Investors are making fortunes as more discoveries continue to be announced.

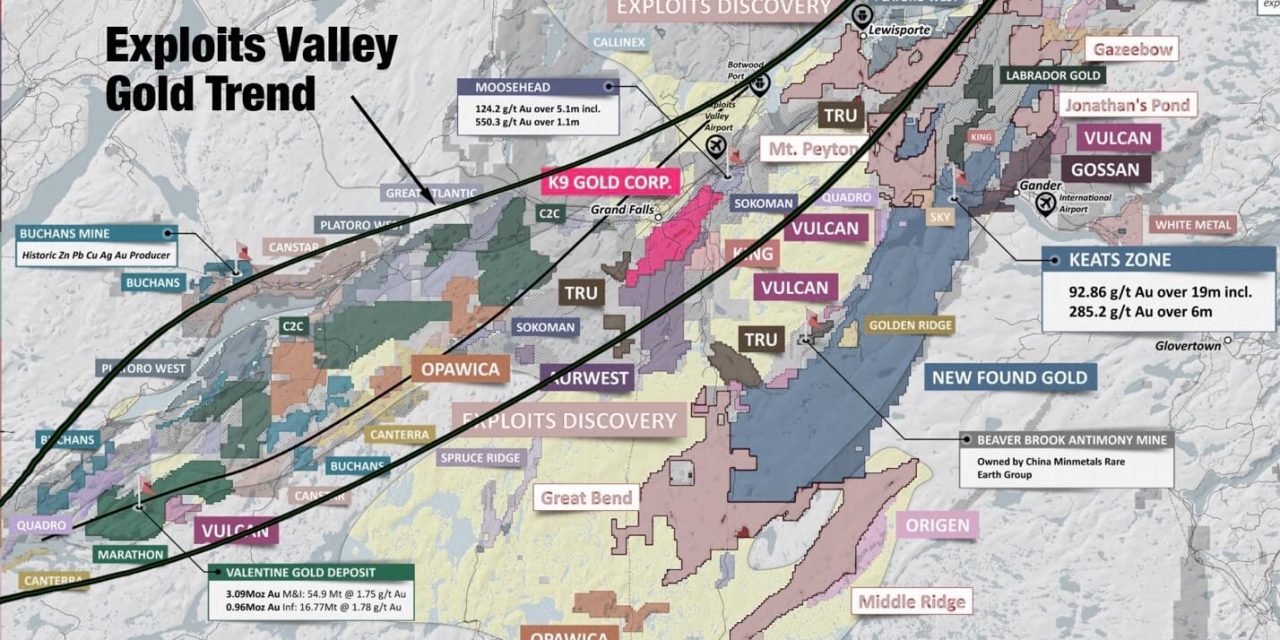

Take a look at the claims map to get a solid idea where you can get started. There’s still time to get in, but you should act fast.

Massive discoveries continue to be added as exploration proceeds on this recently opened Newfoundland gold trend.

Investors have been pouring in, triggering enormous gains for early entries. But this is just getting started.

One company, K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF), secured a massive 32,185 acre in the heart of this emerging trend. Millions of ounces have already been discovered along neighboring properties to the north and the south.

They bought it, now they’re working it!

K9 Gold’s initial field work and exploration is now bearing fruit. Assays from trench and surface sampling have yielded results far exceeding economical cutoffs. Targets for advanced exploration have been identified and drilling has commenced. Announcements should follow soon.

Now is the time to launch your due diligence into K9 Gold Corp (OTC: WDFCF, TSX-V: KNC)… before the next round of news releases.

Now is the time to launch your due diligence into K9 Gold Corp (OTC: WDFCF, TSX-V: KNC)… before the next round of news releases.

K9 Gold’s 2021 exploration launch could verify significant new finds on this prolific gold trend…just as it has for neighboring projects!

K9 Gold holds 100% interest in a massive 50+ square mile claim in the heart of the newly discovered Exploits Valley Gold Trend in northern Newfoundland. For investors seeking an early entry into a well-positioned junior, K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) sits as a standout opportunity in one of the best gold-bearing regions in all of North America.

Timing couldn’t be better for early investing in K9. If you’re an aggressive investor seeking outsized opportunity from a junior gold, then now is the time to consider your next move. K9 Gold could be ideal for anyone considering an entry level position in a junior gold with explosive growth potential.

Big moves have already begun!

Just a few months ago, K9’s immediate neighbor to the north, Sokoman Resources knocked it out of the park on preliminary results from its position on the Exploits Valley Gold Trend.

Sokoman launched exploration ahead of K9 and has since seen explosive gains in its share price.

