WonderFi Technologies Inc. (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) Delivers Investors Exposure to Regulated Crypto Trading

By now, many investors have already heard about the current crypto liquidity crisis1, and have even been perhaps spoked off the space for the time being because of a looming crypto winter2.

But few know the tale of two ‘Sharks’—a story of how two famous investors swam different routes through the turbulence of the crypto markets.

One nearly drowned, while the other more prudent shark followed his instincts and secured a bright future for his investment.

Back in early July, celebrity entrepreneur and Shark Tank star Mark Cuban got caught up in the ripple effect of a $667-million default that effectively sunk massive crypto lender Voyager Digital.3

Cuban’s troubles began when it became known that Voyager Digital—with whom Cuban’s NBA Dallas Mavericks signed a 5-year crypto deal4—was filing for bankruptcy after a loan to now-infamous crypto hedge fund Three Arrows Capital (aka 3AC).

The failure of 3AC led to the vaporization of trillion dollars of market value, having caused market panic and selloffs.5

The 3AC bomb didn’t just take out Voyager but also BlockFi, Babel Finance and many others in its wake.

But it didn’t harm one major crypto player… the one that just happened to be crypto entity that drew Cuban’s Shark Tank co-star, Kevin O’Leary.

That company is WonderFi Technologies(TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF).

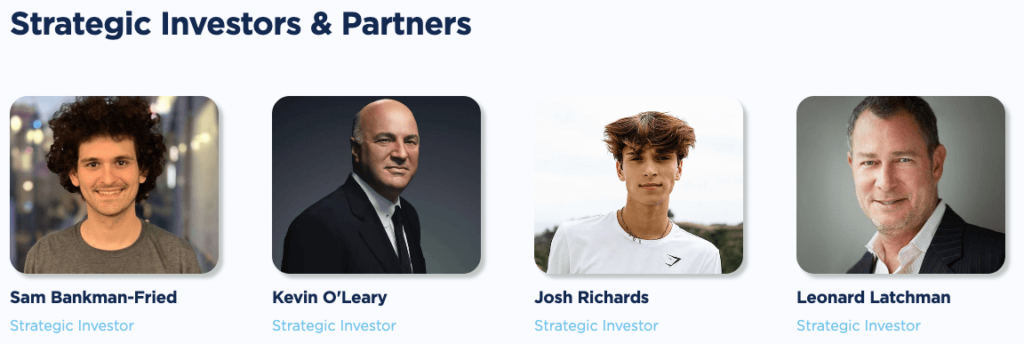

Less than two years after O’Leary infamously shared his anti-crypto claims,6 he became one of the strategic investors behind WonderFi along with billionaire FTX CEO Sam Bankman-Fried.

WonderFi has successfully positioned itself to attract and convert one of the world’s most famous crypto critics in O’Leary, into one of the space’s biggest evangelists.7

It’s done this by making itself one of the best ways for investors looking to have exposure to crypto, namely through compliant crypto.

