EV Demand Set Lithium Portfolios On Fire. Now It’s Tellurium‘s Turn As Investors Eye Plans For Solar Expansion

Editorial Feature | Jan 8, 2022 | Industry

IF YOU’VE NEVER HEARD OF TELLURIUM… This Rare Earth Mineral Is 8X Less Abundant Than Gold, Rarer Than All Rare Earths, and As Critical To Solar Panels As Lithium Is To EVs

- For decades, China’s rare earth stranglehold has crippled North America’s efforts to take a leading role in the green energy revolution. That may not be the case for much longer.

- A brand-new mining sector has birthed a stunning opportunity, and one company at the center of it has seen its shares rise more than 100% in just 2 months.

- Investors need to get up to speed in a hurry because this new U.S. mine could be a potent threat to China’s grip on 93% of the world’s rarest minerals.1

This Could Be the Beginning of a Massive Field Day, As History Is Made in the American West

A small minerals exploration outfit is developing a project that could soon yield one of the world’s rarest, and suddenly most important minerals.

That rare mineral is tellurium.

It is a hard-working mineral that’s essential in making the thin-film photovoltaic cells for solar panels.

BUT TODAY, TELLURIUM IS ALSO AT THE HEART OF A BREAKTHROUGH THAT COULD FUEL ONE OF MANKIND’S MOST SENSATIONAL ADVANCES IN SOLAR TECHNOLOGIES.

That’s why investors need to make a deep dive in a hurry into junior explorer First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF).

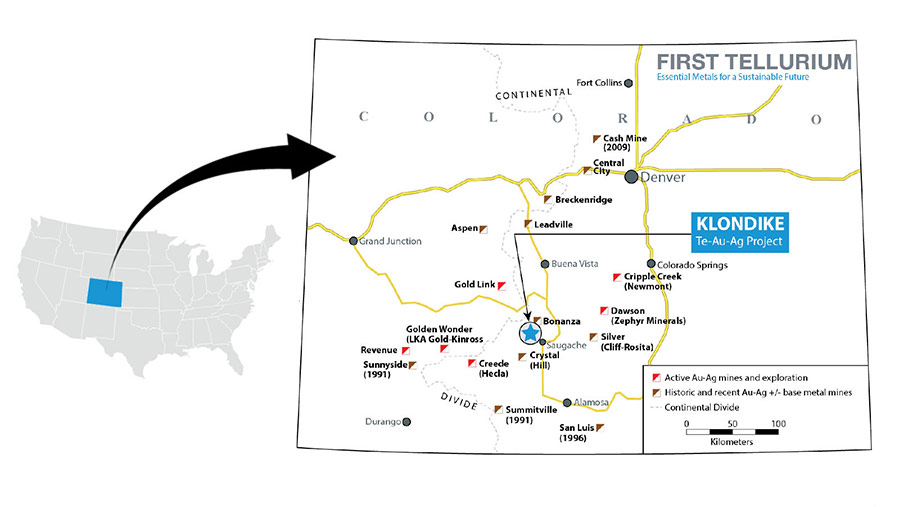

First Tellurium’s property, known as the Klondike, has a story behind it that should quicken the heartbeats of even the most veteran natural resource investor.

That’s because First Tellurium’s property was formerly owned and explored by First Solar (NASDAQ:FSLR), which is one of the world’s largest solar panel makers and has a share price pushing $120.

It optioned the Klondike for one reason alone – to build a mine as a private, steady, and exclusive source of the tellurium that’s vital to its solar panel manufacturing.

Then All Hell Broke Loose with Its Shareholders

Ultimately, First Solar sold the property after shareholder concerns because its operation was the opposite of the company’s earth-friendly, green-industry brand.

To resolve the dispute, First Solar sold the Klondike property to members of its executive mining team, headed by the company’s acting North American Exploration Manager, John Keller.

The mining team then concluded an agreement with First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) for the property.

America’s First Dedicated Tellurium Mine

Now, here’s the real kicker. Not only does First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) look to be sitting on what could be a bonanza-grade property.

Its Klondike project would be the very first dedicated tellurium mine in the U.S… and the second in production world-over. 3

A rather surprising fact for a mineral that’s so vital to the world’s energy needs. But, there’s a good reason for the lack of tellurium mines across the globe.