On April 28 this year, Sokoman announced “high-grade intercepts” at its Moosehead Project, which lies contiguous to K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) on its northern boundary. A few weeks later, on May 18, the company announced “additional high-grade results” at the same location.2

The first hint of its gold resource potential actually came a month earlier when Sokoman optioned off its southern East Alder project (also on trend directly south of K9) to Canterra Minerals.3

Some speculated that Sokoman made the move to focus resources exclusively on the results it was seeing at the Moosehead project. That exploration area lies just above the boundary with K9 and was bringing in exceptional results. Investors quickly agreed. Through that time frame, Sokoman shares rocketed out of a prior 11¢ CA low to eclipse 75¢ following the above exploration announcements.

As could be expected, Canterra Minerals took a quick hit on the option announcement, but quickly took off, nearly doubling to 40¢ over the next 30 days once the significance of the option agreement sank in. Historic exploration on the project suggested enormous unrecognized potential. That became clearer when the company announced that this area, directly south of K9, bears a “2 kilometre gold-in-soil trend with gold results continuous with the gold-in-soil anomaly from Canterra’s Wilding Project.” 4

Then there’s the Valentine Gold project owned by Marathon Gold situated on the southern portion of the Exploits Valley Gold Trend. Marathon Gold is the first exploration company to announce resource calculations from its exploration on the Exploits Valley Gold Trend.

The impact was significant. Google Finance reports Marathon Gold shares “up 620.14% [in the] past 5 years”.5 Significantly, the greatest percentage of those gains occurred in recent months as results from its 2020 and renewed 2021 exploration programs led to 43-101 compliant measured and inferred resource calculations exceeding four million ounces of gold.

Keep in mind that K9 not only lies on the same trend as Marathon, historical and updated exploration on the K9 site strongly suggests significant undiscovered gold potential.

Here’s why K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) holds such strong growth potential.

As far back as 1989, Canada’s largest diversified resource mining company, Teck Resources moved exploration geologists onto what is now the K9 Gold property to seek, find and report on the gold prospects. Back then, gold prices were crashing on a path to under $400.6 Though the 43-101 compliant geology report came in favorably for its gold findings,7 Teck officials tabled the project and ultimately sold the claims.

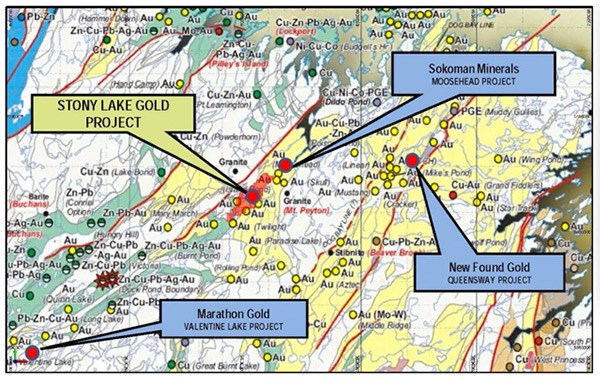

In 2018 a detailed compilation of all historical exploration from that report, along with substantial exploration data accumulated over subsequent years, was published for the current K9 Gold property (Stony Lake) and properties bounded to the northeast on trend.

The report concludes: “There have been significant gold discovery results from past intermittent exploration work on the current Stony Lake East Project area…hosting very anomalous to high-grade gold values in tills, soils and rocks occur on District Copper’s Project.” 8

For comparison, the same report identifies Sokoman’s Moosehead discovery to the north as being exceptionally rich. From that same report:

“The Moosehead property has seen more than 25 years of sporadic exploration, with discoveries of angular, epithermal-style auriferous quartz vein boulders assaying up to 442 g Au/t (13 oz Au/t) and drill intersections of up to 171 g Au/t (5 oz Au/t) over 1.5 m, 14.1 g Au/t over 16.8 m and 112.0g Au/t over 2.0 m.” 9 (Emphasis from the original document!)

These are stunning assays well above typical economic cut-off grades at today’s gold price and point clearly to the enormous gold mineralization potential that exists in the Exploits Valley Gold Trend.

History launches again. The new discoveries continue to build.

In late October exploration from initial step-out drilling at Moosehead continued to intercept significant gold mineralization on trend; 22.3 g/t over 41.35 meters and 31.2 g/t over 18.85 meters!10 Again, these are exceptional results that appear to be the start of more to come.

Recent exploration work bears out K9’s potential on trend.

In 2019, an extensive field program was launched on the K9 Gold Corp (OTC: WDFCF, TSX-V: KNC) prospect to map and further sample gold mineralization near surface. In addition, a property-wide magnetometer and radiometric survey was commissioned to map structural features and identify target areas for advanced on-the-ground exploration. That exploration is now underway for the summer of 2021 and announcements could begin flowing at any time.

