Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) is Helping Overcome the “Battery Bottleneck” That is Holding EV Production Back

Is there a sector investors love more than electric vehicles right now?

With major countries like China, Canada, the US, and the Eurozone making significant moves toward phasing out fossil-fuel vehicles within the next two decades,123 investors have been looking closely at almost any electric vehicle-related name.

This has been amplified by the “SPAC boom”, which has resulted in valuations like…

$24 billion for Lucid Motors,4 $5.4 billion for Arrival,5 almost $20 billion for battery maker QuantumScape,6 and $3.1 billion for electric vehicle components maker REE Automotive7 – even though most have yet to produce a single product.

The established automakers have also taken notice, investing hundreds of billions in producing their own electric vehicles.

But here’s the problem…

| Company | Symbol | Market Cap* | Share Price* | EV Investment |

|---|---|---|---|---|

| Tesla | NASDAQ:TSLA | $610.1B | $635.62 | $12 Billion8 |

| Toyota Motor | NYSE:TM | $214.1B | $153.87 | $2 Billion9 |

| Volkswagen | OTC:VWAGY | $187.8B | $37.75 | $86 Billion10 |

| General Motors | NYSE:GM | $84.3B | $58.51 | $33.8 Billion11 |

| Ford Motors | NYSE:F | $49.6B | 12.46 | $29 Billion12 |

| Hyundai Motors | OTC:HYMTF | $43.6B | $45.20 | $87 Billion13 |

*Share price and market cap taken from Yahoo Finance on March 30, 2021

All These Companies Are Playing in an Increasingly Crowded and Competitive “Red Ocean” Market

The Wall Street Journal puts it succinctly14…

Consider that China’s electric vehicle market has over 400 competitors15…

And many established global automakers are themselves heavily involved in electric vehicle battery development.16

Undoubtedly, all this competition is great for the consumer – but not necessarily for the investors.

That’s why we’re so excited about Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF), a company that is revolutionizing the way electric vehicle battery materials are made.

Because instead of simply being another “me too” electric vehicle company looking to dethrone Tesla or challenge battery makers with decades of industry experience…

Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) is Taking a Different Road and Approaching the Industry Like No Other Company Has Ever Done Before

The company has created – and patented – a revolutionary process that allows the materials found in electric vehicle batteries to be produced cheaper, faster, longer lasting, and GREENER!

This means more durable batteries, produced quicker, at higher profit margins.

The best part? Its business model.

Unlike other companies, which are looking to produce the batteries themselves, Nano One Materials’ main focus is on licensing its patented technology or joint venturing with strategic partners.

This means any battery or electric vehicle producer could benefit by using the company’s breakthrough process to get a competitive edge…

Allowing Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) to potentially achieve massive scale while still keeping its costs low.

(Yet at the same time, the company remains nimble enough to shift or expand into other business models, such as joint ventures.)

The “Battery Bottleneck” is Holding the Electric Vehicle Supply Chain Back

Switching from the internal combustion engine to an electric motor isn’t as easy as plugging it in and driving away…

Manufacturing electric vehicle batteries needs raw metals, namely lithium, nickel, cobalt, manganese, iron, and phosphorus to name a few.

And the supply of these metals have not kept up with the demand, sending prices spiralling upward. As automakers stepped up their electric vehicle plans, metal prices hit a 52-week high near the end of February 2021.17

This is important, because electric vehicle batteries account for as much as 30% of the total vehicle cost18…

Supply crunches have already previously caused automakers like Audi, Jaguar, and Mercedes to slow down production.19

Expanding metals mining is the most obvious way of fighting this supply constraint – but it is also the most resource-intensive and time consuming…

It’s also not the most profitable way to get in on the EV market…

Real Money’s Jim Collins points out that the best way to capitalize on the EV battery market isn’t with the materials themselves, but in companies with technologies that make EVs, their batteries, and their use of base materials more efficient. Among the top picks in that category is Nano One.

