Can Canada’s Newest Discoveries Reduce Fears of Battery Metal Shortages?

Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) is Positioned to Capitalize on Two Significant Battery Metal Plays in Canada

Editorial Feature | Oct 11, 2022 | Industry

Quite possibly the most important metal in most of today’s electric vehicles (EVs) isn’t lithium, cobalt, nor manganese—it’s NICKEL.1

However, right now the world’s fourth largest nickel producer (Russia)2 remains under sanctions, taking 5-6% of the world’s supply, 9% of its production, and 17% of its high-purity nickel production offline with it.3,4

According to London-based CRU Group’s principal base metals analyst Nikhil Shah, the chaos that has ensued in this market is not only “unprecedented” but prices will likely remain higher for the rest of 2022.5

Showing how potential nickel shortages were already a concern before the conflicts began, Tesla CEO pointed out back in 2020 the importance of adding more nickel production.6

Showing how potential nickel shortages were already a concern before the conflicts began, Tesla CEO pointed out back in 2020 the importance of adding more nickel production.6

With Russia out of the picture for the foreseeable future, and the world’s largest nickel producer (Indonesia) is under fire for its ESG issues,7 demand for newer, safer, cleaner nickel supplies is skyrocketing.8,9

Thankfully, recent discoveries in Canada have given hope to a market fearing shortages of some of the world’s most important battery metals.

This is why you need to know about Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA), an attractive early-stage copper-nickel explorer with promising properties in two of the world’s most favorable jurisdictions in British Columbia and Quebec, Canada with an important project next door to one of the country’s most significant nickel discoveries of the year.

7 Reasons Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) is Built to Succeed in the New Nickel Era

- Great Real Estate: Next door to one of the bigger new discovery stories in the market (Go Metals) with its HSP Quebec Nickel project.

- Types of Deposits: Gama’s Tyee project covers an area that is along trend from where Go Metals is, and is only 12km away. The company strategically staked this project because of strong geophysical indicators.

- The PEOPLE Behind This Project: Leading the way for Gama Exploration is a management and advisory team stacked with expertise in management, exploration geology, and capital markets, that includes experience with BHP, Ivanhoe, Haywood Securities, Go Metals and more.

- Favourable Share Structure: With only ~42 million shares outstanding (a significant % of which is owned by insiders and strategic shareholders), the structure of Gama Exploration remains closely held, having recently raised $1.2 million at $0.25, with only 86k warrants outstanding at $0.30 (no overhang).

- Strong Canadian Portfolio: The flagship Big Onion Copper project has a past historical resource with exploration upside potential, extensive drilling and other generative work already done on it, and is ideally situated a short drive from Smithers, BC.

- Huge Global Trend in Battery Metals: The world is being moved into electric battery power due to global warming and the rising price of oil and gas. Battery metals, such as copper and nickel, are crucial to this transition.

- Strong Comparables: While Go Metals is the obvious comparison, other stories come to mind, such as when properties like those of Great Bear Resources and K92 had discoveries, and those that were in close proximity went up, such as Northwest Copper.

Experienced Management and Leadership

In any mining operation, in order to be successful, the team needs to be strong in finding, developing, and financing the project to make it all work—and for all that Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) ticks every box.

At the core of the GAMA story is the leveraging of management’s technical and operational track record. In particular, this team has a significant amount of experience working with Majors, specifically with M&A activity in the mining space. They are growth-oriented with a particular focus on technically sound exploration assets.

GAMA’s management and advisors have diverse backgrounds including geology and Equity Research, including:

Dr. Mick Carew – Chief Executive Officer

A PhD geologist with over 25 years of experience in the mining industry, Dr. Carew has both regional and near-mine mineral exploration experience working for several major and junior mining/exploration companies. He has worked on a variety of uranium, base and precious metal ore deposits in three continents including BHP Olympic Dam in Australia and with Ivanhoe Mines in Mongolia. Dr. Carew has corporate management experience at the executive level and was previously a research analyst at Haywood Securities, where he used his technical expertise to evaluate companies and projects ranging from early and advanced stage exploration, resource and development to production.

Dr. Jacob Verbaas – Technical Advisor

Dr. Verbaas is an exploration geologist whose strengths are regional targeting as well as identifying and executing project- scale exploration strategies. He has experience in Australia, northern Africa and Canada and has worked in executive roles for Canadian public exploration companies since 2017. Dr. Verbaas found and staked the HSP project during his time as VP Exploration with Go Metals (which in 2022 resulted in a significant nickel discovery) and is a Founder, Director and CEO of CAVU Energy Metals, a copper exploration company in the process of being acquired by Alpha Copper.

Bill Cronk – Technical Advisor

Cronk has 25+ years of experience as a geologist and manager of exploration programs for precious and base metal deposits in Africa, Europe as well as North and South America with expertise that ranges from grass roots reconnaissance up to advanced stage and pre-feasibility work.

