Electric Vehicle Industry Is Getting Hotter And EV Technology (NEO:EVTG)(NEO:EVTG) Is Gearing Up To Dominate It

Did you know that big money can be made in the electric vehicle industry?

According to Forbes, “the electric vehicle market just hit its tipping point.”1

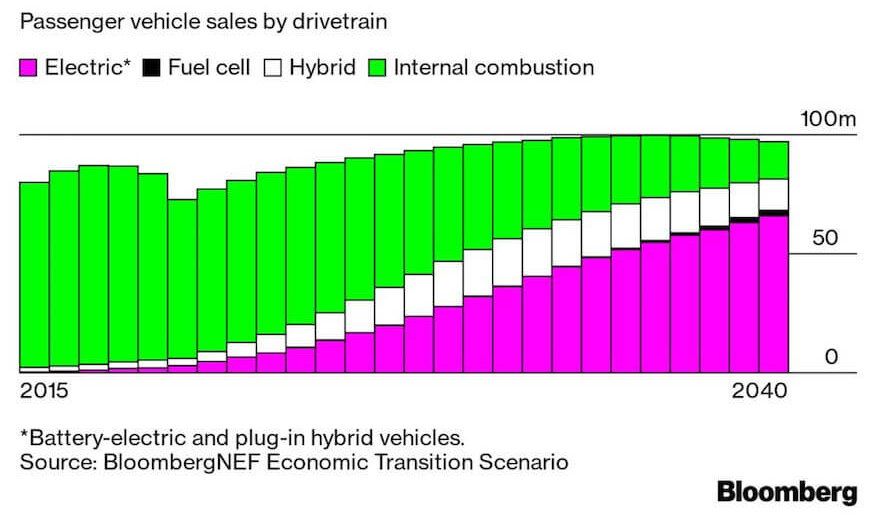

This is perfectly shown when electric vehicles sales soared during the pandemic, while the overall car market stagnated.2 And it’s clear the market is continuing in that direction.

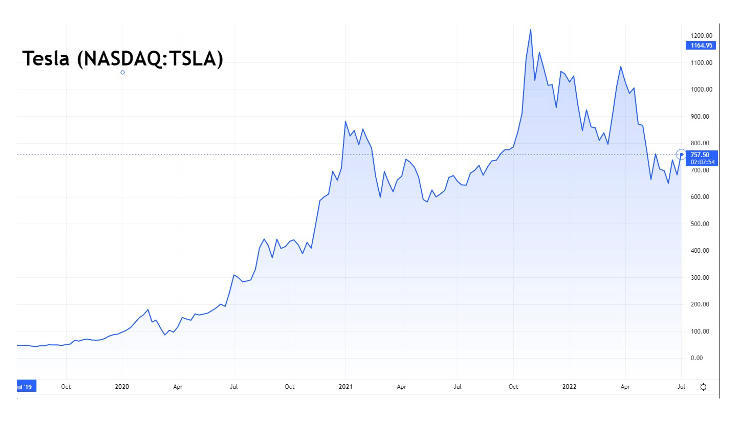

Tesla sold 87% more cars in 2021 than it did in 2020, which set up its stock price for a major surge.3

