BREAKING: Inflation Reduction Act Sets Up American Lithium Mining Boom

US Lithium Production Needs to Multiply 15x By 2025 to Satisfy Domestic Demandi

Editorial | May 5, 2023 | Industry

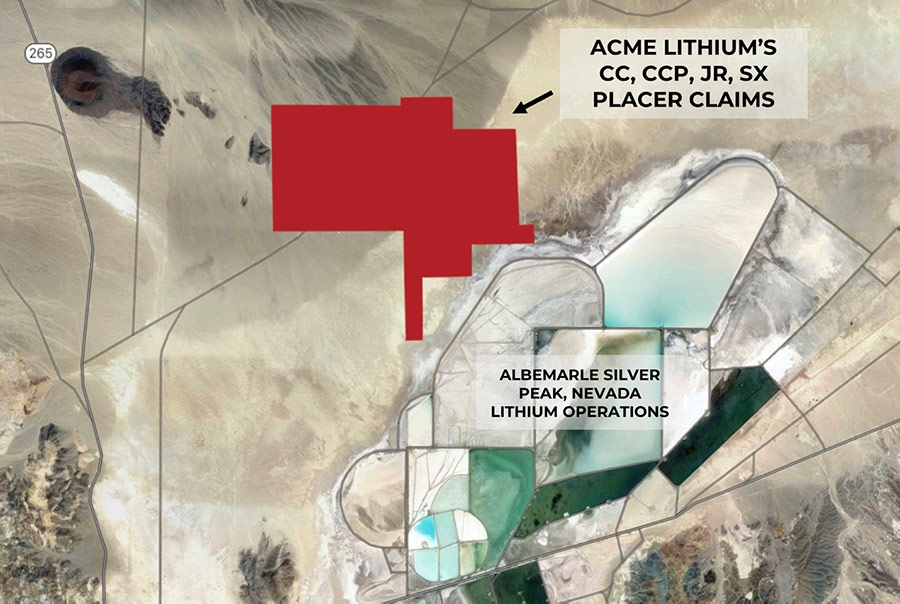

ACME Lithium (CSE:ACME | OTC:ACLHFCSE:ACME | OTC:ACLHF) has acquired rights to a sizable project in one of richest lithium territories in North America — a region that holds what the US Geological Survey calls “The best-known (brine) deposit in the world.”ii

Early results are positive – and the next stage is underway, with Phase 2 drilling commenced in the first quarter of 2023.

