What made Kevin O’Leary completely change his tune on crypto and DeFi?

It had to be a BIG money-making opportunity.

It had to be a BIG money-making opportunity.

Why?

Because the investment guru and Shark Tank’s “Mr. Wonderful” was calling Bitcoin “garbage”, “worthless” and a “digital game” just over 2 years ago.1

But then this May he dropped a bombshell.

He’s a major shareholder of a new DeFi company.2

He’s a major shareholder of a new DeFi company.2

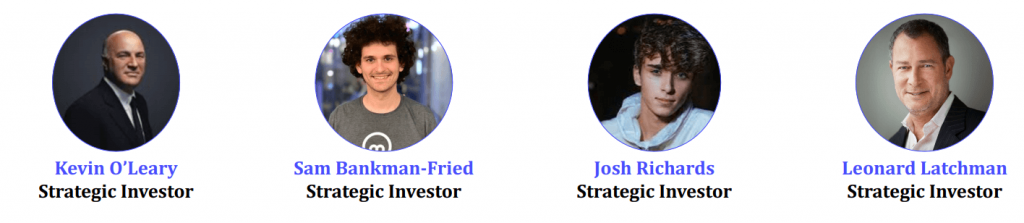

Actually, O’Leary is the company’s BIGGEST shareholder,3 which is saying a lot once you see some of the other major investors onboard.

He told the Midas Letter he plans to use DeFi to lend out assets in exchange for yields of up to 8% per year.4

“Imagine if I could have over these years had a five percent yield on my gold, that would have been incredible. Well, I can on my crypto so that’s really what I’m doing in DeFi and I think I’ve got the best team in North America.”

– Kevin O’Leary5

O’Leary’s not the only big time investor excited about the rapid rise of DeFi.

Over 72% of US accredited investors are planning to invest in DeFi in 2021.6

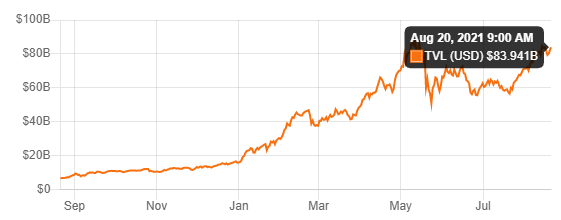

No surprise, since the total valued locked (TVL) in DeFi jumped over 1,156%7 since the start of 2021 to over $83 Billion!

Meanwhile, more major institutions are wading into DeFi waters every day.

Now O’Leary is DeFi’s champion.

Convinced that DeFi’s “potential is huge,”8 and pointing out that new companies entering the space will hold an early adopter advantage,9 O’Leary got a team of experts to uncover the sector’s best opportunities.

That’s how he found the DeFi investment gem he was looking for.

O’Leary promptly led a $17.7 million financing round10 for the startup.

He even renamed the company after his “Mr. Wonderful” persona:

“I am going to rename it to WonderFi because it is going to be my vehicle and I think it’s just the beginning of some great things to come.”

– Kevin O’Leary11

Now that WonderFi Technologies Inc. (NEO:WNDRNEO:WNDR)

Now that WonderFi Technologies Inc. (NEO:WNDRNEO:WNDR)

has begun trading, it isn’t only O’Leary that can get in on this little-known company’s potential for gains from the hot new DeFi sector.

In fact, 29 year-old crypto billionaire Sam Bankman-Fried is another strategic investor in WonderFi.

And as the founder and CEO of the crypto exchange FTX, Bankman-Fried is someone you want in your corner. He’s worth an estimated $8.7 billion and manages $2.5 billion through Alameda Research, a quantitative crypto trading firm he also founded in 2017.

Through Alameda, Bankman-Fried invested in WonderFi Technologies Inc. (NEO:WNDRNEO:WNDR)

alongside Kevin O’Leary, cementing their partnership and strong working relationship (O’Leary is a long term investor and spokesperson for FTX).

His companies don’t move slowly, and WonderFi could very likely follow suit. FTX has been on a run of acquisitions lately, valuing the company at ever-loftier heights. The company acquired Blockfolio in August, for $150 million, rebranding it to FTX later on.

FTX is nothing if not high-profile, with deals bringing Tom Brady and Gisele Bundchen on as long-term investors.5 The firm is valued at $18 billion after its latest funding round that included Softbank among 60 other high-profile investors. WonderFi could be next to take off as it has joined Bankman-Fried’s list of top picks.13 14

When a guy like Sam Bankman-Fried, who is looking to grow his net worth as fast as possible and as big as possible, invests in a company like WonderFi, the market takes note.

