capitalization of $170 million.

By mid-2012, First Majestic Silver acquired Silvermex, which put First Majestic on track to become the $3+ billion producer it is today and listed on the New York Stock Exchange.

The second project was the aforementioned Timmins Gold.

Also from a $7 million start, Mr. Bragagnolo launched Timmins Gold, overseeing its growth from a junior exploration company to a 100,000 ounce/year gold producer that achieved a peak market capitalization of over $450 million!4

Mr. Bragagnolo was also a director of Continuum Resources Ltd. when it acquired the San Jose Mine in Oaxaca, Mexico. Continuum Resources Ltd. merged with Fortuna Silver in 2004 and the San Jose Mine is now its flagship asset with 2022 production of 5.76 million ounces of silver and 34,000 ounces of gold.

And now it looks as if Mr. Bragagnolo could dwarf the success he had at Timmins Gold.

But here’s where it gets very interesting.

Regency (TSXV:RSMX) (OTCQB:RSMXF) could not initially begin to assess the depth of mineralization because…

The drill it used for the exploration only went 1,640 feet (500 meters) deep. It has now brought in a much larger rig that can drill below 1000 meters.

It has also just finished the ground program of a higher resolution, 3D Induced Polarization (IP) survey using the latest in technology that can also see down to 1,000 metres. Initial indications are that Regency is drilling into a large, long lived magmatic-hydrothermal Au-Cu-Ag system with multiple overprinting events.

Bruce Bragagnolo stated ,”Our drill and IP programs are designed to verify management’s model of a large, district scale magmatic-hydrothermal gold-copper-silver system.”

And the timing couldn’t be more strategic, as many of Mexico’s leading precious metals producers see signs of a drop off in grades and ounces at existing projects.

Declining Grades Plague Mexico’s Leading Gold Producers

Mexico is Latin America’s largest gold producer, with output of 3.87 million ounces in 2022, but its leading mining companies are in need of adding ounces to their balance sheet.2

In fact, many of Mexico’s leading miners have seen lower output over the last few years, so much so that the country’s overall output is down 10%3.

- Newmont Gold’s Penasquito’s mine saw its average grades go from 0.82 g/t from 0.63 g/t.4

- At Argonaut’s huge La Colorada mine complex the average gold grade is 0.63 g/t.5

- Azucar Minerals’ massive El Cobre project has an average grade between 0.49 g/t Au and 0.42 g/t Au.

The lower grades have also affected Mexico’s second largest miner.

- Fresnillo Plc., saw the first quarter gold production at its famous Herradura mine decrease by 8.5% 6.

Moreover, its first half gold production there decreased 17% due to ore grade. Fresnillo reported its gold ore grade is expected to remain in the range of 0.65- 0.75 g/t in 2023.7

This bodes well for Regency’s major discovery, as it could offer these established producers much-needed ounces.

5 Reasons To Put Regency (TSXV:RSMX)(OTCQB:RSMXF) On Your Radar Now

- Regency’s major discovery could translate into a large gold and copper deposit at its Dios Padre project.

- That would be no surprise to investors who follow Regency’s CEO, Bruce Bragagnolo who founded and oversaw Timmins Gold’s output to more than 100,000 ounces a year. Its market cap soared from $7 million to nearly $450 million

- Most Mexican gold projects have just barely sustainable grades, such as 0.64 grams per metric ton. Regency’s discovery suggests that it is sitting on a deposit that features mineralization with grades of 6.84 g/t gold, 0.88% copper and 21.8 g/t silver over the width of a ten story building. The beauty of Dios Padre is that Regency doesn’t have to find higher grade or width, they just have to find more of the same material. Recent drilling has discovered more of the same mineralization.

- Prior exploration at Dios Padre was looking for silver extensions near the historical mine, but the main source was never discovered. Regency reinterpreted the Induced Polarization (IP) surveys of the area immediately adjacent to the existing Dios Padre mine site. The team’s new insights into the surveys indicated evidence of a large, unexplored formation that lies only 1,600 feet to the north of the mine. Their recent drill results have provided conclusive evidence which they are now following up.

- Judging by the new discovery, as well as silver extensions, Regency could be drilling into a very large system with high grade mineralization. Positive results from ongoing drilling should lead to a dramatic impact on Regency’s market valuation.

Regency holds significant potential for gains typical of a successful junior exploration company. The key to unlocking its potential is to launch your research and due diligence without delay.

This could be a short-lived entry opportunity as Regency is drilling on an ongoing basis and is soon about to release the results of seven more drill holes.

Precious metal investors are already keenly focused along the Sierra Madre Occidental. This is the largest silver-producing region in the world today and new discoveries can trigger a flood of funds flowing to new discovery. With Bruce Bragagnolo’s, past successes already well known, Regency is definitely a company to watch.

Now is the time to dig deeper into the significant potential of Regency (TSXV:RSMX) (OTCQB:RSMXF)(TSXV:RSMX) (OTCQB:RSMXF).

You can begin your due diligence at the company website.

1https://asiabasemetals.com/corporate/board-of-directors/bruce-bragagnolo/

2 https://www.bnamericas.com/en/features/gold-miners-in-mexico-hit-by-lower-grades

3 https://www.bnamericas.com/en/features/gold-miners-in-mexico-hit-by-lower-grades

4 https://www.bnamericas.com/en/features/output-at-top-latam-gold-mines-falls-on-grade-decline

5 https://www.argonautgold.com/English/assets/operations/la-colorada/default.aspx

6 http://www.fresnilloplc.com/what-we-do/mines-in-operation/herradura/

7 http://www.fresnilloplc.com/what-we-do/mines-in-operation/herradura/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Regency Silver Corp. (“RSMX”) and its securities, RSMX has provided the Publisher with a budget of approximately $30,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by RSMX) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company RSMX and has no information concerning share ownership by others of in the profiled company RSMX. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to RSMX industry; (b) market opportunity; (c) RSMX business plans and strategies; (d) services that RSMX intends to offer; (e) RSMX milestone projections and targets; (f) RSMX expectations regarding receipt of approval for regulatory applications; (g) RSMX intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) RSMX expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute RSMX business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) RSMX ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) RSMX ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) RSMX ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of RSMX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) RSMX operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact RSMX business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing RSMX business operations (e) RSMX may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Regency Silver Corp..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Regency Silver Corp. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Regency Silver Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Regency Silver Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Regency Silver Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Regency Silver Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Regency Silver Corp. industry; (b) market opportunity; (c) Regency Silver Corp. business plans and strategies; (d) services that Regency Silver Corp. intends to offer; (e) Regency Silver Corp. milestone projections and targets; (f) Regency Silver Corp. expectations regarding receipt of approval for regulatory applications; (g) Regency Silver Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Regency Silver Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Regency Silver Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Regency Silver Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Regency Silver Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Regency Silver Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Regency Silver Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Regency Silver Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Regency Silver Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Regency Silver Corp. business operations (e) Regency Silver Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Regency Silver Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Regency Silver Corp. or such entities and are not necessarily indicative of future performance of Regency Silver Corp. or such entities.