This gem remains grossly undervalued being in Canada’s premier gold producing district.

Priced as a junior, yet it sits on world-class production potential in Red Lake, Canada elephant country.

Trillium Gold (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) is the largest claims holder in Canada’s largest historically proven gold region. But, few have taken notice.

This could be the most massively undervalued gold stock in the market today.

The numbers are stunning and why Trillium Gold remains trading at under $2.00 (CAD) is perplexing…and likely to be short-lived.

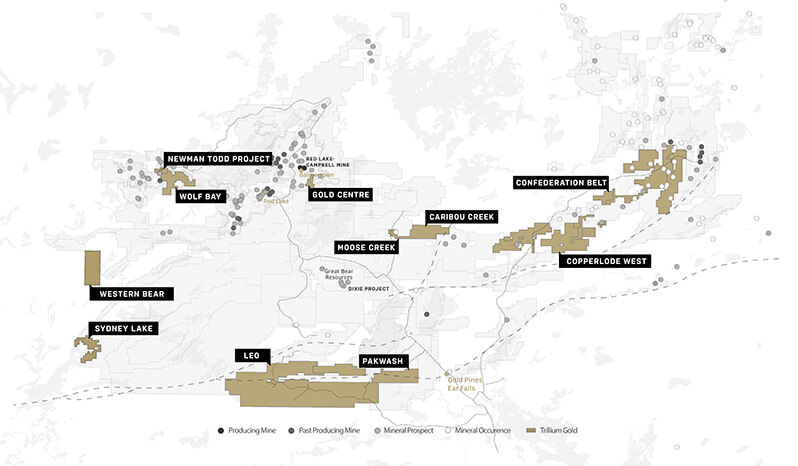

Trillium Gold (in tan) has grown to become the second largest claims holder in the Red Lake mining district where approximately 30 million ounces of gold has been produced to date with exploration discovery and production still growing. Red Lake now ranks among the richest gold districts found anywhere in the world. The company holds a net total ownership of 55,000 acres in total, throughout the district. (All prospects are 100% owned by Trillium Gold with the exception of Wolf Bay where the company holds a 50% net interest and Gold Centre where the company holds an 80% net interest.)

A simple analysis suggests that Trillium Gold stock should be trading well outside its current trading range of $1.90 (CAD); it makes no sense when you dig in and evaluate its potential.

Exploration is pending and the results could be stunning. Now is the time to consider if this could be an investment you’d take on for your wealth-building objectives.

The Red Lake mining district is world-class elephant country where volcanic activity in the distant past pushed millions of ounces of gold to near surface. It’s a site that’s unique in the world where gold production has already passed tens of millions of ounces worth billions at today’s gold price.

Gold ore grades found throughout the region are stunning, typically ten to twenty-times economical grades found elsewhere throughout North America.1And it continues to produce as new discoveries accrete enormous wealth to claims holders and investors.

A massive claims holder that remains totally off radar

Over the last few years, Trillium Gold (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) quietly and aggressively moved into Red Lake to become the largest landowner in the region behind Australia’s Evolution Mining (ASX:EVN $8.7AU Billion).2

Evolution has already scored big from its Red Lake holdings. The company completed its Red Lake acquisition in April, 2020 and now reports that it “…envision[s] a possible sustainable production rate of 300,000 – 500,000 ounces [gold] per year.” With a currently reported mine life of 13 years based on known resources, total production potential at this location alone totals upwards to 7.5 million ounces of gold.3

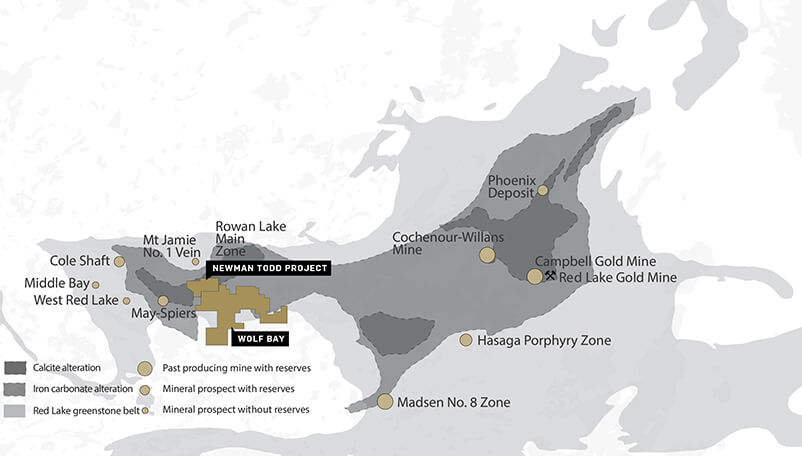

Important to note is that the Red Lake district holds highly concentrated gold bearing formations extending from the eastern most regions past Evolution’s holdings to a region westward of Trillium’s Newman Todd and Wolf Bay prospects. (See map).