WonderFi is Making DeFi Easy, Generating Yields & Attracting Major Investors

WonderFi Technologies Inc. (NEO:WNDRNEO:WNDR) is on a mission to bring DeFi to the masses.

As Business Insider put it, “The company is working to find a commercial solution to DeFi investing, enabling anyone who has a wallet to wrap their assets and utilise DeFi’s benefits automatically and in a compliant way.”15

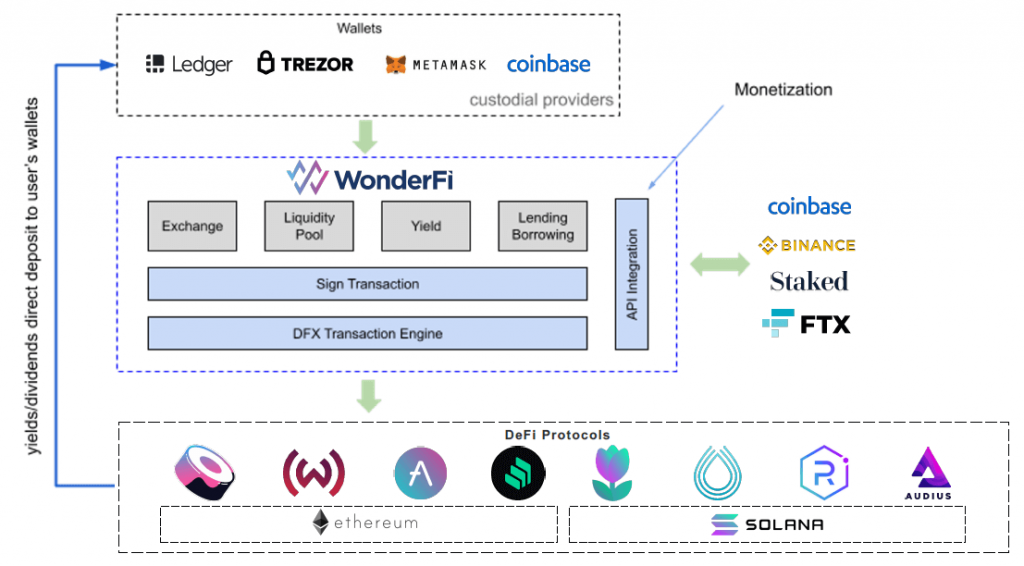

Their big competitive advantage is the easy-to-use WonderFi dashboard platform.

"With the help of Mr. Wonderful, the potential for WonderFi’s proprietary dashboard is huge." – Midas Letter Live 16