“…But the intriguing thing about Nano is that it offers technology instead of the materials themselves,” Collins writes. “…Instead of a huge open pit in New Brunswick, Nano has a bunch of really, really, really smart engineers working in Burnaby, British Columbia.”

McKinsey pinpoints 2025 as the year that supply challenges will begin to pose a real threat to electric vehicle adoption20…

And as automakers scramble to find scalable solutions before shortages hit their bottom line while maintaining a positive ESG mandate…

Investors are waking up to the fact that batteries are the largest constraint to mass electric vehicle adoption, which is why…

We Are in the Middle of a “Battery Boom”

Promising battery companies and the like are seeing multi-billion dollar valuations. And these companies are all going to need to get their battery materials from somewhere (or will need an updated tech process), which is where Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) steps in.

| Company | Symbol | Market Cap (USD) | Share Price (USD) | Revenue TTM (USD) |

|---|---|---|---|---|

| Nano One Materials | TSX:NANO OTC:NNOMF | $377.7 Million | $4.23 | N/A |

| EnerSys | NYSE:ENS | $3.9 Billion | $91.60 | $3 Billion21 |

| QuantumScape | NYSE:QS | $16.7 Billion | $44.07 | N/A |

| Plug Power | NASDAQ:PLUG | $20.1 Billion | $34.04 | $307 Million |

| BYD Company | OTC:BYDDY | $71.0 Billion | $44.35 | $138.9 Billion |

| Livent Corp. | NYSE:LTHM | $2.5 Billion | $16.91 | $288 Million |

| Umicore | OTC:UMICY | $12.7 Billion | $13.19 | $20.7 Billion |

It’s not just the public markets. Battery tech company Sila Nanotechnologies recently raised $590 million in private funding, pushing its implied valuation to $3.3 billion.22

And Swedish battery developer NorthVolt raised $600 million in equity in 2020, giving it a $2 billion valuation.23

But again, these are mostly battery manufacturers who must compete with each other…

Whereas Nano One Materials has the option to license its patented technology to nearly anyone in the industry or partner in strategic joint ventures.

7 Reasons Why Nano One Materials Corp.'s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Battery Material Tech Could Dominate the Batteries Market

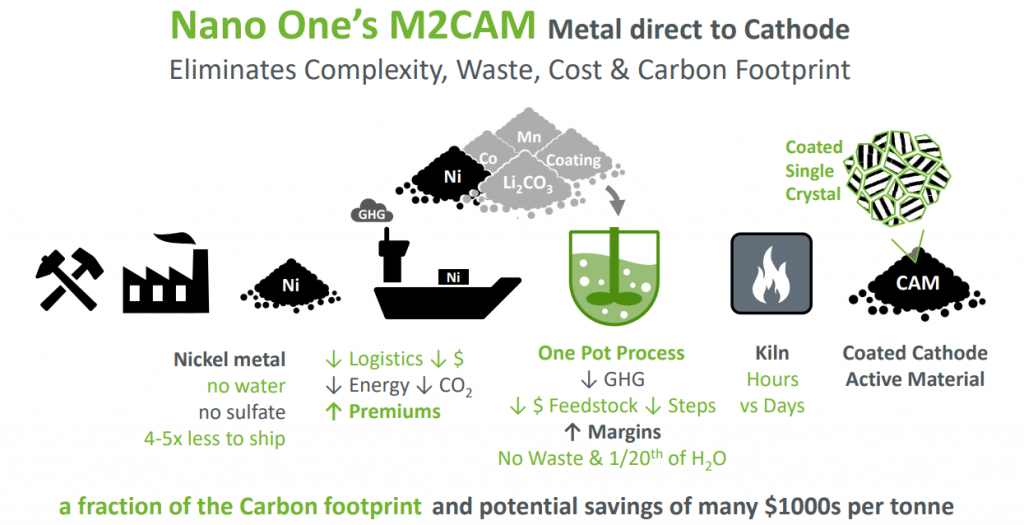

- Improves Charge Life of Lithium-Ion Batteries: The company’s patented “One-Pot” process results in individually coated single cathode crystals. Coatings protect each individual grain of cathode powder from side reactions as the battery is charged and discharged, improving the durability of the battery.

