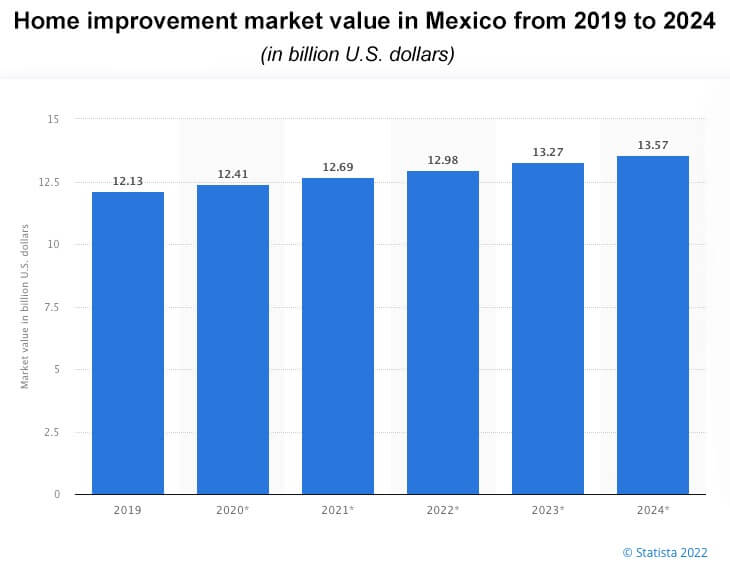

Microcap Takes Aim On A Wide Open $12.3 Billion Home Improvement Market1

Editorial Feature | April 10, 2023 | Industry

Pedro’s List (OTC: PDRO) is first to stamp its footprint into vast virgin territory.

Its teams are in place, its software is perfected, and the rollout is on pace to rapidly cover 16 urban metro areas with 104 million inhabitants.

America’s mature economy is ripe with potential. But today’s best investment opportunity could be a smart young Mexican startup that trades on the U.S. markets.

That’s not surprising considering Mexico’s 2022 GDP has been growing faster than the United States… great news for investors looking for a new land of opportunity.

Mexico is set to join the global club of fully developed market economies. That means the country is home to a slew of early-stage investment and business opportunities.

One of the best could be Pedro’s List (OTC: PDRO), a company with first mover advantage in a rapidly growing market.

It looks poised to dominate Mexico’s home improvement and repair market, a market that’s estimated at more than $12 billion, much in the way Angi (formerly Angie’s List) dominates the US.

Here’s the whole story.

A $12.3 Billion Problem Looking for a Solution

When Eden Miller, founder of Pedro’s List, headed to Cabo San Lucas intending to live the good life in the beautiful oceanside resort, he got a shock.

His new home needed substantial repairs. Miller needed contractors to repair fencing, do electrical work, and plumbing upgrades. His roof also needed a fix, and the concrete had cracks.

And there was no simple way to find the five different specialists he needed immediately. In Mexico, one can’t use a search engine to find “roof repair near me.”

Now consider that Mexico is a fundamentally a middle-class country, with 50 percent of its population solidly middle class, and 30 percent upper class.2

Mexico’s got money to spend, plenty of it. Oil-rich Saudi Arabia has 313,000 millionaires. Quiet Mexico has 318,000 millionaires3.

Most of them are homeowners. So are 80% of Mexicans.4

Mexico is becoming a fundamentally middle-class country with 50 percent of its population as middle class, and 30 percent being in the upper class.

What’s more, in Mexico, renters are usually responsible for home repairs. They need help finding home improvement contractors, too. That adds up to a $12.3 billion annual home repair market that no one else had tried to organize, mediate, and facilitate.

Pedro’s List (OTC: PDRO) Answers the Need

Today that solution is rolling out across Mexico. When Miller realized his problem was shared by millions, he took action. And a new enterprise was born.

Miller had already seen highly successful services, like Angi in the US, that matched contractors with homeowners and rated their performance.

But because of Mexican laws and regulations, it’s extremely unlikely that a US-based company like Angi will ever move into Mexico.

