Now The Focus Could Shift To

Cognetivity (

CSE: CGN

| OTCQB: CGNSF

CSE: CGN

| OTCQB: CGNSF)

And Its New AI Breakthrough That Discovers Alzheimer’s At Its Earliest Moments

Now The Focus Could Shift To Cognetivity (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) And Its New AI Breakthrough That Discovers Alzheimer’s At Its Earliest Moments

- Biogen’s new drug slows early-stage Alzheimer’s disease.

- But the U.S. government makes it impossible for all but the wealthy to get a test for an early diagnosis.

- That’s now changed forever as one small biotech started rolling out a revolutionary Alzheimer’s early-detection test that’s already approved in Great Britain and across Europe.

- The combination of events has led a noted analyst to nearly double its target for these affordably priced shares.

Something on the scale of a small miracle is now on the way for people suffering early-stage Alzheimer’s disease.

To be sure, this has nothing to do with a cure.

This leap forward is being made by new drugs – such as Biogen’s aducanumab – that slow Alzheimer’s steady advance by starting their attack at the disease’s earliest stages.

But, amid the anticipation and hope, there’s a flaw… you see, any form of detection, at all, has been Alzheimer’s major stumbling block.

So it was one thing for the FDA make history and approve Biogen’s new drug on June 7.

So it was one thing for the FDA make history and approve Biogen’s new drug on June 7.

It could be another thing altogether for patients, doctors, even Biogen, to discover the 80 million new cases of Alzheimer’s that are forecast to emerge worldwide in the next 25 years.1

In fact, as of May 2021, U.S. Medicare & Medicaid rules make it near impossible for people to get the one established medical test that detects Alzheimer’s early – an amyloid PET scan.2

Moreover, researchers found that worldwide there are dearth pet scan machines, technicians to operate them, and doctors to read the results.3

On top of that, even as nearly six million people a year are forecast to acquire Alzheimer’s, the researchers calculate that, were there enough resources, a mere 100,000 amyloid PET scans a year would cost $160 million.4

The Problem Is Clear

That means, right now, Biogen can manufacture all the aducanumab it wants, but chances are that most people with early cognitive impairment might not get its help.

That’s because they still face the hurdle of first confirming their Alzheimer’s.

And, that’s why investors need to quickly home in on Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF).

That’s because Cognetivity Neurosciences is blazing a new trail with a technology that diagnoses the earliest onset of Alzheimer’s disease.

That’s because Cognetivity Neurosciences is blazing a new trail with a technology that diagnoses the earliest onset of Alzheimer’s disease.

And, it’s a brilliant artificial intelligence-driven technology that can also be downloaded into a smartphone or an iPad with results that can be shared with a doctor.

Such a straightforward setup means Cognetivity’s fast, accurate diagnosis costs pennies on the dollar compared with a PET scan.

Moreover, Cognetivity’s test can be given at the first moment Alzheimer’s is suspected… such as when someone forgets a recipe in the middle of baking or is confused while operating a television remote control.

Ultimately, along with its massive investment potential, Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) could also become one of the world’s most important companies.

Because by making an accurate test available worldwide, Cognetivity is democratizing Alzheimer’s diagnoses

Cognetivity’s AI Is Big News For Companies With Early-Stage Alzheimer’s Therapies, Such As Biogen’s

That altruism aside, you can also imagine what Cognetivity’s AI technology could mean to Biogen.

It has at least $500 million wrapped up in its aducanumab research, not including dreams for billion in future revenues.5 Headlines were calling the FDA’s approval of Biogen’s Alzheimer’s drug a “Blockbuster” moment.

That’s why this could be the rarest of investment moments… the one that demands biotech investors must pounce.

Because there’s likely no sector, other than biotechnology, in which a relationship such as this one could unfold…

A micro-cap such as Cognetivity Neurosciences, with a $40 million market cap, could come to the rescue of a global powerhouse like Biogen that sports a $40 billion market cap.

After all, there is no blockbuster without a diagnosis.

A Sudden Bullseye On Cognetivity Neurosciences

And, we’re sure Biogen could be well aware of Cognetivity Neurosciences’ (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) AI diagnostic breakthrough.