- Saves Time and Costs in Production Process: Eliminates the need for energy intensive conversion of feedstocks that would result in waste streams and extra cathode production steps, meaning the process is faster and cheaper with a fraction of the carbon footprint – resulting in higher margins for manufacturers.

- Applicable to Every Type of Lithium-Ion Battery: There are a number of different lithium-ion battery chemistries, each serving different needs, but that doesn’t matter to Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF), because its patented process can be used for every type.

- Easily Scalable: Because of its licensing model, Nano One Materials Corp.’s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) can easily roll out its patented technology to many automakers and battery material manufacturers while still maintaining a low cost base. It already has several major joint development partnerships in place, with more on the way.

- Protected by a Fortress of Patents: With 16 currently approved patents and over 30 pending, the company’s technology is protected in multiple jurisdictions, patenting the process, the materials, and the products made with the process and materials.

- Helps Overcome the “Battery Bottleneck”: For electric vehicles to truly reach mass adoption, we must overcome the constrained battery supply chain. Making the battery materials production process more efficient is vital in this effort while remaining a good global corporate citizen and maintaining ESG mandates.

- Aligned with Sustainability Objectives: The company’s process also reduces the amount of waste products generated. Tighter ESG mandates are being passed by governments, and Nano One can help companies fit under these new laws. Since electric vehicle adoption is being driven by their sustainability benefits, this would further align the industry with Nano’s core objectives.

It’s All Thanks to Nano One Materials Corp.'s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Patented “One-Pot” Process

To understand why Nano One Materials’ technology could be a gamechanger, you must first understand the battery materials production process…

Specifically, how cathodes – which account for about 20% to 40% of the cost of the entire battery cell – are made.

First, the mined raw metals are converted into sulfate form using an energy and carbon intensive process that magnifies the weight by 5 times, before being transported to the cathode producer.

Then, the producer uses an aggressive chemical reaction to combine various metal sulfates into a composite powder, with the previous sulfate (plus water) discarded as waste.

After that, lithium hydroxide – converted from lithium carbonate – is added and milled into a mixed powder.

Everything is then cooked in a furnace, sometimes for days, with grinding, milling and re-firing until a fine powder is reached. Finally, a protective coating is applied and baked on in a final firing step.

Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) patented “One-Pot” process simplifies and consolidates the entire thing.

Nano One’s M2CAM process lowers GHG emissions and costs by allowing cathode materials to be made directly from metal feedstocks (M2CAM). This eliminates the conversion of base metals into sulfates – reducing cost, energy, shipping weight, and environmentally problematic waste streams.

Also, lithium carbonate can be used directly without needing to convert it into hydroxide.

And not only can the crystal coating process be done simultaneously with all these, but the result is individually-coated grains of cathode powder (coated single crystal or monocrystalline). Unlike competitive coatings on clustered grains of cathode powder (polycrystalline), Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) coated single crystals add durability because they are protected from side reactions, even when clusters break apart from the stresses of repeated charging.

