Opioid Alternative is FDA-approved and ready to launch the fortunes of Q BioMed

Projected $150 million in sales by 2024 1

It’s rare to see a microcap biotech with a revenue-generating drug, which puts Manhattan-based Q BioMed (OTCQB: QBIO) in a class of its own.

The company has a number of potential new drugs in its pipeline. But one in particular is getting a lot of attention.

Metastron is an opioid alternative for the alleviation of cancer-related pain.

The widespread push to reduce the use of opioids means that clinicians are actively seeking effective alternatives. Opioid addiction is at crisis levels.

But addiction isn’t the only problem with opioids. For those with the most severe pain, there are few alternatives. Yet the side effects of opioids can be so bad that many patients prefer the pain.

But addiction isn’t the only problem with opioids. For those with the most severe pain, there are few alternatives. Yet the side effects of opioids can be so bad that many patients prefer the pain.

Brain fog, nausea, vomiting, abdominal distention, and constipation can be excruciating for opioid users . What’s worse, prolonged use can lead to tolerance, which means the drug is no longer able to mask the pain.

For the hundreds of thousands who suffer with cancer that has spread to bone, Q BioMed’s (OTCQB: QBIO) Metastron offers an alternative to the horrors of opioids.

Metastron is non-addictive, works in 80% of patients, & continues working for 6 months with a single dose2

Metastron is specifically designed to target pain caused by cancer that has spread to the bone, which is a common occurrence in the prostate, breast, and lung cancers, among others.