That breakthrough is what led FORBES, in 2019, to identify Cognetivity’s technology as so groundbreaking it named Cognetivity Neurosciences as one of “Five Young Companies Making An Impact On The World.” 6

Since then regulators similar to the FDA have approved Cognetivity’s AI-driven Integrated Cognitive Assessment (ICA) software for clinical use across the United Kingdom and Europe.

While the FDA could act any day now, it’s also fair to note that the U.K. and Europe are Cognetivity’s home court.

For as FORBES also noted, Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) was founded by a team of Cambridge University Ph.Ds.

For as FORBES also noted, Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) was founded by a team of Cambridge University Ph.Ds.

Their breakthrough Integrated Cognitive Assessment test challenges large portions of the human brain with natural images

Then the ICA analyses sections of the brain for accuracy, speed, and image recognition in order to calculate the user’s risk of having early signs of dementia.

Cognetivity’s ICA Delivers Unhear Of Accuracy

Other than a PET scan, such precision on the scale the ICA offers has never been attained before.

Moreover, the ICA software is designed as a quick, easy-to-use tool for clinicians. Its five-minute test is currently administered via an iPad.

This should be music to Biogen’s ears.

Cognetivity’s ICA is a fast diagnostic tool, that can be downloaded to iPads – soon smartphones, too – so it can be used anywhere in the world.

Analysts Agree With Cognetivity’s Potential

Biogen’s tight squeeze – and the fact that Cognetivity Neurosciences may be its only widely available solution – is what led analysts are Echelon Capital Markets to raise their price target for Cognetivity by 76%.

The analysts wrote, “While [the FDA’s decision was] a controversial outcome, it is clearly a major positive catalyst for Cognetivity as we anticipate that potential demand for its Integrated Cognitive Assessment… screen for cognitive impairment will likely increase meaningfully as millions of patients will need to be triaged for their suitability for aducanumab.

“[T]oday’s news is potentially a game-changer for the company. Given the ICA’s unique attributes and ease of use, it has the potential to be used broadly as a tool to identify cognitive impairment and AD among 700 million people over 65 years old globally during routine medical exams. The ICA platform can also be used to remotely monitor these at-risk patients between clinical visits.”

Clearly, this presents ideal timing to latch on to Biogen’s history-making news and run.

Aggressive, growth-focused investors in medical technology stocks could leap on Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) prior to it becoming more widely known.

Worldwide recognition could likely happen soon and suddenly because Cognetivity has been on a fast roll when it comes to hitting critical benchmarks.

- In late 2019 Cognetivity validated the effectiveness of is key technology. Then it published its results in the influential and peer reviewed Nature Scientific Reports. The rigorous standards of this prestigious medical journal mean that the science presented within its pages is of the highest scientific importance.

- Then, as noted, in early 2020, Cognetivity’s (ICA) technology won regulatory approval by UK’s Medicines and Healthcare products Regulatory Agency. That means Cognetivity is now authorized for sale and clinical use the UK and Europe.

- Next, in mid 2020, Cognetivity published compelling new data on ICA’s capabilities in the peer-reviewed May 2020 journal of BMC Neurology.

- In August 2020, the company made a huge presentation on the peer-reviewed research of its ICA to 31,000 attendees of the Alzheimer’s Association International Conference.

- By September, Cognetivity had signed its first agreement for distributing ICA technology through the UK National Health Service.

- In November, the first deployment of that technology was released to the port city of Sunderland, England, providing this first-of-its-kind dementia diagnostic tool to general practitioners.

- In December 2020, the company announced its upcoming research collaboration with Oxford University to pursue expansion of ICA technology onto smartphone-based platforms. This can open pathways to billions of smartphones worldwide and open channels for remote diagnostic evaluation of patients presenting symptoms of cognitive impairment.

- Finally, Cognetivity made the final cut in the Texas Medical Center’s Fall 2020 Innovation program. And, the company has now been featured in The Times, The Globe and Mail, and the Wall Street Journal alongside companies such as Microsoft and Apple for the use of artificial intelligence (AI) in early dementia detection.9

- The reality is that FDA may have painted itself into a corner. Because there is no easily dispensed, low-cost, and accurate test for Alzheimer’s, it finds itself in a place where it must fast-track Cognetivity’s ICA.

