This Upstart Swedish Miner Could be About to Revolutionize the EV Battery Market

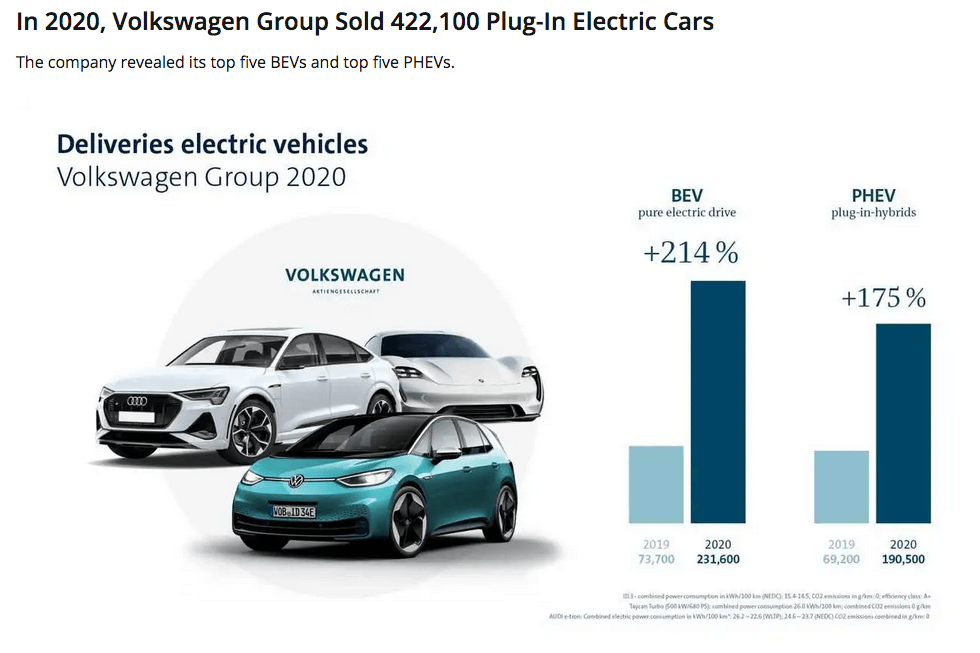

- Even Wall Street is in denial, but it’s fact… Germany’s VW has already passed Tesla in EV sales1 and upended all lithium supply projections.

- Europe now needs 30 more gigafactories by 2025 to fill lithium battery demand there2, and VW is already building the first two of them, on the way to six.3

- Only one European company is poised to mine lithium in VW’s back yard–United Lithium (CSE: ULTH, OTC: ULTHF) in Bergby, Sweden.

- ULTH’s European focus means this Canadian-American company is under the radar at an extreme low price, but not for long. High-grade ores, a new process and unique access to a ready-made market are dead in its sights.

There’s one more surprise for investors in the EV battery story, and this one has nothing to do with Tesla. It’s not about China’s stranglehold on lithium, either.

Lithium prices jumped 170% this year, hitting a 3-year high. EV makers like Tesla and battery companies are sucking up everything coming to market now, and all the mining companies’ planned expansions as well.

Then the news broke that VW just passed Tesla in EV sales…

Everything changes now. Ignore China and Tesla because Europe is where deep opportunity is at this moment.

And that’s why aggressive natural resources investors need to immediately pay rapt attention to United Lithium (CSE: ULTH, OTC: ULTHF).

It could have what VW needs…

A massive amount of lithium that United looks to be sitting on just six hours down the road from VW’s outrageously huge battery Gigafactory.

This Just Got Serious

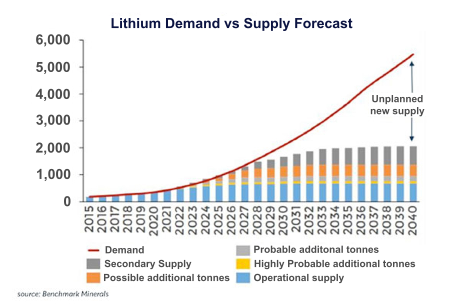

In March 2021, BloombergNEF said there would be enough lithium mining to cover all needs by 2025.4

Three months later, Benchmark Minerals Intelligence threw water all over that claim.5

It projects lithium shortages lasting at least to 2040.

