This controversial health breakthrough has earned the backing of billionaire investors Peter Thiel, Chip Wilson and Kevin O’Leary.

Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) intends to launch what could become the largest indoor psilocybin and functional mushroom production facility in North America.

For anyone seeking ground floor entry into the soaring market in psychedelic pharmaceuticals, Optimi Health stands out as an ideal opportunity.

Over the last year, well-funded psychedelic start-ups have absolutely rocketed, creating immense shareholder value from their launch dates.

And Optimi Health is definitely well funded. The Company just completed its IPO, backed by initial investment from billionaire financier, Chip Wilson, who made his fortune as a founder of Lululemon Athletica Inc.

Wilson, now worth over $5 billion, endorsed his son, J.J. to launch the Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) project. Optimi raised CAD $20.7 million in its February 2021 IPO and stands to be one of the best funded psychedelic compound production facilities in the world. As news of its operations grows, investor interest is sure to follow.

It’s a market that’s soaring worldwide.

One German company, ATAI Life Sciences, made big news late last year when billionaire financier Peter Thiel invested $125 million in the company’s mission to introduce psychedelic medications to mental health treatment. The company has since raised over $325 million in private placements and is currently executing a $214 million Nasdaq IPO targeting a valuation of approximately $2.3 billion! 1

Thiel’s move sparked massive interest in the sector.

Individual investors saw huge gains almost immediately after Field Trip Health launched public trading in October last year at around $2.00. Over the next six months, the stock more than tripled to a $7.49 high as the company executed its recent up-list to the TSX and explores a potential future on the Nasdaq.2

Celebrity investor, Kevin O’Leary of Shark Tank, is the third big name to dive deep into the future of psychedelic medications. CNBC quote O’Leary as saying that the investment potential in psychedelics “far exceeds” cannabis’ potential. He backed that belief with significant investments in MindMed and Compass Pathways.

Mind Medicine had been overlooked by investors for much of 2020. The stock traded through Q3 at around 34¢, then gained traction and shot up ten-fold from October through December. It now trades in a steady range near its record high of $3.92/share!3

The market appears to have an insatiable demand for early-entry opportunities in this psychedelic space. Well-funded companies, like those listed above, began rocketing in value in Q4, 2020, spiking three- to four-times initial values as investors discovered the opportunity.

High-net-worth investors, like Peter Thiel, Chip Wilson, and Kevin O’Leary are pouring millions into the future of psychedelic medicine. Their intention is to profit enormously from a market projected by some to hit $6.85 billion by mid-decade.4

It can be a huge benefit to get started early.

Optimi Health holds the same kind of quick growth potential for early investors.

With 20,000 square feet of new, indoor cultivation coming online along with the backing of a well-known billionaire investor, Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) stands to gain quick traction in a red-hot market for entry into psychedelic pharmaceuticals.

And it’s not just industrial scale production of the psychedelic psilocybin mushroom that is driving this company’s growth prospects.

On a parallel track to its psilocybin production, Optimi Health is now cultivating “functional mushrooms” for the growing nutraceutical markets.

Later in this article you’ll find details on how massive the market for functional mushrooms has become. The trend began gaining traction only a few years ago. Now it’s on track to become a $34 billion market by mid-decade.

Even bigger than the functional mushroom market may be the market emerging in pharmaceutical extracts from the psilocybin variety of mushrooms.

Since 1971, psilocybin has been outlawed as a naturally derived pharmaceutical with “no known medicinal benefit”. That view has changed dramatically over the last few years.

In 2016, Johns Hopkins researchers published astonishing results from their research into psilocybin therapies in treating depressive disorders. Their studies showed that…

“Johns Hopkins Medicine researchers report that two doses of the psychedelic substance psilocybin, given with supportive psychotherapy, produced rapid and large reductions in depressive symptoms, with most participants showing improvement and half of study participants achieving remission through the four-week follow-up.” 5

With a potential 50% cure rate, therapeutic uses for psilocybin are completely changing how medical science and government regulators view the drugs pharmaceutical potential.

