Strong Fundamentals and Leadership Place Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) in Investor Spotlight as Money Pours Back into the Cannabis Market

We all saw the legal cannabis market’s explosive kickoff in 2018 and 2019. It was an era of multi-billion-dollar valuations for those with the biggest grow operations, and most licenses.

Then we saw it all radically shift in 2020, away from the “bigger is better” plays into what it should’ve been about all along: FUNDAMENTALS.

Today’s market has wised up, only rewarding serious players with solid financials, expansive market reach, and strong leadership.

Those who meet these criteria have a real chance of gaining investor traction in a market still projected to grow to $176 billion by 2030 at a CAGR of 23.9%.1

Between now and 2030, there’s plenty of runway for the cannabis industry to run through the four common phases of any industry’s life cycle:2

Introduction > Growth > Maturity > Decline

In the case of cannabis, for far too long it was stuck in the Growth phase. But now we’re finally seeing signs of a coming Mature market—and one of the biggest signals for that was the increase in consolidations.3

For example:

- TerraVida Holistic Centers and Verano Holdings merged4

- HEXO Corp. purchased Zenabis for $235 million5

- Plus, Curaleaf raised approximately $300 Million to boost its position and purchase assets.6

However, by far, the biggest deal was the staggering $7.6 billion acquisition of GW Pharmaceuticals by Jazz Pharmaceuticals.7

So how did GW Pharma warrant such a big pay day?

Because it had the financials, leadership and extensive market reach driven by its flagship asset, Epidiolex—a cannabis-based medication that treats certain rare types of childhood-onset epilepsy.

Naturally, GW Pharma’s success has sent investors in search of the next cannabis company with the fundamentals, team and product to break out … and that company is Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC).

6 Reasons Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) is a REAL Contender

- Strong Leadership: Led by a proven team with decades of industry-leading experience across consumer packaged goods (CPG) brands and managing global eCommerce, retail, and distribution, including former Macy’s and Amazon execs,8 and from esteemed research institutions such as Vanderbilt University and Betty Ford.

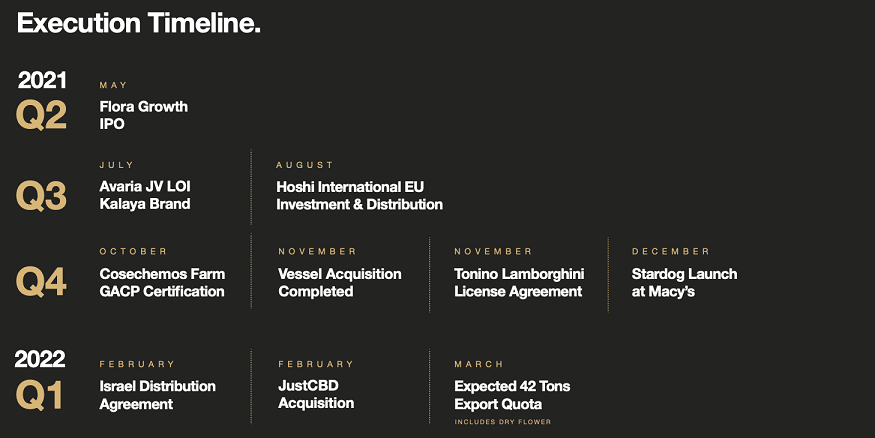

- Rapid Revenue Growth and M&A: Ever since its successful IPO in May 2021, Flora Growth’s revenue has been rapidly growing. In H1 2022, revenue rose by a staggering 604% (and that’s after it grew by 329% in H2 2021). For FY 2022, the company is predicting $35-$35 million in revenue, meaning 300-400% growth year over year. Flora also achieved this without substantial capital, raising only $80M9 versus most others who raised hundreds of millions if not billions.10

- HUGE Portfolio of Assets: Over 600 products and 70+ medical cosmetic licenses across 16,500+ points of distribution in the US, LATAM, and Europe, with category-leading brands like JustCBD, which already boasts over 300 products, 14,000 points of distribution, and over 300,000 customers, having generated audited revenues of US$28 million in FY 2020.11 Meanwhile, Flora’s acquired brand Vessel has been growing over 90% each year since 2018.12