Among others, he’s worked for mining industry leaders such as Dundee Precious Metals, and Northern Empire – which was acquired by Coeur Mining where he gained invaluable management experience and honed his skills in business development, project generation, program design, budget implementation and project management.

Norman Brewster – Director

Brewster is President, Director and CEO of Cadillac Ventures, with development projects in Ontario (copper) and New Brunswick (tungsten). He’s served on many public and private company boards over his career in the mineral industry, including as the interim President and CEO of Iberian Minerals, successfully financing, developing and putting into production the Aguas Tenidas Mine in Andalucia, Spain which became the region’s largest employer. During his tenure, Brewster also led a committee in reviewing the successful bid by Trafigura Group to acquire Iberian Minerals, in an all-cash takeover.

Jason Riley – Director

Riley is a corporate executive with a wealth of knowledge and experience in the Canadian capital markets. He’s currently serving as a Director of Bessor Minerals, a junior mining exploration company, and Phoenix Copper, a base and precious metals exploration and development company. He’s also the Chairman, President, and CEO of ExGen Resources, a mineral exploration company. Riley is also the CEO of EVOS Media, a digital media company.

Follow the Battery Metals Trends

BOTH nickel and copper are in the spotlight due to thee green electric revolution already underway.

In nickel, the long-term outlook is VERY strong. Earlier this year, the London Metals Exchange halted trading of nickel for several days, because excessive short sellers stood to lose billions.10

According to analyst Nikhil Shah, who was quoted as saying: “In my 15 plus years (working in the industry), I mean, it’s definitely unprecedented… I’m thinking that the price still will remain elevated in the second half of the year.”11

But there’s a shortage looming in the type of high-grade nickel that’s needed for EV batteries.12

More nickel is needed to maintain the energy density (battery life) of new batteries.

According to Mark Beveridge at Benchmark Mineral Intelligence:

“We’re heading towards, you know, 90 percent of the cathode being nickel for certain specific cell types.”

And a LOT of high-grade nickel was coming from Russia, prior to its conflict. Domestically, the US is short on nickel resources, with only one primary nickel mine (Michigan’s Eagle Mine) in operation—and that mine is expected to close in 2025.13

Copper is another story, having seen its price fall by nearly a third since March. However, a massive shortfall looms for the world’s most critical metal.14

Goldman Sachs Group estimates that miners need to spend about $150bn in the next decade to solve an eight million-tonne deficit,15 according to a report published in September 2022.

Goldman Sachs also forecasts that the benchmark London Metal Exchange price will almost double to an annual average of $15,000 a tonne in 2025.16

BloombergNEF predicts that by 2040, the mined-output gap could reach 14 million tonnes, which would have to be filled by recycling metal.

“We’ll look back at 2022 and think, ‘Oops’”

~ John LaForge, Head of Real Asset Strategy at Wells Fargo on copper’s downturn

It’s clear that inventories tracked by trading exchanges are now near historical lows.

Coupled with the latest price volatility, this means that new mine output—already projected to start petering out in 2024—could become even tighter in the near future. Because it takes years to get a mine into production, supply simply can’t keep up with demand.17

So we’re left with upcoming shortages in both nickel and copper on deck.