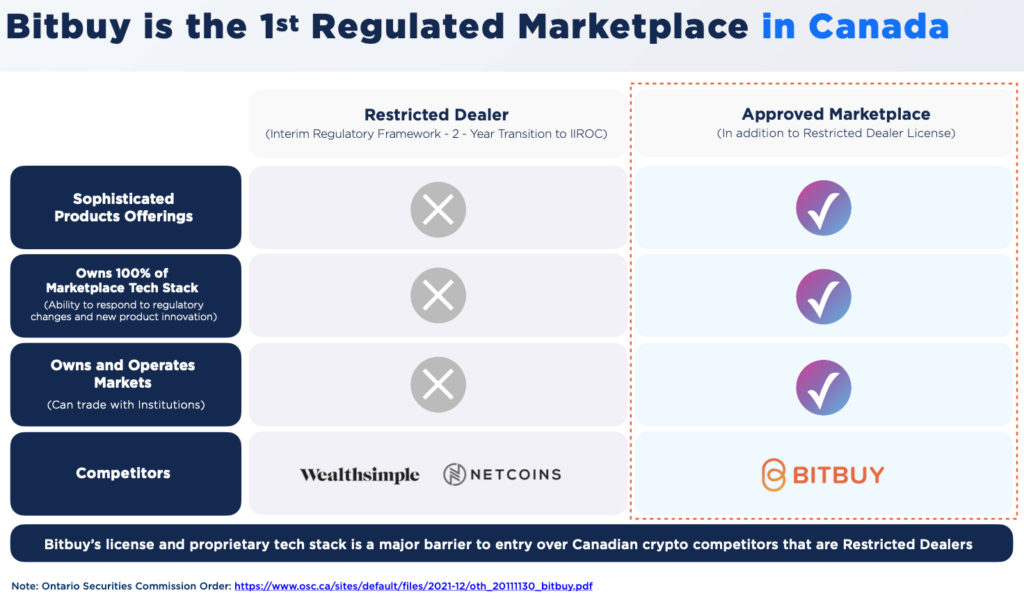

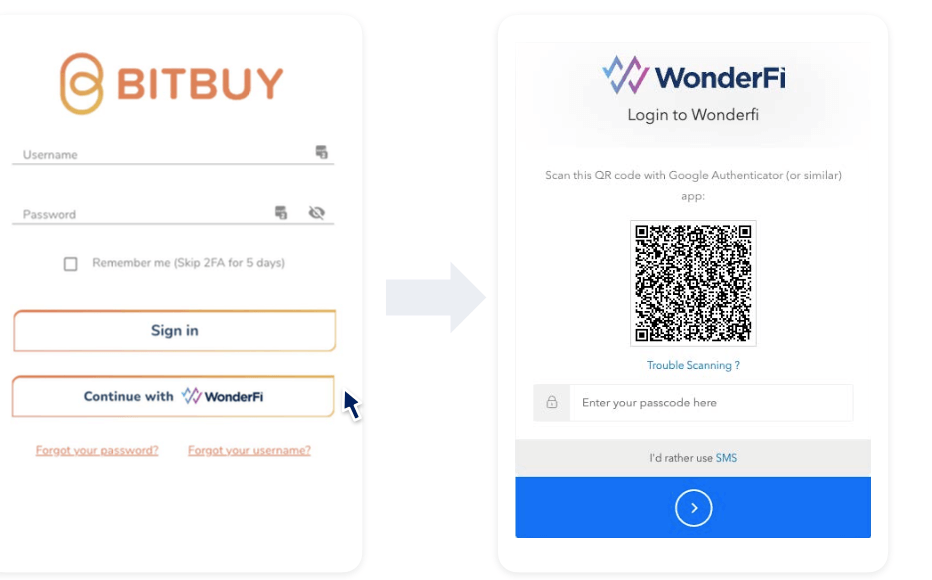

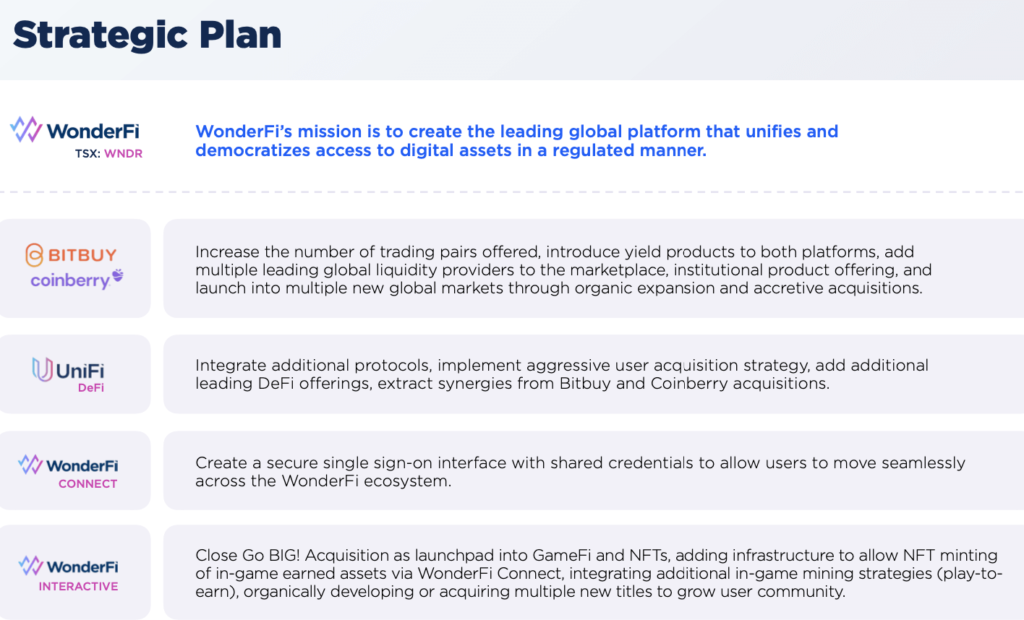

One of its biggest splashes to date was the acquisition of Canada’s largest approved crypto trading marketplace Bitbuy,8 which in 2021 received full approval from the Ontario Securities Commission (OSC), to become the first registered marketplace that’s also a brokerage of crypto assets9.