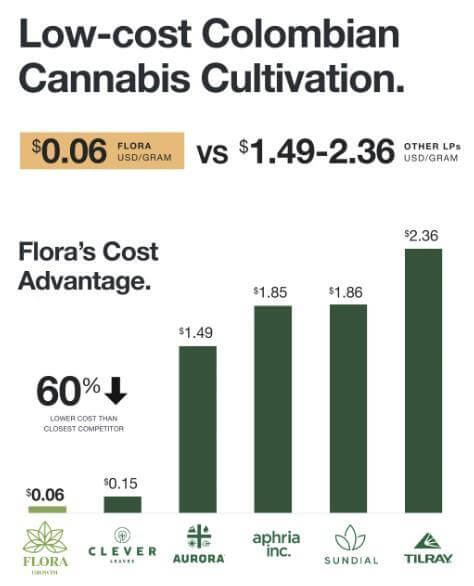

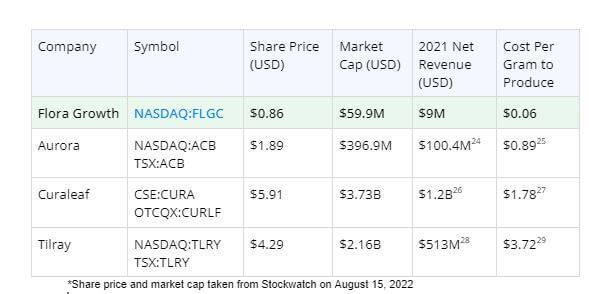

- Ultra Low-Cost Production: Huge logistical advantage from cultivation operations in Colombia, thanks to favorable regulations, optimal growing conditions, seasoned workers, a currency advantage, and ultimately a MAJOR cost-per-gram advantage. It costs Flora only $0.06/gram, which is +98% less than Tilray, ~97% less than Sundial and Aphria, ~93% less than Aurora, and even 60% less than their next closest competitor Clever Leaves.

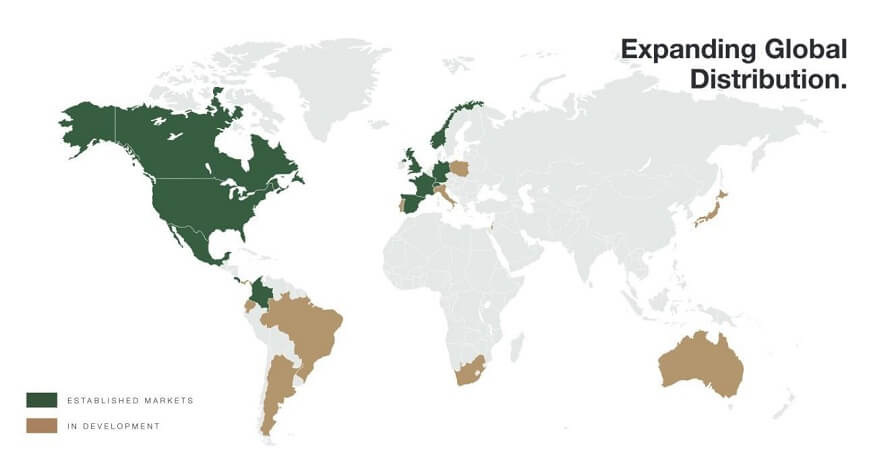

- Global Expansion: Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) has successfully entered 13 countries through multiple cannabis sales agreements and GMP-compliant and certified facilities allowing for access to both medical and recreational markets. It now has offices in the UK and partnerships in the EU to advance its brand and commercial sales.

- Cannabis Research: Flora Life Sciences Division was formed to identify scientific gaps in cannabis research and work to translate that to new data-backed pharmaceutical cannabis products, to further expand and improve upon the rapidly growing portfolio of consumer wellness products.