This Could Be A Fast Expanding $278 Million Instant Marketplace For Cognetivity

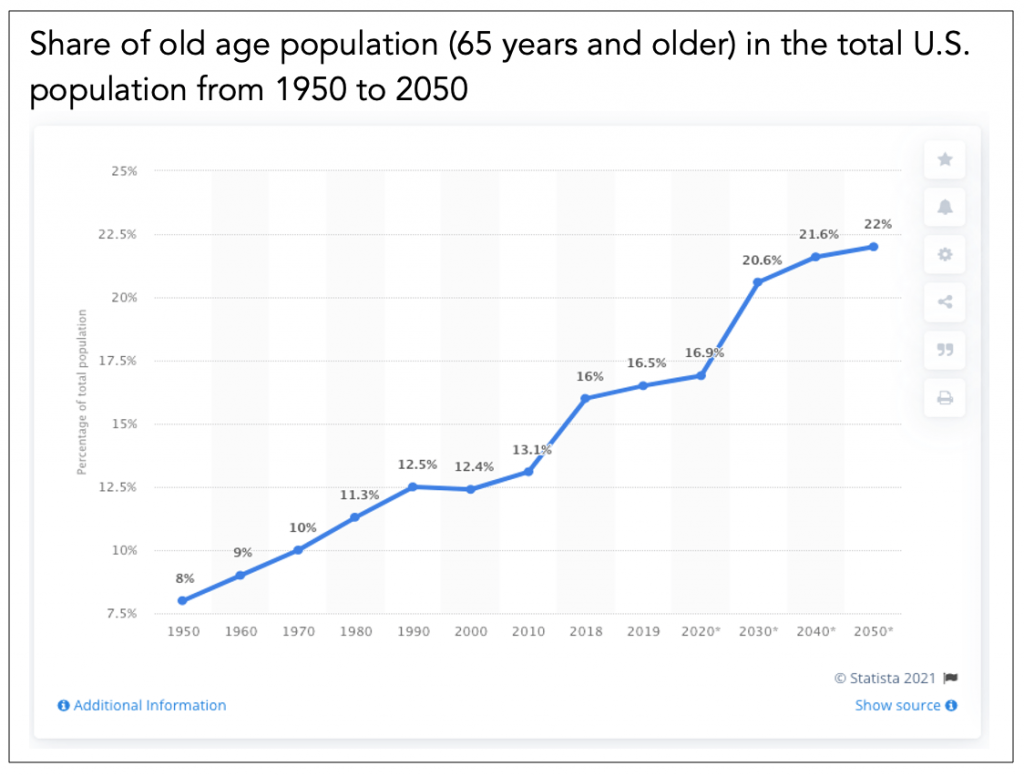

According to Statista, about 17% of today’s U.S. population is over 65 years old.

That’s about 55.7 million people… this year.

By 2030 it’ll be about 21% of the population, by 2040, about 21.6%, and by 2050 it’s estimated people over 65 will make up 22% of the U.S. population.

They may not want to be called senior citizens, but chances are most people over 65, and many under 65, live in fear of acquiring a brain wasting disease such as Alzheimer’s.

Most of them can’t pay the out of pocket costs for an amyloid PET scan.

But what about an app on an iPad?

A Texas Medical Center modeling program sets the price at $2 for what insurance companies could reimburse Cognetivity for each iPad ICA test.7

If doctors only were administering the test, the potential for Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) is staggering.

Office Visits Add Up

In general, the 55.7 million people older than 65 in the U.S. visit their primary care physical 2.5 times a year. There are nearly 1 billion people over 65 worldwide.8

The question is then, what value will seniors place on peace of mind… $2 would seem ultra reasonable.

If the answer is almost all of them, then investors need to make an immediate move into Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF).

Because those worried seniors could be about to create a $278 million AI-driven ICA market for Cognetivity.

Cognetivity’s Impressive Data Partner

And, Cognetivity has its eyes on the big picture, too.

It just completed a partnership that will allow the worldwide medical community a way to store, and access, ICA test results.

After all, the test is one thing, storing its data so doctors can track patients’ histories is a big deal too.

To that end Cognetivity has partnered with InterSystems, which will integrate with the ICA platform to make electronic healthcare records.

And that will enable the efficient adoption of Cognetivity’s technology in healthcare systems throughout the world.

This is a big deal because InterSystems is a big deal.

It’s headquartered in Cambridge, MA, and has data solutions for the healthcare, finance and logistics sectors. It has customers and partners in over 80 countries, which include HSBC, 3M, SPAR and the European Space Agency.

Within the healthcare industry, InterSystems counts the world-renowned Mass General Brigham Hospital, Roche Diagnostics, US Veterans Association, and the NHS among its customers.

It stores more than one billion health records worldwide. And it manages technology for the 20 best hospitals in the U.S., according to the latest US News & World Report… including the Mayo Clinic, Cleveland Clinic, and The Johns Hopkins Hospital.

The Money In Healthcare Has Always Been Fortune Building

It all added up in 2019, to InterSystems recording more than $720 million in revenue.

This, of course, goes back to an earlier point…

That biotechnology is one, perhaps the only sector, where major companies such as InterSystems comfortably partner with microcaps, such as Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF).

There is a reason why eagled eyed investors get richer.

They see opportunity in technology advancement.

For example, Cognetivity’s new technology could revolutionize Alzheimer’s diagnosis in the same manner that digital blood pressure monitors revolutionized heart disease diagnosis.

To put that in perspective, since first introduced, the market for digital blood pressure monitors has skyrocketed…and continues to fly.

Fortune Business Insights reports that: “The global digital blood pressure monitor market size stood at $666.6 million in 2017 and is projected to reach $1.4 billion by 2025.”9

Other analysts are even more aggressive in their projections. iHealthcare Analyst forecasts growth to $4 billion by 2023 as digital blood pressure monitors become a routine part of medical exams.

Cognetivity’s ICA technology could be a massive breakthrough for a disease that affects 40 to 50 million people worldwide, and for which, until now, there was no effective early diagnosis.

First To Market Means Cognetivity Has A Wide Open Field

With a global population aging fast, the first-ever device for early onset dementia testing could be worth billions.

In fact, research firm Market Research Future forecasts that the Alzheimer’s disease diagnostic market will reach $12 billion by 2022, six times larger than the blood pressure monitoring device market.

To be blunt, there is no Alzheimer’s diagnostic market except Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF).

Because, as the U.S. National Institute on Aging puts it…

Alzheimer’s disease can be definitively diagnosed only after death, by linking clinical measures with an examination of brain tissue in an autopsy.10

It’s a market vacuum with enormous potential.

Friends In High Places

Finally, though led by some of Britain’s top Ph.D. neuroscientists, Cognetivity enhanced its global reputation when a top expert agreed to join its advisory team.

A member of the United Kingdom’s House of Lords, James O’Shaughnessy is that new advisor.

This is a big deal because between 2016 and 2018, Lord O’Shaughnessy served as Parliamentary Under-Secretary of State at the Department of Health. It was there that he led efforts to enhance innovation in the National Health Service.

He was also responsible in this role for the development of the UK’s Life Sciences Industrial Strategy and acted as ministerial lead for key public sector organizations such as NHS Digital and the Medicines and Healthcare products Regulatory Agency.

Biogen And Alzheimer’s Could Be Making A Week’s Worth Of Headlines

Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) is a company you probably need to act on quickly – before the first-to-market window of opportunity slams shut! Or before other smart investors bid up its share price.

Here’s another way to look at this.

Alzheimer’s is the most common type of dementia and the sixth leading cause of death in the United States.

And the cost is staggering. According to the Alzheimer’s Association, early intervention could collectively save $7 trillion to $7.9 trillion in long-term care costs.

In America, one new patient is developing Alzheimer’s disease every 65 seconds – resulting in nearly half a million new cases this year alone – demand for an early and accurate diagnostic test cannot be overstated.