Now, with VW’s new revelations, even that’s in question.

It is going to take all the expansion plans from all the mines in the world… plus all the “secondary supplies” from things like recycled batteries to cover demand. And the shortfall is getting worse every year.

New Lithium Mines Desperately Needed

The International Energy Agency forecast for lithium is even more dire.

IEA collects data from its 38 member and associate countries and helps them plan energy policies. It’s forecasting that lithium demand will increase 40-fold in the next 19 years.6

The whole world is plunging into a lithium supply crunch. We need more, urgently. But Europe needs added supply most of all because it is the only major manufacturing continent with NO lithium mines!

That’s right… Europe has no working lithium mines… and the one that’s planned in Portugal is meeting stiff resistance from the farmers whose bucolic land the mine will destroy. It will probably never happen.

That makes United Lithium’s (CSE: ULTH, OTC: ULTHF) Bergby, Sweden, discovery of high-grade lithium deposits more important with every month that goes by.

As Volkswagen takes the crown of world’s top-selling EV maker, United is the only potential lithium supplier in the German automakers own back yard.

A True Under-the-Radar Opportunity for Investors

If you’re sharp, you have to wonder… Why would the ONLY lithium property in Europe fly under the radar? After all, it has high-grade lithium concentrations, experienced management and excellent infrastructure.

It’s because the bankers have their own vested interests. So they want you to focus on other companies.

Like Albemarle (NYSE:ALB), the huge Australian lithium miner, and Tesla (NASDAQ:TSLA). Wall Street banks have tons of ALB and TSLA stock to sell the unwary. Institutions still own 84% of ALB and 41% of TSLA.

Heck, even Elon Musk is selling off a sizeable chunk of Tesla7.

It’s been easy for Wall Street banks to play games with the facts because the U.S. is inclined to go its own way. We drive a lot of miles. So gas-guzzlers dominate our roads for good reason.

We don’t see a lot of EV’s. A car that can only go 300 miles before it needs 10 hours at the charging station is pretty useless in a big land.

But new lithium battery technology and more charging options are changing that.

Even in America. And that means lithium is the chokepoint. The EV revolution depends on it.

EV Trend Is Exploding Faster Than Americans Realize

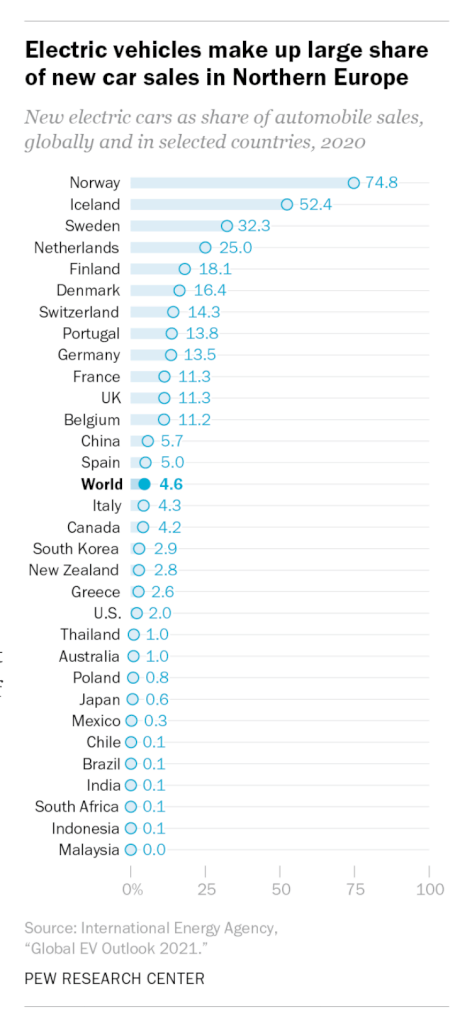

Pew Research confirmed Americans were far behind on the EV-buying bandwagon in 2020 at just 2% of new car registrations.