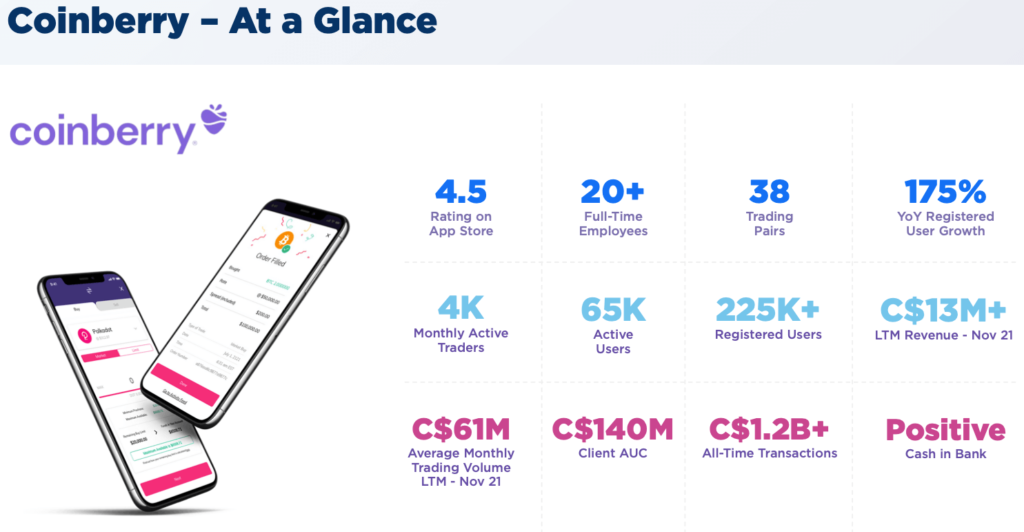

It didn’t stop there, as by July 2022, WonderFi also closed the acquisition of one of Canada’s leading crypto asset trading platforms registered with the Canadian Securities Administrators (CSA) and Canada’s first pure-play licensed crypto broker, Coinberry.10

