Demand for Lithium is Rapidly Outpacing Supply, and E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) is Primed to Benefit with Proprietary Tech to Produce Domestically in Alberta, Canada

While the world seems to be undergoing a great GREEN revolution, there’s a potentially catastrophic problem on the horizon before we get there.

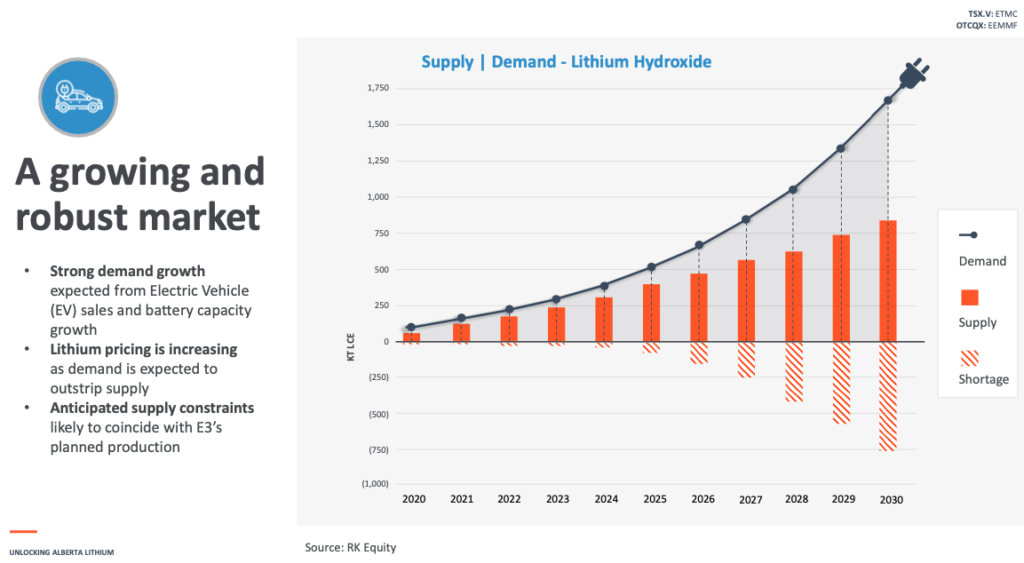

According to Benchmark, lithium demand is expected to reach 2.4 million tonnes LCE (lithium carbonate equivalent) in 2030 – this is almost 1.8 million tonnes more than the 600,000 tonnes of lithium Benchmark expects will be produced in 2022.1

This means the mining sector will need to step up its production by at least 3x to meet demand, at a cost estimated to be an additional US$42 billion to accomplish.2

And the costs to consumers could keep rising, as we’ve already seen in 2022 with top bids for lithium up 140%, causing Tesla CEO Elon Musk to call the new price point ‘Insane Levels’.3

Luckily, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) is ready to help increase the global lithium supply with one of the world’s largest recorded lithium resources and the proprietary technology to become a dominant lithium producer for +20 years.

Now we’re seeing even more factors piling up that could cause even these price estimates to come in low and/or overly conservative.

What kind of factors?

Since the Eastern European conflict and its subsequent sanctions,4 the race is on around the world to find new sources of lithium.5

Africa is getting more attention from lithium seekers,6 especially from China, which still wants/needs more!7

South America is experiencing political changes that could put its lithium supplies at risk in the Lithium Triangle.8

And now the EU has voted to ban all sales of gas and diesel vehicles by 2035.9

On top of all that… there’s also a growing chorus of criticism against conventional lithium miners for not being overly ESG friendly.10

Considering all of these factors, smart money is ready to get in on the action and is looking for the perfect combination of long-term lithium production that’s ESG friendly, and safely located in a reliable jurisdiction.

Enter E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF), which not only holds an impressive land position in business-friendly Alberta, Canada, but it also brings to the table one of the largest lithium resources on the planet, and a proprietary technology that could change the lithium industry as we know it.

E3 Lithium, which trades under the symbol ETL on the TSX Venture Exchange,11 just released some extraordinary news that simply can’t be ignored (more on this BIG NEWS later).