The answer to Mexico’s challenges is best solved with an answer that fits Mexican realities and culture. A company whose working parts are all-Mexican. It operates from Mexico, serves customers only within Mexico, and hires Mexican employees.

That’s exactly what Miller created.

This early move and local focus makes Pedro’s List the frontrunner in a wide-open market that no other service has tapped.

For-Fee Service Companies Like Pedro’s List Are Profit Leaders

At first glance, you might not see why Pedro’s List is like iTunes or PayPal, but it has an important feature that those high-profit companies do….

PDRO’s main business assets are its community and its proprietary software platform. Companies that can charge other companies fees for the use of their audiences and infrastructure are veritable cash cows.

Take for example NCR:

NCR can set up ATM kiosks and POS terminals to handle cash and transact sales. PayPal can also handle cash transfers without installing kiosks and point of sale hardware.

- NCR needs a lot of capital to build, sell, install, and service its machinery. So it earns 4% on its assets. PayPal’s fees are all based on software as a service, and its 11% return on assets reflects that.

Or Accenture, which can advise you on how to manage your business from your sleek new office versus Steelcase, which can supply the best furniture for it.

- Accenture charges fees for its people’s knowledge and earns 22% on those assets. Steelcase delivers the goods that look great, but only makes 1.2% on its assets.

Tapping A Critical Need with Millions of Potential Customers

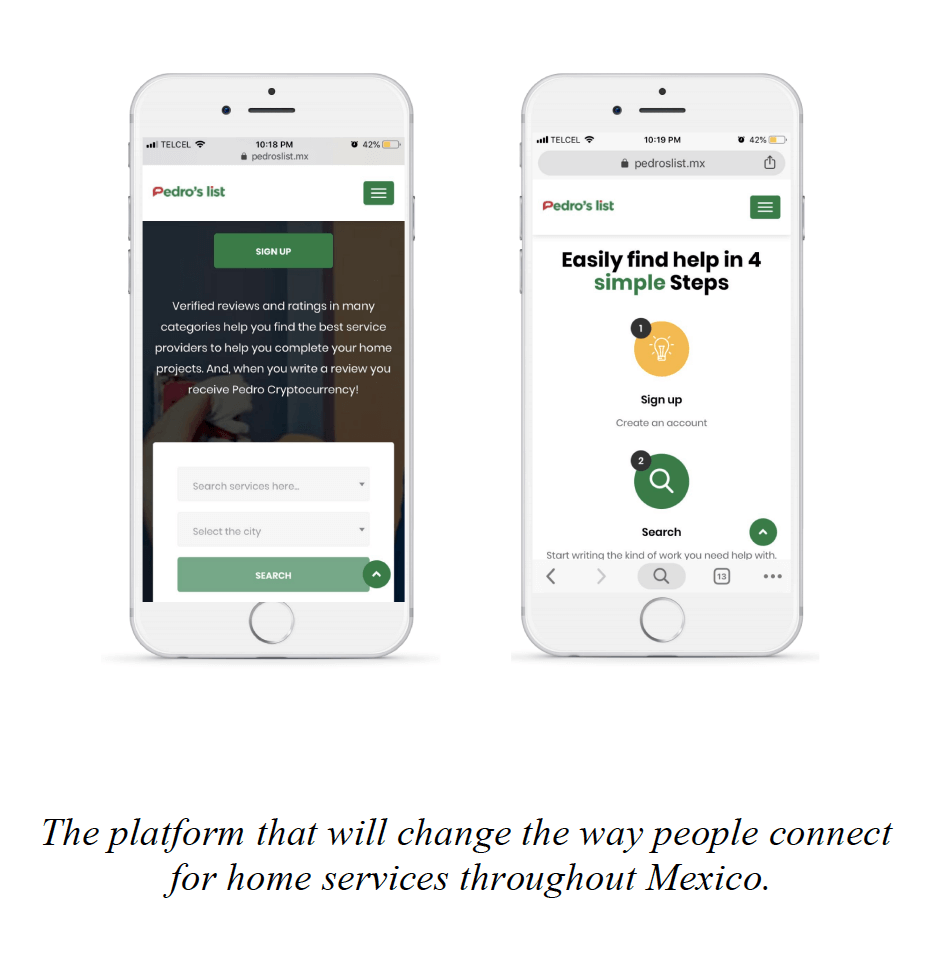

Only 43% of Mexican households have a computer5. And for those who do, broadband connections are usually slow. But some 80% of Mexicans own a mobile phone and are avid app users.6