A rapidly growing body of evidence supports the untapped pharmaceutical potential in psilocybin compounds. Psilocybin’s uses have expanded to include treatment for PTSD, opioid addiction and a host of depressive disorders that impose the highest costs of care for any health category including heart disease.6

In the United States alone, the direct costs for treating mental health patients now exceeds $225 billion annually.7 Lost productivity adds another $44 billion to that figure.

Worldwide the figures could be double to triple that.

Psilocybin holds compelling promise as a breakthrough pharmaceutical, the most effective medication yet discovered for treatment of mental health patients.

And now, due to the unprecedented impact of Covid-19 restrictions, the number of Americans reporting mental health challenges has leaped to an astonishing 42% of the U.S. adult population.

The online journal Nature.com reports:

“More than 42% of people surveyed by the US Census Bureau in December reported symptoms of anxiety or depression in December, an increase from 11% the previous year. Data from other surveys suggest that the picture is similar worldwide.” 8

As you launch your due diligence into the investment potential with Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN), keep in mind that demand for the pharmaceutical compounds extracted from the psilocybin mushroom could be an entirely new untapped market.

Due to decades of illegality, the scalable, pharmaceutical grade production of psilocybin mushrooms has been virtually non-existent.

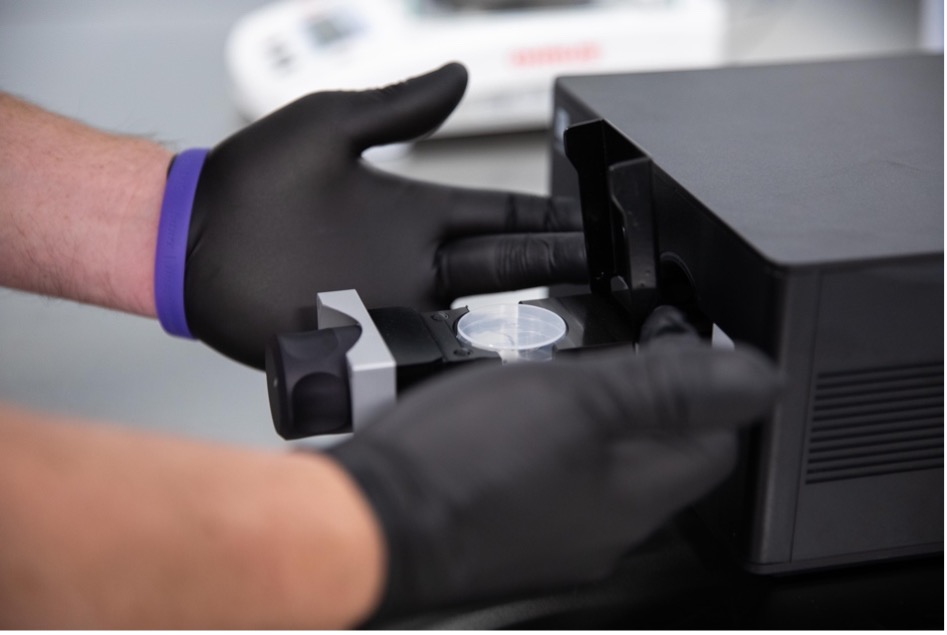

That’s about to change in a very dramatic way as Optimi Health launches operations in 10,000 square feet of pristine facilities specifically built for the industrial scale production of psilocybin mushrooms, and another 10,000 square feet allocated for functional mushroom cultivation for the consumer markets for a total build of 20,000 square feet.

