Gold prices have settled back from last year’s breakneck highs, but don’t expect that to last long. Trillion-dollar government deficits and panic over higher-than-expected inflation is triggering a new run on the shiny metal.

A rare combination of factors have come together in recent months that could make junior gold exploration stocks the play of the decade.

- The April CPI inflation reportfrom the Bureau of Labor Statistics confirmed the inevitable: Inflation is here, and it’s adding new stress to an already fractured economy.1

- Investors need to get up to speed in a hurry because pandemic and political headlines have buried this stunning news: The rate of inflation over the past year jumped to 4.2%— the highest level since 2008.2

- In the U.S., consumer prices increased by the most in 13 years as booming demand amid a reopening economy came head to head with bottlenecks in the supply chain3.

- Now, just as gold demand seems to be soaring in the face of trillion-dollar government deficits, small exploration company, Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) appears to have made a significant find.

There are many signs gold may be on the verge of another historic boom.

Since March 2021, the price of gold has been rising3, having already jumped 55%4 in the past three years, from $1,1875 an ounce to $1,836.6

In addition, the reappearance of gasoline shortages and lines in some states in the U.S. as well as skyrocketing commodity prices – not seen since the 1970s — have led to fears that hyperinflation may be on the horizon.

The U.S. Labor Department reported that consumer prices in the U.S. jumped 4.2% in the past year — the fastest rise since a 4.9% gain in the 12 months that ended in September 2008.

For certain commodities, prices have soared much higher. Lumber prices are up a staggering 280%7 as builders scramble for supplies amidst mass shortages. From steel and copper to corn and sugar, commodities are surging to levels not seen for decades.8

Plus, the unprecedented surge in the U.S. money supply – seen in the estimated $5.8 trillion9 in new deficit spending the Biden Administration has announced – could herald a weakening of the U.S. dollar.

Rising inflation and a falling dollar have historically been bullish for gold – but it is small exploration companies such as Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) that offer the best leverage to soaring gold prices.

All-Star Mining Team Just Delivered In A Big Way

Golden Independence just released an authoritative report on its flagship 640-acre project in Nevada -- located a quarter-mile from the hugely profitable Nevada Gold Mines (a joint venture of Newmont /Barrick).

Known as a Mineral Resource Estimate (MRE), the new report is the result of 69,000 feet of exploratory drilling in 176 holes.

Plus, the company just released an authoritative report revealing they control a lot of gold: a measured and indicated resource of 537,000 ounces of gold plus inferred resource of 945,000 ounces.

And for a small exploration company like Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) currently valued at under $10 million and selling for less than 20 cents per share, a discovery like this could represent potential windfall profits for investors.

Junior Gold Companies in Nevada, California and Arizona Have Seen Triple-Digit Gains in Recent Months

For example…

- Fiore Gold Ltd (OTC: FIOGF), with projects in Nevada and Washington State, jumped from $0.2610 per share in March 2020 to $0.97 per share in May 2021 – a gain of 273% in just over a year.11

- West Vault Mining (WVMDF), an early-stage exploration company with a project in Nevada, also saw its shares jump 209%12 in just over a year, from $0.3113 a share to $0.96.14

- The shares of Arizona Metals Corp (AZMCF), another exploration stage company, jumped from 46 cents15 last October 2020 to $2.3816 a share in May 2021 – a gain of 417%17 in less than a year.

- And since March 2020, KORE Mining (OTC: KOREF), with properties in California and British Columbia, is up a staggering 660%.18

Compared to similar companies at this stage of development, Golden Independence is way ahead of its peers – with drilling already completed and estimated resources of 1.5 million ounces.

Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) Was Already Hugely Undervalued BEFORE Release of This Resource Report