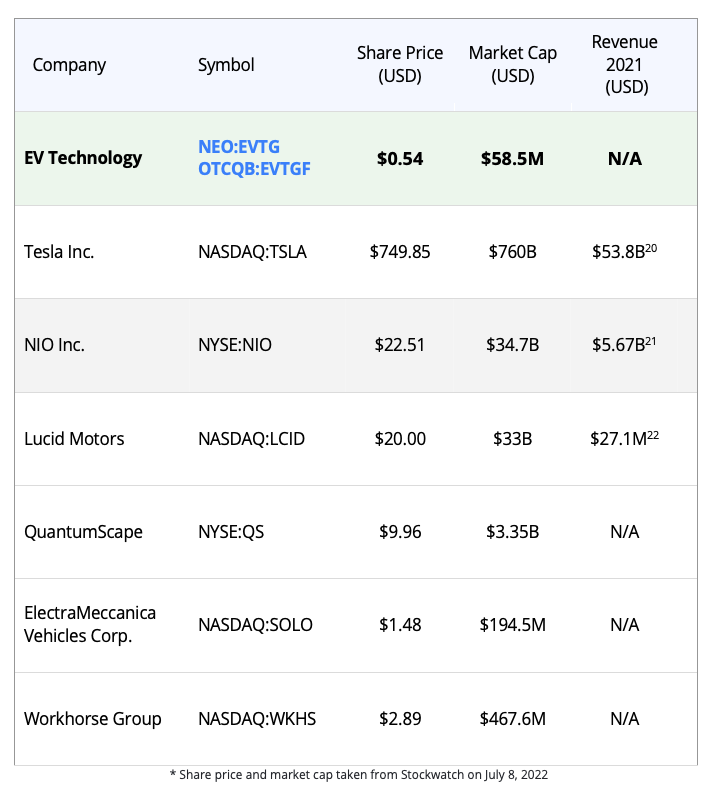

But whole Tesla is all over the news, many insiders know it won’t be the monopoly of the electric vehicle industry forever.

It’s been said that one of the fastest-growing players could be one up and coming company that is helping iconic brands “go electric” known as EV Technology Group Inc (NEO:EVTG).

Why You Won’t Hear About EV Technology Group (NEO:EVTG)(NEO:EVTG) From The Traditional Financial Media

Because it’s that exclusive still.

Yet, EV Technology Group (NEO:EVTG)(NEO:EVTG) has already received more than half a million Euros worth of pre-orders for the iconic MOKE that is helping to electrify in 2022.

And this is just the beginning because the company is well-positioned to make a substantial fortune from the emergence of a new giant industry.

As we speak, the world’s smartest investors are racing to get a piece of the exciting electric vehicle boom.

With Tesla’s explosion, it’s easy to see why.

CNN reports investors are searching for the “next Tesla.”4

And many experts believe EV Technology Group (NEO:EVTG)(NEO:EVTG) could be a heavyweight contender for that title because it could disrupt the electric vehicle market in a BIG WAY.

So, if you want a chance at returns that may rival Tesla’s stock, learn why more “smart money” could keep flowing into EV Technology (NEO:EVTG)(NEO:EVTG) right now.

Reason #1 - Electric Vehicles Reach “Tipping Point”

The electric vehicle industry used to be reserved exclusively for insiders, big institutions, and a few people who understood the tech early on.

However, this is about to change.

Right now, the electric vehicle industry is on the cusp of mass adoption.

And many investors will be shocked once they see what’s possible with electric vehicle investments.

Take Tesla shares, for example. If you got in on TSLA stock in July 2020, you would be up 1,287% in just two years!

And if you got in on Tesla when it first went public back in late 2010, you would be up a whopping 21,156%. Meaning, if you put in just $10K back then, you would be a multimillionaire!

The fact is, you would have made more money than you ever imagined had you invested in Tesla before you saw its cars everywhere.

The potential of EVs was already evident 20 years ago when a visionary like Elon Musk founded Tesla.

But now, it could be even bigger!5

There are currently 4,600% more electric cars on the road compared to 2012.6

Year-over-year sales growth has doubled from 42% to 108% between 2020 and 2021.7

NASDAQ reports the sector has consistently outperformed the S&P 500.8

One industry report expects a 34%+ CAGR, with 11 million electric vehicles expected to be sold by 2025 and 28 million units annually by 2030!9

So, if you missed out on Tesla’s legendary gains, don’t worry.

Now, you have a second chance to reap similar returns Tesla investors enjoyed.

Many experts believe that the mass adoption of electric vehicles will reduce emissions of greenhouse gasses and save the earth!

That’s why governments around the world put billions of dollars into the sector and mandated that ALL gas-powered cars be replaced by electric vehicles as early as 2030.

So, imagine what this could potentially mean for people that took an early look at EV Technology Group (NEO:EVTG)(NEO:EVTG)

Reason #2 - EVT (NEO:EVTG)(NEO:EVTG) Rides The Clean Energy Revolution

Have you noticed the world has become “greener”?

A recent study reveals 85% of consumers now prefer environmentally-friendly products.10

So, gone are the days when profit-margin was all that mattered.

This is why governments have begun to support electric vehicles rollouts, as they feel pressured to catch up in the race towards a “greener” future.