Optimi Health COO and Director, Bryan Safarik comments, “Activities are moving ahead rapidly, and every day brings us another step closer to moving in and getting to work. We are extremely excited by the interest in our venture and pleased by the response to our commitment to all-natural products. We aim to become the leading supplier of natural mushroom-based goods to the health & wellness community, as well as a future developer of clinically proven therapeutic psilocybin formulations for discerning users who understandably prefer a non-synthetic solution for what are very personal care solutions. Mental health care options are going to change with the advent of innovative products, and we believe the finest products come from nature – naturally. We are passionate about delivering the best and we plan to build our brand based on that…”

North American lawmakers pave the way for Optimi Health’s market penetration.

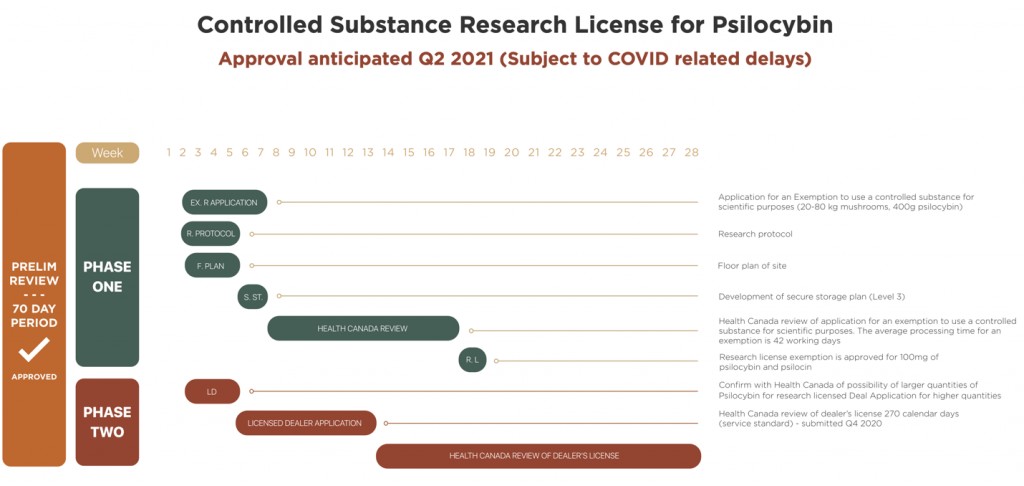

In 2018, Canadian lawmakers broke through the stigmas of illegality to become the first G20 country to authorize medicinal uses for marijuana. Two years later, the processes for legalizing the therapeutic uses of psilocybin have begun, which included the Ministry of Health authorizing 16 health professionals to develop psilocybin therapies for future use.9

Optimi Health appears way ahead of the legalization and research curve in psilocybin therapies.

As Canadian officials began opening doors to pharmaceutical uses for psilocybin, Optimi Health leaped into action. They broke ground on two new 10,000 square foot production facilities, one purpose-built for the large-scale cultivation of therapeutic psilocybin mushrooms, and one for the cultivation of functional mushrooms.

And that’s not all.

U.S. state legislators are passing new laws that set the stage for a booming industry in psilocybin-based mental health therapies.

On the heels of mounting evidence of breakthrough mental health treatments, U.S. state legislatures have begun decriminalizing cultivation, possession, and use of psilocybin. Following Denver’s groundbreaking legislation in 2019, California is the latest to do so through State Bill 519, which opens pathways for medical professionals to incorporate psychedelic compounds in their treatment plans. Already getting a pass in the California Senate in early June, the bill now moves on to the Assembly, where it is likely to be penned into law in the near term.

Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) intends to become North America’s #1 supplier of naturally sourced psilocybin extracts.

The growth potential as a ground-floor stakeholder in Optimi Health appears substantial.

Starting from an almost standing start, the market size for psychedelic drugs used predominately in mental health therapies has been projected to $7.56 billion by 2028.10

Estimates are that pharmaceutical demand for hard-to-obtain naturally derived psilocybin compounds could rocket into mid-decade. As you dig into your own research you’ll likely find that exact figures are hard to come by. One thing seems clear though, pharmaceutical production of psilocybin has a mid-term growth trajectory that could make early investors significant gains.