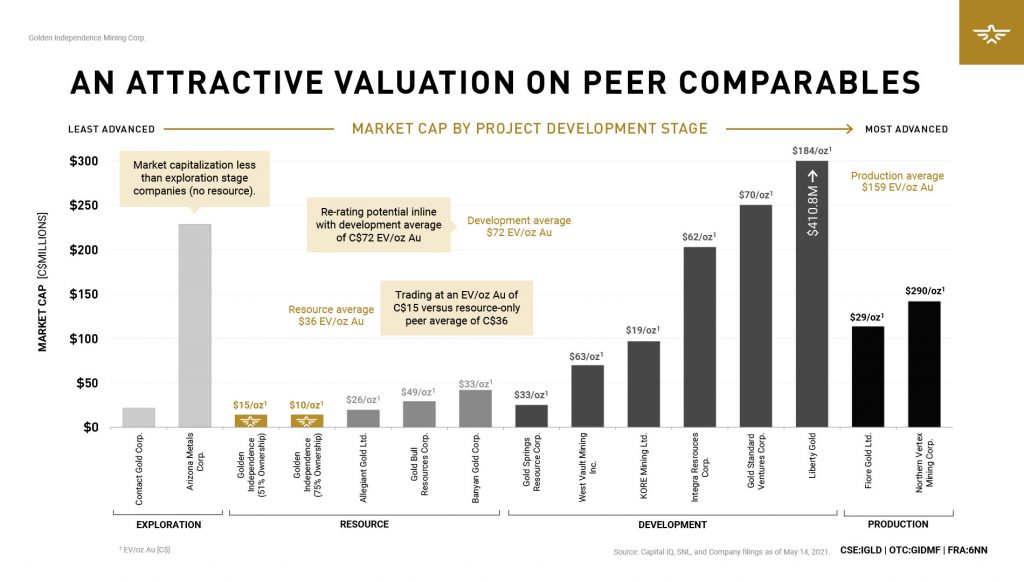

Golden Independence is now especially undervalued when you consider the amount of gold projected in the property — with a valuation of C$10 per ounce (market capitalization less cash divided by ounces) compared to resource-stage peers trading at over C$36 per ounce and development-stage peers up to C$200 per ounce.

Right now, Golden Independence has a market capitalization of under $10 million (C$12 million), a fraction of earlier-stage exploration companies with values in the C$40–50 million range.

These are companies that do not even have defined resources and therefore are a much higher risk.

It means that even if Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) had not found a single ounce of gold, investors could very well see a significant return just by the company’s share price catching up with those of its peers.

Yet as the recently released Mineral Resource Estimate indicates, Golden Independence has a lot more gold than it originally estimated – 1.5 million ounces in total.

Why Now is the Time to Invest in

Nevada Gold Exploration Companies

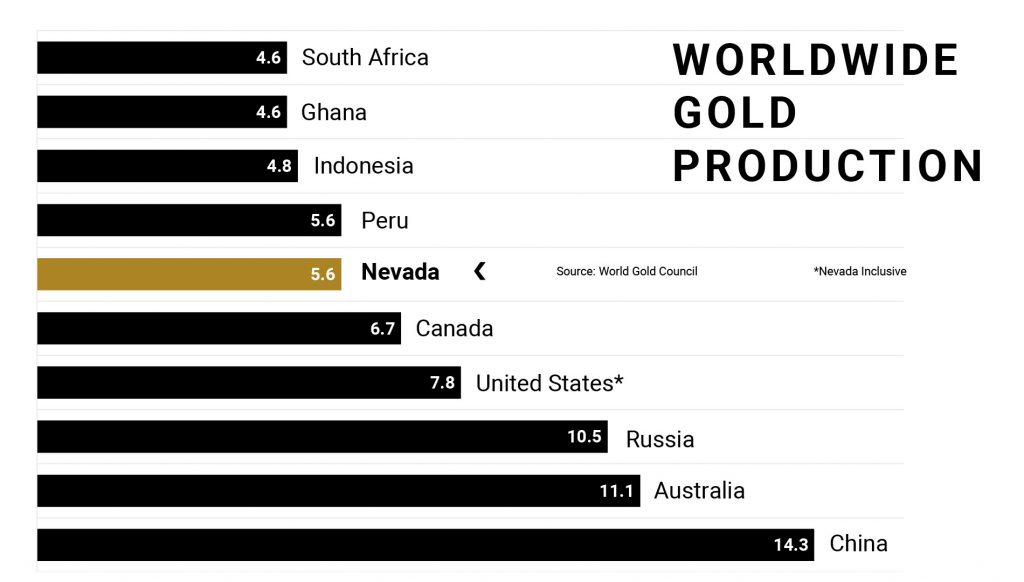

The United States is the 4th largest gold producing country in the world – and the State of Nevada is where more than 70% of gold production occurs within the United States.

According to the Annual Survey of Mining Companies, Nevada ranks as the number one mining jurisdiction in the world. That’s why the location is attractive to most gold investors.

Golden Independence is located about a tennis ball’s throw away from Nevada Gold Mine’s mega gold project, a joint venture between Barrick Gold and Newmont Gold, the world’s two largest gold producers. They’re expecting to produce 2.1 to 2.25 million ounces of gold this year alone!