Now let’s break down the numerous reasons E3 Lithium is THE BEST WAY to invest in the coming lithium shortage crisis, with a company that’s built to make a huge impact on the industry.

7 Reasons to Invest in E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) as a Lithium Production Game Changer

- Lithium Market is BOOMING: Thanks to surging demand for EVs and lithium-ion batteries for tech, the world is scrambling for lithium supply, with structural shortages in the lithium market for years to come.

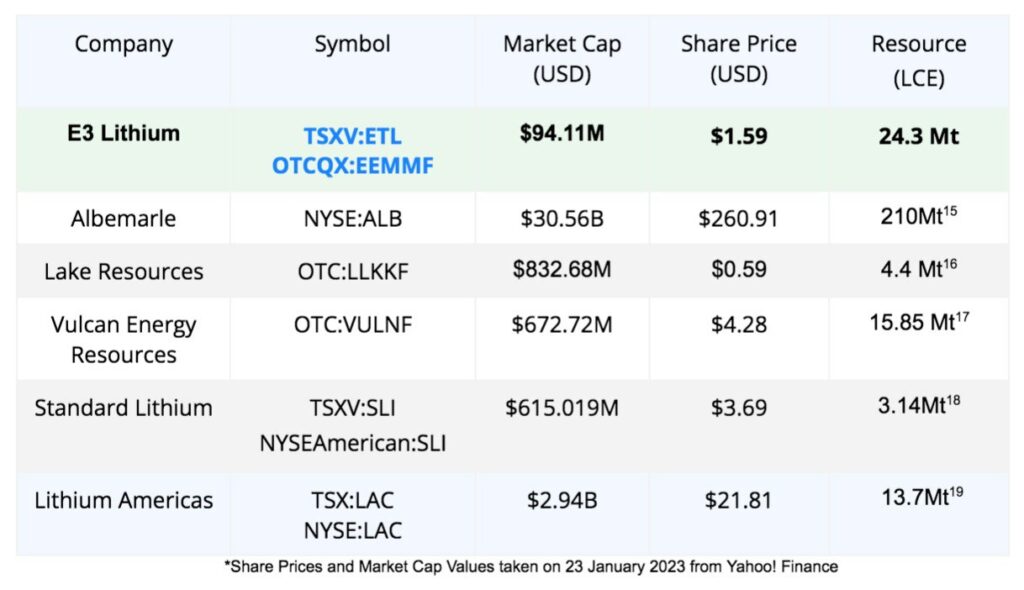

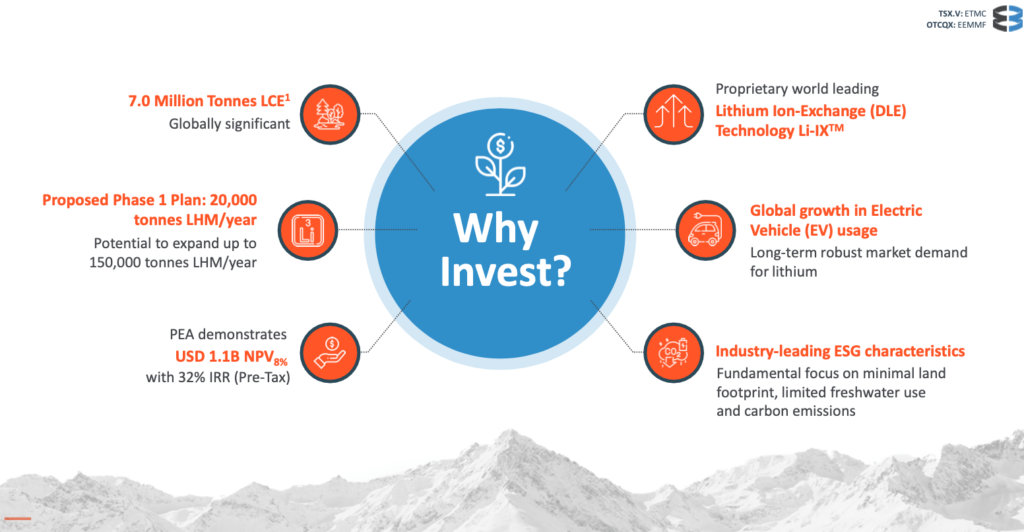

- Flagship Asset with Globally Significant Resource: With 24.3 million tonnes inferred LCE on the books, E3 Lithium has one of the largest lithium resources in the world. This only entails about 70% of the company’s entire resource area.

