Poised to Benefit from Silver's Sweet Spot, New Pacific Metals Corp. (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) has Three Drill Programs and an Upcoming Mineral Resource Estimate and Preliminary Economic Assessment this year.

Silver is in a sweet spot.

Silver is in a sweet spot.

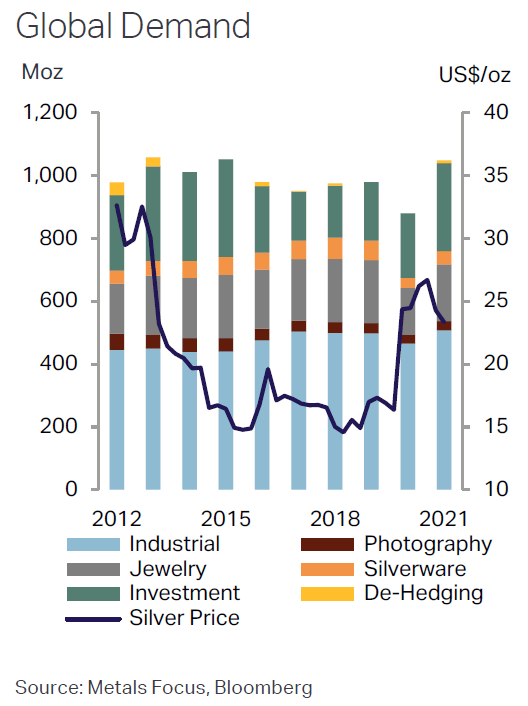

In 2021, demand rose in every category of silver use for the first time since 1997.1

Demand surged to its highest in 7 years, up 19%.2

It’s expected to rise another 5% this year.

That would be silver’s highest level on record.3

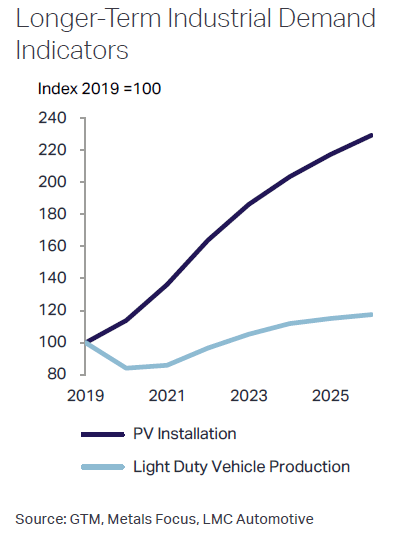

The biggest demand driver by far is industrial fabrication. Up 9% in 20214 and forecast to grow another 5% this year.5

Industrial fabrication is expected to keep demand elevated, especially as more silver is used in critical green technologies as governments push to meet climate goals:

- Silver’s use in solar panels shot up 13% last year

- Electronic and electrical demand – such as wind turbines – rose by 9%6

No surprise there’s a global silver supply squeeze.

No surprise there’s a global silver supply squeeze.

Last year, the silverr market suffered its biggest shortfall since 2010.7

Another shortfallll is expected this year…only 38% LARGER this time.8

“We believe that this is the start of a structural change in the market where we see deficits that will carry on for some time.”

–Metals Focus director Philip Newman (Mining.com, Apr. 20, 20229)

That’s good news for investors in silver and silver mining companies since supply squeezes increase prices.

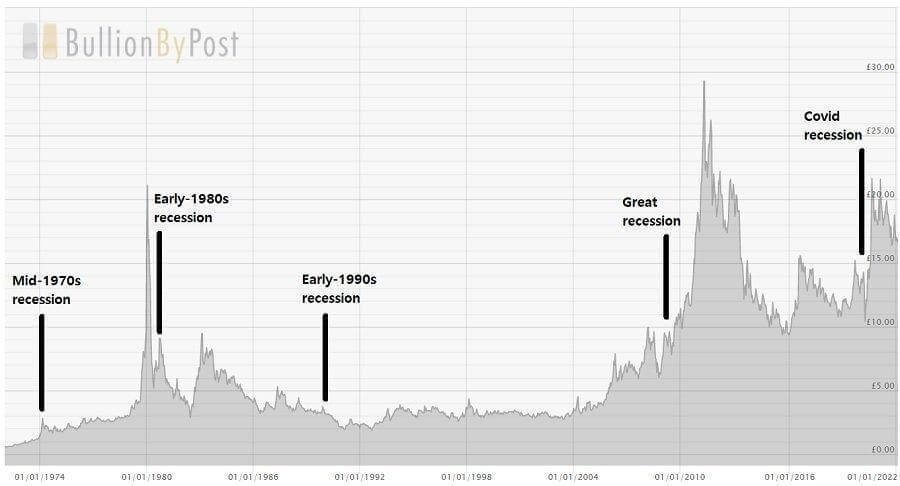

Now at the same time, silver demand is increasing and we are also facing a growing risk of recession. Factors such as the Ukraine War, sanctions against Russia, China COVID-19 shutdowns, rising inflation in the US and other areas,10 and US Federal Reserve interest rate hikes impeding economic growth.

In March 2022, the former president of the Federal Reserve Bank of New York warned that a recession was now “virtually inevitable”. Yes, the Fed has taken steps to avoid it, but too little, too late.11

And we all know that when economic conditions get uncertain, like they are now, investors seek safe haven investments like silver and silver mining companies bringing new supply to a hungry market.