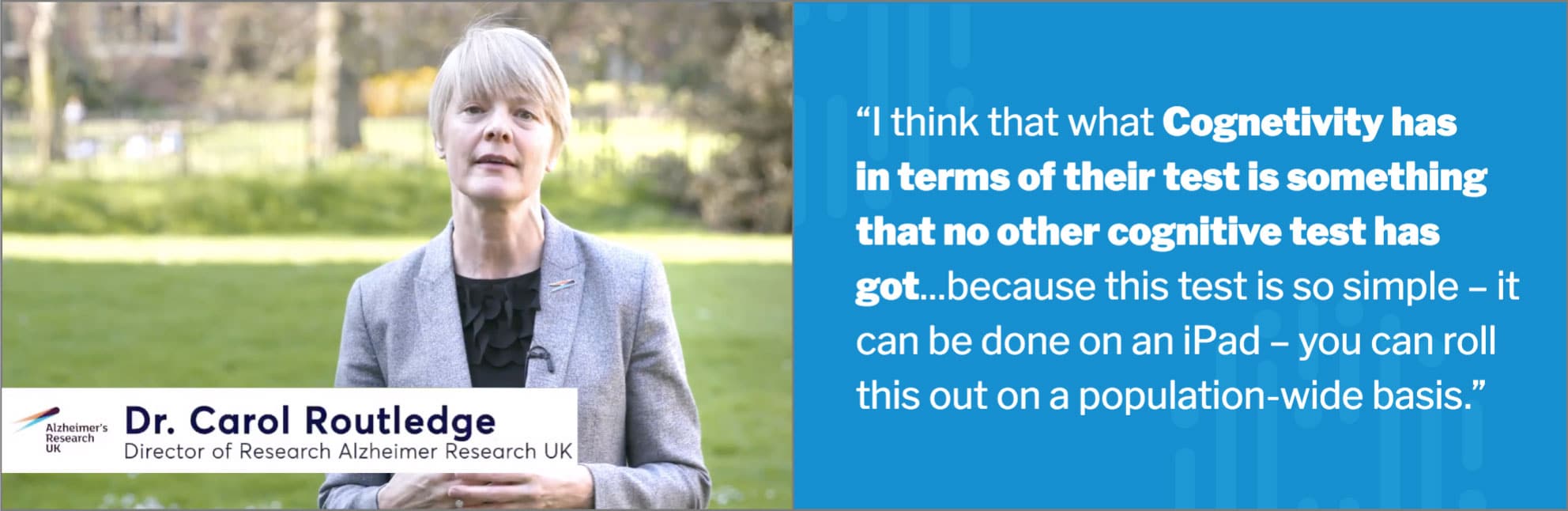

In fact, Dr. Carol Routledge, Director of Research at Alzheimer’s Research UK, made this key observation about Cognetivity’s testing platform.

This test is so simple and easily deployed “…you can roll this out on a population-wide basis.”

Rapid widespread rollout is but one of the

7 Reasons Investors Should Consider Adding Shares of Cognetivity Neurosciences Today

- First to Market…ZERO Competition! The market for cognitive testing is massive – yet no other company has developed a realistic solution. Thanks to a lack of competitors and its comprehensive patent protection, Cognetivity should have a significant first- to-market advantage over any potential competitors.

- Instant Market – 55.7 million seniors visit the primary care physician 2.5 times a year. Models suggest insurance companies will reimburse $2 for each test… that’s as much as a $278 million market on worried 65+ year olds.

- Massive Potential Market — According to the World Economic Forum, dementia is the biggest healthcare challenge of the 21st century…a crisis with a staggering $1 trillion-per-year impact on the global economy.

- Game-Changing Early Diagnosis Potential — Cognetivity is aggressively working to tackle the global dementia crisis by bringing a potentially game-changing testing platform to market. Cognetivity’s high-tech solution will help enable early detection of dementia – a breakthrough that is badly needed – and one that can open a door to appropriate future care and treatment.

- Superior A.I. Tech Testing Platform — Cognetivity has developed a testing platform that looks to be superior to – and has a number of critical advantages over – existing testing methods. This software-driven solution could allow cognitive testing to be as simple, inexpensive and prevalent as an annual blood pressure check.

- Hardware Platform Already in Place — Cognetivity’s software launches on Apple’s iPad device. Apple reports having sold over a half billion iPads worldwide; a number that continues to grow at around 40 million devices per year.

- Early Alzheimer’s Diagnoses Will be Key to Future Drug Utilization — Currently, over 100 advanced clinical trials are being conducted for Alzheimer’s pharmaceuticals. With many new drugs anticipating FDA approval, Cognetivity’s early diagnostic AI could play an essential role in each drug manufacturer’s marketing programs.