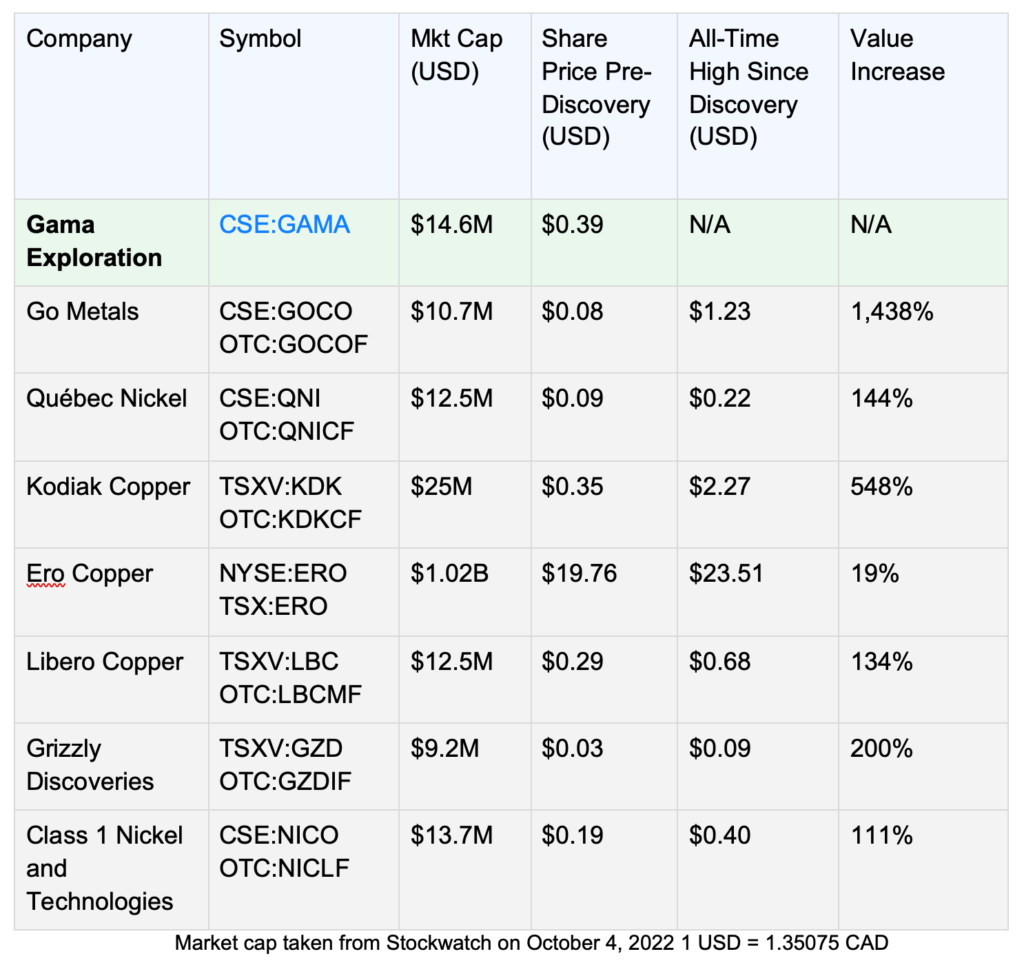

In recent years, the market greatly rewarded explorers when making new copper or nickel discoveries, especially those in the most mining-friendly jurisdictions in Canada.

For Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA), it has the right geologists to lead the exploration programs in both their Big Onion and Tyee projects in British Columbia and Quebec respectively.

Directly adjacent to Gama’s Tyee project is the HSP Nickel project of Go Metals, which most recently had a discovery on it that sent the company’s stock soaring.

It’s worth taking a look at the impact that a new discovery has had on some of Canada’s miners, and their respective share prices.

Tyee Ni-Cu Project – Nickel Sulphide in Quebec

Located 130km north of the town of Havre St. Pierre, Quebec, and adjacent to Go Metals’ recent HSP Ni-Cu discovery, Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) newly-acquired Tyee Ni-Cu project is optimally positioned for big moves ahead.

The Tyee Claims cover the Havre St. Pierre anorthosite complex, which contains known nickel, copper and PGE occurrences.

In terms of infrastructure, the project is only 12km from the Romaine IV hydroelectric power facility, with roads in place to the property.

Initially not meant to be a flagship property, it’s hard to ignore what the Tyee Ni-Cu project brings to the table with its nearly 81.5km2 footprint and glaringly obvious vicinity to the Go Metals discovery.

A distinct magnetic anomaly is present within the claims, which could represent a mafic to ultramafic feeder to the surrounding anorthosite (magnetic low). This feature will be a key focus for exploration as these types of feeders and conduits are prospective for nickel-copper sulphide cumulate systems.

Big Onion Cu-Mo-Au Project – Smithers, BC

Like the Tyee, the Big Onion Cu-Mo-Au project is located close to current infrastructure, providing access to experienced local workers. The project is only 16km (only a 20-minute drive) away from the mining-friendly town of Smithers, BC.

Far ahead of the Tyee in terms of development,Gama’s (CSE:GAMA)(CSE:GAMA)flagship project, the Big Onion already has nearly 50,000 metres of historical drilling on the site, as well as 630km of heliborne magnet geophysical survey completed in 2016, with defined 2D and 3D anomalies in place.

Early exploration work recognized the property’s potential to host a large, low-grade bulk tonnage copper resource. Work further developed the premise that a significant portion of the mineralization is hosted within a near-surface zone of supergene enrichment.

It’s directly to the west of the Dome Mountain Project that’s currently owned by Blue Lagoon Resources Inc., which published a mineral resource on the project in 2020.

Copper and molybdenum mineralization is largely contained within northeast trending, northwest dipping shears and veinlets that parallel the fault controlled intrusive.

Cashed Up with Very Little Overhang

Recently Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) successfully raised $1.28 million at $0.25 with no warrant attached.18

RECAP: 7 Reasons to Seriously Look Into Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) NOW!

- Great Leadership

- Favourable Share Structure

- Strong Canadian Portfolio With The Tyee Nickel Project in Close Proximity to Go Metals Big Discovery

- Great Real Estate

- Huge Global Trend in Battery Metals

- Types of Deposits

- Strong Comparables

For those looking at junior miners that have great discovery potential involving battery metals in Canada, they’ll want to do more research on this well-structured company and great management team presented by Gama Exploration Inc.

