Rampant Inflation, Economic Blockades and Political Upheaval Across Europe Sends Gold Soaring Towards $2,000

Editorial Feature | March 8, 2022 | Economy

- With Vladimir Putin pursuing plans to rebuild the Soviet Union, and military action tearing across Europe, the west has declared financial war with Russia.

- Escalating sanctions from the U.S. and European Union have blocked Russia’s Central Bank from using emergency reserves, and Russian banks from using the SWIFT network. Even Visa and Mastercard have joined in the action, barring a handful of financial institutions from their payment platform.

- Gold is no longer a special situation trade. A perfect storm of record high inflation, economic instability, and global conflict have sent gold prices on a tear.

- And its drawing renewed investor interest to undervalued junior gold explorers whose share prices failed to lift, even on news of major discoveries, while gold prices remained stagnant.

“People aren’t in this space to double their money. They’re in this space to make 10-fold their money.”

— Jan 29, 2021, gold stock tycoon Jeff Phillips

This is a rare moment for investors who have been sitting on the sidelines, waiting for gold to make its next big move.

And it’s centered around what could be the greatest mispriced gold opportunity of this or any lifetime. A stock that’s priced in pennies instead of dollars.

That’s why farsighted natural resource investors need to quickly focus on Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD).

Because, at this moment, most investors still think Golden Independence is an exploration company. It is not.

It’s found as many as 1.18 million ounces of gold in Battle Mountain, Nevada, that have a raw value of at least $2 billion.

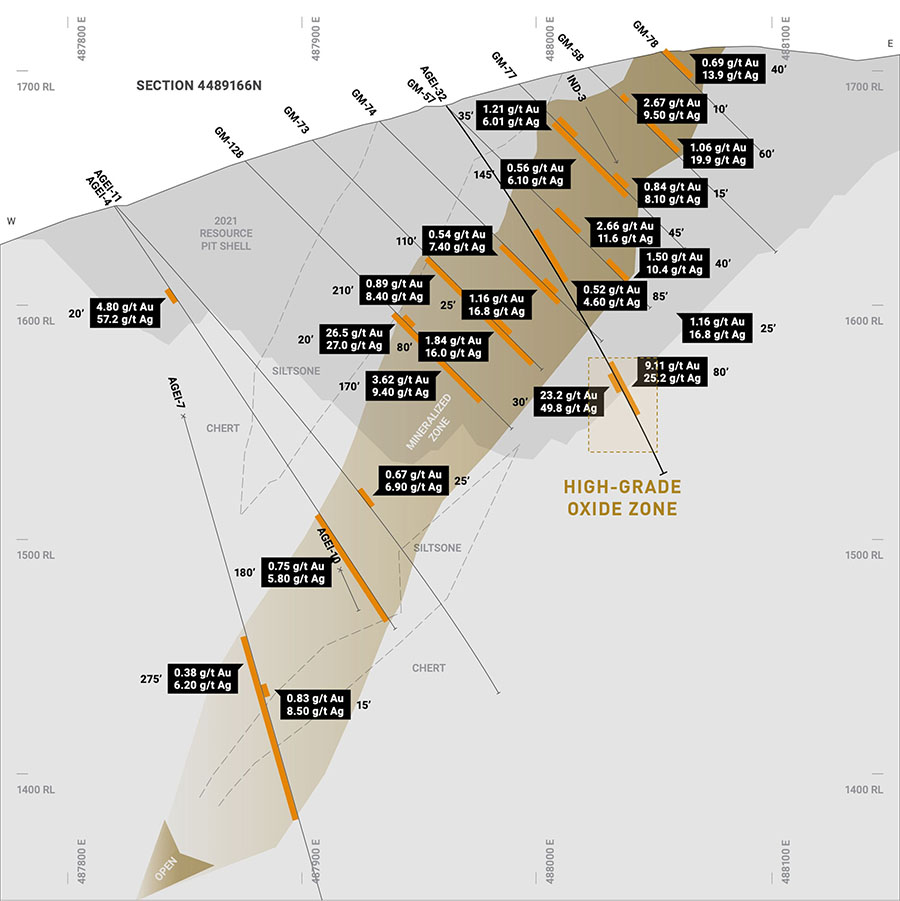

With more than 200 drill holes logged, and $37 million spent over the years, the company doesn’t need to explore anymore. Today it’s focused on developing a mine, which means it could be less than a year away from starting mining operations.

The first step would be to grab the estimated 195,443 ounces of near-surface gold, which, after the cost to mine it, could generate about $198 million in operating cash flow at today’s prices.