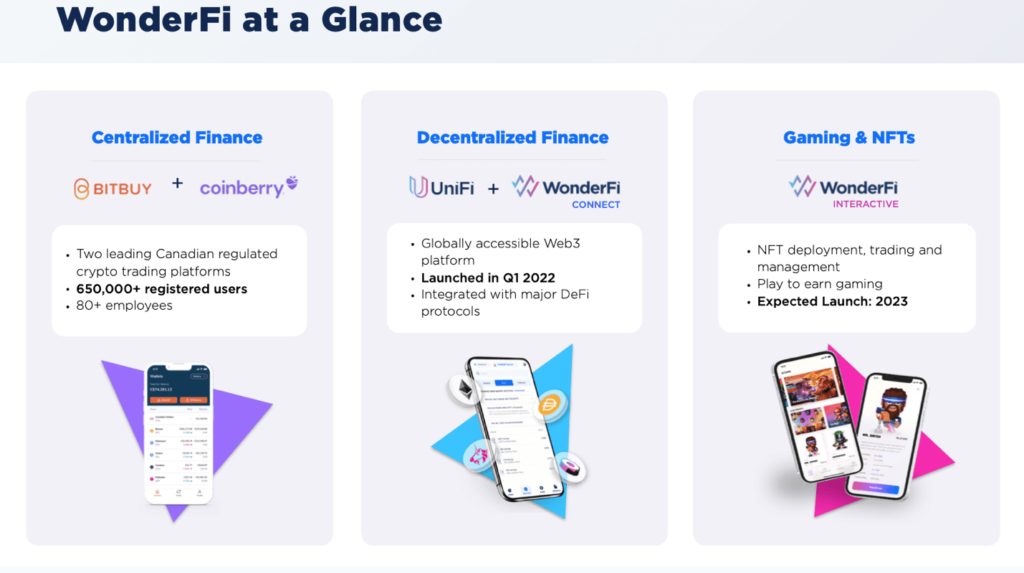

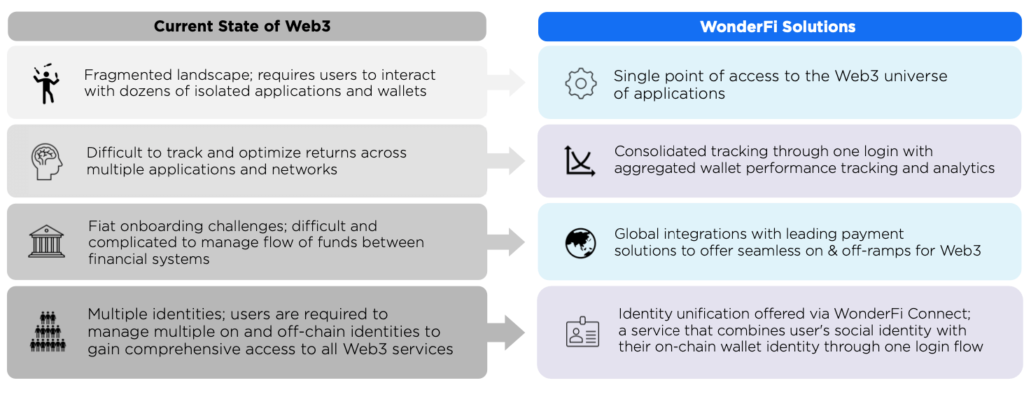

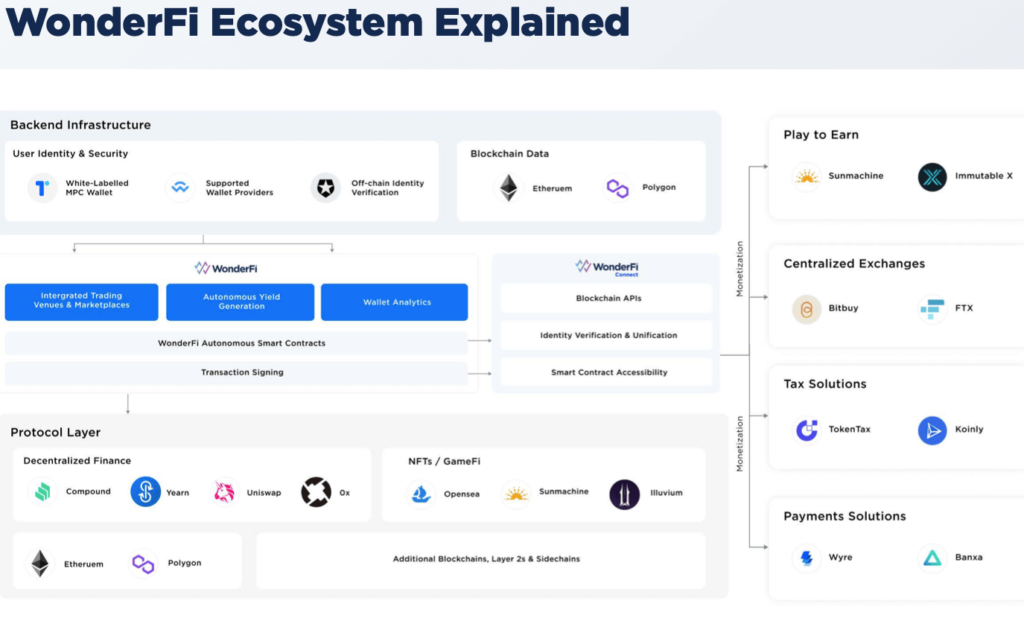

Prior to these acquisitions, WonderFi established itself with its UniiFi and WonderFi Connect platforms as a provider of a globally accessible Web3 platform, integrated with major Decentralized Finance (DeFi) protocols.

Together, these pieces together make for a powerhouse in the crypto space, secured and regulated, all WITHOUT any leverage bombs, the likes of which took out Voyager Digital and its peers.

Now, let’s break down the numerous factors that likely led to O’Leary dropping his skepticism of the crypto space leading to his big investment in WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) and why it’s easily THE BEST WAY to gain safe, reliable exposure to the crypto world, without getting burned through imprudent, over-leveraged risk.