This gives Golden Independence some significant advantages over other small gold companies, not only in mineralogy but also in permitting.

Exploration and mining companies are often harassed and ultimately shut down by environmental groups. But because Golden Independence is within Nevada Gold Mines plan of operations, the company can fast-track development.

What Does This Mean For Investors?

Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is currently trading at a 70% discount to its peers – and could be a very attractive candidate for a “swing for the bleachers” trade.

As governments continue to spend trillions of dollars and gold potentially soars past $3,000 and ultimately hits $5,000 an ounce, the payday could be extraordinary.

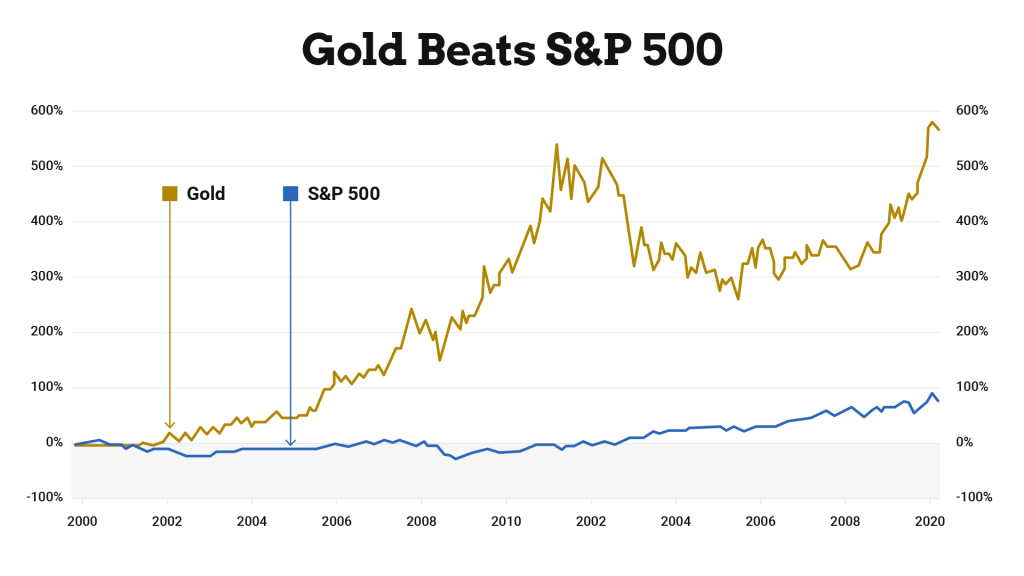

Savvy investors long ago realized that gold and gold stocks have far outperformed most other asset classes over the past 20 years.

TAKE A LOOK AT THE S&P 500:

Since January 2000, the index of America’s 500 biggest stocks has risen from 1,469 to 4,17319 – a total return of 184%20 or about 4.5% a year on average. In contrast, the price of gold has risen from $284 an ounce in early 2000 to $1,82821 in 2021 – a total return of 543%22.

The Profits on Gold Stocks Can Equal or Even Surpass the Huge Gains Made with Bitcoin

Cryptocurrency investors are reconsidering gold stocks as a hedge against rising inflation and the devaluation of the U.S. Dollar.

While Bitcoin has seen impressive gains recently – rising more than 552%23 since January 2020 – the right gold mining shares have done even better over time.

Plus, unlike the “here today, gone tomorrow” vaporware profits of cryptocurrencies, the gains in gold stocks are tied to a real physical asset – tons of gold metal being extracted from the earth.

In just the past five years, investors in gold shares have pocketed life-changing profits… profits that have not vanished into the Internet ether the way cryptocurrency gains sometimes do.

For example…

- Kirkland Lake Gold (KL) shot up from $4.90 a share at the end of 2016 to $41 today – a gain of 736%.24

- Maverix Metals Inc (MMX) was selling for just 8 cents per share back in June 2015 but quickly rose to $5.9525 per share today – a gain of 7,337%.26

- And Metalla Royalty and Streaming Ltd (MTA) skyrocketed from just 3 cents a share in December 2015 to $9.70 today – a gain of 32,233%.27

That’s enough to turn every $5,000 into as much as $1.6 million28 in five years.

Is such a scenario realistic or likely? No, of course not. What’s more, past performance is no guarantee of future results – and gold mining shares are just as much speculative investments as cryptocurrencies.

But the point is: If you’re looking for “swing for the bleachers” profits, they are more likely to be found in small gold mining shares than in cryptocurrencies. The profits can be just as staggering in some cases… and they don’t tend to disappear overnight the way cryptocurrency profits can.

