Branding is the new number one commandment in cannabis marketing.

It’s well understood today that cannabis companies that get branding right will thrive…and those who don’t will take a dive.

No one gets that better than long-time venture capitalist and CanaFarma Hemp Products Corp CEO, David Lonsdale.

Which is why Lonsdale and the CanaFarma team have focused its market-savvy efforts on creating a stable of successful brands, including Yooforic and Herbal State of Mind.

CanaFarma’s unique hemp-based products are generating a lot of buzz, from The New Yorker and Worth magazines to ABC, NBC, Fox News, and even in a recently-released music video from Grammy-winning hit make Sean Paul.

Now the company is launching its biggest venture yet.

CanaFarma deal makes headlines around the world

In a deal that made headlines from London to Los Angeles and Australia to India, CanaFarma entered a partnership with celebrity icon “Foodgod.”

Foodgod, aka Jonathan Cheban, first took the spotlight as Kim Kardashian’s best friend. Since then, his celebrity has grown spectacularly.

Now the entrepreneur and celebrity pops up regularly on entertainment shows like TMZ, Radar, E! Entertainment, and BravoTV.

He’s in the pages of glossy celebrity magazines including People, GQ, Esquire, InStyle.

And he’s often featured on popular websites like PageSix.com, EliteDaily.com, Delish.com, and Variety.com.

Now CanaFarma and Foodgod are partnering to introduce a hemp-based line of foods through Cheban’s company, FeelGoodCBD LLC.

Cheban will help guide product development from his unique perspective as a top social media influencer with millions of Instagram followers.

The Foodgod product line will initially include snacks, desserts and assorted treats, all consisting of premium quality hemp oil and other ingredients.

CanaFarma is a “marketing machine”

That’s the conclusion of stock analyst Jay Lutz of The Deep Dive.

In his May 9 analyst opinion, Lutz highlights CanaFarma’s brand focus, writing:

“This marketing and sales strategy is the core of what sets Canafarma apart from its CBD-focused peers. Rather than center on the hemp cultivation sub-sector which has a low barrier to entry and little differentiation among competitors, the company has focused on developing a brand that has strong consumer support.”

The Foodgod tie-in is part of a larger strategy for CanaFarma.

With the discipline and precision of a general and his army on the field of battle, CanaFarma is conducting a campaign to become on one of the most dominant cannabis marketers.

That focus and dedication is how CanaFarma became…

CanaFarma named one of the “Top 3 Stocks Riding the Hemp Boom”

That’s what The Seed Investor advisory called CanaFarma on April 12, 2020.

Soon after, Financial Trends made CanaFarma their top “New Opportunity.”

Early investors are already all in. But it won’t be long before others start piling in too, driving up share price to a more fair value.

There are five reasons why investors are taking their positions in Canafarma. Starting with:

1. CanaFarma (CSE: CNFACSE: CNFA) founders are start-up and marketing heavyweights

Uniquely, CanaFarma was not founded by “pot farmers,” as so many other cannabis companies have been.

Instead, the founders are marketing and start-up heavyweights who wanted to apply their expertise to what they recognized would be a huge and fast-growing new industry.

CEO David Lonsdale is a gifted entrepreneur who founded, built, and then sold three venture-funded companies, including one that was purchased by Microsoft and another that was purchased by Sun Microsystems.

COO Frank Barone is a pioneer in outside-the-box direct-to-consumer product marketing strategy, and previously founded several multi-million dollar direct-to-consumer health supplement and cosmetics companies, bypassing margin-shrinking distributors and retailers

In a testament to their vision and skills, after launching sales of its first products in June of 2019, CanaFarma achieved $4 million in revenue in just their first six months.

What’s more, they’re on track to reach $80-$100 million in their first 12 months.

One reason for their early success is because company founders studied the market and identified the biggest, fastest-growing, most profitable segment to focus on.

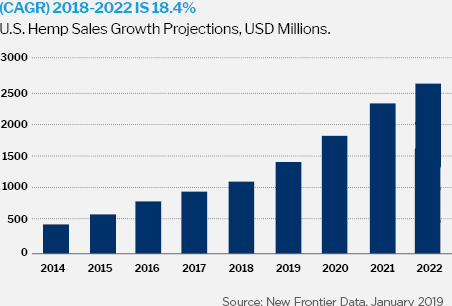

2. CanaFarma (CSE: CNFACSE: CNFA) has first-mover advantage in a $22 billion market

CanaFarma is concentrating its energies on creating and marketing a category of products that is experiencing surging demand: CBD ingestibles made from full-spectrum hemp.

