NANOTECHNOLOGY COMPANY IS CROSSING A NEW FRONTIER AND IS DISRUPTING THREE MASSIVE INDUSTRIES

The boundaries of science fiction and reality continue to blur with innovations like Sixth Wave's (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) Molecularly Imprinted Polymer technology

Billionaires like Musk, Branson, and Bezos are racing each other to be the first to launch themselves into space, joke digital coins have billion dollar market caps, and previously unfathomable technology is our new normal.

Movies like Terminator or Star Trek may have seemed like impossibilities at one point, and their technological predictions were shocking to be sure. However, we’ve seen incredible, so-called “impossible” advancements regularly in the past decade.

A new but mind-blowing technology called “nanotechnology” is the next frontier for human advancement, and it just might change the entire landscape of some of the biggest markets out there.

A traditionally farming-based industry, hemp is ripe for nanotechnology disruption. The $28.5 billion hemp extraction market loses billions every year due to inefficient technologies.

An innovative company called Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) has a solution.

But, that isn’t all this company is doing…

Disrupting the Multi-Billion Gold Mining Industry, the CV-19 Diagnostic Market AND the $28.5 Billion Extract Industry

Sixth Wave Innovations’ (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) patented MIPs nanotechnology could soon disrupt:

- The gold mining industry, which produces over 3,000 metric tons of gold each year1. At current prices of about $1,775/oz2 that equates to over $187 billion worth of gold annually.

- The CV-19 diagnostic market, which Grandview Research puts at $105.6 billion in 20213.

- The green extract industry, a market Grandview Research estimates will reach $28.5 billion by 20274

Now, the possible applications for MIPs nanotechnology go far beyond these three markets.

But Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) is not just focused on science – it is first and foremost a business, with the intention of creating as much value for investors as possible.

That’s why the company is only using its MIPs nanotechnology in industries where it can create higher yields, greater scale, increased stability, cost and time savings, and operational simplicity.

Because helping others make more money is one of the surest paths of making money yourself.

The company is also doing all this with a lean operating model, with its technology being the main driver of value.

So, while it’s not quite software, this makes the company far more scalable than a traditional manufacturer.

And the good news for investors?

They have an opportunity to get in just as the company is commercializing its extraction product – while also making rapid progress on its diagnostic devices and negotiating key gold mining partnerships.

Because based on recent initial inquiries alone, the potential of just its green extraction product line could be worth hundreds of millions in revenue each year.

7 Reasons Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) is a Rare Investment Opportunity With Massive Disruption Potential

- It Could Add $10.5 Billion in Incremental Margins for the Gold Mining Industry Each Year. The company’s IXOS® product is estimated to save gold miners $100/oz in the gold production process5, which could equate to $10.5 billion a year.

- Its MIPs Nanotechnology has Already Shown it can Detect CV-196AND the UK and South African Variants.7 The company has already proven its proof of concept and is moving forward with product development. The company’s future “smart masks” could change the entire rapid test diagnostic landscape.

- A Lean Operating Model Combined with an Aggressive Global Patenting Program. The company is keeping its operating model lean and flexible by relying on manufacturing partners to do the heavy lifting. The value lies in their MIPs nanotechnology, which they are protecting through an aggressive patenting program in both the US and at least 40 other countries.

- A Team of Business and Scientific Geniuses. With a team that includes 7 PhD members (including the founder), they have a proven business track record of developing and closing multi-million dollar development programs and overseeing large capital raises.

- It Could Save Hemp Companies Billions in Extraction Costs. The company’s Affinity™ product cuts the complex extraction process from seven steps to three with savings of about $200/kg – without the need for a lot of space, skilled staff, or regular replacements8.

- Its Extraction Product Line Could Potentially Generate Hundreds of Millions in Revenue per Year. The company estimates that each Affinity™ machine would generate about $1.2 million in annual revenues. Even at this stage, the company has already received inquiries for over 250 units9, which by itself would equate to a potential annual revenue of $300 million.

- Commercial Rollout of its Green Extraction Product Line is Just Beginning. With the final manufacturing design for the Affinity™ product now finalized, the first units are expected to ship by the end of the year10.

Ushering in a New Era of Efficiency for Gold Mining - Sixth Wave Can Get MORE Gold out of the Same Rock!