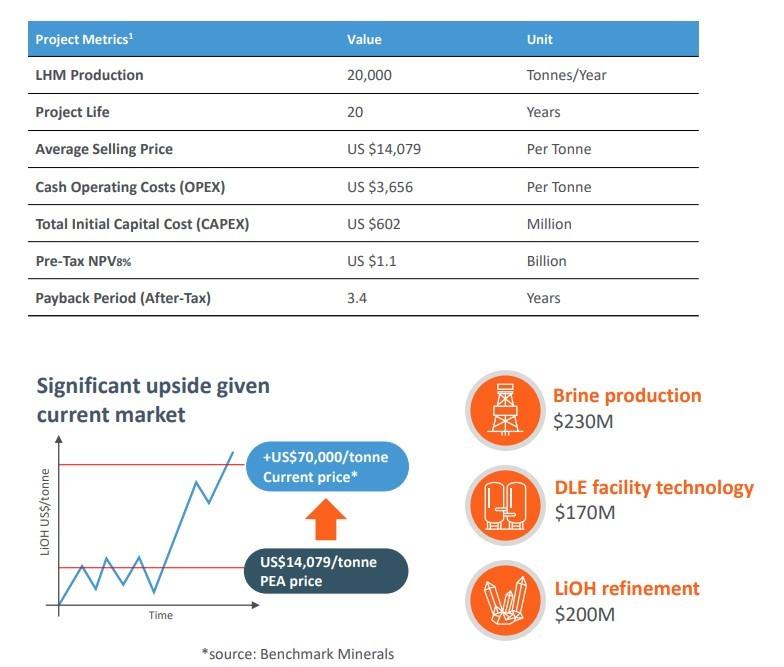

- Very Attractive Economics: Thanks to the above-mentioned Resource and its average of 74.6 mg/L Li, the project outlines a USD 1.1B NPV (8%), for just the first phase of production of 20,000 tonnes of lithium hydroxide annually over the first 20 years, according to ETL’s Preliminary Economic Assessment (PEA)12

- Proprietary, ESG-Friendly Technology: 100% brine disposal and a small land footprint makes the company’s proprietary DLE ion-exchange technology a potential monumental game changer in the lithium space.

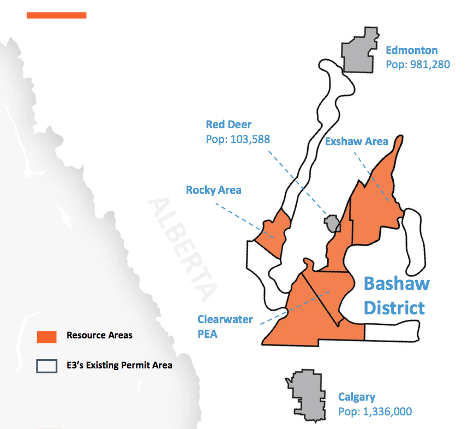

- World-Class Jurisdiction: Within industry-friendly Alberta, E3 is capitalizing on the famous “Alberta Advantage”, with over 600,000 hectares of brine permits in an area where 4,000 oil and gas wells have already been drilled to-date.13

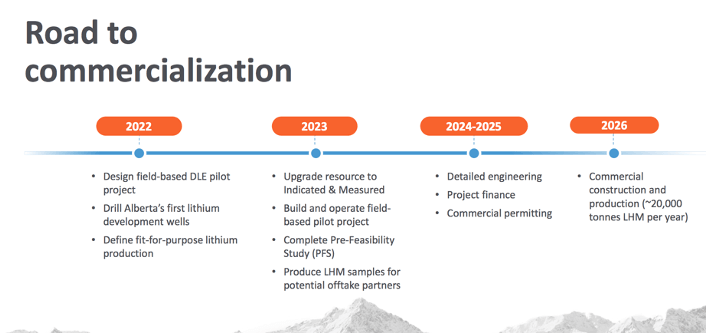

- Progressing Towards Commercial Operations: Using brines derived from drilling Alberta’s first brine production wells in the Clearwater Project area, the company is steadily progressing towards commercial production by 2025-26.