For example:

- The White House has asked US automakers to pledge at least 40% new vehicle sales to be EVs by 2030 to reduce greenhouse gas pollution.11

- French President Emmanuel Macron developed a plan called “France 2030” to invest up to $15 billion in renewable energy sources, nuclear, electric vehicles, and low-emission aircraft.12

- A European regulation aims to cut CO2 emissions from light and medium commercial vehicles by 15% by 2025.13

- And even Uber is going 100% electric by 2030.14

“Never Before Has The Clean Energy Revolution Experienced Such Urgency”

So, if you had to choose only one industry to bet on, make sure it’s thee EV sector.

While others speculate on something like digital currency, the smart money is pouring into electric vehicles because “green” companies have been on fire.15

As a result, electric vehicles stocks have tremendous upside potential in the next 8-10 years!

EV Technology Group (NEO:EVTG)(NEO:EVTG) is taking advantage of the clean energy revolution by implementing its own environmental policy.

It uses up to 95% sustainable car materials and reduces carbon impact by 75% in manufacturing.

Of course, this could attract many eyeballs who’ve seen “green” stocks quadruple their money.

Reason #3 - EV Technology Group's (NEO:EVTG)(NEO:EVTG) Huge Potential By Electrifying Classic and Iconic Cars

If you’re wondering what EV Technology Group (NEO:EVTG)(NEO:EVTG) is, and why it’s different from other electric vehicles, the answer is simple.

Famous people everywhere love the iconic car brands they are electrifying – such as the MOKE.

French actress, Bridgitte Bardot, drove it in the 1960s.

James Bond drove it in the movie “Live and Let Die.”

James Bond drove it in the movie “Live and Let Die.”

As a result, the car became a cult classic in many of the world’s most beautiful places – from the Caribbean to the South of France – a few decades ago.

In fact, even the Kardashians, own a fleet of them!16

Yet, EV Technology Group (NEO:EVTG)(NEO:EVTG) isn’t about bigger engines or longer-lasting batteries.

Instead of spending capital building a car brand from scratch, it simply…

- Buys car brands with great potential…

- Uses its expertise and modern technology to help them ‘go electric’…

- And keeps the original design…

… saving MILLIONS of dollars!

So even though many self-proclaimed “Tesla Killers” dominate the news, don’t fall for their hype.

The truth is, many of them are “losing money” despite selling well.17

But the good news is, EV Technology Group (NEO:EVTG)(NEO:EVTG) can easily scale without cost limitations.

That is why it is set to quickly reward early investors with handsome returns.

The problem with electric vehicles nowadays is that they are all beginning to look the same, chasing the same mass-market segment, which is getting boring.

As Jeremy Clarkson, the host of the famous motoring program Top Gear, says, “Call me a dinosaur, but … I prefer a Ford Mustang to a Tesla.”

That’s why MOKE International, a leading brand in EVT’s portfolio, looks different – by adopting beloved classic designs for the EV age.

MOKE electric’s exterior was designed in the 1960s by the same guy who also created the legendary Mini Cooper, Sir Alec Issigonis.

Interestingly, the mother of the Kardashians, Kris Jenner, gifted each family member a MOKE Electric for Christmas last year.18

Interestingly, the mother of the Kardashians, Kris Jenner, gifted each family member a MOKE Electric for Christmas last year.18

And this sparked a wave of excitement among electric vehicles lovers.

The result? Almost half of all MOKE electric cars expected to be sold in 2022 have already been pre-ordered!19

But this unique market approach is just one of many of EV Technology Group’s (NEO:EVTG)(NEO:EVTG) strategies.

There are many more ways for the company to position itself as a dominant player in the ultra-profitable electric vehicle industry… and to become many competitors’ worst nightmare.

For example…

Reason #4 - EV Technology's (NEO:EVTG)(NEO:EVTG) “3-Pronged Approach” To Maximize Profits

One of the best things investors love about EV Technology (NEO:EVTG)(NEO:EVTG) is that it runs three complementary business lines that synergize to maximize profits.

You’ve learned a little about the first one, which is…

Strategic Brands & Platforms

This is where it acquired brands like MOKE International. But with EV Technology Group (NEO:EVTG)(NEO:EVTG) constantly hunting for new companies and acquiring them, the sky’s the limit in market share.

This means the company is differentiating itself with multiple product suites, leading to more revenue streams – from proven brands.

