New Free-to-Play Platforms Let Sport Junkies Win Prizes Betting on NFL and NHL Games -- Pioneered by Companies Like Live Current Media OTCQB: LIVC

The combination of the Covid-19 lockdowns and the temporary sidelining of live sporting events helped boost a brand-new billion-dollar industry in 2020 – one that is making savvy investors fortunes overnight and shows no sign of slowing down.

CNN calls this new industry “a fast-growing international phenomenon with billions of dollars up for grabs.” 1

CNBC says that “vast amounts of money” are being made in this rapidly emerging industry that “has attracted a great amount of interest from investors who want to get in on the action.”2

Forbes says this industry is “Fast on its way to becoming the most financially lucrative market on the planet.”3

Fast Company says “the industry has become a massive force…. It’s no wonder why companies like Apple and Google are trying to cash in.”4

The industry is eSports (short for “electronic sports”), the quickest growing form of mass entertainment in the 5world. Shares of some eSport companies have skyrocketed by up to 1,802%6 in the past 24 months.

In the broad sense, eSports refers to competitive, organized video gaming that is played, watched and followed by hundreds of millions of people online through such platforms as Fortnite, League of Legends, Counter-Strike, Call of Duty, and Overwatch, to name a few.

According to data gathered by LeagueOfBetting.com, the number of eSports participants is expected to reach a staggering 877.3 million this year — with the number of players jumping to 1 billion by 2024.7 If these participants created their own country, only China with 1.4 billion people and India with 1.36 billion would be larger.

Within the eSports industry, however, there are specific niches that are outpacing even the explosive growth of the industry as a whole. One in particular, which combines elements of fantasy sports with traditional betting on professional football, basketball and hockey games, has taken off just in the past few months.

Like a Game of Superbowl “Squares” Every Week

Upstart companies like Live Current Media OTCQB: LIVC are capitalizing on the surging interest in eSports by developing new “Free-to-Play” gaming platforms that allow players to win cash prizes by picking winning scores for real-life sports games every week.

Upstart companies like Live Current Media OTCQB: LIVC are capitalizing on the surging interest in eSports by developing new “Free-to-Play” gaming platforms that allow players to win cash prizes by picking winning scores for real-life sports games every week.

Meanwhile, the eSports phenomenon is garnering serious interest among both Wall Street investors as well as entrepreneurs from the sports world.

Billionaire NFL team owners Robert Kraft and Jerry Jones have bought in. So has Dallas Mavericks owner and venture capitalist Mark Cuban.

Medium says “it’s not just venture capitalists hopping aboard” though. Clued-in “investors are going in every day”.7

Even such high-profile celebrities as Jennifer Lopez and Alex “A-Rod” Rodriguez are investing millions in eSports. And with some eSport stocks seeing gains as high as 462%8 in the past 12 months, this surging new industry is the number one place to be today for big profits.

The reasons why come down to money… lots of money.

“The opportunities here are absolutely enormous.” -- Forbes 10

Consider: The winner of the 2019 Fortnite World Cup took home $3 million in prize money, about the same as that year’s Wimbledon winner. More than two million fans watched that tournament.11

eSports tournaments nab up to 454 million viewers during any given period, right behind the Olympics, the World Cup, and Formula One racing.12 (22% of all millennial males watch eSports, the same number who watch baseball.13)

From just $100 million in 2010, eSports revenues now exceed an eye-popping $1 billion annually, and are growing at a compound annual rate of 20% to reach a projected $3 billion by 2025.14

The betting on eSports – over and above other revenues — is already estimated to be worth about $30 billion.15

With that much money sloshing about, it’s little wonder the world’s biggest companies have moved in – and small, unknown startups are seeing their shares rocket higher.

eSports Companies Already Worth Billions as Share Prices Skyrocket

Amazon was one of the first to see the future of eSports, paying a staggering $1.1 billion back in 2014 to buy Twitch, the leading live streaming gaming platform, after a bidding war with Google.

That was the earliest sign that eSports was transitioning from a niche novelty to a multi-billion dollar industry.

Hardly anyone in the investing world had ever heard of Twitch. Yet at the time of the sale, it already had the fourth highest internet traffic in the U.S., after Netflix, Google, and Apple.16

Today Twitch has more than 15 million daily active users and is worth an estimated $3.79 billion.17

And that value is just a drop in the bucket compared to some eSports companies.

- Electronic Arts (EA), which owns some of the biggest franchises in gaming including Madden and Star Wars, is valued at $29.5 billion. Its shares are up 66% in the past year.

- Activision Blizzard (ATVI), maker of the popular games Overwatch, Starcraft, and Call of Duty, sports a $44.83 billion market cap. Its network has nearly 500 million monthly active users in 196 countries, a reason why its shares have soared 78% in 12 months.

- Zynga Inc (ZNGA), the world’s largest social game developer, has surged 75% in the same period.18

- Take-Two Interactive (TTWO), a leading developer, publisher and marketer of interactive entertainment with a market cap of $23 billion, doubled its investors money in 2020 as its shares gained 103%.19

- DraftKings (DKNG), a digital sports gaming company based in Boston, saw its shares jump from $11.301 on March 23, 2020, to $46.502 by the end of the year – a gain of 311.5% in just nine months.And the digital entertainment company Sea Limited (SE), based in Singapore, has seen sales skyrocket from $414 million in 2017 to $2.1 billion21 at the end of 2019. Its shares are up 1,802%22 over the past 24 months, enough to turn every $5,000 investment into $95,000.

These companies are now multi-billion-dollar giants, and their biggest moves may be behind them.

Yet all signs suggest the eSport industry is still in its infancy. Goldman Sachs forecasts that eSports revenue will climb from $869 million in 2018 to $2.96 billion by 2022 – a leap of 241%.

That’s why investors are keeping an eye on small companies like Torque eSports (TSXV:GAME), eSports Entertainment Group (GMBL), Super League Gaming (SLGG), and Allied eSports Entertainment (SLGG) to make their mark.

But the most promising of them all could be Live Current Media (LIVC).

Live Current Media OTCQB: LIVC Enters $88 Billion Free-to-Play Market

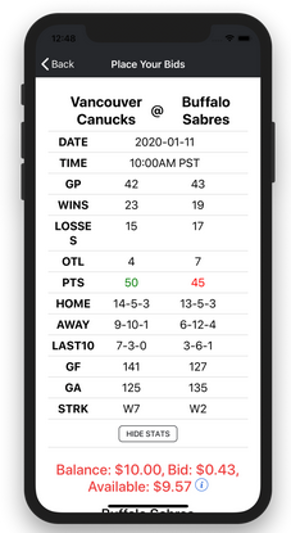

Live Current Media has developed a revolutionary mobile gaming app, , that allows players to bid every week on the final scores of professional sports games, including NFL, NBA, and NHL.

There’s nothing quite like this technology on the market today.

It’s fun, free to play, unique and offers thousands of dollars in cash prizes. The player whose bids win the greatest number of games, wins the SPRT MTRX and the cash prize.

Challenges are held throughout the week — and include all of the major league sports games in play.

SPRT MTRX can be downloaded for free right now from both Apple App Store and Google Play Store – or by visiting https://sprtmtrx.com. SPRT MTRX is currently in beta mode, with plans to finalize the app for launch in winter 2021.

Live Current Media OTCQB: LIVC to Debut New E-Boxing League

In addition to its revolutionary new sports gaming platform, Live Current Media is also developing a new eSports boxing league through the website, Boxing.com FEDERATION.

In addition to its revolutionary new sports gaming platform, Live Current Media is also developing a new eSports boxing league through the website, Boxing.com FEDERATION.

Boxing video games are among the most popular with gamers worldwide, with titles like Fight Night, George Foreman’s KO Boxing, and Knockout Kings, each of which boast millions of players.

Bringing boxing video gaming into the world of eSports is a natural progression in the category’s evolution.

In fact, Forbes names boxing as the top sport “with untapped eSports potential.”23

And according to the boxing news website Round by Round Boxing, “boxing seems to be ideally placed to make a big hit in the eSports world.” 24

Uniquely Positioned to Cash in on the Free-to-Play Gaming Revolution

Live Current Media OTCQB: LIVC is one of the few upstart Free-to-Play gaming companies that is publicly traded — and the only one that is developing platforms for all four major league franchises (football, basketball, baseball and hockey) as well as boxing.

Led by Canadian technology entrepreneur and turnaround expert David Jeffs, famous for growing a tech company to a market cap of $40 million, Live Current Media has attracted a unique team of gaming enthusiasts and digital engineers.