One company that ticks all of the right boxes is New Pacific Metals Corp. (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) which has not one, not two, but three very exciting mining assets, one of which is moving rapidly towards development.

And now could be the absolute perfect time to get in on this sleeping giant.

You see, history tells us this chaos could potentially drive the price of silver to once-in-a-lifetime highs.

Silver prices shot up during or just after 3 of the 4 major recessions in the past 50 years.12 That’s what safe-haven investments like silver – and gold – are known to do.

So it makes sense that silver exchange-traded products saw a 6% rise last year13 while sales of silver coins and bars jumped 36% to their highest levels since 2015.14

The forecast for physical investment in silver in 2022 is for more double-digit gains, to hit a 7-year high.15

That’s why silver is in a sweet spot:

- If demand grows and the supply squeeze tightens, silver prices are expected to rise

- If a recession hits, safe-haven investing takes off and silver prices are expected to rise

Either way, it could mean one of the biggest boosts in a long time to silver mining company valuations…especially companies like New Pacific Metals, which is set to release a stream of positive news this year.

New Pacific Metals Corp. (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) is Poised to Benefit from Silver's Sweet Spot

New Pacific Metals is a Canadian exploration and development company investors should keep a very close eye on this year.

New Pacific Metals is a Canadian exploration and development company investors should keep a very close eye on this year.

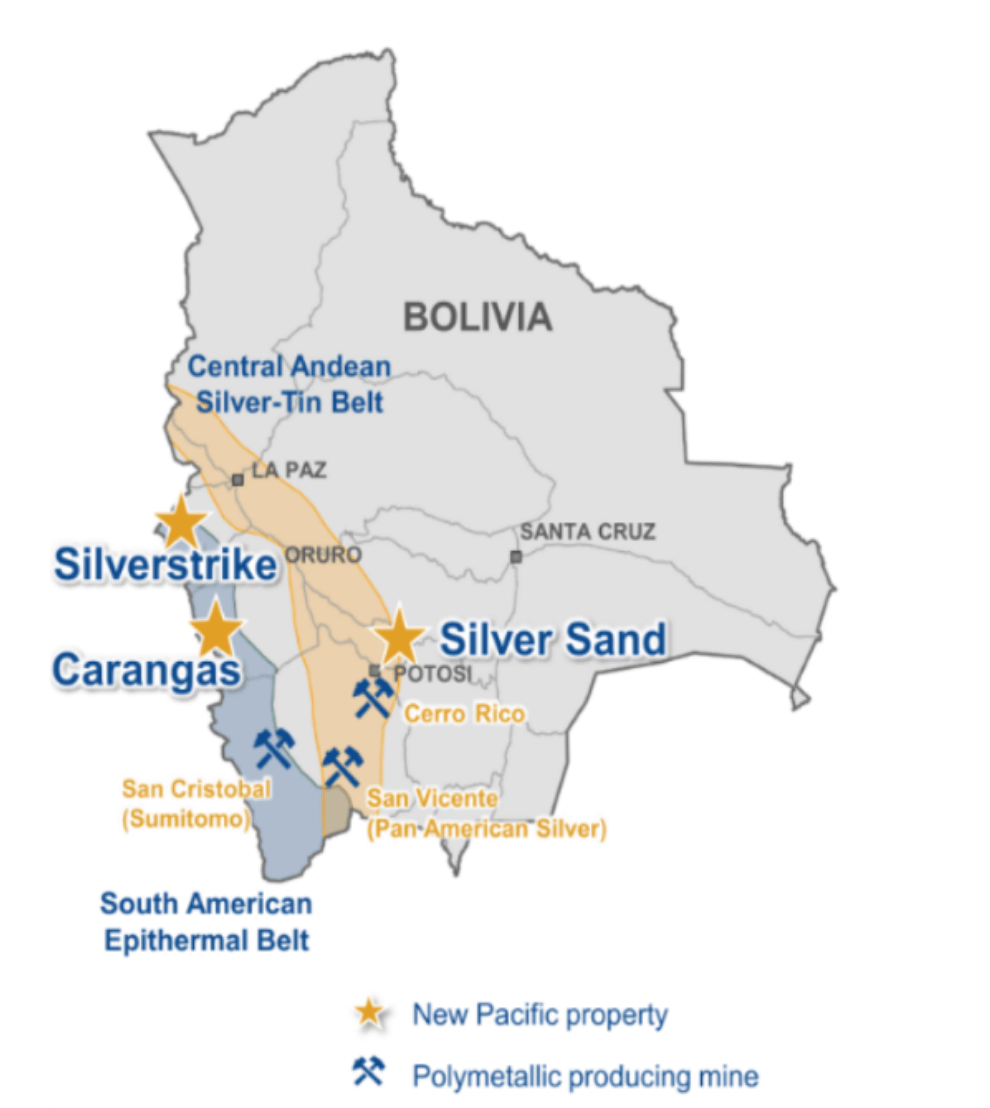

The company is actively advancing three very promising projects with world-class potential in Bolivia:

- Carangas: Big catalysts expected here. The company’s 2021 drill program found a broad silver system…plus a large gold deposit. So expect to hear a lot about the 30,000-meter drill program this year.

