Recent drilling suggests Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF) – aka Fosterville 2.0 -- could be another huge win for Australia’s legendary Lachland Fold Gold Belt.

Gold investors looking for fast profits know that timing is everything. This was seen recently with Kirkland Lake’s purchase of the Fosterville Mine in Australia’s legendary Lachland Fold Gold Belt.

The Fosterville Mine began in 2005 but it was only in 2016-2017, when diamond drilling produced a resource estimate in the millions1 of tons, that the new owners realized they were literally sitting on a gold mine.

Now the Largest Gold Producer in Victoria

Today, Fosterville is the largest gold producer in Victoria, Australia, yielding 619,3662 ounces in 2019 and 640,4673 ounces in 2020.

And that’s just recent production: Estimates of current gold reserves are in excess of 2 million4 ounces.

The mine is one reason why Kirkland Lake’s shares skyrocketed from $1.73 a share in 2015 to as high as $545 in 2020 – a gain of up to 3,021%6.

Now, investors worldwide are eying the latest newcomer in the area, Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF)

, a spinoff of Fosterville South Exploration.

Anticipation is high as Leviathan recently deployed a second diamond drilling rig at its Avoca Project.

Enormous Profits in Just a Few Months

The company from which Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF) is a spinoff, Fosterville South, caught investors’ attention in 2020 when its shares jumped from 87 cents7 to $4.228 per share9 – a gain of 385%10 in just a few months – before the whole industry pulled back at the end of 2020.

Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF)‘s Avoca and Timor projects are proven producers of gold, having been mined back in the late 19th century and early 1900s, reportedly producing 1.3 million11 ounces of gold.

However, the methods used a century ago were primitive, largely confined to extraction of shallow, near-surface and visible deposits from ancient river beds.

Incredibly, no systemic, modern exploration of the projects has been carried out until Leviathan Gold arrived on the scene with an array of state-of-the-art geophysical and drilling techniques.

All told there are 3012 quartz reef targets already identified just on the Avoca property. Only one, the Surprise Reef, has ever seen any drilling.

Leviathan Gold has identified 30 quartz reef targets on the Avoca property alone, only one of which has ever seen any drilling:

- PYRENEES REEF: 16,199 tons mined for 16,602 ounces of gold to 130 meters at an average recovered grade of 32 g/t gold, worked intermittently from 1860 to 1912.13

- EXCELSIOR REEF: 13,200 tons mined for 9,260 ounces of gold to 100 meters at an average recovered grade of 22 g/t gold, worked from 1909 to 1915.14

- VALE’S REEF: 1,444 tons mined for 1,388 ounces of gold to 52 meters at an average recovered grade of 29.4 g/t gold, worked from 1865 to 1883.

- MONTE CRIOSTO REEF: 2,795 tons mined** for 937 ounces of gold to 30 meters at an average recovered grade of 10.3 g/t gold, worked from 1872 to 1877.

Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF)’s nearby Timor Project consists of two high priority targets:

- The Leviathan Group, a large group of historical mines that produced 189,054 tons – or 56,474 ounces – at an average recovered grade of 9.14 grams of gold per ton.

- Shaw’s Reef, which produced 16,881 tons and 12,623 ounces to a depth of 130 meters with an average recovered grade of 22.9 grams of gold per ton.

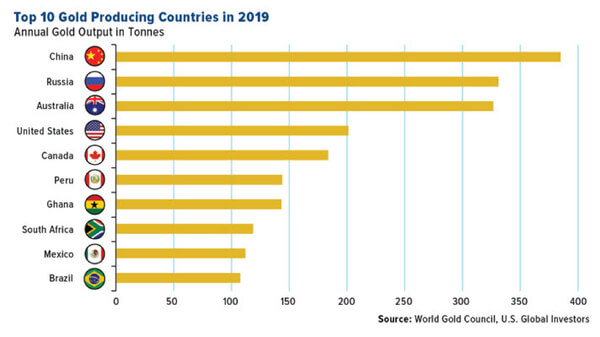

What’s clear is that this part of Australia is one of the richest gold-producing areas in the entire world. Australia is the world’s 3rd largest gold producer today (over 300 tonnes per year), just behind #2 producer, Russia.

