Some of the world’s wealthiest investors are investing in the Therapeutic Mushroom Boom, and it’s opening huge opportunities for investors.

“Shark Tank’s” Kevin O’Leary invested in MindMed, which exploded 940.7% in just 12 months….

One of billionaire investor Peter Thiel’s stocks — Compass Pathways — gave investors the chance to better than triple their money in just 3 months when it shot up 240.2%.

And now Chip Wilson, founder of the apparel company Lululemon, and a successful investor with a net worth of around $6.1 billion, is putting his name and some of his money behind Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN), a company with a unique three-prong strategy for cashing in on the boom in biopharma therapeutic mushrooms.

As you may know, medical studies at Johns Hopkins, NYU, and more show that this compound, the active ingredient of “magic mushrooms,” can be highly effective at treating major depression and other mental health and wellness conditions.

Better yet, it can get those results without any of the terrible side effects many people experience with antidepressant drugs.

This has sparked a rush of biopharma companies seeking to develop new medicinal mushroom-based drugs.

However, Optimi Health has already secured 3 major “unfair advantages” over its competitors in this emerging field. And that makes it one of your best bets for making windfall profits off the boom in biopharma therapeutic mushrooms.

Unfair Advantage #1: Special government favor helps generate immediate revenue

Optimi Health aims to be a major producer of pharmaceutical-grade therapeutic mushrooms that it will provide to other biotech companies for use in clinical trials.

This potential revenue stream will fund company operations and eventually help fund development of the company’s own proprietary medicinal mushroom-based drugs.

But unlike many other companies hoping to capitalize on the medical therapeutic mushroom boom, Optimi is uniquely positioned to pull it off.

That’s because Optimi Health has been granted a Research Exemption from Health Canada that allows it to pursue therapeutic mushroom research. This puts the company far ahead of other companies that can’t legally conduct this kind of research.

Optimi has also applied for a Health Canada Dealer’s License, which will enable them to both produce and distribute therapeutic mushrooms they produce.

Optimi is nearing completion of a 10,000-square-foot research and manufacturing facility devoted to producing therapeutic mushrooms for use by biotech companies who have drugs in clinical trials.

In addition, Optimi is nearing completion on a 10,000-square-foot facility in British Columbia for the cultivation of the “magic mushrooms” from which this compoud is derived.

This new facility is Good Manufacturing Processes capable, which means its purpose built to meet a variety of standards that help ensure quality and consistency in the finished product.

This facility and favorable treatment from the government already gives Optimi a major edge in this rapidly growing sector, but the company isn’t stopping there…

Unfair Advantage #2: Optimi is taking profitable advantage of a $25 Billion Market that is one of 2021’s biggest food trends

Optimi Health is also seizing opportunity in the natural health products space with a line of nutraceutical products including protein powders, supplements, coffees and more…all made with “functional mushrooms” … and all available over the counter. No prescription needed.

Functional mushrooms are mushroom varieties such as Cordyceps, Reishi, Lion’s Maine and Turkey Tail that offer powerful health benefits said to include immune system support, reducing blood pressure and fatigue, and more.

And these benefits have caught the attention of health-conscious consumers. Demand is growing so fast that Whole Foods recently called “functional foods and adaptogens” the #1 top food trend for 2021.

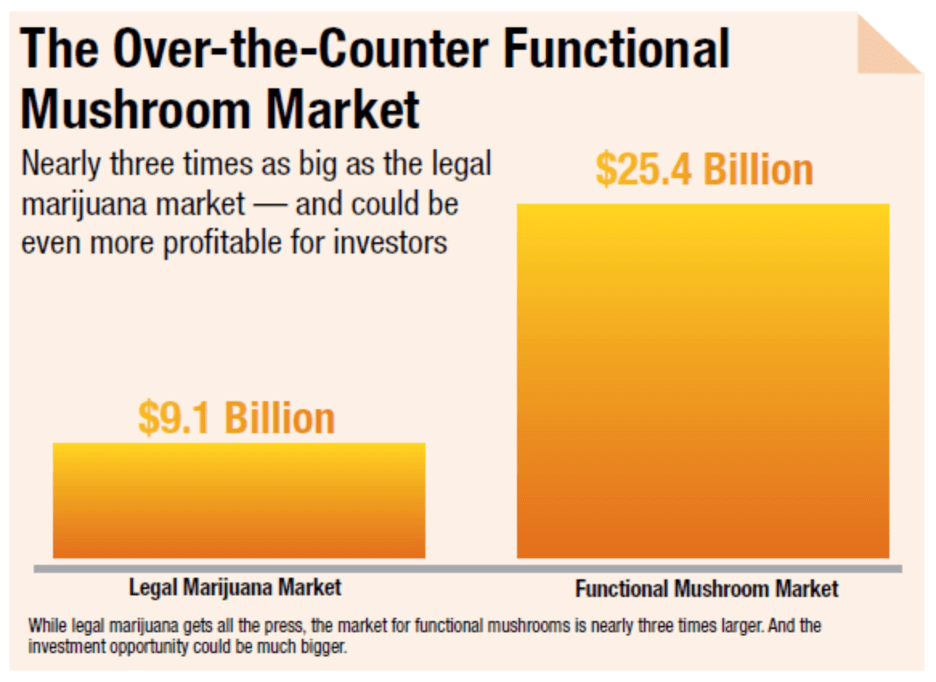

As a result, the $25.4 billion functional mushroom market is now more than twice the size of the $9.1 billion legal marijuana market which has already made many investors a fortune.