This growth trajectory could mirror what has already taken place in the legalization history of medical marijuana. Early investors made huge gains as the medical marijuana market gained traction. The market for medicinal psilocybin appears to be on a similar course. For an early position in the sector it is vitally important to get started now. If it fits to your investment objectives, Optimi Health could be an ideal entry to this rapidly emerging market trend.

The process is already underway.

Early in May, Optimi Health announced jointly through its partnership with Canadian-based Numinus Wellness (TSXV:NUMI C$237.4MM) that the companies have submitted the first in what could become a series of pre-clinical trial applications to the Canadian Health Ministry for approved use of all-natural psilocybin extracts.

“We have been given the green light to submit the formal application for the proposed phase I dosing study from Health Canada and are on track to initiate the trial in Q3 of this year. Health Canada indicated they have no concerns over the plan as presented, and they’ve clarified that the next step is now to submit the formal application to receive approval to move ahead with a phase I study. In parallel with this, we will continue to further outline the required non-clinical testing that will be needed as we continue to develop the product and move forward into phase II and larger phase III trials in the future.”

For a market projected to soar to $6.85 billion over the coming few years… stringent quality control and scalable production technologies will be essential to supplying future pharmaceutical demand.

Company founders and management not only come to the company with deep pockets, there’s deep history in health care and alternative technologies. Most notable for a company entering the psychedelic space is experience in large-scale cultivation of cannabis for medicinal markets. The skill sets and contacts nurtured, especially in the cannabis sector, set the stage for rapid, aggressive moves into the surging market for psilocybin compounds.

Chip Wilson, the billionaire financier who helped fund Optimi Health’s IPO, is a part of a stellar executive team that not only is deeply experienced in alternative medication technologies, they’ve exceptional depth in upper level management skills necessary for nurturing and growing an international-scale company.

J.J. Wilson, a graduate from Harvard Business School, serves as Optimi’s chairman of the board and brings to the company substantial experience in international business development.

Chip Wilson, Canadian Billionaire, Entrepreneur and Philanthropist.

Wilson, a principal financier behind Optimi Health’s IPO, has a long history launching successful health and fitness companies. Most notable among them is the yoga-inspired athletic apparel company Lululemon Athletica Inc., which he left in 2015 to pursue other interests.

Wikipedia reports: “In 2004, Ernst & Young named Wilson its Canadian Entrepreneur of the Year for Innovation and Marketing. As of 2012, Forbes ranked Wilson the 10th-wealthiest Canadian and 401st in the world, with an estimated net worth as of March 2013 of $2.9 billion.” Wilson’s current net worth is now reported to exceed $5 billion.

Source: Wikipedia.org https://en.wikipedia.org/wiki/Chip_Wilson

Optimi Health COO, Bryan Safarik, co-founded BC Green Pharmaceuticals, a Canadian company that launched as Canada liberalized cannabis regulations. BC Green pioneered GMP (Good Manufacturing Practices) production protocols that focused on “the latest propagation technology” for extraction of “pharmaceutical grade products”.11

Safarik’s success and experience in cannabis transfers directly to Optimi Health’s launch of mushroom propagation practices.

Prior to working in cannabis, Safarik had already developed a learned ability to grow an international brand. Working with his father Edward, founder of Ocean Fisheries Ltd. and advisor to Optimi Health, Safarik assisted with the successful sale to Canadian conglomerate, The Jim Pattison Group for .

Jacob Safarik, also a BC Green co-founder, serves as Optimi Health’s CFO. On top of his years of experience as a Chartered Professional Accountant, Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) shareholders should note that he played a pivotal role in the sale of a $6 billion San Francisco enterprise.