The Flora Growth Story So Far

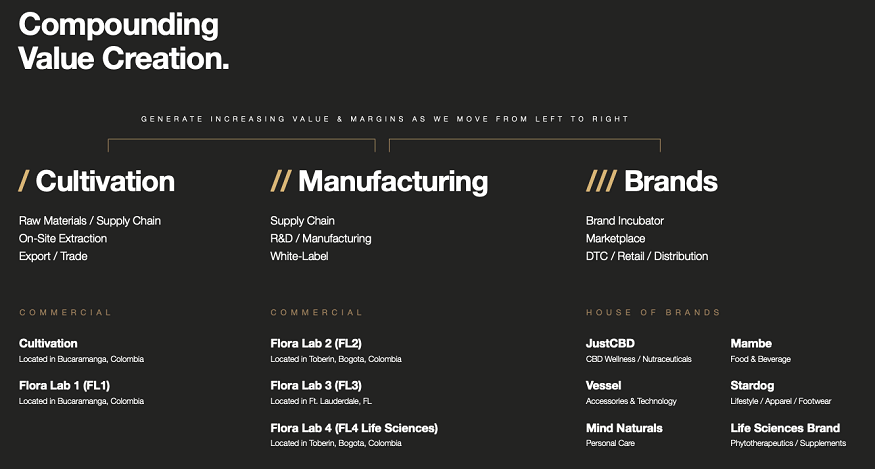

Flora Growth is a next-generation cannabis company that stands out due to a unique three-pillar business model involving wholesale, brands and life sciences.

Flora Growth is a next-generation cannabis company that stands out due to a unique three-pillar business model involving wholesale, brands and life sciences.

It’s a business model that makes Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) a strong play for both direct cannabis company investors as well as “pick-and-shovel” investors looking to put money into the tools and services that lead to a finished cannabis product.

But can Flora Growth really be another multi-billion-dollar buyout target like GW Pharma?

Flora Growth has teamed up with molecular biologist Dr. Annabelle Manalo-Morgan with the mission of bringing new life-saving cannabis-based medicines to the market.

This led to scientific clinical trials being initiated globally, focusing on the use of cannabinoids in patients suffering from chronic pain and Fibromyalgia, which affects 4 million US adults13 and nearly 1 in 20 people globally,14 with the primary research sites located in the US and the UK.15

Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) appointed Dr. Annabelle Manalo-Morgan as the Lead Scientific Advisor to further its research and development of unique product formulations and to educate individuals on the benefits of cannabinoid and plant-based medicine.

Dr. Annabelle Has Seen Firsthand Just How Powerful Cannabis-Related Medicine Can Be

When Dr. Annabelle’s young son, Macario, was born in 2016, he was suffering up to 200 seizures a day and was forced to take seven different prescription medications.

When Dr. Annabelle’s young son, Macario, was born in 2016, he was suffering up to 200 seizures a day and was forced to take seven different prescription medications.

His situation got even worse when doctors had to remove 38% of his brain.

Desperate for an alternative, Dr. Annabelle created a new CBD formulation for her son.

She began giving Macario the CBD Oil formulation daily and stopped the other medicines he was taking.

Five years later, he is a happy, healthy, energetic five year old.

“(Macario) is six years old today. He will start kindergarten in the fall. He has no developmental deficits. If you saw him, you would never know there was a thing wrong with him. He is not autistic, delayed, nothing. He is a normal 6-year-old boy.”16

Now Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) is submitting Manalo-Morgan’s CBD compound for further testing and expects to fast-track traditional NHS timelines by running phase trials in parallel (in vitro, in vivo, pilot in human, safety/efficacy, etc.).17 These clinical trials could be completed as soon as Q4 2022 which we don’t think the market is appreciating!

Dr. Manalo-Morgan and her CBD compound are just two of the many factors working in Flora Growth’s favor.

This is a company that has quickly become a …

Leading All-Outdoor Cultivator, Manufacturer, & Distributor of Global Cannabis Products & Brands

Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) is built to upend what it means to be a “cannabis company.”

With multiple lines of revenue and a presence in multiple countries, Flora Growth is developing a diverse collection of brands and services to address the different expressions of cannabis and plant-based derivatives more broadly.

For example, Flora Growth is building out robust wholesale and distribution channels, a suite of consumer goods brands, and research and laboratory divisions to support institutional and individual consumers.

Here are six powerful reasons why Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) could be the next big breakout in the cannabis industry.

Reason #1 – The Best Location in the World to Grow Cannabis

When it comes to growiNg cannabis you would be hard-pressed to find a location that offers all the benefits that Colombia does.