That’s why EV Technology Group (NEO:EVTG)(NEO:EVTG) investors can enjoy a more stable price trajectory than other electric vehicle stocks.

Advanced Engineering & Manufacturing

EVT is planning to develop deep supply chain and manufactureng integration, meaning EV Technology Group can easily guarantee quality and deliveries, meaning it’s well-positioned to always see a robust EBITDA base.

And so, EV Technology Group (NEO:EVTG)(NEO:EVTG) can consistently reinvest in itself at higher ROE, which every savvy investor ought to keep an eye on.

The third business line is…

Distribution & Experiences

Currently, it operates in France through MOKE France, and through it, many believe EV Technology Group (NEO:EVTG)(NEO:EVTG) could soon skyrocket in popularity.

Here’s why: Besides distributing as a dealer for MOKE International in France, MOKE France has also secured an exclusive storefront lease in St Tropez.

As you may know, St Tropez is one of the world’s most beautiful spots, well-known for luxury beachside motoring.

Over there, It’s not just about providing MOKE rentals but also premium experiences like MOKE beach tours and customized MOKEs for top beach clubs in Europe.

As the name of this business line suggests, MOKE France is all about creating a “MOKE Experience” in a unified way to boost the brand’s integrity and premium pricing.

Simply put, think of it as a… Disneyland For Electric Vehicles.

And by combining rentals, experience, and merchandise at St Tropez, MOKE France expects to grow from $5.3 million in revenue in 2022 to $21 million by 2025.

In fact, MOKE France reported generating €500,000 worth of orders in just one month (from the end of April to the end of May) after opening an initial pilot sales program. Those who purchased a MOKE were required to deposit €990 to secure their order, with the remainder to be paid on delivery, which MOKE France anticipates being within the year.

But that’s not the end of the story!

MOKE France’s business model will soon expand to other countries, including MOKE Caribbean, MOKE Spain, MOKE UAE, MOKE Greece, MOKE Thailand, and MOKE Brazil.

And once that happens, MOKE International’s brand awareness could spread like wildfire, similar to how Disneyland boasts Disney’s fame.

On May 24, the company announced a collaboration with renowned French artist, Quentin Monge, who plans to install a series of digital and physical artworks, inspired by the heritage of the MOKE. The campaign should help bring to life the charming, colorful, and unique aesthetic of the brand.

MOKE France also announced in June a partnership with GOMECANO, a nationally recognized vehicle servicing company, that provides Electric MOKE owners with access to on-demand mechanics for vehicle repairs in just a few simple steps, from the comfort of their home or office.

All of this is why EV Technology Group (NEO:EVTG)(NEO:EVTG) doesn’t have to be a first-mover in the electric vehicle space to succeed because of its one-of-a-kind strategy.

In fact, if you look at many of the top-performing companies, such as Google, Apple, and Facebook, every one of them prevailed not by being the first, but instead…

… by challenging established companies like Yahoo, IBM, and MySpace, respectively, through improvised models.

Everyone knows which companies won in the end, which is why historyy could soon be about to repeat itself as EV Technology Group (NEO:EVTG)(NEO:EVTG) rolls out its grandiose plan like no others.

But that’s not all to EV Technology Group’s three complementary business lines!

There’s a big picture strategy behind them.

As a result of all three working synergistically from manufacturing to distribution, EV Technology Group (NEO:EVTG)(NEO:EVTG) can capture up to 70%+ of the value of each vehicle it produces.

This means it can charge the same price as competitors but retain much more of the profit!

That’s why EV Technology Group (NEO:EVTG)(NEO:EVTG) could thrive so well.

And for earlier investors, this could finally mean the end of hunting the next unicorn.

Reason #5 - EV Technology's (NEO:EVTG)(NEO:EVTG) Business Model Could Be A Limitless Growth Machine

Experts believe EV Technology Group (NEO:EVTG)(NEO:EVTG) is an incredible opportunity because it can keep growing by:

- Acquiring more iconic brands

- Loading up on client contracts on the engineering and manufacturing side of things

- And expanding its distribution and experience centers around the world.

So unlike many stocks, the sky’s the limit with EV Technology Group (NEO:EVTG)(NEO:EVTG) business model!

That’s why you must consider it now before its price makes a move!

Why? Because stocks making moves this big don’t remain under thee radar for long.

Once these companies reach their potential, they explode before mainstream media has a chance to cover them.