- Strong Leadership Team: Proven management team combines over 150 years of experience in emerging technologies, finance, mining, petroleum and unconventional resource plays as well as process engineering, development and optimization.

Lithium: The Next Gold Rush

It can’t be stressed enough how big of an opportunity the lithium market presents at this stage in time.

We’re living through a WILD shift, with lithium consumption nearly quadrupling since 2010.14

“I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business. We think we’re going to need to help the industry on this front.” ~ Elon Musk, CEO of Tesla Inc.

Clearly NOW is the time for something BIG to hit the lithium market, and give consumers something to hope for. This is where E3 Lithium is not only well-equipped but also perfectly timed to succeed.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) is Targeting Commercial Production by 2025-26

Unlike conventional lithium producers like Albemarle and Lithium Americas, who produce from evaporation ponds and/or hard rock mining, E3 Lithium has a UNIQUE strategy to succeed.

E3 has already outlined a Preliminary Economic Assessment (PEA) from third-party experts, revealing that its proprietary DLE ion-exchange technology, large resource, and favorable jurisdiction are ideal for lithium development.

Globally Significant Lithium Resource

At the core of the E3 Lithium story is one of the largest lithium resources in the world (24.3 Mt LCE), all within a business-friendly jurisdiction (Alberta, Canada) with a government that’s making an effort to evolve into a serious player in the lithium market.20

At the core of the E3 Lithium story is one of the largest lithium resources in the world (24.3 Mt LCE), all within a business-friendly jurisdiction (Alberta, Canada) with a government that’s making an effort to evolve into a serious player in the lithium market.20

Existing data on E3’s resource demonstrates fairly consistent lithium grades throughout, all while suggesting there’s additional upside as exploration across the remaining land package continues.

On July 11, 2022, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) increased its Inferred Mineral Resources to a whopping 24.3 million tonnes of lithium carbonate equivalent (LCE) more than tripling its inferred resource.21

The Bashaw District combines and extends the Clearwater Resource and Exshaw Resource areas into a consolidated resource that contains an estimated total of 59 billion cubic meters (59 cubic kilometers) of brine formation water at an average grade of 74.5 milligram/litre lithium.

The increase in the resource comes after significant work by E3 Lithium‘s team to improve and expand the company’s understanding of the highly saline Leduc Aquifer in the Bashaw District.

The ‘Alberta Advantage’

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) owns over 600,000 hectares (~1.48 million acres) in industry-friendly Alberta, where the government has committed to a strategy that it hopes will help the province become an international player in mineral extraction—and they believe E3 Lithium will help them get there.

The province has already provided $1.8 million to E3 in grant funding, as historically, there have been over 4,000 oil and gas wells drilled within the same areas of the company’s brine permits.

E3 has re-entered these wells to conduct sampling and testing and leverage over 70 years of historical data to understand the lithium potential at depth. All of this valuable data affords E3 the ability to delineate an inferred resource, without the need for new, costly drilling.

E3 Lithium just finished drilling its first brine production wells22 —the FIRST of their kind in Alberta.23

As part of its first exploratory drill program, E3 Lithium has pulled up brine samples from several zones of each well to verify lithium concentrations and production testing, confirming flow rates and deliverability from the Leduc Reservoir.