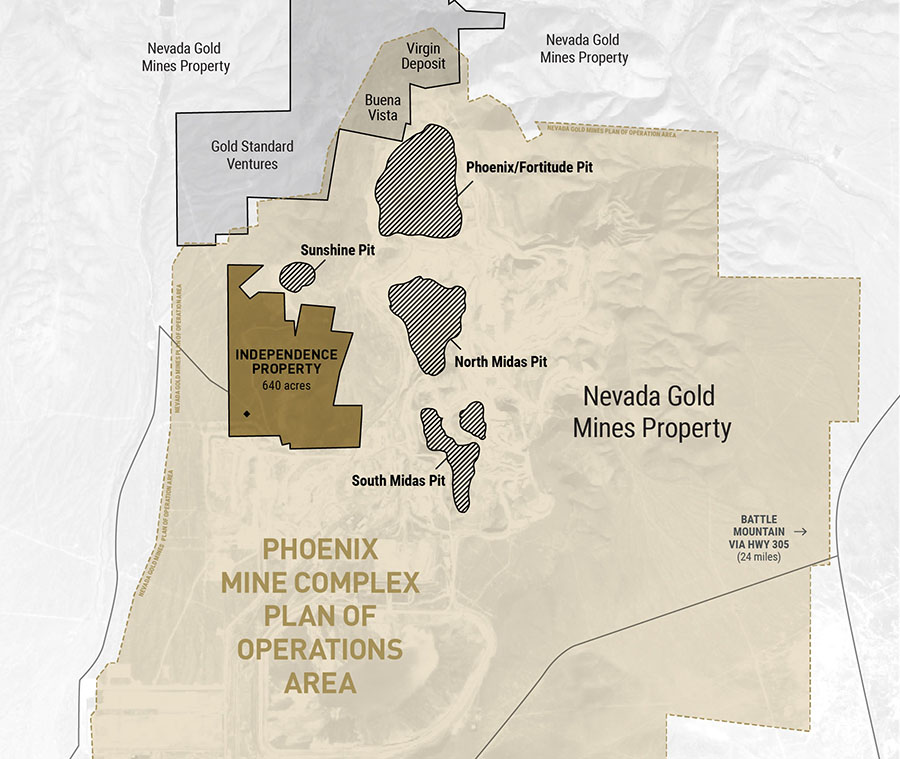

There’s a big reason confidence is so high in Golden Independence’s future. In order to get to its developing mine, you have to drive through the security gate at Barrick Gold’s massive Nevada Gold Mines project. The two properties are so close they share the same access road.

It also means that Golden Independence can ride Barrick Gold’s coattails for environmental and water approvals and permits because the entire project resides within Barrick’s permitted Plan of Operations.

This could be the brief moment before could Golden Independence files for the permits that would allow it to mine a proven gold-rich Nevada property.

The Results Are Beyond Encouraging

Unless you rent a helicopter, there’s only one way to approach Golden Independence’s Battle Mountain, Nevada property. You must drive through Barrick Gold’s security gate.

Barrick’s Nevada Gold Mines open pit is a third of a mile from Golden Independence, and Barrick engulfs their property on all sides. Barrick has claimed it intends to mine 2 million ounces a year from its Nevada properties, and so far it has been hitting that goal.1

As a small company, Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) has more modest goals. Plans for its initial foray into Nevada mining call for a near-to- surface mine.

It’s one, however, that could be extremely lucrative.

A 2021 Preliminary Economic Assessment outlined a low-cost mine, with a six- year life with a total production of 195,443 ounces of gold. The assessment figured it would cost $1,078 all-in to mine each ounce of gold.

From an investor’s point of view, that means Golden Independence could be sitting on about $198 million in operating cash flow or $31 million a year.

$28 Million Worth Of Silver Sitting Under The Surface

One of the great things about gold mining is that there are usually other metals buried in all that dirt and rock that’s being dug up.

A lot of times it’s copper. But in the case of Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) it’s a silver lining.

Because the same 2021 Preliminary Economic Assessment that estimated all the gold near to the surface also produced 1.3 million ounces of silver.

Today, silver trades in the $25 range. People don’t typically look at silver as a store of wealth or a hedge against inflation, so let’s set the potential value of this huge pile of silver at the 10-year average of $22.10.

That comes out to be a $28.3 million bonus.

Another $1.6 Billion In Underground Gold

For a small company like Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) that’s the kind of profit that could finance the operations that goes after the big game hidden deep in the earth.

There could be, at today’s prices, about $1.6 billion in gold underground in Golden Independence’s Battle Mountain property.

After more than 200 drill holes were logged, to the tune of $37 million spent over the years, the company reported in a regulatory filing that as of December 2021 it had an Inferred Resource of 796,200 ounces of gold.

For a small exploration company like Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) currently valued at under $10 million and selling for less than 10 cents per share, a discovery like this could represent potential windfall profits for investors.

And it’s all due to big-gain hunters’ favorite word… “leverage.”

The Power Of Leverage

While gold prices are now soaring at an outrageous pace, it’s actually the smaller gold stocks that look to have the longest runway.

Because while the price of gold has jumped 16% in the past year… the shares of junior gold explorer stocks have the potential to soar 10X, 50X, even close to 100X higher than that.

More than just about any other business class, a junior exploration company’s value grows sharply and predictably as its projects progress through each stage from discovery to mineable resource.

Milestones like drill or assay results, resource expansion, or in the case of Golden Independence, expectations of near-term production, can light a fire under share price. And it happens fast.