And with projected annual growth of 8.44% now through 2026, the functional mushroom market is just getting warmed up. That’s why Optimi is completing a second 10,000-square-foot GMP-certified facility to cultivate functional mushroom varieties. This will allow large-scale production of the company’s nutraceutical products. To tap into this booming market, (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN)plans a comprehensive rollout of its nutraceutical products, including an Amazon rollout… influencer marketing programs… white labeling of its products for other retailers… and direct product sales on its company web site.

These product launches will harness Chip Wilson’s brand-building experience, which he used to grow Lululemon into a $51 billion giant.

Chip Wilson’s expertise gives me a great deal of confidence that Optimi products could quickly gain huge name recognition and distribution.

But there’s still one more major advantage that could make Optimi a big winner for your portfolio:

Unfair Advantage #3: Optimi has established critical partnerships for developing therapeutic mushrooms pharmaceuticals for depression and other conditions

Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) recently established a research partnership with Numinus Wellness Inc, a mental healthcare company focusing on innovative treatments for mental health conditions.

In May of 2021 the companies submitted a pre-clinical trial application for their initial therapeutic mushrooms extract, meaning that testing of this new drug is coming soon. Optimi has also partnered with the University of Calgary, which gives the company access to medical experts and a large, legal patient base for clinical trials.

The new drugs Optimi is developing are badly needed because Big Pharma has failed to deliver effective, long-lasting treatments for most mental health conditions. And the need has never been higher for safe and proven mushroom-based treatments for depression and other conditions.

That’s because more than 300 million people around the world suffer from some form of depression, and another 400 million suffer from some other mental disorder.

Thankfully, as I mentioned earlier, medical studies have proven the therapeutic mushroom’s effectiveness at treating depression and anxiety, without the side effects of traditional antidepressants. Studies also show the therapeutic mushroom’s is effective in treating PTSD, alcohol dependency and cigarette and drug addiction…

Bottom line: Optimi Health’s new drugs could massively disrupt the fields of mental health and addiction treatment.

Optimi has such a powerful story, it has already raised $26 million

I have every confidence that Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) can make its three-Unfair Advantages pay off for the company and its investors. And I’m not alone.

In February of this year, the company went public and hauled in $20.7 million from investors. And that’s on top of the $4.5 million in private placement financing they raised in the fall of 2020.

This raise — which included a syndication of the brokerage firms Canaccord Genuity Corp., Mackie Research Capital Corp. and Stifel Nicolaus Canada Inc. — shows the tremendous confidence investors have in Optimi’s potential.

And two of the brokerage firms that backed Optimi Health Corp. have financed hundreds of millions of dollars into the psychedelic mushroom space, with companies including:

- Mind Medicine Inc. (Nasdaq: MNMD) — $1.044 billion market cap, underwritten by Canaccord Genuity…

- Compass Pathways (Nasdaq: CMPS) — $1.455 billion market cap… backed by Canaccord Genuity…

- Numinus Wellness Inc. (TSXV: NUMI) — $195 million market cap… backed by Mackie Research Capital Corp…

- Cybin Inc. (OTC: CLXPF) — $485.5 million market cap… backed by Canaccord Genuity.

The backing of these prominent investors — combined with Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) successful IPO — allows these three unfair advantages speaks volumes about the company’s upside potential.

Learn More About Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) at your brokerage today!

Learn More About Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) at your brokerage today!

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Optimi Health.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Optimi Health and has no information concerning share ownership by others of any profiled Optimi Health. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Optimi Health or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Optimi Health. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Optimi Health’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Optimi Health future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Optimi Health industry; (b) market opportunity; (c) Optimi Health business plans and strategies; (d) services that Optimi Health intends to offer; (e) Optimi Health milestone projections and targets; (f) Optimi Health expectations regarding receipt of approval for regulatory applications; (g) Optimi Health intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Optimi Health expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Optimi Health business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Optimi Health ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Optimi Health ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Optimi Health ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Optimi Health to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Optimi Health operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Optimi Health business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Optimi Health business operations (e) Optimi Health may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Optimi Health or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Optimi Health or such entities and are not necessarily indicative of future performance of Optimi Health or such entities.