And you could miss out like many people did on Tesla.

But the fact that you are learning about EV Technology Group (NEO:EVTG)(NEO:EVTG) now means the opportunity is still ripe.

This could be like Tesla when it IPO’d. It’s really that promising!

Reason #6 - EV Technology (NEO:EVTG)(NEO:EVTG) Has A Management Team With Proven Track Record

The savviest investors in the world always look for one thing, which is the track record of the management team:

Wouter Witvoet - CEO and Co-founder

Wouter is co-founder and Chief Executive Officer of EV Technology Group. Before starting EV Technology Group, Wouter Witvoet co-founded Valour Inc, which bridges the gap between centralized and decentralized finance. Valour is listed in Canada under ticker NEO:DEFI. Wouter founded and lead Secfi, a San Francisco based FinTech company and the market leader in financing for start-up employees. Secfi has invested over US$480M in start-ups (DoorDash, Palantir, Uber, Snowflake, and more). Witvoet has a background in computer science and graduated from the University of Cambridge.

Olivier Roussy-Newton - President and Co-founder

Olivier is a co-founder and President of EV Technology Group. Before co-founding EV Technology Group, Roussy Newton co-founded Valour Inc and HIVE Blockchain Technologies, the first crypto mining company to list publicly in 2017. He is the managing director of BTQ, AG and Founder of Latent Holdings.

Dan Burge - Chief Product Officer

Dan Burge is a highly experienced global automotive industry executive, with over 20 years of high-level commercial, operational and technical roles. Dan is joining from Radford where he was CEO. Dan previously served as Commercial Director of Lotus Engineering, a global leader in automotive engineering and product development. In addition Dan has held senior commercial and programme roles at Williams Advanced Engineering and Prodrive Automotive Technologies.

David Maher - VP Investments & Strategy

David began his career at McKinsey & Company, serving as an Engagement Manager in McKinsey’s Private Equity and Digital Transformation practices. David has since specialized in leadership roles in M&A, strategy and marketing in growth stage companies. He worked as Head of Marketing Operations at Lazada Group (Alibaba), the leading e-commerce player in South-East Asia, where he helped lead marketing efforts across 6 South-East Asian countries, as the company grew past a US$3B valuation. Subsequently, Mr Maher was Vice President of Valour Inc., responsible for corporate development David completed his Masters of Business Administration at Harvard Business School.

EV Technology Group’s (NEO:EVTG)(NEO:EVTG) executive team are complimented by invited executives from Rolls Royce, McLaren, and BMW, who are helping lead the MOKE brand to market.

And by working together, EV Technology Group (NEO:EVTG)(NEO:EVTG) could replicate Wouter’s and Olivier’s amazing success with companies like Secfi, Valour and HIVE.

Imagine enjoying your stake with a growth rate like that, if not better.

So because of these 6 reasons, investing in EV Technology (NEO:EVTG)(NEO:EVTG) could be one of the smartest things you could do right now.

The sooner you get started, the sooner you’ll be able to position yourself for what could be one of the biggest windfalls of the decade.

RECAP: 6 Reasons “Smart Money” Could Keep Pouring Into EV Technology (NEO:EVTG)(NEO:EVTG)

- Electric vehicle adoption is are reaching a“tipping point” (one industry report expects a 34%+ CAGR, with 11 million electric vehicles expected to be sold by 2025 and 28 million units annually by 2030!)

- EV Technology Group (NEO:EVTG)(NEO:EVTG) rides the clean energy revolution (the company takes advantage of the clean energy revolution by implementing its own environmental policy)

- EV Technology Group’s huge potential thanks to its unique, high margin products (including the Electric MOKE, with pre-orders lining up for 2022)

- EVT’s “3-pronged” approach to maximizing profits (Strategic Brands & Platforms, Advanced Engineering & Manufacturing, and Distribution and Experiences)

- EV Technology’s (NEO:EVTG)(NEO:EVTG) business model could be a limitless growth machine (the company could keep growing through acquisitions, client contracts, and expanding experience centers)

- EV Technology Group has a management team with a proven track record (CEO and President have scaled multi-million dollar businesses, while MOKE International team members came from Rolls Royce, BMW, and McLaren)

1 https://www.forbes.com/sites/andystone/2020/10/25/ev-market-hits-its-tipping-point/?sh=4681d5bf7dad

2 https://www.google.com/url?q=https://www.nytimes.com/2022/01/17/business/electric-vehicles-europe.html&sa=D&source=docs&ust=1645539365402065&usg=AOvVaw26Q-RX5I1AGuDxkg3D3T8I

3 https://www.auto123.com/en/news/tesla-sales-million-vehicles-2021/68816/#:~:text=That%20represents%20a%20healthy%2087,of%202021%2C%20or%20308%2C600%20units.