7+ Reasons Fully Compliant WonderFi Technologies inc. (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) is the Best Way to Gain Exposure to Leverage-Free Crypto

- Web3 is a Large, Disruptive & Rapidly Growing Market: The total addressable market for Web 3 (CeFi, DeFi, GameFi and NFTs) is now over $500 billion.11

- Canada’s Largest Crypto Userbase: After acquiring one of Canada’s leading crypto asset trading platforms in Coinberry, and Canada’s leading digital currency platform Bitbuy, WonderFi (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF)has amassed over 650,000 registered users (and growing) to become Canada’s largest registered crypto platform by user base.

- First Approved Crypto Marketplace in Canada: In 2021, Bitbuy became the first crypto platform to be registered with the Ontario Securities Commission, while Coinberry is also registered with the Canadian Securities Administrators.12

- Big Backers: Kevin O’Leary and billionaire Sam Bankman-Fried (aka ‘SBF’) are both major investors in WonderFi (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF). They’ve both shown a special knack for identifying breakout companies.

- Well-Funded with Big Assets and Revenue Opportunity: $356 million in total assets as of June 30, which includes $15 million in cash and $5.6 million in crypto assets and inventory, including $187 million of Assets Under Custody for customers.13

- Aggressive Customer Acquisition: Kevin O’Leary and Josh Richards have audiences in the tens-of millions that can bring DeFi to the intergenerational masses for less, driving down customer acquisition costs, while a new partnership with Facebook parent company Meta is designed to optimize marketing, and increasing userbase.

- Board Stacked with Public Company & Digital Currency Heavyweights: Company leadership includes big league experience from such heavy-hitters as Hut 8, Galaxy Digital, Amazon, Salesforce, Bitfarms, Argo Blockchain, UBS, Hootsuite, Spotify and more.

BONUS:

- GameFi: User integration into the WonderFi system allows users to download and play games, earn NFT assets which are claimed in WonderFi, and then trade and monetize their rewards on WonderFi and Bitbuy, allowing another crucial angle to gaining new users to the platform. This would come through the proposed acquisition of yet another blockchain leader, Blockchain Foundry Inc, a leading North American blockchain development firm.14

Having Gained the Backing of Industry Leaders, WonderFi is Poised to Capitalize in the Crypto Space

O’Leary isn’t the only backer that’s gotten on board the WonderFi Technologies Inc. (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) train.

Though O’Leary is the company’s most notable shareholder, he’s also joined by Mind Medicine (MindMed) Inc. (NASDAQ:MNMD) (NEO:MMED) co-founder Leonard Latchman and Samuel Bankman-Fried (aka ‘SBF’) who is the founder and CEO of globally-recognized crypto exchange FTX.

By simply looking at its credentials, there’s currently no other company that can compare with the potential of WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF).(TSX:WNDR) (OTCQB:WONDF)

- DeFi platform WonderFi is globally accessible in 174 countries

- CeFi platforms Bitbuy and Coinberry available in Canada, with expansion to Australia, US and EU planned for 2023

- Bitbuy & Coinberry are both licensed with the Ontario Securities Commission

- Together they bring more than 650,000 total licensed crypto exchange registered users to-date and growing

- Full-service Web3 retail suite, with WonderFi Connect set to soon bridge access to all of WonderFi’s platforms together under one secure Web3 login portal

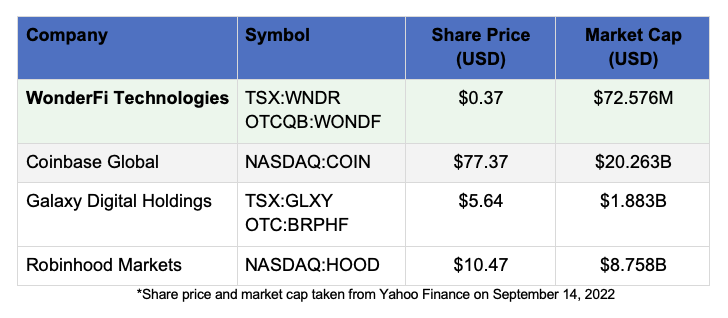

So while there are other publicly-traded companies that give access to the crypto space, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) stands out from the pack with its compliance, and leverage-free business model that provides one of the safest access points to the sector, while still providing MAJOR growth potential.

Unlike its competitors such as Galaxy Digital which is a financial services and investment management company with a varied portfolio of assets, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) is a non-custodial platform.