This is a country that has favorable cannabis-growing government regulations, low-cost cultivationn, optimal year-round growing conditions (including approximately 12 hours of sunlight a day), and an experienced workforce that is 1/10th the cost of US workers.

Considering all of this, it is little wonder that Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) chose to house its grow and processing operations, Cosechemos, in Bucaramanga, Colombia.

Cosechemos is a 254 acre cannabis cultivation operation and a 16,000-square-foot extraction facility with a state-of-the-art laboratory focused on delivering natural, high-quality cannabis flower and derivatives to be sold through wholesale and retail channels.

In early April, Colombia finalized its cannabis flower regulatory checklist under Resolution 539 permitting licensed cannabis cultivators with export quotas, including Flora, to pass a mandatory approval process for the export of both CBD and THC flower.18

In early April, Colombia finalized its cannabis flower regulatory checklist under Resolution 539 permitting licensed cannabis cultivators with export quotas, including Flora, to pass a mandatory approval process for the export of both CBD and THC flower.18

Upon this exciting development, Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) reaffirmed its ability to produce 43.6 tonnes of low-cost THC with production costs of just 6 cents per gram of dried flower!19

When you compare it to industry giants like Tilray, which reported $3.79 per gram or even Aurora, which reported $0.89 in 2020, Flora is saving 1,000-6,000% on every gram of quality flower it produces.

How is such a low production cost possible? This is because Colombia, which is responsible for 15% of the global supply of cut flowers,20 has a highly skilled agricultural workforce that is a fraction of the cost of US workers.

At the same time, the location in Bucaramanga, Colombia provides natural water springs, regular 12-hour light cycles and consistent wind thanks to its ideal location atop a 360-degree view mountain.

Progress at the grow facility is being made quickly. In January of this year, Flora Growth Corp. (NASDAQ:FLGC)(NASDAQ:FLGC) produced the first batch of crude oil through Cosechemos. It also initiated the EU-GMP certification process for the ability to produce oils, distillates and isolates for medical application. 21

Flora Growth has already established a strong reputation for the quality of its manufacturing practices. It holds 3 GMP certifications for Cosmetics, Phytotherapeutics, and Dietary Supplements.22

Flora is currently manufacturing and distributing more than 63 over-the-counter (OTC) products registered with INVIMA, which are selling across 2,500+ distribution channels.

Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) also just signed a joint venture agreement with the largest indigenous tribe in Colombia, Pharma Indigena Misak Manasr Sas, to develop cultivation best practices, manufacturing, export, and marketing of cannabis and cannabis-containing products.23

With the Cosechemos facility ramping up production and Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) being able to produce high-quality flower for such a low cost it has an immediate marketplace advantage.

In fact, many of its so-called competitors are becoming customers!

Here is how Flora Growth compares to the competition right now:

Looking at the chart above, it’s easy to see how significant the cost savings per gram are for Flora Growth’s cultivation. However, when looking at revenues and P/S Ratio figures, it might not be as easy to see how the company stacks up financially.

Let’s waste no time getting into that…

Reason #2 – Rapidly Growing Revenue and Flurry of M&A

Since its successful IPO listing on NASDAQ in May of 2021, Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) has wasted no time getting down to business, and it’s easy to see how sharp the trajectory is going upward.

- Total revenuefor H1 2022 was $14.9 million, a 604% increase from H2 2021 and 117% up from H2 2021

- Gross Profits increased to $6.5 million, up more than 5x year-over-year and 4x sequentially

- Cash on hand as of June 30, 2022 was approximately $10.3 million

- Guidance of $35-45 million in 2022, which would realize projected revenue growth of 300-400% year over year

YES, you read that right: Their guidance for 2022 is $35-45 Million, which includes revenue contributeions from its various operating divisions, including wholesale cannabis revenues from Cosechemos, and profits from recently acquired Vessel Brand and its other lucrative brands.

Perhaps one of the biggest boosts to Flora Growth’s 2022 guidance comes from the recently acquired JustCBD brand which generated audited revenues of US$28 million and EBITDA of US$7 million in fiscal year 2020 across multiple categories, including gummies, tinctures, vape cartridges, creams, and pet wellness, among others.30

Perhaps one of the biggest boosts to Flora Growth’s 2022 guidance comes from the recently acquired JustCBD brand which generated audited revenues of US$28 million and EBITDA of US$7 million in fiscal year 2020 across multiple categories, including gummies, tinctures, vape cartridges, creams, and pet wellness, among others.30

At a cost of only US$33 million, it’s clear that acquisitions like JustCBD will quickly pay themselves off—and contribute to the new 2022 guidance.

