Inflation woes in the United States are not over yet as executives at the Federal Reserve recently announced further interest rate hikes for the coming weeks.

John Williams, president of the New York Fed, addressed the media on Monday, November 28th, following an event held by the Economic Club of New York, and opined that interest rates are soaring higher than he predicted several months ago.

According to Williams, there has been a stronger demand for labor, leading to a stronger demand in the economy than he assumed earlier this year. At the same time, underlying inflation has been higher than expected, leading him and other analysts to consider a slightly higher path to financial policy.

Nevertheless, Williams assured reporters that while figures are higher than anticipated, any changes will not be massive or drastic.

Meanwhile, James Bullard, president of the St. Louis Fed and one of the Federal Reserve’s most hardline executives, remarked that today’s markets are underpricing the risk that the Federal Open Market Committee (FOMC) needs to be more aggressive when it comes to halting inflation in the United States.

On the other hand, Thomas Barkin, president of the Federal Bank of Richmond, would rather slow down the pace at which rate hikes are being implemented, seeing how drastically aggressive the Fed has been overall. He added that the peak would need to be held at higher levels for a slightly protracted period if the central bank wants to cast a lasting damper on inflation. Barkin also expects peak rates to be at a higher level than previously forecast.

The Fed has advised that the benchmark rate may be raised by 50 basis points during their final meeting of the year which is slated for December 13 and 14. This is a considerably lower hike than those previously implemented which raised interest rates by 75 basis points at each time.

It’s also possible that Fed policymakers may raise their forecasts as to how high-interest rates can go as they make updates to their economic projections during the said event. However, it remains unclear as to how much higher these forecasts are expected to go.

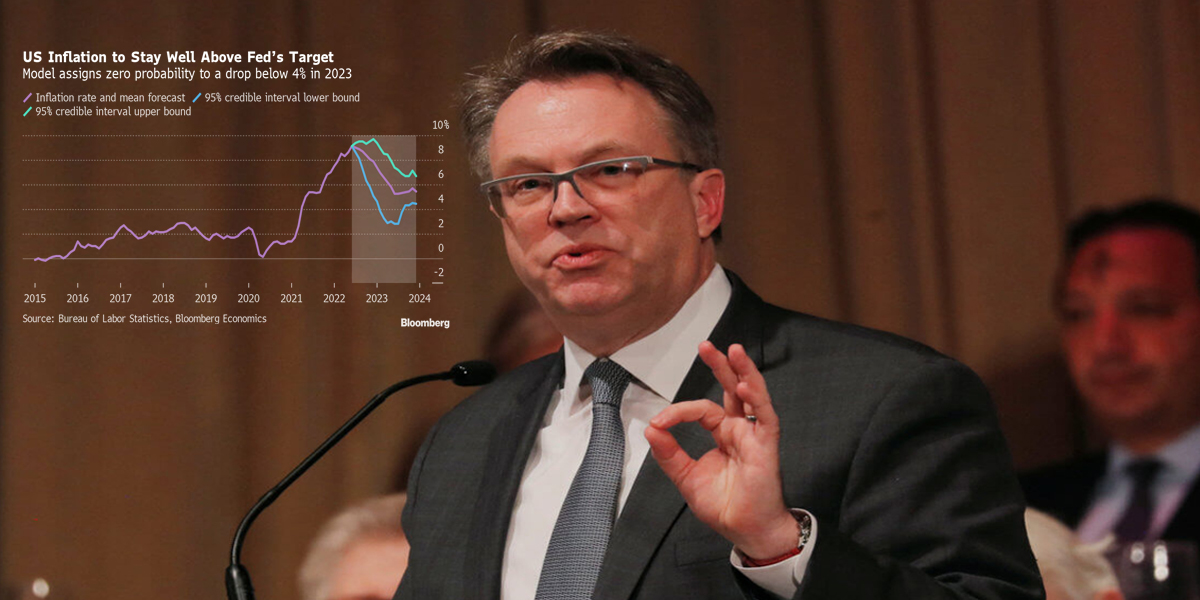

At present, the main rate is within the target range of 3.75% to 4%. Many investors expect it to peak within the neighborhood of 5% come early 2023, based on the pricing of futures contracts.

As to long-term projections, most policymakers have avoided any discussions regarding forecasts for as far as 2024. Instead, their immediate focus is on the need to hike interest rates with the end goal of halting inflation in its tracks.