Gaming App Publisher Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) Intends to Bring “Watch Party” Live Streaming to Sports and Gaming Sectors in a Move Observers Call a Potential Breakthrough

An announced merger agreement between an app publisher in the online and mobilee gaming sector and a “watch party” video streaming company with millions of users could revolutionize at least two industries simultaneously.

And with shares of some gaming stocks seeing gains as high as 1,000%2 over the past 24 months, investor interest is intense.

Investors pricked up their ears when the announcement was made in late January that a merger agreement had been signed by Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) and Evasyst (Kast), a company based in San Diego, that has developed “virtual living room” video streaming technologies.

Under the agreement, Live Current Media will take over Kast, headed by media technology entrepreneur Mark Ollila, in an all-stock reverse takeover. The company intends to issue up to 125M shares to the current shareholders of Kast for all their issued and outstanding shares.

Investor interest is easy to understand.

The merger would bring together two of the hottest tech trends driving the market right now: cloud-based video streaming and online gaming.

Video streaming stocks, of course, have made investors significant amounts of money just in the past 24 months alone. Spotify (SPOT) is up 120%3 as of September 27, 2021… Zoom (ZM) has soared 197%4… Roku (ROKU) has skyrocketed 216%5… And Netflix (NFLX) shot up 327%.6

And those are just the large-cap stocks!

Some small, undiscovered stocks in both the video streaming and online and mobile gaming markets, such as Sea Limited (SE)7, have seen the values of their shares explode as much as 1,000%8 in the same period.

One reason: According to data gathered by Fortune Business Insights, the global video streaming market is projected to reach a staggering $842.93 billion by 2027, growing at an average annual compounded rate of 12% a year over the next five years.9 Video streaming in North America alone stood at $148 billion in 2019.

In addition to video streaming, the number of people involved in online gaming and eSports is expected to reach a staggering 1 billion10 this year.1 If these participants created their own country, only China with 1.4 billion people and India with 1.36 billion would be larger.

In dollars and cents, the online gaming market is currently estimated to be worth some $178 billion worldwide with 48% of the revenue being derived from games on smart phones.11

Thus, by adding video streaming “watch party” technology to its existing online gaming applications, a company such as Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) is bringing together two of the largest and most lucrative markets on the planet.

One of the Fastest Growing Forms of Entertainment in the World

Kast is an online “hangout” platform for friends that lets people in different locations watch videos together, play video games and chat.

The platform, which became especially popular during the COVID pandemic, allows individuals to live-share experiences in real time, engage within a community, and build relationships with like-minded people. Acting as a “virtual living room” community members are arranging private gaming sessions and competitions, watch parties for new films by film makers, and creating experiences that were not earlier possible.

Entrepreneurs discovered early on the Kast was also a perfect platform for online gaming – and also for eSports. What is eSports? It refers to competitive, organized video gaming that is played, watched and followed by hundreds of millions of people online through such platforms as Fortnite, League of Legends, Counter-Strike, Call of Duty and Overwatch, to name a few.

Within the games industry, however, there are specific niches that are outpacing even the explosive growth of the industry as a whole. One in particular, which combines elements of fantasy sports with traditional betting on professional football, basketball and hockey games, has taken off in the past few years.

Like a Game of Superbowl “Squares” Every Week

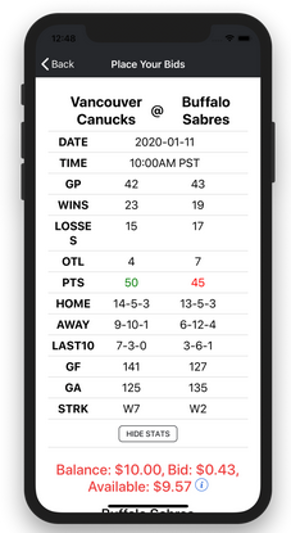

Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) capitalized on the surging interest by developing a new “Free-to-Play” gaming app that allows players to pick winning scores for real-life sports games every week.

The addition of video streaming technology to the mix through the contemplated merger with Evasyst (Kast) – allowing friends to watch events together online – may turn a popular new entertainment medium into a worldwide sensation.

Plus, the linking of sports and games has been garnering serious interest among both Wall Street investors as well as entrepreneurs from the sports world.

Plus, the linking of sports and games has been garnering serious interest among both Wall Street investors as well as entrepreneurs from the sports world.

Billionaire NFL team owners Robert Kraft2 and Jerry Jones3 have bought in. So has Dallas Mavericks owner and venture capitalist Mark Cuban4.

Medium says “it’s not just venture capitalists hopping aboard,” though. Clued-in “investors are going in every day.”5

Even such high-profile celebrities as Jennifer Lopez6 and Alex “A-Rod” Rodriguez7 have invested in eSports.