And many experts think that estimate is on the conservative side.

In fact, institutional investors are starting to take notice of the company’s strong financial situation and powerful three-pillar diversified business model.

That’s why Flora Growth’s ownership structure now includes a strong institutional presence. Here is the structure:

- 9.29% insiders

- 9.10% institutions

- 10.03% of float held by institutions

- Number of institutions holding shares – 37 (including Morgan Stanley and Highbridge Capital)

All of this support led to Flora Growth’s favorable cash position, and its ability to drive forward with a series of acquisitions that are truly the milestones of an empire in the making. Versus other companies, raising hundreds of millions to achieve similar revenue profiles, Flora has only raised $80M since inception with no debt and still has cash in the bank.

Reason #3 – Building the Ultimate Global Brands Empire

While the cultivation side of the business is very promising, as outlined in reason #1 above, Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) has been VERY active in M&A, putting together a huge house of brands that includes 600+ products, 70+ medical cosmetic licenses, and 16,500+ points of distribution in Latin America and the US with sales across 13 countries.

Back in February 2022, Flora Growth made a splash, acquiring the nutrition and wellness brand JustCBD.

And what did they get with that acquisition?

JustCBD alone brought into the portfolio over 300 products and a seamless omni-channel approach that includes a direct-to-consumer business with over 300,000 customers and a network of over 14,000 distribution points across the United States and internationally.

Another deal nearly equal in value (US$30M), Flora Growth acquired Vessel Brand, a team of exceptional brand builders with a proven track record of launching brands and capturing market share in the rapidly expanding U.S. cannabis landscape.31

Another deal nearly equal in value (US$30M), Flora Growth acquired Vessel Brand, a team of exceptional brand builders with a proven track record of launching brands and capturing market share in the rapidly expanding U.S. cannabis landscape.31

At the time of the acquisition, Vessel had achieved trailing 12-months revenue of US$6.6 million and year-over-year growth of 90%.32

In May, Flora Growth launched the Vessel brand into the lucrative Canadian market, which the company estimates will be worth C$5.9 billion this year.

Subsequently, Flora signed a deal with the Ontario Cannabis Store and launched Vesselbrand.ca, a direct-to-consumer online store.

These two acquisitions are just an example of the growing portfolio of brands in the Flora Growth arsenal, and they’re clearly not done growing and expanding their market reach.

Reason #4 - Expansive Global Reach

Beyond its strong presence in the Latin American and US and Canadian markets, Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) is steadily expanding globally.

For instance, their JustCBD brand is set to open four brick-and-mortar locations in Germany and the Czech Republic in Q1 2022, with up to 50 additional stores planned in 2023. These stores will be in partnership with Greenyard and will allow for additional distribution through Poland, Austria, Switzerland, Ukraine, Georgia and Estonia.33

In March of 2022, Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) also announced a distribution agreement with Israel-based DNO Group to distribute the company’s Mind Naturals brand in the Hong Kong region.34

These were just the most recent of a series of announcements and transactions designed to expand Flora Growth’s reach around the world. Additional announcements have included:

- Vessel brand signed a distribution agreement with JustCBD partners, Florida-based Speedy Distribution, which services over 1,000 stores in the US, and increased Flora Growth’s existing customer base to over 500,000 customers.35

- Signing an agreement with Artos Ltd. (“Artos”) to sell approximately 3,600 kg of dried high-THC cannabis flower to Israel. Artos has a network of over 4,000 distribution points generating over $50 million in revenue.36

- Launched sales of Mind Naturals skincare brand has through Walmart.com and Coppel, a nationwide department store chain in Mexico with 1,253 stores.37

Reason #5 – World-Class IMPORTANT Research

Since last October Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) has been ramping up its research through the Flora Life Sciences Division.

Since last October Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) has been ramping up its research through the Flora Life Sciences Division.