Market research firm Brightfield Group predicts the CBD market could balloon from just $547.58 million in 2019 to $22 billion by 2022.

The 2018 Farm Bill legalized hemp production and sales in all U.S. states. That includes the sale of hemp-based CBD products like those that CanaFarma is achieving market success with.

While the CBD molecule in hemp is identical to the CBD molecule in marijuana, only hemp-derived CBD is legal across the whole U.S.

So far, most cannabis companies have focused on the market for high-THC cannabis.

THC is the psychoactive compound within cannabis that is responsible for the “high.” CBD, though, has no psychoactive properties.

Companies that make and sell high-THC cannabis are restricted to selling only within one of the 11 states that have legalized recreational use or the 33 states that have legalized restricted medical use.

Companies are further restricted to selling only within individual states where they have been granted state licenses.

Hemp-based CBD products, on the other hand, can be sold across state lines without having to be licensed in each individual state of sale.

That gives CanaFarma access to a tremendous market that few other cannabis companies have recognized yet.

Says the Brightfield Group, “Hemp-derived CBD has been gaining huge momentum in the shadows of its oft-spoken about cousin, marijuana, allowing its growth to be largely overlooked by the cannabis industry.”

The cannabis industry isn’t the only group that has overlooked hemp-based CBD, either. Investors have failed to recognize the huge opportunity in companies like CanaFarma that are leading the CBD charge.

But while the vast majority of cannabis companies and their investors continue to focus on producing and selling high-THC cannabis, the real market potential is in CBD.

Launching at the end of 2018, CanaFarma had first-mover advantage as one of the first companies to be granted a hemp cultivation and processing license by the State of New York.

From that Syracuse facility, the company sells and ships product nationwide.

3. CanaFarma (CSE: CNFACSE: CNFA) products boast the highest CBD absorption rate in the market

CanaFarma’s marketing-savvy founders recognized from the very beginning that one of the keys to their success would be to produce high quality products that resonate with consumers.

First and foremost, that means overcoming the problems that have plagued other CBD product makers – low potency, lack of consistency, and lack of uniqueness.

Potency has been a major problem in the industry, with maximum CBD absorption rates no higher than about 46%.

What’s more, many CBD products contain different potencies from batch to batch, making it hard for consumers to reliably know what the effect of a particular product will be.

CanaFarma solved those problems by developing a product by a unique patent-pending technology that results in the highest absorption rate of any CBD product in the market today.

By creating a product that delivers CBD through the mouth’s mucus membranes instead of through the stomach by digestion, CanaFarma was able to achieve a groundbreaking 84% absorption rate.

That makes CanaFarma’s product 8 times more potent than gummies, 2.5 times more than tinctures or oils, and 2 times more than vapes.

This is proving to be a significant draw for consumers.

CanaFarma is finding those customers at surprisingly low cost by engaging cutting edge marketing strategies.

4. CanaFarma (CSE: CNFACSE: CNFA) is a savvy consumer products marketer

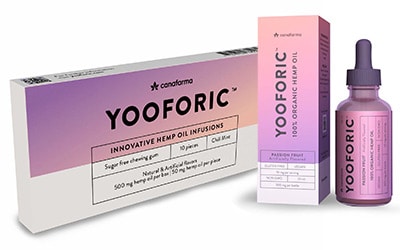

The first product developed by CanaFarma is branded as Yooforic, a unique chewing gum that delivers its CBD through absorption by the mouth’s mucus membranes

The initial marketing campaign for Yooforic launched the product with a free trial offer. Success would hinge on converting consumers who took advantage of that low-risk way to try the gum into paying customers.

In fact, the conversion rate was an incredible 80%, driving sales of more than 200,000 units in the first six months, achieving revenue of $6 million.

What’s more, they did it without securing a single distributor and without having a presence in even one retail store.