Get Started Now:

At the risk of sounding cold, it should be noted that seniors are paranoid of Alzheimer’s.

Why?

Because Alzheimer’s disease is not a normal part of aging.

But Alzheimer’s is a disease almost exclusively of the aged.

The older you get, the more likely you are to get it.

Denis Evans, director of the Rush Institute for Healthy Aging, estimates that about 13% of Americans 65 and older suffer from Alzheimer’s.

And among those 85 and older, more than 40% do.11

People fear this more than death because it steals your personality and turns you into somebody that requires total care.

Now, with Biogen’s new drug… and perhaps those in clinical trials from Biohaven Pharma, Athira Pharma, and Eli Lily… there is a chance to delay the worsening affects.

Perhaps even delay until a more powerful solution is found.

Either way, investors should not hide from Alzheimer’s tragic, emotional, and fear-inducing realities.

Check with your broker or advisor today.

Once they check out all the facts on Cognetivity, they’ll could likely agree that this is one of “those” biotech opportunity…

The kind where the sooner you get in on Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) the higher you could fly.

Learn More About Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) at your brokerage today!

Learn More About Cognetivity Neurosciences (CSE: CGN | OTCQB: CGNSFCSE: CGN | OTCQB: CGNSF) at your brokerage today!

1https://www.sciencedirect.com/science/article/abs/pii/S155252600700475X#aep-abstract-sec-id12

2https://www.statnews.com/2021/05/25/medicare-cover-pet-scans-dementia/

3https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6709060/

4https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6709060/

5https://endpts.com/going-all-in-biogen-commits-an-extra-500m-to-alzheimers-blockbuster-hopeful-aducanumab/

6https://www.forbes.com/sites/alisoncoleman/2018/12/30/five-young-companies-making-an-impact-on-the-world-to-watch-in-2019/?sh=312ef99c1ac4

7https://advisor.echelonpartners.com/research/content/CGN%20041621%20submit.pdf

8https://www.un.org/en/development/desa/population/publications/pdf/ageing/WorldPopulationAgeing2019-Highlights.pdf

9https://www.fortunebusinessinsights.com/industry-reports/digital-blood-pressure-monitors-market-100066

10https://www.nia.nih.gov/health/how-alzheimers-disease-diagnosed

11https://www.nytimes.com/2002/11/11/nyregion/more-than-death-fearing-a-muddled-mind.html

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Cognetivity Neurosciences (“CGN”).

The Website Host has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Website Host is not aware, and has no meaningful way to confirm with certainty, if 3rd Party has been compensated for publishing the article. The Website Host expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP

The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any CGN or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the CGN. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled CGN’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding CGN future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to CGN industry; (b) market opportunity; (c) CGN business plans and strategies; (d) services that CGN intends to offer; (e) CGN milestone projections and targets; (f) CGN expectations regarding receipt of approval for regulatory applications; (g) CGN intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) CGN expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute CGN business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) CGN ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) CGN ability to enter into contractual arrangements with additional (xxxx); (e) the accuracy of budgeted costs and expenditures; (f) CGN ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of CGN to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) CGN operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact CGN business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing CGN business operations (e) CGN may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of CGN or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of CGN or such entities and are not necessarily indicative of future performance of CGN or such entities.

** IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY! **

This article is a paid advertisement. Tycona Media, Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Cognetivity Neurosciences (“CGN”) and its securities, CGN has provided the Publisher with a budget of approximately $550,536.76 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by CGN) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher owns shares and/or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to CGN industry; (b) market opportunity; (c) CGN business plans and strategies; (d) services that CGN intends to offer; (e) CGN milestone projections and targets; (f) CGN expectations regarding receipt of approval for regulatory applications; (g) CGN intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) CGN expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute CGN business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) CGN ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) CGN ability to enter into contractual arrangements with additional (XXXX); (e) the accuracy of budgeted costs and expenditures; (f) CGN ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of CGN to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) CGN operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact CGN business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing CGN business operations (e) CGN may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE.

By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here: link. If you do not agree to the Terms of Use, please contact [email protected] to discontinue receiving future communications.

INTELLECTUAL PROPERTY.

Tycona Media is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.