This means WonderFi comes with a HUGE competitive advantage of NOT taking ownership or full control of the users’ assets—Because if there’s one thing that most digital currency enthusiasts value, it’s decentralization.15

WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) and its user-friendly UniiFi platform not only provides users with access to the full power of DeFi, but also provides access to some of the most prominent, regulated centralized platforms in the world today.

Not only can WonderFi address the problems that are currently slowing the widespread adoption of DeFi, but also gain trust through KYC and regulated CeFi options, and it’s PAYING OFF.

In its Q3 2022 earnings report, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) reported $356 million in total assets as of June 30, 2022, including $15 million in cash, another $5.6 million in crypto assets and inventory, and $187 million of assets under custody for customers.16

Now let’s take a deeper look at the breakdown of these assets and platforms, one by one.

Centralized Finance (CeFi): Bitbuy+Coinberry

WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) kicked off 2022 making a HUGE splash, by announcing the acquisition of Bitbuy Technologies’ parent company First Ledger Corp.

During the period since its founding up until the acquisition, Bitbuy had garnered a reputation as a trusted execution platform that services over 375,000 users, having transacted more than $4.4 billion through the platform.[17

In November 2021, Bitbuy became Canada’s first approved crypto marketplace, and was ranked 9th in the Deloitte Technology Fast 50™ program, with 3,379% in revenue growth from 2017 to 2020 making it the highest-ranking crypto asset trading platform amongst the Fast 50 winners.

Through the twelve months ended September 30, 2021, Bitbuy generated over $31.0 million in revenue.

Next, WonderFi didn’t stop there, as it went on to add crypto trading platform Coinberry to the mix.

The acquisition of Coinberry brought with it a ton of value for WonderFi, including adding approximately 225,000 users and $99.5 million of client assets.

After the dust settled on both acquisitions, WonderFi had solidified itself as the largest crypto exchange business in Canada by number of registered users, with over 650,000 and growing.

“We’re in the process of creating the largest crypto user base in Canada” – WonderFi Co-founder and CEO, Ben Samaroo18

DeCentralized Finance (DeFi): The WonderFi Way

With the crypto liquidity crisis in full swing, many questions are being (justly) asked about which companies in the space have over-exposed themselves, and are at risk of facing liquidity issues, or insolvency—as like what just happened to Voyager, Celsius, and BlockFi.

For those who are considering WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) and its subsidiaries Bitbuy and Coinberry, the answer is simple—they DON’T use leverage or put customer deposits at risk!

WonderFi doesn’t have any debt, nor do they ever lend out client assets. 19

One of the key benefits of operating licensed, regulated crypto trading platforms like Bitbuy and Coinberry is that WonderFi’s customer assets are held with licensed, qualified custodians in a secure and insured environment.

They’re simply NOT PERMITTED to put customer assets at risk through lending. Plain and simple.

Because of this, WonderFi is providing regulated access to what’s known as Web3.

Due to its simple user interface and suite of features, WonderFi makes Web3 and DeFi accessible for the masses.

By marrying its regulated CeFi platforms Bitbuy and Coinberry to the WonderFi family, the company has proven it can jump through the correct hoops, and gain the trust of regulators and users alike, and avoid the massive pitfalls and punishments that others in the space have incurred.

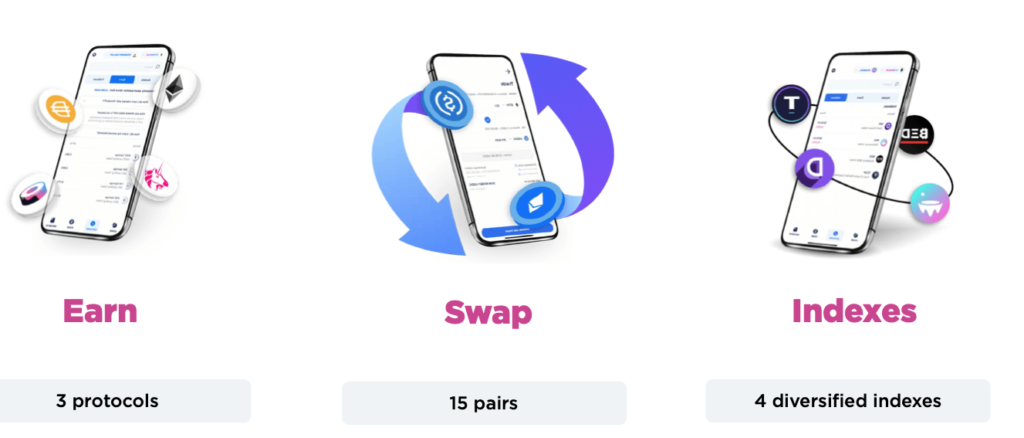

All the while, they’ve done this while still allowing users to retain full control of the private keys needed to access their assets. This is CRUCIAL for getting more people involved in DeFi—including staking, which is the process of locking tokens into a smart contract in exchange for more of the same token.