All together, 90 million people in Mexico use mobile apps as of 20227. And 94% of Mexicans bank with mobile apps.8

That makes app-based Pedro’s List (OTC: PDRO) the perfect solution for a common problem that no one else is addressing…

Along with great craftsmen, Mexico has thousands of terrible ones.

It’s common for contractors to quote one price, then charge far more or quit. Or to walk off the job without finishing, no explanation, no forwarding address. Substituting poor materials and doing shoddy work happens all too often. And sometimes workers never show up at all.

Pedro’s List’s centralized, user-friendly interface helps solves these problems for homeowners. Reviews and tracking weed out the duds, so users can make more informed choices.

Pedro’s List gives the best contractors several ways to stand out. They can achieve higher ratings with good reviews. That means they also get higher placements in search results.

Pedro’s List gives the best contractors several ways to stand out. They can achieve higher ratings with good reviews. That means they also get higher placements in search results.

Contractors can also use the Pedro’s Perks cybercurrency as a reward to encourage new customers and thank recurring ones.

Mexico’s also tough for good contractors who are trying to connect with new customers because of the low Internet usage levels.

In places like Cabo San Lucas, where many wealthy and celebrity homeowners are part-timers dropping in from elsewhere, the Pedro’s List app offers contractors visibility.

It’s no surprise Pedro’s List has been quickly populating its app with hundreds of available contractors, and amassing thousands of users in every locality.

And every time a search leads to a successful contract, Pedro’s List (OTC: PDRO) gets a percentage of the job fee.

Upgrade Revenues Add More Potential

Pedro’s List also offers three levels of premium access at a set fee to homeowners and contractors. That’s additional revenue for the company. Incentives for homeowners to upgrade include higher reward structures, greater discounts, or priority access to popular contractors.

For the contractors, paying into a premium system means higher search placements and more visibility to call out their listings, as well as opportunities for advertising.

Then there’s also the revenue stream that will come from third-party advertising for businesses such as hardware stores, lumber yards and toolmakers.

Pedro’s List began running tests before launch to learn how well their plans to attract users would work, and the projections look great.

In the least effective tests, about 1% of the users exposed to the company decided to download the app. In the best cases, the adoption rose to 3%. Given the 28.2 million homeowners in the areas where PDRO has set up, that would yield anywhere from 281,000 to 845,000 app downloads over a 1-2 year campaign.

If only half the users use the service for a modest job, assuming the lowest 1% response, that could amount to $1.4 million in revenues per month.

But that’s only the base. Upgraded services and advertising could easily raise the revenues to $5.7 million per month.

6 Reasons To Add Pedro’s List (OTC: PDRO) To Your Watchlist Today

- Groundwork Completed. Pedro’s List founder put his own capital into developing the app, studying the competition, and laying down company infrastructure. For investors, those early capital-draining costs are already out of the way. From here on, every move is toward generating strong revenues. Which leads to strong profit-making potential.

- Made in Mexico Advantage Keeps Big Competitors Out of the Way. Pedro’s List is an American corporation with a US stock listing, but at its heart, the company is established, staffed, licensed and operated in Mexico by Mexican people with a good understanding of local ways.

- Perks Are Flowing. Pedro’s Perks let homeowners win. They essentially get paid in the Pedro’s Perks cybercurrency when they use services. They can trade their Perk tokens in for elite status, discounts, and special services with selected vendors. They also win Pedro’s Perks by referring other customers and writing reviews.

Just as airline miles keep customers coming back to the company where they can cash in points, Pedro’s Perks will encourage repeat business instead of looking elsewhere.