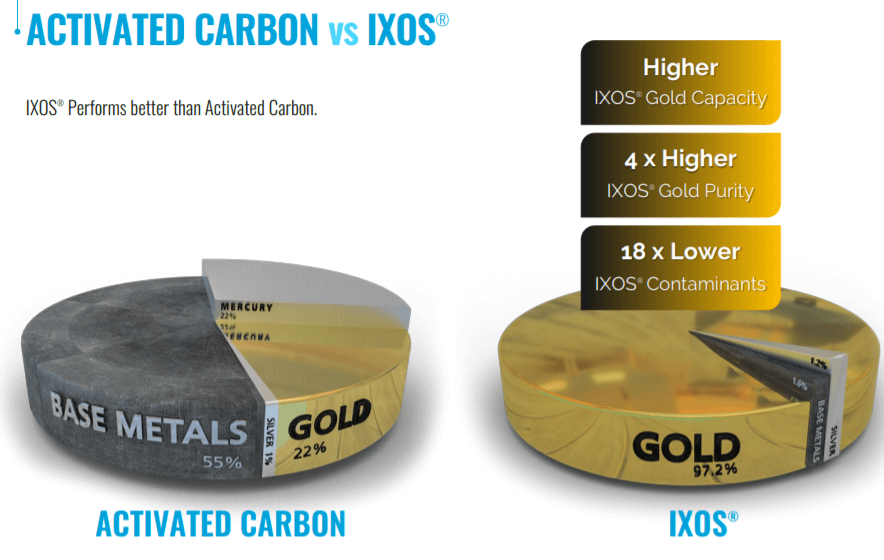

For over 100 years, the mining industry has used activated carbon to extract gold from the mined ores.

The current process is riddled with inefficiencies:

- After the activated carbon has bonded with the gold from the ores, it takes a complex, expensive, and time-consuming process (over 18 hours) to separate the gold from the carbon

- Activated carbon breaks down too easily, and the gold bonded to these fine particles can no longer be separated, creating wastage

- Activated carbon also attracts other base metals like copper, causing wasted time and materials

Sixth Wave Innovations’ (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) gold extraction product – IXOS® – solves every one of these problems.

- After the MIPs beads bond with the gold molecules, it only takes 30 minutes to separate the gold from the MIPs beads (which can then be reused)

- The MIPs beads won’t break down, and can even hold 10x the gold capacity per kilogram compared to activated carbon

- Because MIPs are specifically “imprinted” to gold molecules, it won’t inadvertently bond with other base metals instead

In short, IXOS® results in higher yields, lower costs, and quicker processing – while also being much more environmentally-friendly.

Based on the company’s conclusive pilot tests, IXOS® would result in $100 in total savings for every ounce of gold mined (plus a 30% lower plant setup cost).

And considering that over 3,000 metric tonnes – more than 105 million ounces – of gold is produced each year11, IXOS® could result in $10.5 billion per year in incremental margins for the industry.

The company expects to collect about 30% of these incremental margins – about $30/oz – as revenue, giving it a total market opportunity of $3.15 billion per year.

That means even a 1% market share is $31.5 million in annual revenues, with a 5% market share equating to $157.5 million in yearly revenues.

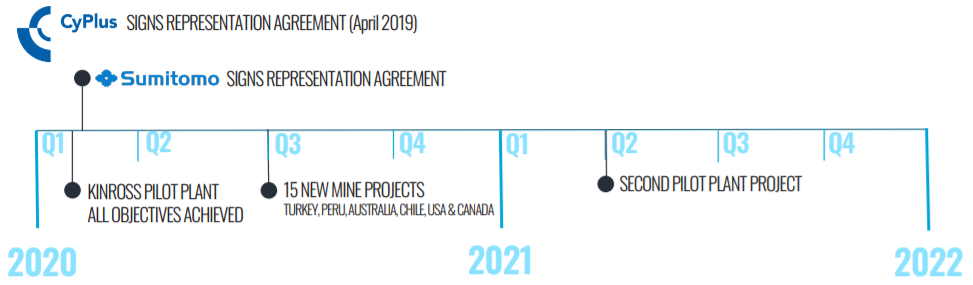

Now, because most gold mines are outside North America, CV-19 has put a lot of the company’s planned partnerships on hold.