This map shows distribution of the gold-bearing calcite and iron carbonate alteration within the 00 square mile Red Lake gold mining region. Also mapped is the Red Lake greenstone belt that underlies other Trillium Gold holdings detailed later in this report. Trillium Gold’s Newman Todd project sits squarely on the analogous geology that hosts Evolution’s Red Lake Gold Mine and its Cochenour-Williams mine, both of which are targeted for $100 million in additional work to develop its substantial resource potential.

Now that Trillium Gold (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) has achieved 100% ownership of the Newman Todd project, work can begin in earnest.

The company reports that it is launching its exploration and development program on a strong historical foundation. Exploration work dates back to the 30s and 40s, but technology and gold pricing at the time apparently dissuaded further work. Reports of trenching, drilling and bulk sampling results came to light 70 years later when modern exploration results were brought to bear.

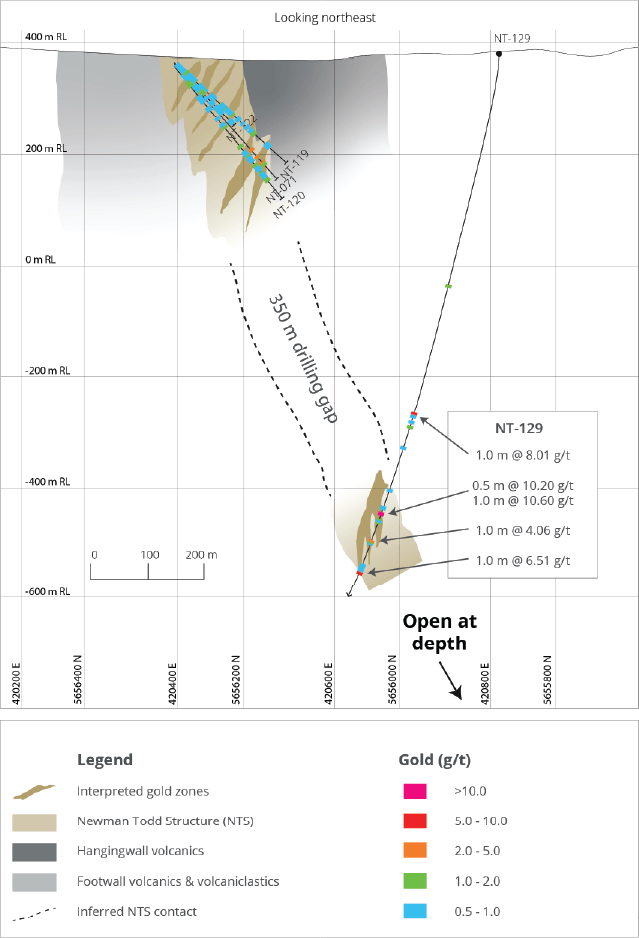

In 2011, targets were identified for 56 holes drilled to shallow depth restrained to less than 400 meters. By 2012, assay results from core samples returned stunning figures.

41% of the drill holes intercepted grades that exceeded 10g/t (grams/tonne) gold over varying interval lengths. That’s roughly ten-times the g/t grading that can be economically produced using current gold mining technology.

One hole designated “NT-114” hit an astonishing 681.0 g/t grade over a 0.5 meter length. Drill hole NT-162 hit 7.43 g/t gold across 10 meters! 4

One hole designated “NT-114” hit an astonishing 681.0 g/t grade over a 0.5 meter length. Drill hole NT-162 hit 7.43 g/t gold across 10 meters! 4

Aggregate results from this 2011/2012 exploration program identified multiple zones of high-grade gold mineralization. (Further exploration below that 400 meter limit could intercept even more.) These results are consistent with the early exploration data that can be expected from the Red Lake region, particularly from the calcite alteration that underlies Trillium Gold’s near neighbor, Evolution. Historical production records of 25 million ounces produced to date combined with future production projections combine to make their single Red Lake site a 32-million-ounce gold resource prospect.5

How valuable does this make Trillium Gold?

At present, Trillium Gold (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) appears substantially undervalued with a paltry $47 (CAD) million market cap, a market cap that belies its solid potential for tens of millions of ounces of potential gold discoveries.

This is not idle speculation. Major discoveries are consistent throughout this mining district. Its potential has been reinforced by earlier exploration work that intercepted stunning gold gradings.

