Start-up XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) Aims to Disrupt a Covid Diagnostic Market Estimated at $84 Billion

Biotech investors appear to have flocked in recent months to a new generation of healthcare venture capital firms seeking to create fast and innovative solutions for the world’s pressing health problems.

Diversified VC accelerators such as XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) are a part of this new generation that have the ability to address urgent health problems much faster, sometimes with lightning speed, than their larger counterparts who get saddled down with bureaucracy.

From an investment perspective, the hope is that these fast and innovative solutions could potentially result in comparable gains in share prices. Healthcare-oriented VC companies such as Horizon Technology (HRZN)1, Hercules Technology Growth Capital (HTGC)2 and Triplepoint Venture Growth Bdc (TPVG)3 are examples that it can work out that way when the technology performs. Just look at what has taken place as the shares of these companies have all more than doubled in value over the past 12 months.

Plus, the Covid-19 pandemic has presented numerous opportunities for smaller, more nimble healthcare VC companies. These “fast strike” companies can often accomplish in a few months what takes biotech giants years, even decades.

For example, throughout the year-long nightmare of the Covid-19 pandemic, one thing has mystified the general public: Why has it taken governments and big biotech companies so long to produce a quick and accurate Covid-19 test?

Greatest Hurdle in Fighting The Pandemic

Particularly in the early days, rapid Covid tests appeared tragically inaccurate, and accurate Covid tests were painfully slow. Rapid antigen tests proved to yield unacceptably high false negative and positive rates, while accurate polymerase chain reaction (PCR) diagnostics, often took weeks to get results.

This problem is looming even larger now as governments and airlines worldwide begin allowing international travel again – on the condition that travelers produce an accurate PCR test taken within 72 hours.

Unfortunately for many travelers, large centralized labs are often not able to produce PCR results quickly, sometimes leaving travelers stranded.

The Gold Standard in Covid-19 Testing

So-called antigen tests can return results in about 15 minutes. Yet they only detect the presence of viral proteins that are not always present, particularly in the early stages of infection which is a critical time for transmission of Covid.

So-called antigen tests can return results in about 15 minutes. Yet they only detect the presence of viral proteins that are not always present, particularly in the early stages of infection which is a critical time for transmission of Covid.

The gold standard in Covid-19 testing is the PCR test. This is widely hailed as the most sensitive and reliable technique available to detect and measure the presence of the Covid-19 in current patients. It is the definition of a Covid diagnosis.

The problem has been that PCR tests require expensive lab equipment, highly trained staff and significant time to process – until now.

An Innovative, Accurate, Incredibly FAST Test for a Definitive Covid-19 Diagnosis

XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY), which sees itself as a “next-generation bioscience accelerator,” recognized an enormous business opportunity in the shortage of fast, accurate, point-of-care Covid-19 diagnostic solutions.

Working with its German development partner, 3a-diagnostics GmbH (3a), the agile VC startup was able to produce and market an accurate, rapid and highly portable PCR diagnostic test system, dubbed Covid-ID Lab, for the European market.

This RT-PCR test, which can be used with either nasal or oral samples, provides a more comfortable and less invasive experience for patients.

In addition, it can accurately detect the presence of Covid-19 genetic material within 25 minutes – and with simple, relatively inexpensive off-the-shelf lab equipment.

A Global Opportunity Knocks

The company’s disruptive PCR Covid test kits could potentially be the ultimate solution for a number of industries that require accurate “on the spot” Covid-19 testing, airlines being one.

And make no mistake, the size of this market alone is substantial.

For example, in 2019, U.S. airlines carried more than 926 million4 passengers. If even a fraction of passengers had to use a PCR test kit at the airport in order to board their flights, the sales could be in the millions of units.

Overall, the total Covid-19 diagnostics market worldwide is expected to grow from $84.4 billion in 2021 to $195.1 billion by 2027, at a compound annual growth rate (CAGR) of 15% during 2021-2027.5 The rapid test portion of that market is projected to reach USD $39.1 billion by 2023.

Some experts now predict that it is unlikely the Covid-19 virus will be eradicated quickly, if at all, and therefore Covid screening and vaccinations are likely to remain, like their counterparts with the flu, part of the new health landscape for years to come.

What’s more, in addition to airlines, dozens of other industries might use point-of-entry PCR tests, the way they now use forehead thermometers tests, if they were inexpensive, convenient, and fast.