The Opportunity at a Glance

The Market

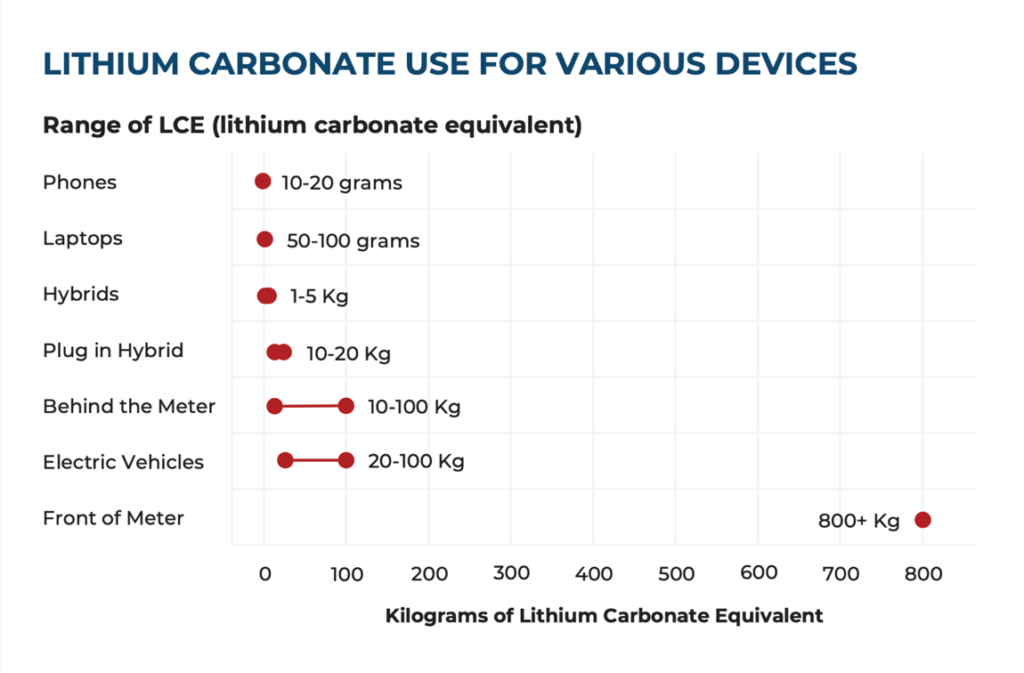

- Demand for lithium is skyrocketing — led by the meteoric growth in EVs. Lithium demand for EVs in the US alone is projected to grow from 40,000 tonnes to 400,000 tonnes by 2030, with CAGR growth over 23%. By 2040, global demand for lithium is expected to grow 4,000% from today.

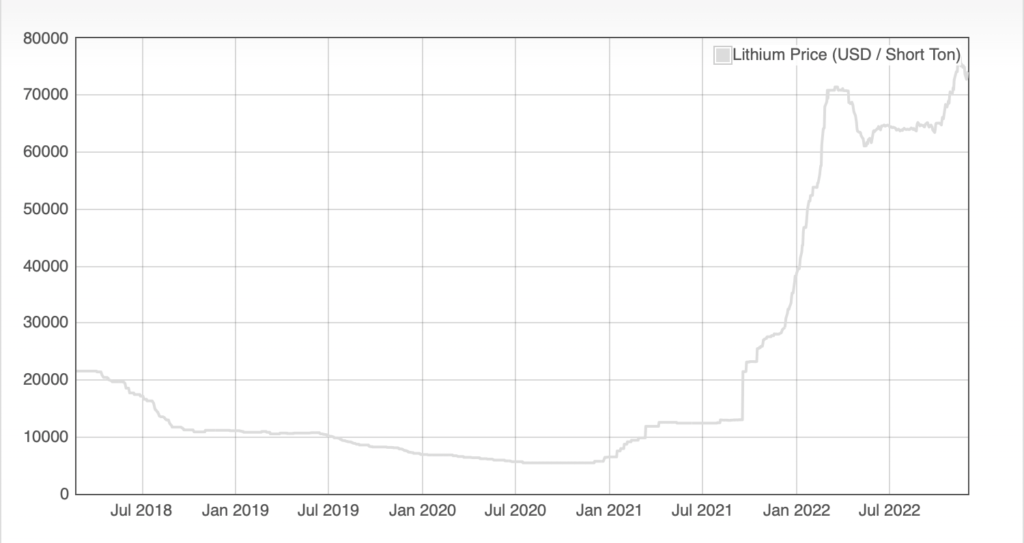

- Even with the majority of demand growth still in the future, current demand has pushed the price of lithium up nearly 20x in the past two years — from just over $5,000/tonne, to nearly $80,000/tonne.