But as global vaccination progress continues to ramp up and borders slowly reopen, most of these could come roaring back – especially once the gold miners see firsthand just how much savings IXOS® can give them.

Sixth Wave Innovations' (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) Patented Nanotechnology Could Help Hemp Companies Save Billions

Hemp companies must accelerate their shift into higher margin businesses like oils and tinctures.

That’s why the extract market is expanding so quickly and is expected to hit $28.5 billion in 2027.

Every major hemp company uses C02 extraction.

Unlike cheaper methods like ethanol or hydrocarbon extraction, it captures the full profile of flavonoids and carotenoids that separate the “passable” from the “great”.

The final product is “pure”, with no trace amounts of solvents like butane and propane in the final product (a potential byproduct of the other methods)12.

Plus, there’s no safety risk from dealing with highly flammable substances13.

But while C02 extraction is the “industry gold standard”, it’s also the most expensive method by far.

Which is why the ability to make the C02 extraction process more efficient and cost-effective is immensely valuable – and could be the key to helping unlock sustainable profitability for the industry.

Which is why the ability to make the C02 extraction process more efficient and cost-effective is immensely valuable – and could be the key to helping unlock sustainable profitability for the industry.

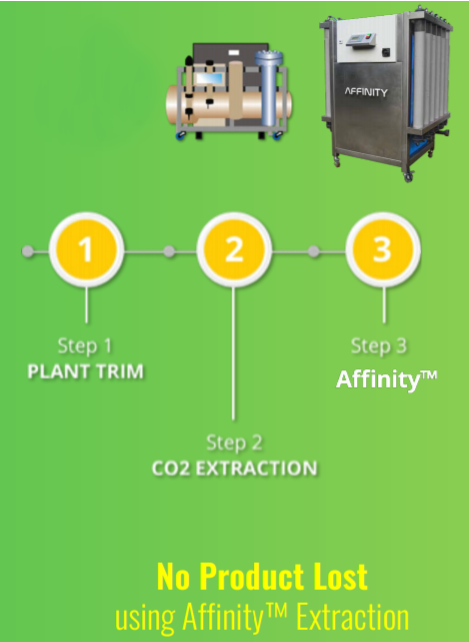

It could all come down to this simple looking machine.

Called the Affinity™, it can cut the traditional C02 extraction process – where up to 50% of product can be lost in the final four steps – from this:

To this:

It does this by using MIPs beads to “grab” the particles at a molecular level.

Not only does this result in higher yields, but it also slashes the setup costs of the final four steps by about 87.5%. Most of the processes are automated, meaning minimal staff training is required (resulting in further cost savings).

And instead of using the “printer cartridge” business model where the printer machine is cheap but they rake customers over the coals for the replacement cartridges, Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) offering hemp producers an unbeatable deal:

We only make money when you make money.

The company is planning to only charge the hemp producers per kilo of output, since even including its fee, these producers will still save hundreds of dollars per kilo of extract produced (and this doesn’t even account for the 10% to 15% higher yields).

Which is why Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) expects each Affinity™ machine to generate $100,000 in revenues each month.

But although it will not charge for replacing the MIPs beads in the machines, the cost to the company will be minimal.

Why? Because the company has perfected its MIPs nanotechnology to the point where the MIPs beads can be reused again and again.

This ingenious business model – combined with the technology – gives the company the potential for massive scale with minimal additional overhead.

Interest is Quickly Building for Sixth Wave Innovations' (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) Affinity™ Product

Considering all the advantages that the Affinity™ offers to licensed producers, it’s no surprise that interest is quickly building.