Historically, it’s produced in excess of 2,500 tonnes of gold – or more than 80 million15 ounces.

This includes the largest gold nugget ever discovered, the 3,123-ounce nugget known as the Welcome Stranger, uncovered in 1869.

It also includes the two fist-sized nuggets discovered in 2020 by two miners, Brent Shannon and Ethan West, estimated to be worth $250,000.

With mining stocks, there are no sure bets, but LVX offers investors strong odds. For more information on Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF) and what’s happening in Australia’s Golden Triangle, clink on the link below:

Learn More About Leviathan Gold (TSX.V: LVX)

Learn More About Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF) at your brokerage today!

Learn More About Leviathan Gold Ltd. (TSXV:LVX, OTC:LVXFFTSXV:LVX, OTC:LVXFF) at your brokerage today!

1“Soon David’s thoughts turned to proper mining at Fosterville. Exploration by percussion and later diamond drilling produced a resource estimate of 3.5 Mt at 2.3 g/t of material suited to open pit mining and heap leaching. AMC was engaged to prepare a feasibility study for the project.”” https://amcconsultants.com/experience/kirkland-lake-fosterville-gold-mine/

2https://www.kl.gold/our-business/australia/fosterville-mine/default.aspx

3https://www.kl.gold/our-business/australia/fosterville-mine/default.aspx

4https://dynamicwealthresearch.com/news/leviathan-gold-goes-public-with-exciting-high-grade-gold-opportunity

5Jul 31, 2020 52.02 54.74 51.80 54.60 54.21 https://finance.yahoo.com/quote/KL/history?p=KL

6https://percentagecalculator.net/

7Converted from CAD $1.10. See https://www.xe.com/currencyconverter/convert/?Amount=5.35&From=CAD&To=USD

8Converted from CAD $5.35. See https://www.xe.com/currencyconverter/convert/?Amount=5.35&From=CAD&To=USD

9Figures provided in: https://www.newswire.ca/news-releases/leviathan-gold-to-commence-drilling-with-a-second-rig-at-its-newly-acquired-avoca-and-timor-projects-871254990.html

10https://percentagecalculator.net/

11https://www.newswire.ca/news-releases/leviathan-gold-to-commence-drilling-with-a-second-rig-at-its-newly-acquired-avoca-and-timor-projects-871254990.html

12From PDF, “DWR_Leviathan_InvestorReport_6”

13Ibid.

14Ibid, etc.

15https://www.newswire.ca/news-releases/leviathan-gold-to-commence-drilling-with-a-second-rig-at-its-newly-acquired-avoca-and-timor-projects-871254990.html

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher’s compensation for articles appearing on this website is as follows:

The Publisher has been paid approximately $500 per week while the advertisement campaign was active by Think Ink Media as compensation to host the article profiling Leviathan Gold Ltd.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP

The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Leviathan Gold Ltd.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Leviathan Gold Ltd.’s industry; (b) market opportunity; (c) Leviathan Gold Ltd.’s business plans and strategies; (d) services that Leviathan Gold Ltd. intends to offer; (e) Leviathan Gold Ltd.’s milestone projections and targets; (f) Leviathan Gold Ltd.’s expectations regarding receipt of approval for regulatory applications; (g) Leviathan Gold Ltd.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Leviathan Gold Ltd.’s expectations with regarding its ability to deliver shareholder value.

Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Leviathan Gold Ltd.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Leviathan Gold Ltd.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) the accuracy of budgeted costs and expenditures; (e) Leviathan Gold Ltd.’s ability to attract and retain skilled personnel; (f) political and regulatory stability; (g) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (h) changes in applicable legislation; (i) stability in financial and capital markets; and (j) expectations regarding the level of disruption to as a result of COVID-19.

Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Leviathan Gold Ltd.to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Leviathan Gold Ltd.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Leviathan Gold Ltd.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Leviathan Gold Ltd.’s business operations (e) Leviathan Gold Ltd.may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, Leviathan Gold Ltd. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Leviathan Gold Ltd.nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Leviathan Gold Ltd. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

Historical Information

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Leviathan Gold Ltd. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Leviathan Gold Ltd.or such entities and are not necessarily indicative of future performance of Leviathan Gold Ltd. or such entities.