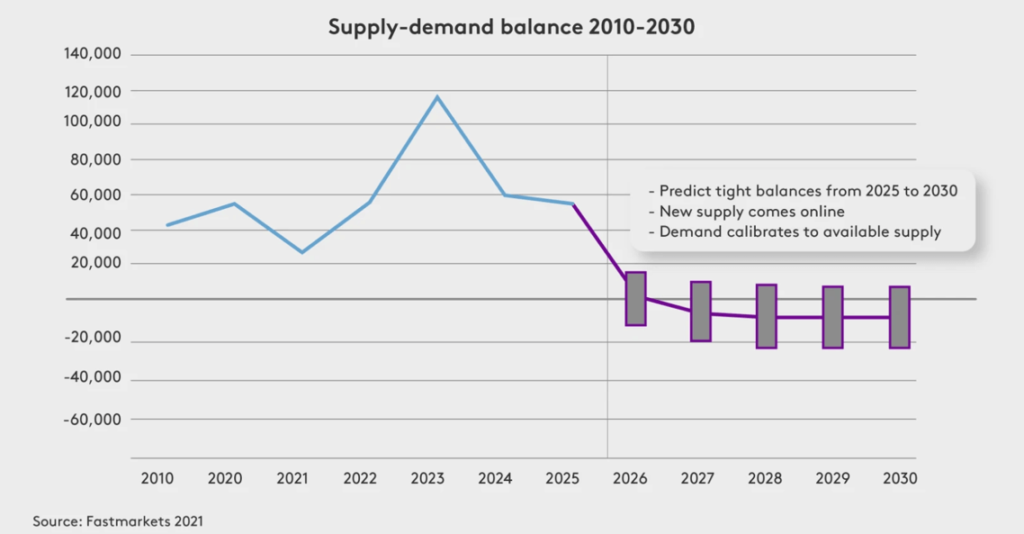

- To date, supply has kept up with demand, but that is changing quickly. By 2025, demand is expected to outstrip supply by a multiple of 15 times.Many analysts estimate lithium supply will grow nearly 4X over the next eight years, from the 320,000 metric tons mined last year to 1.4 million metric tons by 2030.iii Even with an anticipated quadrupling of supply, that means lithium will inevitably fall into a perpetual deficit, that only gets greater by the year.

UBS’s renowned Global Head of Mining Research, Glyn Lawcock, issued a warning about this coming shortfall…

“There is not sufficient supply to meet this demand projection based on our knowledge of known projects today. That includes all projects whether they are under construction, in feasibility or still in exploration.” iv

And, with the average lithium mine taking 4-10 years from discovery to production, there is little hope of supply catching up in the near term. As demand passes supply, expect the price of lithium to shoot up at a pace that dwarfs what we’ve seen to date.

- Today, approximately 95% of all lithium is produced in only four countries — Argentina, Chile, Australia, and China. And Chinese companies control a significant slice of Australian output v.

The US needs to ensure strategic metals like lithium are supplied domestically. And lithium — a crucial input for most electronics — is now considered a strategic material. That’s why, as part of the Inflation Reduction Act, there is a $10,000 tax credit available for any EV bought — provided that the lithium and other strategic resources are sourced from the US, Canada, or another formal US ally.

This, in turn, has kicked off a domestic lithium boom like none that has ever been seen before.

The Opportunity

- ACME Lithium (CSE:ACME | OTC:ACLHFCSE:ACME | OTC:ACLHF) owns and is under option for 100% mining rights to 122 claims covering 2,440 acres in Clayton Valley, directly northwest of the only lithium extraction operation in the United States — Albemarle’s Silver Peak Project. Directly above a huge aquifer of lithium-rich brine, the US Geological Survey calls Silver Peak the best known source of brine lithium in the world.

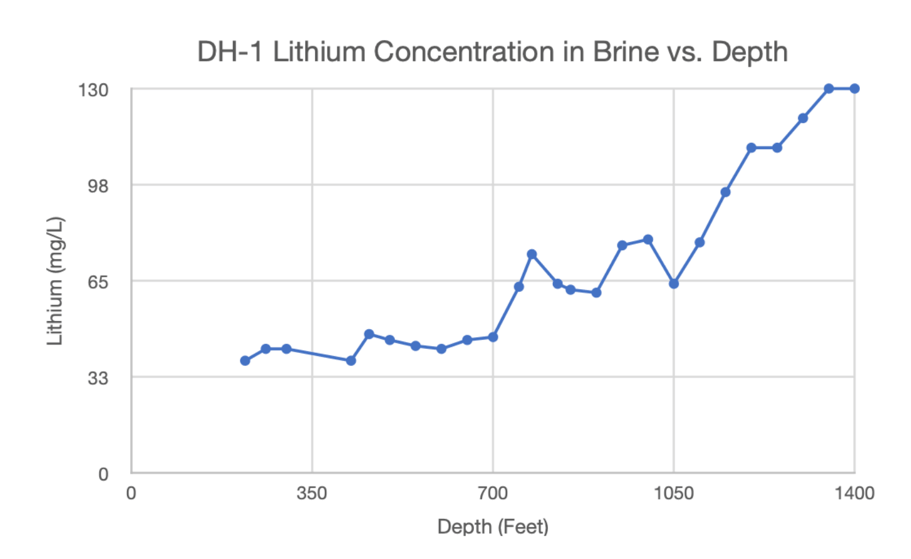

- These claims have already undergone discovery drilling, with positive results. Lithium brine was found at 800 feet depth, and concentrations continued to increase in grade to the bottom of the hole at 1400 feet. Commencing in early 2023, ACME’s current drill program will include a larger-diameter test well to 2,000 feet as well as three new exploration holes. The largest program to date, this pump test and new drilling will see how easily the brine can be brought to the surface, and also the potential size of what the Company hopes is an economic lithium resource.