Flora Life Sciences’ primary focus is on identifying scientific gaps in the cannabis industry and ultimately working to fill those gaps with pharmaceutical cannabis products backed by scientific data.38

Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) started by bringing on the aforementioned Dr. Annabelle Manalo-Morgan as Lead Scientific Advisor to oversee the division and signing an agreement to begin clinical trials globally.39

The Human Pilot Study, which was initiated in the UK with an internationally recognized clinical research group based at the University of Manchester, is focused on the use of cannabinoids in patients suffering from Fibromyalgia or chronic pain, with the primary research sites located in the United States and the United Kingdom.

Flora Life Sciences expects to fast-track traditional FDA and NHS timelines by running phase trials in parallel (in vitro, in vivo, a pilot in humans, safety/efficacy, etc.) focusing on pain and inflammation illnesses – casting a wide net for cannabis applications.

Then in May, Flora Growth signed a deal with Dr. Annabelle to acquire her Masaya brand and patent-pending CBD formulations.40

Masaya’s 100% THC-free pure, potent CBD oil formulation, which was developed initially to treat Dr. Annabelle’s son, has now been used by thousands of consumers and has a long track record of positive testimonials.

Masaya’s 100% THC-free pure, potent CBD oil formulation, which was developed initially to treat Dr. Annabelle’s son, has now been used by thousands of consumers and has a long track record of positive testimonials.

Masaya will become a part of Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) growing portfolio of brands and will be the first offering from Flora Life Sciences. The products will be initially sold in the US, but the company also intends to distribute the brand and its formulations worldwide.

What’s more, the original patent-pending formulation, Masaya Pure,41 is intended to be used in Flora’s current clinical trials with the University of Manchester.

Reason #6 - Exceptional Leadership Team

Leading the way for Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) is a bottomless talent pool of Executives and Directors with a wide range of expertise that is fully equipped to bring the company success, including:

Luis Merchan

President and CEO

Mr. Merchan is a proven executive with over 10 years of experience in enterprise sales management, corporate strategy, merchandising and expense management and customer experience. He previously served as Vice President of Workforce Strategy and Operations for Macy’s Inc. where he managed the enterprise’s P&L expense line for its 540-store portfolio.

Tim Leslie

A Yale Law graduate, Mr. Leslie has a strong pedigree of success, working with scaling companies including two decades at Amazon, where he served as Vice President and Associate General Counsel responsible for building and managing Amazon’s international legal team before changing roles to oversee the international launch of Amazon Prime Video. Following his successful tenure at Amazon, Mr. Leslie made the leap to the burgeoning cannabis industry where he served as CEO of one of the world’s most authoritative digital cannabis data sources, Leafly.

Elshad Garayev

Elshad Garayev brings over 25 years of experience in finance supporting successful organizations through the development and implementation of accounting and reporting policies as well as building high-performance finance teams. Prior to joining the Flora team, Garayev served in a variety of financial leadership roles at companies such as Amazon, Boeing BP and RPK Capital, managing a diverse array of initiatives at various companies including reporting, accounting, investments, private equity, international operations, mergers and acquisitions, energy services, and manufacturing.

Dr. Annabelle Manalo-Morgan

Dr. Manalo-Morgan is a scientist, educator, author, mother of five, and a respected key opinion leader. She is a cell and developmental biologist from Vanderbilt University in Nashville, Tennessee, with a background in neuroscience from Georgetown University. She earned her Ph.D. in Cell and Developmental Biology with a focus in Cardio-Oncology.

James Choe

Mr. Choe was the Founder/CEO of Vessel, the leading brand in cannabis consumption technology, which was acquired in November 2021 by Flora Growth. Choe got his first taste of startups in 1999 with broadband pioneer Softnet Systems in Mountain View, CA. After building the business to prominence and growing to more than 400 employees.

Jessie Casner

Ms. Casner was previously the Vice President of Marketing for Vessel Brand, the recently acquired ancillary accessory brand based in Carlsbad, California. An experienced omni-channel marketer and storyteller, Casner previously operated her own agency, Junction Marketing, where she developed and executed bespoke go-to-market strategies. She was an early team member of The Active Network during its rapid growth phase (pre-IPO and acquisition), MOGL (now FIGG, during series A/B funding), 2XU, and Total Gym.

If you aren’t yet convinced of the massive potential this company offers, here are 4 reasons to consider investing in Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC).