But a year later, Pew had to revise that figure to 7%!

EV registrations in the U.S. more than tripled in one year.

Even more surprising, 39% of Americans are currently thinking about making their next car an EV.

So you now can begin to see why VW’s sudden leadership in EV’s has knocked all previous projections sideways. European demand is soaring, too… and it’s taking off from even higher levels.

More important, VW makes brands people love. It ranks second in the world, just behind Toyota and ahead of Ford.

Suddenly, it’s VW—not Tesla—that’s the 400-pound gorilla to watch. And that’s why United Lithium (CSE: ULTH, OTC: ULTHF) is on the cutting edge of the new lithium reality.

In March, VW announced a $14 billion investment in Northvolt, its partner and a major lithium battery producer. It keeps adding to the total, throwing in another half billion in June9.

This summer, German automaker VW revealed plans that shocked everyone.10

It’s now putting out more EV cars than anyone—it just passed Tesla. And there’s not one single lithium mine in Europe.

VW’s headquarters are just a long day’s drive away from United Lithium (CSE: ULTH, OTC: ULTHF) in Bergby, Sweden. But the property is only 350 miles from Northvolt’s new gigafactory in Skelleftea, Sweden.

There’s no one else in Europe with the potential to supply it, and the major operators in China, Chile, and Australia are thousands of miles away.

Market Shocker—Tiny Bergby, Sweden, Population 816, Could Soon Hold Key to Lithium

You have an edge right now. That’s because the investment crowds stay hypnotized by trends that have come and gone…

And Wall Street bankers are keeping them hooked. That’s not an idle claim. That’s for real…

Morgan Stanley just gave Tesla an overweight rating.11 That followed a splashy “overweight” rating from a Piper Sandler analyst. He told investors they should buy because competitors were falling behind Tesla.12

Baloney. You already know that’s wrong.

And don’t believe for a moment that every banker on Wall Street has gone blind. They know the numbers.

It’s almost certain that Volkswagen sold more EV’s than Tesla in 2021… Final numbers will tell. But VW’s definitely taking the lead from 2022 onward.

That’s why it’s time to take a look at what’s happening right now in Bergby, Sweden, where United Lithium (CSE: ULTH, OTC: ULTHF) is uncovering world-class concentrations of lithium in the most unexpected place.

400% Demand Meets 81% Supply

This is reality straight from Barron’s: “Auto manufacturers know that the industry has to grow battery capacity fourfold by the middle of the 2020s to meet companies’ announced EV goals.”13

That’s a 400% increase in demand around 2025.

But lithium supply is on track to only grow 90% from 2022 to 2025 according to Benchmark Mineral Intelligence14 or 81% per Statista.15

In a moment, we’ll look at a similar property to get an idea what’s potentially in store at Bergby. As you’re about to see, this could be a mammoth of a mine.

But even if Bergby somehow added a mere 5,000 tons of lithium to the marketplace per year (from a site where 10X that much might be possible) it would be a fortune maker. At current prices, that would make Bergby a $60 million annual operation.16

For investors who are wise enough to take a position in United Lithium (CSE: ULTH, OTC: ULTHF) today, 2022 could be the best year they ever enjoyed in the stock market.

“Secondary” Producers Like ULTH Will Be The Winners

It’s a fact. Newer, smaller operations like ULTH are critical to boosting the world’s lithium outlook.17