For example…

- West Vault Mining (OTC: WVMDF), an early-stage exploration company with a project in Nevada, also saw its shares jump 165% in two years, from $0.35 a share to $0.93.

- The shares of Arizona Metals Corp (OTC: AZMCF), another exploration stage company, jumped from $0.70 last January 2021 to $5.27 a share in March 2022 – a gain of 650% in just over a year.

- And Goldquest Mining (OTC: GDQMF) is up almost 200% in the last 6 months, between October 2021 and March 2022

When you look at all these gains, what should jump out to you is that they represent a master class in the power of leverage.

Because, while gold stalled through most of 2021, investors could have cashed in sensational gains with these junior gold stocks.

That is the power of leverage… and the way 2022 is shaping up, your leverage with junior gold stocks such as Golden Independence will only gain strength.

That’s because the forecast is for gold prices to make history again… to jump past the all-time high of $2,036.

What Does This Mean For Investors?

Compared to similar companies at this stage of development, Golden Independence is way ahead of its peers – with drilling already completed and estimated resources of 1.3 million gold-equivalent ounces.

Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is currently trading at a 70% discount to its peers – and could be a very attractive candidate for a “swing for the fences” trade.

As governments continue to spend trillions of dollars and gold potentially soars past $3,000 and ultimately hits $5,000 an ounce, the payday could be extraordinary.

That Is why there are…

9 Reasons Why Both Gold Investors And Trend Investors Need To Put Golden Independence (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) On Their Radars Now

- Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) is located in one of the best gold-mining locations in the world, next door to some of the most profitable mining operations in the world.

- It just released a Mineral Resource Estimate (MRE) that indicates its project has 1.18 million ounces of gold plus 7.6 million ounces of silver.

- A 2021 Preliminary Economic Assessment outlined a low-cost mine, with a six-year life with a total production of 195,443 ounces of gold. From an investor’s point of view, that means Golden Independence could be sitting on about $200 million in net profit just from the surface alone.

- The same assessment found that, at today’s prices, there could be about $1.6 billion in gold deeper in Golden Independence’s Battle Mountain project.

- Gold is still a widely favored asset class to invest in during in times of uncertainty and rising inflation.

- Due to a record $6 trillion in proposed deficit spending in the U.S. by the Biden Administration, many experts predict that gold could soon hit record highs.

- While cryptocurrencies such as Bitcoin have seen 500% gains in recent years, some gold mining stocks have historically produced even bigger profits – as high as 6,700% or more.

- The smart money believes that we could be in the midst of the most significant gold bull market of all time – and are recommending junior gold exploration stocks for the biggest potential returns.

- Significantly undervalued compared to its peers and selling for less than $0.10 per share, Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD) has the built-in potential to more than double your money just due to its low share price alone. If its drilling program goes as planned, then all bets are off. Shareholders could potentially see a substantial return.

This could be that golden moment when a small gold explorer hits the big time.

Just as a confluence of events drives the price of gold higher… global conflict, meets a weak dollar, high inflation, and spiking national debt.

Gold thrives during times of fear and inflation. It could be heading to $4,000.

Talk to your broker or adviser about this trend… it’s likely they’ll show you the same research you’ve just read here.

The facts are lining up. Now is the ideal time to make a move on Golden Independence Mining (OTC: GIDMF, CSE: IGLDOTC: GIDMF, CSE: IGLD).

1https://www.barrick.com/English/news/news-details/2022/barrick-delivers-on-production-targets-for-the-third-consecutive-year/default.aspx

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Golden Independence Mining Corp. (“IGLD”) and its securities, IGLD has provided the Publisher with a budget of approximately $100,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by IGLD) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company IGLD and has no information concerning share ownership by others of in the profiled company IGLD. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to IGLD industry; (b) market opportunity; (c) IGLD business plans and strategies; (d) services that IGLD intends to offer; (e) IGLD milestone projections and targets; (f) IGLD expectations regarding receipt of approval for regulatory applications; (g) IGLD intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) IGLD expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute IGLD business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) IGLD ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) IGLD ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) IGLD ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of IGLD to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) IGLD operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact IGLD business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing IGLD business operations (e) IGLD may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Golden Independence Mining Corp.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Golden Independence Mining Corp. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Golden Independence Mining Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Golden Independence Mining Corp. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Golden Independence Mining Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Golden Independence Mining Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Golden Independence Mining Corp. industry; (b) market opportunity; (c) Golden Independence Mining Corp. business plans and strategies; (d) services that Golden Independence Mining Corp. intends to offer; (e) Golden Independence Mining Corp. milestone projections and targets; (f) Golden Independence Mining Corp. expectations regarding receipt of approval for regulatory applications; (g) Golden Independence Mining Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Golden Independence Mining Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Golden Independence Mining Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Golden Independence Mining Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Golden Independence Mining Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Golden Independence Mining Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Golden Independence Mining Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Golden Independence Mining Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Golden Independence Mining Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Golden Independence Mining Corp. business operations (e) Golden Independence Mining Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Golden Independence Mining Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Golden Independence Mining Corp. or such entities and are not necessarily indicative of future performance of Golden Independence Mining Corp. or such entities.