A by-product of copper and gold refining, tellurium supply has long been adequate to meet the minor demand of about 490- to 500-metric tons a year.

That was the case, until First Solar recently announced plans for a massive expansion.

At the same time, a major technological breakthrough revealed tellurium’s hidden ability to supercharge lithium batteries.

And this next factor could radically accelerate demand even higher, putting the little- known resource on the radar of investors across the globe…

Right on the heels of what looks to be a massive supply crunch, the U.S. government crippled a domestic tellurium supply chain when they denied permits for a significant new gold and copper mine in Alaska, as well as a copper mine in Minnesota. Expectations are likely that this trend in permit denials could become the status quo.

What were once counted on as important tellurium supply chains are now vanishing, just as tellurium is set to become a vital advanced battery component.

This trifecta could place First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) at the forefront of the rare earth minerals mining scene.

Here’s The Whole Story

As you read about tellurium’s critical role in the manufacturing of photovoltaic cells for solar panels keep in mind one sobering reality.

There’s a huge reason why a small company such as First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF), could likely have a starring role on the world stage.

As it is with many of the energy metals, the tellurium supply revolves around China, which mines 93% of the all the world’s rare earth elements.3

This could create a huge risk of supply disruptions for two reasons:

- On many occasions, China has tightened their export of essential rare earth elements due to supply crunches.

- China’s ports are vulnerable to both labor problems and natural disasters.

But while the devastation of a natural disaster or limited supply could have grave repercussions for the world’s rare minerals trade, it is political machinations that’s the real threat.

Having a near Monopoly on Crucial Elements like Tellurium Allows China to Restrict Access Whenever It Wants

For example, when Japan detained the captain of a Chinese fishing trawler that collided with Japanese coast guard vessels in 2010, China responded by halting all shipments of rare earth elements to Japan, which the country relies on to produce hybrid cars and electronics.

For example, when Japan detained the captain of a Chinese fishing trawler that collided with Japanese coast guard vessels in 2010, China responded by halting all shipments of rare earth elements to Japan, which the country relies on to produce hybrid cars and electronics.

Holding a weak hand, Japan capitulated and released the captain.

China exerted its influence again a few years later when it lowered the price of global rare earth minerals in a vicious (and successful) ploy to force a U.S. company operating the Mountain Pass Rare Earth Mine in California into bankruptcy.

Now keep in mind, it’s relatively easy for China to push around a small company mining a singular resource. But that won’t be so simple with a diversified mining company like First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF).

As China Eyes Afghanistan’s $1 Trillion of Minerals The Taliban Could Be All Ears

When the U.S. invaded Afghanistan in 2001, the global economy looked a lot different… there was no Tesla, no iPhone, no iPad, a world full of EVs was a distant, almost unimaginable, idea.

Back then, China was just emerging as a first-world economy and months away from joining the World Trade Organization.

Now China is entrenched in the modern global economy. It’s an economy powered by high-tech chips and large-capacity batteries of varying sizes.

The chips and the batteries are made with a range of minerals, including rare earths, of which tellurium is one. And China covets rare earth minerals.

When the U.S. walked away from Afghanistan in late August, it knew it was handing the militant Taliban government complete control of rare earth deposits estimated to be worth at least $1 trillion by the U.S. Defense Department.

Now the Fear Is That China Will Ingratiate Itself with Neighboring Afghanistan

The state-owned China Metallurgical Group has already invested nearly $3 billion, including $371 million for infrastructure, to build a copper mine at Mes Aynack.4

Moreover, China has committed $62 billion toward improving infrastructure in Pakistan, which shares a border with China and Afghanistan.

A trillion dollars of rare earth minerals is a big, tempting number, even for revolutionary militants such as the Taliban.

So, the question now is, as Afghanistan descends into economic chaos, will the Taliban consolidate its power by offering such sweet deals that China has no choice but to open its checkbook?

The U.S. and Canada should not wait for the answer. They need to drop the pedal to the metal and as rapidly as possible develop reliable domestic sources of rare earth minerals.

And, that is why, companies such as First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) could be so vital to the smooth expansion of the North American economy.

An Ace Up First Tellurium’s Sleeve

You see, once First Tellurium starts its mining operation, it’s unlikely China could gain leverage against it.

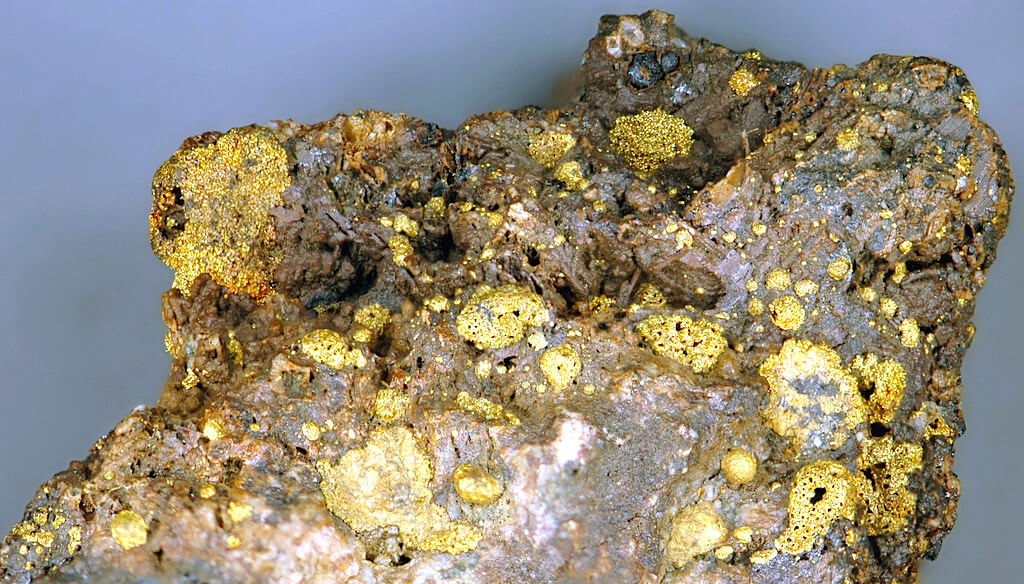

Initial exploration of its Colorado tellurium property suggests that the Klondike property also holds as much as 1.2 ounces of gold per ton (33 g/t) of rock and earth. Those are significant grades, especially for a company that’s just beginning exploration.3

And with Newmont Mining’s famous Cripple Creek project just 68 miles to the northeast, the likelihood of a massive discovery has real potential.

Not to get too far ahead of First Tellurium’s potential, but over the decades, Cripple Creek has produced more than 23 million ounces.

In 2019 alone Cripple Creek produced 322,000 troy ounces of gold worth more than $523 million,5 with proven and probable reserves reported to be 3.45 million troy ounces.6

Just something to consider: With tellurium as the target, gold is a heck of a byproduct.

Surface exploration has found the ground to hold as much as 3% tellurium.7 To give you a clear picture of what that means – 3% of a ton is 60 pounds or 27.27 kilograms. That may sound small, but it’s outrageously huge as tellurium deposits go.

In fact, most rocks contain an average of about 3 parts per billion tellurium, making it rarer than rare earth elements and eight times less abundant than gold.8

Clean Energy Goals Multiply The Potential

The looming demand for tellurium is based on the world’s desire to mitigate or reverse environmental damage.

Forget the politics. Hungry investors stay in the world of money and wealth during business hours, and the numbers favor ESG investors.

A 2020 Pew Research poll found that 52% of Americans “saw climate change as a top priority.9 That number rocketed to 64% in 2021.10

And the industry at the heart of lowering the global carbon footprint is solar energy, which has long been tellurium’s sweet spot.

That means First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) could be perfectly positioned to ride this breakout trend.

It also means First Tellurium is still flying a bit under the radar. But that likely will not be the case for much longer.

An Unstoppable Tellurium Mega Trend

Tellurium has just started to force its way onto the natural-resources investment scene, and the main reason for that is solar panels. And particularly First Solar, the Western Hemisphere’s largest solar manufacturer.

It wants to grow bigger… a lot bigger.

In June 2021, First Solar announced its plans for massive growth, spending an anticipated $680 million on a new Ohio plant, with plans for it to manufacture 3.3 gigawatts a year.11

And in turn, created an unquenchable appetite for tellurium.

That desire is why First Solar originally pursued the Klondike property for its private and exclusive tellurium supply. Its cranky investors may have given First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) investors a fortuitous opportunity.