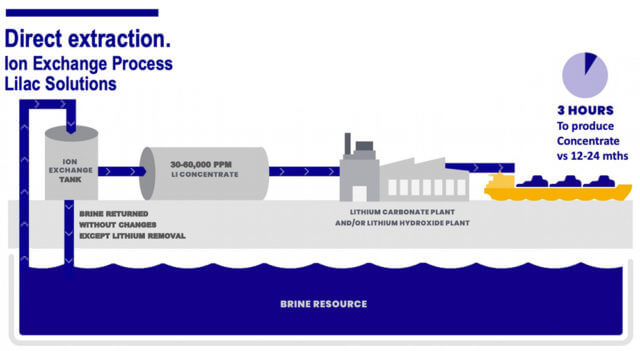

- In the future, thanks to a new technology called Direct Lithium Extraction (DLE), ACME hopes to remove lithium from brine with what could be a faster process, at much less cost, and with much less disturbance to the environment. Using this new technology, brine will be returned almost immediately to the aquifer — after its lithium carbonate has been removed.

- Lithium found in brine aquifers is rare — The U.S. Geological Survey has identified Clayton Valley as one of only three lithium-enriched areas in the world. ACME’s project sits within this prolific region.

Lithium in this form is incredibly valuable, as it is the easiest to turn into liquid lithium-ion batteries. - ACME Lithium is diversified in other areas as well. The Company holds claims at another project in southwestern Nevada with neighboring clay lithium projects in late stage feasibility within the immediate area. And the company holds promising lithium projects in Manitoba and Saskatchewan, Canada, with the Manitoba land holdings contiguous with the only hard rock lithium mining and production in the country. Hard rock lithium can be more easily processed into lithium hydroxide, which has the capacity for greater energy density than lithium-carbonate. That’s a necessary feature for the development of solid-state batteries— which are lighter and cheaper than regular lithium-ion batteries.vi The phase 1 drilling program just concluded in Manitoba, with 223 samples sent out for testing. That means assay results, and a further drill program to explore promising new targets, should be coming online in the near-term.

How Lithium Became the Most Important Metal in the World

China controls the lithium market, having conducted a multi-year campaign to secure lithium resources across the globe, specifically in South America.

According to the U.S. Geological Survey (USGS), China “has been buying stakes in mining operations in Australia and South America where most of the world’s lithium reserves are found.” vii

Together with Australia, Chile, and Argentina, they produce about 95% of the world’s lithium.

On top of that, 60% of the lithium brought out of the ground elsewhere must travel to China to be refined.viii As director of the Center for Critical Minerals Strategy at Securing America’s Future Energy, Abigail Wulf put it,

“If China wanted to cut off supplies of processed materials for li-ion batteries, as it did with rare-earth materials to Japan in 2010, it would create a dire situation.” ix

And the lithium market, to a greater and greater extent every year, controls the tech industry.

Every portable electronic device needs it. Every lithium-ion battery uses more lithium than any other metal, as you’d guess from the name.

And, while EVs made up 4% of vehicle sales in 2020, its expected that 52% of US car sales will be EVs by 2030.

With EV growth accelerating, the largest customers for lithium are now waking up. EV demand is projected to consume over 90% of lithium supply by the time the sector is mature.

Given the demand for lithium… and the fact that most of lithium supply runs through China… the US has a major problem.

Many US companies need lithium to create their products. Without lithium, Apple — the largest company by market cap in the world — would crash.

The world is rapidly transitioning away from fossil fuels — which means greater reliance on electricity carried in batteries. That includes EVs, of course — but also renewable power that stores energy for when the sun isn’t shining or the wind isn’t blowing.

And lithium is becoming of greater strategic importance for the military. It can be found in everything from small drones to the power packs of augmentation systems like advanced vision goggles, to the communications systems embedded in helmets.