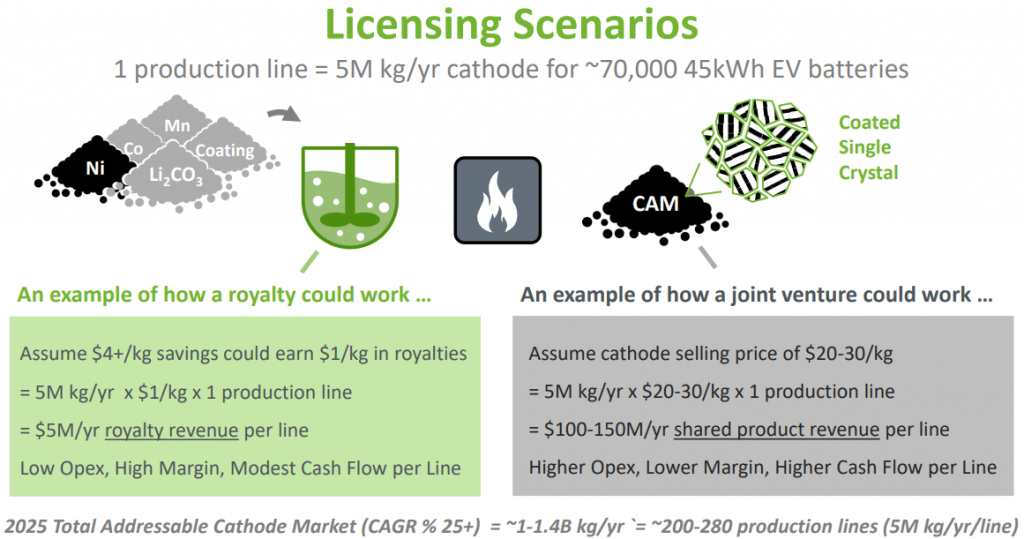

The increased margins manufacturers can enjoy are more than worth the royalty fee that Nano One will collect.

The worldwide cathode market is already at $17.4 billion and is projected to grow by 6.3% a year to reach $28.3 billion by 2027.24 5% of that in royalty revenues amounts to an addressable licensing market of $1.4 billion, with even larger revenue opportunities in joint ventures.

And because of the company’s proven technology and business model…

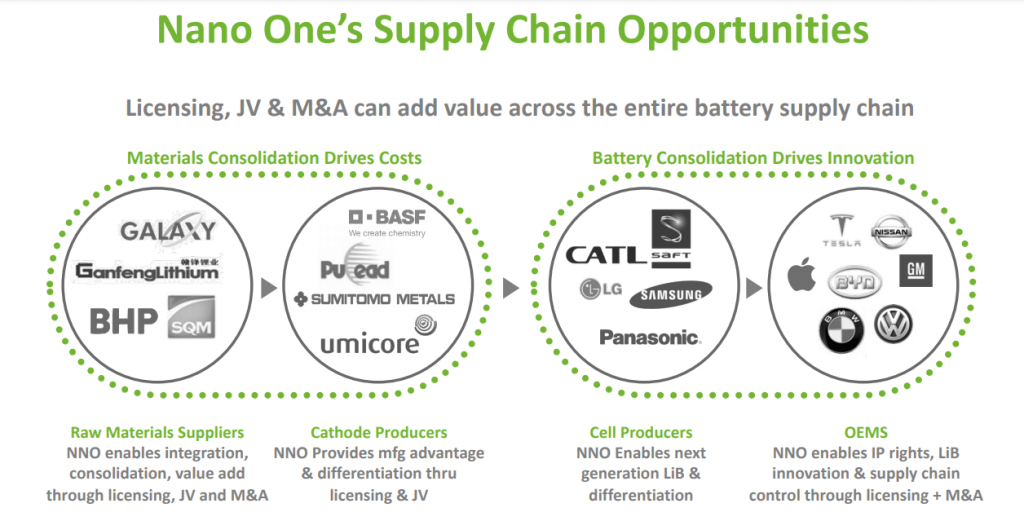

Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Has the Flexibility to Capitalize on Multiple Supply Chain Opportunities

Its technology has the ability to add value across the entire battery supply chain, whether through licensing, joint ventures, or mergers and acquisitions.

The company already has major partnerships in place, including Volkswagen, Pulead (a major Chinese cathode producer), and 400-year old ceramics and glass producer Saint-Gobain.

It also has two more “secret partnerships” – an American OEM that is a large global auto producer and a multi-billion Asian cathode producer.