IN SHORT: If you’re wondering how to protect your portfolio against a catastrophic collapse of the U.S. dollar but aren’t ready to bet the farm on cryptocurrencies, then gold and gold exploration stocks like Golden Independence are worth considering.

Eight Key Takeaways:

- Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is located in one of the best gold-mining locations in the world, next door to some of the most profitable mining operations in the world.

- It just released a Mineral Resource Estimate (MRE) that indicates its project has 5 million ounces.

- Gold is still a widely favored asset class to invest in during in times of uncertainty and rising inflation.

- Due to a record $6 trillion in proposed deficit spending in the U.S. by the Biden Administration, many experts predict that gold could soon hit record highs.

- While cryptocurrencies such as Bitcoin have seen 500% gains in recent years, some gold mining stocks have historically produced even bigger profits – as high as 6,700% or more.

- The smart money believes that we could be in the midst of the most significant gold bull market of all time – and are recommending junior gold exploration stocks for the biggest potential returns.

- Significantly undervalued compared to its peers and selling for less than $0.20 per share, Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) has the built-in potential to more than double your money just due to its low share price alone. If its drilling program goes as planned, then all bets are off. Shareholders could potentially see a substantial return.

1 https://www.bls.gov/news.release/pdf/cpi.pdf

2 https://www.reuters.com/business/us-consumer-prices-surge-april-2021-05-12/

3 Up about 10% from March 1 to May 15, 2021.

4 From $1,187 to $1,836 per ounce, https://percentcalc.com/

5 September 28, 2018, see https://ycharts.com/indicators/gold_price_in_us_dollar

6 As of May 15, 2021. https://ycharts.com/indicators/gold_price_in_us_dollar

7 https://www.msn.com/en-us/money/news/pure-panic-lumber-prices-up-a-staggering-280percent-as-builders-scramble-for-supply/ ar-BB1gnV9n

8. https://www.moneycontrol.com/news/business/markets/supply-shortage-soaring-demand-drive-up-commodity-prices-shankar- sharma-explains-backwardation-in-lumber-and-tin-6870901.html

9 https://www.nytimes.com/2021/04/28/us/politics/biden-spending-plans.html

10 03/23/2020. See https://www.barchart.com/stocks/quotes/FIOGF/price-history/historical

11 http://percentageincrease.com/

12 http://percentageincrease.com/

13 02/11/2020, $0.3100. See https://www.barchart.com/stocks/quotes/WVMDF/price-history/historical

14 https://www.barchart.com/stocks/quotes/WVMDF/price-history/historical

15 10/23/2020, Opened at $0.4667. https://www.barchart.com/stocks/quotes/AZMCF/price-history/historical

16 https://www.barchart.com/stocks/quotes/AZMCF/price-history/historical

17 http://percentageincrease.com/

18 From $0.10 a share on 03/16/2020 to $0.76 per share as of May 15, 2021. https://www.barchart.com/stocks/quotes/KOREF/price- history/historical

19 Updated as of May 15, 2021

20 Updated.

21 Updated as of May 15, 2021

22 Updated.

23 Updated: From $72,91 on January 3, 2020 to $47,606 on May 15, 2021 – a return of 552%.

24 Updated.

25 https://www.barchart.com/stocks/quotes/MMX/interactive-chart

26 Updated.

27 Updated.

28 Updated.

29 https://www.mining-journal.com/energy-minerals-news/news/1408535/lithium-prices-continue-to-rise

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Golden Independence Mining Corp.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP

The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Golden Independence Mining Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Golden Independence Mining Corp.’s industry; (b) market opportunity; (c) Golden Independence Mining Corp.’s business plans and strategies; (d) services that Golden Independence Mining Corp. intends to offer; (e) Golden Independence Mining Corp.’s milestone projections and targets; (f) Golden Independence Mining Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Golden Independence Mining Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Golden Independence Mining Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Golden Independence Mining Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Golden Independence Mining Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Golden Independence Mining Corp.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Golden Independence Mining Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Golden Independence Mining Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Golden Independence Mining Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Golden Independence Mining Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Golden Independence Mining Corp.’s business operations (e) Golden Independence Mining Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Golden Independence Mining Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Golden Independence Mining Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Golden Independence Mining Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

Historical Information

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Golden Independence Mining Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Golden Independence Mining Corp. or such entities and are not necessarily indicative of future performance of Golden Independence Mining Corp. or such entities.