These include the company’s technical architect Dymytro Dvynyaninov, who co-founded an online scheduling & booking software company acquired by Groupon and launched a next-generation interface for Bitcoin; director John da Costa, founder of a company that has provided management and accounting services to public and private companies since August 2003; and director Amir Vahabzadeh, involved in the internet industry as a private online business owner and consultant for over 20 years.

Live Current Media OTCQB: LIVC and the $88 Billion Free-to-Play Industry

The company’s app is free to users, and will generate revenue through advertising and in-app purchases. This free-to-play (F2P) model is widely used in gaming, and generates upwards of $88 billion in revenue per year.25

With the total gaming market now worth a staggering $110 billion and growing fast, the F2P model used by Live Current Media holds a significant share of the market. In comparison, purchased games amount to about $16 billion.

Live Current Media will generate SPRT MTRX revenue through short (3-5 second) video ads before bidding results are shown as well as through in-app purchases.

It is now possible for top games to derive the majority of their revenues from in-game advertising alone, with daily ad revenues reaching well into the $100,000s.26

In fact, 72% of all revenues generated by the App Store and Google Play are generated from games.27

Like most development stage gaming companies, Live Current Media is still small and relatively undervalued.

But that may not be the case for long. Media interest is picking up, and with it so has investor interest.

With SPRT MTRX already live and the launch of Boxing.com FEDERATION coming soon, the time to take a good look at LIVC is now.

For more information about eSports in general and Live Current Media OTCQB: LIVC in particular, visit the company’s website.

1 https://www.cnn.com/2018/08/27/us/esports-what-is-video-game-professional-league-madden-trnd/index.html

2 https://www.cnbc.com/2018/12/19/from-michael-jordan-to-drake-athletes-celebrities-invested-millions-esports.html

3 https://www.forbes.com/sites/jamesayles/2019/12/03/global-esports-revenue-reaches-more-than-1-billion-as-audience-figures-exceed-433-million/?sh=5020cbd71329

4 https://www.fastcompany.com/90434063/this-startup-wants-you-to-make-money-popping-bubbles-on-your-phone

5 https://www.barchart.com/stocks/quotes/SE/performance

6 https://leagueofbetting.com/number-of-online-gamers-to-hit-1-billion-by-2024/

7 https://medium.com/@breakthrough_lab/celebrity-esports-investors-you-didnt-know-about-eb9a8c395292

8 https://www.barchart.com/stocks/quotes/SE/performance

9 https://www.forbes.com/sites/kenrapoza/2019/05/29/global-esports-popularity-give-gamer-companies-reason-to-be-bullish/#8692bcf1bde6

10 https://estnn.com/6-esports-facts/

11 https://estnn.com/6-esports-facts/

12 http://powerupgaming.co.uk/2019/07/15/7-amazing-facts-about-esports/

13 https://www.marketwatch.com/press-release/global-esports-market-will-grow-at-a-cagr-of-nearly-20-during-the-forecast-period-2019-2025-2019-08-26

14 https://estnn.com/6-esports-facts/

15 https://www.gamespot.com/articles/twitch-ranked-4th-in-peak-internet-traffic-ahead-of-valve-facebook-hulu/1100-6417621/

16 https://www.feedough.com/twitch-tv-business-model-how-does-twitch-make-money/

17 https://www.barchart.com/stocks/quotes/ZNGA/performance

18 https://www.barchart.com/stocks/quotes/TTWO/performance

19 https://finance.yahoo.com/quote/DKNG/history?p=DKNG

20 https://finance.yahoo.com/quote/DKNG/history?p=DKNG

21 https://www.barchart.com/stocks/quotes/SE/income-statement/annual

22 https://www.barchart.com/stocks/quotes/SE/performance

23 https://www.forbes.com/sites/brianmazique/2017/06/09/5-games-with-untapped-esports-potential/#3129f2b649a5

24 https://roundbyroundboxing.com/will-boxing-ever-come-to-esports/

25 https://techcrunch.com/2019/01/18/free-to-play-games-rule-the-entertainment-world-with-88-billion-in-revenue/

26 https://deltadna.com/blog/monetization-age-ads/

27 https://www.businessofapps.com/data/app-revenues/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Live Current Media.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.