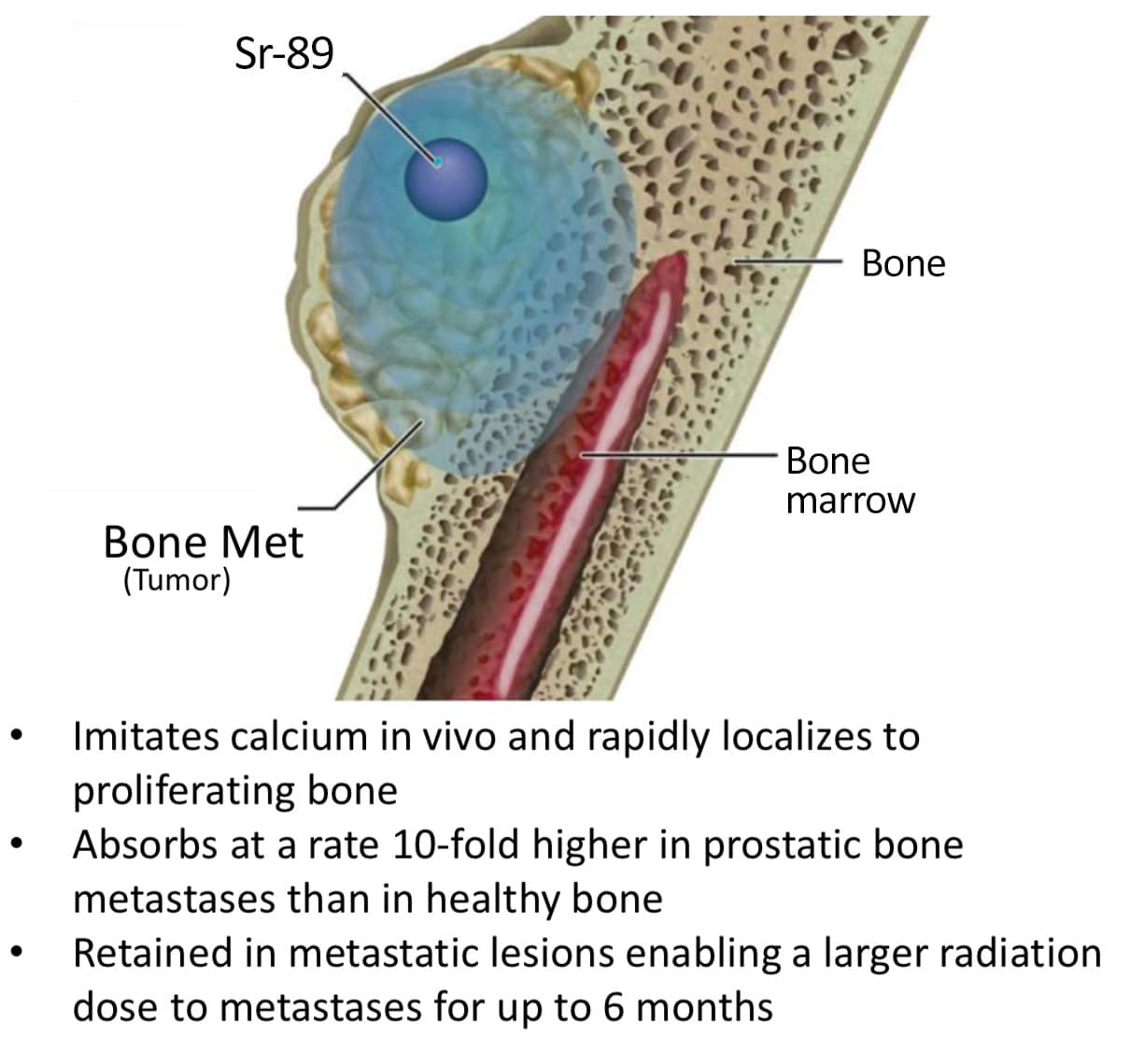

The active ingredient in Metastron is a radioactive isotope of the chemical element strontium. When injected into the body strontium acts like calcium, being taken into the bone at sites of tumors and lesions.

It then delivers radiation directly to the sites, relieving pain.

Q BioMed (OTCQB: QBIO) bought Metastron from GE Healthcare, where it surprisingly never got the marketing push it needed to grow sales, even though Metastron’s development was hailed by the pharmaceutical and biotechnology industries as a “major advance” in pain control.3

Metastron is FDA-approved, as well as approved for sale in 21 other countries. It is reimbursable by Medicare and most health plans.

After FDA approval of Q BioMed’s U.S. based contract manufacturing facility, expected in the second half of 2019, the drug will be rolled out to the market.

The company projects sales to be as high as $150 million within the next five years.4 Look for share price to soar as revenues grow. Brookline Capital Markets rates QBIO a Buy with a target price of $16.00.5

Next step is to seek approval as a therapeutic drug, giving Q BioMed (OTCQB: QBIO) enormous revenue potential

Importantly, a Phase II clinical trial published in the prestigious medical journal The Lancet showed that cancer patients lived a significant nine monthslonger when given Metastron as a combination therapy. This could be compared to just two months for a competitive blockbuster drug.

Importantly, a Phase II clinical trial published in the prestigious medical journal The Lancet showed that cancer patients lived a significant nine monthslonger when given Metastron as a combination therapy. This could be compared to just two months for a competitive blockbuster drug.

A planned Phase IV trial is expected to confirm those results, and will exponentially increase potential revenue for the company and its shareholders.

A similar drug that has a limited application for a relatively small patient population in prostate cancer, and which offers only a small overall survival benefit generates more than $500 million a year in revenue for its manufacturer.

Metastron targets a much larger potential patient universe. The company believes that if clinical trials prove what previous studies have shown, the market for therapeutically prescribed Metastron could be several hundred million dollars. 7

Pain associated with bone cancer is an underserved market

Medications for alleviating the pain occurring from cancer comprise more than 25% of the overall pain management therapeutics market, which is set to reach $83 billion by 2024.8

The market for bone cancer treatment is even larger than for bone cancer pain control. In 2018 that market reached $62.9 million, and it is projected to grow to $83.8 million by 2024.9

While there are several treatments currently available, their effectiveness is often limited for long term pain management, they are associated with several undesirable side effects, and/or are constrained by factors like chemotherapy and health condition of the patient.

Expected sales to grow rapidly

More than 280,000 Americans are living with bone cancer today,10 with an expected 3,500 new cases diagnosed in 2019.11 If Q BioMed’s (OTCQB: QBIO) Metastron were prescribed to just 2% of all patients, at its estimated $10,000 per dose that would mean $56 million in revenues.

If the drug were approved for bone cancer therapy, the company projects that additional revenues could be as much as $500 million.

What’s more, bone pain can be indicated in other primary cancers as well, and that could be a much bigger market. Q BioMed intends to pursue label expansion to include therapy of other primary cancers as well as in combination with other therapies. This would require additional clinical trials, which could easily be financed with sales revenue.

Metastron is one of two drugs in Q BioMed’s pipeline ready for commercialization, the other being a generic version of Metastron. However, the company has several other promising drugs in development too.