4 https://www.cnn.com/2021/12/26/investing/tesla-ev-stocks/index.html

5 https://www.ev-volumes.com/

6 https://www.ev-volumes.com/

7 https://www.ev-volumes.com/

8 https://www.nasdaq.com/articles/ev-supplier-stocks-outperform-as-automakers-invest-in-the-electric-future-2021-10-22

9 Investor Deck Executive Summary

10 https://www.businesswire.com/news/home/20211014005090/en/Recent-Study-Reveals-More-Than-a-Third-of-Global-Consumers-Are-Willing-to-Pay-More-for-Sustainability-as-Demand-Grows-for-Environmentally-Friendly-Alternatives

11 https://www.reuters.com/business/autos-transportation/white-house-wants-us-automakers-back-least-40-ev-target-by-2030-sources-2021-07-29/

12 https://europe.autonews.com/automakers/frances-35b-industrial-revival-plan-sets-ev-production-target

13 https://www.google.com/url?q=https://www.globenewswire.com/news-release/2021/10/21/2318059/0/en/Global-Electric-Vehicle-Market-Size-2021-2028-is-Anticipated-to-Grow-USD-1-318-22-Billion-at-a-CAGR-of-24-3.html&sa=D&source=docs&ust=1645561223715515&usg=AOvVaw1MwtjYlw74qEKuUWUp_Io4

14 https://www.theverge.com/2020/9/8/21427196/uber-promise-100-percent-electric-vehicle-ev-2030

15 https://www.nasdaq.com/articles/10-best-green-energy-stocks-for-2022

16 https://people.com/tv/kim-kardashian-reveals-kris-jenner-gifted-her-family-cars-for-christmas-how-cool/

17 https://www.cnn.com/2021/01/31/investing/tesla-profitability/index.html

18 https://people.com/tv/kim-kardashian-reveals-kris-jenner-gifted-her-family-cars-for-christmas-how-cool/

19 Investors Deck

20 https://www.nytimes.com/2022/01/26/business/tesla-earnings.html

21 https://ir.nio.com/news-events/news-releases/news-release-details/nio-inc-reports-unaudited-fourth-quarter-and-full-2

22 https://www.statista.com/statistics/1306291/revenue-lucid-motors/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of EV Technology Group Inc. (“EVTG”) and its securities, EVTG has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by EVTG) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company EVTG and has no information concerning share ownership by others of in the profiled company EVTG. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to EVTG industry; (b) market opportunity; (c) EVTG business plans and strategies; (d) services that EVTG intends to offer; (e) EVTG milestone projections and targets; (f) EVTG expectations regarding receipt of approval for regulatory applications; (g) EVTG intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) EVTG expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute EVTG business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) EVTG ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) EVTG ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) EVTG ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of EVTG to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) EVTG operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact EVTG business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing EVTG business operations (e) EVTG may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling EV Technology Group Inc.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled EV Technology Group Inc. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any EV Technology Group Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the EV Technology Group Inc. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled EV Technology Group Inc.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding EV Technology Group Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to EV Technology Group Inc. industry; (b) market opportunity; (c) EV Technology Group Inc. business plans and strategies; (d) services that EV Technology Group Inc. intends to offer; (e) EV Technology Group Inc. milestone projections and targets; (f) EV Technology Group Inc. expectations regarding receipt of approval for regulatory applications; (g) EV Technology Group Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) EV Technology Group Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute EV Technology Group Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) EV Technology Group Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) EV Technology Group Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) EV Technology Group Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of EV Technology Group Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) EV Technology Group Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact EV Technology Group Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing EV Technology Group Inc. business operations (e) EV Technology Group Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of EV Technology Group Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of EV Technology Group Inc. or such entities and are not necessarily indicative of future performance of EV Technology Group Inc. or such entities.