And with some eSport stocks seeing gains as high as 1,000%8 in the past 24 months, this surging new industry is the number one place to be today for big profits.

“The opportunities here are absolutely enormous.” -- Forbes 9

Consider: The winner of the Fortnite World Cup one year took home $3 million in prize money, about the same as that year’s Wimbledon winner. More than two million fans watched that tournament.10

eSports tournaments nab up to 454 million viewers during any given period, right behind the Olympics, the World Cup, and Formula One racing.11 (22% of all millennial males watch eSports, the same number who watch baseball.12)

From just $100 million in 2010, eSports revenues now exceed an eye-popping $1 billion annually, and are growing at a compound annual rate of 20% to reach a projected $3 billion by 2025.13

With that much money sloshing about, it’s little wonder the world’s biggest companies have moved in – and small, unknown startups are seeing their shares rocket higher.

Some eSports Companies Already Worth Billions as Share Prices Skyrocket

Amazon was one of the first to see the future of both eSports and video streaming, paying a staggering $1.1 billion back in 2014 to buy Twitch, the leading live streaming gaming platform, after a bidding war with Google.

That was the earliest sign of a looming convergence between eSports and video streaming, a convergence exemplified by Live Current Media and Evasyst (Kast).

At the time of the Amazon acquisition, hardly anyone in the investing world had ever heard of Twitch. Yet at the time of the sale, it already had the fourth highest internet traffic in the U.S., after Netflix, Google, and Apple.14

Today Twitch has more than 15 million daily active users and is worth an estimated $3.79 billion.15

And all signs suggest that both the eSports and video streaming industries are still in their infancies.

Goldman Sachs forecasts that eSports revenue alone will climb from $869 million in 2018 to $2.96 billion by 2022 – a leap of 241%.

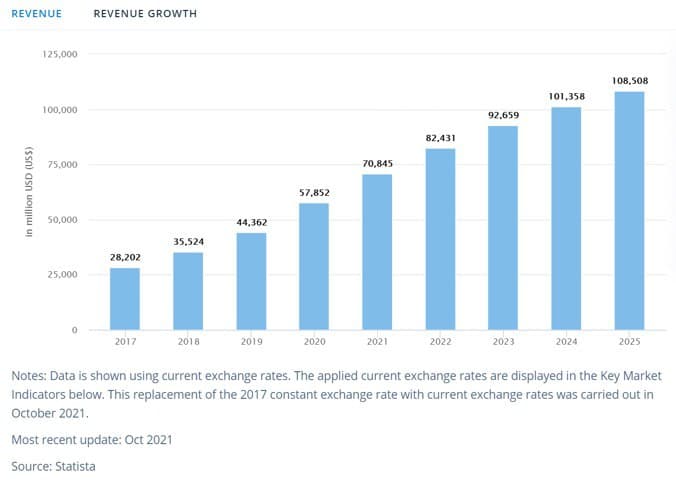

As for video streaming, its growth is projected to be even greater.

Worldwide Video Streaming Revenue

According to one report, the global video streaming industry could hit $149.34 billion by 2026, registering a CAGR of 18.3% during the previous years.12

That’s why investors are keeping a sharp eye on smaller companies like Cinedigm Corp. (CIDM), Genius Brands International (GNUS), and Dolphin Entertainment (DLPN) to make their mark.

But the most promising of them all could be Live Current Media.

Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) Invests in the $88 Billion Free-to-Play Market

A merger between Live Current Media and Evasyst (Kast) would give it a unique position in the mobile gaming, eSports and video streaming worlds.

Kast’s video sharing platform allows friends to organize “watch parties” from the comfort of their own living rooms, with 20 people sharing a screen on camera and up to 100 people watching.

In a sense, it’s an entertainment-optimized version of Zoom.

Friends can watch movies together, play video games – or watch eSports and live sports and they’ll soon be able to bid through the Live Current Media sports gaming app, SPRT MTRX.

This makes Live Current Media virtually unique in both the gaming and live streaming markets. Most of the company’s competitors are focused on the B2B market and offer little, if any, entertainment functionality.

And the only companies even remotely similar – such as Twitch or Discord – are privately held or owned by large conglomerates, such as Amazon.

This makes Live Current Media virtually unique in both the gaming and live streaming markets. Most of the company’s competitors are focused on the B2B market and offer little, if any, entertainment functionality.

And the only companies even remotely similar – such as Twitch or Discord – are privately held or owned by large conglomerates, such as Amazon.

Uniquely Positioned to Cash in on the Free-to-Play Gaming & Live Streaming Revolutions

Live Current Media (OTCQB: LIVC)(OTCQB: LIVC), with the completion of the merger with Kast, will be one of the few upstart Free-to-Play gaming and live streaming “watch party” companies that is publicly traded.