As stated, big things can happen quickly for new discoveries in the mining sector, just like what happened with Go Metals. GAMA is set for action in both British Columbia (copper) and Quebec (nickel) with world-class geologists.

Look out for them to be releasing a steady stream of updates in the weeks and months to come.

So, be sure to continue following the Gama Exploration Inc. (CSE:GAMA)(CSE:GAMA) story starting today.

1https://www.linkedin.com/pulse/5-reasons-nickel-most-important-battery-metal-jerad-ford-/

2 https://www.globaldata.com/data-insights/mining/the-top-five-nickel-producing-countries-thousand-tonnes-2021/

3 https://www.wsj.com/livecoverage/russia-ukraine-latest-news-2022-03-08/card/nickel-market-sent-on-wild-ride-by-russia-concerns-oepHo6J9PSoxNNoOCbZf

4 https://northernontario.ctvnews.ca/nickel-markets-may-be-chaotic-but-long-term-outlook-very-strong-analysts-say-1.5841240

5 https://northernontario.ctvnews.ca/nickel-markets-may-be-chaotic-but-long-term-outlook-very-strong-analysts-say-1.5841240

6 https://northernontario.ctvnews.ca/as-elon-musk-calls-for-more-nickel-production-a-mining-analyst-has-some-suggestions-1.5037952

7 https://www.brookings.edu/blog/up-front/2022/09/21/indonesias-electric-vehicle-batteries-dream-has-a-dirty-nickel-problem/

8 https://www.mckinsey.com/industries/metals-and-mining/our-insights/how-clean-can-the-nickel-industry-become

9 https://www.argusmedia.com/en/news/2326899-class-1-ni-shortfall-complicates-nickel-supply-chain

10 https://www.ctvnews.ca/business/china-s-tsingshan-fires-nickel-rally-as-it-cuts-costly-exposure-sources-1.5810369

11 https://northernontario.ctvnews.ca/nickel-markets-may-be-chaotic-but-long-term-outlook-very-strong-analysts-say-1.5841240

12 https://www.cnbc.com/2022/03/19/why-elon-musk-and-tesla-are-banking-on-a-minnesota-nickel-mine.html

13 https://www.miningjournal.net/news/front-page-news/2021/11/eagle-mine-update-given-in-community-forum/#:~:text=The%20expected%20mine%20life%20is,that%20rigor%2C%20of%20planning.%E2%80%9D

14 https://www.thenationalnews.com/business/2022/09/24/why-investors-are-selling-copper-and-how-a-looming-shortage-will-affect-the-economy/

15 https://stockhead.com.au/resources/goldman-sachs-the-only-way-well-meet-copper-demand-by-2030-is-if-prices-top-us13000/

16 https://www.livemint.com/market/commodities/why-copper-prices-can-t-remain-at-historic-low-explained-11663805226402.html

17 https://www.kitco.com/news/2022-09-28/-Copper-is-the-new-lithium-these-metals-are-facing-shortages-Nicole-Adshead-Bell.html

18 https://www.juniorminingnetwork.com/junior-miner-news/press-releases/3133-cse/gama/122943-gama-explorations-completes-private-placement-of-common-shares.html

*Attribution Source for the image: https://commons.wikimedia.org/wiki/File:Elon_Musk_2015.jpg

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Gama Explorations Inc. (“GAMA”) and its securities, GAMA has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by GAMA) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company GAMA and has no information concerning share ownership by others of in the profiled company GAMA. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to GAMA industry; (b) market opportunity; (c) GAMA business plans and strategies; (d) services that GAMA intends to offer; (e) GAMA milestone projections and targets; (f) GAMA expectations regarding receipt of approval for regulatory applications; (g) GAMA intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) GAMA expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute GAMA business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) GAMA ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) GAMA ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) GAMA ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of GAMA to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) GAMA operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact GAMA business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing GAMA business operations (e) GAMA may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Gama Explorations Inc..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Gama Explorations Inc. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Gama Explorations Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Gama Explorations Inc.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Gama Explorations Inc.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Gama Explorations Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Gama Explorations Inc. industry; (b) market opportunity; (c) Gama Explorations Inc. business plans and strategies; (d) services that Gama Explorations Inc. intends to offer; (e) Gama Explorations Inc. milestone projections and targets; (f) Gama Explorations Inc. expectations regarding receipt of approval for regulatory applications; (g) Gama Explorations Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Gama Explorations Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Gama Explorations Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Gama Explorations Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Gama Explorations Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Gama Explorations Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Gama Explorations Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Gama Explorations Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Gama Explorations Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Gama Explorations Inc. business operations (e) Gama Explorations Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Gama Explorations Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Gama Explorations Inc. or such entities and are not necessarily indicative of future performance of Gama Explorations Inc. or such entities.