The BIG Four:

- Low-Cost Production – Colombia offers Flora Growth one of the lowest per-gram production costs in the entire sector along with favorable regulations, optimal growing conditions and seasoned workers.

- Rapid Revenue Growth and M&A – After a successful May 2021 IPO, the company continues to boast STRONG financials, growing revenues 604% in H1 2022 over H2 2021 and 117% from H2 2021, and acquiring strategic assets that have allowed Flora to confidently project a breakthrough 2022 with guidance of $35-45 million for the year which would represent year-over-year revenue growth of 288-400%.

- Global Brand Expansion – Flora has over 600+ products and 70+ medical cosmetic licenses and 16,500+ points of distribution in LATAM and the US! Multiple cannabis sales agreements and GMP-compliant and certified facilities have resulted in access to 13 countries to date.

- The People – Flora Growth (NASDAQ:FLGC)(NASDAQ:FLGC) is led by a proven team that shares decades of industry-leading experience building CPG brands and managing global eCommerce, retail, and distribution.

Remember, word is JUST STARTING to get out about this undervalued gem and it won’t be long before the market catches on.

So obviously now is the time to act before it’s too late and the price soars. We recommend you start doing your due diligence immediately.

1 https://www.businesswire.com/news/home/20220203005879/en/Global-Cannabis-Market-Size-Forecast-Report-2021-A-176-Billion-by-2030—Growing-Legalization-of-Medical-Cannabis-in-Various-Countries-Driving-Growth—ResearchAndMarkets.com#

2 https://www.investopedia.com/terms/i/industrylifecycle.asp

3 https://www.forbes.com/sites/roberthoban/2021/03/22/the-year-of-cannabis-industry-consolidation/?sh=5f5870377715

4 https://www.forbes.com/sites/roberthoban/2021/03/22/the-year-of-cannabis-industry-consolidation/?sh=3270cc037715#open-web-0

5 https://www.forbes.com/sites/roberthoban/2021/03/22/the-year-of-cannabis-industry-consolidation/?sh=3270cc037715#open-web-0

6 https://www.forbes.com/sites/roberthoban/2021/03/22/the-year-of-cannabis-industry-consolidation/?sh=3270cc037715#open-web-0

7 https://www.forbes.com/sites/roberthoban/2021/03/22/the-year-of-cannabis-industry-consolidation/?sh=3270cc037715#open-web-0

8 https://www.floragrowth.com/flora-growth-taps-amazon-executive-elshad-garayev-as-chief-financial-officer/

9

10 https://techcrunch.com/2021/10/14/cannabis-investment-jumps-82-the-second-half-of-2021-165-over-2020-levels/

11 https://www.newcannabisventures.com/flora-growth-acquires-justcbd-for-33-million-in-cash-and-stock/

12 https://financialpost.com/pmn/press-releases-pmn/business-wire-news-releases-pmn/flora-growth-completes-acquisition-of-vessel-brand-inc

13 https://www.cdc.gov/arthritis/types/fibromyalgia.htm

14 https://www.news-medical.net/health/Fibromyalgia-Epidemiology.aspx

15 https://www.businesswire.com/news/home/20211006005394/en/Flora-Growth-Forms-Flora-Pharma-Division-Launches-Global-Clinical-Trials

16 https://fox17.com/news/ferrier-files/molecular-biologist-in-nashville-says-she-saved-her-sons-life-with-cbd-oil-cannabis-medical-marijuana-stigma-health-studies-molecules-recovery-science-dr-annabelle-manalo-morgan

17 https://www.businesswire.com/news/home/20211006005394/en/Flora-Growth-Forms-Flora-Pharma-Division-Launches-Global-Clinical-Trials

18 https://www.businesswire.com/news/home/20220404005388/en/Flora-Growth-Recognizes-Colombia%E2%80%99s-Completion-of-Cannabis-Flower-Export-Rules-Prepares-First-Export-Under-New-Regulations

19 https://www.businesswire.com/news/home/20220404005388/en/Flora-Growth-Recognizes-Colombia%E2%80%99s-Completion-of-Cannabis-Flower-Export-Rules-Prepares-First-Export-Under-New-Regulations