Instead of just sitting on their digital assets, users can reward themselves through yield farming their holdings.

Bringing it ALL Together: UniiFi

Bringing all of these aspects of the business together, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) provides its users with the UniiFI App, which simplifies DeFi, integrates over 10 leading DeFi protocols and is available in 174 countries.

The UniiFI offering is compatible with all major hardware and software wallets, and its simple features are designed to scale across the entire DeFi universe.

Meshing all of these together, WonderFi is touting the ability to give its users unified access to ALL of its regulated centralized and decentralized platforms together through a secure Web3 login portal, while leaving itself open to scaling in infrastructure for users to connect to each new wave of Dapps.

Over the course of building out its empire, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) has amassed an ecosystem that gives its users ample ability to capitalize on several aspects of thee Web3 evolution.

Not stopping there, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) is aggressively set to grow its userbase through a partnership with Facebook’s parent company Meta Platforms, Inc. (NASDAQ:META) under its Meta Venture Capital Partnerships division.20

Through the deal, Meta Partnerships will provide strategic advice to WonderFi on growth marketing, performance and scale of its business, as well as consult on creative strategies with other Meta departments and guidance on privacy-focused regulations.

Experienced Management and Leadership

While the influences of its strategic investors such as Kevin O’Leary, Leonard Latchman and SBF have been discussed above, the overall operations of WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) are in the capable hands of an experienced management team and Board of Directors, who have strong records across the digital currency and internet space.

WNDR’s leadership team includes:

Ben Samaroo – CEO and Director: Samaroo is an entrepreneur with executive and advisory experience in private and public companies across fintech, blockchain and digital assets. He was formerly an executive officer of First Coin Capital, a cryptocurrency start-up acquired by Galaxy Digital, and served on the Galaxy Digital leadership team. He serves as an advisor to the British Columbia Securities Commission on the Fintech Advisory Forum and to FINTRAC on virtual currencies.

Dean Sutton – CSO and Director: Sutton is a technology founder, venture builder and investor with a decade of experience in leading technology-centric companies through development, financing and commercialization. As an active founder, executive and participant in fintech, blockchain and digital currencies since 2015, he has supported and advised a number of companies, including the first bitcoin mining company to list on the London Stock Exchange. He is a Co-Founder of LQwD Financial Corp. and Atlas One Digital Securities.

Stephanie Li – Director: Li brings more than 15 years of finance experience with a particular specialty in high-growth environments. She is currently the Chief Financial Officer at Cielo Waste Solutions, one of the fastest growing ESG companies in North America and previously served in a leadership role at Northview Apartment REIT, a Toronto Stock Exchange listed real estate investment trusts (REIT) which was acquired in 2020 for $4.9 billion.

Cong Ly – CTO: Experienced tech leader with extensive working knowledge in Fintech, blockchain and distributed computing development. He’s held management positions at Hootsuite responsible for volume business and strategic integration. Former Director of Technology at First Coin Capital.

Kartik Bajaj – Director of Technology: Bajaj brings 10+ years of software development experience and working in blockchain tech since 2017. He’s held key engineering roles at companies like Amazon, Salesforce and Hootsuite, focused on building platforms used by millions of users. He was the first engineer at First Coin Capital, where he helped multiple clients build products on top of different blockchains.

RECAP: 7+ Reasons To Seriously Look Into WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) NOW!

- Web 3 is a Large, Disruptive & Rapidly Growing Market

- Canada’s Largest Crypto User Base

- First Approved Crypto Marketplace in Canada

- Big Backers

- Well-Funded with Big Assets and Revenue Opportunity

- Aggressive Customer Acquisition

- Board Stacked with Public Company & Digital Currency Heavyweights

BONUS: Rewards Through GameFi Platform

It’s clear that WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF)(TSX:WNDR) (OTCQB:WONDF) is poised for BIG THINGS in the crypto space, otherwise it wouldn’t have already drawn the interest of the heavy hitters that it has. However, it has no plans on stopping here, as there’s still PLENTY of growth left to come, which means that NOW is the time to seriously discern this company and what it can bring to the smart investor in this space.