Those industries could include schools, hospitals, pharmacies, sports clubs, gyms, law courts – any place where large groups of people interact and cannot easily practice social distancing.

Newer, Faster “At Home” Tests Being Developed

The company shipped its first order of new PCR test kits in mid-March, 9,600 individual tests packaged in 200 kits of 48 tests each. The company also signed in April an agreement with a German pharmaceutical wholesaler for the distribution, storage and logistics of its diagnostic products throughout Germany.

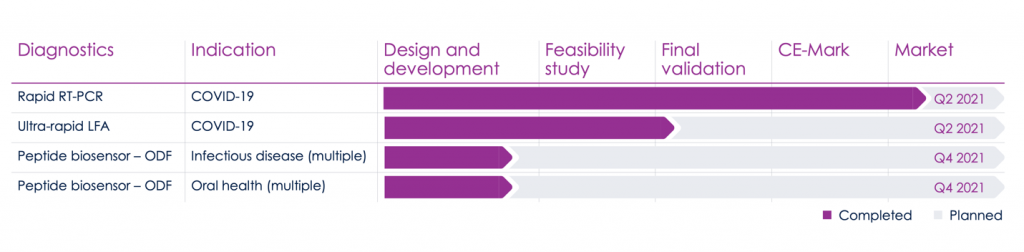

In addition to its rapid PCR test, XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) is also planning to launch a portfolio of infectious disease products later in 2021.

The new rapid-results PCR test is merely the first phase in XPhyto’s long-range plan to develop infectious disease diagnostics and other urgent healthcare needs neglected by the large biotech firms.

For example, XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY), working again with its German partner 3a, is developing oral screening test kits for a wide variety bacterial and viral infectious diseases, including influenza A, group A strep, stomatitis, periimplantitis, and periodontitis.

Its oral test for early detection of highly pathogenic influenza A strains should be ready in late 2021.6 The company is also close to marketing a new test for detecting infection associated with dental implants7, a common problem in modern dentistry.

This is welcome news for a small company like XPhyto Therapeutics (OTC:XPHYF, CSE:XPHY), since it means there will be a built-in market for its flagship products going forward.

Expanding Beyond Diagnostics to Neurological Treatments

In addition to its state-of-the-art diagnostic tests for infectious diseases, XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) is also developing a portfolio of drug formulations, including psychedelics, for a number of neurological disorders.

Working with its German subsidiary, Vektor Pharma TF GmbH, a leader in the development of transdermal and sublingual drug formulations, XPhyto plans to complete in 2021 human pilot studies for transdermal or oral treatments for four life-threatening neurological diseases: Parkinson’s disease, epilepsy, multiple sclerosis and anorexia.

As part of its research into treatments for neurological ailments, XPhyto is also engaged in research into next-generation neuro-pharmaceutical solutions. These are based on substances once classified as “psychedelics,” including psilocybin, mescaline, LSD, MDMA, DMT, and others.

To conduct this research, the company first is developing the industrial-scale biotechnology processes for the production of psilocybin, a psychoactive chemical found in certain mushrooms. In addition, XPhyto is developing industrial-scale processes for the production of pharmaceutical grade mescaline, a psychoactive compound naturally occurring in a variety of cacti in the Americas. Both psilocybin and mescaline have shown significant promise in the treatment of a wide range of mental health related conditions.

The US Food and Drug Administration has twice designated psilocybin as a “breakthrough therapy” for the treatment of severe and treatment-resistant depression. Mescaline has been used for hundreds of years in certain Native American rituals and spiritual practices.

Next Generation “Fast Strike” Healthcare VC Firms

XPhyto’s stated plans highlight the potential of this new generation of venture capital companies that see themselves as “bioscience accelerators.”

With the financial backing of investors and substantial technical expertise, these new “fast strike” VC firms are able to quickly capitalize on healthcare opportunities ignored or inaccessible by the biotech giants.