- Silver Sand: Pure silver deposit. 38,000-meter drill program underway. Mineral Resource Estimate – M&I: 155.86 million ounces at 137 grams per tonne silver – to be updated by September. Preliminary Economic Assessment (PEA) by the end of the year.

- Silverstrike: Drilling to start this year at multiple high-priority targets in this large exposed silver district.

That’s a lot of drilling in 2022. At a big investment of $16 million.

But New Pacific is more than fully funded to complete it all. (It has $35 million in the bank.)

The story just gets better when you add in:

- 14% institutional ownership,

- 8% insider ownership,

- major investments from other silver mining companies,

- leadership team with over 125 years of mining and capital markets experience,

- and coverage from multiple analysts.

The big boys obviously like what they see in New Pacific Metals.

Let’s take a closer look at what’s behind the stock’s upside potential this year.

5 Big Reasons

Why New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) Could Be This Year's Breakout Mining Stock

- Silver’s Sweet Spot: Rising demand, supply squeeze and/or recession expected to boost silver prices in the near term.

- Three World-Class Gold and Silver Projects in Bolivia: Silver Sand, Carangas and Silverstrike offer New Pacific a large, very promising land package with upside potential.

- News Flow from Potential Catalysts in 2022: New Pacific Metals has 3 important mining assets. 3 drill programs. Silver Sand Mineral Resource Estimate update by Q3 and Preliminary Economic Assessment by year’s end.

- Strong Financial Backing & Treasury: Institutional and insider investments, including Silvercorp Metals and Pan American Silver and Management. $35 million in the bank.

- Strong Leadership Team: New Pacific Metals’ (TSX:NUAG) (NYSEAMERICAN:NEWP) (TSX:NUAG) (NYSEAMERICAN:NEWP)management brings 125+ years of mining and capital markets experience to the table.

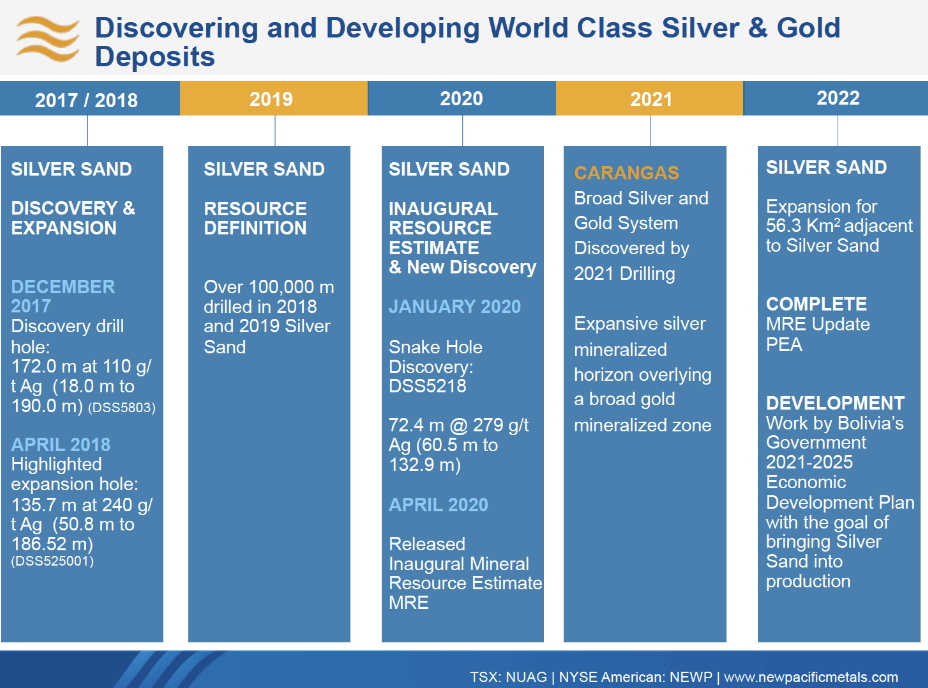

Discovering and Developing World-Class Silver and Gold Deposits in Bolivia

Bolivia represents a LOT of advantages.

Here’s a shortlist from the US International Trade Administration:16

- 500+ years of continuous mining

- Mining is one of the most important economic activities today

- Mining accounted for ~22% of national exports in 2020 ($1.5 billion)

- Principal and industrial minerals include silver and gold

- Estimates say only 10% of Bolivia’s mineral resources have been extracted

It helps that Bolivia has the most stable currency in Latin America.

It helps that Bolivia has the most stable currency in Latin America.

Plus major silver deposits, including one of the world’s largest, Cerro Rico,17 which has produced 1.4 billion ounces of pure silver since the 1500s18 (New Pacific Metals’ Silver Sand Project is 35 km northeast of Cerro Rico).

Still, the country’s been under-explored for the past 20 years…but Bolivia’s new government is changing all that.

Since the landslide general election win in 2020,19 the focus has been on economic revival by developing Bolivia’s resources and welcoming companies with expertise and capital.

It’s an exciting opportunity for mining companies that offer strong potential and modern exploration activities, like New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP).