Continue following the WonderFi story by getting all news and updates from the company’s newsletter, which you can sign up for by clicking here TODAY.

1https://www.thestreet.com/investing/cryptocurrency/crypto-liquidity-crisis-spreads-to-major-exchanges

2 https://www.thestreet.com/investing/cryptocurrency/bad-news-for-bitcoin-fans-crypto-winter-may-have-only-just-begun

3 https://www.thestreet.com/investing/cryptocurrency/mark-cuban-caught-in-bankruptcy-of-crypto-lender-voyager

4 https://www.mavs.com/mavsvoyager/

5 https://nymag.com/intelligencer/article/three-arrows-capital-kyle-davies-su-zhu-crash.html

6 https://www.cnbc.com/2021/01/12/kevin-oleary-on-why-he-wont-invest-in-bitcoin-btc.html

7 https://fortune.com/2022/06/15/what-is-crypto-bottom-kevin-oleary-panic-events-zero-bitcoin/

8 https://www.wonder.fi/press-release/wonderfi-announces-closing-of-bitbuy-acquisition

9 https://financialpost.com/fp-finance/cryptocurrency/torontos-bitbuy-first-crypto-marketplace-to-receive-full-osc-approval

10 https://www.wonder.fi/press-release/wonderfi-announces-closing-of-coinberry-acquisition

11 WonderFi Technologies Investor Presentation, Slide 6

12 https://financialpost.com/fp-finance/cryptocurrency/torontos-bitbuy-first-crypto-marketplace-to-receive-full- osc-approval

13 https://www.wonder.fi/press-release/wonderfi-announces-q3-2022-financial-results

14 https://www.wonder.fi/press-release/wonderfi-announces-agreement-to-acquire-blockchain-foundry

15 https://www.zenledger.io/blog/what-is-crypto-decentralization

16 https://www.wonder.fi/press-release/wonderfi-announces-q3-2022-financial-results

17 https://www.wonder.fi/press-release/wonderfi-to-acquire-bitbuy-canadas-first-approved-crypto-marketplace-with-over-4-4b-transacted

18 https://betakit.com/wonderfi-to-acquire-coinberry-for-38-5-million-in-all-stock-deal-as-canadas-crypto-space-continues-to-consolidate/

19 https://www.linkedin.com/pulse/crypto-liquidity-crisis-ben-samaroo/

20 https://www.wonder.fi/press-release/meta-parent-company-of-facebook-and-instagram-partners-with-wonderfi-to-provide-strategic-advice-on-growth-marketing

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of WonderFi Technologies Inc. (“WNDR”) and its securities, WNDR has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by WNDR) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company WNDR and has no information concerning share ownership by others of in the profiled company WNDR. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to WNDR industry; (b) market opportunity; (c) WNDR business plans and strategies; (d) services that WNDR intends to offer; (e) WNDR milestone projections and targets; (f) WNDR expectations regarding receipt of approval for regulatory applications; (g) WNDR intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) WNDR expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute WNDR business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) WNDR ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) WNDR ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) WNDR ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of WNDR to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) WNDR operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact WNDR business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing WNDR business operations (e) WNDR may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling WonderFi Technologies Inc..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled WonderFi Technologies Inc. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any WonderFi Technologies Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the WonderFi Technologies Inc.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled WonderFi Technologies Inc.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding WonderFi Technologies Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to WonderFi Technologies Inc. industry; (b) market opportunity; (c) WonderFi Technologies Inc. business plans and strategies; (d) services that WonderFi Technologies Inc. intends to offer; (e) WonderFi Technologies Inc. milestone projections and targets; (f) WonderFi Technologies Inc. expectations regarding receipt of approval for regulatory applications; (g) WonderFi Technologies Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) WonderFi Technologies Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute WonderFi Technologies Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) WonderFi Technologies Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) WonderFi Technologies Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) WonderFi Technologies Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of WonderFi Technologies Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) WonderFi Technologies Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact WonderFi Technologies Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing WonderFi Technologies Inc. business operations (e) WonderFi Technologies Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of WonderFi Technologies Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of WonderFi Technologies Inc. or such entities and are not necessarily indicative of future performance of WonderFi Technologies Inc. or such entities.