In the first well, E3 achieved its total planned depth of 2,670 meters (m), allowing for full data collection, including 36.9 meters of core sample. It also reached total depth in its second well. The company acquired an existing well for its third, saving about $1.5M.24

E3’s ESG-Friendly Lithium Ion-Exchange Tech: The Next Generation of Li Production

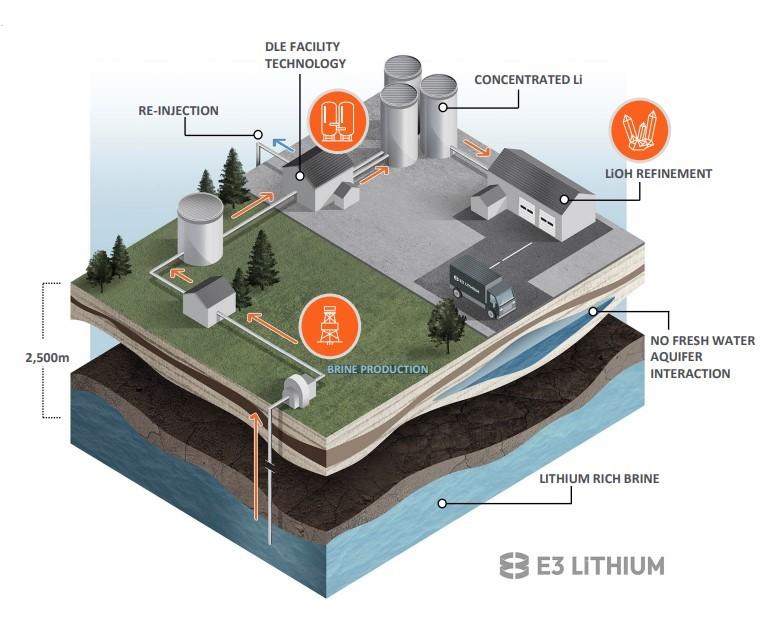

Beyond the globally-significant lithium resource, one of E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) most promising assets is its Direct Lithium Extraction (DLE) Ion-Extraction Technology, which utilizes a proprietary sorbent designed to be highly selective towards lithium ions.

At an energy conference in April 2022, US Energy Secretary Jennifer Granholm said this about DLE: “It’s such a game-changer. There’s huge opportunities.”25

DLE’s potential has drawn the interest of Warren Buffett’s Berkshire Hathaway to the tune of a $15 million investment to test the technology at California’s Salton Sea—ahead of what is proposed to result in a multibillion-dollar production facility, capable of producing 90,000 metric tons of lithium per year.

On February 2, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) reached a monumental milestone in the development of its Lithium Ion-Exchange (Li-IX) pilot plant in the Clearwater Project Area, which is now on track to begin construction and operation in Q3 2023.

The pilot plant, which will test Li-IX technology on a larger scale for direct lithium extraction in real-world operating conditions, is a crucial step in unlocking the value of E3 Lithium‘s 24.3 Mt inferred lithium resources. At the pilot scale, demonstrating Li-IX technology significantly de-risks the commercial design.

So far, lab results have demonstrated:

- Rapid kinetics, recovering lithium ions in minutes, not months

- Lithium recoveries consistently exceeding 90%, with peak recoveries exceeding 95%

- High contaminant rejection exceeding 98% removal

E3’s resource – the Leduc Reservoir – is capable of producing 130,000m3 of brine per day.

It’s all done with a closed loop system, with 100% brine re-injection.

E3’s DLE technology generates a high-purity concentrate solution. Refinement of the lithium concentrate results in battery-quality lithium hydroxide for direct sale to battery manufacturers that could include Tesla, Panasonic or others.

In fact, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) has already partnered up with Pure Lithium to create its first successful lithium metal battery using lithium from its resources.

Pure Lithium used lithium from E3 to create the lithium metal to produce a pouch cell battery to demonstrate the proof of concept.

Following the success of the initial test program, the two companies signed an MOU to complete a series of testing over the next six to nine months to define how their technologies can be combined to produce a commercially-viable production process for lithium metal batteries and electrodes.

In July, E3 Lithium reached another monumental milestone when it oversaw the successful manufacture of its first quantity of continuously produced, commercial scale sorbent – which is critical to the success and commercialization of its ion-exchange DLE technology.26

The company worked with a third-party equipment design and manufacturer using their in-house development equipment to produce an initial 20 kilograms of E3’s proprietary sorbent in a single continuous run.

This 20 kg test run not only demonstrated that large-scale production is possible using this equipment, but it positions E3 Lithium to achieve its goals of:

- Having the vendor produce several tonnes of sorbent for its field pilot project

- Designing the equipment to be implemented in the commercial processing facility as part of the company’s Clearwater Project

As mentioned, E3 is now moving onto the next major phase of the pilot project, which is expected to begin operation in Q3 2023.

Incredibly ESG Friendly

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) DLE provides the potential for industry-leading ESG, through carbon seequestration in Alberta as a potential for Carbon Neutrality.27

100% of the brine brought to surface for lithium extraction will be recycled back into the aquifer.

Less than 3% of land will be required for E3’s development compared to similar conventional lithium projects.

And on top of all that, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) process requires no open pit mining, tailings ponds or evaporative ponds.

Furthermore, E3 recently acquired28 a third-party well in its Clearwater Project Area within the Bashaw District. The acquisition will reduce the environmental footprint associated with E3’s drilling program, represents a potential cost savings of more than $1.5 million and repurposes the oil and gas infrastructure and represents the ‘Alberta Advantage’ in action.

Derisking and Progressing Towards Commercial Operations

The E3 Lithium project is steadily progressing towards commercial production, which the company currently projects to be achievable by 2025-26.

As part of the efforts towards this milestone, E3 Lithium just finished drilling Alberta’s FIRST two brine productions well in the Clearwater Project area.

Using brines from wells in this area, E3 is developing a modular field pilot to demonstrate its proprietary ion-exchange technology.

While applying the best fit-for-purpose LiOH production process for its flowsheet, E3 will also provide LiOH samples for its potential offtake partners from their DLE Field Pilot.

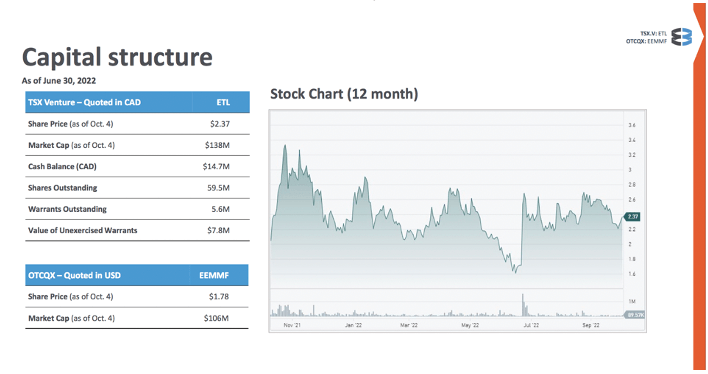

All the while, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) has kept its financial position stable, and its share structure tidy.

Strong Leadership Team

To take a proprietary technology in a newly developing lithium production region, the ambitious project requires good stewardship. It takes more than just a friendly business jurisdiction to make something like this work. Thankfully, E3 Lithium is in VERY capable hands.

ETL’s leadership team includes:

Chris Doornbos P. Geo

Multi-talented Doornbos is an innovator, entrepreneur, and a founder of emerging ideas and technology. Passionate about collaboration and progressing innovation, he brings a broad range of experience in capital raising and M&A. At E3 Lithium, Doornbos emphasizes risk management, developing and managing an exceptional technical team and well-strategized project generation, with a clear focus on developing and capturing value for shareholders. He successfully led E3 Lithium from the foundation of a private company with a handful of permits to the public company with a global scale lithium resource and industry-leading innovative extraction technology it is today.

Raymond Chow CPA, CA

Chow is a dynamic senior finance professional with +17 years of finance and accounting experience in high-growth companies and corporate financial services. He’s served at ATB Financial in the project finance group and previously held progressively senior roles within the energy industry including serving as interim CFO for a private equity-backed, intermediate private oil and gas producer. His experience includes go-public initiatives, M&A transactions totaling over a billion dollars in value and expertise in the financial reporting functions for public companies.

Chris Ward P.Eng

Ward is a seasoned project manager with +25 years of experience in both design and operation of mining assets across North and South America. He’s completed several +$1B mining and mineral processing projects in his career, involving multiple commodities including mineable oil sands, copper, molybdenum, lead, zinc, silica, and gold. Ward brings a deep background in process design, as well as a comprehensive knowledge of project design and project management. He most recently worked on tailings and infrastructure projects for Imperial Oil and Syncrude.

Peter Ratzlaff P.Eng

Ratzlaff has +25 years of diversified engineering and production/operations experience. His experience includes management of the overall production strategy, field operations, and capital programs in the Oil and Gas industry. He’s served as Manager Operations at Huron Resources, Production Manager at Cequence Energy, and held progressively senior roles with public companies including Canadian Hunter Exploration, Burlington Resources and ConocoPhillips.

Joanie Kennedy, P.Geo, PMP

Kennedy is a Senior geologist with 15 years’ experience working in Western Canada. She has a background in drilling operations, exploration and development, and business development. She brings with her a background in project management and has been involved with several successful drilling and exploration programs and she has worked a number of different hydrocarbon plays, both in carbonate and clastic reservoirs throughout Alberta and Saskatchewan.

Josh Rubenstein, M.Sc, P.Eng

With two decades of North American and international industry experience, Rubenstein brings extensive process engineering and technology development expertise to E3 Lithium. He has a strong background in process design from initial concept to execution, including all stages of engineering, start-up and commissioning, plant stabilization, operations support, debottlenecking, and optimization. Moreover, he has global experience across a range of commodities—scaling up process designs from initial lab tests to commercial plants.

Caroline Mussbacher, B.Sc, P.Eng

Mussbacher is an industry-leading expert in ion exchange and DLE with ~20 years of experience working with produced water and brines in the Alberta oilsands and unconventional resource plays. She’s designed and operated water treatment systems on both the pilot and commercial scale and has experience commissioning and troubleshooting in real time to drive exceptional performance.

7 Reasons To Seriously Look Into E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) NOW!

- Lithium Market is BOOMING

- Flagship Asset with Globally Significant Resource

- Very Attractive Economics

- Proprietary, ESG-Friendly Technology

- World-Class, Business-Friendly Jurisdiction

- Progressing Towards Commercial Operations

- Strong Leadership Team

Enough reading… Now it’s time to ACT!

THIS IS THE PERFECT TIME for smart investors to seriously follow the ongoing E3 Lithium story.

E3 has plenty of potential to make a huge impact in the lithium market, with its massive land portfolio, globally-significant resource, and potentially industry-changing DLE technology.

So, do your due diligence, and don’t forget to click here to sign up for the company’s newsletter to make sure you don’t miss out on any of E3 Lithium’s news and milestones.

Learn More About E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) at your brokerage today!

Learn More About E3 Lithium (TSXV:ETL) (OTCQX:EEMMF)(TSXV:ETL) (OTCQX:EEMMF) at your brokerage today!

1https://www.benchmarkminerals.com/membership/analysis-lithium-industry-needs-42-billion-to-meet-2030-demand/

2 https://www.benchmarkminerals.com/membership/analysis-lithium-industry-needs-42-billion-to-meet-2030-demand/

3 https://www.mining.com/web/top-bid-for-lithium-up-140-after-musks-insane-levels-call/

4 https://www.nytimes.com/2022/03/02/climate/ukraine-lithium.html

5 https://oilprice.com/Energy/Energy-General/The-World-Is-Scrambling-For-Lithium-Supply.html

6 https://www.forbes.com/sites/arielcohen/2022/01/13/china-and-russia-make-critical-mineral-grabs-in-africa-while-the-us-snoozes/?sh=2038d2486dc4

7 https://www.onecharge.biz/blog/how-china-came-to-dominate-the-market-for-lithium-batteries-and-why-the-u-s-cannot-copy-their-model/#:~:text=%E2%80%9CChina’s%20success%20%5Bin%20battery%20manufacturing,for%20EVs%20was%20no%20accident.

8 https://www.bloomberg.com/news/features/2022-06-23/lithium-king-crowned-in-dictatorship-sees-3-5-billion-fortune-at-risk#xj4y7vzkg

9 https://www.cnbc.com/2022/06/09/goodbye-gasoline-cars-eu-lawmakers-vote-to-ban-new-sales-from-2035.html

10 https://capitalmonitor.ai/sector/raw-materials/resurgent-lithium-risks-backlash-from-esg-conscious-investors

11 https://e3lithium.ca/newsroom/news-releases/e3-lithium-commences-trading-under-new-symbol-etl

12 https://www.e3lithium.ca/_resources/reports/technical/20210917-NI43-101-PEA-Report-Amended-Final.pdf?v=0.027

13 https://boereport.com/2022/01/26/a-deeper-dive-into-albertas-lithium-natural-gas-connection/

14 https://elements.visualcapitalist.com/lithium-consumption-has-nearly-quadrupled-since-2010/

15 https://www.albemarle.com/businesses/lithium/resources–recycling/lithium-resources

16 https://lakeresources.com.au/about-us/

17 https://v-er.eu/wp-content/uploads/2022/04/Apr-Corp-Preso.pdf

18 https://www.standardlithium.com/investors/company-information

19 https://www.lithiumamericas.com/news/lithium-americas-expands-resource-at-thacker-pass-and-increases-phase-1-capacity-to-target-40000-tpa-lithium-carbonate

20 https://redcloudresearch.com/e3-metals-corp-tsxvetmc-move-over-oil-albertas-next-boom-is-lithium/

21 https://e3lithium.ca/newsroom/news-releases/e3-lithium-outlines-234-mt-lce-inferred-mineral-resource-in-consolidated-bashaw-district-

22 https://e3lithium.ca/newsroom/news-releases/e3-lithium-finishes-drilling-its-first-well–completion-and-sampling-program-to-begin

23 https://www.e3lithium.ca/_resources/news/nr-20220608.pdf

24 https://e3lithium.ca/newsroom/news-releases/e3-lithium-acquires-existing-well–repurposing-infrastructure-and-reducing-environmental-impact

25 https://www.reuters.com/article/mining-lithium-technology-focus-idCAKCN2LZ25R

26 https://e3lithium.ca/newsroom/news-releases/e3-lithium-completes-first-production-of–commercial-scale-sorbent

27 https://www.e3lithium.ca/_resources/news/nr-20220121.pdf

28 “News Releases – E3 Lithium.” https://e3lithium.ca/newsroom/news-releases/e3-lithium-acquires-existing-well–repurposing-infrastructure-and-reducing-environmental-impact. Accessed 29 Sep. 2022.

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of E3 Lithium (“ETMC”) and its securities, ETMC has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by ETMC) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company ETMC and has no information concerning share ownership by others of in the profiled company ETMC. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ETMC industry; (b) market opportunity; (c) ETMC business plans and strategies; (d) services that ETMC intends to offer; (e) ETMC milestone projections and targets; (f) ETMC expectations regarding receipt of approval for regulatory applications; (g) ETMC intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ETMC expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ETMC business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ETMC ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ETMC ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ETMC ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ETMC to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ETMC operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ETMC business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ETMC business operations (e) ETMC may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling E3 Lithium.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled E3 Lithium and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any E3 Lithium or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the E3 Lithium. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled E3 Lithium’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding E3 Lithium future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to E3 Lithium industry; (b) market opportunity; (c) E3 Lithium business plans and strategies; (d) services that E3 Lithium intends to offer; (e) E3 Lithium milestone projections and targets; (f) E3 Lithium expectations regarding receipt of approval for regulatory applications; (g) E3 Lithium intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) E3 Lithium expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute E3 Lithium business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) E3 Lithium ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) E3 Lithium ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) E3 Lithium ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of E3 Lithium to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) E3 Lithium operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact E3 Lithium business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing E3 Lithium business operations (e) E3 Lithium may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of E3 Lithium or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of E3 Lithium or such entities and are not necessarily indicative of future performance of E3 Lithium or such entities.