Mike Stier, Optimi Health CEO, formerly worked as a licensed Senior Financial Advisor with the CIBC, an international bank headquartered in Toronto and Chicago. Again, cannabis runs deep in the skill sets at Optimi. Stier currently sits as the president and CEO of New Leaf Ventures, a publicly traded company that, “is a professional management group dedicated to evaluating and accelerating advanced stage operations in the North American Cannabis sector.”12

Dane Stevens, CMO, has 12 years of experience in international product sourcing, manufacturing and quality control. In addition, he has depth of experience in wholesale and direct-to-consumer sales channels that can be pivotal to Optimi’s immediate revenue-generating strategies in the marketing of functional mushrooms and nutraceuticals.

Harley Pasternak appearing with Simone de la Rue on network program, Access Hollywood. .

Pasternak is a Canadian-American personal trainer, motivational speaker, author and television host. He is known for his books The Body Reset Diet and The 5-Factor Diet, along with an extensive career working with many celebrity clients as a personal trainer. Pasternak boosted his on-camera career as a co-host of ABC’s 2012 daytime talk show, The Revolution. He serves as a celebrity trainer to dozens of top-name entertainers and is a credited fitness coach in numerous Hollywood movies featuring A-list actors and directors.

Source: Wikipedia.org https://en.wikipedia.org/wiki/Chip_Wilson

All this talent needs a voice in the market, and none can be more influential than Harley Pasternak.

Creating a great product does not ensure success. Getting the word out is key and Harley Pasternak, an important company advisor, has the contacts to make that happen.

Pasternak is an internationally known fitness and nutrition specialist whose client roster includes some of the top A-listers in entertainment, including Lady Gaga, Ariana Grande, Kim Kardashian, Katy Perry, Robert Downey, Jr., Gwen Stefani and many more.

Pasternak stars on the E! channel Revenge Body with Khloe Kardashian, is a best-selling fitness and diet author published now in 14 languages and has made speaking appearances worldwide. There’s more to say about Pasternak…but most important to Optimi shareholders is Pasternak’s essential roll advocating for the company, which includes Optimi’s complete line of functional mushroom nutraceutical products.

Pasternak stars on the E! channel Revenge Body with Khloe Kardashian, is a best-selling fitness and diet author published now in 14 languages and has made speaking appearances worldwide. There’s more to say about Pasternak…but most important to Optimi shareholders is Pasternak’s essential roll advocating for the company, which includes Optimi’s complete line of functional mushroom nutraceutical products.

Market demand in the functional mushroom space has begun to soar.

Market growth is now gaining traction as Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) launches a near-term goal to generate early revenue with its proprietary brand of functional mushroom nutraceuticals.

Recent research is proving what ancient, traditionall medicine has known for millennia. Certain strains of mushrooms, such as lion’s mane, reishi, turkey tail and others have shown remarkable efficacy in boosting immune functions and contributing to the healthful function of vital organs.

Over the last decade in particular, hundreds of scholarly articles have been published extolling the “lost” therapeutic benefits of medical, aka functional mushrooms. Just a moment of due diligence into this topic will deliver a wealth of information. What’s important to an investor is simple:

The market for functional mushroom products is taking off right now. Optimi Health could be an ideal entry point.

With 10,000 square feet of pristine, indoor functional mushroom cultivation and processing, Optimi Health is one of the few companies worldwide positioning themselves for fully scalable propagation of these in-demand products.

A current 6% annual growth rate in the sector is propelling the global market to $34 billion by mid-decade, the majority of which is projected in nutraceutical market share, exactly where Optimi Health is targeting its products.

Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) has positioned itself to earn an enormous, if not the lion’s share of this North American market. They may be the only company in the U.S. or Canada that specializes in propagation and production of superior quality “fruiting body” mushrooms needed for the higher potency, end-product nutraceuticals.

Optimi Health positions itself to generate near-term revenue through product delivery into the rapidly expanding health and wellness markets.

Optimi Health introduced a full line of functional mushroom nutraceuticals for retail shelves and direct-to-consumer markets. The company’s vertical production capacity provides them with total quality and quantity control from propagation to end product. Optimi Health is one of the few companies in the world today that maintains that capability and is targeting to become the largest of its kind in North America.