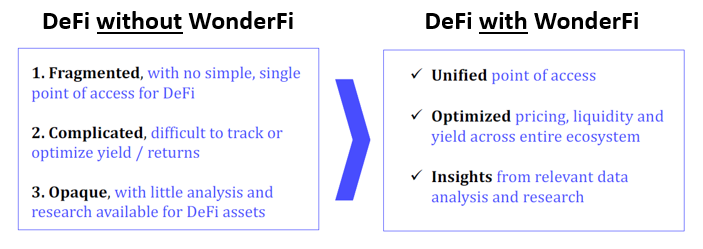

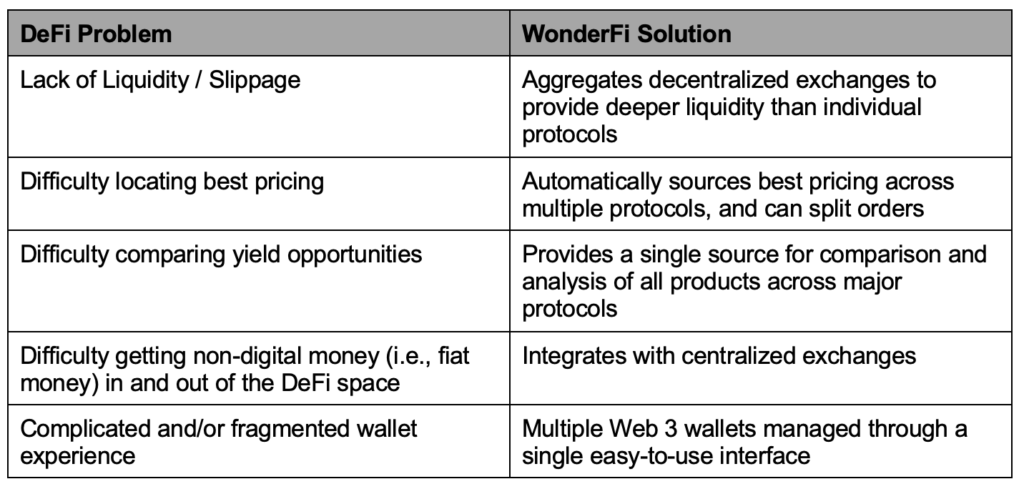

Existing DeFi applications are built for crypto traders and experts. That’s preventing a MUCH bigger market from adopting DeFi.

That’s why WonderFi Technologies Inc. (NEO:WNDRNEO:WNDR) first uses its platform to remove the complexities from the DeFi space.

Then it enables ordinary people to lend, borrow, earn interest, track performance, and trade assets through smart contracts that can be more efficient than traditional financial products.17

On top of that, WonderFi’s platform is “non-custodial”.

That means the platform never takes ownership or full control over users’ assets.

Instead, the users have control because only they have the private keys needed to access their assets.18

Once users have assets in the WonderFi platform, they’ll find educational resources to help them understand the DeFi options they can leverage.

For example, unlike ETFs, WonderFi (NEO:WNDRNEO:WNDR) has the ability to stake digital assets and generate yield using a variety of strategies available within the DeFi ecosystem, including smart contracts on platforms like Ethereum and Solana.

That’s what Kevin O’Leary was referring to back on May 25th when he told Business Insider,

“We’ve had tremendous volatility on bitcoin these last ten days. That actually enhances DeFi, it makes it better. I’m making way more on my contracts now.”19

The business model and WonderFi’s unique platform is obviously getting investors excited.

On March 9th, they raised C$2 Million20 in their seed financing round.

Then less than 3 months later, they closed a private placement for C$17.7M21 led by Kevin O’Leary and including strategic investors such as:

- Leonard Latchman, co-founder of psychedelics startup MindMed (Market Cap: $1.22B)

- Argo Blockchain, large-scale cryptocurrency miner (Market Cap: $710.4M)

- BIGG Digital Assets, leading blockchain company (Market Cap: $294.3M)

- Sam Bankman-Fried, millennial billionaire, founder & CEO of crypto exchange FTX, manages $2.5B of assets through Alameda Research22

- Josh Richards, top social influencer, entrepreneur & co-founder of Animal Capital investment fund

WonderFi Technologies (NEO:WNDRNEO:WNDR) looks all the more attractive to investors since they’re led by a team of proven business builders and engineers that have built world-class, game-changing products like Shopify and Hootsuite.

When you put it all together, newly listed WonderFi Technologies is now giving investors access to high growth opportunities in the DeFi space.

- Large, Disruptive & Rapidly Growing Market: Total valued locked in DeFi up 400%+ since the start of 2021

- App Poised to Bring DeFi to Mainstream Audience: Solves DeFi’s biggest problems – fragmentation and complexity – giving users access to the best parts of DeFi without the need for crypto experience

- Big Backers: Kevin O’Leary and billionaire Sam Bankman-Fried are both investors in Bankman Fried’s FTX, valued at $18 billion, is a powerhouse in the crypto space and Sam is a crypto king.

- Assets on the Balance Sheet: By earning interest through digital assets WonderFi (NEO:WNDR) holds, they give public market investors exposure to DeFi asset

- Well Funded: Raised $28M CAD already this year

- Lower Customer Acquisition Costs: Kevin O’Leary and Josh Richards have audiences in the tens-of-millions that can bring DeFi to the intergenerational masses for less, driving down WonderFi’s customer acquisition costs

- Board Stacked with Public Company & Crypto Heavyweights: Includes Sean Clark, co-founder & former CEO of Hut 8, the biggest bitcoin miner in North America, and Mark Binns, CEO of BIGG Digital