- One Stop Satisfaction. When Eden Miller needed five or more contractors, he had to try to reach a dozen different people to get everything lined up.

With Pedro’s List, homeowners can access the app for any home improvement service they need. The company has already reached out to thousands of service providers and expects to rapidly increase its reach as it moves into the Mexican market with virtually no competition.

- Good Citizens Win Friends. Pedro’s List also supports its community with charitable giving… and customers get to help decide where the dollars go. All a part of building a responsible, high-quality business that suits its community and encourages new customers.

- Good Financial Expectations. PDRO can earn a good income on the fees it collects when a customer and contractor agree to a project. It also charges for enhanced level access, as well as offer advertising.

The first challenge is getting thousands of users in place, but the prospects are high. The team ran outreach tests to determine how well their marketing and signup would work. They determined that even the most minimal response level (1% of those contacted downloaded the app) would quickly yield 280,000 downloads

The best results—a modest 3% adoption rate—would bring in 840,000 downloads.

Even when it assumes the adoption rate is only 1% adoption, the company projects it will reach $68 million revenues within 1-2 years.

What to do now…

Take this report to your broker and ask him to look at the facts. Consider how it fits your portfolio. PDRO is a micro-cap stock today, and that status should be regarded as speculative. It may be right for that segment of your portfolio holdings.

But today’s low-key profile and modest price also poise this stock for an exceptional run in the coming year as revenues come in and SEC reports show its success.

That means the time when the stock price stays in the startup range may soon end.

1https://www.statista.com/statistics/1186929/market-value-home-improvement-mexico/

2Mexico is becoming a fundamentally middle-class country with 50 percent of its population as middle class, and 30 percent being in the upper class.

3https://en.wikipedia.org/wiki/List_of_countries_by_number_of_millionaires

4https://www.kevinklinkenberg.com/blog/why-does-mexico-have-a-higher-rate-of-home-ownership-than-the-us

5https://www.statista.com/statistics/712803/household-ownership-computer-mexico/In 2020, the number of smartphone users in Mexico was estimated at nearly 81 million. This is an increase of about five percent from the 77 million users registered the previous year.

6https://www.statista.com/statistics/236791/fixed-telephone-lines-per-100-inhabitants-in-mexico/ In 2020, there were 18.46 fixed telephone subscriptions per 100 inhabitants in Mexico, which translated into 23.8 million subscriptions in …

7https://www.statista.com/statistics/183604/mobile-phone-user-penetration-in-mexico/

8https://www.statista.com/statistics/1201021/mexico-number-app-users/

9https://www.pymnts.com/news/mobile-payments/2022/study-94-of-mexican-consumers-use-mobile-banking/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Pedro’s List (“PDRO”) and its securities, PDRO has provided the Publisher with a budget of approximately $70,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by PDRO) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company PDRO and has no information concerning share ownership by others of in the profiled company PDRO. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to PDRO industry; (b) market opportunity; (c) PDRO business plans and strategies; (d) services that PDRO intends to offer; (e) PDRO milestone projections and targets; (f) PDRO expectations regarding receipt of approval for regulatory applications; (g) PDRO intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) PDRO expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute PDRO business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) PDRO ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) PDRO ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) PDRO ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of PDRO to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) PDRO operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact PDRO business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing PDRO business operations (e) PDRO may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Pedro’s List.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Pedro’s List and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Pedro’s List or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Pedro’s List. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Pedro’s List’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Pedro’s List future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Pedro’s List industry; (b) market opportunity; (c) Pedro’s List business plans and strategies; (d) services that Pedro’s List intends to offer; (e) Pedro’s List milestone projections and targets; (f) Pedro’s List expectations regarding receipt of approval for regulatory applications; (g) Pedro’s List intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Pedro’s List expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Pedro’s List business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Pedro’s List ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Pedro’s List ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Pedro’s List ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Pedro’s List to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Pedro’s List operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Pedro’s List business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Pedro’s List business operations (e) Pedro’s List may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Pedro’s List or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Pedro’s List or such entities and are not necessarily indicative of future performance of Pedro’s List or such entities.