The milestones timeline below shows just a small part of the significant progress New Pacific has made on its Bolivian mining assets to date:

New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) commitment to sound ESG (Environmental, Social and Governance) principles makes the company even more attractive to the country…and investors.

"Miners that can demonstrate their contribution to a sustainable future will have a competitive advantage." – EY, Oct. 202120

New Pacific has demonstrated that commitment by providing economic and social benefits to the local communities where it operates.

That includes things like:

- 82% of its employees being Bolivian

- Creating local business opportunities

- Safety targets met at all exploration programs

- Zero recordable environmental incidents

This win-win between Bolivia and New Pacific Metals represents a big advantage toward growing value in a mining-friendly mineral-rich region.

Cementing Its First-Mover Advantage in an Underexplored World-Class Silver District

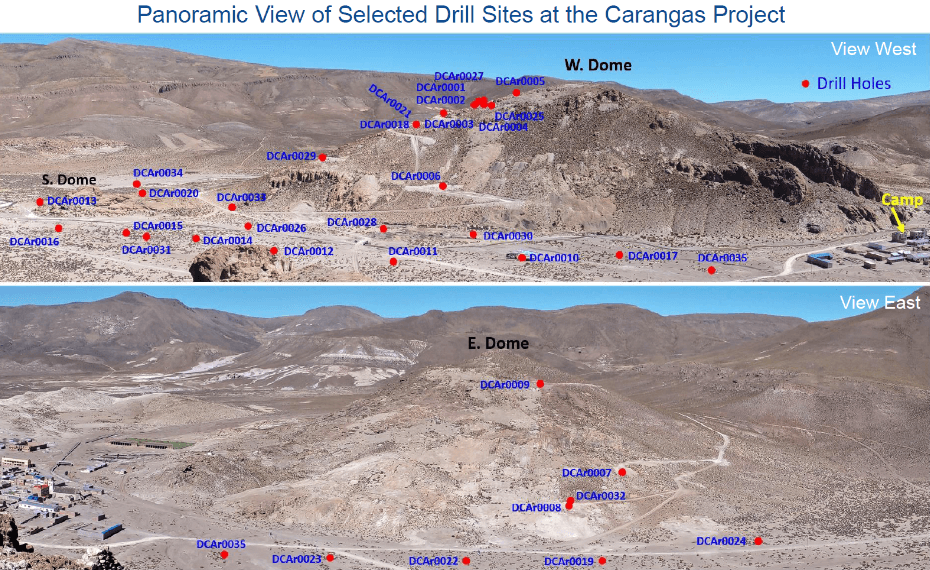

New Pacific Metals’ (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) Carangas silver and gold project representts huge mineral potential in Bolivia.

The project includes:

- Large Size:25 square kilometers

- Nearby Center: City of Oruro (~180 km northeast)

- Easy Access: 10 km road from major highway

- Multiple Metal Targets: Silver, gold and lead

The photos below show how New Pacific Metals has been very busy advancing Carangas since the company signed an agreement with a private Bolivian corporation to acquire a 98% economic interest in the project in Q2 2021.

In 2021, the company completed an ambitious 13,000 meters of drilling in 35 holes.

In the process, New Pacific (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) discovered an extensive, near-surface silver-rich zone of mineralization, stacked above a broad zone of gold mineralization.

Promising sampling highlights have included 30 meters at an average grade of 101 grams per ton (g/t) silver, 15 meters at an average grade of 252 g/t silver, and 8 meters at an average grade of 512 g/t silver.21

Those encouraging results convinced New Pacific Metals to ramp up a 30,000-meter drill program that’s currently underway with two drill rigs onsite.

As the company leverages its expertise in project advancement at Carangas, investors won’t want to miss the latest news and potential catalysts coming from that drill program this year.

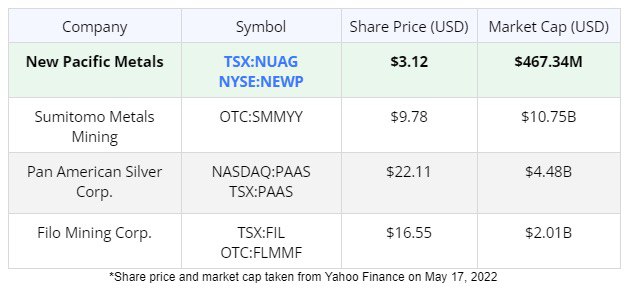

In Good Company with Bolivian Producers & Explorers

New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) isn’t the only company smart enough to take advantage of Bolivia’s mineral potential and mining-friendly environment.