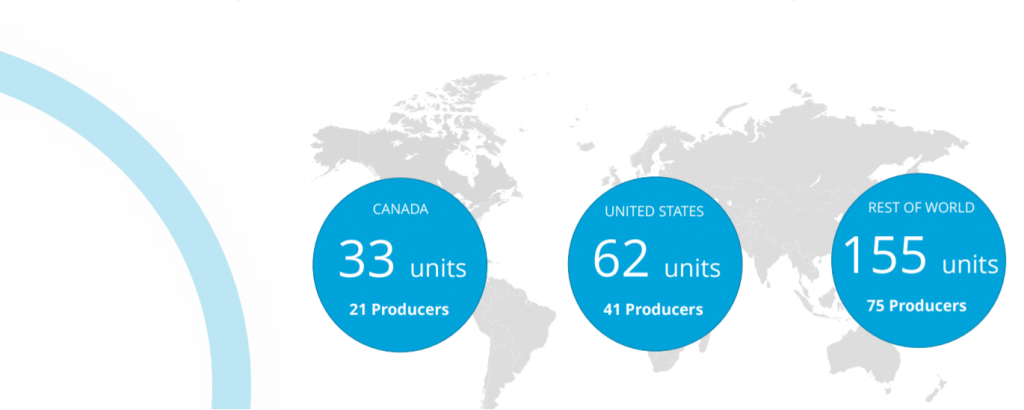

The company has already signed an MOU for three units from an Oregon-based licensed processor.

And it has received inquiries for 250 units from over 135 licensed licensed producers from all over the world14.

Just 250 units could already give Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) an estimated $300 million in annual revenues – indicating how much potential it has.

The benefits of the Affinity™ product also means:

Sixth Wave Innovations (CSE:SIXW) (OTCQB:SIXWF) is a Potentially Lucrative Acquisition Target

With competition in the hemp industry intensifying, a company that gets the sole and exclusive use of this technology could create an almost unbeatable competitive advantage.

Once Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) starts to officially deliver its Affinity™ units in the next few months – and licensed producers witness firsthand its advantages – it would not be a surprise to see a “bidding war” break out.

As Benzinga reports15:

We’ve already seen megadeals like:

- Jazz Pharmaceuticals $7.6 billion acquisition of GW Pharmaceuticals in May 2021 16

- Tilray and Aphria’s $3.8 billion merger in December 202017

- Trulieve buying Harvest Health for $2.1 billion in May 202118

Not to mention multiple other “smaller” deals like HEXO’s $750 million acquisition of Redecan in May 202119 or Columbia Care’s $240 million buyout of Green Leaf Medical in June 202120.

And with Sixth Wave Innovations’ (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) valued at just C$26.2 million as of July 2, 202121, an opportunity like this may never come again for these companies – or for investors.

Because once the Affinity™ product is rolled out and the company gains momentum, it could soon become a leading extraction company worth hundreds of millions.

In fact, Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) could become a superior version of The Valens Company, a leading Canadian extraction company worth C$526.9 million as of July 2, 202122.

| Company | Symbol | Market Cap23 | Share Price |

|---|---|---|---|

| Sixth Wave Innovations | CSE:SIXW OTCQB:SIXWF | $21.3M | $0.23 |

| Valens Company | TSX:VLNS | $426.7M | $2.46 |

| Jazz Pharmaceuticals | NASDAQ:JAZZ | $11.07B | $181.50 |

| MediPharm Labs | TSX:LABS | $98.2M | $0.38 |

| Neptune Wellness Solutions | NASDAQ:NEPT TSX:NEPT | $188.9M | $1.13 |

Because, remember, Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) keep its costs low thanks to its external manufacturing partners, with the company’s value coming from its MIPs nanotechnology that is secured by a fortress of global patents.

This gives it a technological and scalability advantage over other hemp extraction companies.

And this doesn’t even account for its solutions in other verticals like gold mining and rapid testing.

The Future of the $105.6 Billion CV-19 Diagnostic Market?

Although Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) is channeling most of its focus toward launching its Affinity™ product (and waiting for the borders to reopen), its science team isn’t just sitting idle.