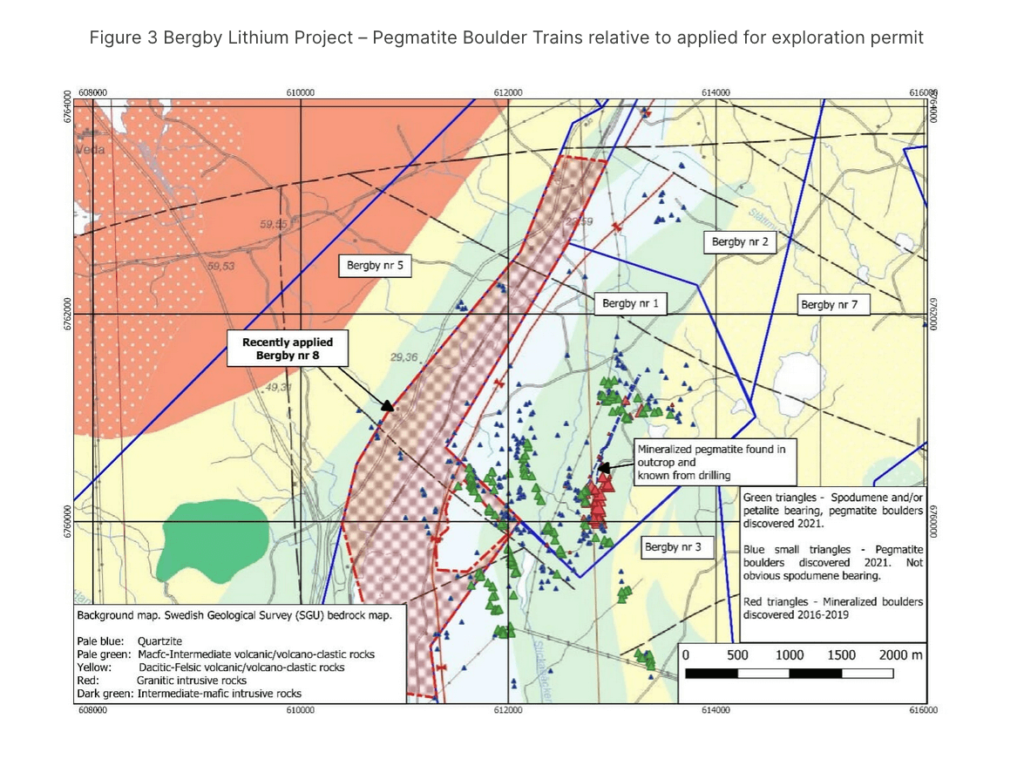

ULTH’s new 1,902-hectare Bergby property is a welcome light as makers scramble for supplies. That’s more than 8 square miles.

For a hard-rock lithium mine, that’s plenty of room when ore grades are high and intrusions are significant.

That’s how it is at Bergby…

This Brings Lithium Back to Its True Hard-Rock Roots

Sweden is a mining country, and that’s good for ULTH because it makes all the permitting, hiring experienced workers and other practicalities easier.

Mining is an important industry there. The majority of the population not only embrace it, they believe the government should support it.

In addition, United Lithium would be able to supply VW, its battery gigafactories or any other European manufacturer without tariffs and duties.

The mines in Sweden are mostly about iron, copper and gold. But lithium?

Actually, Sweden is where it all started.

Spodumene is the mineral that hard-rock miners crush and treat to extract lithium. The big mines today are in Australia, but the mineral was discovered in Sweden in 180018 . Brazilian scientist Jose Binifacio de Andrada e Silva came across this new rock while traveling in Sweden.

Like A Slice of Greenbushes in the Far North

Bergby is a small property compared to Australia’s vast Greenbushes open pit mine. But it’s big enough to send millions of dollars in production to market in coming years.

Take a side trip to the world’s largest hard-rock lithium mine to see why a “little” operation like United Lithium (CSE: ULTH, OTC: ULTHF) Bergby property could be worth multimillions…

In 2018, Greenbushes began what everyone called a “significant expansion.”

This new “Great Pit” was projected to raise mine production to 160,000 metric tons of lithium carbonate equivalent (LCE) per year. Before the expansion, Greenbushes’production was 80,000 tons LCE.

At today’s prices around $12,000 per ton, that extra 80,000 tons LCE is worth $960 million. Per year.

And how big is that expansion? It’s 2.8 km long by 1 km wide. About a third the size of Bergby.19

Of course, all of Bergby won’t end up as a working pit, but exploration has already shown rich potential.

Profit Potential Multiplier—Industry-Leading Recovery Rates

Lithium occurs all over Earth, but Spodumene is the mineral with the best concentrations for hard-rock mining.