In fact, Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF)

Joint Development Agreement (JDA) with the multi-billion-dollar Asian cathode producer is progressing quite well.

The first two phases of the JDA, which have now been successfully completed, were focused on LNMO (lithium nickel manganese oxide) cathode materials and have met both performance metrics and initial economic targets. Next, the two parties will be working towards scaling up, detailing an economic analysis, third-party evaluation, and making preliminary plans for commercialization.

LNMO is of increasing global interest as it delivers energy and power on par with other high-performance cathodes and is more cost effective because it is cobalt free. Its unique three dimensional structure allows faster charging and operates at a 25% increase in voltage, enabling fewer cells. VW referred to it on their Power Day as a critical battery chemistry, showing OEM interest in the material in the future.25

Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) has at least 2 different ways to monetize its technology, both of which could be lucrative. First, the licencing model via a royalty structure, which shows a high margin revenue flow per line, and if you speculate even a modest 10% capture of the market by 2025, you can see that it would generate over $100 million a year with little costs. Second, the joint venture structure where cash flow would be higher, as would capital investment. Although margins would be lower based on revenue flow, the net cash flow to Nano One would be greater per line, so the bottom line would generate more money for the company.

Either way, by 2025+, that would be a market worth over $20 billion, potentially giving the company hundreds of millions in revenues with relatively low costs.

The best part? Thanks to $25 million in recent equity raises, plus $13 million in non-dilutive grants awarded, a newly announced $25 million bought deal offering,26 and still $5 million to be drawn down from the Canadian government, the company ALREADY has enough cash to sustain itself until at least 2024.

Nano One Materials Corp.'s (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Exciting Short- and Long-Term Catalysts

In the immediate term, the company is expanding its pilot and laboratory facilities, tripling its size from 4,800 square feet to over 15,000 square feet to support its growing list of strategic relationships. These are critical steps to put into place towards its commercialization process.

The company is focused on strategically critical cathode materials, such as nickel manganese cobalt (NMC) for long range EV battery applications, cobalt-free high-voltage spinel (HVS, LNMO) for solid state lithium-ion battery applications27 – the most important next generation battery in development – and lithium iron phosphate (LFP) for mass market and heavy duty EV applications.

And Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) will continually scale up its client base – all while maintaining the ethos of continuous innovation that has brought the company to where it is today.

2021 Could Be the Inflection Point for Electric Vehicles

At the CES 2021 conference, GM CEO Mary Barra boldly stated that the automotive industry has reached an inflection point in zero-emissions transportation.28

Online car shopping site Edmunds predicts 2021 will be a “pivotal year” for electric vehicles,29 with 30 electric vehicle models from 21 brands entering the market.

And Automotive World points to the convergence of “public policy, capital markets, industry investment, and consumer demand” as making 2021 the tipping point for electric vehicle adoption.30

As we’ve seen, industry players and investors are throwing huge money at this space…

IHS Markit forecasts a 70% increase in global electric vehicle sales for the year31…

And the new Biden administration will give the sustainable investing trend – already estimated to account for a third of all US assets under management32 – a further boost.

This is extra good news for Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF). Because the company is not just operating in a red hot “sustainable sector”…

Its technology also makes the industry even more environmentally friendly…

Which is why it has obtained $13 million in non-dilutive grants from various Canadian Government funds…

And was named in the Toronto Stock Venture Exchange’s 2021 Venture 50 in the Clean Technology and Life Sciences category.33

Led By Its Highly Experienced Leadership Team, Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Stands Ready to Disrupt the Battery Materials Market

Nano One Materials has the rare combination of:

- A patented breakthrough technology that can benefit a big fast-growing market…

- A business model that could allow it to gain massive scale without the usual high costs…

- And a stock that has already delivered triple-digit returns to early investors while still remaining underpriced relative to the hot names in the space.