In short, the US needs to secure alternative sources of lithium, and fast.

The US Government is Pumping Billions into Lithium Production

The US government isn’t lying about idle while this potential supply crisis emerges.

It will not leave itself in position to be economically undermined. China has done exactly that to other countries before — like when it cut Japan off from rare earth metals during a political spat, or when China shut down resource exports to Australia for similar reasons.

But the US also cannot allow its supply of lithium to be cut. It would be devasting to the economy, and dangerous for the military.

That’s why the US is investing heavily in building out domestic supply of lithium.

To be clear — the demand for lithium would lead to development of domestic lithium resources either way.

But, given the strategic nature of the metal, and its fragile supply chain, the US government is injecting billions into the industry as an accelerant. The US knows it needs to reduce reliance on Chinese lithium and refining as quickly as possible.

As a result, grants are being made available to companies willing to advance domestic exploration and production. The Department of Energy recently gave Albemarle nearly $30 million to expand lithium production at their Silver Peak project, for example — which will eventually lead to doubling output.

But the biggest subsidy to date comes inside the Inflation Reduction Act, or the IRA for short.

It stipulates that every EV sold in the US is eligible for a $10,000 tax rebate… provided that the lithium and other important metals in it are sourced from the US, Canada, or a close ally.

Car manufacturers balked at this provision — because it currently can’t be fulfilled. The US doesn’t have the capacity to produce enough lithium for demand — with only one operating mine, producing a fraction of the required lithium each year.

That’s the point.

This part of the act is designed to accelerate both adoption of EVs… and development of domestic lithium supply.

ACME Lithium (CSE:ACME | OTC:ACLHFCSE:ACME | OTC:ACLHF) is well positioned to benefit from this policy, strategically located in two of North America’s enviable mining jurisdictions.

Advancing Exploration In One of the Fastest Growing Markets Today

There is only one active lithium mine in the United States, and only one active mine in Canada.

ACME Lithium has claims contiguous to both of them.

First, let’s take a closer look at Clayton Valley — home to Albemarle’s Silver Peak lithium brine project.

Today, Silver Peak produces around 5,000 tonnes of lithium a year — with that number expected to reach 8,000 soon, thanks to an injection of cash from the DOE.

But that may be just scratching the surface.

This is partially because Albemarle is using traditional ways of extracting lithium from brine. Namely, creating huge pools of the brine, and waiting around two years for the water to evaporate and leave behind a lithium carbonate residue, which can then be collected.x

According to the National Renewable Energy Lab, there are faster methods available today.i

Direct Lithium Extraction (DLE) is a new process whereby the brine is brought up from underground — basically using a well.

That brine is then treated, removing the lithium from it in a matter of hours.

After extracting the lithium, the brine is reinjected into the aquifer.

Caption: Not all DLE use Ion Exchange Processes, but the basic concept is the same for them all xi.

This allows for much faster lithium extraction.

DLE is also very new — with only a few test projects currently in place.

If and when ACME use DLE at Clayton Valley, it could completely change the pace at which lithium can be extracted.

The National Renewable Energy Lab has also indicated that DLE is a much more eco-friendly process. There’s no need to convert large tracts of land into brine pools with the brine going back into the ground after the lithium has been captured.

And there’s less disturbance of the ecosystem — either above ground or below. The process is essentially the same as digging a well. Only this well doesn’t produce potable water — it produces lithium-rich brine.

ACME’s initial discovery drilling found promising lithium concentrations, with higher concentrations of 130 mg/L found at greater depth.

As part of a phase 2 multi-hole drilling program, the Company recently announced the commencement of a test well installation, followed by well development, and a pumping test.

In 2023, ACME will get independent analyzed results from the newest development drilling program. If there are no surprises, that positions ACME Lithium one step closer to identifying a new domestic lithium resource.

US-based lithium will be crucial to claiming the $10,000 tax credit on EVs — which means US automakers will be fighting to get their slice of this incredibly lucrative supply.

Further, Nevada is perhaps the ideal spot for this mine. Nevada has laws and regulations that are friendly to miners, and a climate that allows work to be done 12 months a year.

There’s a reason Tesla built its first battery-producing Gigafactory a short drive awa

We’ve long known Clayton Valley is, as the US Geological Survey says, the best-known brine resource in the world.ii

But Clayton Valley isn’t the only iron in the fire.

Diversified Lithium Holdings Throughout North America

Not far from Clayton Valley, ACME Lithium also holds substantial claims in Fish Lake Valley, totaling 4,002 acres.

15-20 million years ago, this area was fed lithium by the same volcanic activity that fed Clayton Valley.

Only this lithium is found in clay, instead of brine.

Until recently there was no economical way to mine these near-to-the-surface clays, which can be made up of as much as 90% lithium. But recent technological advancements are now making this process possible, and as such, are attracting industry-wide attention.

Lithium Americas Corp’s Thacker Pass project in Nevada, just a few counties away, marks a clear example of this newfound interest in lithium clays.

The company established a proven resource estimate of 3.1 million tonnes of lithium carbonate.xii

ACME Lithium (CSE:ACME | OTC:ACLHFCSE:ACME | OTC:ACLHF) is now starting the process of proving up a lithium discovery at their claim area in the Fish Lake Valley.

As a pilot project, ACME Lithium was granted the honor of being the first company in North America to take advantage of a ground-breaking satellite based technology with ASTERRA.

Based in Israel, ASTERRA has developed a revolutionary Synthetic Aperture Radar (SAR) utilizing data analytics, patented algorithms and artificial intelligence to identify lithium specific targets.

Eight of the company’s particularly high grade lithium targets were analyzed, leading to the collection of fifty-eight samples for further testing.

Completed in March 2023, this geochemical sampling survey, resulted in the highest surface lithium values to date, with concentrations up to 1,418 ppm lithium. That’s more than double the highest concentration identified in historical sampling.

The company moved quickly on these positive results, snatching up another 63 claims over 1,295 acres, directly contiguous to the south east of the existing project.

But that isn’t the end of the story.

ACME’s Fish Lake Valley project directly adjoins Ioneer Ltd’s world class Rhyolite Ridge project to the west. That’s a critical point because Rhyolite Ridge has been making headlines since last summer, when Toyota announced a joint battery venture with Panasonic Corp. to purchase 4,000 tonnes of lithium carbonate per year for a total of five yearsxiii.

That news was eclipsed on January 13th, when the US government announced a commitment of up to $700 million in construction funding to Ioneer’s project. Under the Department of Energy’s Advanced Technology Vehicles Manufacturing (ATVM) loan program, the proposed loan to Ioneer could allow the company to start mine construction next yearxiv.

That could draw newfound attention to this developing lithium hotspot… and to ACME Lithium’s nearby 207 mining claims.

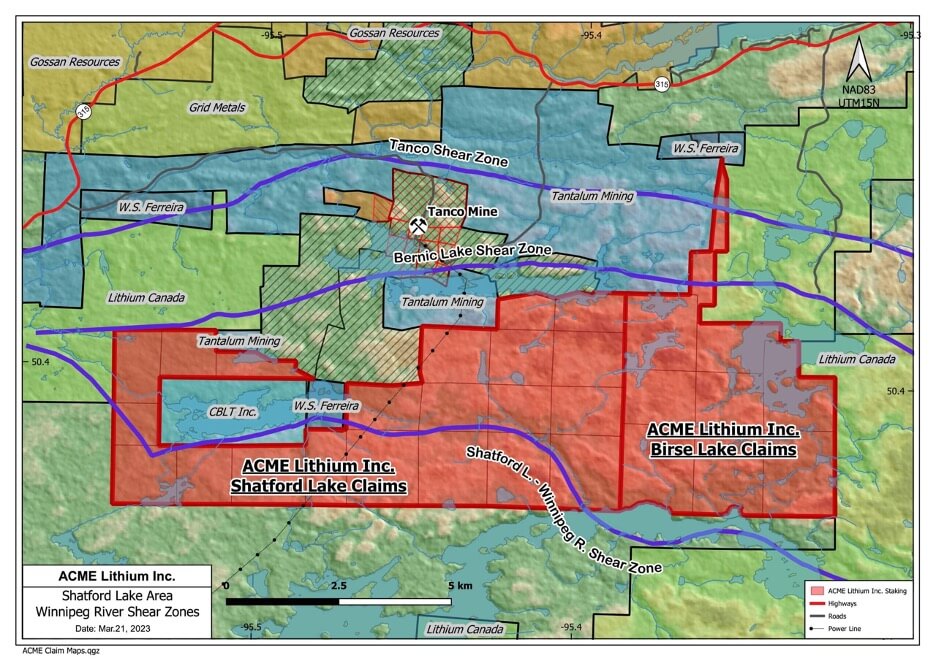

Two Projects Within Miles Of The Historically Rich Tanco Mine

In Manitoba, Canada, ACME Lithium has a project directly next to the only hard-rock lithium mines in the country.