There are companies on the smaller side:

- Santacruz Silver Mining Ltd

- Acquired Bolivian assets from natural resource giant Glencore in Q1 2022

- Assets includes silver production, exploration and mining infrastructure22

- Andean Precious Metals Corp

- Operates Bolivia’s only commercial silver oxide plant; over 65 million ounces produced to date23

- Also focused on extraction of silver from secondary mineral deposition at Cerro Rico24

Then there are companies on the large side:

- Sumitomo Metals Mining

- Producing for ~15 years from the largest open-pit mining operation in Bolivian history, the San Cristobal Mine25

- Produces ~1,500 tonnes per day of zinc-silver and lead-silver concentrates26

- Pan American Silver

- Operates the San Vicente Mine (south of New Pacific’s Silver Sand project)

- 4 million ounces of silver reserves (Proven + Probable)

- 3 million ounces of silver produced to date27

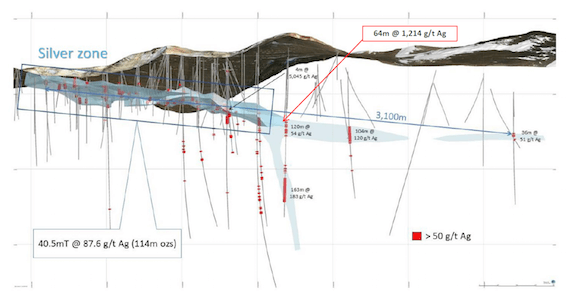

But the most interesting company for investors checking out New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) is Filo Mining Corp.

Why Filo Mining?

Because it recently went from small to large after advancing a project that’s very similar to New Pacific Metals’ Carangas Project.

Filo’s project is south of Bolivia near the border of Chile and Argentina.

In 2021, Filo hit copper and gold. Further drilling targeted a near-surface horizontal silver zone.

By January 2022, Filo had reported one of the top silver intercepts globally in the past decade: 64 meters at 1,214 g/t silver and 0.49 g/t gold from a depth of 362 meters.28 Now the project has an Indicated Resource of 147 million ounces of silver.29

Filo’s ongoing efforts to expand the project’s mineral potential were enough for the stock to rocket up by 967% from January 1, 2021 to now.

It’s too late to catch those massive stock gains for Filo…

…but the next Filo could be New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) as its 2022 drill programs march forward, expanding the exploration findings on the company’s similar Carangas Project and its 2 other projects.

Unlocking a Large, Near-Surface, World-Class Pure Silver Deposit

The New Pacific Metals (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) story gets even better thanks to its Silver Sand Project.

The project includes:

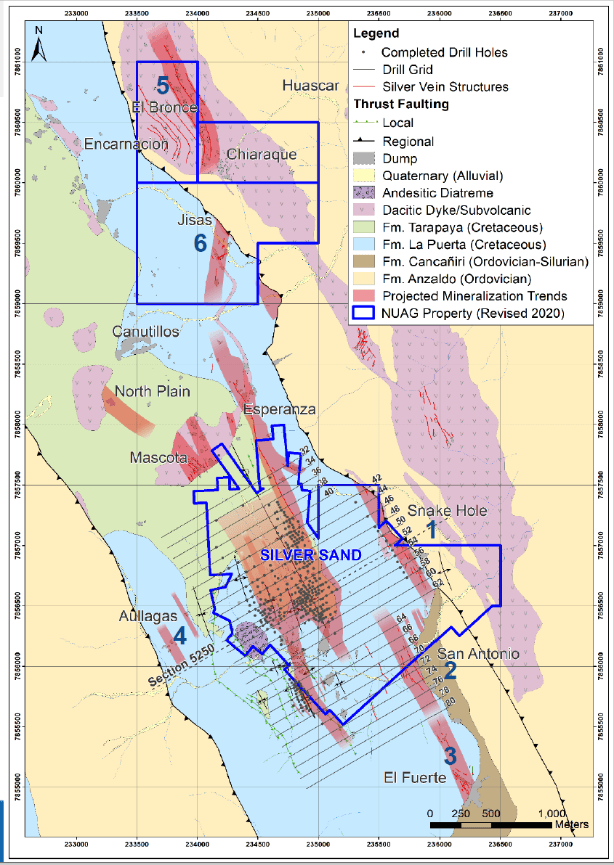

- Large Size:42 square kilometers

- Nearby Center: City of Potosi (54 km to the west)

- Easy Access: 27 km paved highway + year-round gravel road

- Near-Surface Resource: amenable to lower-cost open-pit mining; ~70% of the resources are within 200 meters of the conceptual open pit surface

The project is only 35 km northeast of one of the world’s largest silver deposits, Cerro Rico,30 which has produced 1.4 billion ounces of pure silver since the 1500s.31