In a recent interview, company management stated that:

“Back in 2013, when gold was between $1,300 and $1,500, Trillium Gold owned 50% of its flagship asset, Newman Todd. For acquisition purposes at that time Trillium Gold was valued at $100 (CAD) million. We consider this to be an important data point. As of November 25, 2020 Trillium Gold acquired 100% interest in the Newman Todd gold prospect. With gold near $1,850 (CAD) today, Newman Todd can now be valued around $270 (CAD) million when referenced to that 2013 valuation. Since our company goal is to de-risk this asset for acquisition, we believe that Trillium Gold’s current market cap of around $47 (CAD) million is significantly undervalued against this one underlying asset at Newman Todd. Bear in mind that the Newman Todd project is not our only asset that can accrue to shareholder value. Trillium Gold also owns, or has significant interest in more properties in the Red Lake area, the most prolific gold mining region in Canada.” 6

This is just getting started. There are seven Trillium Gold projects in total…all but one in the Red Lake mining district.

Not shown on prior map is Trillium Gold’s (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) Gold Centre prospect. What’s significant about this site is that it lies exactly on trend with Evolution’s Red Lake project…in fact, its boundary sits about a football field’s length from Red Lake mine workings.

Gold Centre sits as a gem in the making. Despite its proximity to Red Lake’s 32-million-ounce history and prospect, Gold Centre mineralization remains unexplored and undocumented. Geologically, Balmer volcanics intercepted in preliminary exploration prove analogous to the known gold-bearing structures at Red Lake and all along this trend.

Trillium Gold’s Gold Centre prospect lies squarely on the trend with Evolution’s Red Lake mine, within about 380 yards from the Red Lake #3 shaft. This is the same trend line that feeds production from Golden Eagle, McKenzie, Cochenour, and Campbell mines, which have been targeted by Evolution as part of its $100 million project development plans.

With such an exceptional location adjacent to a record-producing mine, Gold Centre holds enormous promise for resource development. Trillium Gold fully intends to launch in-depth exploration on the site, but has chosen to focus immediate attention on its Newman Todd prospect. This advanced project is much closer to achieving NI 43-101 certifications of the prospect’s resources needed to propel shareholder value. By setting that priority, Trillium Gold can more quickly drive its resource potential to certifiable results.

Looking beyond Newman Todd…

Newman Todd could be a powerful influence on Trillium Gold’s (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) near future stock price. But it’s not the only resource that could fuel future stock valuation.

The Gold Centre prospect holds stunning potential in addition to Newman Todd. Just look at its neighbors on trend. Less than six miles further northwest, the Golden Eagle mine sold in 2008 for a breathtaking $1.5 billion! This was a site that was priced in results tallied from 200 drill holes that looked exactly like the neighboring Cocheneur mine…which now logs in as a 2.5 million ounce mine.7

If Gold Centre sold for even half that amount, it could launch shares to over $14/share. That’s about ten times what Trillium Gold trades at today.

Please note, this is NOT an attempt to project a future value on Trillium Gold shares. Do not make a decision about Trillium based on this figure. Nothing known to date allows such a projection. However, this puts into perspective what the growth potential could be from a prospect in the Red Lake district.

And for those of you familiar with the profit potential in undiscovered junior resource companies, this is not atypical of a junior’s wealth building potential for early shareholders. (It’s why many leap at the chance to get in on an undiscovered gem like Trillium.)

One thing seems clear, the Red Lake district holds some of the most valuable real estate on the planet. This is the heart of the highest-grade gold camp in North America having produced more than 29.5 M ounces of gold at an average grade of 15.41 g/t Au during the past 91 years.8

And there’s more in the Trillium Gold prospect portfolio.