Decentralized Finance is Traditional Finance’s Biggest Threat

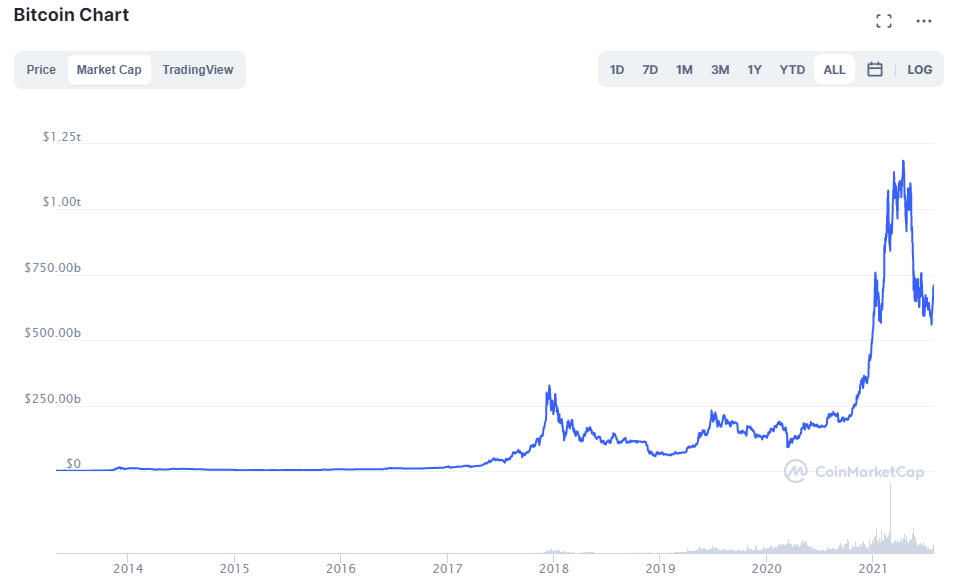

Bitcoin’s success paved the way for DeFi’s rapid growth.

According to Forbes, Bitcoin’s rapid growth as a digital store of value that shattered the $1-trillion-dollar mark earlier this year is “forcing banks, traditional financial institutions and even crypto-skeptics to take it seriously.”23

While DeFi and its smart contracts are still far behind Bitcoin in terms of mass market adoption, Forbes maintains they have “the potential to be even more valuable given their many use cases and potential to digitize, democratize and transform global finance.“24

Simply put, DeFi is expected to be a major disruptor:

- Cuts out traditional banks & brokers

- Enables faster & cheaper financial transactions

- No paperwork or minimum transaction amounts

- Full transparency & auditability25

DeFi enables users to send money anywhere in the world, transfer currencies, earn yield on deposits, lend or borrow, and all in a decentralized and transparent manner.26

In other words, DeFi is taking down the gates put up by traditional centralized financial institutions and rewriting the rules of finance at a rapid pace.

Not only that, but money that COULD be flowing into the traditional finance sector is flooding into DeFi instead.

The total valued locked (TVL) in DeFi on September 1, 2020 was $9.58B. By January 1, 2021, it was up 70% to $16.36B. By August 20, DeFi’s TVL reached an impressive $82..8B…that’s a 1,156% increase in one year!27

In other words, DeFi isn’t merely another unwelcome disruption for traditional banks, it’s an existential threat.28

The rise of DeFi is part of a wider cultural shift.

Consumers are increasingly placing value on digital assets such as cryptocurrencies and non-fungible tokens (NFTs).

NFTs have exploded in popularity lately, with sales including a digital flower for $20K, a sock for $60K, and a LeBron James clip for $99,999.29

WonderFi Technologies (NEO:WNDRNEO:WNDR) couldn’t have picked a better time to get listed and bring its user-friendly WonderFi platform to the emerging DeFi space.

Major Investments Flooding into Crypto & DeFi Space

Another piece of good news for WonderFi Technologies and its investors is that there’s no shortage of investment money flowing into cryptocurrency and DeFi right now.

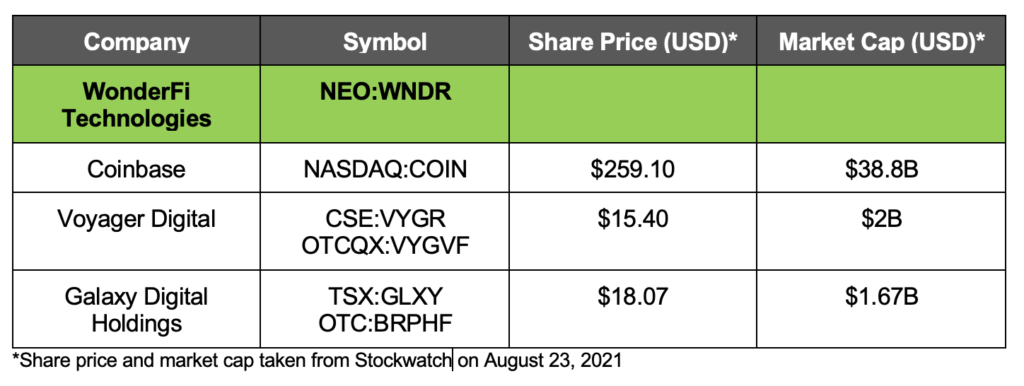

Coinbase, the largest crypto exchange in the US, just went public in April. It was the first listing of a major cryptocurrency company.

Coinbase, the largest crypto exchange in the US, just went public in April. It was the first listing of a major cryptocurrency company.

The New York Times referred to Coinbase’s $86B valuation at the time as a ‘Landmark Moment’ for crypto.[1]

Coinbase brought in a massive $1.28B in revenue in 2020,[2] more than 2.4X as much as the year before.

Then there’s Tokens.com. They power digital asset transactions, including DeFi applications.

Then there’s Tokens.com. They power digital asset transactions, including DeFi applications.

In March, they closed a $25M private placement.[3]

Another example in the space is Fintech startup Eco.

They take in deposits, lend them to reap high yields, and offer customers savings accounts paying 2.5-5% interest.

Eco had already raised $8.5M, but then in March they raised another $26M[4]

Eco had already raised $8.5M, but then in March they raised another $26M[4]

There’s also been a ton of investments pouring into the private crypto space this year and a handful of planned SPACs and IPOs.

Solana Labs, creator of top Ethereum competitor Solana, received $314M through a private token sale.

Then, there is payments and treasury infrastructure provider Circle, which plans to go public in a SPAC valued at $4.5B. The company just raised an impressive $440M in a private equity round that included several notable investors.

At the same time, crypto lending company BlockFi, which is aiming to go public in the next year or so, pulled in $350M[5] and was handed a post-money valuation of $3B.

In short, there is no shortage of interest (and capital) flowing into the space, making it an ideal time for WonderFi to join the public sector.

Comparables & WonderFi's DeFi Distinctions

As a crypto exchange, a company like Coinbase isn’t considered a direct competitor to WonderFi Technologies (NEO:WNDRNEO:WNDR) and its WonderFi platform.

You need to look at companies like Galaxy Digital or Voyager Digital to find some overlap in DeFi services provided.

For example, Voyager Digital is a crypto-asset trading platform for buying, selling, and earning interest on crypto assets.

But Voyager is NOT non-custodial. Their site does say, “Soon you’ll have the choice to self-custody your crypto on Voyager using a private key that you control,”[1] but that’s cold comfort for users with assets on that platform.

Then, there’s Galaxy Digital, a financial services and investment management company with an ever-growing portfolio of assets.

While newcomers to the space may prefer the simplicity of custodial services, most crypto enthusiasts value decentralization, meaning WonderFi (NEO:WNDRNEO:WNDR) has the huge competitive advantage of having a non-custodial platform (i.e., the WonderFi platform does NOT take ownership or full control of the user’s assets).

In other cases, public DeFi companies are largely holding companies that simply hold crypto assets without tapping into all that DeFi offers.

In contrast, WonderFi Technologies and their user-friendly WonderFi platform not only offer users access to the full power of DeFi, but they also solve problems that are currently slowing consumers’ adoption of DeFi.

By making the full DeFi user experience easier and holding crypto and DeFi assets on its balance sheet which allow them to generate yield, WonderFi is on track to fulfilling their mission of bringing DeFi to the masses, which could translate into gaining significant market share.

VCs, Celebrities & Athletes Betting Big on DeFi

- Kevin O’Leary

- Leonard Latchman, co-founder of MindMed

- Sam Bankman-Fried, millennial billionaire

- Josh Richards, top social influencer, entrepreneur & co-founder of Animal Capital

Then there are celebrities like Sean “Diddy” Combs and Justin Blau (American DJ and music producer known as “3LAU”), who recently invested in the Fintech start-up Eco, along with the NBA’s Kevin Durant.37

The sports world is also investing in DeFi in the form of non-fungible tokens (NFTs):

- Warner Bros. is launching NFT collectibles around their Space Jam movie reboot and the NBA’s LeBron James38

- Major League Baseball recently sold a digital copy of a historic speech by legend Lou Gehrig (the closing bid was around $70,400)39

- The NHL’s Florida Panthers recently announced they’ll enable selling and trading their first official NFT collections40

These examples are more evidence of society increasingly placing value on digital assets, which is another sign that WonderFi Technologies has entered the market with perfect timing.

Experienced Leadership Team Overcomes Barrier to Entry

In any cutting-edge tech sector, talent is a major barrier to entry.

That’s even more the case in the crypto, blockchain and DeFi space.

Which is why WonderFi Technologies’ (NEO:WNDRNEO:WNDR) team gives them a BIG competitive advantage.

Their engineers have built world-class, game-changing products like Shopify and Hootsuite and blockchain products dating back many years.

Their business builders, meanwhile, have proven themselves capable of maximizing the potential of tech startups.

Ben Samaroo – CEO and Director

Entrepreneur with exec and advisory experience in private and public companies in Fintech, blockchain and digital assets. Former executive officer of First Coin Capital crypto start-up acquired by Galaxy Digital. Served on Galaxy Digital leadership team. Advisor to British Columbia Securities Commission on the Fintech Advisory Forum and to FINTRAC on virtual currencies.

Cong Ly – CTO

Experienced tech leader with extensive working knowledge in Fintech, blockchain and distributed computing development. Held management positions at Hootsuite responsible for volume business and strategic integration. Former Director of Technology at First Coin Capital.

Dean Sutton – CSO and Director

Tech founder, venture builder and investor with a decade of experience in leading tech-centric companies through development, financing and commercialization. Co-Founder of LQwD Financial Corp., a bitcoin infrastructure and payments company focused on the Lightning Network, and Atlas One Digital Securities, a Canadian digital securities investment platform.

Kartik Bajaj – Director of Technology

10+ years of software development experience and working in blockchain tech since 2017. Held key engineering roles at companies like Amazon, Salesforce and Hootsuite, focused on building platforms used by millions of users. Was the first engineer at First Coin Capital, where he helped multiple clients build products on top of different blockchains.

Stanislav Korsei – Head of Product

A founder, product leader and developer. Co-founder and former CEO of Zeetl, which sold to Hootsuite in 2014. Former Product Manager at Hootsuite following the acquisition. Led product development for the new Shopify Plus product.

- Market: Large, disruptive & rapidly growing

- Platform: Easy-to-use, solves DeFi’s biggest problems: fragmentation and complexity

- Valuable Exposure: Assets on the balance sheet enable WonderFi to generate revenue, giving public market investors exposure to DeFi assets

- Billionaire-Backing: Sam Bankman-Fried, crypto billionaire at just 29, is an investor

- Well Funded: Raised $28M CAD this year

- Lower Costs: Kevin O’Leary’s & Josh Richards’ large audiences can enable driving down customer acquisition costs

- Leadership: Experienced team & board stacked with public company and crypto heavyweights

1 https://www.cnbc.com/2019/05/14/mr-wonderful-kevin-oleary-calls-bitcoin-garbage.html

2 https://finance.yahoo.com/news/shark-tank-kevin-o-leary-063231836.html

3 https://www.coinspeaker.com/shark-tank-kevin-oleary-defi/

4 https://midasletter.com/2021/06/kevin-oleary-moves-into-decentralized-finance-with-wonderfi/

5 https://finance.yahoo.com/news/shark-tank-kevin-o-leary-063231836.html

6 https://news.bitcoin.com/survey-unveils-72-of-us-accredited-investors-are-planning-to-invest-in-defi-in-2021/

7 https://defipulse.com/

8 https://finance.yahoo.com/news/heres-why-kevin-oleary-invests-211734148.html

9 https://finance.yahoo.com/news/heres-why-kevin-oleary-invests-211734148.html

10 https://finance.yahoo.com/news/shark-tank-kevin-o-leary-063231836.html

11 https://finance.yahoo.com/news/shark-tank-kevin-o-leary-063231836.html

12 https://www.ft.com/content/c8ffb228-1dbe-4e8a-b30b-be7203d71e7d

13 https://www.reuters.com/technology/crypto-firm-ftx-trading-raises-900-mln-18-bln-valuation-2021-07-20/

14 https://www.ft.com/content/c8ffb228-1dbe-4e8a-b30b-be7203d71e7d

15 https://markets.businessinsider.com/news/currencies/kevin-oleary-shark-tank-defi-ventures-investing-crypto-anthony-pompliano-2021-5

16 https://midasletter.com/2021/06/kevin-oleary-moves-into-decentralized-finance-with-wonderfi/

17 https://midasletter.com/2021/06/kevin-oleary-moves-into-decentralized-finance-with-wonderfi/

18 https://www.brinknews.com/decentralized-finance-the-next-big-threat-for-the-finance-sector/

19 https://markets.businessinsider.com/news/currencies/kevin-oleary-shark-tank-defi-ventures-investing-crypto-anthony-pompliano-2021-5

20 https://www.newswire.ca/news-releases/defi-ventures-announces-launch-and-closing-of-seed-financing-818338429.html

21 https://finance.yahoo.com/news/defi-ventures-inc-announces-closing-214500097.html

22 https://www.forbes.com/profile/sam-bankman-fried/

23 https://www.forbes.com/sites/patriciakemp/2021/07/06/why-you-need-to-care-about-decentralized-finance-defi/

24 https://www.forbes.com/sites/patriciakemp/2021/07/06/why-you-need-to-care-about-decentralized-finance-defi/

25 https://www.forbes.com/sites/kenrapoza/2021/03/21/whats-the-big-deal-about-defi-and-how-do-you-invest-in-it/

26 https://www.forbes.com/sites/patriciakemp/2021/07/06/why-you-need-to-care-about-decentralized-finance-defi/

27 https://defipulse.com/

28 https://sifted.eu/articles/banks-defi/

29 https://www.adweek.com/media/nfts-guide-nonfungible-tokens-cryptomedia-trend-ownership-internet/

30 https://www.nytimes.com/live/2021/04/14/business/stock-market-today

31 https://www.sec.gov/Archives/edgar/data/1679788/000162828021003168/coinbaseglobalincs-1.htm#i86a9d9b35e45447ea6eb369e5dcf1e6a_43

32 https://www.globenewswire.com/en/news-release/2021/03/16/2194121/0/en/Tokens-com-Announces-Closing-of-25-Million-Private-Placement.html

33 https://www.forbes.com/sites/ninabambysheva/2021/05/20/how-this-fintech-startup-scored-investments-from-major-vcs-and-celebrities/

34 https://techcrunch.com/2021/03/11/blockfi-lands-a-350m-series-d-at-3b-valuation-for-its-fast-growing-crypto-lending-platform/

35 https://research.investvoyager.com/the-voyager-token/

36 https://www.coindesk.com/parafi-invests-in-kyber-network-as-buzz-grows-around-defi-projects

37 https://www.forbes.com/sites/ninabambysheva/2021/05/20/how-this-fintech-startup-scored-investments-from-major-vcs-and-celebrities/

38 https://www.fastcompany.com/90654240/how-warner-bros-is-using-space-jam-to-get-into-the-nft-business

39 https://www.forbes.com/sites/kenrapoza/2021/07/12/mlb-goes-all-in-on-nfts-with-lou-gehrig-now-la-dodgers-art-why-is-this-still-a-thing/

40 https://www.nhl.com/panthers/news/panthers-partner-with-fanaply-to-release-exclusive-nfts-experiences/c-325642200

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling WonderFi Technologies Inc..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled WonderFi Technologies Inc. and has no information concerning share ownership by others of any profiled WonderFi Technologies Inc. . The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any WonderFi Technologies Inc. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the WonderFi Technologies Inc. . Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled WonderFi Technologies Inc. ’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding WonderFi Technologies Inc. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to WonderFi Technologies Inc. industry; (b) market opportunity; (c) WonderFi Technologies Inc. business plans and strategies; (d) services that WonderFi Technologies Inc. intends to offer; (e) WonderFi Technologies Inc. milestone projections and targets; (f) WonderFi Technologies Inc. expectations regarding receipt of approval for regulatory applications; (g) WonderFi Technologies Inc. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) WonderFi Technologies Inc. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute WonderFi Technologies Inc. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) WonderFi Technologies Inc. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) WonderFi Technologies Inc. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) WonderFi Technologies Inc. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of WonderFi Technologies Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) WonderFi Technologies Inc. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact WonderFi Technologies Inc. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing WonderFi Technologies Inc. business operations (e) WonderFi Technologies Inc. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of WonderFi Technologies Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of WonderFi Technologies Inc. or such entities and are not necessarily indicative of future performance of WonderFi Technologies Inc. or such entities.