Now, due to recent breakthroughs in the development of solid-state lithium batteries, demand for the lithium hydroxide that can be processed from lithium hosted in spodumene is on the rise.

- They weigh less than traditional lithium-ion batteries — a crucial concern for auto manufacturers.

- They are more energy dense.

- And they last longer than traditional lithium-ion batteries.

Solid-state batteries are in the early stages of development. We will still use traditional lithium-ion batteries for years.

However, in the future, solid-state batteries are likely to grow in popularity.

And with them, so will hard-rock lithium mines.

ACME Lithium actually has three active projects in the pegmatite region of Manitoba — two of which adjoin the only operating hard-rock lithium mine in the country.

The Tanco Mine has been in operation since the 1950s, and started producing lithium in the 1980s, before being shut down in 2009 due to lapsing lithium prices.xvi About 1.8 million tonnes of spodumene has been mined at the site since 1984.

More than a decade later, the mine reopened just last year under Sinomine’s ownership, drawing eyes to this once bustling mining region.

Just due south of the Tanco Mine, ACME Lithium has just completed an initial drill program on their 100%-owned Shatford Lake and Birse Lake projects. A total of eight holes were diamond drilled, covering a total of 3280 meters. Pegmatites were encountered in six of the eight holes.

The company has submitted 235 samples for assay, with results expected in the near-term.

Led by Experts in the Field

It shouldn’t be a surprise that ACME Lithium (CSE:ACME | OTC:ACLHFCSE:ACME | OTC:ACLHF) has such a extensive portfolio, with astute plans for development.

CEO, Stephen Hanson, has headed up companies in numerous sectors including alternative energy, mining and oil and gas. He’s been successful in a number of M&A strategies including several exits for major firms.

Director, Yanis Tsitos, is a geophysicist with almost 30 years’ experience in the mining industry. He has 19 years with BHP Billiton, group one of the biggest mining companies in the world. He is also currently president of Goldsource Mines, and sits on several boards as an independent director.

And VP for Exploration, William Feyerabend, is a Certified Professional Geologist and a member of the American Institute of Professional Geologists. He has direct working experience in the exploration and development of lithium projects, including technical reports in Nevada.

What to do now…

By the time you read this, Phase 2 drilling is now completed in Clayton Valley, Nevada and results are anticipated for Manitoba.

If you want exposure to North America’s burgeoning lithium mining industry, it’s hard to find a company with a more diversified range of domestic projects than ACME Lithium (CSE:ACME| OTC:ACLHFCSE:ACME| OTC:ACLHF).