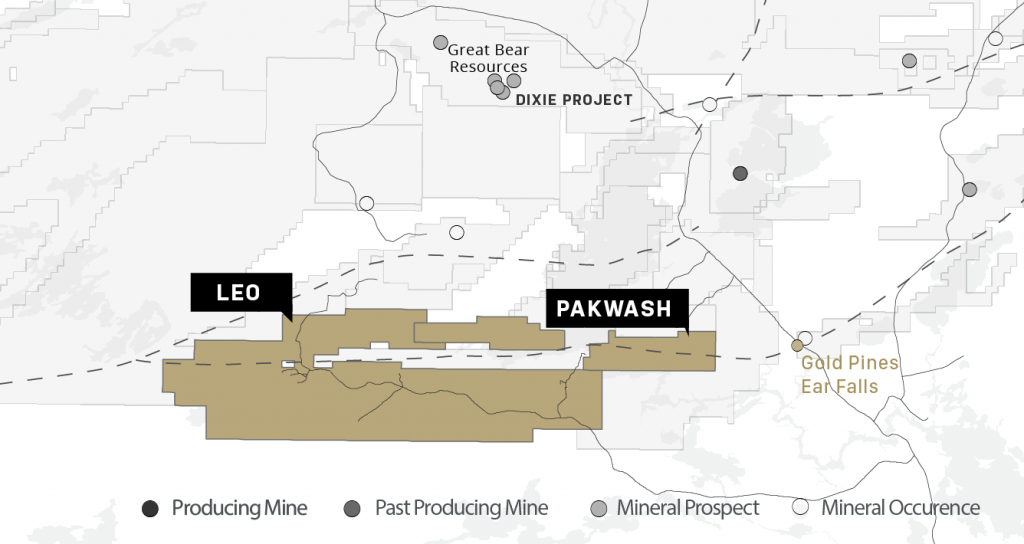

Trillium Gold’s Leo prospect is a massive holding that lies just a few kilometers south of Great Bear Resources Dixie mine, also in the Red Lake mining district. The Leo prospect is a “greenfield” project meaning that despite its very favorable geology and proximity to known resources and production, it remains unexplored. Trillium Gold management acquired 100% interest in Leo with the long-term view of its exploration potential.

Historical work identified numerous locations within Leo’s boundaries for mineralized channels and concentration of gold and other metals typical in volcanic formations. These include multiple gold deposit types that with further exploration could prove to become substantial resources. It’s a large property accessible by road, which provides good transportation for equipment, supplies and personal needed in pursuit of an exploration program. Additionally, accessibility adds much value in any future buyout.

Next on Trillium’s list are Western Bear and Sydney Lake prospects. These claims are located near the Sydney Lake fault, a trend that hosts the multiple mineral occurrences and prospects in the Dixie Lake area. This includes the Great Bear Resources Dixie project, a site that Great Bear reports has, “…completed 180 of approximately 300 planned drill holes into the LP Fault target, as part of its 5 kilometre long by 500 metre deep grid drill program. Gold mineralization has been intersected in all (100%) of the drill holes for which assays have been returned to-date.” (Emphasis in original.) 9

Also in the Trillium Gold (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) portfolio is the Shining Tree prospect, which lies outside the Red Lake district in the also productive Kirkland Lake mining district. Located in the famed Matachewan -Kirkland Lake mining district.

Kirkland Lake has risen to become a major gold-bearing resource where exploration to date has documented 111 million ounces of gold in resource estimates. Aggressive exploration continues throughout the region and Trillium Gold management believes that holding this well-positioned prospect within the Kirkland Lake mining district will eventually accrue significant additional value to the company’s shareholders.

How valuable could Trillium Gold be in the near future?

With this portfolio of exceptional land assets, Trillium Gold appears to be significantly undervalued at present, but that assessment is based entirely on future prospects that may not bear out as planned. As with any early-stage gold resource company, future value is almost entirely based upon discoveries of gold resources in the ground…certified in NI 43-101 reports. Trillium Gold has yet to file a 43-101 resource certification, so its potential for significant future growth must be characterized as highly speculative. However, situated with substantial holdings in one of the world’s largest and most productive gold districts, it may simply be a matter of time before future certifications are made public and trigger anticipated share price movement.

What to do now…

Why Trillium Gold (TSXV: TGM | OTCQX:TGLDFTSXV: TGM | OTCQX:TGLDF) has not yet gained traction in the market remains a mystery. It could be that with all the explosive developments in the Red Lake mining district, its larger neighbor, Evolution Mining, simply cast a big shadow. That can’t last long.

Trillium Gold management has targeted its Newman Todd project for advanced exploration; news of discoveries and subsequent resource reports can be anticipated. Today is the ideal point to begin looking into Trillium Gold’s investment potential. Get started with your due diligence now beginning first on the company website here.

While on site, be sure to provide your email address for future news and updates that the company releases through its email database. This will keep you ahead of any news that might drive stock prices.

Get started now at the company website.

Go to trilliumgold.com and don’t forget to leave your email address for future news and updates.

1 https://en.wikipedia.org/wiki/Red_Lake_Mine “The Red Lake Mining District has produced over 22 million ounces of gold through 2004, worth over $US 35 billion at 2014 prices. The two principal mines, Campbell and Red Lake, both have historic ore grades averaging about 0.57 oz/ton Au (22 g/tonne).”

2 https://www2.asx.com.au/markets/company/EVN

3 https://evolutionmining.com.au/wp-content/uploads/2020/08/Red-Lake-fact-sheet-FY20_LR.pdf

4 https://trilliumgold.com/newman-todd/

5 https://evolutionmining.com.au/red-lake/

6 Paraphrased from client email quote, 11-11-20

7 11-11-20 email

8 https://trilliumgold.com/gold-centre/

9 https://greatbearresources.ca/projects/overview/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Trillium Gold Mines Inc.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.