A robust pipeline of developmental drugs

Q BioMed (OTCQB: QBIO) follows a tightly structured business model. Starting from a well-capitalized foundation, the company conducts its own research to identify innovative technologies that have been under-serviced, undervalued, or ignored, but which have inherent potential.

The strategy has garnered the company a full pipeline of five drugs in the pre-clinical stage, one in Phase II trials, and two that have achieved commercialization.

Promising treatment for one of the most heartbreaking forms of autism

Among the more than 60,000 children in America who develop Autism Spectrum Disorders (ASD) every year, 20,000 become nonverbal. Similar numbers in Europe also suffer with this disorder.12

For most, the diagnosis means they will have to rely on assisted living for the rest of their life. There is currently no treatment with lasting effects on how children develop.

Q BioMed’s (OTCQB: QBIO) developmental drug, QBM-001, regulates faulty ion channels to allow language development.

It works by regulating the faulty neuron membrane channels associated with the disorder. Defective membrane channels interfere with how neurons communicate and develop.

Verbal capabilities and language development, like all cognitive developmental functions, depend on effective signal transmission between neurons in the brain. Increasing neuronal growth and connectivity associates with learning and behavior development.

However, these connections for language development-specific neurons remain unutilized in the subset of ASD children and are targeted for elimination starting around age two.

Consequently, such loss and impaired development of neuronal connections permanently affect language learning and use.

Clinical trial planned for early 2020

Q BioMed (OTCQB: QBIO) is currently being studied with genetically identified children at high risk of developing ASD during their toddler years. QBM-001 is designed to allow toddlers to actively develop language and speech and avoid life-long speech and intellectual disability of being non-verbal. QBM-001 also is believed to reduce inflammation in the brain and by so doing may reduce the amount of long-term nerve loss.

An IND is planned for 2019 allowing for a clinical trial to begin in early 2020. Study design calls for around 240 patients three years of age or younger. The placebo-controlled study will take about 12 months to reach primary outcome and interim data could be available at 4 months, which might include testing understanding and verbalization of words.

$5 billion potential market size

In US and EU, if granted orphan status, it would result in QBM-001 gaining 7.5 and 12 years, respectively, of market exclusivity from NDA including extensions for an expected pediatric designation.

With 20,000 diagnosed each year in the US and slightly more in the rest of the world, Q BioMed (OTCQB: QBIO) projects their drug could treat 50,000 patients per year.

At an estimated $100,000 treatment cost per case, QBM-001 could potentially generate $5 billion per year.

New hope for those with liver cancer, glaucoma, and more

Q BioMed (OTCQB: QBIO) is also developing new therapies for liver cancer, glaucoma, acute kidney injury, pulmonary artery hypertension, and infectious diseases. All five are in the preclinical stage.

The company is partnering with the Oklahoma Medical Research Foundation for research on

Both of those drugs could address the needs of multi-billion dollar markets.

Now is a good time to follow the company

Q BioMed (OTCQB: QBIO) anticipates that FDA approval of their Metastron contract manufacturing facility could happen early in the 2nd half of 2019. The company could then start producing the drug and have it on the market generating revenue before the end of this year.

As that date grows nearer and the company issues news of its progress toward market distribution, expect to see share price increase substantially.

Ask your broker about Q BioMed (OTCQB: QBIO). And always remember to do your own due diligence.

- 1 https://www.crainsnewyork.com/node/673521/printable/print

- 2 J Natl Med Assoc. 1986 Jan; 78(1): 27–32

- 3 https://www.thepharmaletter.com/article/metastron-hailed-as-major-advance

- 4 https://www.crainsnewyork.com/node/673521/printable/print

- 5 https://backend.otcmarkets.com/otcapi/company/research/189314/content

- 6 Lancet. 2001 Feb 3;357(9253):336-41

- 7 https://finance.yahoo.com/news/imminent-fda-decision-prompts-ignition-130000576.html

- 8 Transparency Market Research, “Pain Management Therapeutics Market,” 2016

- 9 Research and Markets, “Bone Cancer Treatment Market,” 2019

- 10 https://www.cancer.gov/types/bone/bone-fact-sheet

- 11 https://www.cancer.org/cancer/bone-cancer/about/key-statistics.html

- 12 Brookline Capital Markets, 2018

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Publisher has not been compensated by any of the profiled companies. The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

SHARE OWNERSHIP. The Publisher does not own any shares of any profiled company and has no information concerning share ownership by others of any profiled company. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY. The Market Tactic is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.