i Demand projected to hit 75,000 tonnes by 2025: https://medium.com/prime-movers-lab/does-the-u-s-have-enough-lithium-to-support-the-growing-ev-market-d73a44a969e5 – Only working project — Silverlake — produces 5,000 tonnes. The article above says Silverlake only produces 1,000 tonnes – if we go with that number, we can change to 75x ii https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf iii https://www.statista.com/statistics/1225076/global-lithium-mine-production-projection/ iv https://www.forbes.com/sites/danrunkevicius/2020/12/07/as-tesla-booms-lithium-is-running-out/?sh=615454371a44 v https://www.instituteforenergyresearch.org/renewable/china-dominates-the-global-lithium-battery-market/ vi https://piedmontlithium.com/why-lithium/lithium-101/where-lithium-comes-from-does-make-a-difference-brine-vs-hard-rock/ vii https://www.pv-magazine.com/press-releases/aqua-metals-and-dragonfly-announce-loi-to-supply-lithium-hydroxide-to-dragonfly-energy-in-ongoing-development-of-solid-state-li-ion-batteries/ viii https://www.voanews.com/silicon-valley-technology/how-china-dominates-global-battery-supply-chain ix https://www.wardsauto.com/industry-news/expert-warns-china-calling-shots-ev-battery-materials x https://www.wardsauto.com/industry-news/expert-warns-china-calling-shots-ev-battery-materials xi https://www.reuters.com/article/mining-lithium-technology-focus-idCAKCN2LZ25R xii https://stockhead.com.au/resources/lake-resources-md-steve-promnitz-on-why-the-asx-lithium-stock-is-an-expert-favourite/ xiii https://www.lithiumamericas.com/usa/thacker-pass/ xiv https://money.usnews.com/investing/news/articles/2022-07-31/toyota-panasonic-battery-jv-to-buy-lithium-from-ioneers-nevada-mine xv https://www.reuters.com/business/autos-transportation/us-offers-700-million-loan-ev-battery-material-project-2023-01-13/ xvi https://www.manitoba.ca/iem/min-ed/mbhistory/mininv/197.htm xvii https://www.northernminer.com/news/historic-tanco-mine-in-manitoba-producing-lithium-again-but-this-time-under-chinas-sinomine/

IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY!

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of ACME Lithium (“ACME”) and its securities, ACME has provided the Publisher with a budget of approximately $40,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by ACME) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company ACME and has no information concerning share ownership by others of in the profiled company ACME. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ACME industry; (b) market opportunity; (c) ACME business plans and strategies; (d) services that ACME intends to offer; (e) ACME milestone projections and targets; (f) ACME expectations regarding receipt of approval for regulatory applications; (g) ACME intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ACME expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ACME business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ACME ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ACME ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ACME ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ACME to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ACME operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ACME business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ACME business operations (e) ACME may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling ACME Lithium .

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled ACME Lithium and has no information concerning share ownership by others of any profiled ACME Lithium . The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any ACME Lithium or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the ACME Lithium . Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled ACME Lithium ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding ACME Lithium future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to ACME Lithium industry; (b) market opportunity; (c) ACME Lithium business plans and strategies; (d) services that ACME Lithium intends to offer; (e) ACME Lithium milestone projections and targets; (f) ACME Lithium expectations regarding receipt of approval for regulatory applications; (g) ACME Lithium intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) ACME Lithium expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute ACME Lithium business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) ACME Lithium ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) ACME Lithium ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) ACME Lithium ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of ACME Lithium to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) ACME Lithium operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact ACME Lithium business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing ACME Lithium business operations (e) ACME Lithium may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of ACME Lithium or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of ACME Lithium or such entities and are not necessarily indicative of future performance of ACME Lithium or such entities.

CAUTIONARY NOTE TO INVESTORS CONCERNING ADJACENT PROPERTIES:

This presentation contains information about adjacent properties on which we have no right to explore or mine. Investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.

FORWARD-LOOKING STATEMENTS:

This communication contains certain statements which may constitute forward-looking statements, such as estimates and statements that describe future plans, objectives or goals, including words to the effect that the company expects or management expects a stated condition or result to occur. Such forward-looking statements are made pursuant to the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The following list is not exhaustive of the factors that may affect any of forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on forward-looking statements.

Actual results relating to exploration, mine development, mine construction, mine operation, and mine reclamation related to projects could vary materially from those expectations. Capital costs and operating costs could vary materially from those expectations. Resource and reserve calculations could vary materially from those expectations. Reason or factors that may cause such variability in expected results includes resources and reserves differing from expectations, changes in general economic conditions and conditions in the financial markets, changes in demand and prices for the products that may be produced. Other factors may include litigation, legislative, environmental and other judicial, regulatory, political and competitive developments in domestic and foreign areas in which we operate, technological and operational difficulties encountered, productivity of our resource properties, changes in demand and prices for minerals, labor relations matters, labor, material, and supply costs, and changing foreign exchange rates. This list is not exhaustive of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Further information regarding these and other factors is included in our filings with the Canadian provincial securities regulatory authorities (which may be viewed at www.sedar.com (http://www.sedar.com/)).

*Please note, proximity of location to Albemarle’s property is no indication that ACME Lithium’s exploration will show similar findings.