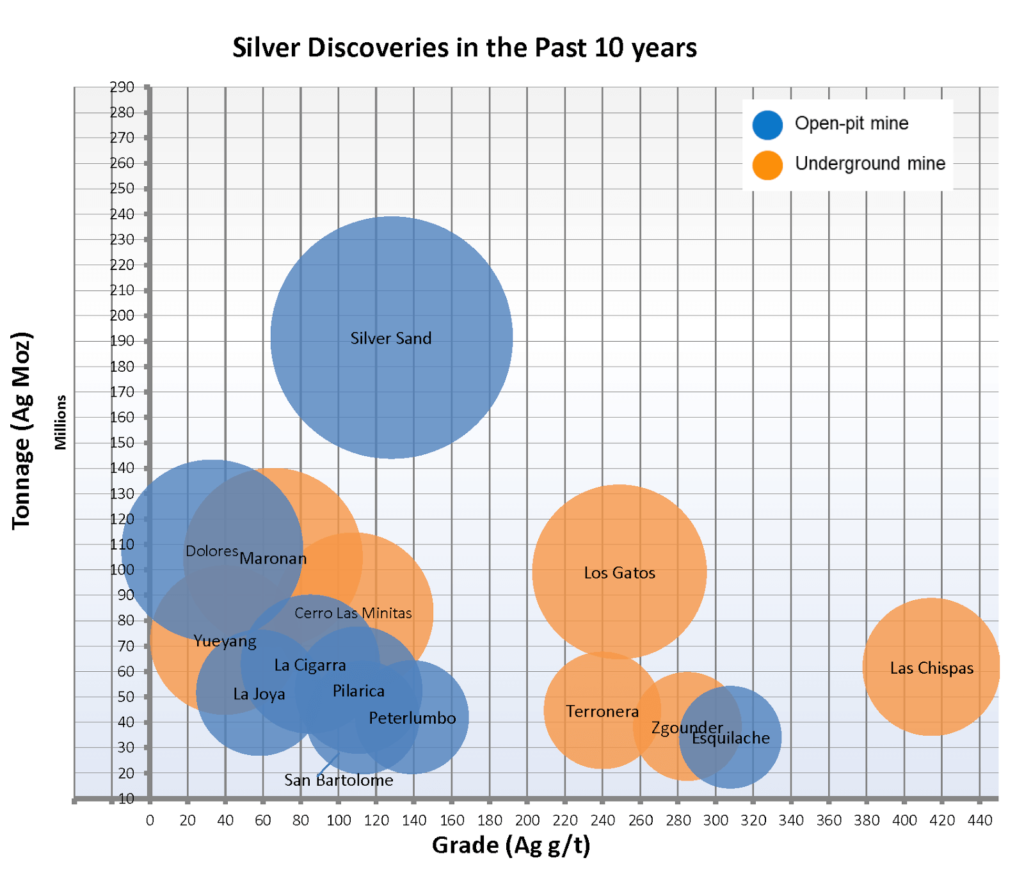

The Silver Sand deposit itself is one of the more significant new global primary silver discoveries in the last decade.

Data Source: S&P, 202032

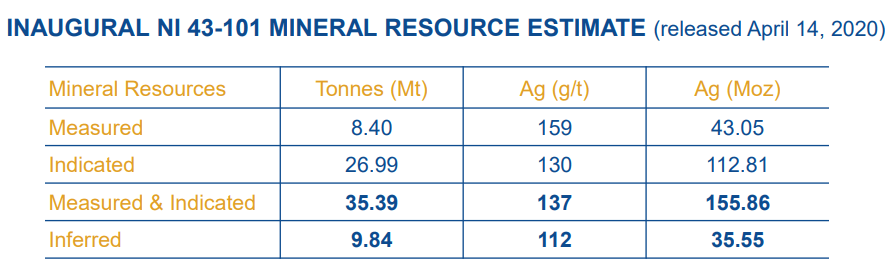

The project’s 2020 Mineral Resource Estimate (MRE) represents:

- Measured + Indicated: 86 million ounces at 137 g/t silver

- Inferred Resource: 55 million ounces at 112 g/t silver

That doesn’t even include the recently discovered Snake Hole zone. That’s where drilling intercepted 72.4 m grading 279 g/t silver.33

Now New Pacific Metals’ (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) 38,000-meter resource expansion drill program for 2022 is underway. Targets include Snake Hole and 5 others. All assays are expected by the end of June.

Now New Pacific Metals’ (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) 38,000-meter resource expansion drill program for 2022 is underway. Targets include Snake Hole and 5 others. All assays are expected by the end of June.

The company will then use those results– together with results from 135 other holes that were received since the last MRE was prepared – to provide an updated Mineral Resource Estimate by this September.34

Once the MRE is updated, New Pacific Metals expects to have a Preliminary Economic Assessment (PEA) study completed by the end of 2022.

That means this project alone will be churning out a ton of newsflow in the very near term that could act as major catalysts for driving u1p New Pacific Metals’ (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) stock price.

Strong Backing & Management with Skin in the Game

New Pacific Metals has the balance sheet and backer support to realize the potential that its projects and Bolivia represents.

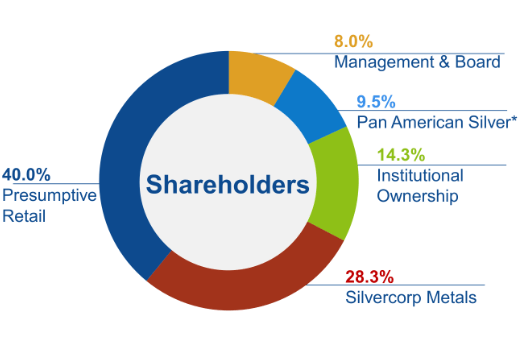

That includes $35 million USD in the bank, 14.3% institutional ownership and significant investments from other silver companies.

Pan American Silver Corp. (NASDAQ: PAAS) (TSX: PAAS) was a strategic investor in the company in 2017.

Pan American Silver Corp. (NASDAQ: PAAS) (TSX: PAAS) was a strategic investor in the company in 2017.

“Silver Sand is an exciting discovery and New Pacific has done excellent work advancing the project to the initial resource stage.”

– Michael Steinmann, President and Chief Executive Officer of Pan American35

![]() Silvercorp Metals Inc. (TSX:SVM) (NYSE American:SVM) entered a bought deal that same quarter. The company holds a 28.3% ownership interest in New Pacific.

