ADVERTISEMENT

This gem remains completely overlooked, yet could be worth billions. Priced as a junior, yet it sits on world-class production potential in Red Lake, Canada elephant country.

We may have found the most massively undervalued gold stock in the market today.

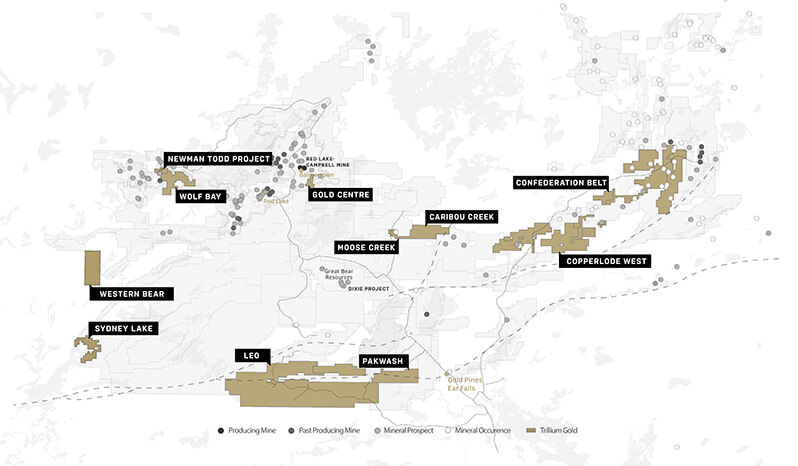

Few have taken notice while this gold producer has moved into position as the second largest claims holder in Canada’s largest historically proven gold region.

A simple analysis suggests that their stock should be trading well outside its current trading range of $1.50 (CAD); it makes no sense when you dig in and evaluate its potential.

The Red Lake mining district is world-class elephant country where volcanic activity in the distant past pushed millions of ounces of gold to near surface. It’s a site that’s unique in the world where gold production has already passed tens of millions of ounces worth billions at today’s gold price.

Gold ore grades found throughout the region are stunning, typically ten to twenty-times economical grades found elsewhere throughout North America.1 And it continues to produce as new discoveries accrete enormous wealth to claims holders and investors.

A massive claims holder that remains totally off radar

Over the last few years, this company has quietly and aggressively moved into Red Lake to become the second largest landowner in the region.

The company completed its Red Lake acquisition in April, 2020 and now reports that it “…envision[s] a possible sustainable production rate of 300,000 – 500,000 ounces [gold] per year.” With a currently reported mine life of 13 years based on known resources, total production potential at this location alone totals upwards to 7.5 million ounces of gold.2

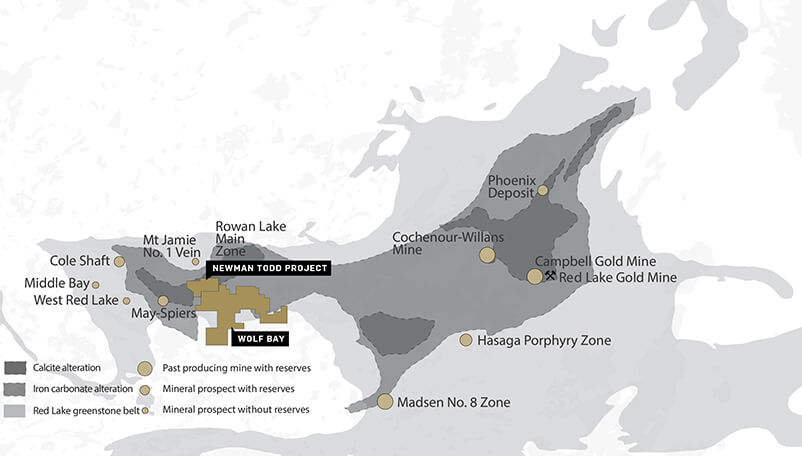

Important to note is that the Red Lake district holds highly concentrated gold bearing formations locally distributed across a 10 mile trend extending from the eastern most regions to a region westward of the Newman Todd and Wolf Bay prospects. (See map).

And now that they have achieved 100% ownership of the Newman Todd project, work can begin in earnest.