Plans To Dramatically Double Demand

If you’ve read this far, this is the real prize.

When the new plant is up to full capacity in 2025, it will allow First Solar to produce 6 gigawatts total.12

According to Wood Mackenzie Business, at 8 grams of tellurium per 2-foot by 4-foot, First Solar needs about 100 metric tons of tellurium for each gigawatt of PV production.13

That means manufacturing 6 gigawatts of thin-film photovoltaic panels a year will demand about 600 metric tons.

So, investors can see the clear problem… and the fortune that could be made by investing in the solution First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) could offer.

- The world is only producing about 500 metric tons a year for all uses now.14

- On top of that, the Chinese are producing 60% of it, or 300 metric tons.15

- And, in the U.S., First Solar has to share demand with companies that manufacture thermoelectric devices for cooling and energy generation, companies that use it in in alloys, and companies that use it as a vulcanizing agent and accelerator for making rubber.16

So, the question now is where First Solar will find a new tellurium supply to meet its demands alone, which is about to spike past the current total global demand.

One answer will likely be First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF).

After all, First Tellurium intends the mine the very property First Solar once owned and coveted as an exclusive tellurium supply.

Another High-Grade Project

And First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) also has a secondary source of tellurium.

It’s found at First Tellurium’s Deer Horn property in Canada

In a government certified exploration report – known as a National Instrument 43- 101 – a leading geologist found that Deer Horn could hold as much 93 metric tons of tellurium.

Moreover, the geologist’s reported that Deer Horn could hold as many as 100,000 ounces of gold.

The geologist’s report also suggests the Deer Horn property could hold as many as 3.03 million ounces of silver.

And those numbers are based on the PEA (Preliminary Economic Assessment) done in June 2018, that represents only 20% of the known zone that was drilled.

The PEA also shows an after tax IRR (Internal Rate of Return) of 42%. At the time that was based on $1,300 gold and $17 silver. As you know, those prices are now much higher.

That means First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) could soon join the list of junior explorer moonshots.

In other words, this is the style of junior mineral explorer play on which aggressive natural resource investors are always ready to pounce.

CEO Known For A Killer Deal

This is exactly the kind of fertile opportunity for which First Tellurium’s CEO Tyrone Docherty is known.

Docherty is the former President and CEO of Quinto Mining, where with limited resources in a difficult market, he raised more than $30 million and advanced the Quebec iron ore property to a viable project.

He then sold Quinto to Consolidated Thompson Iron Mines in June 2008, for a share value equal to $175 million. That’s a big jump over 11 years from their origins at a $4 million market cap.

2 years later, Cliffs Resources then went on to buy Consolidated for a staggering $4.9 billion, meaning the Quinto enterprise value was over $1 billion for Quinto investors who held their shares.

Docherty was also Director and Chairman of Mason Graphite Inc. from 2012 to 2018, which is developing one of the world’s top graphite deposits. During this period of time, he took the company to a $250 million market cap.

This superbly accomplished leadership is but one of the…

6 Reasons To Get Into First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF) Before The Looming Demand Crisis Makes Headlines

-

A PRIVATE, EXCLUSIVE DEAL – With its voracious appetite for tellurium now public, it’s hard not to imagine that First Solar or any other companies needing a domestic supply of tellurium could seek an exclusive deal with First Tellurium.

-

DEMAND WILL LIKELY OUTSTRIP SUPPLY – First Solar’s plan could, by itself, more than double the world’s demand for tellurium from 500 tons a year to 1,100 tons a year.

-

COME FOR THE TELLURIUM – Klondike has tested at a fantastic 3% tellurium content, way more the usual 3 parts per billion. And based on the PEA done in June 2018 that represented only 20% of the known property zones at the Deer Horn property, a noted geologist reported a potential 93,000 tons of tellurium.

-

STAY FOR THE GOLD – While tellurium is the target of opportunity, First Tellurium is sitting on published high-grade precious metals in British Columbia and high-grade assays in Colorado. That’s a hell of a bonus.

-

THE CHINA SYNDROME – China controls 93% of the world’s rare earth metal, such as tellurium. It’s time North America broke that grip. First Tellurium could be part of that solution.

-

IT COMES DOWN TO LEVERAGE – Word of First Tellurium’s massive potential could be due to get out soon. News of a more efficient, stronger, longer-lasting battery won’t stay quiet for long.

WITH THE HUNT FOR NEW SOURCES OF TELLURIUM NOW PART OF A WORLDWIDE CRISIS, YOU COULD EXPECT THIS CRITICAL MINERAL TO STAY IN THE NEWS FOR YEARS TO COME.

That’s why now could be the very best time to latch onto its affordably priced shares.

That means it’s time to call your broker or advisor and show him or her this report. Then discuss these new opportunities in tellurium and, in particular, with First Tellurium.

Because, when you take your position now in First Tellurium Corp. (CSE:FTEL, OTC:GODYFCSE:FTEL, OTC:GODYF), you could find yourself among the earliest and biggest winners.

1https://earth.stanford.edu/news/critical-minerals-scarcity-could-threaten-renewable-energy-future#gs.euifcm

2https://pubs.usgs.gov/fs/2014/3077/pdf/fs2014-3077.pdf

3https://earth.stanford.edu/news/critical-minerals-scarcity-could-threaten-renewable-energy-future#gs.euifcm

4https://foreignpolicy.com/2021/09/28/afghanistan-china-rare-earth-minerals-latin-america-lithium/

5https://en.wikipedia.org/wiki/Cripple_Creek_%26_Victor_Gold_Mine

6https://en.wikipedia.org/wiki/Cripple_Creek_%26_Victor_Gold_Mine

7https://firsttellurium.com/assets/docs/FTEL-Presentation-Oct-2021-Draft-5-1635194316.pdf

8https://pubs.usgs.gov/fs/2014/3077/pdf/fs2014-3077.pdf

9https://www.theverge.com/2021/5/26/22454633/pew-research-american-attitudes-climate-change-fossil-fuels-renewable-energy

10https://www.theverge.com/2021/5/26/22454633/pew-research-american-attitudes-climate-change-fossil-fuels-renewable-energy

11https://investor.firstsolar.com/news/press-release-details/2021/First-Solar-to-Invest-680m-in-Expanding-American-Solar-

Manufacturing-Capacity-by-3.3-GW/default.aspx

12https://investor.firstsolar.com/news/press-release-details/2021/First-Solar-to-Invest-680m-in-Expanding-American-Solar-

Manufacturing-Capacity-by-3.3-GW/default.aspx

13https://www.greentechmedia.com/articles/read/first-solar-owns-a-tellurium-mine

14https://www.miningnewsnorth.com/story/2020/12/31/critical-minerals-alaska-2020/solar-powers-demand-for-rare-tellurium/6513.

html

15https://www.miningnewsnorth.com/story/2021/09/16/critical-minerals-alliances/solar-powers-demand-for-rare-tellurium/6987.

html

16https://www.miningnewsnorth.com/story/2020/12/31/critical-minerals-alaska-2020/solar-powers-demand-for-rare-tellurium/6513.

html

17https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/top-gold-miners-record-decreased-all-in-

sustaining-costs-in-q3-20-61530508

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Command Marketing as compensation to host the article profiling First Tellurium Corp..

- Command Marketing has been compensated $190,000 USD as of the date hereof under an agreement with First Tellurium Corp. for providing investor relations and marketing services to the company. Please see Plant Veda’s news release dated October 22, 2021 and filed under its SEDAR profile at www.sedar.com.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled First Tellurium Corp. and has no information concerning share ownership by others of any profiled First Tellurium Corp.. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any First Tellurium Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the First Tellurium Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled First Tellurium Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding First Tellurium Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to First Tellurium Corp. industry; (b) market opportunity; (c) First Tellurium Corp. business plans and strategies; (d) services that First Tellurium Corp. intends to offer; (e) First Tellurium Corp. milestone projections and targets; (f) First Tellurium Corp. expectations regarding receipt of approval for regulatory applications; (g) First Tellurium Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) First Tellurium Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute First Tellurium Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) First Tellurium Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) First Tellurium Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) First Tellurium Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of First Tellurium Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) First Tellurium Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact First Tellurium Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing First Tellurium Corp. business operations (e) First Tellurium Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of First Tellurium Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of First Tellurium Corp. or such entities and are not necessarily indicative of future performance of First Tellurium Corp. or such entities.