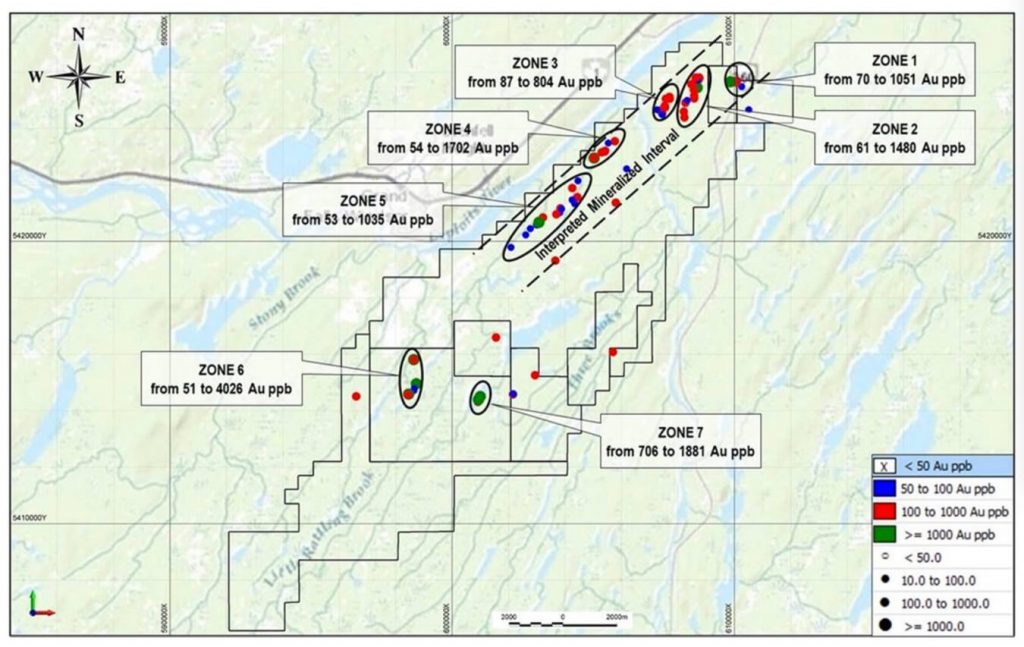

Eight areas of highly anomalous to high grade gold (15.05 g/t) mineralization have been delineated and are now targeted for exploration that can yield 43-101 compliant resource calculations.

Newly identified mineralization zones.

At current gold prices and with the relatively low cost of mining these near surface resources, economical cut-off grades can begin at 0.5 grams/per ton gold (Au). Updated exploration results identified seven high-quality prospects for advanced exploration with multiple assays ranging from cut-off grade to four grams per ton Au.

Referring back to the regional map at the top of this report, data released by K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) management describe Stony Lake as being geologically analogous to the New Found Gold Queensway project which lies to east on a parallel gold trend. New Found Gold got an earlier start in the region, launching its sampling program in 2016.

Since that time, the company has released numerous gold findings that gave them a jump start on share price growth. On October 2, 2020, Mining Journal reported that:

“Shares in newly-listed explorer New Found Gold shot up to a fresh peak on Friday as the company reported high-grade results from its first drill hole at the Lotto zone, at its Queensway project in Canada’s Newfoundland.”

“Hole NFGC-20-17 returned 4.75m at 41.2g/t gold from 35m and 5.15m at 25.4g/t from 57m.”

“New Found Gold has said there was “strong evidence to suggest” the Central Newfoundland gold belt held many similarities to the Bendigo goldfields in Victoria, Australia, which hosts Kirkland Lake Gold’s high-grade Fosterville mine.”11

Why is this important? Please note that Mining Journal described New Found Gold as “newly listed” in the U.S., but it came to America too late for the big gains. The stock price had already been run up on Canada’s Toronto Exchange where the shares rocketed on news of its Queensway exploration progress. From its March low of 69¢, shares soared to a recent high near $4.00 CAD per share.[2]

The door to this entry-level buy on New Found Gold was closed even before it got started!

However, K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) stands wide open!

As of today’s report, K9 trades under 40¢/share in the US and it’s just getting started. Advanced work on trend with Sokomon bordering on the north and Marathon to the south, along with significant historical exploration on site suggest that K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) stands out as an entry-level opportunity capable of explosive gains for those who lock in an early shareholder position.

Is K9 Gold a “buy now” even after its recent climb and retreat?

Beginning in 2021, news of K9 Gold launched shares from under 25¢ earlier to a quick double at 58¢ by June 2. Quick profit taking triggered a drop to around 40¢ where it found support. You might consider this to be an outstanding entry point regardless of where the price lies at the time of this reading.

Newfoundland is in the midst of a modern-day gold rush that has investors pouring into the province and growing wealth right now. Consider any price dips to be buying opportunities as weaker hands take money off the table. Longer term, the Exploits Valley Gold Trend could be exceptionally profitable for early investors.