The company reports that it is launching its exploration and development program on a strong historical foundation. Exploration work dates back to the 30s and 40s, but technology and gold pricing at the time apparently dissuaded further work. Reports of trenching, drilling and bulk sampling results came to light 70 years later when modern exploration results were brought to bear.

In 2011, targets were identified for 56 holes drilled to shallow depth restrained to less than

400 meters. By 2012, assay results from core samples returned stunning figures.

41% of the drill holes intercepted grades that exceeded 10g/t (grams/tonne) gold over varying interval lengths. That’s roughly ten-times the g/t grading that can be economically produced using current gold mining technology.

One hole designated “NT-114” hit an astonishing 681.0 g/t grade over a 0.5 meter length. Drill hole NT-162 hit 7.43 g/t gold across 10 meters!

Aggregate results from this 2011/2012 exploration program identified multiple zones of high-grade gold mineralization. (Further exploration below that 400 meter limit could intercept even more.) These results are consistent with the early exploration data that can be expected from the Red Lake region, particularly from the calcite alteration that underlies their neighbors. Historical production records of 25 million ounces produced to date combined with future production projections combine to make their single Red Lake site a 32-million-ounce gold resource prospect.

At present, this company appears substantially undervalued with a paltry $47 (CAD) million market cap, a market cap that belies its solid potential for tens of millions of ounces of potential gold discoveries.

This is not idle speculation. Major discoveries are consistent throughout this mining district. Its potential has been reinforced by earlier exploration work that intercepted stunning gold gradings.

This is just getting started. The company has seven gold projects in total…and all but one is in the historic Red Lake mining district.

With such an exceptional location adjacent to record-producing mines, these seven projects hold enormous promise for resource development. One thing seems clear, the Red Lake district holds some of the most valuable real estate on the planet. This is the heart of the highest-grade gold camp in North America having produced more than 29.5 M ounces of gold at an average grade of 15.41 g/t Au during the past 91 years.3

Historical work identified numerous locations within the boundaries for mineralized channels and concentration of gold and other metals typical in volcanic formations. These include multiple gold deposit types that with further exploration could prove to become substantial resources. It’s a large property accessible by road, which provides good transportation for equipment, supplies and personal needed in pursuit of an exploration program. Additionally, accessibility adds much value in any future buyout.

Historical work identified numerous locations within the boundaries for mineralized channels and concentration of gold and other metals typical in volcanic formations. These include multiple gold deposit types that with further exploration could prove to become substantial resources. It’s a large property accessible by road, which provides good transportation for equipment, supplies and personal needed in pursuit of an exploration program. Additionally, accessibility adds much value in any future buyout.

With this portfolio of exceptional land assets, this junior appears to be significantly undervalued at present, but that assessment is based entirely on future prospects that may not bear out as planned. As with any early-stage gold resource company, future value is almost entirely based upon discoveries of gold resources in the ground…certified in NI 43-101 reports. While they have yet to file a 43-101 resource certification, it may simply be a matter of time before future certifications are made public and trigger anticipated movement.

What to do now…

This is a rapidly developing story that deserves your immediate attention. Why this undervalued company has not yet gained traction in the market remains a mystery. I urge you to sign up for our newsletter and learn the name of this little-known gold producer, before more news comes out, and as gold prices are finally taking off again.

1 https://en.wikipedia.org/wiki/Red_Lake_Mine “The Red Lake Mining District has produced over 22 million ounces of gold through 2004, worth over $US 35 billion at 2014 prices. The two principal mines, Campbell and Red Lake, both have historic ore grades averaging about 0.57 oz/ton Au (22 g/tonne).”

2 https://evolutionmining.com.au/wp-content/uploads/2020/08/Red-Lake-fact-sheet-FY20_LR.pdf

3 https://evolutionmining.com.au/wp-content/uploads/2020/08/Red-Lake-fact-sheet-FY20_LR.pdf

Legal Notice: This work is based on what we’ve learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Don’t trade in these markets with money you can’t afford to lose. Investing in stock markets involves the risk of loss. Before investing you should consider carefully the risks involved, if you have any doubt as to the suitability or the taxation implications, seek independent financial advice. Invictus News expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Invictus News, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast.