2021 was a very interesting year for currencies.

Crypto gained serious market attention – BTC skyrocketing to over $65K and ETH jumping 272% from January 1 to December 1, 2021. Even so-called shitcoins (crypto with little or no value) like Dogecoin and Shiba Inu exploded this year.

But hands down, the craziest thing happening in the world of currencies is the endless money printing in the US.

Would you believe me if I told you that over 40% of the money in the US was printed in the last 12 months?1

I wish I was lying, but the fact is, the US Fed printed over $13 trillion dollars in the last year – that’s more than the country spent in its 13 most expensive wars combined!2

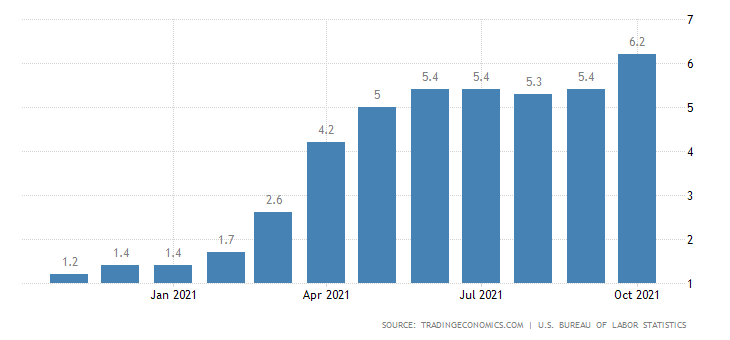

Meanwhile, inflation rose to an unbelievable 6.2% in October 2021, marking the largest rise in three decades.3

Meanwhile, inflation rose to an unbelievable 6.2% in October 2021, marking the largest rise in three decades.3

It’s no wonder that Gemini co-founder and billionaire investor Tyler Winklevoss is calling the US dollar “the ultimate shitcoin.”4

The fact is, your money is worth a lot less than it was a year ago. And the emergence of yet another CV-19 variant in the US5 could lead to more money printing, more inflation and even more need for safe haven investments to protect your wealth.

Some investors are looking at crypto as their savior, but others see silver and gold as the best hedge against the impending market crash.

One example is Billionaire Investor Eric Sprott. He continues putting his money on precious metals and it’s clearly paying off.

One example is Billionaire Investor Eric Sprott. He continues putting his money on precious metals and it’s clearly paying off.

Sprott Inc.’s AUM increased by 88% in 2020 to a record high of $17.4 billion, mostly due to new inflows into the Sprott Physical Silver Trust,6 and has now surpassed $20 billion AUM.7

The silver market has had a rocky few months, but fundamentals point to a strong rebound on the horizon and now could be the perfect time to buy the dip.

And I think one of Sprott’s recent investments could be the perfect way to get in on silver before the market makes a comeback.

I’m talking about Summa Silver Corp. (TSXV:SSVR, OTCQB:SSVRFTSXV:SSVR, OTCQB:SSVRF), a junior mining and exploration company drilling two high-grade past-producing silver-gold properties in Nevada and New Mexico.

There are a ton of reasons I’m excited about this company, but I’ll start by sharing:

5 Reasons Why Summa Silver is Such an Exciting Opportunity

- Significant Investors: Not only does legendary investor Eric Sprott own 18% of the company, the leadership team has a ton of skin in the game, with 30% insider ownership

- Shareholder Control: Tight share structure and inside ownership means that management and the legendary Eric Sprott have good control over operations, capital management, and future investment.

- Two High-Grade Properties: The Hughes and Mogollon properties are located in high-grade past-producing properties in mining-friendly silver-gold districts. Summa is in just the right location.

- Rapidly Advancing Work Programs: A 15,000m drill program is underway at Mogollon, and upcoming assay results from Hughes. The company also intends to file for a NI 43-101 compliant resource for both projects in Q4 2022.

- Hot Sector: Silver mining stocks heating up fast – Canadian company SilverCrest Metals stock went from US$1.90 in March 2018 to US$9.12 on November 16, 2021; 380% higher!

Breakout at Any Moment?

Summa Silver Corp. (TSXV:SSVR, OTCQB:SSVRFTSXV:SSVR, OTCQB:SSVRF) trades at C$0.97, has 63.78m shares issued and a market cap of C$45.7 million on December 8, 2021. The stock has remained in a stable and rising range since its IPO, and has most importantly broken above its moving average several times since April 2021. On December 7, 2021, the stock broke out of the oversold territory on the RSI indicator, and above its moving average. The confluence of the two bullish signals continued on December 8 and the stock kept rising toward resistance at C$1.18.

Two Rapidly Advancing Properties in Top Mining Regions

Summa Silver Corp. (TSXV:SSVR, OTCQB:SSVRFTSXV:SSVR, OTCQB:SSVRF) has been rapidly advancing both the Mogollon and Hughes properties.

Summa Silver has already seen significant results from the ongoing drill program at the Hughes Property, which hosts the Belmont Mine, one of the most prolific silver producers in the US from the 1920s.

In September, Summa announced that Rescue veins from the Belmont Mine intersected 1,699 g/t silver equivalent over 4.3 m including 9,989 g/t silver equiv. over 0.6 m.8

Summa has just wrapped up the 10,000 meter 2021 drill program at Hughes and expects assay results in Q4 2021 and Q1 2022. This could be huge news coming in the very near-term!9

The company also just began a 15,000m drill program3 at the 2,467-acre Mogollon Property in New Mexico and provided an update on property-wide geological, geophysical and remote sensing surveys.

And Summa isn’t slowing down in 2022, with plans for new resource-style drilling at Hughes and of course, a focus on new discoveries.

Oh and did I mention that Summa Silver is targeting a NI 43-101 compliant resource for these two high-grade properties next year as well?

You will want to dig even deeper about what this company has to offer.

Find out more about Summa Silver Corp. (TSXV:SSVR, OTCQB:SSVRFTSXV:SSVR, OTCQB:SSVRF) now, before everyone else does, by clicking here.

1https://techstartups.com/2021/05/22/40-us-dollars-existence-printed-last-12-months-america-repeating-mistake-1921-weimar-germany/

2 https://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-more

3 https://www.washingtonpost.com/business/2021/11/10/cpi-inflation-october/

4 https://twitter.com/tyler/status/1401271670367830023?lang=en

5 https://www.cnn.com/world/live-news/omicron-covid-19-variant-12-01-21/index.html

6 https://www.globenewswire.com/news-release/2021/02/26/2183306/35318/en/Sprott-Announces-2020-Annual-Results.html

7 https://www.stockwatch.com/News/Item/U-z8387463-U!SII-20211105/U/SII

8 https://summasilver.com/summa-silver-intersects-1699-gt-silver-equiv-over-4-3m-including-9989-g-t-silver-equiv-over-0-6-m-at-the-hughes-property-in-tonopah-nevada/

9 https://marketjar.docsend.com/view/93ganjhkdzfiqdkz

10 https://summasilver.com/summa-silver-commences-drill-program-at-the-historically-producing-high-grade-silver-gold-mogollon-property-new-mexico/

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Summa Silver Corp. Market Jar Media Inc. has or expects to receive from Summa Silver Corp.’s Digital Marketing Agency of Record (Native Ads Inc.) one hundred fifty-three thousand eight hundred dollars USD for 22 days (16 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on MicroSmallCap.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on MicroSmallCap.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Summa Silver Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Summa Silver Corp.’s industry; (b) market opportunity; (c) Summa Silver Corp.’s business plans and strategies; (d) services that Summa Silver Corp. intends to offer; (e) Summa Silver Corp.’s milestone projections and targets; (f) Summa Silver Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Summa Silver Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Summa Silver Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Summa Silver Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Summa Silver Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Summa Silver Corp.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Summa Silver Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Summa Silver Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Summa Silver Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Summa Silver Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Summa Silver Corp.’s business operations (e) Summa Silver Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Summa Silver Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Summa Silver Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Summa Silver Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Summa Silver Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Summa Silver Corp. or such entities and are not necessarily indicative of future performance of Summa Silver Corp. or such entities.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Summa Silver Corp..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Summa Silver Corp. and has no information concerning share ownership by others of any profiled Summa Silver Corp.. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Summa Silver Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Summa Silver Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Summa Silver Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Summa Silver Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Summa Silver Corp. industry; (b) market opportunity; (c) Summa Silver Corp. business plans and strategies; (d) services that Summa Silver Corp. intends to offer; (e) Summa Silver Corp. milestone projections and targets; (f) Summa Silver Corp. expectations regarding receipt of approval for regulatory applications; (g) Summa Silver Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Summa Silver Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Summa Silver Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Summa Silver Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Summa Silver Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Summa Silver Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Summa Silver Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Summa Silver Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Summa Silver Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Summa Silver Corp. business operations (e) Summa Silver Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Summa Silver Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Summa Silver Corp. or such entities and are not necessarily indicative of future performance of Summa Silver Corp. or such entities.