That’s not the only trend that may be working in your favor.

While the Newfoundland gold rush fuels new investor excitement, the underlying asset itself has been under increasing pressure to launch. With the prospect of significant inflation now pressing on the U.S. dollar, the potential for soaring gold prices could double or triple the growth curve of all companies on the Exploits Valley Trend. As a true entry level buy, K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) holds outsized growth potential as it is yet to report exploration results.

Of course, there is substantial risk that has to be considered as well. Gold prices could reverse and fall back from current ranges. K9 Gold Corp could fall short of expectations. Any investment into a junior resource company should be considered as a high risk for substantial if not complete loss of your investment. Limit your investment decision only to that amount you feel comfortable with putting into a high-risk investment.

But keep in mind, for building wealth, few opportunities can match what can be earned from a well-placed position in a successful junior company holding the potential of K9 Gold Corp. Look at the results that neighboring projects who got an earlier start on the same gold trend. Share prices soared by triple digits in a matter of just months. The key is that those gains were earned by investors who secured those early positions…exactly where K9 appears today.

What to do now...

Get started on your due diligence. Go to the company website. Sign up for email news releases. Contact your broker and put K9 on your stock watch list.

Better still, consider getting some skin in the game while K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF) shares are priced so low. Now is the ideal time to act aggressively and both maximize your profit potential and limit your risk exposure!

Recapping...

- A modern day gold rush is underway right now in the Canadian province of Newfoundland. Millions of ounces are being discovered, which has triggered a global rush of investing interest into the region.

- K9 Gold Corp has launched its 2021 exploration program on what’s known to be one of the most prolific gold trends in Newfoundland, the Exploits Valley Gold Trend. Bounded on the north by Sokoman Minerals and further to the south with Marathon Gold and Canterra Minerals, recent and historic exploration has documented millions of ounces of gold resources all along this trend shared by K9 Gold Corp (TSXV: KNC, OTC: WDFCFTSXV: KNC, OTC: WDFCF).

- The underlying asset, gold, appears on track for a major bull run particularly in the face of growing inflationary pressures. The Federal government’s profligate spending coupled with global central bank currency debasement puts significant upside pressure on gold.

The conclusion is simple. Now is an ideal time to be making a move on gold. Everything is aligned for growth and few investments in the market today offer the rapid growth potential of a gold exploration company. To get started, visit the K9 Gold Corp website and make sure you enter your email address for future information and breaking news. Stay ahead of the market to make the most of your investment decision.

1https://canterraminerals.com/news-releases/canterra-minerals-enters-into-option-agreement-to-acquire-100-of-the-east-alder-gold-project-newfoundland/

2https://sokomanmineralscorp.com/news/page/2/

3https://sokomanmineralscorp.com/2021/04/19/sokoman-minerals-options-the-east-alder-gold-project-in-central-newfoundland-to-canterra-minerals-corporation/

4ibid

5July 2, 2021: https://www.google.com/search?client=safari&rls=en&q=marathon+gold+stock+price&ie=UTF-8&oe=UTF-8

6https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

7Source: First Year Assessment Report on the Geology and Geochemistry of the Bishop’s Falls Property, 1990, J. Wayne Pickett

8National Instrument 43-101Technical Report: Compilation of Historical Geological, Geochemical and Geophysical Exploration Work Carried Out Over the Stony Lake East Epithermal Gold Project, 2018, Larry Pilgrim , P. Geo, page 26

9Ibid. page 27

10

11https://www.mining-journal.com/discovery/news/1396436/lotto-find-lifts-new-found-gold

12https://www.theglobeandmail.com/investing/markets/stocks/NGD-T/

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling K9 Gold Corp

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled K9 Gold Corp and has no information concerning share ownership by others of any profiled K9 Gold Corp The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any K9 Gold Corp or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the K9 Gold Corp Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled K9 Gold Corp’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding K9 Gold Corp future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to K9 Gold Corp industry; (b) market opportunity; (c) K9 Gold Corp business plans and strategies; (d) services that K9 Gold Corp intends to offer; (e) K9 Gold Corp milestone projections and targets; (f) K9 Gold Corp expectations regarding receipt of approval for regulatory applications; (g) K9 Gold Corp intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) K9 Gold Corp expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute K9 Gold Corp business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) K9 Gold Corp ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) K9 Gold Corp ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) K9 Gold Corp ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of K9 Gold Corp to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) K9 Gold Corp operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact K9 Gold Corp business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing K9 Gold Corp business operations (e) K9 Gold Corp may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of K9 Gold Corp or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of K9 Gold Corp or such entities and are not necessarily indicative of future performance of K9 Gold Corp or such entities.