Now ULTH is taking that one step further… the best mineral with the best processing.

It has nearly completed its bench testing for a new production method that yielded 99.1% pure lithium carbonate in tests.

Reality will be right around the same level.

This is not only extremely clean finished product, it produces lithium carbonate, which commands a better price than lithium sulfate.

Investors should admire the added profit potential from a method with better recovery rates (about 30% more than standard methods) and lower costs.

The new technology, developed with Process Research Ortech is greener. It works at lower temperatures with less chemical inputs. It not only uses less water, but it recycles the water to avoid waste.

Sampling Promises Great Outlook for Bergby

Until freezing weather stops work, ULTH is continuing to explore and test its property.

So far, it’s drilled 33 boreholes, and 27 showed good lithium grades.

So far, it’s drilled 33 boreholes, and 27 showed good lithium grades.

Geologists are looking for the highest concentrations on the property so they can plan the next stage. They’ve been following “boulder trains.” Those fan-shaped scatterings of rocks are left behind as glaciers moved in the prehistoric past.

These boulder groupings, according to United Lithium CEO Michael

Dehn, are like stations on a railway pointing us where to go.

The last round of samples came back with assays showing lithium grades as high as 2.54% Lithium dioxide and multiple samples over 1.3%.

Numbers like that are economic.

Better than that. They’re world-class amazing.

Bald Hill, one of Australia’s top hard-rock lithium mines, mines areas with as little as 0.3% of lithium oxide… its average grade is 1.0%.20

Early samples in other areas of the Bergby property are even richer than the recent ones.

Potential Unknown

United Lithium (CSE: ULTH, OTC: ULTHF) is exploring the site and will then map where to begin operations.

Because this is hard-rock mining, that could happen in a blink. Once permits are acquired—which is fairly straightforward and efficient in mining-friendly Sweden—work can begin within days.

So what could annual production come to? The comparable Greenbushes expansion area should deliver 80,000 tons LCE per year. Let’s scale that way back. Call it 5,000 tons of LCE per year to start at Bergby.

You’re looking at $6 million a year in production.

You could project it will be twice that high and still be reasonable.

But even at a rock-bottom projection you can see this is an opportunity of rare merit.

The land is rich. The team is experienced. The demand is off the charts. And you may never find ULTH at such a low price again.

Automakers Are Lining Up Capacity

The proposition is simple….

The proposition is simple….

Without batteries, the EV industry will stall.

Without lithium, there won’t be enough batteries.

That’s why all the world’s big automakers are locking down supplies and even building their own battery plants.

Ford and partners will spend $11.4 billion to build two battery plants in Tennessee and Kentucky.

GM is dumping $25 billion into EV technology including building two new battery plants.

As we already mentioned, Volkswagen, now the leader in EVs, has plans for six new battery plants in Europe.21

Europe is at the center of the EV revolution. And ULTH alone is squaring up to supply lithium from a European source.

And remember that the pace of EV buying you see on this chart will soon be out of date. Again. VW’s EV sales doubled this past year. Nearly 40% of US buyers are suddenly thinking about going electric.

There’s only one thing that can slow this trend now. … a shortage of lithium.

That’s why United Lithium (CSE: ULTH, OTC: ULTHF) is worth your most serious interest.

By next year, ULTH could be starting environmental permitting on the project and running pilot plant testing of their more robust and environmentally friendlier flow sheet. This under $1 stock will finally get the attention it merits. The time to act is now.

Could This Be The Last Year for “Cheap” Lithium?

There’s one thing missing from these estimates—facing reality about what soaring demand is doing to lithium prices.

In 2020, concentrate prices fell because of Covid-19 slowing the whole world down. Now demand is back and accelerating,

That $12,000 per ton of LCE figure we’ve used is probably ridiculously low. In 2017, prices hovered around $17,500 and sometimes went higher.

Fitch Solutions is already forecasting lithium prices at $15,000 a ton in 2022.22

There’s More At Stake than Cars

The switch from gas to EV cars is a huge trend, but there’s another force pushing lithium supplies. This one is moving much faster and the impact could be even bigger. Especially in Europe.