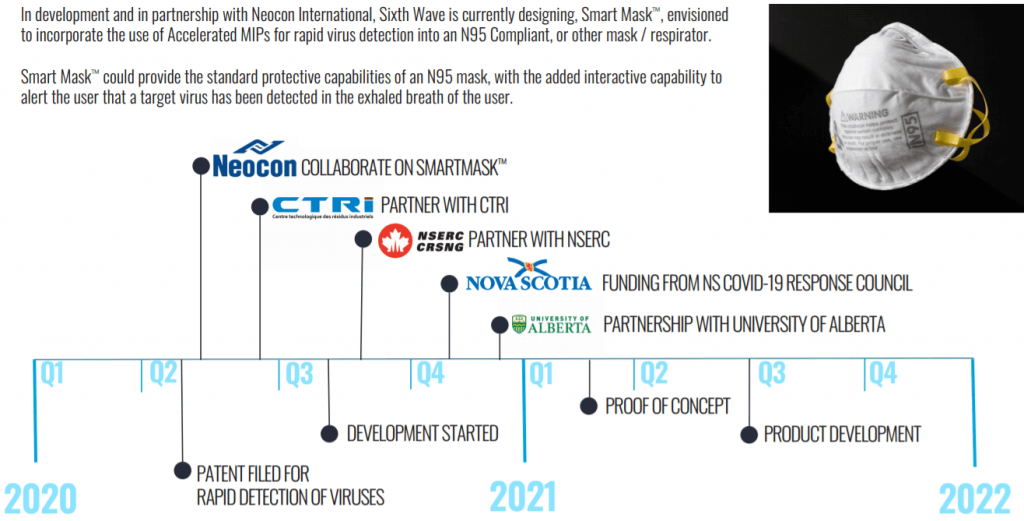

They’ve been working on the company’s rapid testing product line, where MIPs will be used to detect the CV-19 virus – just like the original SAFE-T product did for explosives.

The company has already successfully shown the technology can detect both the UK and South African variants24.

It has partnered with the Alberta Center for Advanced Micro/Nanotechnology Products to integrate the center’s advanced RFID technology with the MIPs test into N95 “smart masks”25.

Imagine how valuable a mask that can instantly tell someone if they are CV-19 positive would be.

Especially because experts are saying that the coronavirus is “here to stay”26.

That’s why Grandview Research estimates the size of the CV-19 diagnostic market to remain almost unchanged at $104.7 billion in 2027 (compared to $105.6 billion in 2021)27.

Meaning that although a final product is unlikely to be completed this year, it is still a powerful longer-term growth catalyst for Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF).

Plus, although CV19 is the current focus, the company is also exploring how the technology could be used to detect other viruses like HIV and hepatitis.

This technology could change the entire diagnostics landscape, with every company having no choice but to license Sixth Wave Innovations’ (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF)technology.

Sixth Wave Innovations' (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) Genius Management Team

Dr. Jonathan Gluckman – President and CEO

Dr. Jonathan Gluckman – President and CEO

Dr. Gluckman brings a 25-year track record of innovative, technology-driven achievements to his role as President of Sixth Wave. As founder and CEO of Integrated Dynamics, a government engineering services company since 1996, Dr. Gluckman focused on the development and subsequent transition of advanced technologies into commercial applications. As the leader of 6th Wave since 2012, Dr. Gluckman has concentrated his efforts to complete IXOS®, in the metals processing industry. Dr. Gluckman holds a Ph.D from the University of Cincinnati.

Sherman McGill – Chief Development Officer

Sherman McGill – Chief Development Officer

McGill is a seasoned sales and business development executive with a documented track record of developing and closing multi-million dollar development programs (R&D), product sales and training services to high profile US and international customers. He is spearheading business development efforts to lead Sixth Wave toward becoming a world leader in using its patented MIPs nanotechnology to help other industries save costs, improve efficiency, and generate higher yields.

John Cowan – Chief Operating Officer

John Cowan – Chief Operating Officer

Copwan brings with him 25 years of experience at multinational power company Eaton Corporation, where he contributed in all levels of leadership within the Operations Engineering and Quality disciplines. He was responsible for 11 precision manufacturing facilities and also launched various facility and product lines, including a greenfield engine assembly plant, two large engine block and head plants, and a medical manufacturing and distribution facility. A noted systematic thinker, Cowan is constantly exploring how processes can be improved to drive business performance.

Dr. Garrett Kraft – Vice President of Innovations

Dr. Garrett Kraft – Vice President of Innovations

Dr. Kraft has over a decade of polymer synthesis experience and holds a PhD in Polymer Science from the University of Connecticut. He has spearheaded multiple initiatives in the company, including the development of its pathogen detection product, as well as managing the company’s overall intellectual property portfolio. Since joining the company in 2017, he has personally been named as an inventor on many of its patents.

RECAP: 9 Sixth Wave Innovations (CSE:SIXW, OTCQB:SIXWFCSE:SIXW, OTCQB:SIXWF) Could be THE Early Opportunity Investors are Looking For

- Company is has a very low market cap of C$26.2 million (as of July 2, 2021)

- It has a proven and urgent solution that hemp companies desperately need if they want to move toward sustainable profitability

- Its Affinity™ product is on the brink of a full commercial launch and could generate $300 million in annual revenues with just 250 machines

- Pilot tests have already shown that its IXOS® product could save gold miners $100/oz of gold produced

- The company’s IXOS® product could generate $31.5 to $157.5 million in annual revenues to the company with just a 1% to 5% market share

- Once borders reopen, the company will immediately begin developing partnerships with gold miners so they can witness firsthand IXOS’® capabilities

- Already proven the concept of its CV-19 rapid test – which will be a powerful long-term growth catalyst

- Lean operating model coupled with an aggressive global patenting program gives it strong scalability potential

- Led by a management team of business and scientific geniuses

1https://www.statista.com/statistics/238414/global-gold-production-since-2005/

2https://www.tradingview.com/symbols/XAUUSD/

3https://tinyurl.com/hjh9myuf

4https://tinyurl.com/52d3fpp5

5https://sixthwave.com/Presentations/SixthWave_CorporatePresentation.pdf

6https://tinyurl.com/wr8xn2rm

7https://tinyurl.com/3hm3wmdr

8https://sixthwave.com/Presentations/SixthWave_CorporatePresentation.pdf

9https://sixthwave.com/Presentations/SixthWave_CorporatePresentation.pdf

10https://finance.yahoo.com/news/sixth-wave-innovations-inc-takes-110000321.html

11https://www.statista.com/statistics/238414/global-gold-production-since-2005/

12https://mjbizmagazine.com/digital-issues/2018-10-Oct/59/#zoom=z

13https://mjbizmagazine.com/digital-issues/2018-10-Oct/62/#zoom=z

14https://sixthwave.com/Presentations/SixthWave_CorporatePresentation.pdf

15https://tinyurl.com/4cmuvja3

16https://www.fool.com/investing/2021/05/05/jazz-pharmaceuticals-acquisition-of-gw-pharmaceuti

17https://tinyurl.com/93zcjrap

18https://tinyurl.com/43c3hb48

19https://tinyurl.com/395bf83u

20https://www.businesswire.com/news/home/20210611005241/en/Columbia-Care-Completes-Acquisition-of-Green-Leaf-Medical-Cements-Market-Leading-Position-in-Mid-Atlantic

21https://finance.yahoo.com/quote/SIXW.CN?p=SIXW.CN&.tsrc=fin-srch

22https://finance.yahoo.com/quote/VLNS.TO?p=VLNS.TO&.tsrc=fin-srch

23Market cap and share price taken from Yahoo Finance as of 2 July 2021. USDCAD rate = 1.23

24https://finance.yahoo.com/news/sixth-wave-detects-uk-south-110000498.html

25https://finance.yahoo.com/news/sixth-wave-partners-acamp-develop-132700151.html

26https://www.nature.com/articles/d41586-021-00396-2

27https://tinyurl.com/hjh9myuf

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Sixth Wave Innovations.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Sixth Wave Innovations and has no information concerning share ownership by others of any profiled Sixth Wave Innovations The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Sixth Wave Innovations or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Sixth Wave Innovations Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Sixth Wave Innovations’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Sixth Wave Innovations future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Sixth Wave Innovations industry; (b) market opportunity; (c) Sixth Wave Innovations business plans and strategies; (d) services that Sixth Wave Innovations intends to offer; (e) Sixth Wave Innovations milestone projections and targets; (f) Sixth Wave Innovations expectations regarding receipt of approval for regulatory applications; (g) Sixth Wave Innovations intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Sixth Wave Innovations expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Sixth Wave Innovations business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Sixth Wave Innovations ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Sixth Wave Innovations ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Sixth Wave Innovations ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Sixth Wave Innovations to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Sixth Wave Innovations operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Sixth Wave Innovations business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Sixth Wave Innovations business operations (e) Sixth Wave Innovations may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Sixth Wave Innovations or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Sixth Wave Innovations or such entities and are not necessarily indicative of future performance of Sixth Wave Innovations or such entities.