Silvercorp Metals Inc. (TSX:SVM) (NYSE American:SVM) entered a bought deal that same quarter. The company holds a 28.3% ownership interest in New Pacific.

Even more important is its insider ownership status.

New Pacific Metals’ CEO, Dr. Rui Feng, owns ~8% of the company.

This isn’t typical. Mining execs often own no shares in the companies they manage. Their salary is often what’s most important. Which can result in a perpetually declining share price.

So, whenever you see a CEO with skin in the game, you know he’ll take care of his investment the way you would want as an investor yourself.

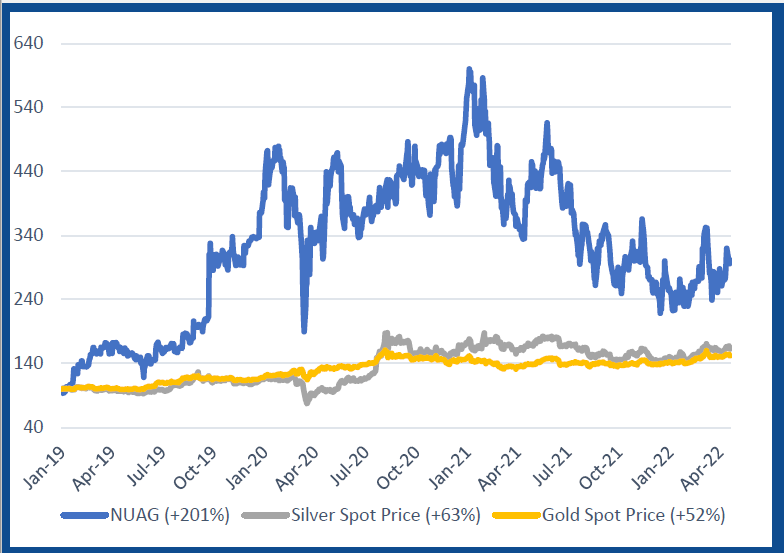

And judging by New Pacific Metals’ (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) stock trend (up 159% since January 1, 2019), those investments are on the right track.

Leadership Team with Extraordinary Mining & Capital Markets Experience

The New Pacific Metals success story wouldn’t be possible without its standout leadership team, which includes:

Dr. Rui Feng

CEO & Director

- Successful entrepreneur, explorer and mine builder with over a quarter century of global mining industry experience

- Explored and acquired mineral opportunities worldwide

- Significant discoveries of mineral resources

- Integral in discovering Jinshan Gold’s CSH Gold Mine in China in 2002 (acquired by China Gold International)

- Founded Silvercorp in 2003 by acquiring early-stage properties in China. Through discovery and development, Silvercorp has become one of the most profitable Canadian mining companies, with multiple mines in China.

- As CEO of New Pacific Metals Feng led the company to Bolivia in 2017 and acquired the Silver Sand and Carangas projects, which let to recent significant discoveries

- Believes a sustainable operation requires innovation and more effective management

Alex Zhang

VP Exploration and Founder:

- +25 years of exploration technical and managerial experience

- Professional Geoscientist registered with Engineers and Geoscientists BC (EGBC) and in good standing, with more than 30 years of experience in mineral exploration and has worked with Eldorado Gold, Afcan Mining, Sino Gold, Silvercorp and New Pacific Metals

- Supervised the exploration activities of multiple major gold projects and silver-lead-zinc polymetallic projects in China, Canada and Bolivia at various stages from exploration through development to production with roles of senior exploration geologist, senior resource geologist, exploration manager, chief geologist and vice president of exploration, and brings a full range of technical and managerial skills related to mineral exploration and mining projects.

5 Big Reasons

Why New Pacific Metals Corp. (TSX:NUAG) (NYSEAMERICAN:NEWP)(TSX:NUAG) (NYSEAMERICAN:NEWP) Could Be This Year's Breakout Mining Stock

- Silver’s Sweet Spot: Rising demand, supply squeeze and/or recession expected to boost silver prices in the near term

- Three World-Class Gold and Silver Projects in Bolivia: Silver Sand, Carangas and Silverstrike offer New Pacific a large, very promising land package with huge potential.

- News Flow from Potential Catalysts in 2022: 3 important mining assets. 3 drill programs. Silver Sand Mineral Resource Estimate update by Q3 and Preliminary Economic Assessment by year’s end.

- Strong Financial Backing & Treasury: New Pacific Metals has garnered Institutional, insider and silver company investments, including Silvercorp and Pan American Silver. $35 million in the bank.

- Strong Leadership Team: 125+ years of mining and capital markets experience.