The cherry on top is its management team. With them at the helm, the company is well on its way toward becoming the next “big name” in batteries.

Dan Blondal – CEO, Director & Founder –With 26 years of profes sional engineering experience focusing on managing high-growth technology, Blondal has seen it all – from medical devices and industrial printing to materials science and nuclear fusion. As Product and Technology Manager at Creo and Kodak, he led strategically vital initiatives valued at $20 million annually.

Dr. Stephen Campbell, PhD, CSci, CChem, MRSC – Chief Technology Officer – With over 25 years of experience leading industrial automotive research in electrochemical systems and over 20 patents to his name, Dr. Campbell is a world-renowned electric chemist. He served 7 years as Principal Scientist at Automotive Fuel Cell Cooperation Corp. – a joint venture between fuel cell company Ballard Power, Daimler, and Ford created to bring Ballard’s technology into the automotive industry. He also served as Principal Scientist for Ballard Power for almost 14 years.

Paul Matysek M. SC. – Chairman and Director – A serial entrepreneur, geochemist, and geologist with over 40 years of experience in the mining industry, Matysek has, since 2004, primarily focused on the exploration, development, and sale of five publicly listed companies, in aggregate worth over $2 billion.

Matysek held leadership positions at Lithium X Energy Corp., which sold for $265 million in cash, Lithium One, which merged with Galaxy Resources of Australia to create a multi-billion-dollar integrated lithium company, and Potash One, which was acquired by K+S Ag for $434 million in cash. He also co-founded uranium company Energy Metals Corp., which grew from a market capitalization of $10 million in 2004 to approximately $1.8 billion when sold in 2007.

Alex Holmes – Chief Operating Officer – Holmes commands over 15 years of experience as a senior executive with a number of public companies, most recently serving as the CEO of Plateau Energy Metals. He has co-founded two different companies, and was instrumental in working with them to raise more than $250 million in capital to advance and grow the businesses.

RECAP: 11 Reasons Why Nano One Materials Corp. (TSXV:NANO, OTC:NNOMFTSXV:NANO, OTC:NNOMF) Could Be an Exciting Opportunity for Investors

- Has a patented and proven technology that reduces the cost, complexity, and carbon footprint of battery cathode material production while adding durability

- Benefits every player in the battery supply chain, from miners to cathode producers to electric vehicle manufacturers

- Battery-type agnostic – technology is still beneficial regardless of which battery type comes out on top

- Strong position thanks to its licensing model and fortress of patents protecting its technology

- Licensing business model will allow it to quickly scale up and conquer the $28.3 billion cathode market

- Helps overcome the “battery bottleneck” that is constraining mass electric vehicle adoption

- Makes manufacturing battery materials more sustainable – meaning it can capitalize on the sustainable investing megatrend

- Exciting near and long-term catalysts, with commercial plant buildout coming soon

- Long cash runway that is enough to sustain the company until at least 2024

- Five major partnerships already in place, with more on the way

- A highly experienced management team with proven track records in both technology and scaling companies

1 https://www.weforum.org/agenda/2020/11/china-bans-fossil-fuel-vehicles-electric/

2 https://www.gov.ca.gov/2020/09/23/governor-newsom-announces-california-will-phase-out-gasoline-powered-cars-drastically-reduce-demand-for-fossil-fuel-in-californias-fight-against-climate-change

3 https://www.reuters.com/article/us-autos-canada-emissions-idUSKBN27W289

4 https://techcrunch.com/2021/02/22/lucid-motors-strikes-spac-deal-to-go-public-with-24-billion-valuation/

5 https://edition.cnn.com/2020/11/18/investing/arrival-startup-spac/index.html

6 https://finance.yahoo.com/quote/QS/

7 https://ree.auto/press-release/ree-automotive-opens-new-engineering-center-of-excellence/

8 https://electrek.co/2020/10/26/tesla-tsla-12-billion-investment-electric-car-battery-factories/

