Investment Mega Trend Alert!

How Social Distancing And Covid-19

Created A Surprise 12X Investment

Opportunity That No One Saw Coming

IT MAKES SENSE – That’s because open water and lots of fresh air are today’s ultimate social distancing activity.

LOW-PRICED SHARES – Now, a young company, new to the stock market, has breakthrough artificial intelligence that could forever revolutionize recreational boating, all as it rewards its earliest investors.

A $42 billion industry is at the heart of remarkable new investment opportunity that’s both sudden and unexpected.

This is a high-potential mega-trend investment.

But it’s only for people who’ve accepted a new pandemic-lifestyle reality: Covid-19 has scrambled much more than work life and school life.

It’s changed the whole idea of what it means to be safe.

That’s why what you’re about to see is one of the few ways to invest in the worldwide social distancing mega trend.

Because, today, people are fleeing stifling, close-quarter, virus-incubator cities in search of more wide open spaces in the suburbs.

Millions of Americans had family Thanksgiving dinners outdoors, for safety reasons alone.

And they’re turning their backs on close-contact soccer, softball, and bowling leagues and are flocking to less crowded pursuits such as golf, tennis, camping, and boating. 1 2 3

Maritime Mania, A Sudden Investment Trend

The biggest trend, however, is that people are adapting. And that’s caught boating industry off guard.

Because, after assuming the pandemic would keep people pinned indoors, the boating industry looks to be the biggest winner.

Fortune magazine said this, “As stir-crazy Americans take refuge on the water, the boat industry is booming.”4

As USA Today put, “Everyone is buying boats’ during the pandemic, and it’s causing a short supply.”5

And, as The Associated Press reported this, “Crush of boat buyers seek recreation, safety during pandemic.”6

Boatim Inc. (OTC:BTIMOTC:BTIM) Fills A Critical Need

This is why aggressive investors need to quickly turn their focus to Boatim Inc.

Boatim is a high-tech startup disguised as a boat brokerage company, that is now also eying the vacation boat charter and rental market.

The most exciting aspect of its operations is the AI based data analytics model, which is first of its kind to be introduced to the vast boating market. The product plan is modeled very much like world-famous Airbnb, and VRBO, both short-term home rental companies driven by cutting-edge software.

As Airbnb and VRBO prove, unlike with sales, short-term rentals can generate explosive profits.

Airbnb is set for a Nasdaq IPO. Even amid the Covid-19 pandemic it just booked $219.3 million in third-quarter profit.7

VRBO, or Vacation Rental By Owners, is part of the Expedia Inc.(EXPE) conglomerate, which sports a $17 billion market cap and a share price around $120.8

Outrageous Demand, Scant Supply

That’s because Boatim’s boat brokerage, combine with its future short-term rental platform, form a powerful sweet spot aimed at relieving today’s most critical industry problem – lack of supply.

In fact, Boatim (BTIM) is en route to meet pent up demand by its rapid growth of new listings since it rolled out its Smart Connect Inventory™ tool a few weeks ago. just with the current and extensive listings its online brokerage offers.

Since then, more than 160 new dealers, amongst them a few of the biggest in the US, have signed up. Pop-Yachts alone brought the large part of of more than 3,000 boats from its extensive inventory live on Boatim´s online brokerage. Sources confirmed that, with its applied AI Boatim (BTIM) completed a task in a matter of hours, that would usually require weeks of tedious manual labor. After all, the more than 2,500 pages of boats for sale on its website are only a first indicator of what Boatim´s (BTIM) data-driven products are capable of accomplishing for the boating industry.

It all adds up to the fact that a pandemic-fueled supply crisis should be music to Boatim investors’ ears

Because, from Florida, to Connecticut, to Missouri to California, boat dealers are swamped with sales demand that has outstripped supply.

Part of that is due to factory shutdowns last spring as the pandemic emerged.

But, mostly, it’s the crazy demand that’s causing shortages as The New York Times found in July when it went to Kelly’s Port, a boat dealership in Osage Beach, MO.

The dealer was way down to less than five percent of its usual inventory.9

“We know there are a lot of people hurting right now,” Ryan Kelly said. “But speaking on dollars and cents, we’ve never ever, ever seen boat sales like this.”

Chuck Cashman, the chief revenue officer of the nationwide boat dealership MarineMax (HZO), was feeling the same stress.

“In this social isolation, there’s so few things you can do that are exciting, and boating is one of them.”10

He said at MarineMax, which has 64 locations in 23 states, sales are up in every single category.11

Soaring Stock Prices

A look at MarineMax’s share price tells the story better than Cashman can.

MarineMax (HZO) share price rocketed 242%, from $9.30 on April 1 to $31.87 on November 17.12

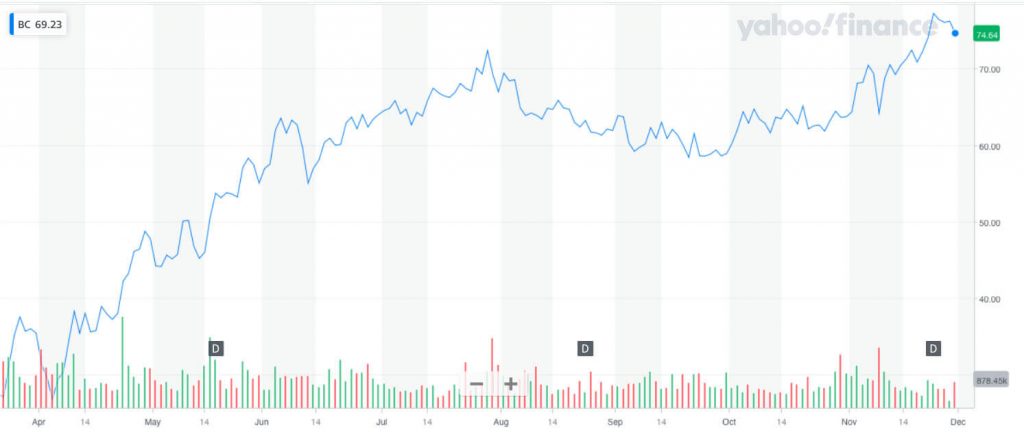

The unprecedented demand also finds Brunswick Corp. (BC) tooling up to build more boats, as its CEO David Foulkes told CNBC’s Jim Cramer on October 30.

Brunswick, which makes Mercury, Mariner, Boston Whaler, and Bayliner, saw its share price more than doubled from $30.29 in April to $72.43 on November 17.13

“We did not have enough pipeline inventory to serve that… which means that we are ramping up as fast as we can in all of our production facilities,” Foulkes said.14

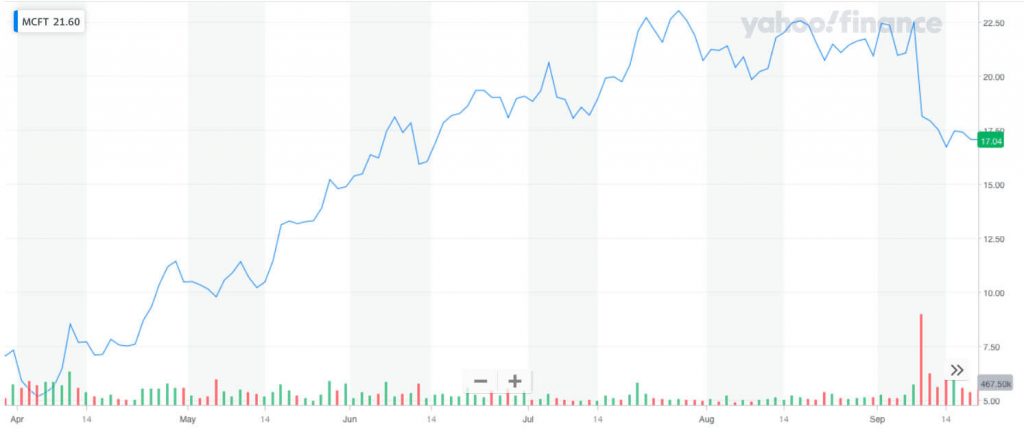

The story is even better at Mastercraft Holdings (MCFT) where shares have soared 372%, from $5.63 on April 1 to $23.62 on November 17.15

And, you can find similar good news at Malibu Boats Inc. (MBUU).

Its share price has more than doubled from an April low of $21.20 to $58.23 on November 17.16

Even the industry’s laggard, Marine Products Corp. (MPX), saw its shares jump 111% over the same time frame.

Boatim: Ready To Tap Its Vast Potential

Look no further these outstanding stock-price jumps for solid proof that investors need to pay close attention to the boating industry.

And, they especially need to keep a sharp eye out for Boatim Inc. (OTC:BTIMOTC:BTIM), the industry’s newest publicly traded upstart with a share price around $1.

Moreover, investors also need to consider Boatim as a long-term play and not just a potentially skyrocketing pandemic play.

That’s because there’s more than just social distancing fueling this mega trend.

Boating was huge even before the Covid-19 pandemic stressed the industry’s supply chain.

More than 140 million Americans go boating every year… a number believed to be even higher now since many discovered the boating lifestyle for the first time in 2020 due to the pandemic.

The total boating industry is estimated at $120bn annually in the US – making about half of the global total market, which Boatim goes for with its digital products..

Families and friends have registered 15 million recreational boats in the U.S., more than 70% in the up to 26ft size range.

The overall U.S. numbers jumped by8% to 260,000 in new-boat salesin 2019. The average price point was $55,000 with total new-boat sales topping $14 billion.

At the same time nearly 1 million pre-owned boats , $15 billion in total sales, changed hands at a $15,000 average price.

For those who don´t want to buy a boat right away, the sharing and charter industry also has lots in stake – double digit growth rates of between 12%-17% per year outperform most other markets by far.

All that action is made to order for Boatim’s breakthrough, artificial intelligence enhanced and data analytics driven digital boating products.

Breakthrough Technology Is Disruptive

Boatim´s technology was built by a team lead by two of Europe’s top SaaS, software as a service, developers – Patrick Heneise and Chris Roy.

Heneise is Boatim’s Chief Technology Officer. His team built the serverless architecture, which is backed by ElasticSearch, Couchbase, CouchDB, Firebase, PostgreSQL, and NoSQL databases.

Roy is Boatim’s new Chief Products Officer. His extensive portfolio includes designing novel software for the likes of TescoBank, Sumerian, GFI Software, Axios Systems or Skyscanner. His last firm, TravelPerk, raised more than $100m and scaled their developer staff from 20 to over 500 people, he knows how to keep up with big momentum.

Roy and Heneise are two of the leading heads of Boatim’s tech, product and marketing team, who foresaw the many opportunities for digital innovation in an industry that´s been somewhat legging behind when it comes to adjusting to a generation shift in buyers and users – the Generations Y1&Y2 are all digital and Boatim digital boating products perfectly cater to this new generation of users.

Its algorithms are designed to handle complex tasks and make judgments and decisions based on real-world experience, which, of course, also enhances human performance.

Think about all the steps it takes to buy a car, multiply that difficulty for buying a boat, then you can easily understand why Boatim (BTIM) will put its data analytics and algorithms next onto items like boat financing, party verifications, streamlined valuation reports and so on – at the end, all you will have to do is push a button in your Boatim app to close the deal when you go to pick up your new boat. And Boatim will handle all the rest and keep track of things for you and the boat going forward.

Right Down To The Last Bolt

Because, save for one step, Boatim’s digital tools will be able to change the entire experience of buying and owning a boat for the better.

On the simple end of things, Boatim’s tech matches buyers’ needs with sellers’ boats – paying attention to what´s relevant for each buyer, providing guidance on the process and best fit – from data learned on the boats, the customers, and from the special interest social community for boating that´s embedded in Boatim´s platform.

These easy steps can search and arrange for both dealership and peer to peer sales.

From there, Boatim can assess the proper value of the boat for sale and inform a prospective buyer if the price is in the proper range.

Because of its massive reservoir of large-data & knowledge, the AI will also assess a boat’s reliability and servicing needs. It will even be able to suggest whether or not a boat should have a thorough marine survey, then set up the prospective owner with a top notch surveyor.

Investing In A Radical Breakthrough

Think about, once Boatim products have digitized most of what is currently still an offline manual process or item, their smart data pool will hold a boat’s entire schematics, down to the last nuts.

It knows where a boat has spent its life. And, while it may not be able to get down on its hands and knees like a surveyor can, their large data can point surveyors to potential problems they might have overlooked on a specific type.

After all, no new boat owner wants to discover through the hull fittings or seacocks that are corroded or frozen open.

Other items on Boatim´s short term digitization list: Let them seamlessly generate a buyers credit rating, arrange consumer finance, even calculate the advantages of a buy versus lease process.

And, Boatim’s platform will finalize the deal doing all the paperwork… registration, title, insurance, and even initiate and receive secure payments.

And most features and tools are expected to be applicable not only to a marketplace, but also to charter, rent and other boating options – a lot of reach – and market share.

Essentially, the only aspect of a boat sale that Boatim’s platform won´t be able do is to hand a new boat owner the keys to the motor. Well, that is until your boat is started by phone and boat keys are history.

Granted, Boatim´s marketplace has only just begun to attract attention of the industry´s big players earlier this quarter and, thankfully, Boatim is only at the beginning of bringing its disruptive digital products to the boating industry. But to give you a feel for their momentum: They´ve onboarded more than 160 new dealers since roll-out of their machine learning listings & inventory management tool “Smart Connect Inventory™” in October – that is more than 2 new dealers every day! We found more than 3,300 listings from Pop-Yachts in Boatim´s current inventory; that´s one of the industry´s biggest dealers right there.

Perfect For Pandemic

Talk about the ultimate in social distancing!

It’s a growing trend, at the perfect time, too.

That’s because it is a common occurrence today to deal with advanced computer software that can sell complex machinery without hands-on human assistance.

Carvana sells vehicles online that consumers can pick up at giant vending-machine like buildings.

Moreover, CarGurus (CARG) is very similar to Boatim Inc. (OTC:BTIM), up to a point.

The global car dealer has a shopping website that assists users in comparing local listings for used and new cars. Then, CarGurus artificial intelligence algorithms analyze and compare prices and features on cars for sale.

Users can search for specific cars in their local area and compare listings by price, features, and dealership reputations.

The company also offers a discussion platform for car enthusiasts and automotive experts, who submit questions, offer insight, gather and share information, and provide reviews.

While Boatim Inc. (OTC:BTIM) shares some similar traits with CarGurus, like applying data analytics and smart algorithms to improve their customers´ experience and to ensure relevance of all search results, Boatim will be taking things to a whole new level.

Aiming at digitizing currently offline processes will open up entirely new markets, creating large trends in the industry and moving big chunks of those market volumes towards the disruptive innovator, who first captures the customers with its digital boating products.

And, instead of just a discussion platform, like CarGurus, Boatim is set to roll out a deep and complex online social network aimed specifically at the U.S.’s millions of boaters and boat owners.

Keeping boaters engaged on one site alone will be worth a fortune to Boatim in both good will and revenues.

The foresight to add a social network element to its business is but one of the…

8 Reasons Why Boatim Inc. (OTC:BTIMOTC:BTIM) Looks Set To Offer Investors A Mighty Reward By Revolutionizing A Boating Industry Stuck In The Last Century

- DISRUPTIVE TECHNOLOGY – Boaters know the truth. They pick up actual print editions of magazines full of boat sales offerings, which are available at their local marinas. That’s quaint and so last century. The magazines are just pictures and prices. Boatim offers a much richer experience with a deep look into every boat it lists for sale. Its data analytics driven algorithms will know the boat’s schematics down to the last bolt.

- ALGORITHMIC MATCHMAKER – It’s almost too easy to buy a or sell a boat with Boatim Inc. (OTC:BTIMOTC:BTIM). For example, buyers enter what they seeks, Boatim´s technology will deliver the most relevant options that are with in their price range. And suggest the best value.

- GLOBAL ENTERPRISE – There’s a reason Boatim has offices in Florida and Spain. It’s because boating is a $100 billion global marketplace.

- DISRUPTIVE TECHNOLOGY – Nearly $40 billion worth of new and used boats changed hands last year. Boatim aims to release digital products that can handle every aspect of a sale, right down to getting a boat the proper insurance… even teach basic seamanship through its Boatim Academy.

- WEEKEND WARRIORS – Boatim’s tech allows for creating another Airbnb for boat owners who want to rent out their boats peer to peer or with certified captains. Of course Boatim gets a piece of that action. But the rentals also introduce people to the boating life. That means many more potential buyers down the line. And through their boating community platform they learn all about boaters´ interests and trends – allowing to be there with relevant input when their customers want it.

- HOT INVESTMENT TREND – Boatim’s shares have started to move They could soon join the mega trend in boating stocks. MarineMax (HZO) shares are up 242% since April 1. Brunswick (BC), and Malibu boats (MBUU) saw their share prices more than doubled since April 1. Mastercraft (MCFT) is up 372%, and Marine Products (MPX) is up 111%.

- GROUND FLOOR – There may never again be a better time or a better price at which to buy Boatim Inc. (OTC:BTIMOTC:BTIM).

- WILD CARD MEETS DESIRE – Brunswick bought Freedom Boat Club last year, because they know digital and shared economy are the biggest trends in boating for the foreseeable future. Boatim’s breakthrough approach to bring data analytics, machine learning, smart marketing and algorithms to the boating industry has a value that is essentially impossible to calculate. There’s a huge reason why a company such as Expedia might want to own it. That’s because Expedia (EXPE) bought VRBO’s parent, Home Away, for $3.9 billion. That was a bargain, because it saved Expedia from having to build a rental platform and then to spend years building up its own vacation rental supply. Boatim (OTC: BTIM) is a nearly exact corollary. But, there’s not even a hint of a rumor that Expedia has such a desire.

Tech Startups Are The Source Of Investing Legends And It’s Perfectly Reasonable To Dream That Boatim Inc. (OTC:BTIMOTC:BTIM) Could Be To Boats What Amazon (AMZN) Is To Retail, Or Apple (APPL) Is To Computing

Today is the day to make a move into Boatim Inc. (OTC:BTIMOTC:BTIM) for what could be its lowest share price. That would give you a chance to put yourself among the earliest and biggest winners.

But, before you do take any action, make sure to show your investment advisor or broker a copy of this story.

Then, chances are, you’ll both be in agreement that Boatim Inc. (OTC:BTIMOTC:BTIM) is a tech startup like no others.

1 https://www.soccertoday.com/coronavirus-covid-19-impacting-soccer/

2 https://www.wcax.com/2020/07/28/ny-bowling-alleys-stuck-in-the-gutter-awaiting-word-from-governor/

3 https://www.inquirer.com/sports/golf-increase-business-coronavirus-pandemic-philadelphia-national-courses-rounds-equipment-20200927.html

4 https://fortune.com/2020/07/26/americans-boating-industry-us-coronavirus-pandemic-boats/

5 https://www.usatoday.com/story/news/nation/2020/08/29/coronavirus-boat-sales-making-waves-pandemic/5639610002/

6 https://apnews.com/article/lifestyle-california-pandemics-travel-virus-outbreak-f16a669d4885fba9083350d70456ca95

7 https://finance.yahoo.com/news/airbnb-files-for-ipo-what-the-company-learned-from-the-pandemic-175049711.html?.tsrc=fin-srch

8 https://finance.yahoo.com/quote/EXPE?p=EXPE&.tsrc=fin-srch

9 https://www.nytimes.com/2020/07/02/style/boat-sales-summer.html

10 https://www.nytimes.com/2020/07/02/style/boat-sales-summer.html

11 https://www.nytimes.com/2020/07/02/style/boat-sales-summer.html

12 https://finance.yahoo.com/quote/HZO?p=HZO&.tsrc=fin-srch

13 https://finance.yahoo.com/quote/BC?p=BC&.tsrc=fin-srch

14 https://www.cnbc.com/2020/10/30/brunswick-ramps-up-boat-production-to-meet-rare-off-season-demand.html

15 https://finance.yahoo.com/quote/MCFT?p=MCFT&.tsrc=fin-srch

16 https://finance.yahoo.com/quote/MBUU?p=MBUU&.tsrc=fin-srch

17 https://finance.yahoo.com/quote/HZO?p=HZO&.tsrc=fin-srch

18 https://finance.yahoo.com/quote/BC?p=BC&.tsrc=fin-srch

19 https://finance.yahoo.com/quote/MCFT?p=MCFT&.tsrc=fin-srch

20 https://skift.com/2015/11/04/expedia-acquires-homeaway-for-3-9-billion/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

- The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Boatim Inc..

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.