1https://www.mining.com/web/silver-demand-to-reach-its-highest-on-record-in-2022-silver-institute-says/

2 https://www.globenewswire.com/en/news-release/2022/04/20/2425497/0/en/Global-Silver-Demand-Surged-in-2021.html

3 https://www.mining.com/web/silver-demand-to-reach-its-highest-on-record-in-2022-silver-institute-says/

4 https://www.globenewswire.com/en/news-release/2022/04/20/2425497/0/en/Global-Silver-Demand-Surged-in-2021.html

5 https://www.silverinstitute.org/global-silver-demand-forecast-reach-record-1-112-billion-ounces-2022/

6 https://www.globenewswire.com/en/news-release/2022/04/20/2425497/0/en/Global-Silver-Demand-Surged-in-2021.html

7 https://www.globenewswire.com/en/news-release/2022/04/20/2425497/0/en/Global-Silver-Demand-Surged-in-2021.html

8 https://www.mining.com/web/silver-demand-to-reach-its-highest-on-record-in-2022-silver-institute-says/

9 https://www.mining.com/web/silver-demand-to-reach-its-highest-on-record-in-2022-silver-institute-says/

10 https://www.silverinstitute.org/global-silver-demand-surged-2021/

11 https://www.aljazeera.com/economy/2022/4/8/is-a-global-recession-on-the-way-in-us-china-risks-are-growing

12 https://www.bullionbypost.co.uk/index/silver/silver-price-during-recession/

13 https://www.silverinstitute.org/global-silver-demand-forecast-reach-record-1-112-billion-ounces-2022/

14 https://www.mining.com/web/silver-demand-to-reach-its-highest-on-record-in-2022-silver-institute-says/

15 https://www.silverinstitute.org/global-silver-demand-forecast-reach-record-1-112-billion-ounces-2022/

16 https://www.trade.gov/country-commercial-guides/bolivia-mining-sector

17 https://www.andeanpm.com/OurCompany

18 https://www.bnnbloomberg.ca/bolivia-s-rich-mountain-continues-to-give-1.1479050

19 https://ca.proactiveinvestors.com/companies/news/935562/bolivian-people-resource-investors-have-high-hopes-as-new-government-targets-economic-growth-935562.html

20 https://www.ey.com/en_gl/mining-metals/top-10-business-risks-and-opportunities-for-mining-and-metals-in-2022

21 https://www.newpacificmetals.com/carangas

22 https://www.santacruzsilver.com/news/santacruz-silver-announces-the-closing-of-its-acquisition-of-glencores-producing-bolivian-silver-zinc-assets/

23 https://www.andeanpm.com/OurCompany

24 https://www.andeanpm.com/Operations/CerroRicoDeposits

25 https://miningdataonline.com/property/538/San-Cristobal-Mine.aspx

26 https://www.minerasancristobal.com/v3/en/inicio/operations/

27 https://www.panamericansilver.com/operations/south-america/san-vicente/

28 https://filo-mining.com/news/filo-mining-reports-64m-at-1-214-g-t-silver-at-fil-122590/

29 https://filo-mining.com/operations/resource-estimate/

30 https://www.andeanpm.com/OurCompany

31 https://www.bnnbloomberg.ca/bolivia-s-rich-mountain-continues-to-give-1.1479050

32 https://www.bnnbloomberg.ca/bolivia-s-rich-mountain-continues-to-give-1.1479050

33 https://www.newpacificmetals.com/news-and-media/2020/1/13/discovery-drill-hole-intercepts-724-metre-mineralization-grading-279-grams-per-tonne-silver-including-33-metre-mineralization-grading-517-grams-per-tonne-silver-at-the-snake-hole-prospect

34 https://www.newswire.ca/news-releases/new-pacific-provides-an-update-on-the-silver-sand-project-preliminary-economic-assessment-849692653.html

35 https://www.panamericansilver.com/news/news-releases/detail/136/2020-05-19-new-pacific-metals-corp-announces-bought-deal-financing-c25-million

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of New Pacific Metals Corp. (“NUAG”) and its securities, NUAG has provided the Publisher with a budget of approximately $10,000.00 USD to cover the costs associated with creating and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by NUAG ) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of any profiled company NUAG and has no information concerning share ownership by others of in the profiled company NUAG . The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to NUAG industry; (b) market opportunity; (c) NUAG business plans and strategies; (d) services that NUAG intends to offer; (e) NUAG milestone projections and targets; (f) NUAG expectations regarding receipt of approval for regulatory applications; (g) NUAG intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) NUAG expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute NUAG business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) NUAG ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) NUAG ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) NUAG ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of NUAG to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) NUAG operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact NUAG business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing NUAG business operations (e) NUAG may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

- The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling New Pacific Metals Corp..

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled New Pacific Metals Corp. and has no information concerning share ownership by others of any profiled companies and The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of any New Pacific Metals Corp. or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the New Pacific Metals Corp.. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled New Pacific Metals Corp.’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding New Pacific Metals Corp. future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to New Pacific Metals Corp. industry; (b) market opportunity; (c) New Pacific Metals Corp. business plans and strategies; (d) services that New Pacific Metals Corp. intends to offer; (e) New Pacific Metals Corp. milestone projections and targets; (f) New Pacific Metals Corp. expectations regarding receipt of approval for regulatory applications; (g) New Pacific Metals Corp. intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) New Pacific Metals Corp. expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute New Pacific Metals Corp. business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) New Pacific Metals Corp. ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) New Pacific Metals Corp. ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) New Pacific Metals Corp. ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of New Pacific Metals Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) New Pacific Metals Corp. operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact New Pacific Metals Corp. business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing New Pacific Metals Corp. business operations (e) New Pacific Metals Corp. may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of New Pacific Metals Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of New Pacific Metals Corp. or such entities and are not necessarily indicative of future performance of New Pacific Metals Corp. or such entities.