Kast, led by CEO and Co-founder Mark Ollila, has attracted a unique team of gaming enthusiasts and digital engineers. Mr. Ollila has more than twenty years of experience in the gaming and media technology industry, including senior roles at Microsoft and Nokia (where he led Nokia’s First Party Games Publishing) and is slated to take over as CEO of Live Current Media once the transaction has been consummated.

Ollila also served on the advisory board of the Game Developers Conference (Mobile) and was a board member of the EMEA Chapter of the Mobile Ecosystem Forum. He was also Chairman of the Board of Physics Middleware provider Meqon Research AB (acquired by Ageia and then NVIDIA) and currently is on the board of Blind Squirrel Entertainment.

Live Current Media’s gaming app is free to users, with the revenue model of revenue through advertising and in-app purchases. This free-to-play (F2P) model is widely used in gaming, and generates upwards of $88 billion in revenue per year.16

With the total gaming market now worth a staggering $178 billion13 and growing fast, the F2P model used by Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) holds a significant share of the market.

Kast’s video “watch party” platform, on the other hand, generates revenue through the recurring, subscription based model.

Like most development stage gaming companies, Live Current Media is still small and relatively undervalued.

But that may not be the case for long. Media interest is picking up, and with it so has investor interest.

With Live Current Media’s gaming apps and Kast’s video streaming “watch party” apps currently live, the time to take a good look at LIVC is now.

For more information about the merger of mobile gaming, eSports and video streaming, and about Live Current Media (OTCQB: LIVC)(OTCQB: LIVC) in particular, visit the company’s website.

1https://leagueofbetting.com/number-of-online-gamers-to-hit-1-billion-by-2024/

2https://www.espn.com/esports/story/_/id/24203693/how-blizzard-convinced-robert-kraft-other-billionaires-buy-overwatch-league

3https://smartseries.sportspromedia.com/news/esports-cowboys-owner-jerry-jones-buys-complexity-gaming

4https://fortune.com/2015/06/30/mark-cuban-esports-unikrn/

5https://medium.com/@breakthrough_lab/celebrity-esports-investors-you-didnt-know-about-eb9a8c395292

6https://www.theguardian.com/games/2017/dec/25/esports-jennifer-lopez-gillette-audi-mercedes-benz-a-piece-of-the-action

7https://www.cnbc.com/2016/10/28/a-rod-and-shaq-buy-a-stake-in-nrg-esports-team.html

8Sea Limited (SE), cf. https://www.barchart.com/stocks/quotes/SE/performance

9https://www.forbes.com/sites/kenrapoza/2019/05/29/global-esports-popularity-give-gamer-companies-reason-to-be-bullish/#8692bcf1bde6

10https://estnn.com/6-esports-facts/

11https://estnn.com/6-esports-facts/

12http://powerupgaming.co.uk/2019/07/15/7-amazing-facts-about-esports/

13https://www.marketwatch.com/press-release/global-esports-market-will-grow-at-a-cagr-of-nearly-20-during-the-forecast-period-2019-2025-2019-08-26

14https://www.gamespot.com/articles/twitch-ranked-4th-in-peak-internet-traffic-ahead-of-valve-facebook-hulu/1100-6417621/

15https://www.feedough.com/twitch-tv-business-model-how-does-twitch-make-money/

16https://techcrunch.com/2019/01/18/free-to-play-games-rule-the-entertainment-world-with-88-billion-in-revenue/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Live Current Media (“LIVE”) and its securities, LIVE has provided the Publisher with a budget of approximately $50,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by LIVE) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company LIVE and has no information concerning share ownership by others of in the profiled company LIVE. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to LIVE industry; (b) market opportunity; (c) LIVE business plans and strategies; (d) services that LIVE intends to offer; (e) LIVE milestone projections and targets; (f) LIVE expectations regarding receipt of approval for regulatory applications; (g) LIVE intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) LIVE expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute LIVE business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) LIVE ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) LIVE ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) LIVE ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of LIVE to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) LIVE operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact LIVE business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing LIVE business operations (e) LIVE may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Live Current Media.

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled Live Current Media and has no information concerning share ownership by others of any profiled Live Current Media. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any Live Current Media or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Live Current Media. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Live Current Media’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding Live Current Media future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Live Current Media industry; (b) market opportunity; (c) Live Current Media business plans and strategies; (d) services that Live Current Media intends to offer; (e) Live Current Media milestone projections and targets; (f) Live Current Media expectations regarding receipt of approval for regulatory applications; (g) Live Current Media intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Live Current Media expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Live Current Media business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Live Current Media ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Live Current Media ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) Live Current Media ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Live Current Media to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Live Current Media operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact Live Current Media business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Live Current Media business operations (e) Live Current Media may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Live Current Media or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Live Current Media or such entities and are not necessarily indicative of future performance of Live Current Media or such entities.