There’s a perfect storm sweeping copper to new highs.

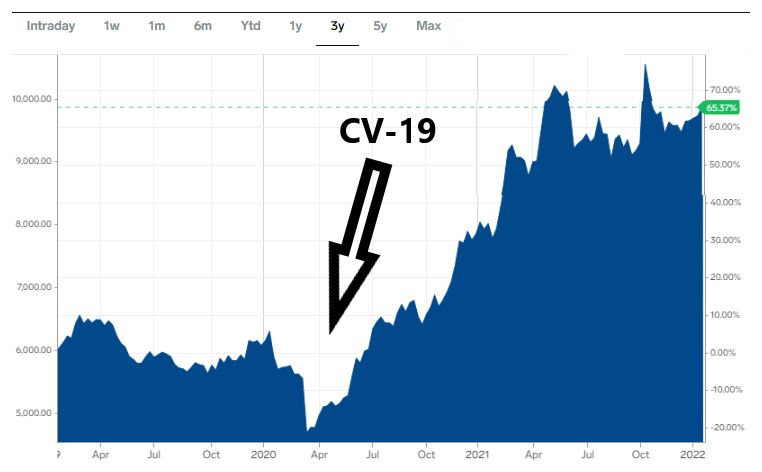

When CV-19 showed up, prices dipped…but then they took off.

The last year has been amazing for copper.

Prices for the red metal recently broke just through the $10,000 mark for the second time in a decade.

Even with the current volatility, the Bank of America believes copper could more than double to $20,000 per tonne by 2025.1

Why?

Because we’re using more copper than ever today, but copper inventories are at levels seen 15 years ago.2

Meanwhile, there are multiple drivers for growing copper demand as a base metal:

- Vaccines and boosters are rolling out3

- The global economy is recovering4

- Government stimulus is increasing5

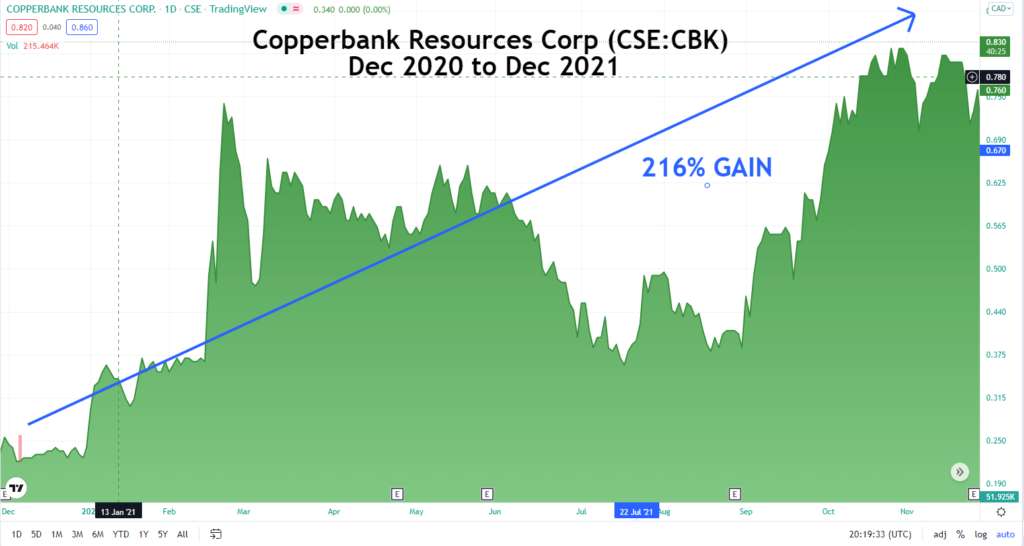

That all adds up to a major tailwind that’s helped copper stocks like Taseko Mines and Copperbank Resources generate big value in the past year.

While those stock gains have already come and gone, newly-listed Zacapa Resources (TSXV:ZACATSXV:ZACA) is fresh on the scene to benefit from the hot copper market.

Especially since there’s another MAJOR factor behind the increases in copper demand and prices…

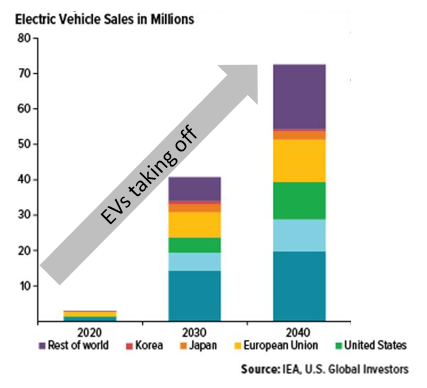

…the rise of electric vehicles (EVs).

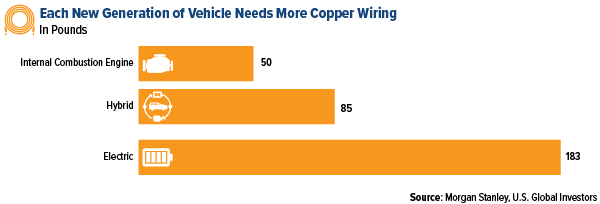

EVs rely heavily on copper. They use 3X to 4X as much copper wiring as a traditional vehicle.6

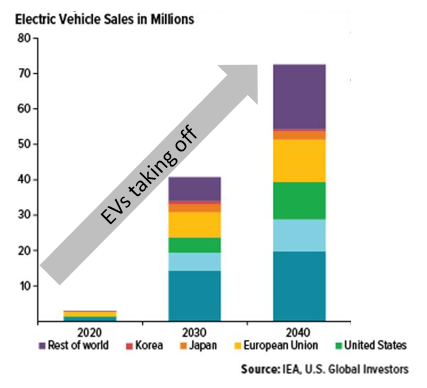

With EV sales expected to skyrocket in the near term, copper demand and prices are expected to skyrocket too.

But EVs are just one catalyst driving copper to new highs.

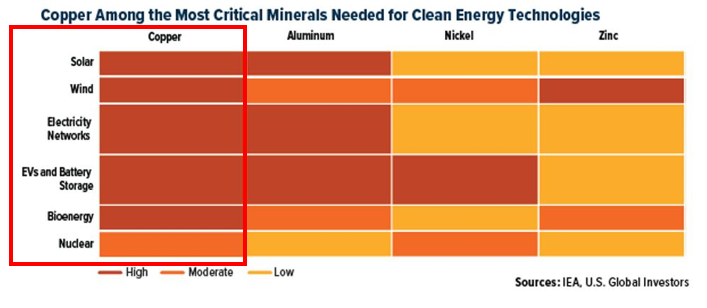

Copper is also essential to our future existence since renewable energy technologies also need lots of copper.

The International Energy Agency says copper will remain the most widely used metal in renewable energy technologies.7

Goldman Sachs predicts that by 2030, copper demand will surge by nearly 600%.8

That’s all good news for copper miners and their stocks.

But which copper stocks are likely to get the biggest boost from this perfect storm?

The ones that have a proven team and enough strategic projects in hot regions so they can produce a steady stream of news.

That’s why investors need to keep a close eye on newly-listed Zacapa Resources (TSXV:ZACATSXV:ZACA)

Meet Today's Hot New Copper Stock

- Newly listed discovery-focused company (so lots of upside potential)

- Proven team with street cred (more on that later)

- 3 large copper projects (2.9X the size of Manhattan Island combined)

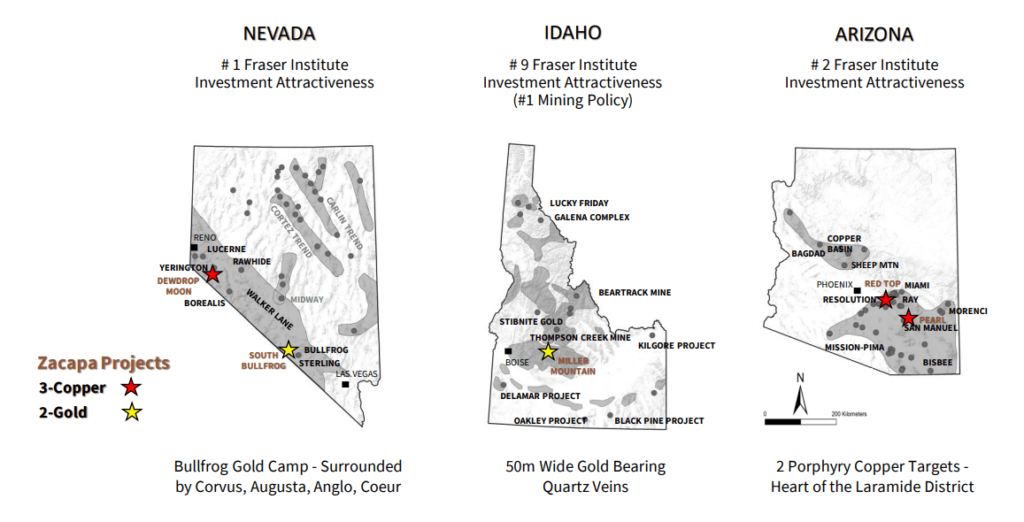

- Located in Nevada, Arizona & Idaho (3 of the world’s top regions for mining investment attractiveness)9

- Plus 2 gold projects (just to sweeten the pot)

They’re also fully financed to complete their aggressive exploration programs (last financing was $9M).10

Reason #1 - Riding the Near-Term & Long-Term Copper Wave

The copper boom over the last year isn’t some SHORT-term market blip.

In the NEAR-term, copper has already surpassed Goldman Sachs’ price forecast of $10,000 per tonne copper in 2022, marking the second time in history the metal has reached 5 digits.

Over the LONG-term, major copper demand growth is expected to come from electric vehicles (EVs).

Last year, EV sales were around 3 million.

Last year, EV sales were around 3 million.

By 2040, they could be as high as 70 million.12

That’s a 23X increase in EV sales!

That means huge copper demand increases.

There’s also the extra demand for copper wires in EV charging stations and infrastructure.

Wood Mackenzie estimates that by 2030 there will be 20+ million global EV charging points.13

That ALONE would consume 250% more copper than in 201914.

Then there’s more copper demand expected from the rise of other tech advances, like renewable energy infrastructure.15

But growing copper demand doesn’t just come from new sectors. Copper makes up the very backbone of our modern way of life.

It’s in most everything that has wires: electric motors, generators, buildings and houses, planes, cars, and every electronic device you can imagine.16

So it only makes sense that:

- Copper demand will continue to grow

- That demand will support strong copper prices

- Copper companies will be rewarded for exploring, finding and producing more copper…in the NEAR-term and the LONG-term.

That’s great news for Zacapa Resources (TSXV:ZACATSXV:ZACA) as it continues to aggressively move its copper projects forward.

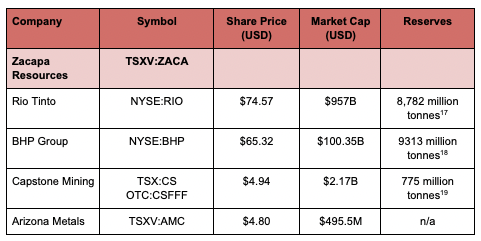

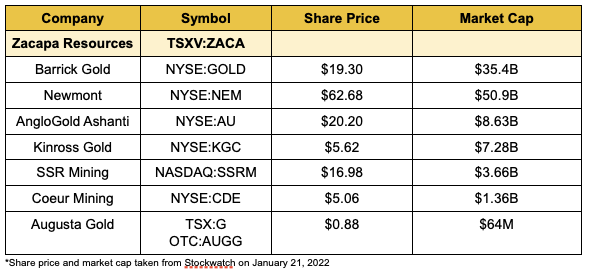

Before we dive into Zacapa Resources (TSXV:ZACATSXV:ZACA) copper projects, the table below shows some of their world-class neighbors and copper companies they’re working to be like.

Reason #2 - Three Very Promising Copper Projects in Development

- #1 = Nevada

- #2 = Arizona

COPPER PROJECT #1: DEWDROP MOON PROJECT

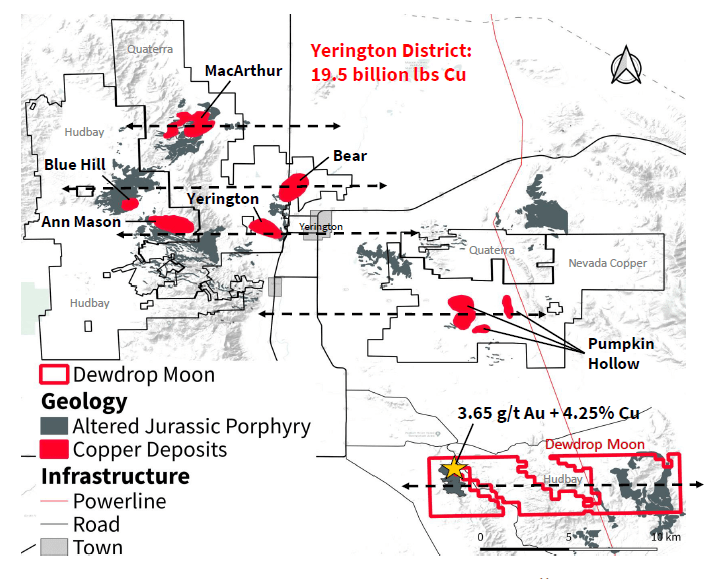

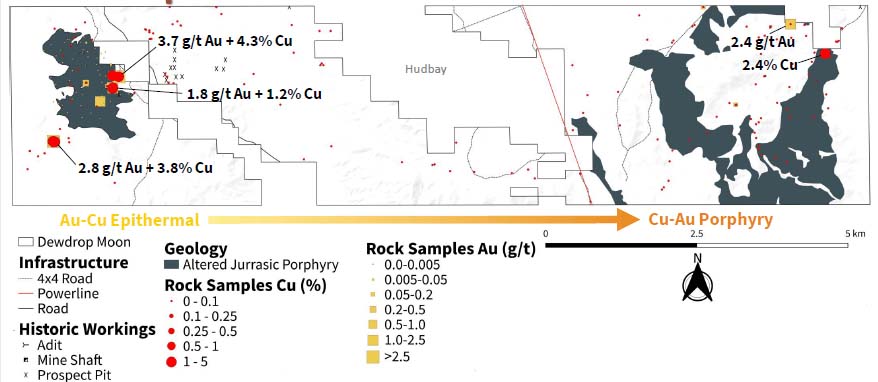

This is a large Nevada-based project (18.5 square miles; 48 km2).

The appeal of the district is confirmed by the active mid-tier and major mining companies nearby.

The neighboring Pumpkin Hollow Mine (to the north of Zacapa’s project) went online in 2019, making it America’s first new copper producer in the last decade.22

The mine is projected to average 60 million pounds of copper annually in years 1-5, and 50 million pounds annually after that.23

Zacapa Resources (TSXV:ZACATSXV:ZACA) Dewdrop Moon project is road-accessible on permit friendly BLM claims with drill-ready targets.

Sampling has already identified encouraging results, including:

- 4.3% copper associated with exotic copper-oxide (2020)

- Outcropping epithermal gold targets with up to 3.7 grams per ton (g/t) gold (2020)

- Additional copper and gold anomalous zones with up to 3.8% copper and 2.8 g/t gold (2021)

- Yerington: 128 million tons (Measured + Indicated)24

- Ann Mason: 2.2 billion tonnes (Measured + Indicated)25

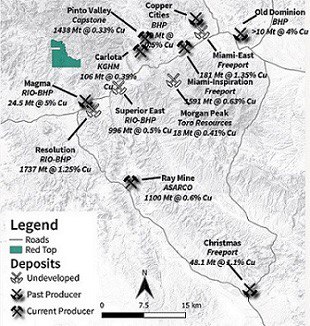

- Resolution (Rio Tinto/BHP)

- Superior East (Rio Tinto/BHP)

- Pinto Valley (Capstone Mining)

- Carlota (KGHM International)

- Ray (ASARCO)

- San Manuel-Kalamazoo (BHP)

- Florence (Taseko)

The Resolution-Globe-Miami area includes 4+ giant porphyry copper deposits that are over 1 billion tons each and over 7.4 billion tons @ 0.73% copper (that means 120 billion pounds of copper!)27

The Resolution-Globe-Miami area includes 4+ giant porphyry copper deposits that are over 1 billion tons each and over 7.4 billion tons @ 0.73% copper (that means 120 billion pounds of copper!)27

Just 5 miles (8 km) to the southwest of Zacapa Resources (TSXV:ZACATSXV:ZACA) Red Top project, the world’s 2 largest mining companies – Rio Tinto and BHP28– are developing the Resolution Copper deposit.

Resolution Copper is one of the largest undeveloped copper projects in the world.29

It has an estimated copper resource of 1.8 billion tonnes at an average grade of 1.5% copper.

That means this single nearby mine has the potential to supply nearly 25% of all the copper demand in the US.30

Zacapa Resources (TSXV:ZACATSXV:ZACA) Red Top project is drill ready and already permitted.

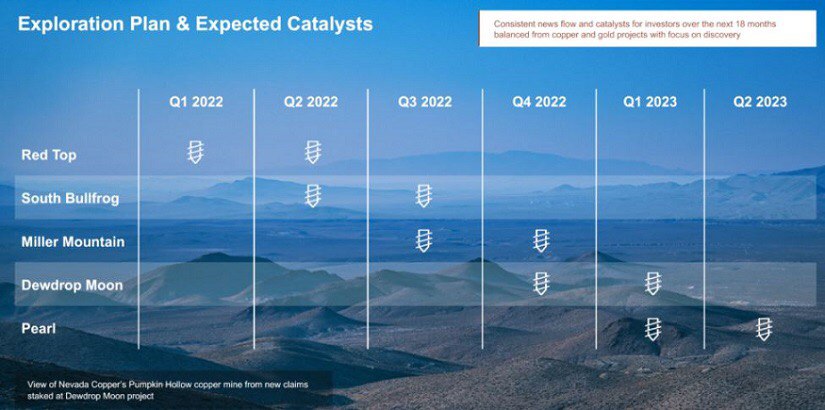

The company is expecting drill results in Q4 2021, and they’re starting a 3-hole program later in October.

So watch for ongoing news flow from this project.

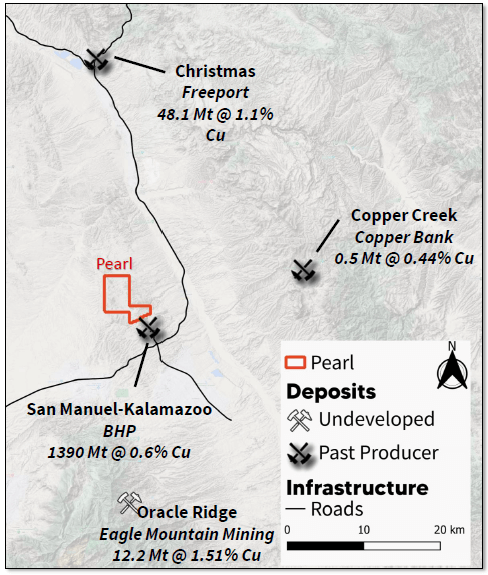

COPPER PROJECT #3: PEARL

This project is located directly south of Zacapa Resources’ Red Top copper project.

This project is located directly south of Zacapa Resources’ Red Top copper project.

It’s also right next to BHP’s former San Manuel/Kalamazoo mine, which operated from 1955 to 1999, and was once the world’s largest underground copper mine31.

Zacapa Resources (TSXV:ZACATSXV:ZACA) Pearl project borders active FreeportMcMoRan and BHP claims.

The Pearl project features favorable host rocks with up to 3.8% copper at surface and outcropping copper oxides that extend for over 650 meters (~2,132 feet).

Upcoming news flow will come from mapping and sampling at Pearl in Q4 2021.

- Produces over 80% of the gold mined in the US

- Averaged ~5.5 million ounces of gold production per year over the past decade32

- Has 28 active gold mines33

Better yet, Nevada is home to recent high-grade gold discoveries.

The world-class Goldrush deposit – a JV between Barrick and Newmont (Nevada Gold Mines) – will start producing in 202134, with an expected mine life of 21 years and annual gold production targeted at 450,000 ounces.35

Right next to Goldrush is the Fourmile deposit.

Each of these deposits could produce 5 million ounces of gold over a decade.

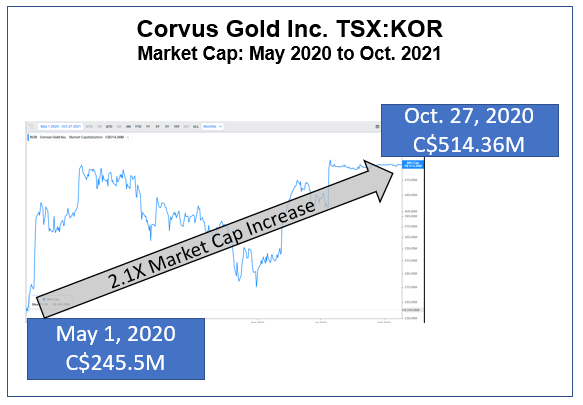

Nevada also enables small gold mining companies to join the big players…like when Corvus Gold more than doubled their market cap in the last year and a half and got bought out by AngloGold Ashanti for their Nevada assets for US$370M in September.36

Nevada is THE place to be for gold exploration and production…and Zacapa Resources (TSXV:ZACATSXV:ZACA) is actively developing its project there.

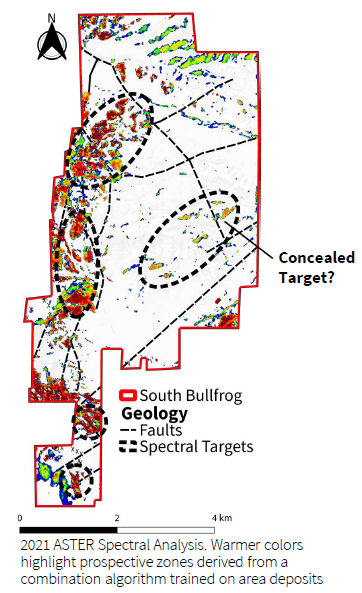

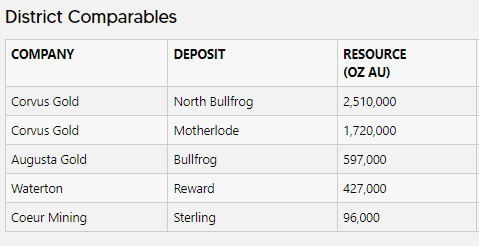

Before we look at how Zacapa Resources (TSXV:ZACATSXV:ZACA) is in one of Nevada’s most prolific gold trends, the table below shows some of their world-class neighbors and gold companies they’re working to be like.

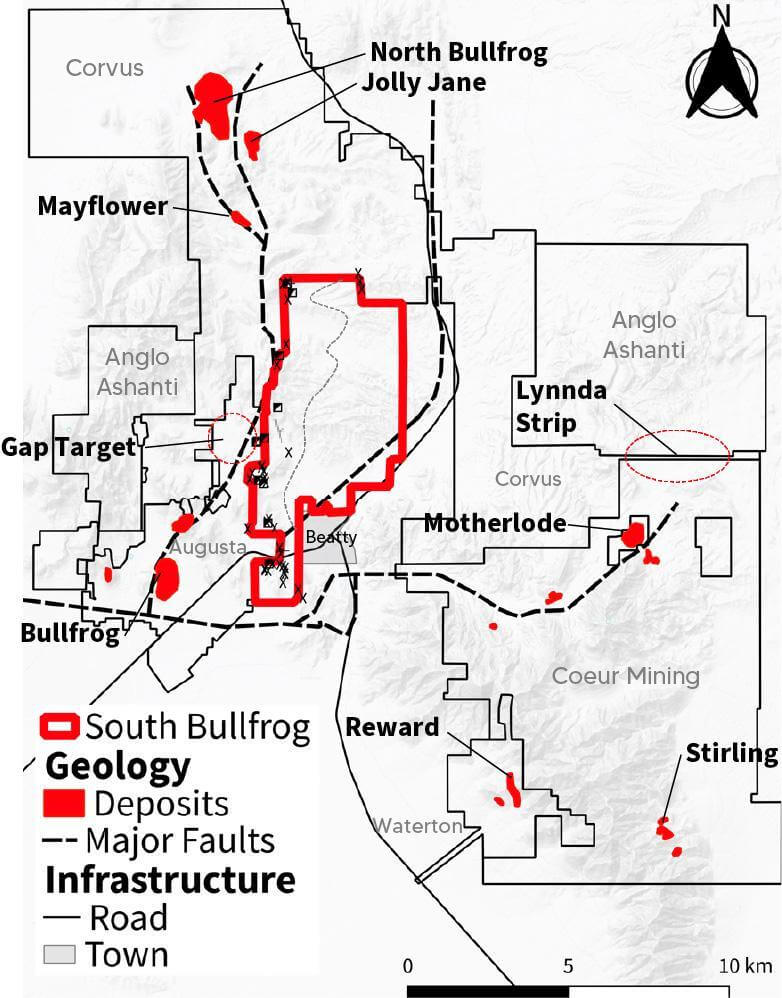

Reason #4 - Drilling Two Very Promising Gold Projects

- The historic Bullfrog Mine, which produced 2.33 million ounces (Moz) gold

- Corvus’ North Bullfrog deposit (2.1 Moz gold M+I)37 and Mother Lode deposit (1.55 Moz gold M+I)38

- Recent exploration success by Corvus at Lynnda Strip (108.2m @ 1.13 g/t gold, 114.3m @ 0.96 g/t gold and 100.6m @ 0.94 g/t gold)39

- Augusta Gold’s C$25 million exploration program underway to the west at Bullfrog’s 1 Moz maiden gold source40

- Their ground geophysics program planned for Q4 2021 to ensure they’re choosing the right targets to drill

- Their 10,000-meter drill program expected to start in Q1 2022

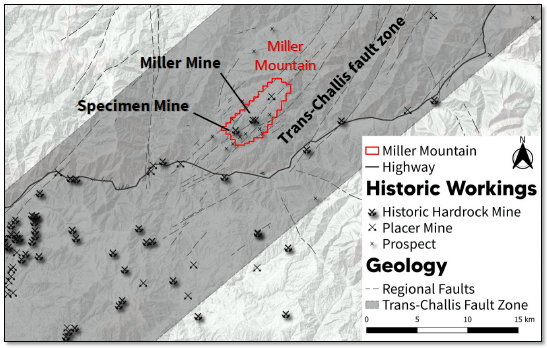

GOLD PROJECT #2: MILLER MOUNTAIN

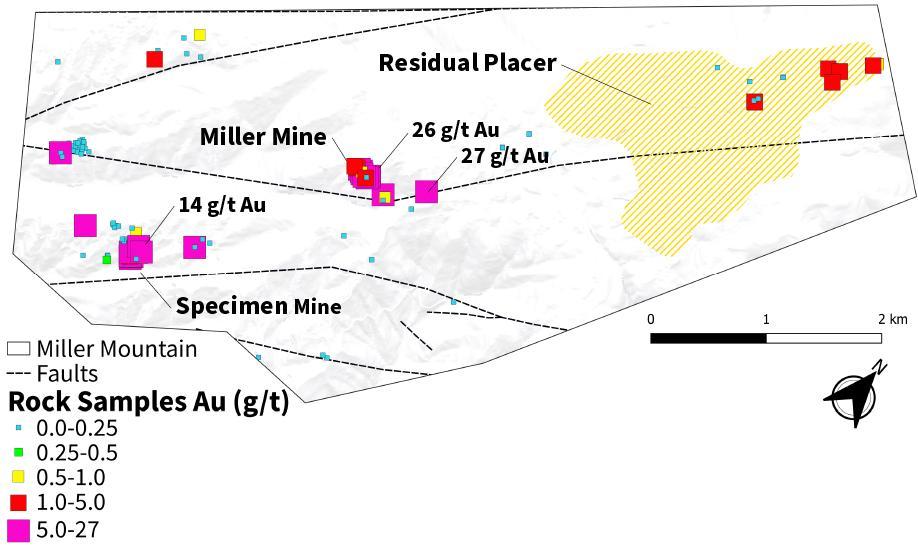

Zacapa Resources (TSXV:ZACATSXV:ZACA) exciting Miller Mountain gold project in Idaho has multiple impressive high-grade rock chip samples of up to 27 g/t gold.

Zacapa Resources (TSXV:ZACATSXV:ZACA) exciting Miller Mountain gold project in Idaho has multiple impressive high-grade rock chip samples of up to 27 g/t gold.

The 7.7-square-mile (20 km2) property is 3 miles (5 km) northeast of the Boise Basin, which produced ~2.9 Moz gold.41

The project lies in the regional Trans Challis fault system, which contains numerous epithermal gold-silver deposits and over 3 Moz of historic production.

The Miller Mountain project covers a ~4.7-mile (7.5-km) strike length of the fault system.

The Miller Mountain project covers a ~4.7-mile (7.5-km) strike length of the fault system.

Historic drilling on the property intercepted up to 22 feet (6.7m) of 23.7 g/t gold.42

The Miller Mountain project also hosts historical resources at the Miller and Specimen mines.

Zacapa Resources (TSXV:ZACATSXV:ZACA) will be spinning out news about the project over the coming months related to:

- Mapping, sampling and augering in Q4 2021

- 2,500-meter drilling program in Q2 2022

Reason #5 - Proven Leadership Team

Adam Melnik – CEO and Director

- Over 15 years in natural resources, cleantech, investment banking & consulting

- Experience in strategy, corporate development, operations, and IR through his time with Vedanta Resources, Pembridge Resources, London Business School, Innovate UK, and Y Combinator-backed CarbonChain

- Former research analyst with Canaccord Genuity in Toronto and London focused on precious and base metals producers and developers

Dr. Timothy MacIntrye, PhD – VP Exploration

- Economic geologist

- Over 15 years researching and exploring for copper deposits

- 5 years with Ivanhoe Mines exploration teams in the DRC, including at the world class Kamoa deposit, ultimately as Regional Exploration Manager

- Former Senior Consulting Geologist for Rio Tinto Exploration in Zambia

- Completed PhD with First Quantum Minerals at the Kansanshi Cu-Au deposit, Africa’s largest copper mine

Ian Slater – Executive Chairman

- Chartered accountant, entrepreneur & founder of numerous companies

- Over 24 years in mining industry

- Former Managing Partner of both Ernst & Young’s Canadian and Arthur Andersen’s Central Asian Mining Practices

Marc Boissonneault – Director

- Former Head of Global Nickel Assets for Glencore

- Led the development of key business opportunities: new geological discoveries, early-stage capital project developments & collaborative mine agreements between mining companies

- Fostered productive relationships with top government officials

- Cultivated constructive relations with aboriginal communities internationally

James Hynes – Director

- Geological engineer

- Over 15 years in mining and metals sector

- Former head of exploration for Lafarge Northwest Division

- Co-founder of Reperio Resources and Executive Chairman of Kore Mining

- Board member for various mining sector companies

- Expertise in preliminary resource identification, resource evaluation and testing, reserve calculations, financial analysis

- Strong copper market fundamentals providing tailwind for stock price gains

- Newly-listed stock with lots of upside growth potential

- Located in enviable copper and gold production regions

- Leadership & technical team capable of building a sector-leading company

- Fully funded for aggressive work programs

- Large drill-ready projects that can be drilled year round

- Diversified with promising copper and gold projects

1 https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

2 https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

3 https://www.bloomberg.com/graphics/covid-vaccine-tracker-global-distribution/

4 https://www.worldbank.org/en/news/feature/2021/06/08/the-global-economy-on-track-for-strong-but-uneven-growth-as-covid-19-still-weighs

5 https://www.reuters.com/business/us-consumer-spending-income-rebound-march-2021-04-30/

6 https://www.usfunds.com/investor-library/frank-talk-a-ceo-blog-by-frank-holmes/asset-prices-are-up-up-and-away-where-are-the-value-buying-opportunities/

7 https://www.forbes.com/sites/greatspeculations/2021/06/01/the-race-for-copper-the-metal-of-the-future/?sh=55e99629319a

8 https://www.forbes.com/sites/greatspeculations/2021/06/01/the-race-for-copper-the-metal-of-the-future/?sh=55e99629319a

9 https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2020-execsum.pdf

10 https://zacaparesources.com/corporate-presentation/Zacapa_Investor-Presentation.pdf

11 https://www.proactiveinvestors.co.uk/companies/news/935908/goldman-sachs-says-copper-price-could-hit-10000-by-2022-935908.html&ct=ga&cd=CAIyGjYwMWJjNmRlNzBlMWQ1MzU6Y29tOmVuOkdC&usg=AFQjCNEUdUyDXNFFzJndbjv6r_WUpXIFl

12 https://www.forbes.com/sites/greatspeculations/2021/06/01/the-race-for-copper-the-metal-of-the-future/?sh=55e99629319a

13 https://www.reuters.com/article/sponsored/copper-electric-vehicle

14 https://www.reuters.com/article/sponsored/copper-electric-vehicle

15 https://www.forbes.com/sites/greatspeculations/2021/06/01/the-race-for-copper-the-metal-of-the-future/?sh=55e99629319a

16 https://azbigmedia.com/business/arizona-mining-industry-steps-up-to-meet-skyrocketing-demand-for-copper/

17 https://www.riotinto.com/-/media/Content/Documents/Invest/Reports/Annual-reports/RT-annual-report-production-2020.pdf (total reserves at operating mines + total reserves at development projects)

18 https://www.bhp.com/-/media/documents/investors/annual-reports/2021/210914_bhpannualreport2021.pdf

19 https://s25.q4cdn.com/701614211/files/doc_financials/2020/ar/AIF_2020.pdf

20 Taseko Mines – Annual Information Form for the year ended Dec. 31, 2020 (accessed on Sedar.com)

21 https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2020-execsum.pdf

22 https://www.mining.com/nevada-copper-begins-production-at-pumpkin-hollow/

23 https://nevadacopper.com/projects/underground-mine/

24 https://quaterra.com/projects/quaterras-yerington-copper-projects/yerington-deposit/

25 https://hudbayminerals.com/united-states/default.aspx

26 https://azbigmedia.com/business/arizona-mining-industry-steps-up-to-meet-skyrocketing-demand-for-copper/

27 https://zacaparesources.com/corporate-presentation/Zacapa_Investor-Presentation.pdf

28 https://www.mining.com/top-50-biggest-mining-companies/

29 https://www.bhp.com/what-we-do/global-locations/united-states/resolution-copper-arizona

30 https://www.resolutioncopper.com/about-us.html

31 https://tucson.com/news/local/mine-tales-san-manuel-was-once-worlds-largest-underground-copper-mine/article_cbe2c60f-9516-520d-bcd3-b58679c1435d.html

32 https://www.reviewjournal.com/business/2-new-major-finds-may-extend-nevadas-gold-boom-for-years-1972010/

33 https://en.wikipedia.org/wiki/List_of_active_gold_mines_in_Nevada

34 https://www.reviewjournal.com/business/2-new-major-finds-may-extend-nevadas-gold-boom-for-years-1972010/

35 https://www.carlingold.com/projects/why-nevada/why-nevada-0

36 http://www.corvusgold.com/news/releases/index.php?content_id=372

37 http://www.corvusgold.com/projects/north-bullfrog/preliminary-economic-assessment/

38 http://www.corvusgold.com/projects/mother-lode/preliminary-economic-assessment/

39 http://www.corvusgold.com/news/releases/index.php?content_id=366

40 https://www.augustagold.com/news/augusta-gold-announces-maiden-resource-estimate-at-bullfrog-gold-project

41 https://thedeepdive.ca/freeman-gold-getting-idaho-back-to-its-gold-mining-roots/

42 Zacapa Resources Investor Presentation, Slide 18

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by Zacapa Resources. Market Jar Media Inc. has or expects to receive from Zacapa Resource’s Digital Marketing Agency of Record (Native Ads Inc.) one hundred ninety one thousand eight hundred USD for 26 days (20 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on MicroSmallCap.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on MicroSmallCap.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Zacapa Resources’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Zacapa Resources’s industry; (b) market opportunity; (c) Zacapa Resources’s business plans and strategies; (d) services that Zacapa Resources intends to offer; (e) Zacapa Resources’s milestone projections and targets; (f) Zacapa Resources’s expectations regarding receipt of approval for regulatory applications; (g) Zacapa Resources’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Zacapa Resources’s expectations with regarding its ability to deliver shareholder value.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Zacapa Resources

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Zacapa Resources and has no information concerning share ownership by others of any profiled Zacapa Resources The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Zacapa Resources or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Zacapa Resources Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Zacapa Resources ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Zacapa Resources future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Zacapa Resources industry; (b) market opportunity; (c) Zacapa Resources business plans and strategies; (d) services that Zacapa Resources intends to offer; (e) Zacapa Resources milestone projections and targets; (f) Zacapa Resources expectations regarding receipt of approval for regulatory applications; (g) Zacapa Resources intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Zacapa Resources expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Zacapa Resources business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Zacapa Resources ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Zacapa Resources ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Zacapa Resources ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Zacapa Resources to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Zacapa Resources operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Zacapa Resources business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Zacapa Resources business operations (e) Zacapa Resources may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Zacapa Resources or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Zacapa Resources or such entities and are not necessarily indicative of future performance of Zacapa Resources or such entities.