Instead giving up any portion of their profits to distributors, retailers, or marketing agencies, they are keeping the vast majority of those profits and using them to grow their business.

CanaFarma also recruits celebrity social influencers who engagingly introduce the Yooforic brand to their fans.

The company’s outside-the-box marketing strategy has initially relied on a network of affiliate marketers who promote and sell CanaFarma’s products directly to consumers in exchange for a small commission.

In this way, CanaFarma has been able to grow their sales to an impressive $1 million per month, a figure that is increasing steadily month-by-month.

They now formulate and market two additional full-spectrum hemp-based CBD products, which are proving to be popular with consumers, a tincture and hemp-infused cream.

Phase 2 market expansion plans call for establishing partnerships with distributors, national retail chains, and large online retailers.

Having products that boast the industry’s highest absorption rate will be a big factor in gaining both shelf space and new consumers.

For all its early success, though, CanaFarma has been surprisingly overlooked by investors. That is sure to change.

5.CanaFarma (CSE: CNFACSE: CNFA) is grossly undervalued compared to peers

Tilray is a cannabis producer that was founded in 2013 and went public in July of 2018. That year, five years after launching the company, Tilray’s total sales reached just $43.1 million.

Yet that was enough for investors to drive up Tilray’s share price to as high as $148, inflating their market cap to $26 billion.

Today, annual sales have increased to $167 million, and are projected to reach $200 million for 2020. The company’s market cap is a more down-to-earth $914 million and its stock trades at roughly $8.00

Comparatively, CanaFarma’s sales are on track to reach, conservatively, $80 million in year one. That’s more than double Tilray’s 2018 revenue, when Tilray traded for $148, and a little less than half their 2019 revenue, when the stock traded at an average range of about $40.

Yet right now Tilray’s market cap is more than 10 times CanaFarma’s, and their stock trades nearly 11 times higher.

That makes CanaFarma a relative value for investors.

CanaFarma (CSE: CNFACSE: CNFA) is ripe for acquisition

With their strong branding, their focus on high profit-margin edibles, their industry-leading absorption rates, their low debt load, and their innovation-driven leadership, CanaFarma is positioned to become a major player in the budding CBD industry.

And with few outstanding debts, the company is attractive for acquisition. Few of CanaFarma’s competitors have reached a similar level of advantage.

The next year should see a considerable number of mergers and acquisitions in the industry.

ArcView Market research and BDS Analytics recently issued a joint report stating that “As the edibles business grows and regulatory fears in the US ease, the pace of intra-industry mergers and outside acquisitions will increase exponentially.”

The report goes on to say, “The brands being built today will be the edibles powerhouses of tomorrow, and they’ll be very attractive acquisition targets when the attention of the multi-billion-dollar mainstream food and beverage industry shifts to possibilities offered by legal cannabis—and it will, especially with national legalization in Canada and continued movement in that direction in the U.S.”

Major consumer package goods manufacturers are looking for ways to grab a share of this potential $22 billion market. Growth through acquisition is considered to be a quicker, cheaper, and far less risky way to achieve growth. Many companies opt to buy expertise, product, and market penetration.

CanaFarma is an attractive target, giving potential investors yet one more reason to look closely at this dynamic company in the new CBD bull market.

You can see CanaFarma’s corporate presentation on their website here.

Ask your broker about CanaFarma (CSE: CNFACSE: CNFA) And don’t forget to always perform your own due diligence research before investing.

1 https://financialstrend.com/canafarma-cse-cnfa-builds-powerful-new-approach-to-brand-expansion-in-24b-hemp-space

2 CanaFarma Investor Deck p5

3 Ibid

4 2019 sales: https://finance.yahoo.com/news/global-cannabinoid-hemp-oil-market-012500711.html; 2020 projection: https://blog.brightfieldgroup.com/cbd-worth-22-billion-by-2022

5 https://blog.brightfieldgroup.com/cbd-worth-22-billion-by-2022

6 https://www.fool.com/investing/2018/09/19/tilray-is-partying-like-its-1999-and-it-wont-end-w.aspx

7 https://www.foodnavigator-usa.com/Article/2018/11/06/Bernstein-Arcview-BDS-Analytics-explore-edibles-cannabis-market-potential#

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Canafarma Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

————-

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.