What to do now…

First steps in your due diligence would be to visit the company website to learn more and register your email address for future company news and updates (www.Optimi-Health.com). The psilocybin market in particular is a fast evolving trend that is beginning to reap enormous gains for early investors. With Canada rapidly rescinding out-of-date laws restricting access to psilocybin, plus similar moves at the state level in America, as we see with California Senate-passed SB-519, the psilocybin market in North America seems poised for explosive growth.

Reputable research has been ongoing for a number of years now and medicines grounded in psychedelic compounds are making huge strides to legitimacy and regulatory approval. As you launch your due diligence, you’ll likely find a substantial body of evidence that supports the pharmaceutical potential in psilocybin as a therapy or even a curative for widespread mental health conditions ranging from PTSD, depression/anxiety disorders, opioid addiction, and more.

As research pours in, laws are relaxed, and regulatory approvals proceed, demand for naturally derived psilocybin compounds could skyrocket.

Optimi Health holds enormous investment potential for those who secure a position early in the game. Now is the time to begin your due diligence and determine if Optimi Health is a good fit to your investment objectives.

Five reasons to put Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) On Your Investment Radar Now.

- Optimi Health completed a successful IPO raising over CAD $20.7 million and has funded 20,000 square feet of new construction dedicated solely to the propagation of functional and psilocybin mushrooms and the extraction of the pharmacological/medicinal compounds.

- The company’s management team is deeply experienced in the commercialization of medicinal compounds, which includes navigation of the regulatory environment and operating the pristine production facilities demanded for supplying extracts to pharmacological markets.

- Psilocybin appears on a rapid rise to become a mental health wonder drug that can be highly efficacious in the treatment of mental disorders now approaching $270 billion in direct and indirect health care cost in the United States alone. As a medication, psilocybin appears on track to become a breakthrough drug with enormous market upside. Optimi Health intends to be the premier North American supplier of psilocybin extracts for pharmacological uses.

- Optimi Health is on the move in practical application of psilocybin medications. In partnership with Numinus Wellness, they’ve already completed their pre-clinical trial application and have received Health Canada approval to submit a formal application to proceed with phase 1 study.

- To get revenue flowing ahead of the anticipated revenue from psilocybin sales, Optimi Health launched its nutraceutical product line, specifically focused on pharmaceutical grade mushroom extracts.

Because the company is vertically integrated from propagation to finished product, Optimi Health is able to ensure production of the most desirable, high quality fruited body extracts that bring the highest prices from consumers. Optimi Health is one of the few companies in the world that has this combined propagation and production capability.

Investors seeking a promising, early entry into the emerging markets for medicinal psilocybin, supplemented by the enormous growing demand for functional mushroom nutraceuticals, could do well getting started today with Optimi Health.

Learn More About Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) at your brokerage today!

Learn More About Optimi Health (OTC:OPTHF, CSE:OPTI, FRA:8BNOTC:OPTHF, CSE:OPTI, FRA:8BN) at your brokerage today!

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Optimi Health.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Optimi Health and has no information concerning share ownership by others of any profiled Optimi Health. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Optimi Health or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Optimi Health. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Optimi Health’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Optimi Health future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Optimi Health industry; (b) market opportunity; (c) Optimi Health business plans and strategies; (d) services that Optimi Health intends to offer; (e) Optimi Health milestone projections and targets; (f) Optimi Health expectations regarding receipt of approval for regulatory applications; (g) Optimi Health intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Optimi Health expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Optimi Health business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Optimi Health ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Optimi Health ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Optimi Health ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Optimi Health to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Optimi Health operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Optimi Health business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Optimi Health business operations (e) Optimi Health may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Optimi Health or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Optimi Health or such entities and are not necessarily indicative of future performance of Optimi Health or such entities.