It’s buses.

Buses aren’t for poor people in Europe. Half to three-quarters of the residents in 16 of Europe’s largest cities use mass transit.

That’s going to put huge demand on lithium most people haven’t even thought about…

The timing couldn’t be better for United Lithium (CSE: ULTH, OTC: ULTHF) with its new lithium lode in Sweden. It’s poised to unleash badly needed new supplies just as the trend goes vertical.

One Bus Is Like 10 Teslas, Or More

One Tesla needs about 180 pounds of lithium for its 54 kWh engine.

But reportedly one new Irizar eBus built in Spain operates on a 525 kWh battery.23 A MAN bus battery pack ranges from 480-680 kWh.24

Those buses will need between 1,585 pounds and 2,244 pounds of lithium. Per bus.

Even small buses need huge batteries because the average bus travels 150-250 miles a day. And most of them are in operation all day—with no time to recharge.

That means it’s not just powerful onboard battery packs to consider. These buses need energy and huge power stations back at the garage for overnight charging.25

Lithium Is Still the One Absolutely Essential Mineral for EV Batteries

This is nothing but a boon for United Lithium and its European-based lithium property in Bergby, Sweden.

Just look at these numbers.

Europe already has more than 2,000 EV buses in service… and Mordor Intelligence expects 20% growth rate in Europe’s electric bus fleet through 2026.26

Now couple that growth with an average 250 kWh battery pack per bus (which is low). You can see how lithium will be mission critical and fast.

Growth in European E-Bus Fleets 2020 to 2026 27

Year # buses in Europe KwH

2020 2062 412,400

2021 2474 494,800

2022 2968 593,600

2023 3561 712,200

2024 5128 1,025,600

Companies are working on all kinds of tweaks to pack more power into smaller spaces and get more miles from a charge.

They’ve tested everything from nickel to tree resins. But the one mineral that is critical in every realistic variation is lithium.

8 Reasons You Should Be Excited About United Lithium (CSE: ULTH, OTC: ULTHF)

- Sole Access—Europe does not have any other lithium mine. ULTH’s Bergby property would be the first. The only one that could actually deliver lithium to processors by roadway in a few hours… or by taking a quick hop down the Baltic Sea.

- Tax and Government Advantages—As an EU country, Sweden does not encounter tariffs or trade barriers on any goods flowing to any other EU country, including Germany, France, and Spain, which are all home to major auto and bus makers as well as battery factories.

- Premium Ores—Successful hard-rock mines are in operation with ore grades as thin as 0.3% lithium oxide concentration. Even 1.0% is worth going after… which makes the Bergby samples with grades up to 2.5% and multiple samples coming in at 1.3% or higher a world-class find.

- VW, VW, VW Part I—the German automaker is on a mission to lead the EV revolution. It’s already passed Tesla and next year should pull clearly away. It plans to sell ONLY EV models in Europe by 2033.28

- VW Part II—Europe may be ground zero, but the automaker is developing a single scalable platform to unify EV manufacturing standards for all its models from mini-cars to large vehicles. It’s truly committed, pouring $845 million into research at its Wolfsburg, Germany plant. Going green is good, but VW says making EV’s is more profitable than making gas-engine cars, as well.

- Skeptics Are Converting—As the saying goes, nothing succeeds like success. People see EVs work. They are becoming so much more common that even 40% of American buyers now say they’re thinking of going electric. Europe is likely within a decade of going all electric.

- Before-the-Curtain-Opens Opportunity—United Lithium is still a “property.” It’s not a mine until operations begin, but that’s coming… most likely by the end of 2022. With all the noise from Tesla and large miners like Albemarle, ULTH shares are a bargain for a company that is looking at a very likely $6 million plus in annual revenues, possibly within months.

Bonus Reason—Management has 50 years combined experience. They know how to get a mine going. And they know how to react when big companies come calling. Whether they operate Bergby or sell at a profit, ULTH investors should be the winners.