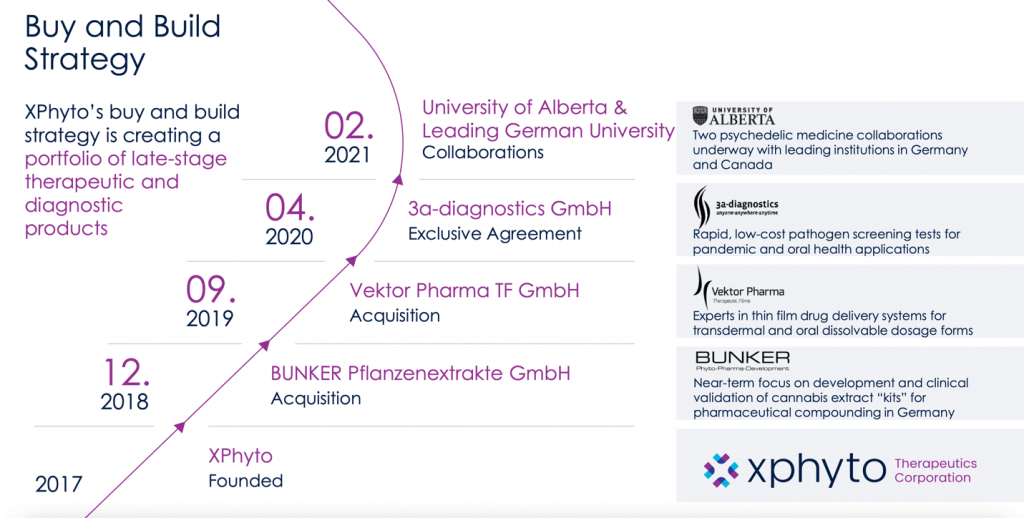

Led by CEO Hugh Rogers, a lawyer with extensive experience in venture capital, XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) was founded in 2017 in Vancouver, British Columbia.

The company quickly expanded over the next two years through the acquisition of German bioscience companies with expertise in film drug delivery systems (Vektor Pharma TF GmbH) and pharmaceutical compounding (BUNKER Pflanzenextrakte GmbH).

It then entered into an exclusive agreement with the German diagnostic innovator 3a-diagnostics GmbH to develop rapid, low-cost pathogen screening tests for Covid-19 and other infectious diseases.

Collaborating with Leading Research Universities

By this time, the company had the research heft to collaborate with some of the leading research universities in both Canada and Germany, seeking to develop new pharmacological treatments for neurological disorders.

Joining CEO Hugh Rogers, the executives and directors at XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) have substantial backgrounds in both venture capital and healthcare.

They include Chief Financial Officer Christopher Ross; Managing Director Wolfgang Probst, a management consultant who specializes in capitalization and mergers and acquisitions; and Head of Corporate Development Manfred Buchberger, an expert in the medical and diagnostics products industry with a decade experience as a CEO and management board member of an $800 million medical diagnostic developer and manufacturer.

The company’s directors and advisors include managing director Thomas Beckert, Ph.D., founder and managing director of Vektor Pharma; director Raimar Löbenberg, Ph.D., founder and director of the drug development and innovation center, faculty of pharmacy and pharmaceutical science at the University of Alberta; and executive advisor Wolfgang Eisenreich, Ph.D., a research group leader in the department of chemistry at the Technical University of Munich.

Making Progress and Helping Battle Covid Related Issues at the Same Time

For investors, the attraction of “fast strike” healthcare VC companies such as XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) is the ability to see enormous opportunities being neglected by Big Pharma and quickly marshaling financing and technological solutions.

So far, such a strategy seems to be paying off for XPhyto.

Although a relatively small startup, the company’s share price has risen 54.8%8 since October 2020.

Past performance is no guarantee of future results, but it’s clear that venture capital is moving into the “fast action” diagnostic and drug formulation industry – and investors are following suit.

The company reminds investors that the best source for full disclosure about the company is the company itself, SEDAR or CSE profile pages for regulatory filings and news releases.

The company does not make any express or implied claims that its product has the ability to eliminate, cure or contain the COVID-19 pandemic.

Learn More About XPhyto Therapeutics (OTC:XPHYF | CSE:XPHYOTC:XPHYF | CSE:XPHY) at your brokerage today!

1 Up 108% in past 52 weeks as of April 16, 2021, see https://www.barchart.com/stocks/quotes/HRZN/performance

2 Up 104% in past 52 weeks, see https://www.barchart.com/stocks/quotes/HTGC/performance

3 Up 139.4%, see https://www.barchart.com/stocks/quotes/TPVG/performance

6 https://xphyto.com/products/poc-diagnostics/

7 https://xphyto.com/products/poc-diagnostics/

8 From $1.33 per share on Oct 29, 2020 to a close of $2.06 per share as of April 21, 2021 – a gain of 54.8% per https://percentagecalculator.net/. Historical prices available at: https://finance.yahoo.com/quote/XPHYF/history?p=XPHYF

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling XPhyto Therapeutics.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.