9 https://www.reuters.com/article/us-toyota-indonesia-idUSKCN1TS1SL

10 https://www.reuters.com/article/volkswagen-strategy-idUSKBN27T24O

11 https://www.gm.com/electric-vehicles.html#investments

12 https://www.motortrend.com/news/ford-ev-investment-2025/

13 https://www.greencarcongress.com/2020/01/20200102-hmg.html

14 https://www.wsj.com/articles/these-11-ev-startups-are-chasing-tesla-they-cant-all-win-11605884422

15 https://www.washingtonpost.com/business/2020/01/16/next-china-trade-battle-could-be-over-electric-cars/

16 https://www.wsj.com/articles/the-leaders-in-the-race-to-build-a-better-ev-battery-11610706600

17 https://www.cnbc.com/2021/02/23/former-tesla-exec-inks-new-recycling-deal-as-battery-costs-soar-.html

18 https://www.bloomberg.com/news/articles/2020-12-16/electric-cars-are-about-to-be-as-cheap-as-gas-powered-models

19 https://www.irishtimes.com/business/innovation/battery-bottleneck-stalls-electric-car-sales-1.4184369

20 https://www.mckinsey.com/industries/oil-and-gas/our-insights/metal-mining-constraints-on-the-electric-mobility-horizon

21 https://investor.enersys.com/static-files/c6654af5-abb3-469b-a13a-06605a75bb4e

22 https://techcrunch.com/2021/01/26/sila-nanotechnologies-raises-590m-to-fund-battery-materials-factory/

23 https://www.forbes.com/sites/mariannelehnis/2020/12/18/these-4-greentech-unicorns-made-billion-dollar-luck-in-2020/?sh=4934bcd7308a

24 https://www.reportsanddata.com/report-detail/cathode-materials-market

25 https://www.youtube.com/watch?v=vdnRfNwj1Fg

26 https://www.globenewswire.com/news-release/2021/03/16/2194112/0/en/Nano-One-Announces-25-Million-Bought-Deal-Offering-of-Common-Shares.html

27 https://www.eenewspower.com/news/cobalt-free-cathode-aims-solid-state-lithium-ion-batteries

28 https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/ces-2021-gm-says-auto-sector-at-inflection-point-toward-zero-emission-future-62081278

29 https://abcnews.go.com/Business/2021-shaping-pivotal-year-electric-vehicles/story?id=75945016

30 https://www.automotiveworld.com/articles/comment-forces-converge-to-reach-the-electric-vehicle-inflection-point/

31 https://ihsmarkit.com/research-analysis/ihs-markit-forecasts-global-ev-sales-to-rise-by-70-percent.html

32 https://www.cnbc.com/2020/12/21/sustainable-investing-accounts-for-33percent-of-total-us-assets-under-management.html

33 https://investorintel.com/markets/cleantech/cleantech-news/nano-one-achieves-tsx-venture-50-recognition-as-a-top-performing-company-and-kicks-off-busy-conference-schedule/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Nano One Materials Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Nano One Materials Corp. and has no information concerning share ownership by others of any profiled Nano One Materials Corp. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Nano One Materials Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Nano One Materials Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Nano One Materials Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Nano One Materials Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Nano One Materials Corp. industry; (b) market opportunity; (c) Nano One Materials Corp. business plans and strategies; (d) services that Nano One Materials Corp. intends to offer; (e) Nano One Materials Corp. milestone projections and targets; (f) Nano One Materials Corp. expectations regarding receipt of approval for regulatory applications; (g) Nano One Materials Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Nano One Materials Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Nano One Materials Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Nano One Materials Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Nano One Materials Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Nano One Materials Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Nano One Materials Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Nano One Materials Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Nano One Materials Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Nano One Materials Corp. business operations (e) Nano One Materials Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Nano One Materials Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Nano One Materials Corp. or such entities and are not necessarily indicative of future performance of Nano One Materials Corp. or such entities.