Talk to your broker now. Share everything you’ve learned here… With the world’s crying need for new lithium and only one prospect in all of Europe, United Lithium (CSE: ULTH, OTC: ULTHF) deserves your serious attention.

1https://insideevs.com/news/465956/in-2020-volkswagen-group-sales-plugin-cars/

2https://cleantechnica.com/2021/05/14/europe-needs-over-30-battery-gigafactories-by-2025/

3https://www.cnbc.com/2021/03/15/vw-to-ramp-up-battery-production-with-six-gigafactories-in-europe-.html

4https://spectrum.ieee.org/evs-to-drive-a-lithium-supply-crunch

5https://www.institutionalinvestor.com/article/b1sdwwdh7zqkxl/can-lithium-supply-keep-up-with-strong-ev-demand

6https://www.institutionalinvestor.com/article/b1sdwwdh7zqkxl/can-lithium-supply-keep-up-with-strong-ev-demand

7https://www.washingtonpost.com/technology/2021/11/07/musk-twitter-tesla-stock/

8https://www.focus2move.com/world-cars-brand-ranking/

9https://www.electrive.com/2021/06/09/volkswagen-invests-another-e500mn-in-northvolt/

10https://www.reuters.com/business/autos-transportation/surge-electric-vehicle-sales-power-lithium-prices-shortages-loom-2021-09-13/

11https://www.cnbc.com/2020/11/18/morgan-stanley-upgrades-tesla-to-overweight-and-says-the-company-i.html

12https://www.fool.com/investing/2021/10/28/why-tesla-stock-jumped-on-thursday/

13https://www.barrons.com/articles/tesla-ford-gm-betting-big-ev-batteries-stocks-51635472423?mod=hp_MAG?mod=article_signInButton

14https://www.institutionalinvestor.com/article/b1sdwwdh7zqkxl/can-lithium-supply-keep-up-with-strong-ev-demand

15statista: 552 metric tones 2022 to 1001 metric tons 2025 = 81% https://www.statista.com/statistics/1225076/global-lithium-mine-production-projection/

16using $12,000 per ton LCE explained in detail farther down

17https://spectrum.ieee.org/evs-to-drive-a-lithium-supply-crunch

18https://www.azom.com/article.aspx?ArticleID=3505

19production numbers and expansion property size from https://www.nsenergybusiness.com/projects/greenbushes-lithium-mine/

20http://www.allianceminerals.com.au/projects/

21https://www.barrons.com/articles/tesla-ford-gm-betting-big-ev-batteries-stocks-51635472423?mod=hp_MAG?mod=article_signInButton

22https://www.investmentmonitor.ai/business-activities/extractive-industries/lithium-price-demand-environment-supply

23https://www.sustainable-bus.com/news/proterra-set-a-new-us-record-for-electric-bus-battery-capacity/

24https://www.sustainable-bus.com/news/proterra-set-a-new-us-record-for-electric-bus-battery-capacity/

25https://www.masstransitmag.com/bus/article/12131451/battery-bus-range-its-all-in-the-math

26https://www.mordorintelligence.com/industry-reports/europe-electric-bus-market

27https://www.sustainable-bus.com/electric-bus/electric-bus-public-transport-main-fleets-projects-around-world/

28https://www.greencarreports.com/news/1132743_vw-plans-to-go-all-electric-in-europe-as-soon-as-2033-us-later

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling United Lithium.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled United Lithium and has no information concerning share ownership by others of any profiled United Lithium. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any United Lithium or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the United Lithium. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled United Lithium’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding United Lithium future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to United Lithium industry; (b) market opportunity; (c) United Lithium business plans and strategies; (d) services that United Lithium intends to offer; (e) United Lithium milestone projections and targets; (f) United Lithium expectations regarding receipt of approval for regulatory applications; (g) United Lithium intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) United Lithium expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute United Lithium business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) United Lithium ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) United Lithium ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) United Lithium ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of United Lithium to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) United Lithium operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact United Lithium business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing United Lithium business operations (e) United Lithium may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of United Lithium or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of United Lithium or such entities and are not necessarily indicative of future performance of United Lithium or such entities.