20 https://www.bizlatinhub.com/colombia-flower-exports-hit-record/

21 https://www.floragrowth.com/flora-growth-completes-successful-first-cannabis-extraction-through-new-facility-initiates-eu-gmp-certification-process-2/

22 https://markets.businessinsider.com/news/stocks/flora-growth-s-flora-labs-receives-good-manufacturing-practices-certification-1030779971

23 https://www.floragrowth.com/flora-growth-announces-joint-venture-with-colombias-largest-indigenous-tribe-to-process-and-distribute-cannabis-products/

24 https://mjbizdaily.com/aurora-cannabis-annual-loss-shrinks-to-ca695-million-in-2021/

25 https://www.newswire.ca/news-releases/aurora-cannabis-announces-fiscal-fourth-quarter-2020-results-870290363.html

26 https://ir.curaleaf.com/2022-03-03-Curaleaf-Reports-Fourth-Quarter-and-Fiscal-Year-End-2021-Results

27 https://ir.curaleaf.com/financial-statements

28 https://tilray.gcs-web.com/news-releases/news-release-details/tilray-inc-reports-2021-fiscal-year-and-fourth-quarter-results

29 https://www.tilray.com/tilraynews-master/2021/2/17/tilray-inc-reports-2020-full-fiscal-year-and-fourth-quarter-results

30 https://www.newcannabisventures.com/flora-growth-acquires-justcbd-for-33-million-in-cash-and-stock/

31 https://www.floragrowth.com/flora-growth-completes-acquisition-of-vessel-brand-inc/

32 https://www.benzinga.com/markets/cannabis/21/11/24133092/flora-growth-completes-acquisition-of-vessel-brand-seeks-to-diversify-its-premium-brand-portfoli

33 https://www.floragrowth.com/flora-growth-to-expand-physical-presence-in-europe-through-justcbd-partnership-with-greenyard/

34 https://www.floragrowth.com/flora-growth-signs-agreement-to-distribute-mind-naturals-in-the-hong-kong-region/

35 https://www.floragrowth.com/floras-consumer-technology-brand-vessel-signs-distribution-agreement-with-justcbd-partner-speedy/

36 https://www.floragrowth.com/flora-growth-signs-agreement-with-artos-ltd-to-send-high-thc-cannabis-flower-to-israel/

37 https://www.floragrowth.com/flora-growth-expands-product-distribution-through-walmart-com-and-coppel-in-mexico-2/

38 https://www.businesswire.com/news/home/20211006005394/en/Flora-Growth-Forms-Flora-Pharma-Division-Launches-Global-Clinical-Trials

39 https://www.floragrowth.com/flora-growth-forms-flora-pharma-division-launches-global-clinical-trials/

40 https://financialpost.com/pmn/press-releases-pmn/business-wire-news-releases-pmn/flora-growth-acquires-cbd-brand-masaya

41 https://www.masayamedical.com/shop-masaya

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Flora Growth Corp. (“FLGC”) and its securities, FLGC has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by FLGC) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company FLGC and has no information concerning share ownership by others of in the profiled company FLGC. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to FLGC industry; (b) market opportunity; (c) FLGC business plans and strategies; (d) services that FLGC intends to offer; (e) FLGC milestone projections and targets; (f) FLGC expectations regarding receipt of approval for regulatory applications; (g) FLGC intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) FLGC expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute FLGC business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) FLGC ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) FLGC ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) FLGC ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of FLGC to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) FLGC operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact FLGC business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing FLGC business operations (e) FLGC may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Flora Growth Corp..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Flora Growth Corp. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Flora Growth Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Flora Growth Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Flora Growth Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Flora Growth Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Flora Growth Corp. industry; (b) market opportunity; (c) Flora Growth Corp. business plans and strategies; (d) services that Flora Growth Corp. intends to offer; (e) Flora Growth Corp. milestone projections and targets; (f) Flora Growth Corp. expectations regarding receipt of approval for regulatory applications; (g) Flora Growth Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Flora Growth Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Flora Growth Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Flora Growth Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Flora Growth Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Flora Growth Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Flora Growth Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Flora Growth Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Flora Growth Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Flora Growth Corp. business operations (e) Flora Growth Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Flora Growth Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Flora Growth Corp. or such entities and are not necessarily indicative of future performance of Flora Growth Corp. or such entities.